Vmw options

Click here to load reader

-

Upload

stockanalyst -

Category

Business

-

view

1.093 -

download

0

description

Transcript of Vmw options

October 15, 2010

Software Weekly Download: Lessons From the Options Market

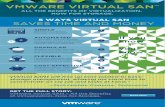

Insights from the Options Market. Option prices contain useful information on future volatility that can offer insights into how the market sees stocks moving over various time horizons. Using Morgan Stanley’s What’s in the Price? Analytics Suite, we have aggregated data from the options market to gauge what options are telling us about our stocks, and to estimate the likely magnitude of stock moves on the day after upcoming earnings releases.

Based on our analysis, the options market is most bullish for RHT and VMW over a one-year time horizon, and most bearish for SYMC, CRM, and MSFT. With a 3-month horizon, option sentiment is similar for most of our companies with the notable exception of ADBE, which is the most bearish among our large-cap names. For our companies that report earnings this month, VMW and CTXS are expected to see the largest moves on the day after earnings (~8.5% and ~7.0%), while MSFT is expected to move the least (~1%).

Key Events in Software Next Week Oct 18 VMW Q3 2010 Earnings 5:00pm ET Oct 20 CHKP Q3 2010 Earnings 8:30am ET Oct 21 FTNT Q3 2010 Earnings 4:30pm ET Oct 21 CTXS Q3 2010 Earnings 4:45pm ET

1-Week 1-Month YTD 2009Return Return Return Return

SW Group: Coverage Return 4.4% 5.3% 24.9% 92.6%SW Group: Large-Cap Return 2.0% -0.9% 23.5% 60.5%SW Group: Small-Cap Return 4.9% 11.1% 26.4% 135.4%S&P 500 Info Tech Index 2.6% 7.4% 3.2% 61.7%S&P 500 Comm Equip. Index 1.3% 6.9% -1.2% 45.9%S&P 500 Hardware Index 4.4% 11.5% 12.7% 74.2%S&P 500 Semiconductors Index 0.7% 5.2% -3.0% 56.7%NASDAQ-100 Tech Index 2.6% 6.6% 9.3% 79.6%MSCI US Broad Market 1.6% 5.2% 6.6% 25.9%NASDAQ 2.2% 6.4% 7.3% 43.9%S&P 500 1.4% 4.7% 5.3% 23.5%Source: Company data, FactSet, Morgan Stanley Research

Average Price Performance: MS Software Group vs. Indices

Recent Reports

Title Date

Microsoft: Windows Phone 7 Shows Potential Oct 11, 2010Adam Holt / Jennifer Swanson, CFA / Melissa Gorham

Intuit: Mgmt. Meetings Point to Accelerating Fundamentals

Oct 13, 2010

Adam Holt / Jennifer Swanson, CFA Software: SaaS Still a Strong Secular Theme, with Room to Grow

Oct 15, 2010

Jennifer Swanson, CFA / Adam Holt / Keith Weiss, CFA

Akamai Technologies, Inc.: Strong Secular Story with Upside Optionality in Video

Oct 14, 2010

Jennifer Swanson, CFA / Scott Devitt / Mary Meeker / Adam Holt

SuccessFactors: New Customers + Upsell Drive Strong Growth; OW

Oct 14, 2010

Jennifer Swanson, CFA / Adam Holt / Keith Weiss, CFA

RightNow Technologies: Business Stabilizing, with Positive FCF Inflection Ahead; Equal-

Oct 14, 2010

Jennifer Swanson, CFA / Adam Holt / Keith Weiss, CFA

NetSuite: Improving Growth, but Too Rich Valuation; Underweight

Oct 14, 2010

Jennifer Swanson, CFA / Adam Holt Taleo Corporation: Solid Platform, but Recruiting Core Limits Growth; EW

Oct 14, 2010

Jennifer Swanson, CFA / Adam Holt DemandTec: Better Times Ahead; Assuming Coverage at EW

Oct 14, 2010

Jennifer Swanson, CFA / Adam Holt / Keith Weiss, CFA

- Pg. 2-4

- Pg. 5

- Pg. 6-12

- Pg. 13-15

- Pg. 16-20Comparable Company Analysis & Metrics Tables

Weekly Performance & Valuation Charts

In This Issue:

Topic of the Week: Option Sentiment & Earnings Impact

Industry News Flow

Software Calendar & Latest Research Published

Morgan Stanley does and seeks to do business with companies covered in Morgan Stanley Research. As a result, investors should be aware that the firm may have a conflict of interest that could affect the objectivity of Morgan Stanley Research. Investors should consider Morgan Stanley Research as only a single factor in making their investment decision. For analyst certification and other important disclosures, refer to the Disclosure Section, located at the end of this report.

Morgan Stanley & Co. Incorporated Adam Holt

[email protected] +1 (1)415 576 2320

Keith Weiss, CFA [email protected]

Jennifer Swanson, CFA [email protected]

Munish Jain

Kelvin Wu

Melissa Gorham

M O R G A N S T A N L E Y R E S E A R C H N O R T H A M E R I C A

Industry View In-Line

2

M O R G A N S T A N L E Y R E S E A R C H

October 15, 2010 Software

Topic of the Week: Insights from the Options Market Option prices contain useful information on future volatility that can offer insights into how the market sees stocks moving over various time horizons. Using Morgan Stanley’s What’s in the Price? Analytics Suite, we have aggregated data from the options market to identify where the market may be undervaluing growth opportunities, and to gauge option sentiment for our large-cap companies. Additionally, we estimate the likely magnitude of stock moves on the day after upcoming earnings releases.

Based on our analysis, the options market is most bullish for RHT and VMW over a one-year time horizon, and most bearish for SYMC, CRM, and MSFT. With a 3-month horizon, option sentiment is similar for most companies with the notable exception of ADBE, which is the most bearish among our large-cap names. For our companies that report earnings this month, VMW and CTXS are expected to see the largest moves on the day after earnings (~8.5% and ~7.0%), while MSFT is expected to move the least (~1%).

Warm-Up: Bull Case Probabilities

We begin by illustrating one use of option-implied probabilities, by identifying where the market may be undervaluing opportunities for upside. The chart below shows the probabilities of MSFT moving beyond our Bull, Base, and Bear case scenarios, as estimated with implied volatility data from the options market. For instance, the probability of MSFT reaching beyond our $35 Bull case in one-year’s time is estimated at ~5%, while the probability of exceeding our $30 PT is ~20%—both of which are among the lowest probabilities for our large-cap stocks. The options market underscores how negative sentiment is for MSFT, and may be too bearish relative to stronger fundamentals.

Exhibit 1 The Options Market is Likely Underestimating the Probability of MSFT Reaching Above our Bull and Base Case Scenarios

US$ 25.23

US$ 35 Prob(> US$ 35 ) ~ 5%

US$ 20 Prob(< US$ 20 ) ~ 25%

US$ 30 Prob(> US$ 30 ) ~ 20%

US$

-

10

20

30

40

50

Oct-08

Jan-09

Apr-09

Jul-09

Oct-09

Jan-10

Apr-10

Jul-10

Oct-10

Dec-10

Feb-11

Apr-11

Jun-11

Aug-11

Oct-11

Source: FactSet, Morgan Stanley Research. Based on Oct 14 prices.

Among our other large-cap companies, CHKP, SYMC, ADBE, and ORCL are also viewed by the market as unlikely to reach above our Bull case scenarios in one year’s time (with probabilities of 10% or less), as shown in the table below. The market’s assessment stands in contrast to our constructive views of CHKP and ORCL, suggesting that the market may be undervaluing the growth opportunities in each of these names.

Exhibit 2 CHKP Viewed by Market as Highly Unlikely to Reach Above our Bull Case Scenarios

Current Price Bull Case

Upside to Bull Case

Prob(>Bull Case)

CHKP $39.29 $56 43% < 5%MSFT $25.23 $35 39% 5%ADBE $27.49 $40 46% 10%SYMC $15.56 $22 41% 10%ORCL $28.33 $38 34% 10%VMW $80.15 $109 36% 20%INTU $47.31 $59 25% 20%RHT $38.41 $50 30% 20%CTXS $58.92 $70 19% 30%CRM $107.36 $120 12% 40%ADSK $33.35 $37 11% 40%

Source: FactSet, Morgan Stanley Research. Based on Oct 14 prices.

Option Sentiment

Option prices can be used to show if market sentiment is more bullish or bearish than usual. As more options investors price in big moves up, the implied probability of a 25%+ rise (say) increases, which we use to indicate an increase in bullish sentiment. Likewise, bearish sentiment would be evidenced by higher probabilities of a 25%+ decline. Since options have expirations that range from months to years, they also enable us to look at the likelihood of moves over different time horizons, providing a more nuanced view of market expectations.

In the chart below, we show option sentiment for VMW, calculated as the ratio of the probability of a 25%+ rise to a 25%+ decline, over a 1-year horizon. By taking the ratio of the probabilities, we can better see the “lean” or sentiment priced into the market. For VMW, current sentiment is significantly higher than historical levels, suggesting that the market is bullish over the medium to long term. We benchmark current sentiment against historical averages in order to adjust for structural forces that may keep the ratio consistently above or below 1.

3

M O R G A N S T A N L E Y R E S E A R C H

October 15, 2010 Software

Exhibit 3 Option Sentiment is Bullish for VMW Relative to Historical Levels

0.0x

0.1x

0.2x

0.3x

0.4x

0.5x

0.6x

0.7x

0.8x

0.9x

1.0x

Oct 08 Jan 09 Apr 09 Jul 09 Oct 09 Jan 10 Apr 10 Jul 10

Probability of a 25% rise / 25% decline as implied by the options market

Source: FactSet, Morgan Stanley Research.

Using the same methodology, the table below shows current sentiment for our large-cap names over a 1-year horizon, benchmarked to their 2-year averages. The far right column shows sentiment normalized to the 2-year mean — whereby positive values imply bullish sentiment and negative values are bearish. For example, MSFT, CRM, and SYMC all score below -1, which indicate unusually bearish sentiment. At the other end of the spectrum, RHT and VMW are the only names to have more bullish-than-usual sentiment.

Exhibit 4 Option Sentiment is Bullish for RHT and VMW Over a 1-Year Time Horizon

Upper Tail Probability

Lower Tail Probability

Current Sentiment (Ratio of

Probabilities)

2-year Average

Sentiment

NormalizedSentiment (Ranked)

RHT 0.25 0.26 0.99x 0.94x 0.81VMW 0.26 0.30 0.87x 0.81x 0.64ADSK 0.25 0.26 0.93x 0.94x -0.18ADBE 0.23 0.25 0.92x 0.95x -0.48CTXS 0.25 0.27 0.93x 0.94x -0.55ORCL 0.19 0.20 0.91x 0.95x -0.68CHKP 0.17 0.17 1.00x 1.04x -0.82INTU 0.19 0.20 0.98x 1.01x -1.00MSFT 0.15 0.21 0.74x 0.84x -1.33CRM 0.28 0.32 0.88x 0.97x -1.35SYMC 0.22 0.24 0.91x 0.99x -1.43

Source: FactSet, Morgan Stanley Research. Current Sentiment as of Oct 14. Note: Normalized sentiment is calculated as the number of standard deviations from the 2-year average,

Likewise, we show option sentiment over a 3-month horizon in the following table, based on probabilities of 15%+ gains and declines. Compared to a 1-year horizon, ADBE shows a markedly more negative sentiment for the next 3 months, suggesting near-term pressure but potentially improving sentiment over the course of the next 12 months. Likewise,

near-term sentiment for VMW appears to be neutral to negative, compared to a more bullish tone for a 1-year horizon.

