Xaris&Energy&(Pty)&Ltd&& Walvis&Bay&Power&Plant& Fuel Selection... · Heavy!Fuel!Oil! ......

Transcript of Xaris&Energy&(Pty)&Ltd&& Walvis&Bay&Power&Plant& Fuel Selection... · Heavy!Fuel!Oil! ......

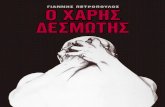

Page 1 of 28 Volume 2: Minimum Functional Specification

Xaris Energy (Pty) Ltd Walvis Bay Power Plant

FUEL SELECTION & SUPPLY OPTIONS

Fuel Selection Page 2

Contents 1 Fuel selection summary .............................................................................................................. 4

2 Supply Options and Market Considerations ............................................................................ 8

2.1 Heavy Fuel Oil ...................................................................................................................... 8

2.2 Liquefied Natural Gas ......................................................................................................... 9

3 Power Generation Environmental Performance ................................................................... 10

3.1 Heavy Fuel Oil .................................................................................................................... 10

3.2 Liquefied Natural Gas ....................................................................................................... 11

4 Plant Operations ........................................................................................................................ 12

4.1 Heavy Fuel Oil .................................................................................................................... 12

4.2 Liquefied Natural Gas ....................................................................................................... 12

5 Fuel Delivery Logistics .............................................................................................................. 13

5.1 Heavy Fuel Oil .................................................................................................................... 13

5.2 Liquefied Natural Gas ....................................................................................................... 13

6 Future Compatibility with Kudu ................................................................................................ 14

6.1 Heavy Fuel Oil .................................................................................................................... 14

6.2 Liquefied Natural Gas ....................................................................................................... 14

7 Spin-offs and Additional Benefits ............................................................................................ 14

7.1 Heavy Fuel Oil .................................................................................................................... 14

7.2 Liquefied Natural Gas ....................................................................................................... 14

8 Fuel Sourcing and Supply ........................................................................................................ 15

8.1 Fuel Specification .............................................................................................................. 15

8.2 Fuel Sourcing ..................................................................................................................... 16

8.2.1 LNG Global Trends .................................................................................................... 16

8.2.2 LNG Sourcing ............................................................................................................. 22

8.2.3 Excelerate Energy: LNG Agent ................................................................................ 24

Fuel Selection Page 3

8.2.4 Fuel Index ................................................................................................................... 25

8.2.5 Alternate Supply Provisions ..................................................................................... 26

8.2.6 Fuel Supply with no Take or Pay Arrangement ..................................................... 27

8.2.7 Scheduling of Drops and Storage Capacity ........................................................... 28

List of Tables

Table 1: Comparison HFO and LNG ....................................................................................... 4 Table 2: GE LM6000 Fuel Specification Range .................................................................... 16 Table 3: Global LNG Supply Outlook .................................................................................... 16 Table 4: Global LNG Imports ................................................................................................. 18

List of Figures

Figure 1: World Liquid Fuel Production ................................................................................... 9 Figure 2: Global LNG Supply Forecast ................................................................................. 10 Figure 3: Carbon Footprint of Various Fuels in Power Generation ....................................... 11 Figure 4: LNG Trading Routes .............................................................................................. 18 Figure 5: LNG Spot Pricing with Reference to Fukushima .................................................... 20 Figure 6: LNG vs HSFO Pricing ............................................................................................ 21 Figure 7: LNG Spot Price as % of Brent Crude Index ........................................................... 22 Figure 8: Loaded by Terminal ............................................................................................... 24 Figure 9: Discharges per Region ........................................................................................... 25 Figure 10: Divertible vs Contracted Volumes Traded ............................................................ 26 Figure 11: Projected Walvis Bay Gas Offtake Agreements ................................................... 27 Figure 12: LNG Inventory ...................................................................................................... 28

Fuel Selection Page 4

1 Fuel selection summary The fuel type and security of fuel supply for the lifetime of the power plant forms the early

baseline decision criteria for the selection of an appropriate technology. Xaris has

investigated the various fuel supply options for a 250MW base load (future mid-merit or

peaking) power plant. The two fuel types initially shortlisted for the project include Heavy

Fuel Oil (HFO) and LNG. Diesel has been excluded from the evaluation due to the extreme

high costs associated with its use.

Further, Compressed Natural Gas (CNG) has been eliminated due to the relative immaturity

of commercially proven technologies, lower energy density of the fuel (less than half the

energy density than LNG) and the delivery distance from the closest source. In addition, the

energy transported per shipment is small in comparison to LNG and there would be more

shipments of product required.

The use of HFO, while feasible from a power generation technology perspective, has

significant limitations when compared to LNG. These limitations are highlighted in the table

below.

Table 1: Comparison HFO and LNG

Fuel Selection Page 5

Key

Considerations Heavy Fuel Oil (HFO) Liquefied Natural Gas (LNG)

Supply

Options/

Security

HFO is a product of the refining

process and there are limited

supply options within the region due

to the lack of Oil production.

Various options including Angola,

Nigeria, Namibian Kudu fields and

other potential future shale gas

production from within the region.

