Inventory to insight: Understanding Content Inventories, Audits, and Analysis

VII.1 Chapter 7 Inventories Learning objectives 1. Inventory terminology. 2. Valuation of inventory...

-

Upload

asa-attard -

Category

Documents

-

view

225 -

download

2

Transcript of VII.1 Chapter 7 Inventories Learning objectives 1. Inventory terminology. 2. Valuation of inventory...

VII.1Chapter 7 InventoriesLearning objectives

1. Inventory terminology.2. Valuation of inventory & measurement of goods sold in a) trading

companies and b) production companies. 3. Various valuation bases for inventory.4. Periodical versus perpetual inventory systems (~ “manual” inventory

system versus “automatic” inventory system). 5. Inventory conventions ~ “Cost flow” assumptions.6. Valuation of costs of goods sold and ending inventory under the various

different inventory conventions/“cost flow” assumptions.

Copyright 2000 by Harcourt Inc. All rights reserved.

VII.2

1. Inventory terminology

DK: Cf. Balance sheet statements (handed out earlier)

state inventories in the balance sheet in the following way:

CURRENT ASSETS

I. Inventories

1. Raw materials and consumables2. Work-in-progress3. Prepayments for goods4. Finished goods and goods for resale

VII.3

1. Inventory terminology (continued)

Inventory is a stock of goods for sale or for further processing. Raw materials are the inventory of materials that are expected to be

used in the production of goods. Work-in-process (“semi-manufactured goods”) is inventory of partially

completed products. Goods for resale is inventory of a wholesale and/or retail company. Finished goods are goods ready for sale produced by a production

company. To make inventory means to prepare a list of the items on hand at some

specified date, to assign a unit cost to each item – and to calculate the total cost of goods in hand and of goods consumed.

Copyright 2000 by Harcourt Inc. All rights reserved.

VII.41. Inventory

The physical amounts of inventories at the end of a period is logically determined by: beginning inventory and additions and withdrawals (consumption) during the course of the accounting period:

Beginning inventory + additions - withdrawals = ending inventory =>

Beginning inventory + additions - ending inventory = withdrawals.

Value relations follow the same logic: For raw material / goods for resaleBeginning inventory value + purchases - consumption = ending inventory valueFor semi-manufactured goods, finished goods respectivelyBeginning inventory value + production costs (for additions to inventories)

- consumptions = ending inventory value

Copyright 2000 by Harcourt Inc. All rights reserved.

VII.5

1. Inventory

Value relations can just as the physical relation be inverted according to needs - if you know three measures then the fourth is determined logically, e.g. consumption

For raw material / merchandise inventory

Consumption = beginning inventory value + purchases - ending inventory value

For semi-manufactured goods, finished goods respectively

Consumption = beginning inventory value + production costs (for additions to inventory) - ending inventory value

Copyright 2000 by Harcourt Inc. All rights reserved.

VII.61. Inventory

Once it has been determined how much one wants to include in the acquisition cost for goods purchased and/or the cost price for manufactured goods, goods purchased and costs for manufactured goods (“the inflows”) are determined on the basis of the actual circumstances one more problem remains to be solved:

The allocations of the value of inflows to (1) the value of the units on ending inventory (goods at hand) and (2) the value of consumption (the outflow)

These two measurements are co-determined

Copyright 2000 by Harcourt Inc. All rights reserved.

VII.71. Inventory

The value of inventory (the balance sheet) and of cost of sales (the income statement) is often big items in the accounts. The accounting allocation of the value of inflows to goods at hand and goods used has often significant influence on the total net result and the total ending inventory – even though the effect of allocation is not significant for a specific item in the inventory list.

VII.81. Inventory

Listing of all problems related to the valuation of inventories and of goods consumed:

1. Which costs are included in the acquisition cost of goods purchased?

2. Which costs are included in the cost price of self produced goods.

3. Which cost (or valuation) basis for items in inventory is to be used?

What is required by the DCAA and AS number 8?

4. With which frequency should inventory computations be carried out, periodically (“manual inventory system”) or perpetually (automatic inventory system)?

5. Which inventory convention (“cost flow” assumptions) shall be used to allocate the “movements” of costs into the inventory to (1) costs of goods at hand and (2) costs of of goods consumed? (The “cost flow” assumption need not correspond to the physical movement of the goods).

Copyright 2000 by Harcourt Inc. All rights reserved.