Exhibit 5 Over a 3-Month Horizon, Sentiment is Bullish for RHT but Neutral to Negative for VMW

Upper Tail Probability

Lower Tail Probability

Current Sentiment (Ratio of

Probabilities)

2-year Average

Sentiment

NormalizedSentiment (Ranked)

RHT 0.22 0.22 1.02x 0.98x 0.91ADSK 0.20 0.20 1.01x 1.01x -0.09VMW 0.24 0.26 0.92x 0.93x -0.12INTU 0.13 0.14 0.91x 0.96x -0.51CHKP 0.12 0.13 0.93x 0.98x -0.56ORCL 0.11 0.13 0.89x 0.97x -0.72CTXS 0.21 0.21 0.97x 0.99x -0.77CRM 0.26 0.26 0.98x 1.05x -1.37SYMC 0.16 0.18 0.91x 1.00x -1.57MSFT 0.08 0.11 0.72x 0.92x -1.65ADBE 0.21 0.22 0.91x 1.00x -2.63

Source: FactSet, Morgan Stanley Research. Current Sentiment as of Oct 14. Note: Normalized sentiment is calculated as the number of standard deviations from the 2-year average,

Earnings Impact

The charts below show the expected impact of next week’s earnings reports for VMW and CTXS, vs. how each stock has moved after recent reports. Based on our analysis, the options market is pricing in moves of ~8.5% for VMW and ~7.0% for CTXS on the day after they report. By comparing these with historical moves, we can gauge the significance of the event as seen by the options market. VMW moved an average 5.5% after the last 4 earnings reports, so the market is pricing in a significantly larger move next week. Likewise, the market sees a large move in CTXS next week relative to recent quarters—if we exclude Q2 when the stock gained 18% after earnings.

Exhibit 6 Options Market Pricing In a ~8.5% Move in VMW on the Day After Earnings

-50%

-40%

-30%

-20%

-10%

0%

10%

20%

3 4 1 2 3 4 1 2 3 4 1 2 3e

2008 2009 2010

% S

tock

Ret

urn

Return on earnings report day

Source: FactSet, Morgan Stanley Research. Based on Oct 14 prices.

4

M O R G A N S T A N L E Y R E S E A R C H

October 15, 2010 Software

Exhibit 7 CTXS Expected to Move ~7% Post Earnings

-15%

-10%

-5%

0%

5%

10%

15%

20%

3 4 1 2 3 4 1 2 3 4 1 2 3e

2008 2009 2010

% S

tock

Ret

urn

Return on earnings report day

Source: FactSet, Morgan Stanley Research. Based on Oct 14 prices.

For the 5 large-cap companies in our group that report this month (shaded below), MSFT is expected to see the least impact from earnings with a move of only ~1%. CHKP’s expected move of ~4% is greater than its 4-quarter average of 2.1%, while SYMC is expected to move ~5.8%, below its 4-quarter average of 8.1%. For companies that report in Nov and Dec, the market-implied moves shown below may well change as they get closer to earnings, as investors focus increasingly on the event.

Exhibit 8 MSFT Expected to Move Only ~1% After Earnings, Below Its 4-Quarter Average of 2.5%

Day After Earnings

Implied Move

ADBE 12/21/2010 10.0%RHT 12/22/2010 9.4%VMW 10/19/2010 8.5%CTXS 10/22/2010 7.0%SYMC 10/27/2010 5.8%CRM 11/17/2010 5.8%ADSK 11/17/2010 4.8%CHKP 10/20/2010 4.0%INTU 11/19/2010 1.2%ORCL 12/17/2010 1.1%MSFT 10/29/2010 1.0%

Source: FactSet, Morgan Stanley Research. Based on Oct 14 prices.

5

M O R G A N S T A N L E Y R E S E A R C H

October 15, 2010 Software

Industry News Flow:

• October 7 – Amazon plans to open an online applications store for smartphones running Google’s Android software, according to The Wall Street Journal. Google’s website currently has 80,000 apps and is the second largest apps source after Apple’s App Store, which has 250,000 apps. Amazon would take a 30% cut of app sales, with developers keeping the rest. Apple and Google charge the same commission fee for their apps stores. Amazon may be able to leverage its existing payment relationships with its customers to drive more apps sales than competitors. (The Wall Street Journal, 10/07/2010)

• October 8 – IBM announced its role as the systems integration partner for the $100M Smart Grid, Smart City initiative led by the Energy/Australia consortium. IBM will play a role in the development of Australia’s first smart grid network. Under the agreement, IBM will build on its existing work on Energy/Australia’s Smart Grid Program, to deliver distributed generation, smart metering and demand management solutions. (IBM Press Release, 10/08/2010)

• October 8 – IDC research shows that the move toward outsourced cloud services will dramatically change the requirements that outsourcers and service providers will need to meet to align with performance and relationship expectations of customers. The IDC study indicates access to new delivery models such as cloud and SaaS is becoming very important, and that the increased need to use these new models is going to significantly elevate customer expectations regarding the performance of their providers. Changing customer expectations will required that providers adjust their delivery capabilities, partner ecosystems, business models and service offerings. (IDC Press Release, 10/08/2010)

• October 11 – AT&T and Microsoft introduced a portfolio of new phones based on Windows Phone 7, Microsoft’s new mobile operating system. The new smartphones from HTC, LG and Samsung will be available exclusively for AT&T customers heading into the holiday season. New devices include HTC Surround, which includes integrated Dolby Mobile and SRS speakers for video watching on the 3.8-inch touch screen. LG Quantum is another new WP7 device, that includes DLNA technology which allows users to wirelessly stream videos, music and pictures from the phone to a DLNA-enabled TV, stereo, Win7 PC and other devices. The Samsung Focus is the thinnest of the WP7 devices with a 9.9 mm-thin touch screen. All three phones will be available in

AT&T stores for $199.99. (Microsoft Press Release, 10/11/2010)

• October 11 – Fortinet announced four new virtual appliances that extend the company’s ability to deliver security across virtualized and cloud environments. The new virtual appliances combine with physical appliances to provide customers with a choice of physical and virtual form factors, working together to mitigate security blind spots and increase security controls within virtualized environments. The new Fortinet virtual appliances were built to run on top of VMware hypervisors. (Fortinet Press Release, 10/11/2010)

• October 11 – Oracle and IBM announced a collaboration to allow developers and customers to build and innovate in the OpenJDK community for open source Java SE development. Oracle and IBM will support the recently announced OpenJDK development roadmap, which accelerates the availability of Java SE across the open source community. (Oracle Press Release, 10/11/2010)

• October 12 – Symantec’s Norton 360 version 5.0 beta is now available for download and testing. Norton 360 beta includes Symantec’s latest generation of reputation-based security technology. The new version also includes identity protection and automatic backup and PC tune-up features. Norton 360 beta also features a new user interface that organizes settings, security controls and information in one simple redesigned screen. The beta is now available for free public download. (Symantec Press Release, 10/12/2010)

• October 12 – Microsoft plans to make a public beta available of a tool that will allow Windows Phone 7 users to sync select content with Mac computers. In fact, according to CNET, Microsoft has been working on a piece of Mac software that will allow certain content to be shared with a Windows Phone 7 device. (CNET, 10/12/2010)

• October 13 – Intuit is preparing as many as five new mobile products for small businesses, according to The Wall Street Journal. Later this year, Intuit expects to unveil and upgrade to its Intuit Online Payroll software that will enable customers to access payroll information from mobile phones, and the company is also working on a sales-register program that will let shop employees take orders and payments from customers as they walk through the store. Intuit is also preparing versions of its existing SMB software to be able to run on table computers, which are expected to be available on the market next year. (The Wall Street Journal, 10/13/2010)

6

M O R G A N S T A N L E Y R E S E A R C H

October 15, 2010 Software

Software Event Calendar:

Exhibit 9

Corporate EarningsDate Ticker Event Time Dial-in / Password

10/18/2010 IBM IBM Q3 2010 Earnings Call 4:30pm ET ph: 210-339-1426 / pwd: 3Q Earnings10/18/2010 AAPL Apple Q4 2010 Earnings Call 5:00pm ET ph: 888-230-549610/18/2010 VMW VMware Q3 2010 Earnings Call 5:00pm ET ph: 517-308-9134 / pwd: Q310/19/2010 EMC EMC Q3 2010 Earnings Call 8:30am ET ph: 210-795-1098 / pwd: EMC10/19/2010 MANH Manhattan Assoc. Q3 2010 Earnings Call 4:30pm ET tba10/19/2010 YHOO Yahoo! Q3 2010 Earnings Call 5:00pm ET ph: 877-384-4189 / pwd: 3122515410/20/2010 CHKP Check Point Q3 2010 Earnings Call 8:30am ET ph: 201-689-8261 10/21/2010 FTNT Fortinet Q3 2010 Earnings Call 4:30pm ET ph: 877-303-6913 / pwd: 1616897010/21/2010 CTXS Citrix Q3 2010 Earnings Call 4:45pm ET ph: 888-799-0519 / pwd: Citrix10/21/2010 CA CA Q2 2011 Earnings Call 5:00pm ET ph: 800-776-0402 10/21/2010 CPWR Compuware Q2 2011 Earnings Call 5:00pm ET tba10/21/2010 INFA Informatica Q3 2010 Earnings Call 5:00pm ET tba10/25/2010 DRIV Digital River Q3 2010 Earnings Call 4:45pm ET ph: 877-303-3145 / pwd: 1693557110/25/2010 ADVS Advent Software Q3 2010 Earnings Call 5:00pm ET ph: 800-299-6183 / pwd: 1545102310/26/2010 JDAS JDA Software Q3 2010 Earnings Call 4:45pm ET ph: 877-941-477510/26/2010 ULTI Ultimate Software Q3 2010 Earnings Call 5:00pm ET ph: 888-262-8797 / pwd: 402478810/26/2010 WBSN Websense Q3 2010 Earnings Call 5:00pm ET ph: 866-757-5630 10/27/2010 SAP SAP Q3 2010 Earnings Call 9:00am ET tba10/27/2010 AKAM Akamai Q3 2010 Earnings Call 4:30pm ET ph: 866-510-0704 / pwd: 6337426810/27/2010 OTEX Open Text Q1 2011 Earnings Call 5:00pm ET ph: 800-814-486110/27/2010 SYMC Symantec Q2 2011 Earnings Call 5:00pm ET ph: 888-208-1711 / pwd: 284956510/28/2010 FIRE Sourcefire Q3 2010 Earnings Call 8:30am ET ph: 866-783-2142 / pwd: 7912261410/28/2010 RNOW RightNow Q3 2010 Earnings Call 4:30pm ET ph: 877-638-9569 10/28/2010 ROVI Rovi Q3 2010 Earnings Call 4:30pm ET ph: 877-941-601010/28/2010 TLEO Taleo Q3 2010 Earnings Call 4:30pm ET ph: 877-459-0998 / pwd: 1765398110/28/2010 BMC BMC Software Q2 2011 Earnings Call 5:00pm ET ph: 913-312-0643 / pwd: BMC10/28/2010 CTCT Constant Contact Q3 2010 Earnings Call 5:00pm ET ph: 877-334-197410/28/2010 SWI SolarWinds Q3 2010 Earnings Call 5:00pm ET ph: 888-455-230810/28/2010 VRSN VeriSign Q3 2010 Earnings Call 5:00pm ET ph: 888-676-877610/28/2010 MSFT Microsoft Q1 2011 Earnings Call 5:30pm ET ph: 888-459-9165 / pwd: MSFT11/1/2010 GUID Guidance Software Q3 2010 Earnings Call 5:00pm ET ph: 877-303-985011/2/2010 CVLT CommVault Q2 2011 Earnings Call 8:30am ET ph: 800-901-524811/2/2010 BLKB Blackbaud Q3 2010 Earnings Call 5:00pm ET ph: 800-967-7134 11/2/2010 KNXA Kenexa Q3 2010 Earnings Call 5:00pm ET ph: 877-407-903911/2/2010 SFSF SuccessFactors Q3 2010 Earnings Call 5:00pm ET ph: 877-398-2615 / pwd: 1643781111/3/2010 BBBB Blackboard Q3 2010 Earnings Call 4:30pm ET ph: 800-561-2601 / pwd: 5219229811/3/2010 QLIK QlikTech Q3 2010 Earnings Call 5:00pm ET ph: 877-312-5507 / pwd: 1706753311/4/2010 TDC Teradata Q3 2010 Earnings Call 8:30am ET tba1/13/2011 INTC Intel Q4 2010 Earnings Call 5:30pm ET tba

