w.c. report

-

Upload

pallavi-jain -

Category

Documents

-

view

225 -

download

0

Transcript of w.c. report

-

8/10/2019 w.c. report

1/27

1]

A

PROJECT REPORT

ON

WORKING CAPITAL MANAGEMENT

SUBMITTED TO: SUBMITTED BY:

Aditya Sharma

-

8/10/2019 w.c. report

2/27

2]

ACKNOWLEDGEMENT

First and foremost, I would like to express my gratitude to all those

people who helped me in completing my project at Hindustan Zinc Ltd,

debari, Udaipur. My project title is WORKING CAPITAL

MANAGEMENT.

I have tried to give credit all sources from where I have drawn Material

in this project still there may have remained unintended errors. I shall

tell obliged if they are brought to may notice.

I am grateful to may product guide at Hindustan Zinc Ltd. for their kindCooperation, support & guidance without it would not have been

possible for me to complete this project work at time.

I would like to express my gratitude to our respected professor Mitisha

Sharma for the valuable guidance, which helped me through the project.

I would very much appreciate & sincerely acknowledge readers for

improving the quality of this project.

Aditya Sharma

-

8/10/2019 w.c. report

3/27

3]

TOPIC PAGE NO.1. INTRODUCTION 4

2.

OBJECTIVES OF WORKING

CAPITAL MANAGEMENT

6

3. MEANING OF WORKING CAPITAL7

4. Classification of Working Capital 8

5. Principles of Working Capital

Management11

6.

Operating Cycle 12

7. Determinants of Working Capital 14

8. THE NEED FOR THE WORKING

CAPITAL

15

9. IMPORTANCE OF WORKING

CAPITAL

17

10.DANGERS OF EXCESSIVE

WORKING CAPITAL

19

11.ESTIMATION OF CURRENT

ASSETS

21

12.

ESTIMATION OF CURRENT

LIABILITIES

24

13.REFERENCE 27

-

8/10/2019 w.c. report

4/27

4]

INTRODUCTION

Working capital management is an important aspect of financial

management. In business money is required for fixed assets and

working capital. Fixed assets are required to be retained in the

business for the long period and yield return over the life of such

assets. The main objective of working capital management is to

determine the optimum amount of working capital required.

Generally, management of working capital means management of

current assets. Working capital management in an MNE requires

managing the repositioning of cash flows, as well as managing

current assets and liabilities, when faced with political foreign

exchange, tax and liquidity constraints. The overall goal is to reduce

funds tied up in working capital while simultaneously providing

sufficient funding and liquidity for the conduct of global business.

This should enhance return on assets and return on equity. It also

should improve efficiency ratios and other evaluation of performanceparameters. The first section of this chapter describes Tridents

operating cycle. The second section analyzes Tridents fund

repositioning decisions. The third section examines the constraints

That affects the repositioning of Tridents funds. The fourth section

identifies alternative conduits for moving funds. The fifth section

introduces the management of net working capital, including accounts

receivable, inventory, and cash. The sixth and final section examines

how working capital is financed, including the various types ofbanking services available. The chapter concludes with the Mini-

Case, Honeywell and Pakistan International Airways, which

demonstrates the complexity of working capital management for

multinational firms operating in emerging markets.

-

8/10/2019 w.c. report

5/27

5]

Working capital is the life blood and nerve centre of a business. Just as

circulation of blood is essential in the human body for maintaining life,

working capital is very essential to maintain the smooth running of a

business. No business can run successfully without an adequate amount

of working capital.

There is operative aspects of working capital i.e. current assets which is

known as funds also employed to the business process from the gross

working capital Current asset comprises cash receivables, inventories,

marketable securities held as short term investment and other items

nearer to cash or equivalent to cash. Working capital comes into

business operation when actual operation takes place generally the

requirement of quantum of working capital is determined by the level

of production which depends upon the management attitude towards risk

and the factors which influence the amount of cash, inventories,

-

8/10/2019 w.c. report

6/27

6]

receivables and other current assets required to support given volume of

production.

Working capital management as usually concerned with administration

of the current assets as well as current liabilities. The area includes the

requirement of funds from various resources and to utilize them in all

result oriented manner. It can be stated without exaggeration that

effective working capital management is the short requirement of long

term success.

The importance of working capital management is indisputable;

Business liability relies on its ability to effective management of

receivables, inventory, and payables. By minimizing the amount of

funds tied up in current assets. Firms are able to reduce financing costs

or increase the funds available for expansion. Many managerial effortsare put into bringing non-optimal level of current assets and liabilities

back towards their optimal levels.