VII.92.a Costs included in acquisition cost

of goods purchased

§ 44. The cost price for current assets must include those costs incurred to acquire the goods or that can be directly related to the produced asset…. Furthermore interests on capital that has been borrowed to finance production of goods and which concern the production period, can be

included in the cost price. Explored in AS 8 paragraph 19: The acquisition cost for

merchandise inventory and raw materials and consumables includes purchase price and costs directly related to the acquisition. The purchase price is net of discounts (cash discounts too?)

Costs directly incurred by the acquisition can e.g. be customs duty, levies and transportation costs.

Copyright 2000 by Harcourt Inc. All rights reserved.

VII.102.a Costs included in acquisition cost

of goods purchased

The textbook is perhaps a bit more specific: The acquisition cost includes all costs used to acquire and

prepare the goods for sale. This includes: Purchase transaction and e.g. expenses incurred to order,

receive, inspect and book the goods. Cash discounts, credit memos (e.g. as a result of returned

goods) are deducted from the acquisition cost of the goods.

The goods are booked in the accounts once title has passed to the buyer.

Copyright 2000 by Harcourt Inc. All rights reserved.

VII.11

2.a (continued)

Because revenues and expenses are measured by the accrual principle, costs will not be recognized as expenses until income recognition has been carried out. Until then costs are recognized in inventory in the balance sheet (debit assets in stead of income statement).

Obviously this principle applies regardless of whether it concerns a commercial or a production company.

VII.122.b Expenses included in the cost price of own manufactured goods

For medium-seized and large companies (75/150/150 total assets/turnover/employees) :

DCAA § 82. The company must include, in the cost price of tangible and current assets it has produced…, those costs that indirectly can be related to the product in question if the costs are incurred in the production period.

Conclusion by inversion: Small companies does not need to include indirect costs (IPO) in the cost price of produced goods.

The requirement of inclusion is new and applies as of 1.1.2002

Copyright 2000 by Harcourt Inc. All rights reserved.

VII.13

2.b Expenses included in the cost price of self produced goods

Summary: The cost price includes the costs to produce and to prepare the goods

for sale. This includes: Direct material such as raw materials that can easily be

identified in the finished product. Direct labor costs that can be related to employees who have

worked on the completion of the goods. In medium-seized and large companies: A proportional share

of the indirect production costs (IPO) which can be related to the production, e.g. depreciation, insurance on production facilities, supervisory labor etc.

Copyright 2000 by Harcourt Inc. All rights reserved.

VII.14

2. (continued)

Inclusion of indirect production costs, IPO, is called “full absorption costing”, because the inventory accounts absorb -include- all the costs that are necessary for the production . (IPOs are as a starting point calculated from maximum production capacity).

US GAAP require this method because it offers total costs for any given inventory. Costs of capacity used are related to the sale of those goods which the capacity has been used for to produce. In case of a possible under utilization of capacity: that part of costs are directly expensed in the under-utilization period (a proportional part of total depreciation).

When applying “variable (direct) costing” (no IPO-inclusion, “variable costing”) it is only the direct (”variable”) costs that are included in the inventory. ”Fixed” manufacturing costs are considered period expenses ~ perception: they are not influenced by production volume.

Copyright 2000 by Harcourt Inc. All rights reserved.

VII.15

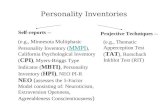

Figure 7.2 -- Flow of Manufacturing Costs Through the Accounts

Copyright 2000 by Harcourt Inc. All rights reserved.

Raw materials inv.(A)cost of Raw matl’sraw costsmaterials incurredpurchases in manuf.

Work-in-process inv.(A)Raw matl’scosts incurredin manuf.

Cash(A) orWages payable (L)

Directlaborcostsincurredin manuf.

Directlaborcostsincurredin manuf.

Cash(A) , Accumulateddepreciation (XA), other

Overheadcostsincurredin manuf.

Overheadcostsincurredin manuf.

Manuf.costs ofunits completedand movedto store-room

Finished Goods inv. (A)Manuf. Manuf.costs of cost ofunits unitscompleted soldand movedto store-room

Cost of goods sold (SE)Manuf.cost ofunitssold

Copyright 2000 by Harcourt Inc. All rights reserved.

VII.16

3. Cost basis for inventory (continued)

Cost price or historical/ acquisition cost -- the price the company originally paid for the goods.

Replacement cost -- (entry value) the amount a company estimates it would have to pay to acquire the goods at the time of the balance sheet.

Net realizable value (exit value) -- the amount the company estimates that a buyer would be willing to pay for the goods less deduction of completion costs and costs for preparing the items for sale.

