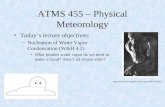

Withdraw Money From Bank of India ATMs Without an Account - The Times of India

-

Upload

pintu-kumar -

Category

Documents

-

view

6 -

download

0

description

Transcript of Withdraw Money From Bank of India ATMs Without an Account - The Times of India

-

3/26/2014 Withdraw money from Bank of India ATMs without an account - The Times of India

http://timesofindia.indiatimes.com/business/india-business/Withdraw-money-from-Bank-of-India-ATMs-without-an-account/pmarticleshow/32657141.cms?prtpag 1/2

Withdraw money from Bank of IndiaATMs without an account Tweet

37

The receiver wou ld receive partial detai ls

for cash withdrawal on mobile phones.

PTI | Mar 25, 2014, 01.38PM IST

MUMBAI: Bank of India on Tuesday became the

first state-run lender to allow withdrawal of funds

to individuals from its ATMs without an account in the bank.

Last month, RBI governor Raghuram Rajan had said that individuals without a bank account will soon be able

to receive money from those with bank accounts, using automated teller machines (ATM).

The city-based bank launched a domestic remittance service called 'Instant money transfer (IMT)' that allows

cardless cash withdrawal from it select ATMs which are tuned for this facility.

The IMT allows a customer to send money to a receiver only by using the receiver's mobile number through the

bank's ATM or using retail Internet banking facility. The receiver may withdraw money from designated BoI ATMs without using a debit card.

The receiver would receive partial details for cash withdrawal on mobile phones.

"This service is in line with the RBI's expectation of expanding financial inclusion, wherein fund transfer can happen from account holders to those

without accounts through ATMs," BoI Chairperson and Managing Director V R Iyer told reporters here.

Iyer said that some of ATMs are already being made ITM-enabled and the rest will be enabled in 20 days. With this facility, a beneficiary can

withdraw up to Rs 25,000 through IMT transaction on monthly basis while per transaction limit is set up Rs 10,000.

The sender will be charged of IMT fee of Rs 25 for every IMT transaction, he or she issues to a receiver or beneficiary.

Iyer said bank has added 2,100 ATMs in the current fiscal and its total network of ATMs stands at 4,000 as of today. The bank will be adding 100

more ATMs in this week, she said.

Gulf airlines defend female

cabin crew policies

Genetically modified crops

hold the key to food security

Gems and jewelry bourse to

come up in Jaipur

FEATURED ARTICLES

Printed from

More from The Times of India

Virat Kohli can be better than Sachin Tendulkar: Kapil Dev 25 Mar2014

Im more Malayali than MOST others 06 Mar 2014

Will pay Rs 20,000 crore to Sebi within one year: Sahara's freshproposal 25 Mar 2014

Free sex for Nikita 15 Mar 2014

Neetu Chandra makes a shocking confession 03 Mar 2014

I will try my best to get Big B to my bedroom: Bua 25 Mar 2014

Recommended by