OBJECTIVES OF WORKING CAPITAL MANAGEMENT

Effective management of working capital is means of accomplishing the

firms goal of adequate liquidity. It is concerned with the administration

-

8/10/2019 w.c. report

7/27

-

8/10/2019 w.c. report

8/27

8]

of that portion of assets of a business which are used in or related to its

current operations. It refers to funds which are used during an

accounting period to generate a current income of a type which is

consistent with major purpose of a firm existence.

Classification of Working Capital

The quantitative concept of Working Capital is known as gross working

capital while that under qualitative concept is known as net working

capital.

Working capital can be classified in various ways. The important

classifications are as given below:

Conceptual classification

There are two concept of working

capital viz., quantitative and qualitative. The quantitative concept takes

into account as the current assets while the qualitative concept takes into

account the excess of current assets over current liabilities. Deficit of

working capital exists where the amount of current liabilities exceeds the

amount of current assets. The above can be summarized as follows:(i) Gross Working Capital = Total Current Assets

(ii) Net Working Capital = Excess of Current Assets over

Current Liabilities

-

8/10/2019 w.c. report

9/27

9]

(iii) Working Capital Deficit = Excess of Current Liabilities over

Current Assets.

Classification on the basis of financial reports

The information

of working capital can be collected from Balance Sheet or Profit

and Loss Account; as such the working capital may be classified

as follows:

(i) Cash Working Capital This is calculated from the

information contained in profit and loss account. This

concept of working capital has assumed a greatsignificance in recent years as it shows the adequacy of

cash flow in business. It is based on Operating Cycle

Concepts which is explained later in this chapter.

(iii) Balance Sheet Working Capital The data for Balance

Sheet Working Capital is collected from the balance sheet.

On this basis the Working Capital can also be divided in

three more types, viz., gross Working Capital, net Working

Capital and Working Capital deficit.

Classification on the Basis of Variability Gross Working

Capital can be divided in two categories viz., (I) permanent or

fixed working capital, and (ii) Temporary, Seasonal or

variable working capital. Such type of classification is very

important for hedging decisions.

Temporary Working Capital Temporary Working Capital isalso called as fluctuating or seasonal working capital. This

represents additional investment needed during prosperity and

favorable seasons. It increases with the growth of the business.

Temporary working capital is the additional assets required to

meet the Variations in sales above the permanent level.8

This can

-

8/10/2019 w.c. report

10/27

10]

be calculated as follows: Variations in sales above the permanent

level.8

This can be calculated as follows:

Permanent Working Capital

It is a part of total current assets which

is not changed due to variation in sales. There is always a minimum

level of cash, inventories, and accounts receivables which is always

maintained in the business even if sales are reduced to a minimum.

Amount of such investment is called as permanent working capital.

Permanent Working Capital is the amount of working capital that

persists over time regardless of fluctuations in sales.This is also called

as regular working capital.

Principles of Working Capital Management

Principles of the risk variation:Risk here refers to

the inability of firm to maintain sufficient current assets to pay its

obligations. If working capital is varied relative to sales, the amount of

risk that a firm assumes is also varied and the opportunity for gain or

loss is increased. In other words, there is a definite relationship between

the degree of risk and the rate of return. As a firm assumes more risk, the

opportunity for gain or loss increases. As the level of working capitalrelative to sales decreases, the degree of risk increases. When the degree

of risk increases, the opportunity for gain and loss also increases. Thus,

if the level of working capital goes up, amount of risk goes down, and

vice-versa, the opportunity for gain is like-wise adversely affected.

-

8/10/2019 w.c. report

11/27

11]

Principle of equity position:According to this

principle, the amount of working capital invested in each

component should be adequately justified by a firms equity

position. Every rupee invested in the working capital should

contribute to the net worth of the firm.

Principle of cost of capital:

This principle emphasizesthat different sources of finance have different cost of capital.

It should be remembered that the cost of capital moves

inversely with risk. Thus, additional risk capital results in

decline in the cost of capital.

Principle of maturity of payment:A company should

make every effort to relate maturity of payments to its flowof internally generated funds. There should be the least

disparity between the maturities of a firms short-term debt

instruments and its flow of internally generated funds,

because a greater risk is generated with greater disparity. A

margin of safety should, however, be provided for any short-

term debt payment.

-

8/10/2019 w.c. report

12/27

12]

Operating Cycle

The duration of time required to complete the following

sequence of events, in case of manufacturing firm, is calledthe operating cycle:

1.Conversion of cash into raw materials.

2.Conversion of raw materials into work-in-progress.

3.Conversion of work in process into finished goods.

4. Conversion of finished goods into debtors and bills

receivables through sales.