Relative Cost

The production of HFO is directly

linked to oil production, as HFO is a

product of the oil refining process.

As such HFO prices tend to trend

the oil price.

Natural gas is produced either as an

oil associated gas or a non-

associated gas. The regional

production is typically non-associated

and therefore not directly linked to the

oil price. In addition, the LNG export

market has seen substantial growth

over the past few years as United

States production of local shale gas

has reduced world demand and

created a demand constrained natural

gas market.

Plant Flexibility

The use of HFO limits the selection

of turbines, as heavy duty machines

are the only suitable contenders.

The machines are typically in the

region of 100 MW in size and

reduce the modularity of the plant.

The HFO-fired machines also

require a cool down period on shut-

down where diesel fuel is required.

Natural gas enables the selection of

smaller aeroderivative turbines, which

improve the modularity of the plant.

These turbines also provide for

flexible operation with high part load

efficiency. Start-up and Shut-down

durations are extremely short.

Fuel Selection Page 6

Key

Considerations Heavy Fuel Oil (HFO) Liquefied Natural Gas (LNG)

Environmental

Performance

The sulphur content of HFO ranges

from 1 to 2% by mass. The

combustion of HFO results in a

much higher sulphur dioxide (SOx)

emission footprint in comparison to

natural gas. The greenhouse gas

emissions of HFO use for power

generation are substantially higher

than that of natural gas and are

further increased due to the lower

efficiencies of turbines running on

HFO. Nitrous oxide (NOx) emissions

are generally greater due to a

higher percentage of fuel-bound

nitrogen. The exhaust gas from

HFO fired systems also contains

Argon. In addition to the poorer

emission performance of HFO,

potential HFO spillages or pipe

ruptures can greatly impact marine

life and soil conditions. HFO is

categorised as “Carcinogenic

category 2 dangerous to the

environment”. In order to reduce

emissions to within World Bank

Guidelines, large quantities of water

and additional clean-up operations

may be required.

Emissions of SOx from natural gas

combustion are low because pipeline-

quality natural gas typically has

sulphur levels of 0.05 to 0.18 % by

mass. Because natural gas is a

gaseous fuel, filterable Particulate

Matter (PM) emissions are typically

low. Greenhouse gas emissions for

natural gas power generation are

among the lowest from fossil fuels.

Limited use of water ensures that the

plant emissions are within World Bank

Guidelines. Natural gas exists as a

vapour at normal conditions and

therefore any potential loss of gas

would result in air emissions. In

addition, gas loss would typically be

detected by pipeline pressure drop, in

which case the pipeline will be shut-

off from the supply to ensure no

further loss of product and reduced

environmental impact. Natural gas

has a very limited risk of soil and

groundwater pollution.

Fuel Selection Page 7

Key

Considerations Heavy Fuel Oil (HFO) Liquefied Natural Gas (LNG)

Logistics and

Delivery

While the storage of HFO is

significantly simpler due to the

relative stability of HFO at ambient

conditions the HFO (depending on

the grade) may require heating in

order to deliver the fuel. The use of

HFO would require a significant

investment in storage capacity and

associated heating operations. The

HFO storage capacity would have

to be constructed in land and would

therefore require suitable land area

for an HFO storage plant. The

supply options, relative cost and

environmental performance of HFO

make it a less attractive alternative

to LNG.

Historically the high cost and lengthy

schedules associated with the

establishment of LNG storage

capacity has been prohibitive. In

addition, the availability of suitable

land area is also prohibitive as the

preferred terminal locations are

typically close to large ports where

LNG carrying vessels are able to

dock. The use of FSRU technology

significantly improves the financial

and schedule benefits of LNG

storage.

Impact on Plant

Maintenance

HFO units are heavy duty units and

need frequent maintenance as well

as part replacement due to the poor

fuel quality. HFO units typically

have long downtimes for major

overhauls, typically every 120 days.

There are additional maintenance

penalties as the units have limited

stop/start operational capability.

Natural gas fired aeroderivative

turbines allow for high start/stop

cycles with no maintenance penalties.

Maintenance for these units is

typically faster and easier than that for

the heavy duty machines.

The aeroderivative units have shorter

downtimes for overhauls, typically 5

days for engine exchange at major

interval of 50,000 hours.

Fuel Selection Page 8

Key

Considerations Heavy Fuel Oil (HFO) Liquefied Natural Gas (LNG)

Future

Compatibility

with Kudu

No, additional natural gas storage

and distribution infrastructure would

be required in order to

accommodate for production from

the Kudu operations.

Yes, LNG terminals would be able to

receive product from the Kudu

operations.

The multiple benefits of a natural gas fired power plant are clearly indicated above. Liquefied

natural gas, or LNG, is the fuel of choice for the Xaris Energy project. Natural gas is the

cleanest, safest, and most environmentally friendly fossil fuel available. Natural gas is a

blend of combustible hydro-carbon gases including methane, ethane, propane, butane, and

pentane. When chilled to extremely low temperatures (-162 °C) the gas liquefies and has a

600 fold reduction in volume. This allows for the transportation of a fuel with a much higher

energy density. In addition, the use of natural gas has the added advantage of enabling the

Walvis Bay region to be “Kudu” ready. Xaris have therefore based the plant design on a

natural gas fuel.