Analyst EventsDate Ticker Event Time Location

10/20/2010 BLKB Blackbaud Analyst Day 1:00pm ET Washington D.C.10/27/2010 ADBE Adobe Analyst Day 11:00am ET Los Angeles11/3/2010 SWI SolarWinds Analyst Day 8:30am ET New York

12/14/2010 BMC BMC Analyst Day 8:30am ET New York

Industry EventsDate Event Location/Time

10/18/2010 Gartner Release: Q3 2010 Preliminary Server Data10/19-10/22 VMW VMware's SpringOne 2GX Event Chicago10/20/2010 ORCL Oracle Webcast: Virtualization Overview http://www.oracle.com/investor10/24-10/27 ADBE Adobe MAX 2010 Los Angeles10/27-10/28 QLIK QlikTech "Q Days" Conference in Atlanta Atlanta10/27/2010 FTNT Fortinet & IDC Webinar: 'Evolution of the Enterprise Firewall' webcast10/28-10/29 MSFT Microsoft PDC 2010 Redmond11/30/2010 ADSK Autodesk University 2010 Las Vegas

Source: Company data, FactSet, Morgan Stanley Research

Software Calendar

Latest Research Published: October 8 – Weekly Download: Stock Sentiment Signals. Most investors are well versed in the traditional tools of fundamental analysis; building models, conducting channel checks, valuing stocks and opportunities, and understanding longer-term market trends. However, there are a number of less traditional metrics that can add additional insight into the intangibles that govern and predict stock behavior, and we call these sentiment indicators. We see three broad buckets of sentiment indicators -- sell-side sentiment indicators, buy-side sentiment indicators and management sentiment indicators – that can impact current or future stock performance. Quantifying these inputs can be a challenge, but we believe that data regarding sell-side ratings, estimate revisions, estimate dispersion, short interest and insider selling can help provide a snapshot of where sentiment is currently.

In April 2010, we inaugurated our sentiment snapshot, which we use to score our stocks every quarter on a variety of metrics. In Exhibit 1, we update this analysis and highlight how those scores have changed over the last 3 months. While this list of metrics is hardly exhaustive, we think it does help provide a sense of where investors are most positive currently, and most negative. CTXS tops the overall list on the back of increasing sellside support (high percentage of recent upgrades and positive revisions to revenue and EPS estimates), while the stock also fares well on metrics intended to reflect buyside sentiment like short interest (which remains relatively low) and valuation. CHKP also scores well and has seen the most improvement in sentiment since our last report, following several recent upgrades. ADBE, ADSK, and MSFT have all shown significant sentiment declines, weighed down by growing concerns from both the sellside and buyside of a slowdown in growth. The recent IPOs— IL and QLIK— are excluded from our aggregate rating system because all the metrics are not yet applicable (i.e., change in ratings and sellside revisions).

October 8 – Software: Security a Rising Priority; Spending Set to Accelerate. Increasing priority for security and accelerating spending into 2011 are supportive of our positive views on CHKP and FTNT. Our Oct. 2010 survey of 100 CIOs identified security as a top 3 spending priority for software in 2H10, while security posted the highest up-to-down ratio amongst comm. equipment IT execs. Security spending looks poised to accelerate into 2011 as 85% of surveyed CIOs expect to increasing spending in 2011 vs. 70% reporting increasing spending in 2010. Network security saw the largest incremental increase in positive spending intentions and we continue to favor security vendors well positioned to benefit

7

M O R G A N S T A N L E Y R E S E A R C H

October 15, 2010 Software

from rising demand for multi-function network security appliances. CHKP and FTNT remain our favorite names in security.

Network security refresh poised to accelerate: Amongst the 3 areas of security spend we track in our survey, network security saw the sharpest rise in the % of CIOs looking to increase spending, up from 60% in 2010 to 74% in 2011. The refresh of network security appliance appears to be picking up, with 16% of software execs. indicating plans to refresh their network security gateways in 2011, up from only 6% in 2010. This refresh timing matches well to commentary we’ve heard from security channel partners.

Endpoint security expectations pick-up as well: Endpoint security also saw a rise in the % of CIOs looking to increase spending in the coming year, at 76% expecting to increase spending in 2011 versus 64% in 2010. However, the % of CIOs planning to upgrade SYMC Endpoint Security by 2011 is down slightly from 56% in the March survey to 53%, indicating that demand for SYMC endpoint may be slightly softening.

Comm. equip. priorities highlight increasing demand on security appliances: Security spending intentions were strong in our survey of communications equipment focused IT execs as well. The ratio of execs expecting to increase vs. decrease spending on security appliances rose sharply to 5.5x in the Sept. survey, from 2.3x and 1.5x in our Mar. and Jan. surveys, respectively.

October 11 – Microsoft: Windows Phone 7 Shows Potential. We attended the Windows Phone 7 (WP7) launch event in NYC and left the event cautiously optimistic that MSFT can differentiate through 1) seamless interoperability with productivity apps (Office), 2) tight integration with social and email platforms, 3) compelling Xbox Live functionality along with proprietary gaming content and 4) a consistent experience for consumer and developers regardless of the handset/carrier. While there is risk that MSFT is too late to the market, with positive reviews and ~$400M in marketing spend, MSFT may be able to curb or reverse share losses next year, which would be positive for the stock given extremely low expectations (see our 10/7 note for full details on WP7).

Distribution Provides Consumers Choice: Nine WP7 handsets from OEMs such as LG, Samsung, HTC, and Dell will be available from > 60 carriers in >30 countries. U.S. carriers AT&T and T-Mobile will offer 5 phones by mid-Nov., in time for the holidays, while CDMA handsets from Verizon and Sprint are expected in 2011. The phones come in several form factors

(touch-screen or Qwerty keyboard), while the OS will remain consistent.

Integration with Office, Bing, and Xbox Are Key Differentiators: WP7 presents a simple but sleek user interface (UI) with “hubs” to address specific tasks such as contacts, photos, or music, which offer compelling integration with MSFT products, such as Office, Zune, and Xbox while a seamless integration with Bing brings MSFT search functionality to the forefront. MSFT also noted that “hundreds of thousands of developers” had downloaded the WP7 developer kit, adding to already developed apps such as Twitter, eBay, and Netflix.

U-verse for WP7 and Xbox 360 a Positive Surprise: AT&T announced it will offer its U-verse TV service through WP7 as an app while the Xbox can now be used as a U-verse receiver. For users not currently U-verse subscribers, AT&T will offer a mobile only subscription for $9.99/month, adding another revenue stream and incentive for AT&T to push WP7 over other OS partners.

October 12 – Software: Modest Uptick in NFIB Index; but Conditions Remain Weak. NFIB’s Sept. survey of small businesses (SMBs) saw modest gains vs. Aug., but at 89.0 the index has yet to break the psychologically significant 90 level, and remains well below pre-downturn levels. Sentiment remains mixed, with more SMBs now expecting the economy to improve while at the same time expecting declines in future sales, earnings and employment. Actual business conditions were flat-to-down from Aug., indicative of a 2H10 slowdown. The SMB “optimism index”, which tracks 10 metrics including jobs, capex, and sales, was up 0.2 pts MoM (following a 0.7 pt increase in Aug.) with 6 of the metrics flat-to-up MoM. Cos. with high levels of exposure to SMBs like ADBE, ADSK, INTU, MSFT, N and CRM will ultimately benefit as the SMB market stabilizes, but we favor stocks where a recovery is not yet in estimates, like INTU & MSFT.

Outlook mixed, sales weak. The number of SMBs expecting bus. conditions to improve over the next 6 mos. rose 5 pts to a net -3%, vs. -8% in Aug., and a net 6% believe the next 3 mos. is a “good time to expand”, up 2 pts MoM. However, expectations for sales over the next 3 mos. declined 3 pts MoM to a net -3%, vs. 0% in Aug, actual net sales of -17% were down 1 pt MoM and earnings were down 3 pts at a net -33%. Actual sales and earnings remain above 2009 lows of -34%/-47%.

Capex improved, pricing fell. Capex plans rose 3 pts MoM to 19% and actual capital outlays were up 1 pt MoM, with 45% of

8

M O R G A N S T A N L E Y R E S E A R C H

October 15, 2010 Software

SMBs making expenditures in the last 6 mos, but remain near all-time lows. Pricing declined 3 pts to a net -11% MoM, while pricing plans also fell 3 pts, with a net 7% expecting higher pricing over the next 3 mos., vs. 10% in Aug.

Labor markets reverse. In the last 3 mos., a net -3% of SMBs increased employment (down 1 pt MoM, and the first decline since Apr-10). Over the next 3 mos., a net -3% plan to create new jobs, which is down 4 pts MoM and the first negative reading in 5 mos. Labor costs were flat, with a net 3% reporting higher comp in the last 3 mos., but plans to increase compensation in the next 3 mos. fell 3 pts to 3%.