5. Conversion of debtors and bills receivables into cash.

The length of cycle will depend on the nature of business. Non

manufacturing concerns, service concerns and financial

concerns will not have raw material and work-in-process so

their cycle will be shorter. Financial Concerns have a shortest

operating cycle.

-

8/10/2019 w.c. report

13/27

13]

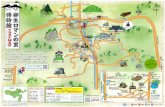

Operating Cycle of Manufacturing Concerns

Determinants of Working Capital

There are no set rules or formulas to determine the working capitalrequirement of a firm. A number of factors influence the need andquantum of the working capital of a firm. These are discussed below:

Nature of industry: The composition of an asset is relatedto the size of a business and the industry to which it belongs.Small companies have smaller proportion of cash, requirementsand inventory than large corporations. Need of working capitalis thus determined by the nature of an enterprise.

-

8/10/2019 w.c. report

14/27

14]

Demand of creditors: Creditors are interested in thesecurity of loans. They want their advances to be sufficientlycovered. They want the amount of security in assets which aregreater than liabilities.

Cash requirements: Cash is one of the current assetswhich are essential for the successful operations of theproduction cycle. Cash should be adequate and properlyutilized. A minimum level of cash is always needed to keep theoperations going.

General nature of business: The general nature of abusiness is an important determinant of the level of theworking capital. Working capital requirements depends upon

the general nature and its activity on work. They are relativelylow in public utility concerns in which inventories andreceivables are rapidly converted into cash. Manufacturingorganizations, however, face problems of slow turn-over ofinventories and receivables, and invest large amount inworking capital.

Time: - The level of working capital depends upon the timerequired to manufacture goods. If the time is longer, theamount of working capital required is greater and vice-versa.

Moreover, the amount of working capital depends uponinventory turnover and the unit cost of goods that are sold. Thegreater this cost, the larger is the amount of working capital.

-

8/10/2019 w.c. report

15/27

15]

Volume of sales: This is the most important factoraffecting the size and component of working capital. A firmmaintains current assets because they are needed to support theoperational activities which results in sales. The volume of sales

and the size of the working capital are directly related to eachother. As the volume of sales increases, there is an increase inthe investment of working capital in the cost of operations, in

inventories and in receivables.

Terms of purchases and sales: If the credit terms ofpurchases are more favorable and those of sales less liberal, lesscash will be invested in inventory. With more favorable creditterms, working capital requirements can be reduced as a firm

gets time for payment to creditors or suppliers.

Inventory turnover:If the inventory turnover is high, theworking capital requirements will be low. With good andefficient inventory control, a firm is able to reduce its workingcapital requirements.

Receivables turnover: It is necessary to have effectivecontrol over receivables. Prompt collection of receivables andgood facilities for setting payables result into low working

capital requirements.

THE NEED FOR THE WORKING CAPITAL

The need for working capital arises due to the time gap between

production and realization of cash from sales. Working capital

-

8/10/2019 w.c. report

16/27

16]

is must for every business for purchasing raw-materials, semi

finished goods, stores & spares etc and the following purposes.

1.

To purchase raw materials, spare parts and other component.

A manufacturing firm needs raw-materials and other

components parts for the purpose of converting them in to final

products, for this purpose it requires working capital. Trading concern

requires less working capital.

2.

To meet over head expenses.

Working capital is required to meet recurring over head expenses suchas cost of fuel, power, office expenses and other manufacturing

expenses.

3.To hold finished and spare parts etc.

Stock represents current asset. A firm that can afford to maintain stock

of required finished goods, work in progress & spares in required

-

8/10/2019 w.c. report

17/27

17]

quantities can operate successfully. So for that adequate quantity of

working capital is required.

4.Pay selling & distribution expenses.

Working capital is required to pay selling & distribution

expenses. It includes cost of packing, commission etc.

5.Working capital is required for repairs & maintenance both

machinery as well as factory buildings.

6.Working capital is required to pay wages, salaries and other

charges.

7. It is helpful in maintain uncertainties involved in business field.

IMPORTANCE OF WORKING CAPITAL

1.Solvency of the business:Adequate working capital helps in

maintaining the solvency of the business by providing

uninterrupted of production.

2. Goodwil l : Sufficient amount of working capital enables a firm

to make prompt payments and makes and maintain the goodwill.

-

8/10/2019 w.c. report

18/27

-

8/10/2019 w.c. report

19/27

19]

conditions such as purchasing its requirements in bulk when the prices

are lower and holdings its inventories for higher prices.

8.Abil i ty to Face Crises: A concern can face the situation during

the depression.

9.Quick and regular return on investments: Sufficient

working capital enables a concern to pay quick and regular of

dividends to its investors and gains confidence of the investors and

can raise more funds in future.