A detailed comparison of the differentiating factors, which have resulted in the selection of

natural gas over heavy fuel oil (HFO), is presented in the sections below.

2 Supply Options and Market Considerations

2.1 Heavy Fuel Oil HFO is a product of the refining process and therefore its is linked to the abundance of

refining activity within the region. Furthermore the global production outlook for world liquid

fuel (Figure 1: World Liquid Fuel Production) indicates an average annual production

increase of less than 2%.

Fuel Selection Page 9

Figure 1: World Liquid Fuel Production

2.2 Liquefied Natural Gas Fundamental analysis of the 2015 to 2021 period indicates that LNG supply will grow with a

compounded annual growth rate (CAGR) of 8.7%, from 264 MTPA in 2015 to 436 MTPA in

2021. A more aggressive assessment would point to the possibility of CAGR reaching 12%

(approximately 521 MTPA), should some of the more speculative liquefaction projects (e.g.

Mozambique LNG, PNG LNG expansion, Jordan Cove LNG) reach the market before 2021.

Either case reveals this six-year period as one of rapid supply expansion periods with

anticipated demand growing only at a CAGR of 6.9%.

Figure 2: Global LNG Supply Forecast indicates the projected LNG global supply forecast.

Fuel Selection Page 10

Figure 2: Global LNG Supply Forecast

Natural gas is produced either as an oil-associated gas or a non-associated gas. In addition,

unconventional shale gas production has increased the natural gas production mix and

exploitation of such unconventional resources globally will continue to increase the growth in

natural gas use.

The benefits of a market with greater supply options point to the selection of natural gas as a

fuel of choice.

3 Power Generation Environmental Performance

3.1 Heavy Fuel Oil HFO is the residue of crude oil distillation that still flows (the quasi-solid residue is asphalt);;

waste oil from other industries are often added. It is the fuel used in large marine vessels

because of price (about half the price of distillates). A typical HFO fuel has a higher heating

value (HHV) of 43 MJ/kg and a composition of 88%wt C, 10%wt H, 1%wt S, 0.5%wt H2O,

0.1%wt ash, and may contain dispersed solid or semi-solid. Due to the high carbon content

of HFO (88%), the combustion products of HFO have a high percentage of carbon dioxide

(see Figure 3: Carbon Footprint of Various Fuels in Power Generation). In addition, the

sulphur content of HFO results in direct sulphur oxide (SOx) emissions and, depending on

the source of HFO, the sulphur content may vary between 1% and 2%. Nitrous oxide (NOx)

emissions are generally greater due to a higher percentage of fuel-bound nitrogen. The

exhaust gas from HFO-fired systems also contains argon. In addition to the poorer emission

Fuel Selection Page 11

performance of HFO, potential HFO spillages or pipe ruptures can greatly impact marine life

and soil conditions. HFO is categorised as “carcinogenic category 2 dangerous to the

environment”.

Figure 3: Carbon Footprint of Various Fuels in Power Generation

3.2 Liquefied Natural Gas Natural gas is a flammable gaseous mixture, composed mainly of methane: CH4 C2H6, C3H8,

and minor concentrations of H2O, CO, CO2, N2, and He. The carbon content of natural gas

is typically between 60-70% and hence the products of natural gas combustion contain less

carbon dioxide than fuels with higher carbon content.

Greenhouse gas emissions for natural gas power generation are among the lowest from

fossil fuels (See Figure 3: Carbon Footprint of Various Fuels in Power Generation) the figure

indicates a carbon dioxide emission of 500 kg/MWh as compared to 720 kg/MWh for HFO.

Emissions of SOx from natural gas combustion are low as natural gas typically has sulphur

levels of 0.05% to 0.18% by mass. Because natural gas is a gaseous fuel, filterable

particulate matter (PM) emissions are typically low.

NOx emissions are typically controlled by the use of dry low NOx technologies and/or turbine

water injection. Natural gas exists as a vapour at normal conditions and therefore any

potential loss of gas would result in air emissions.

0

100

200

300

400

500

600

700

800

900

1000

Coal

Fuel Oil

Natural Gas

Solar PV

Biomass

Nuclear

Hydroelectric

Wind

Carbon Dioxide Footprint [kg CO2 /MWh]

Fuel Selection Page 12

In addition, gas loss would typically be detected by pipeline pressure drop, in which case the

pipeline will be shut off from the supply to ensure no further loss of product and reduced

environmental impact. Natural gas has a very limited risk of soil and groundwater pollution.

Based on the environmental analysis presented above, liquefied natural gas indicates

enhanced performance in comparison to HFO.

4 Plant Operations

4.1 Heavy Fuel Oil The use of HFO limits the selection of turbines, as heavy duty machines are the only suitable

contenders. The machines are typically in the region of 100MW in size and reduce the

modularity of the plant. The HFO-fired machines also require a cool down period on shut-

down where diesel fuel is required. HFO is better suited for reciprocating engine technology,

which is typically limited to 20MW and lower. This limitation requires the deployment of a

minimum of 12 reciprocating engine units in order to meet the minimum power production

requirement of 230MW. The increase in number of units further has an impact with respect

to staffing and maintaining the units.