October 13 – Intuit: Management Meetings Point to Accelerating Fundamentals. We spent two days with CFO Neil Williams, have been breaking apart the INTU model, and feel better about QuickBooks unit growth, ability of INTU to drive unit growth in consumer tax, ASPs for both QBooks and Turbo Tax, the evolving platform story – particularly the ability to accelerate payments and attach of new services, as well as the commitment to margin expansion and buybacks, even at these levels. We think INTU is one of the few co.’s in our coverage that could see accelerating growth next year while cons. ests are still low. As such, we remain buyers.

Consumer Tax banking on upsell and category gains: Tax filings could be flat to down this year, and we do not expect material changes in TurboTax pricing (products will be released in Nov). At the same time, demographic shifts remain favorable, and we feel better about share gains, and the ability to drive price through mix and attach (while guidance is conservative) after our meetings. The IRS’s decision to no longer send paper tax forms could also entice some of the 10-11M people still using paper to file online this year. INTU will continue to focus on conversion rates and retention— and modest improvements are material to rev.

Payments offers most near-term upside: Mgmt. was most bullish on the prospects for Payments, and our work points to ~$800-900M of upside potential here over the next three years. The Payments Network will allow QB customers to transact directly with one another through ACH for $0.50/ transaction, well below other networks, targeting the 50M electronic invoices created by QB users each month. Mobile is a material opp. while core payment attach is accelerating, in part fueled by websites. Merchant growth should remain in the mid to high teens, and volume is a lever as the econ. improves.

Model still improving. We left comfortable with margin improvement to the mid 30s, while INTU will buy back stock to reduce share count at current levels.

October 13 – VMware: Expanding Footprint Should Drive Solid Q3. Our checks suggest that VMW’s Q3 closed well and results should be at least in line with our lic./rev./billings/EPS ests. of $321M / $693M / $768M / $0.34, which are below seasonal, although we believe VMW may manage Q3 to build visibility for Q4. We believe Q3 was paced by solid ELAs, improved transactional rev. (particularly SMB) and Enterprise Plus sales. At 21x EV/FCF, VMW trades below our FCF growth est. of 27% in FY10, and we remain buyers.

What’s new: Based on our conversations with large resellers and our survey of 90 resellers, we believe Q3 will be at least in line with our rev./EPS of $693M / $0.34, although the trend of beating the high end of guidance pushes expects higher. We did not pick up signs of increased discounting to close deals or back end loading, indicating healthy demand & a strong pipeline.

Checks point to solid Q. 63% of surveyed resellers expected to meet/beat Q3 targets—in line with 62% in Q2 when VMW beat the midpoint of guidance by 4%— while 78% of large resellers ($1M+ in VMW biz) met or beat their Q3 targets. Strength in vSphere was driven by: 1) demand for Enterprise Plus, 2) increased traction in the SMB SKU, and 3) interest in mgmt modules like Site Recovery Manager. View 4.5 is seeing increased interest but we did not hear of large deals in rev (we saw some in seats). Europe and Federal segments likely came in line with expectations.

Seasonality provides cushion: With a EUR/USD avg. of 1.29 in Q3, nearly unchanged since guidance, we est. a FX benefit of <$2M on Q3 rev. guidance of $680M-$705M and our billings est. of $768M (up 43% YoY). In addition, cons. Q3 rev. of $697M, up 3% QoQ, is well below the 5-yr avg. of 13% QoQ.

Guidance: Cons. looks for 11% QoQ growth in Q4 rev., which is below how VMW guided in the past 2 yrs (+13% and +12% QoQ). The guide should be at least in line with cons. of $774M/$0.39. We do believe VMW will remind us about Q1 seasonality, and cons. of -1% is above the Q1 guide of -3 to -8% QoQ over the last 2 yrs.

October 14 – Check Point Software: Momentum Building into Q3. With an expanded product portfolio, improved positioning for multi-function network security devices, and an accelerating refresh of the network security gateway base, we expect CHKP to report solid Q3 results which meet or exceed our Q3 estimates of $263.1M in revs., +13% YoY, and EPS of $0.59. Checks suggest the acceleration in business CHKP saw in Q2 — organic revenue growth accelerating from +4% YoY to +8% YoY by our est. — carried into Q3 and we think a return to

9

M O R G A N S T A N L E Y R E S E A R C H

October 15, 2010 Software

double-digit organic rev. growth in 2011 is readily achievable. At just10X EV/CY11e FCF vs. a 15X median for our large cap software names, we believe CHKP shares are undervaluing this re-accelerating and sustainable growth story and we remain buyers.

Checks supportive of a strong Q3: We spoke with several large partners and gathered data from 12 addt’l resellers worldwide, increasing our confidence that CHKP is benefiting from increasing demand for multi-functioned security appliances. Highlights include:

• Conversations pointed to above target CHKP sales as 100% of surveyed resellers met/exceeded Q3 targets, with 17% noting >10% above target.

• Accelerating firewall refreshes and share gains with 42% of resellers reporting Q3 security gateway sales above expectations.

• Blade traction indicated in 33% reporting software blade sales above expectations.

What’s next: Resellers reported 18% YoY growth on avg. in Q3, which is slightly above our 17% Q3 license growth rate, while our license rev. estimate of $102M is down 2% QoQ, below normal Q3 seasonality of flat QoQ. Our Q3 rev/EPS of $263M/$0.59 comes in slightly above cons. at $262M/$0.59. Resellers look for license growth to continue in the high teens in Q4, +17% YoY on avg., vs. our estimate of $127.4M, +6% YoY, which points to low risk to our Q4 rev/EPS ests. of $295M/$0.66 vs. cons. at $293M/$0.66.

October 14 – Microsoft: Q3 PC Data Points to Weak Consumer, Strong Enterprise. INTC Q3 results Tuesday and data from Gartner and IDC point to healthy enterprise demand balanced by softness in the consumer market. MSFT has already discounted the weakness in consumer (and we have lowered ests.) and the PC data points are in line to modestly better than we expected. At 10x, MSFT is pricing in est. cuts, and can still work over the NTM if the multiple holds and earnings are stable, given accelerating mid teens organic EPS growth in FY11 (on our lower than cons. nums). As such, we are still buyers.

PC Data Reflects Slower Consumer Sales: Gartner and IDC recently reported decelerating PC unit shipment growth ests. for Q3 with IDC estimating that units grew 11% YoY (+8% QoQ), ~3% below their initial ests and Gartner projecting 7.6% YoY growth, ~5 pts below their initial ests. However, ests. of PC shipments were largely in line w/consensus at 88-89M in

the Q. Our CYQ3 MSFT est. is more conservative at 84M PCs shipped, +8% YoY and +9% QoQ--and ests. for MSFT have been falling. While consumer was soft, IDC did note that demand improved in Sept. and the commercial refresh continues to be strong.

INTC Results Showed Strength in Enterprise: INTC ($19, rated Equal-weight by Mark Lipacis) reported Q3 results below initial guid. due to weakness in developed consumer. However, mgmt noted solid demand from the enterprise and continued growth in emerging markets. Data center revs. were +30% YoY and +3% QoQ, ASPs were flat, and mgmt expects servers to remain healthy in 4Q. On PC growth, mgmt still expects ’10 PC units to grow 18% YoY— which may be optimistic given recent softness. We model +13% YoY growth in CY10, and we expect MSFT to be conservative with Dec. Q commentary.

Increasing attention on tablets: IDC notes that tablets may have delayed consumer PC purchases in the Q while INTC said that tablets are impacting PC sales “at the margin”. In the medium to long run, we believe that tablets will both expand the PC market and cannibalize some units— with MSFT playing an expanded role as the INTC roadmap falls into place in 1H-CY11.

October 14 – Intuit: HRB Buys TaxACT; Impact to INTU’s FY11 Likely Minimal. In an effort to stem share losses in digital tax-prep, HRB announced plans to acquire TaxACT creator 2SS Holdings, the #2 Online provider of free and low-cost DIY tax software solutions (behind INTU’s TurboTax). We view the acq. is a headline neg. for INTU and puts a good brand and solid mgmt in the hands of a better capitalized co., creating more scale, although still much smaller than INTU. INTU has a well-established free-to-pay strategy, and its ability to have a successful tax season will be largely predicated on a) its ability to drive units (and more HRB marketing could expand the total category), and b) TTax’s ability to continue improvements in mix, attach, conversion & retention. We are buyers on weakness.

What’s new: TaxACT is the 2nd largest dig. tax solution in terms of Online returns, with over 5M filers in the 2010 tax season vs. 15.1M Online returns filed with INTU’s TTax and 3.7M Online returns filed with HRB’s At Home. TaxACT has been successful marketing itself as “the most complete free tax solution”, with 2010 pricing ranging from $9.95- $17.95 for Online, vs. comparable TTax & At Home pricing at ~$14.95- $49.95 (ex. State). Even so, INTU has been able to maintain its premium through continued innovation, driving automation, ease-of- use, and the ability to handle increasingly complex

10

M O R G A N S T A N L E Y R E S E A R C H

October 15, 2010 Software

returns. Both TTax & TaxACT grew units/users by ~12% this year, but INTU’s growth was off a base ~3x as large.

FY11 not impacted, acquisitions always present integration risk: HRB (covered by V. Edelson) plans to operate TaxACT as an independent unit in FY11, with few changes to pricing, marketing or strategy. Longer term, the integration of TaxACT could prove challenging for HRB, as it has to grapple with multiple solutions and pricing-structures, while at the same time attempting to avoid cannibalization among the different price points. At the same time, HRB is likely to spend more on marketing in FY12 and beyond, to promote both At Home & TaxACT, helping to expand the TAM for digital tax solutions, which may actually benefit TTax as the largest/most identifiable brand in the space.

October 14 – Software: SaaS Still a Strong Secular Theme, with Room to Grow. We expect Software-as-a-Service (SaaS) to remain a key growth area within software, but the landscape is evolving past a rising tide that lifts all boats as the SaaS industry moves from niche to mainstream. We expect to see increased differentiation between the long-term winners and the rest, with positive estimate revisions as a key driver for stocks, while above-market growth will be critical for sustaining premium valuations. Our preferred plays are SFSF and IL, which trade at EV/CY12 FCF multiples of 1.2x and 0.9x rev. growth, with room for rev. ests. to move higher.

Leaders are starting to pull away as market moves mainstream: Spending on SaaS apps. has grown 20% over the last 3 years, yet still accounts for less than 10% of application spending overall and we expect continued growth of >15% through 2014. Key demand drivers remain firmly in place, but we anticipate decelerating growth as the market matures, increased competition, a shift towards suites, and a widening divide between the leaders and the laggards. SFSF, TLEO and CRM are best positioned to benefit as emerging suite providers.