10. High morale: Adequate working capital brings an

environment of securities, confidence, high morale which results in

overall efficiency in a business.

DANGERS OF EXCESSIVE WORKING CAPITAL

Too much working capital is as dangerous as too little of it. Excessive

working capital raises problems.

1. It results in unnecessary accumulation of inventories. Thus chances

of inventory mishandling, waste, theft and losses increase.

-

8/10/2019 w.c. report

20/27

-

8/10/2019 w.c. report

21/27

21]

1.Total costs incurred on material, wages and overheads.

2.The length of time for which raw material are to remain in

stores before they are issued for production.

3.The length of the production cycle or work-in-process, i.e., the

time taken for conversion of raw material into finished goods.

4.The length of sales cycle during which finished goods to be

kept waiting for sales.

5.

The average period of credit allowed to customers.

6.The amount of cash required paying day-today expenses of the

business.

7.The average amount of cash required to make advance

payments.

8.The average credit period expected to be allowed by suppliers.

9.Time lag in the payment of wages and other expenses.

ESTIMATI ON OF CURRENT ASSETS

-

8/10/2019 w.c. report

22/27

22]

1.Raw Material I nventory:

The I nvestment i n Raw Mater ial can be computed with the help

of the following formula:-

Budgeted Cost of Raw Average Inventory

Production x Material(s) x Holding Period

( In units ) per unit (months/days)

12 months / 52 weeks / 365days

2.Work-in-progress (W/P) I nventory:

The relevant cost of determine work in process inventory are the

proportionate share of cost of raw material and conversion costs ( labors

and Manufacturing over Head cost excluding depreciation) In case, full

until of raw material is required in the beginning the unit cost of work is

process would be higher, i.e., cost of full unit + 50% of conversion cost

compared to the raw material requirement. Throughout the production

Cycle, working process is normally equivalent to 50% of total cost of

production. Symbolic

Budgeted Estimated work- Average Time Span

Production x in-progress cost x of work-in-progress

per unit inventory (months/days)

12 months / 52 weeks / 365days

-

8/10/2019 w.c. report

23/27

23]

3.F inished Goods I nventory:

Working capital required to finance the finished goods inventory is

given by factors summed up as follows:-

Budgeted Cost of Goods Produced Finished

Goods

Production x per unit (excluding x Holding

Period

(in units) depreciation)

(months/days)

12

months / 52 weeks / 365days

4. Debtors:

The working capital tied up in debtor should be estimated in relation to

total cost price (excluding depreciation) symbolically,

Budgeted Cost of Sales per Average Debt

Production x unit excluding x Collection Period

( In units ) depreciation (months/days)

12onths / 52 weeks / 365days

-

8/10/2019 w.c. report

24/27

24]

5.Cash and Bank Balances:

Apart from Working Capital needs for Financing Inventories and

Debtors, Firms also find it useful to have such minimum cash Balances

with them. It is difficult to lay down the exact procedure of determining

such an amount. This would primarily be based on the motives of

holding cash balances of the business firm, attitude.

ESTIMATION OF CURRENT LI ABIL I TIES

The Working Capital needs of business firms are lower to the extent that

such needs are met through the Current Liabilities(other than Bank

Credit) arising in the ordinary course of business. The Important Current

Liabilities in this context are Trade-Creditors, Wages and Overheads:-1.

1. Trade Creditors:

The Funding of Working Capital from Trade Creditors can be

computed with the help of the following formula:-

-

8/10/2019 w.c. report

25/27

25]

Budgeted Yearly Raw Material Credit Period

Production x Cost x Allowed by creditors

(In units) per unit (months/days)

12

months / 52 weeks / 365days

2. Di rect Wages:

The Funding of Working Capital from Direct Wages can be

computed with the help of the following formula:-

Budgeted Yearly Direct Labor Average Time-lag in

Production x Cost x Payment of wages

(In units) per unit (months/days)

12

onths / 52 weeks / 365dayss

3. Overheads (other than Depreciation and Amortization):

The Funding of Working Capital from Overheads can be computed with

the help of the following formula:-

-

8/10/2019 w.c. report

26/27

26]

Budgeted Yearly Overhead Average Time-lag in

Production x Cost x Payment of overheads

(In units) per unit (months/days)

12 months / 52 weeks / 365days

-

8/10/2019 w.c. report

27/27

REFERENCE

www.google.com

www.wikipedia.org

www.transtutors.com

www.wikipedia.com

www.slideshare.com

http://www.google.com/http://www.wikipedia.org/http://www.transtutors.com/http://www.transtutors.com/http://www.wikipedia.com/http://www.wikipedia.com/http://www.wikipedia.com/http://www.transtutors.com/http://www.wikipedia.org/http://www.google.com/