HFO engines require frequent maintenance due to the poor fuel quality, and the units

typically have long downtimes for major overhauls. The average annual availability of HFO-

fired plants is typically 88%. There are additional maintenance penalties as the units have

limited stop/start operational capability.

4.2 Liquefied Natural Gas Natural gas enables the selection of aeroderivative turbines, which improve the modularity of

the plant as the turbines typically have an output range between 35MW and 65MW. These

turbines also provide for flexible operation with high part load efficiency. Start-up and

shutdown durations are extremely short and there are no maintenance penalties associated

with multiple start/stop cycles. The aeroderivative units have shorter downtimes for

overhauls, typically 5 days for engine exchange at major intervals of 50,000 hours. The

anticipated plant availability for the aeroderivative GE LM6000 is in excess of 97%.

Liquefied natural gas is the fuel of choice based on the plant operational flexibility that

Fuel Selection Page 13

natural gas and its associated power generation technology provide for.

5 Fuel Delivery Logistics

5.1 Heavy Fuel Oil While the storage of HFO is significantly simpler due to its at ambient conditions, the HFO

(depending on the grade) may require heating in order to deliver the fuel. The use of HFO

would require a significant investment in storage capacity and associated heating

operations. The HFO storage capacity would have to be constructed inland and would

therefore require suitable land area for an HFO storage plant. The supply options, relative

cost and environmental performance of HFO make it a less attractive alternative to LNG.

HFO storage, once established, would further require either piped HFO to the power plant or

a road/rail solution. Given the environmental considerations, it would not be attractive to

pipe HFO over a long distance and a trucking solution is likely to be more feasible. This

solution would also raise environmental concerns due to the increased road traffic and the

further potential of HFO spillage and management (for more information see

http://www.truth-out.org/news/item/22695-migratory-birds-face-danger-from-oil-spill-long-

after-shipping-channel-will-open# ).

5.2 Liquefied Natural Gas Historically, the high cost and lengthy schedules associated with the establishment of LNG

storage capacity have been prohibitive. In addition, the availability of suitable land area is

also prohibitive as the preferred terminal locations are typically close to large ports where

LNG-carrying vessels can dock. The use of FSRU technology significantly improves the

financial and schedule benefits of LNG storage.

The final logistic solution of delivering the fuel to the power plant is subject to the same

provisions as HFO and the LNG would either have to be regasified and piped to the plant or

road transported in liquid state. The use of natural gas pipelines is a well-established

solution and a marine trestle pipeline followed by an overland pipeline would be the solution

of choice.

Based on the logistic factors described above, LNG would be the preferred fuel of choice.

(See more on safety of LNG see http://breakingenergy.com/2014/12/22/how-dangerous-is-

Fuel Selection Page 14

lng/ ).

6 Future Compatibility with Kudu

6.1 Heavy Fuel Oil An HFO-fired power plant would in all likelihood support a switch to gaseous fuel if the Kudu

gas fields supply network expands to Walvis Bay. However, it is expected that the real

compatibility with Kudu would be measured by the plant’s ability to operate at a variable and

inconsistent load factor. Due to the additional maintenance penalties, the use of HFO is not

recommended with highly cyclical operations in which multiple stop/starts may be required.

No additional natural gas storage and distribution infrastructure would be required in order to

accommodate production from the Kudu operations.

6.2 Liquefied Natural Gas The FSRU LNG terminal would be able to support integration with the Kudu gas fields as

potential floating liquefaction facilities could be used to supply the FSRU with Kudu gas.

Furthermore, any future gas infrastructural development in the region would seamlessly

integrate with gas supply from the Kudu fields. The gas-fired aeroderivative power plant will

not have any associated maintenance penalties due to cyclical operations and would further

support any additional power that is realised through the Kudu fields.

Based on the compatibility with the Kudu field development, LNG is the fuel of choice.

7 Spin-offs and Additional Benefits

7.1 Heavy Fuel Oil The use of HFO would have limited future benefits as the environmental performance, the

integration potential with the Kudu development, and the logistical solution of fuel delivery

are unlikely to create an expanded HFO market.

7.2 Liquefied Natural Gas The Walvis Bay port is being expanded and the region will require power and water. Natural

Fuel Selection Page 15

gas can provide the solution for powering and providing clean water for the region. The

proposed gas plant, power plant and potential future desalination plant, cover three critical

utilities in one, namely gas, power and water. The results of such a multi-beneficial solution

will result in increased and faster development within the region.

The proposed LNG storage terminal (Walvis GasPort) will provide for access to gas for other

industries in the area including the heavy industries. The fishing factories in the area will be

able to change to gas as a fuel source, saving them money and lessening their

environmental impacts.

The Xaris Energy solution, in combination with the existing power sources, has the potential

to push Namibia towards a positive energy balance. Xaris has already had enquires from

neighbouring countries for the potential purchase of power and gas from the Walvis Bay

development. This would assist in creating further benefits for the Walvis Bay economy and

power generation in the SAPP region.