Markets matter: Sub-markets within SaaS like Customer Service, Collaboration and Performance Mgmt. offer greater growth potential than others like ERP, and companies with significant exposure to those markets should benefit. Our proprietary top-down model for the SaaS market, supported by bottoms-up data from our Oct. CIO survey, suggests that SFSF and IL have the biggest opportunity for positive est. revisions over the next 2-3 years, which should drive the stocks higher.

Margins don’t (for now): Profitability vs. growth remains a tricky question for investors, but we believe that upfront investments in sales that may hurt profits near term should

boost future cash flows and deliver leverage over time. We believe lofty valuations are sustainable in the near-term for high-growth companies like SFSF and CRM, as they are supported by expectations for material cash flow once growth slows.

October 14 – Akamai: Strong Secular Story with Upside Optionality in Video. Initiating coverage of AKAM with Overweight rating, $57 target. We view AKAM as a long-term winner in the shift to Internet content / commerce / cloud computing, with near-term upside driven by accelerating adoption of Internet video and cloud-based apps. YTD stock performance (+81%) reflects stabilization in content delivery (CDN) pricing plus investor interest in companies with exposure to cloud computing. Our base case financial model assumes slight revenue acceleration (paced by rising usage of online video). We believe the shares should trade in line with secular growth mid-cap tech at 30x CY12e earnings (or $57 per share), a one-year price target that is supported by our DCF valuation model.

Strong 1-3 year growth in online video consumption could drive material acceleration in revenue growth. AKAM is the leading provider of online video content delivery services. Early stage / rapid growth in new online media consumption devices (like tablets) and new business models (like Netflix Streaming) should drive acceleration in the volume of video viewed over the Internet. While Cisco estimates video traffic should grow at a 42% CAGR, 2010-2014e, we believe growth could be as high at 60-65% as iPad-type users consume meaningful amounts of online video. We believe AKAM could support above consensus 20%+ revenue growth in its Media business in CY11e, with each additional 2 percentage points of growth adding $0.01 to EPS.

AKAM’s SaaS business to grow faster and longer than expected. Spending on Cloud services (like Salesforce.com and Amazon’s EC3) should grow at a 5-year CAGR of 26% through 2013e, and AKAM can play a key role as application availability and performance become increasingly important to business users who rely on cloud apps for their jobs. This could drive similar rates of growth in AKAM’s app delivery services which now contribute 10-15% of revenue.

October 14 – SuccessFactors: New Customers + Upsell Drive Strong Growth; OW. Assuming coverage of SFSF with an Overweight rating and $32 price target. SFSF is one of the fastest-growing names in SaaS, and we expect 20%+ billings growth to persist for the next 2-3 years through a combination of new customer adds and upsells into the existing base. Valuation is rich at 33x EV/CY12 FCF vs. the group mean of

11

M O R G A N S T A N L E Y R E S E A R C H

October 15, 2010 Software

24x, but growth drives valuation for SaaS stocks, and with SFSF expected to grow FCF at 50%+, we believe this premium is warranted. We see potential for SFSF to grow rev. at 27-30% through 2012 vs. the Street at 20-25%. Faster-than-expected growth would support both multiple expansion and a higher FCF base, driving the stock towards our $32 target.

Attractive end market exposure: SFSF is the leader (~30% share) in Performance Mgmt. (PM) which we see as one of the most attractive sub-markets within SaaS, potentially growing at a CAGR of 20% through 2014. This view is supported by data from our October 2010 CIO Survey, which shows 6% of CIOs using SaaS for PM today, vs. 16% planning to use SaaS for PM one year from now, an increase of 167%. Maintaining share should support 20% growth for SFSF’s core business, with continued share gains a potential added driver.

Growing upsell opportunity: SFSF offers 13 modules, with the avg. customer today running <4. At the same time, SFSF’s push into analytics and BizX strategy argues for using most or all of the modules to maximize the value of the platform. The push from PM to a full HR suite expands SFSF’s total addressable market from ~$600M to ~$3.5-4.0B, offering additional avenues of growth if SFSF can take share in these new markets.

Profitability to come: SFSF’s margins are modest at 1%, but we believe this is a result of aggressive investments in growth which will translate to faster top-line momentum in the near-term to capitalize on a short window of opportunity for land grab, while profitability will come in the future once the focus turns to retaining and upselling the installed base. This strong future cash flow supports SFSF’s rich valuation today.

October 14 – NetSuite: Improving Growth, but Too Rich Valuation; Underweight. We are assuming coverage of N with an Underweight rating and $18 target. We believe that N is seeing improving growth as the company moves upmarket with its OneWorld offering, sees greater traction in new vertical market opportunities, and expands its footprint in the partner channel, which can drive sustainable billings growth of ~15%. However, we also think that ERP apps will be slower to move into the cloud than some other app types, which could cause N to grow more slowly than other SaaS companies like CRM and SFSF. At 5.2x EV/ CY12 Sales and 58.1x EV/CY12 FCF, N is one of the most highly valued stocks in SaaS, which could present downside risk if growth does not come in ahead of current expectations.

Adoption of ERP SaaS apps is growing, but still lags other submarkets: We expect SaaS to be a strong secular source of

growth for the software industry over the next 3-5 years, benefitting a variety of companies including N, but we also see increasing differentiation between software submarkets. We believe that ERP may be slower to move to SaaS than some other app. markets due to high integration and customization needs, and we expect this market to show high-single digit growth through CY14 vs. double-digit growth in other SaaS markets. This view is supported by our recent CIO survey, which shows only a modest increase in the number of CIOs planning to get ERP functionality via SaaS one year from now (16%) vs. today (14%).

Margin expansion may be limited: N turned profitable in CY09 and should deliver margins close to 5% in CY10, but we see the company’s margin profile as more limited longer term as complex ERP implementations typically require longer sales cycles and more professional services which can weigh on margins, while the need to verticalize offerings for specific markets may inhibit leverage. We believe N can see high teens and even low 20’s margins over time, but margin expansion is likely to take longer for N than we expect for other SaaS names given the complex nature of ERP.

October 14 – RightNow: Business Stabilizing with Positive FCF Inflection Ahead; Equal-weight. Assuming coverage of RNOW with an Equal-weight rating. RNOW’s business model appears to have stabilized, which could drive a positive inflection in FCF in CY12, while strong preannounced results for Q3 are certainly encouraging. However, RNOW’s focus on growing within existing customers could limit long-term growth, while CRM is a formidable emerging competitor. At 19.5x FCF vs. the group at 24.5x, RNOW is not expensive, but we believe the valuation is appropriate given that we expect RNOW to grow rev. ~15-20% vs. peers like SFSF & CRM which we think can grow >20%.

Growth profile may be limited: RNOW’s “land and expand” strategy has boosted rev./customer growth to a CAGR of 16% between Q207 and Q210, but new customer adds remain sluggish with the base growing from 1,800 to 1,900 over that same period. Even after adjusting for SMB churn, we believe the base has only grown at a CAGR of 7% vs. the group avg. of 32%, limiting the future upsale opportunity.

Increasing competition in Call Center Automation: Both RNOW and CRM are pursuing the Call Center Automation market, with RNOW holding strong with B2C companies and CRM seeing traction in B2B. Our recent checks suggest that this dynamic remains largely stable today, but we expect CRM to become more aggressive in the space over time, limiting

12

M O R G A N S T A N L E Y R E S E A R C H

October 15, 2010 Software

RNOW’s ability to add customers with a risk of competitive displacements.

Business model stabilization may lead to FCF inflection. RNOW has gone through a series of model transitions, from an on premise to SaaS and then from multi-year to one-year billings. This had led to an increasing amount of business being pushed offbalance sheet, depressing FCF near-term, but building towards a potential inflection in cash flow as this backlog becomes billable. We see this inflection likely happening in FY12 and could present an interesting tactical opportunity, but one that is still 6-12 mos out.

October 14 – Taleo: Solid Platform, but Recruiting Core Limits Growth; EW. Assuming coverage of TLEO with an EW rating. We like TLEO’s emerging platform story and see the company as well positioned to benefit from the broader shift towards SaaS. However, the bulk of TLEO’s business continues to come from Recruiting, a market where the on demand segment is only growing ~10-15%, while emerging opportunities like Perf. Mgmt. remain small. Street estimates for TLEO look reasonable, with some room to move higher, but less room for positive revisions than we see with some other names in the SaaS universe. The stock looks inexpensive at 16x EV/CY12 FCF vs. the group average of 19x, but we think the stock should trade largely in line with the group as we expect the company’s growth to be largely consistent with the growth of SaaS overall.

We expect organic mid-teens billings growth in CY11, but further upside could be limited. We believe that investors expect TLEO to deliver 15-20% organic billings growth in CY11 which we think is achievable, but upside may be limited. The company still derives the bulk of its business from the e-Recruiting market which we believe is growing 10-15%, while TLEO’s ability to gain incremental share is limited due to the company having sizeable share already. Perf. Mgmt. is faster-growing (~20%) with more room for TLEO to take share, but the contribution to the business overall is small and gains will have limited impact while new opps. like e-Learning are small as well.

Investing in growth, but less aggressively than some: We see a close relationship between opex investments and billings growth, and TLEO is expected to show 13% opex growth in 2011 prior to the addition of Learn.com. This translates to 120 bps of margin improvements in CY11 which is a positive for some investors, but also suggests a lower rate of growth vs. peers like SFSF and CRM. With growth as a primary driver of valuation for SaaS names, we believe this supports an in-line

valuation for the stock as well versus the premiums paid for higher-growth peers.

October 14 – DemandTec: Better Times Ahead; Assuming Coverage at EW. Assuming coverage of DMAN with an Equal-weight rating. After a tough FY10, we believe that DMAN’s business is now back on track, and investments in new NextGen offerings should open up new upsell opportunities just as retail IT spending is starting to return. However, following a big move in the stock from $6.78 on 8/16 to $10.48 today (+55%) the shares now trade at 18.9x CY12 FCF, in line with the peer median of 19.2x, suggesting that end market improvements are already priced into the stock while room for further upside is likely limited in the near-term.

Business taking a turn for the better: DMAN had a tough FY10 as retail IT budgets tightened in the face of a tough macro, but signs of stabilization have allowed IT projects to start to move forward again. DMAN refocused their strategy in FY10 around the largest and strongest retail customers, and expanded their product suite with NextGen. Today, we believe these strategic investments are paying off while retail IT spending is starting to return, driving billings growth from 1% in FY10 to 35% in FY11.

Dependence on large deals remains a risk: DMAN’s ~50 retail customers represent ~20% of the company’s installed base, but ~80% of revenue, leaving DMAN’s financial performance susceptible to a few large customers like WMT and TGT. We view big deals as upside opportunities that can drive numbers higher, but the unpredictability of these deals makes us reluctant to give DMAN credit for a big win until the deal is signed.

New verticals and new products offer new growth potential: The longer-term question remains how big can DMAN get given its focus on a relatively small set of large retail and consumer products companies. While focusing on one vertical can limit long term growth, DMAN is only capturing 0.3% of total retail IT spending today suggesting that there is still plenty of room to grow with new products like Assortment and Shopper Insight and new verticals within like quick-service restaurants.

