Working with European Developers Ian Baverstock Senior Partner, Tenshi Consulting.

-

Upload

victoria-young -

Category

Documents

-

view

219 -

download

1

Transcript of Working with European Developers Ian Baverstock Senior Partner, Tenshi Consulting.

Working with European

DevelopersIan Baverstock

Senior Partner, Tenshi Consulting

Overview

•Understanding the European development sector

•Working with European developers as clients to help them develop games

•Working with European developers as partners/suppliers to reach European audiences

• Investing in European developers

Who Am I?

•20 Year veteran game developer based in the UK

•Also previously Chairman of the UK Game Development trade association: TIGA

•Member of the GDC Advisory Board

•Now a consultant, investor and entrepreneur in the games sector

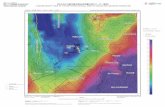

What’s this ‘Europe’ thing?

•The European Union is:

• 27 different countries

• Approximately 500M people

• 23 official languages, 150 regional and minor languages

• A very diverse place

•7% of global population, 20% of global GDP

•That’s just the European Union, not ‘Europe’

European Gamers

•Average participation is 25% of adults, varying from approximately 15% in Poland to 40% in France

•PC remains most popular platform

• Difficult to get accurate data on browser gaming penetration

•Mobile and Wii next most popular devices

• Mobile growing very fast

European Gamers

•Console penetration varies hugely

• Xbox much stronger in UK

• All consoles weak in Eastern Europe

•Gamers are 3:2 Male/Female

•Higher proportion of younger people but still 30% of the 35-44 age group play games

Compared to the US

•Higher importance of handheld games

• Cheaper devices

• More public transport

•More varied mobile market

• Higher penetration for Android

•Online penetration perceived as weaker but caught up

Broadband

•Penetration by household is similar to the US (Approximately 80% on average)

•Penetration by population is slightly higher

• Higher occupancy housing

Facebook/Social

•Europe has more Facebook users than North America (209M vs 168M)

•Penetration is still much lower

•Variation again large (UK 47% vs Germany 24%)

• Facebook is still the only social network that matters in Europe

Sector Overview

•Europe is a strong centre of development for large, graphically powerful retail games

• UK and Nordic region particularly on Console

• Germany and Central Europe particularly on PC

Sector Overview

•Mobile games development has always been strong in the Nordic region, UK and Germany

•Social Game development very strong in the UK

•Both these areas show strong geographical overlap with the non-games development sectors on these platforms

Sector Overview

•Browser based game development has been strongest in Germany

• Reflects the historically strong German PC development sector

• Reaching saturation, now diversifying in to mobile

• Especially mobile free to play

Company Breakdown

• Larger development studios usually owned by their publisher

• UK Still has a large cohort of independent game developers with 50 - 300 staff working on console games

• France hit very hard by tax breaks in Canada

Company Breakdown

•The console publishers are almost all American or Japanese

• Ubisoft is the obvious exception

•Almost all the large studios are familiar with working for ‘remote’ organisations

• Independents work for about $10K/man month

• Almost all now producing own IP in mobile or social too

Distribution

•Physical goods distribution and retail are now suffering significant upheaval as the current console cycle matures

• Declining revenues from physical goods coinciding with end of console life-cycle

•No growth or investment in this area

Company Breakdown

•Mobile studios are still mostly much smaller

•Vast numbers of tiny developers on iOS and Android

• Potential source of IP/ideas

• Market maturing in every way very quickly

• Widely distributed across Europe

Company Breakdown

•Bigger mobile developers are developing marketing and cross promotion platforms

• Learning to monetize their existing community

• Large investment by DeNA & Gree

•Still dominated by US publisher money, US distribution strength and Apple/Google

•Strong European support for Windows 8

Company Breakdown

•Europe very strong on social game development

• A lot of the successful companies are now owned by American corporations

• Investment and start-ups now significantly reduced

•A lot of talent in European social gaming is struggling with the disparate market in Europe

Company Breakdown

•Many start-ups in MMO games

•All driven by free-to-play (F2P)

•Browser game development on Flash is very common but mostly small companies

• Flash dying as an MMO platform

•Most F2P PC games are client downloads

Sector Strengths

•Developers in Europe are used to working for international customers

•They are strong on understanding localisation of games and working with IP that needs to be crafted for a local audience

Sector Strengths

•Relatively low cost for very high end skills

•Creatively led

•Very strong in non-cinematic arts like music, fine art and literary story telling

Sector Market Strengths

•Europe leading the US in free-to-play browser gaming

•At least as strong as the US on mobile

•Close behind the US on social platforms

• Increasing government support & tax breaks

Sector Weaknesses

•Europe is expensive compared to almost everywhere except the US

• Labour immobility (compared to US)

•Very strong employment laws mean staff are a significant commitment by employers

Sector Market Weaknesses

• Fragmented consumer market

• Few European industry champions

•Businesses tend to be smaller & operate at a smaller scale compared to the US

•Weak in subscription MMOs

Supplying services to European developers

• Increasingly competitive market

•Cost is a driver but not determining issue

•There are nearer low cost suppliers

•Timeliness is very important

• If their team is waiting for you, that is very expensive

Supplying services to European developers

•Efficiency of communication crucial

• Significant cost on their side is the management process

• Complaints about quality are really complaints about time & effort needed to get quality right

Supplying services to European developers

•Marketing to them is not a good idea at Trade Shows

•A lot of outsourcers make the mistake of trying to communicate at too high a level in the development companies

•Very small industry: reputation and consistency are crucial to success

Using Europeans to reach a European audience

•The larger independent (ie not publisher owned) developers are mostly service companies

•Going to the publishers is only sensible if you need their distribution strength

• Marketing can be sourced elsewhere

•European publishers often have limited development & production understanding

Online European Distribution

•Very competitive market

•Major players are focused on their own IP and cross promotion within their portfolio

•Other big players are poor at online marketing & inexperienced

• Lots of smaller players though

•Building your own team is possible

• Lots of supporting consultants to help

Online European Distribution

• Important to choose the right location for any European operation

•Generally people are not as mobile as in the US

•Access to a pool of multi-lingual staff crucial

European Investment Overview

•Can’t escape overall investment climate

•Venture Capital and Early Stage money trying to compete but small scale

•Games not dealt with by specialists

•Public markets attaching very low values to games companies

European Investment Overview

•Opportunities for larger Chinese companies to use their higher valuations to add quality assets in Europe that would be much more expensive in the US

•Access to high-end production skills and market expertise are biggest opportunities

•The larger independent developers and smaller publishers represent good value

European Investment Overview

•Social games sector is already mature for investment, those not already acquired are investment opportunities but riskier

•Mobile and mobile/social companies are common and acquirable

• Lots of emerging mobile marketing & community investment opportunities

•Browser gaming distribution is rapidly changing and difficult to find good value

Investment Issues

•Service businesses probably own technology and process IP but not proven game IP

•Staff legal commitments

•Recruitment issues for engineers

•Most of the development sector struggles with the transition away from owner/manager

Tenshi’s View

•Europeans open to business with China

•Used to working across cultures

•Good time to develop relationships there

•Company values are lower than US

•Costs are (a bit) lower than US

•Market opportunities still strong

• Ian Baverstock

•Tenshi provides consultancy and investment advice in the European Games Sector

•www.tenshiconsulting.com