Lower-of-cost-or-market-basis -- Similar to the cost price / acquisition cost principle, however, with a duty to write down the value of the goods to market price if market prices decline.

(”Market price” is DK net realizable value for inventories. Even if the replacement cost is lower than the net realizable value goods will “only” be written down to net realizable value as they would otherwise be written down with more than the expected loss).

Standard cost (cost price calculation method): predetermined estimate of what items of manufactured should typically cost. It is used more in the internal management accounting than in the financial accounts.

Copyright 2000 by Harcourt Inc. All rights reserved.

VII.17

3. Cost basis for inventory (continued)

DCAA § 46: Current assets that are not valued at current values according to §§

37 or 38 (financial assets), must be written down to a lower net realizable value

Inventories can be written up to replacement value (is not used in practice)

Accounting standard number 8:Net realizable value = expected sales price less deduction of completion

costs and costs to prepare the goods for sale, including distribution costs for the goods in question.

VII.18

3. Cost basis for inventory (continued)

Accounting standard number 8: revaluation is made only in special instances if it gives a

more true and fair view. Maximum revaluation is at the lower of net realization value and replacement cost.

I.e. DK -> the starting point is acquisition cost / cost price unless: the net realization value is lower, in which case write-

down must be made. the replacement cost is higher, in which case revaluation

can be made - however maximum revaluation at the lower of net realization value and replacement cost.

VII.193. Cost basis for inventory (continued)

Write-down of inventories to net realizable value: A crediting of the inventory account (or a separate account) is accompanied by a debit to the income statement, i.e. a loss. (In principle the loss is not a(n) cost/expense for goods sold, but a period expense).

Once the written down goods are sold in the future the profit of the sale will be higher since the matching “costs” have been reduced as a result of the write down.

Due to the historical cost valuation of inventories value increases in inventories (unrealized holding profit) are not recognized in the income statement at the points in time when prices increase => profits resulting from such price increases are included in income when the goods are sold.

Copyright 2000 by Harcourt Inc. All rights reserved.

VII.204. Periodical versus perpetual inventory system

Value entries in the inventory accounts DOES NOT NEED to parallel the actual physical flows in and out of inventory.

There are two basic inventory systems: 1. Periodical inventory system (”manual” inventory system)

additions to the inventory are recognized continuously in the company’s accounts department, but withdrawals are not recognized continuously. In stead the company makes a physical count of units on hand at the end of an accounting period after which the inventories are valued and accounts records are updated.

2. Perpetual inventory system (”automatic” inventory system) both additions to and withdrawals from the inventory are recognized

continuously. the method leads to the company being able to state the inventory (unit

cost price) continuously (E.g. used in super markets, shops in general where product bar codes are used today.)

Copyright 2000 by Harcourt Inc. All rights reserved.

VII.21

4.1 Periodical inventory system

Withdrawals from the inventory (consumption of goods) are not recognized which is why the value of withdrawals (consumption) can only be computed after the physical count of the units on hand at the end of the period.

For calculation of consumption: See inventory equation.

Copyright 2000 by Harcourt Inc. All rights reserved.

VII.224.2 Perpetual inventory system

An “automatic” inventory system continuously recognizes both additions and withdrawals, i.e.that the value of consumption is calculated every time a withdrawal is made, not only at year end.

For calculation of the ending inventory after each withdrawal: see inventory equation!

In order to check the inventory system, a check count is made once or more times a year which is then balanced with the record of withdrawals (shrinkage = additional cost of goods sold)

For economical reasons most companies, which use an automatic inventory system count only selected parts of the inventory many times a year (Selection: The goods with a high risk of shrinkage).

Copyright 2000 by Harcourt Inc. All rights reserved.

VII.234. Periodical or perpetual

inventory system?

Periodical inventory system is sometime not as costly because fewer accounting computations are made.

A perpetual inventory system delivers updated information on costs of goods consumed and calculates an estimate of ending inventory. The system is more computation requiring.

A well functioning automatic inventory system, however, leads to the physical inventory counting being reduced and that control with shrinkage can be made more effective.

Shrinkage can only be stated in terms of direct inventory system By use of a manual system shrinkage will “drown” in costs of

goods sold. By use of an automatic inventory system shrinkage can be

controlled if physical counts are made regularly.

Copyright 2000 by Harcourt Inc. All rights reserved.

VII.24

5. Inventory convention/“Cost Flow” assumptions

In relation to valuation of inventories there is a need to lay down an inventory convention / “cost flow” assumption as basis.