13

M O R G A N S T A N L E Y R E S E A R C H

October 15, 2010 Software

Sector Performance: Exhibit 10 Average EV/Sales by Sector: CY09A vs. CY10E

Software Universe: CY09 vs. CY10E EV/Sales6.5x 6.3x

5.7x5.4x 5.5x

4.4x

3.5x 3.7x3.0x

2.4x 2.3x 2.2x

5.4x 5.2x4.7x 4.6x 4.5x

4.0x3.3x 3.1x

2.4x 2.3x 2.2x1.9x

0.0x

1.0x

2.0x

3.0x

4.0x

5.0x

6.0x

7.0x

Hos

ted

Sof

twar

e

MS

Softw

are

Grp

Prod

uctiv

ityA

pps

Larg

e-C

apS

W

Infra

stru

ctur

e

Secu

rity

Div

ersi

fied

App

s

Ana

lytic

s

Larg

e-C

apTe

ch

Pro

cess

ors

Fin.

Tec

h.

Ent

erpr

ise

App

sCY09E EV/Sales CY10E EV/Sales

Source: FactSet, Company data, Morgan Stanley Research

Exhibit 11 Average P/E by Sector: CY09A vs. CY10E

Software Universe: CY09 PE vs. CY10E PE66.2x

30.4x 32.6x36.5x

24.6x 24.8x

33.0x29.1x

20.2x

28.5x

17.2x 16.3x22.5x

18.6x

56.9x

47.0x

34.3x 33.3x29.9x 29.5x 28.0x 25.9x

19.5x 18.6x 16.6x 16.1x 15.4x 14.1x

0.x

10.x

20.x

30.x

40.x

50.x

60.x

70.x

Hos

ted

Softw

are

Pro

duct

ivity

Apps

Sec

urity

MS

Softw

are

Grp

Div

ersi

fied

Apps

Ana

lytic

s

Infra

stru

ctur

e

Larg

e-C

apS

W

Ent

erpr

ise

App

s

Nas

daq

Fin.

Tec

h.

Proc

esso

rs

Larg

e-C

apTe

ch

S&P

500

Avg CY09E PE Avg CY10E PE Source: FactSet, Company data, Morgan Stanley Research

Exhibit 12 Average PEG by Sector: CY10E

CY11E PE to Growth (CY10E-12E % EPS CAGR)

1.9x1.8x 1.7x

1.6x 1.6x 1.5x 1.4x 1.3x 1.3x 1.3x 1.2x

0.0x

0.5x

1.0x

1.5x

2.0x

2.5x

Pro

cess

ors

Infra

stru

ctur

e

Larg

e-C

apS

W

Hos

ted

Softw

are

MS

Sof

twar

eG

rp Nas

daq

Sec

urity

S&P

500

Ana

lytic

s

Pro

duct

ivity

App

s

Ent

erpr

ise

App

s

Source: FactSet, Company data, Morgan Stanley Research

Exhibit 13 Sector Price Performance: 1-Week

1-Week Price Performance

6%5%

4%4%

4%3%

3%2%

2%2%2%

2%1%

0%

-1% 0% 1% 2% 3% 4% 5% 6% 7%

Hosted SoftwareProductivity Apps

Enterprise AppsInfrastructure

MS Software GrpLarge-Cap Tech

SecurityDiversified Apps

Fin. Tech.Nasdaq

Large-Cap SWAnalyticsS&P 500

Processors

Source: FactSet, Company data, Morgan Stanley Research

Exhibit 14 Sector Price Performance: 1-Month

1-Month Price Performance

13%11%

9%8%

7%7%

6%6%

5%5%

5%4%

3%1%

0% 2% 4% 6% 8% 10% 12% 14%

Hosted SoftwareDiversified AppsLarge-Cap Tech

AnalyticsInfrastructure

Enterprise AppsProductivity Apps

NasdaqProcessors

S&P 500MS Software Grp

Fin. Tech.Security

Large-Cap SW

Source: FactSet, Company data, Morgan Stanley Research

Exhibit 15 Sector Price Performance: Year-to-Date

2010 YTD Price Performance

37%36%

32%25%

20%19%19%

15%14%

10%7%

5%4%

-10%

-20% -10% 0% 10% 20% 30% 40%

Productivity AppsHosted Software

InfrastructureMS Software Grp

Large-Cap SWSecurity

Diversified AppsAnalytics

Large-Cap TechEnterprise Apps

NasdaqS&P 500

Fin. Tech.Processors

Source: FactSet, Company data, Morgan Stanley Research

14

M O R G A N S T A N L E Y R E S E A R C H

October 15, 2010 Software

Software Group Performance: Exhibit 16 MS Software Group: CY09A vs. CY10E EV/Sales

MS Software Group: CY11E EV/Sales9.3x

7.3x 7.2x 6.9x 6.8x6.1x 5.9x

5.4x 5.1x 4.8x 4.8x4.0x 3.9x 3.6x 3.6x 3.5x 3.5x 3.3x 3.2x 2.9x 2.7x

2.2x 1.9x1.1x

0.0x1.0x2.0x3.0x4.0x5.0x6.0x7.0x8.0x9.0x

10.0x

VMW

QLI

K

RH

T

SW

I

CR

M

SFS

F N

CH

KP IL

CTX

S

FTN

T

FIR

E

OR

CL

TLEO

INTU

SAP

RN

OW

ADBE

ADSK

DM

AN

MSF

T

WBS

N

SYM

C

GU

ID

Source: FactSet, Company data, Morgan Stanley Research

Exhibit 17 MS Software Group: CY09A P/E vs. CY10E P/E

MS Software Group: CY11E PE167.4x

87.1x72.0x69.2x

49.8x49.4x46.2x38.7x37.2x35.4x32.9x27.3x22.3x21.7x18.9x15.8x15.0x13.4x13.2x12.9x10.6x10.5x

0.x

20.x

40.x

60.x

80.x

100.x

120.x

140.x

160.x

180.x

SFS

F N

CR

M

QLI

K

GU

ID

RH

T

VM

W

RN

OW

FIR

E

TLE

O IL

CTX

S

SW

I

AD

SK

INTU

SA

P

CH

KP

OR

CL

AD

BE

WB

SN

SY

MC

MS

FT

Source: FactSet, Company data, Morgan Stanley Research

Exhibit 18 MS Software Group: CAGR CY09-CY11E

MS Software Group: CAGR CY10E-CY12E384%

131%

89%67%

35%34%34%29%22%21%17%16%15%15%14%14%13%13%13%12%11%11%11%0%

50%

100%

150%

200%

250%

300%

350%

400%

450%

SFS

F

GU

ID N IL

RN

OW

FIR

E

QLI

K

CR

M

VMW

AD

SK

FTN

T

TLE

O

SY

MC

SW

I

CTX

S

WB

SN

INTU

OR

CL

RH

T

MS

FT

AD

BE

SA

P

CH

KP

Source: FactSet, Company data, Morgan Stanley Research

Exhibit 19 MS Software Group Price Performance: 1-Week

MS Software Group: 1-Week Price Performance

27%25%

9%6%5%

5%4%

4%4%4%4%

4%4%

3%3%

3%2%2%2%

2%1%

-2%-3%

-4%

-10% -5% 0% 5% 10% 15% 20% 25% 30%

RNOWIL

QLIKSWI

DMANFTNTADSKTLEOCHKP

SAPRHT

VMWSYMCINTU

MSFTN

GUIDCRM

ORCLFIRESFSF

WBSNCTXSADBE

Source: FactSet, Company data, Morgan Stanley Research

Exhibit 20 MS Software Group Price Performance: 1-Month

MS Software Group: 1-Month Price Performance40%

36%16%

12%12%12%11%

11%10%10%

8%7%

5%4%4%3%3%

1%-3%

-7%-9%

-12%-13%

-15%

-20% -10% 0% 10% 20% 30% 40% 50%

ILRNO

DMANORCLCHKPSFSFTLEO

SWIFTNT

NINTUGUIDQLIK

SYMCSAP

ADSKRHT

MSFTFIREVMWCRMWBS

CTXSADBE

Source: FactSet, Company data, Morgan Stanley Research

15

M O R G A N S T A N L E Y R E S E A R C H

October 15, 2010 Software

Exhibit 21 MS Software Group Price Performance: Year-to-Date

MS Software Group: 2010 YTD Price Performance89%

56%54%

46%44%

43%42%

36%31%

28%26%

21%16%15%15%

14%4%

1%-13%

-17%-23%

-25%

-40% -20% 0% 20% 40% 60% 80% 100%

VMWSFSFINTUCRMFTNT

RNOWCTXS

NADSK

RHTTLEO

DMANCHKPORCL

SAPGUIDFIRE

WBSNSYMCMSFT

SWIADBE

Source: FactSet, Company data, Morgan Stanley Research

16

M O R G A N S T A N L E Y R E S E A R C H

October 15, 2010 Software

Comparable Company Analysis and Metrics Tables

Morgan Stanley Software Group Price Price YTD % of 52 Shares Market Ent. '10-'12 '10-'12 PE to G PE to G

Company Ticker Rating 14-Oct-10 Target Perf. Wk High Out. Cap. Value 2010E 2011E 2012E % CAGR 2010E 2011E 2012E 2010E 2011E 2012E % CAGR 2010E 2011E 2012E 2010E 2011E