8 Fuel Sourcing and Supply The fuel sourcing solution for the power plant is multifaceted and requires careful

consideration of the fuel market, fuel specification requirements, technical requirements of

fuel storage, logistics of fuel transportation to the power plant, and the management of fuel

inventory to ensure sufficient fuel is available to support the power plant at all times.

The Xaris Energy project team has carefully evaluated all of the major criteria in the

selection of fuel. The sections that follow describe the fuel sourcing and supply solution

proposed for the power plant.

8.1 Fuel Specification GE aeroderivative gas turbines have the ability to burn a wide range of gaseous fuels as

shown in Table 2: GE LM6000 Fuel Specification Range. These gases present a broad

spectrum of properties due to both active and inert components. This specification is

designed to define guidelines that must be followed in order to burn these fuels in an

efficient, trouble-free manner, while protecting the gas turbine and supporting hardware.

Fuel Selection Page 16

Table 2: GE LM6000 Fuel Specification Range

Fuel Lower Heating Value Major Components

Natural gas 31.54 – 47.30 Methane

Liquefied petroleum gas 90.67 – 126.14 Propane, butane

Gasification gases Air blown Oxygen blown

3.94-5.91 7.88-15.77

Carbon monoxide, hydrogen, nitrogen, water vapour

Process gases 11.83-118.26

Methane, hydrogen, carbon monoxide, ethane, propane, propene, carbon dioxide, nitrogen

The selection of liquid natural gas (LNG) as a fuel source provides an assurance that the

dew point of the gas is well below the required turbine limits. This is due to the drop-out of

the water contained in the fuel during the liquefaction process.

Because of the wide range of natural gas heating values, the GE LM6000 range of

aeroderivative gas turbines provides for a robust power generation solution which

complements the sourcing of fuels from various regions around the world.

8.2 Fuel Sourcing

8.2.1 LNG Global Trends World trade in LNG has more than tripled over the last 15 years, moving from an annual

trade of 66 million metric tons per annum (MTPA) in 1997 to 240 MTPA in 2013. The market

is further set to continue its growth path as improved production technologies liberate more

gas fields across the world and liquefaction technology advancements continue to improve

the economics of LNG.

World LNG supply is vast in nature and there are a number of diverse LNG exporters

supplying LNG into the market. Table 3: Global LNG Supply Outlook provides an overview of

the global LNG supply capacities by region.

Table 3: Global LNG Supply Outlook

Fuel Selection Page 17

Exporter

World Liquefaction Capacity (MTPA) (Includes facilities that are existing, under construction, & close to financial close)

2014 2015 2016 2017 2018 Abu Dhabi 7.2 7.2 7.2 7.2 7.2 Algeria 12.8 14.5 17.3 17.3 17.3 Angola 0.3 0.8 3.1 4.9 4.9 Australia 23.0 26.9 42.4 64.6 80.6 Brunei 6.7 6.7 6.7 6.7 6.7 Colombia - 0.3 0.5 0.5 0.5 Egypt - - - - - Equatorial Guinea 3.5 3.5 3.5 3.5 3.5 Indonesia 29.9 30.6 31.8 31.8 31.8 Libya - - - - - Malaysia 24.4 24.4 24.7 28.3 29.0 Nigeria 21.1 21.1 21.1 21.1 21.1 Norway 4.0 4.0 4.0 4.0 4.0 Oman 10.2 10.2 10.2 10.2 10.2 Papua New Guinea 3.0 6.6 6.6 6.6 6.6 Peru 4.2 4.2 4.2 4.2 4.2 Qatar 73.6 73.6 73.6 73.6 73.6 Russia-Atlantic - - - 1.9 6.3 Russia-Pacific 9.1 9.1 9.1 9.1 9.1 Trinidad & Tobago 14.7 14.7 14.7 14.7 14.7 USA-Atlantic - - 3.3 10.7 25.2 USA-Pacific 0.1 0.3 0.3 - - Total 254.4 265.0 290.7 327.3 362.8 Source: Woodmac, Excelerate internal

The LNG market has been regionally split into the Atlantic Basin and Pacific Basin markets.

The Atlantic Basin is historically dominated by European buyers and the Pacific Basin by

Japanese and Korean buyers. The evolution of these two linked but yet vastly different

markets, has resulted in an Atlantic Basin LNG market which largely trades in pricing which

is mildly linked to Brent crude oil, with an ever growing influence from local gas indices from

Europe like UK NBP (National Balancing Point), Dutch TTF (Title Transfer Facility), Spain

AOC, and US Henry Hub (Henry Hub is the US natural gas price index. As more US LNG

export terminals come online later this decade, it is anticipated that the Henry Hub index will

Fuel Selection Page 18

influence LNG prices in Atlantic Basin). The Pacific Basin LNG market is largely linked to the

crude cocktail mix of petroleum products.

Figure 4: LNG Trading Routes

The global trading routes for LNG is shown in Figure 4: LNG Trading Routes (courtesy of

Galway Energy Advisors). The trading routes indicate the higher delivery distance

constraints related to LNG shipping.