As a result of changing economic conditions (e.g. inflation or fast developing production techniques) uniform goods will often have varying acquisition costs / cost prices over time. The inventory value and the costs of goods sold will thus depend on which “cost flow” assumption that is used to decide which goods there are on stock and have been sold, respectively.

Four methods/conventíons exist:1. Specific identification2. First-in, first-out (FIFO) 3. Last-in, first-out (LIFO)4. Weighted-average

Copyright 2000 by Harcourt Inc. All rights reserved.

VII.25

5.1 Specific Identification

The acquisition cost / the cost price of valuable and unique goods is known.

Identification number is used where goods are almost identical. For example an automobile dealer who can identify the individual cars

on the basis of their serial number. In such situations it is not meaningful to apply a “cost flow” assumptions.

“Cost flow” assumptions are (should be) used in those instances where the inventory consists of units on stock that are equally valuable and where the units are physically identical. E.g. every day goods such as milk, flour, bread etc. or an inventory of similar silencers, kitchen doors, oil stock etc..

In that case it is more cost-effective and meaningful to assume a “cost flow” than to derive the cost of consumption from the actual cost of the physical units sold - and thus also more enlightening for accounting users.

Copyright 2000 by Harcourt Inc. All rights reserved.

VII.265.2 First-in, first -out (FIFO)

FIFO assumes (/”pretends”) that the earliest bought units are also used/sold first. This is often realistic because it describes the actual flow relations for many goods, e.g. dairy products.

Costs of older units are allocated to costs of goods sold and that is why ending inventory is stated on the basis of the most recent costs.

If prices increase a lot FIFO will result in a sale being matched with some very old and thus low acquisition costs. Ending inventory on the other hand is recognized on the basis of the most new and high prices.

Copyright 2000 by Harcourt Inc. All rights reserved.

VII.275.3 Last-in, first-out (LIFO)

LIFO assumes (/”pretends”) that goods bought most recently are sold first. On the face of it, it is an illogical way of thinking (except for coal piles?) and the method is often used solely to make allowance for inflation.

The most recent acquisition costs are allocated to costs of goods sold whereby the oldest acquisition costs are allocated to ending inventory.

When prices increase heavily LIFO leads to sales being matched with the most recent acquisition costs. In this way the company can be said to obtain a better matching (actual sales prices are matched with “actual” costs). Ending inventory, however, is valued on the basis of older and lower prices which give rise to problems in relation to valuation of the inventory (and in relation to the result of the periods, when a lot of old goods are sold)

LIFO/FIFO: “Conflict” between income statement oriented and balance sheet statement oriented way of thinking?

Copyright 2000 by Harcourt Inc. All rights reserved.

VII.285.3 LIFO Layers

Under the principle of LIFO the oldest acquisition costs are related to ending inventory which can result in

1. the inventory being grossly undervalued when compared with actual prices and

2. highly increased earnings if inventory quantities at a point in time is decreased considerably in some year. Since very old and very low acquisition costs will then be matched with current sales prices income will increase very much in that year - seemingly signaling much higher profitability (jargon says that the company is dipping into the LIFO layers)

Copyright 2000 by Harcourt Inc. All rights reserved.

VII.295.4 Weighted-average

The weighted-average convention assumes (“pretends “) that “the average unit” is sold/is on stock. On the basis of beginning inventory and purchases of the period an average acquisition cost is calculated. The average acquisition cost is applied in both the calculation of the costs of goods sold and ending inventory.

This method is “calculation demanding”. This method does not mirror the actual acquisition costs as quickly in

the income statement as the LIFO principle. The balance sheet statement, on the other hand, is more “correct” than by applying the LIFO principle. This convention may be viewed as a way of compromising the FIFO and LIFO principles.

Copyright 2000 by Harcourt Inc. All rights reserved.

VII.305. Inventory convention / “Cost Flow” assumptions

DCAA § 45. The cost price for inventories can be calculated on the basis of weighted-average prices, the FIFO principle, or another method which mirrors the value of the physical units on stock at the date/time of the balance sheet. (Not LIFO?)

Accounting standard number 8: specific identification, FIFO or weighted average prices.

Accounting standard number 8 : LIFO…often leads to the annual accounts giving an untrue and not fair view, and that is why it cannot be used.

REMEMBER:“Cost flow” assumptions in terms of valuation do not necessarily reflect the actual physical flow of goods.

Copyright 2000 by Harcourt Inc. All rights reserved.