Large CapAdobe Systems ADBE EW $27.49 NA -25% 72% 523 $14,382 $13,328 $3,771 $4,003 $4,451 9% 3.5x 3.3x 3.0x $1.89 $2.09 $2.35 11% 14.5x 13.2x 11.7x 1.3x 1.1xAkamai AKAM OW $46.06 $57 82% 87% 190 $8,773 $7,725 $1,013 $1,195 $1,412 18% 7.6x 6.5x 5.5x $1.43 $1.64 $1.91 15% 32.2x 28.0x 24.2x 2.1x 1.8xAutodesk ADSK UW $33.35 $26 31% 95% 234 $7,797 $6,527 $1,902 $2,044 $2,246 9% 3.4x 3.2x 2.9x $1.27 $1.54 $1.85 21% 26.2x 21.7x 18.0x 1.3x 1.0xBMC Software BMC NC $44.14 NA 10% 100% 184 8112.932 $7,061 $1,981 $2,091 $2,202 5% 3.6x 3.4x 3.2x $2.65 $2.76 NA NM 16.7x 16.0x NA NM NMCA, Inc. CA NC $22.00 NA -2% 91% 511 $11,242 $10,324 $4,438 $4,606 $4,764 4% 2.3x 2.2x 2.2x $1.58 $1.74 NA NM 13.9x 12.6x NA NM NMCheck Point CHKP OW $39.29 $44 16% 98% 212 $8,336 $6,195 $1,056 $1,142 $1,218 7% 5.9x 5.4x 5.1x $2.35 $2.62 $2.89 11% 16.7x 15.0x 13.6x 1.6x 1.4xCitrix Systems CTXS EW $58.92 $56 42% 82% 189 $11,152 $9,744 $1,821 $2,013 $2,193 10% 5.4x 4.8x 4.4x $1.88 $2.16 $2.43 14% 31.4x 27.3x 24.2x 2.3x 2.0xIntuit INTU OW $47.31 $51 54% 99% 314 $14,855 $14,140 $3,598 $3,979 $4,300 9% 3.9x 3.6x 3.3x $2.20 $2.51 $2.84 13% 21.5x 18.9x 16.7x 1.6x 1.4xMicrosoft MSFT OW $25.23 $30 -17% 80% 8,821 $222,554 $183,951 $64,638 $69,264 $73,795 7% 2.8x 2.7x 2.5x $2.14 $2.40 $2.70 12% 11.8x 10.5x 9.3x 1.0x 0.8xOracle ORCL OW $28.33 $32 15% 98% 5,083 $144,001 $137,402 $31,976 $35,552 $37,722 9% 4.3x 3.9x 3.6x $1.85 $2.11 $2.38 13% 15.3x 13.4x 11.9x 1.1x 1.0xRed Hat RHT EW $39.67 NA 28% 95% 194 $7,679 $6,628 $852 $925 $1,055 11% 7.8x 7.2x 6.3x $0.76 $0.80 $0.96 13% 52.4x 49.4x 41.3x 4.2x 3.9xSalesforce.com CRM EW $107.36 NA 46% 87% 134 $14,405 $13,136 $1,598 $1,920 $2,350 21% 8.2x 6.8x 5.6x $1.16 $1.49 $1.92 29% 92.5x 72.0x 55.9x 3.2x 2.5xSAP SAP EW € 38.09 € 38 15% 99% 1,189 € 45,283 € 43,659 € 11,621 € 12,332 € 13,165 6% 3.8x 3.5x 3.3x € 2.17 € 2.41 € 2.70 11% 17.5x 15.8x 14.1x 1.5x 1.4xSymantec SYMC EW $15.56 NA -13% 81% 805 $12,526 $11,887 $5,954 $6,231 $6,541 5% 2.0x 1.9x 1.8x $1.33 $1.47 $1.77 15% 11.7x 10.6x 8.8x 0.8x 0.7xVMware VMW OW $80.15 $90 89% 90% 422 $33,850 $31,520 $2,773 $3,405 $3,900 19% 11.4x 9.3x 8.1x $1.38 $1.74 $2.04 22% 58.0x 46.2x 39.3x 2.7x 2.1xVeriSign VRSN NC $32.03 NA 32% 98% 183 $5,854 $5,092 $752 $776 $867 7% 6.8x 6.6x 5.9x $1.17 $1.48 $1.87 26% 27.4x 21.6x 17.1x 1.0x 0.8xLarge Cap Mean 28% 90% 10% 4.7x 4.2x 3.8x 15% 29.8x 25.4x 21.6x 1.9x 1.7x

SMid CapConcur CNQR NC $49.03 NA 15% 94% 53 $2,595 $2,265 $309 $374 $455 21% 7.3x 6.1x 5.0x $0.79 $1.06 NA NM NM 46.3x NA NM NMDemandTec DMAN EW $10.62 NA 21% 98% 30 $321 $265 $79 $92 $99 12% 3.3x 2.9x 2.7x ($0.03) $0.12 $0.15 NM NA NM NM NM NMFortinet FTNT OW $25.28 $23 44% 97% 76 $1,912 $1,660 $304 $349 $393 14% 5.5x 4.8x 4.2x $0.41 $0.49 $0.56 17% NM 51.3x 44.9x NM 2.9xGuidance GUID UW $5.97 $4.5 14% 98% 23 $138 $111 $87 $97 $109 12% 1.3x 1.1x 1.0x $0.03 $0.12 $0.16 131% NM 49.8x 37.3x NM 0.4xInformatica INFA NC $37.39 NA 44% 96% 108 $4,037 $3,874 $627 $721 $841 16% 6.2x 5.4x 4.6x $1.07 $1.27 $1.50 18% 34.9x 29.4x 24.9x 1.9x 1.6xIntraLinks IL OW $18.50 $20.0 NA 100% 49 $912 $1,015 $177 $200 $219 11% 5.7x 5.1x 4.6x $0.24 $0.56 $0.68 67% 75.5x 32.9x 27.2x 1.1x 0.5xNetSuite N UW $21.69 $18 36% 86% 63 $1,377 $1,278 $189 $218 $247 14% 6.8x 5.9x 5.2x $0.11 $0.25 $0.40 89% NM 87.1x 54.0x NM 1.0xQlik Technologies QLIK OW $23.45 $22 NA 85% 82 $1,924 $1,844 $206 $251 $300 21% 9.0x 7.3x 6.1x $0.23 $0.34 $0.42 34% NM 69.2x 55.8x NM 2.0xRightNow RNOW EW $24.76 NA 43% 99% 33 $828 $742 $183 $212 $240 15% 4.1x 3.5x 3.1x $0.45 $0.64 $0.83 35% 54.8x 38.7x 30.0x 1.6x 1.1xSolarWinds SWI EW $17.70 NA -23% 71% 73 $1,297 $1,197 $149 $174 $201 16% 8.1x 6.9x 5.9x $0.69 $0.79 $0.91 15% 25.6x 22.3x 19.4x 1.7x 1.5xSourcefire FIRE EW $27.90 NA 4% 91% 29 $798 $655 $134 $162 $195 21% 4.9x 4.0x 3.4x $0.54 $0.75 $0.97 34% 51.8x 37.2x 28.8x 1.5x 1.1xSuccessFactors SFSF OW $25.81 $32 56% 96% 73 $1,875 $1,532 $200 $251 $302 23% 7.7x 6.1x 5.1x $0.01 $0.15 $0.22 384% NM 167.4x NM NM 0.4xTaleo TLEO EW $29.60 NA 26% 96% 39 $1,168 $923 $231 $259 $288 12% 4.0x 3.6x 3.2x $0.73 $0.84 $0.98 16% 40.8x 35.4x 30.1x 2.5x 2.2xWebsense WBSN UW $17.56 $17 1% 69% 44 $771 $759 $335 $351 $376 6% 2.3x 2.2x 2.0x $1.19 $1.36 $1.53 14% 14.8x 12.9x 11.5x 1.1x 0.9xSMId Cap Mean 25% 91% 15% 5.3x 4.5x 3.9x 72% 40.8x 56.3x 35.1x 1.9x 1.4x

% YoY Growth 16% 9% 7% 14% 17% 16%Mean 26% 90% 12% 5.2x 4.5x 4.0x 41% 33.3x 39.6x 27.5x 1.9x 1.6xMedian 23% 95% 12% 4.3x 3.9x 3.4x 16% 25.6x 31.3x 24.2x 1.6x 1.4xNASDAQ 7% 96% 19% 18.6x 15.4x 13.1x 1.5x 1.0xS&P 500 5% 96% 14% 14.1x 12.4x 10.9x 1.3x 1.0x

CY Revenue EV/Sales CY EPS CY P/E

Source: FactSet, First Call, Company data, Morgan Stanley Research

17

M O R G A N S T A N L E Y R E S E A R C H

October 15, 2010 Software

Software Group – Cash Flow Metrics Price Price Shares Market Ent.

Company Ticker Rating 14-Oct-10 Target Out. Cap. Value CY10E CY11E CY12E CY10E CY11E CY12E CY10E CY11E CY12E CY10E CY11E CY12E CY10E CY11E CY12E CY10E CY11E CY12E

Large CapAdobe Systems ADBE EW $27.49 NA 523 $14,382 $13,328 9.5x 8.9x 8.0x NM 48.2x 44.8x 6% 7% 7% 12.9x 10.2x 9.0x 7.8% 9.8% 11.1% 11.7x 9.5x 8.4xAkamai AKAM OW $46.06 $57 190 $8,773 $7,725 16.1x 13.4x 11.1x NA NA NA NA NA NA 27.3x 22.5x 20.8x 3.7% 4.4% 4.8% 17.5x 15.6x 14.3xAutodesk ADSK UW $33.35 $26 234 $7,797 $6,527 14.3x 12.4x 10.8x 8.3x 7.8x 7.1x 41% 41% 41% 16.0x 14.9x 14.1x 6.2% 6.7% 7.1% 14.3x 12.6x 11.9xBMC Software BMC NC $44.14 NA 184 $8,113 $7,061 8.1x 7.6x 7.2x NA NA NA NA NA NA 11.7x 10.7x 10.4x 8.5% 9.4% 9.6% 10.4x 9.5x 9.0xCA, Inc. CA NC $22.00 NA 511 $11,242 $10,324 6.6x 6.1x 5.7x NA NA NA NA NA NA 8.8x 8.4x 7.5x 11.3% 12.0% 13.3% 7.6x 7.0x 6.2xCheck Point CHKP OW $39.29 $44 212 $8,336 $6,195 9.6x 9.0x 8.7x 9.7x 8.9x 8.3x 60% 61% 61% 10.7x 10.1x 10.2x 9.4% 9.9% 9.8% 60.8x 10.0x 10.0xCitrix Systems CTXS EW $58.92 $56 189 $11,152 $9,744 18.2x 16.2x 14.6x 9.3x 8.3x 7.6x 57% 58% 58% 21.3x 18.0x 14.7x 4.7% 5.5% 6.8% 18.6x 15.7x 13.0xIntuit INTU OW $47.31 $51 314 $14,855 $14,140 11.1x 9.8x 8.8x NA NA NA NA NA NA 18.1x 15.0x 14.5x 5.5% 6.7% 6.9% 14.7x 12.5x 11.7xMicrosoft MSFT OW $25.23 $30 8821 $222,554 $183,951 6.7x 6.3x 6.6x NA NA NA NA NA NA 8.6x 7.8x 7.4x 11.6% 12.9% 13.5% 7.8x 7.2x 6.8xOracle ORCL OW $28.33 $32 5083 $144,001 $137,402 9.9x 8.9x 8.3x 9.2x 8.5x 7.8x 47% 46% 47% 14.2x 11.2x 13.2x 7.0% 8.9% 7.6% 13.7x 10.9x 12.6xRed Hat RHT EW $39.67 NA 194 $7,679 $6,628 25.9x 23.7x 20.3x 9.1x 8.4x 7.3x 85% 85% 86% 28.2x 25.4x 21.8x 3.5% 3.9% 4.6% 24.8x 22.3x 19.2xSalesforce.com CRM EW $107.36 NA 134 $14,405 $13,136 31.5x 25.9x 20.3x 8.8x 7.3x 5.9x 93% 94% 94% 51.8x 41.2x 31.4x 1.9% 2.4% 3.2% 39.9x 32.0x 24.8xSAP SAP EW $38.09 $38 1189 $45,283 $43,659 11.2x 9.9x 9.3x 6.9x 6.5x 5.9x 54% 55% 56% 26.0x 17.3x 17.1x 3.8% 5.8% 5.8% 21.8x 15.3x 15.0xSymantec SYMC EW $15.56 NA 805 $12,526 $11,887 7.1x 6.3x 6.4x 2.3x 2.2x 2.1x 86% 86% 86% 9.6x 8.7x 7.7x 10.5% 11.5% 13.0% 7.7x 7.2x 6.4xVMware VMW OW $80.15 $90 422 $33,850 $31,520 32.3x 27.0x 23.2x 25.6x 19.2x 15.8x 44% 48% 51% 27.7x 21.3x 17.3x 3.6% 4.7% 5.8% 24.9x 19.1x 15.8xVeriSign VRSN NC $32.03 NA 183 $5,854 $5,092 14.0x 12.4x 12.4x NA NA NA NA NA NA 17.6x 15.6x 13.1x 5.7% 6.4% 7.6% 13.4x 11.7x 10.8xLarge Cap Mean 15.2x 13.4x 11.9x 9.3x 11.7x 10.5x 60% 61% 62% 20.3x 16.9x 15.1x 6.3% 7.2% 7.7% 20.6x 14.4x 12.9x