Table 4: Global LNG Imports indicates that the highest portion of global imports are

attributed to the Pacific Basin (181.50 million MTPA) whereas the Atlantic Basin imports

account for 62.05 million MTPA. The higher demand requirements in the east have

therefore affected the Pacific Basin pricing and LNG exports from the Atlantic Basin to the

east are typically higher premium due to the distance factor.

Major Atlantic and Pacific Basin LNG importers as at 2013 are displayed in Table 4: Global

LNG Imports.

Table 4: Global LNG Imports Importer 2013 Imports of LNG (Million MTPA) France 6.30 Spain 11.64 Portugal 1.68 Turkey 4.32 Belgium 2.48 Italy 4.16 UK 7.04

Fuel Selection Page 19

Importer 2013 Imports of LNG (Million MTPA) United States 2.00 Mexico 5.94 Brazil 4.29 Argentina 4.82 Chile 2.86 Canada .76 Kuwait 1.64 Total Atlantic Basin 62.05 Japan 87.73 South Korea 40.76 Taiwan 12.84 India 13.32 China 18.51 Total Pacific Basin 181.50 World Total (Net imports) 239.11 Source: Waterborne

The expansion of the Panama Canal for the transportation of LNG from the Atlantic Basin to

the Pacific Basin will allow for a greater link between the two markets. However, there has

been recent protest from Japan with regard to the planned limits on the size of ships in the

Panama Canal. The size limitation could prevent some US natural gas from reaching

customers in Asia. The announcement of the size limit has further impacted LNG pricing in

the Pacific Basin.

Expansion began in earnest with the start of Papua New Guinea LNG (6.9 MTPA) in June

2014. The plant came online ahead of schedule and is already producing at nameplate

capacity. BG Group’s Queensland Curtis (4.25 MTPA) is also coming online in Q4 this year,

followed by a slew of projects in Indonesia, Australia, Malaysia, and the US Gulf Coast.

The shift to a better supplied market is significant considering that, since the Fukushima

Daiichi nuclear disaster in Japan in 2011, very little new supply came online globally. Pluto

LNG (3.45 MTPA) came online in Q2 2012 and Angola LNG (5.20 MTPA) started operations

in mid-2013. Pluto produced at 93% of nameplate last year while Angola has faced multiple

challenges, only reaching 6% of nameplate last year before shutting down to address feed

gas and other plant operating issues, with the hope of ramping up the facility in mid-2015.

Lack of incremental supply in the face of increased demand for LNG, particularly from Japan

to meet 31.5 gigawatts of lost nuclear power supply resulting in increased LNG imports of

17.5 MTPA, combined with poor Angola LNG performance and loss of Egyptian LNG

Fuel Selection Page 20

production, contributed to higher LNG prices across the globe. This was especially the case

during the northern hemisphere winter (Figure 5: LNG Spot Pricing with Reference to

Fukushima).

Figure 5: LNG Spot Pricing with Reference to Fukushima

High-sulphur fuel oil (HSFO) is an alternate source of energy for LNG demand across the

world, especially for power. On a US$/MMBtu (million British thermal unit) basis, the

competitiveness of LNG as a fuel source increases during the times of surplus LNG. This

was witnessed especially during the period 2009 to 2011 (see Figure 6: LNG vs HSFO

Pricing) when Qatar LNG megatrains came online. The new wave of LNG supply

expansion by 176 MTPA from the year 2015 to 2021 is larger than the first supply expansion

wave during the period 2009 to 2011 when Qatar’s megatrains started operations, increasing

their LNG production from 29 MTPA in 2008 to 76 MTPA in 2011. This leads us to believe

that, as the new supply from Australia and US starts to come online and exceed the

forecasted demand, LNG spot prices will be suppressed.

Fuel Selection Page 21

Figure 6: LNG vs HSFO Pricing

Liquefaction facilities for the most part are large and capital intensive with very low operating

costs and no real alternate market for the natural gas being converted into LNG (US LNG

will be the exception to this). Because of these characteristics of liquefaction facilities, they

continue to produce LNG despite low price environment. Hence, during the periods when

there is excess LNG supply in the market, like in the years 2009 and 2010, the spot LNG

prices are depressed, especially against the crude oil price, in a pursuit to prod fuel

switching to place the excess LNG. This is especially true during northern hemisphere

summer periods when there is no demand for heating. During the summer of 2009, prices

for spot LNG predominantly stayed between 6.3% Brent and 7.9% Brent (20th percentile and

80th percentile), averaging 7.1% Brent crude index. For the full year 2010, prices

predominantly stayed between 7.7% Brent and 11% Brent, averaging 9.5% Brent. During

the years of supply tightness like in 2013, when there was no new supply that came online

outside of 3.45 MTPA from Pluto LNG and there was a demand shock from Japan after the

Fukushima disaster, spot LNG prices were strong predominantly between 14% and 16%

Brent (Figure 7: LNG Spot Price as % of Brent Crude Index).

Fuel Selection Page 22

Figure 7: LNG Spot Price as % of Brent Crude Index

With that said, considering that there is forecasted excess supply of 24 MTPA for the year

2016 growing to an excess supply of 58 MTPA for the year 2021 (Figure 2: Global LNG

Supply Forecast), an argument can be made that the spot LNG prices will be depressed like

in 2009 and 2010, perhaps averaging below 10% Brent for the full year and well below 10%

Brent during northern hemisphere summer periods. The excess supply referred to here

would be as a result of the new liquefaction projects coming online in Australia and United

States in the next few years and forecasted demand not growing so rapidly.

8.2.2 LNG Sourcing Traditionally, LNG sourcing was done on a long-term basis by large buyers with good

enough international credit ratings to support development and financing of multibillion dollar

liquefaction projects. While this meant availability of LNG at all times at a known price

(security of supply) for the buyer, this also meant that supply was locked in for the buyer

from that location with the risks of smooth production operations. The LNG buyer agrees to

take the scheduled volumes to a specified delivery location. Cargoes cannot be diverted to

higher-priced markets as the offtaker has contractually agreed to take LNG and deliver to

specific markets. For many traditional buyers (primarily utilities in Japan, Korea, Taiwan,

etc.), these terms were acceptable because the price, for the most part, was passed through

to customers whilst the supply availability was guaranteed at a known price. This resulted in

Fuel Selection Page 23

long-term purchasers realising higher average prices than spot prices due to committed

contracts.

This regime of LNG sourcing was first broken when more than 50 MTPA of LNG supply was

developed by various large suppliers for supplying the United States and United Kingdom

gas markets from Qatar, Yemen, Angola, etc. While these were premium markets when the

projects were developed, the markets became unattractive with the advent of unconventional

shale gas production, especially in the United States, and the volumes became available for

supply on mid-term (3-7 years) and spot basis. However, the pricing of these supplies on

mid-term deals predominantly stayed as derivative of Brent (or Dated Brent) like the usual

long-term contracts. Furthermore, suppliers are less inclined to offer fair long-term pricing

for projects that are in pre-financial investment decision (FID) phase on the pretext of

security of supply and certainty of price. This hurdle is slightly improved post FID;; however,

long-term contracts with beneficial terms and pricing for purchasers are only truly realised in

post commercial operation date (COD) LNG sourcing.

Considering the current pricing environment, securing volumes from a single LNG facility

(assuming it was available) on a short-term basis for Xaris would be priced at approximately

12.9% * Brent + $0.20/MMBtu (+/- $0.30). For instance, with October Brent at $102.25/bbl,

the delivered price into Namibia is ~$13.39/MMBtu versus an October JKM DES price (i.e.

spot price) of $12.025/MMBtu (Excelerate’s indicative price for Namibia would be

$11.75/MMBtu). Thus, sourcing in this manner has historically been expensive (see Table 4:

Global LNG Imports above).

In order to support the reduction in the long-term project tariff, the Xaris Energy project will

purchase spot market LNG for the minimum volume required for five years of the project and

pursue a longer-term supply contract thereafter. The benefits of this would be twofold:

• Purchasing long-term supply when there is surplus LNG available in the market

thus depressing the prices

• The project would be at post COD stage meaning no project development

uncertainty for a long-term supplier

Both of these will allow for the negotiation of a more beneficial longer-term contract, which

can be tied to the Xaris Energy power plant.

Fuel Selection Page 24

8.2.3 Excelerate Energy: LNG Agent Walvis GasPort, which is established as a special-purpose vehicle (SPV), will supply gas to

the Xaris Energy power plant. As Walvis GasPort is a newly-formed SPV, it has no LNG

sourcing credentials;; the Xaris team will rely on the expertise of Excelerate Energy for the

sourcing and supply of fuel for the power plant.

Sourcing LNG on a spot basis requires market knowledge/presence, relationships with

suppliers, and shipping expertise. As the requirement for a cargo from Walvis GasPort

realises, LNG needs to be sourced in a timely manner from a location which has spot

volumes available for sale of the right quality, on an LNG ship that is in the right condition to

load, and is compatible with the load port and the discharge terminal. Spot volumes are

priced relative to or as a spread to the world’s popular spot LNG market, known as JKM (the

Japan/Korea Marker). With its experience and relationships with suppliers, Excelerate

Energy is well poised to be the right partner for Walvis GasPort for sourcing LNG.

Excelerate has active LNG trading desks in Houston and London with over 75 LNG master

sales and purchase agreements (SPAs) with reputable LNG companies across the globe.

Excelerate has traded more than 6 million tons of LNG since 2005, often optimizing cargoes

using its logistics experience and ability to de-risk commodity price exposures. The broad

assortment of SPAs in place have allowed Excelerate to load cargoes in every region (see

Figure 8: Loaded by Terminal) and discharge cargoes across the globe (See Figure 9:

Discharges per Region).

Figure 8: Loaded by Terminal

Fuel Selection Page 25

Figure 9: Discharges per Region

To this effect, Walvis GasPort will enter into a fuel supply contract with Excelerate Energy for

the sourcing of fuel for the Xaris power plant.