SMid CapConcur CNQR NC $49.03 NA 53 $2,595 $2,265 25.4x 20.4x NA NA NA NA NA NA NA 37.6x 30.7x 25.3x 2.7% 3.3% 4.0% 28.0x 24.1x 20.2xDemandTec DMAN EW $10.62 NA 30 $321 $265 92.8x 30.7x 25.2x 4.5x 3.9x 3.6x 75% 75% 75% 68.4x 25.2x 19.2x 1.5% 4.0% 5.2% 30.8x 18.2x 13.9xFortinet FTNT OW $25.28 $23 76 $1,912 $1,660 31.6x 26.6x 22.8x 9.0x 7.8x 6.9x 61% 61% 61% 24.0x 19.7x 17.0x 4.2% 5.1% 5.9% 22.0x 17.8x 15.5xGuidance GUID UW $5.97 $4.5 23 $138 $111 23.2x 14.9x 11.6x 2.6x 2.3x 2.1x 49% 49% 49% 22.6x 21.5x 19.7x 4.4% 4.6% 5.1% 14.6x 13.8x 12.4xInformatica INFA NC $37.39 NA 108 $4,037 $3,874 24.8x 21.0x 17.3x NA NA NA NA NA NA 32.5x 26.7x 24.3x 3.1% 3.7% 4.1% 31.9x 25.6x 23.2xIntraLinks IL OW $18.50 $20.0 49 $912 $1,015 18.0x 14.4x 13.1x 8.9x 7.6x 6.6x 64% 67% 70% 45.8x 20.3x 17.3x 2.2% 4.9% 5.8% 21.3x 14.3x 12.6xNetSuite N UW $21.69 $18 63 $1,377 $1,278 77.3x 51.0x 35.1x 7.9x 6.8x 5.9x 85% 86% 87% NM NM 58.0x 0.7% 1.0% 1.7% 79.8x 62.4x 42.5xQlik Technologies QLIK OW $23.45 $22 82 $1,924 $1,844 57.2x 42.5x 33.6x 33.1x 26.0x 19.8x 27% 28% 31% 55.7x 44.9x 35.1x 1.8% 2.2% 2.8% 52.4x 42.4x 33.3xRightNow RNOW EW $24.76 NA 33 $828 $742 27.5x 19.1x 14.9x 5.1x 4.4x 3.8x 79% 80% 82% NM 43.4x 19.9x 0.9% 2.3% 5.0% 48.3x 25.0x 14.4xSolarWinds SWI EW $17.70 NA 73 $1,297 $1,197 15.6x 13.6x 12.1x 16.0x 13.2x 10.9x 50% 52% 54% 20.3x 16.9x 15.3x 4.9% 5.9% 6.6% 19.3x 16.1x 14.6xSourcefire FIRE EW $27.90 NA 29 $798 $655 24.1x 17.9x 13.9x 13.4x 10.6x 8.2x 37% 38% 41% 20.6x 19.8x 17.8x 4.9% 5.1% 5.6% 17.6x 16.2x 14.4xSuccessFactors SFSF OW $25.81 $32 73 $1,875 $1,532 NM 84.7x 51.7x 9.1x 7.1x 5.9x 85% 86% 86% 51.5x 37.5x 33.2x 1.9% 2.7% 3.0% 44.7x 32.3x 28.4xTaleo TLEO EW $29.60 NA 39 $1,168 $923 16.0x 14.6x 13.7x 4.7x 4.2x 3.7x 85% 85% 86% 22.8x 17.4x 16.4x 4.4% 5.7% 6.1% 16.4x 14.6x 13.5xWebsense WBSN UW $17.56 $17 44 $771 $759 8.1x 7.5x 6.8x 2.3x 2.2x 2.0x 100% 100% 100% 8.1x 7.7x 7.1x 12.3% 13.0% 14.2% 7.4x 7.0x 6.4xSMid Cap Mean 36.0x 28.4x 21.7x 10.8x 8.9x 7.4x 64% 64% 65% 33.1x 25.9x 23.7x 3.7% 4.6% 5.4% 31.8x 24.2x 19.1x

Mean 24.8x 20.6x 16.4x 10.1x 10.2x 8.9x 62% 63% 64% 25.2x 20.4x 18.7x 5.4% 6.4% 7.1% 25.9x 18.7x 15.5xMedian 17.2x 14.9x 12.9x 8.9x 7.8x 6.9x 60% 61% 61% 20.9x 17.4x 16.7x 4.6% 5.6% 6.0% 18.9x 15.5x 13.7x

EV/CFFOFCF YieldRecurring Revs/Sales EV/FCFEV/EBITDA EV/Recurring Revs

Source: FactSet, First Call, Company data, Morgan Stanley Research

18

M O R G A N S T A N L E Y R E S E A R C H

October 15, 2010 Software

Software Universe Price YTD Shares Market Ent. '10-'12 '10-'12 PE to G EV/OCCF EV/FCF FCF Yield

Company Ticker 14-Oct-10 Perf. Out. Cap. Value 2010E 2011E 2012E % CAGR 2010E 2011E 2012E 2010E 2011E 2012E % CAGR 2010E 2011E 2012E 2011E 2010E 2011E 2012E 2010E 2011E 2012E CY11E CY11E CY11ELarge Cap Tech. (Non-Software)Apple AAPL $302.31 43% 927 $280,351 $256,063 $68,561 $88,033 $99,708 21% 3.7x 2.9x 2.6x $15.64 $20.28 $22.56 20% 19.3x 14.9x 13.4x 0.7x $20,357 $27,814 $31,141 12.6x 9.2x 8.2x 11.7x 13.3x 7.5%Automatic Data Processing ADP $42.47 -1% 500 $21,222 $19,392 $9,059 $9,440 $10,042 5% 2.1x 2.1x 1.9x $2.26 $2.54 $2.68 9% 18.8x 16.7x 15.8x 1.9x $1,913 $2,146 $2,240 10.1x 9.0x 8.7x 12.0x 17.1x 5.8%Applied Materials AMAT $11.91 -15% 1,349 $16,064 $13,922 $9,594 $9,450 NA NM 1.5x 1.5x NA $1.05 $1.21 NA NA 11.3x 9.8x NA NA $1,884 $2,447 NA 7.4x 5.7x NA 7.0x 8.7x 11.5%Advanced Micro Devices AMD $7.14 -26% 709 $5,062 $5,746 $6,547 $6,536 $6,818 2% 0.9x 0.9x 0.8x $0.35 $0.30 $0.33 -3% 20.2x 23.9x 21.6x NA $805 $732 $761 7.1x 7.8x 7.5x 11.3x 15.8x 6.3%Cisco Systems, Inc. CSCO $23.07 -4% 5,795 $133,691 $109,114 $43,252 $48,184 $54,489 12% 2.5x 2.3x 2.0x $1.67 $1.88 $2.14 13% 13.8x 12.3x 10.8x 0.9x $12,471 $14,157 $16,219 8.7x 7.7x 6.7x 8.7x 10.6x 9.4%Dell Inc. DELL $14.27 -1% 1,960 $27,969 $20,610 $60,937 $63,585 $64,882 3% 0.3x 0.3x 0.3x $1.22 $1.34 $1.36 5% 11.7x 10.6x 10.5x 1.9x $4,386 $4,449 $4,322 4.7x 4.6x 4.8x 5.1x 6.0x 16.7%EMC Corporation EMC $21.21 21% 2,133 $45,241 $41,597 $16,667 $18,837 $21,125 13% 2.5x 2.2x 2.0x $1.22 $1.42 $1.62 15% 17.4x 15.0x 13.1x 1.0x $3,721 $4,185 $4,619 11.2x 9.9x 9.0x 9.6x 12.2x 8.2%Google GOOG $540.93 -13% 322 $174,442 $144,383 $21,201 $23,824 $26,157 11% 6.8x 6.1x 5.5x $27.42 $30.12 $32.68 9% 19.7x 18.0x 16.6x 2.0x $11,705 $12,900 $14,084 12.3x 11.2x 10.3x 12.0x 13.4x 7.5%Hewlett-Packard HPQ $42.13 -18% 2,376 $100,101 $105,424 $126,908 $134,051 $139,947 5% 0.8x 0.8x 0.8x $4.77 $5.32 $5.96 12% 8.8x 7.9x 7.1x 0.7x $19,426 $21,009 $22,635 5.4x 5.0x 4.7x 6.2x 8.3x 12.0%International Business Machines IBM $141.50 8% 1,297 $183,483 $197,892 $98,811 $103,955 $109,088 5% 2.0x 1.9x 1.8x $11.30 $12.80 $14.54 13% 12.5x 11.1x 9.7x 0.8x $25,222 $28,348 $30,499 7.8x 7.0x 6.5x 9.0x 11.2x 8.9%Intel Corporation INTC $19.32 -5% 5,694 $110,008 $91,590 $43,284 $41,221 $43,582 0% 2.1x 2.2x 2.1x $1.97 $1.60 $1.70 -7% 9.8x 12.1x 11.3x NA $20,177 $17,289 $17,862 4.5x 5.3x 5.1x 5.6x 8.6x 11.6%Juniper Networks JNPR $31.30 17% 539 $16,869 $14,646 $4,038 $4,745 $5,532 17% 3.6x 3.1x 2.6x $1.25 $1.53 $1.82 21% 25.1x 20.4x 17.2x 1.0x $930 $1,189 $1,467 15.8x 12.3x 10.0x 14.2x 16.2x 6.2%Texas Instruments TXN $28.31 9% 1,221 $34,567 $32,262 $13,674 $13,364 $12,774 -3% 2.4x 2.4x 2.5x $2.40 $2.44 $2.32 -2% 11.8x 11.6x 12.2x NA $5,208 $5,042 $4,708 6.2x 6.4x 6.9x 7.4x 9.6x 10.4%