Upon establishment of the power plant and post COD, Excelerate Energy will explore the

options of adjusting a portion of the sourcing to long-term supply contracts with improved

LNG pricing. Any such improvement in pricing will be passed through to the power plant as

a change in cost provision as detailed in the Power Purchase Agreement.

8.2.4 Fuel Index As a result of the vast global export capacity and regional dynamics, the LNG market has a

number of indices, which are utilised in LNG supply contracts globally. The traditional

indices that have been applied to LNG contracts include:

• NBP, UK National Balancing Point

• Brent/Dated Brent/JCC crude indexed

• Henry Hub indexed

• JKM, Japan/Korea Marker

The JKM index is a spot index and will be utilised as the LNG fuel index for the project.

Typical forward curves for spot price LNG purchases are limited to three months and spot

price peaks generally coincide with the northern hemisphere winter months. It is anticipated

that the LNG and power demand in Namibia will peak outside the northern hemisphere

winter envelope, which will further enhance the securing of LNG at a more favourable price.

Fuel Selection Page 26

8.2.5 Alternate Supply Provisions Xaris Energy has been in discussion with Angola LNG Marketing Limited for the supply of

LNG for the planned project. Angola LNG has indicated that, due to the current state of the

liquefaction trains, they are not in a position to fully commit LNG supply to the project. This

being noted, Walvis GasPort has appointed Excelerate Gas Marketing to act as agent for

fuel sourcing. Should Angola LNG be in a position to provide gas to the project, Excelerate

Gas Marketing would facilitate the transaction.

One of the benefits of sourcing volume from spot market as opposed to signing a long-term

contract is the ability to source LNG from any facility. Under a long-term contract, the buyer

has certain obligations to work with the seller under force majeure circumstances at the load

port, costing the buyer time and money. Furthermore, the buyer may not be able to

terminate the contract owing to force majeure events until certain limits are triggered. When

securing volumes from the spot market, the buyer maintains the optionality to procure LNG

from a range of potential liquefaction facilities based off of the buyers schedule and volume

requirements, and perhaps from a facility that is not plagued by force majeure events.

According to current project schedules, approximately 24.8 MTPA of divertible supply will be

online in the US Gulf Coast alone by 2018 and approximately 80 MTPA by 2021. The

International Group of LNG Importers’ (GIIGNL’s) latest annual report also confirms that spot

trades continue to increase in volume and as a percentage of total LNG trade (see Figure

10: Divertible vs Contracted Volumes Traded)

Figure 10: Divertible vs Contracted Volumes Traded

Fuel Selection Page 27

Buying on a spot basis leads to more advantageous pricing as it capitalizes on the

expansion of the market while also diversifying supplies from one plant to many, providing

more operational security of supply against force majeure events.

8.2.6 Fuel Supply with no Take or Pay Arrangement NamPower has indicated through the request for proposal that it has a preference for a no-

take or pay arrangement for the fuel. The Walvis GasPort project will aim to support this

requirement by diversification of the Walvis GasPort gas offtake client base. Engagement

with various interested parties has commenced and Figure 11: Projected Walvis Bay Gas

Offtake Agreements indicates the projected gas offtake agreements that would support the

Walvis GasPort project.

Figure 11: Projected Walvis Bay Gas Offtake Agreements

The gas offtake agreements with potential clients will result in a benefit to NamPower as the

proposed LNG facility will be in a position to negotiate increased gas sales to other clients

should the power station not utilise its projected fuel requirements.

0

10

20

30

40

50

60

2016

2017

2018

2019

2020

2021

2022

2023

2024

2025

2026

2027

2028

Million mmBTU

Period

Gas Offtaker 7

Gas Offtaker 6

Gas Offtaker 5

Gas Offtaker 4

Gas Offtaker 3

Gas Offtaker 2

Gas Offtaker 1

NamPower Xaris Energy

Fuel Selection Page 28

8.2.7 Scheduling of Drops and Storage Capacity The Walvis GasPort project will communicate the scheduled drops for fuel with Excelerate

Gas Marketing. The current proposed drop schedule is based on the Xaris Energy power

plant. The scheduled fuel drops indicate an average period of 6 weeks between fuel drops.

Figure 12: LNG Inventory

The floating storage facility makes provision for the storage of 138,000 cubic meters of

liquefied natural gas. This storage volume translates into an energy content of 3.2million GJ,

which will provide 54 days of storage for the power plant as specified by NamPower.

The multiple benefits of a natural gas- fired power plant are clearly indicated above. In

addition, the use of natural gas has the added advantage of enabling the Walvis Bay region

to be “Kudu” ready. Xaris have therefore based the plant design on a natural gas fuel.

0

0.5

1

1.5

2

2.5

3

3.5

0

0.05

0.1

0.15

0.2

0.25

0.3

0.35

0.4

0.45

1 4 7 10 13 16 19 22 25 28 31 34 37 40 43 46 49 52 55 58 61 64 67 70 73 76 79 82 85 88 91

Remaining Inventory [mmBTU]

Million mmBTU

Weeks of Operation

Namibia Second Gas Off-Taker Inventory