Valuation of Financial Options Ahmad Alanani Canadian Undergraduate Mathematics Conference 2005.

-

Upload

malcolm-filby -

Category

Documents

-

view

219 -

download

0

Transcript of Valuation of Financial Options Ahmad Alanani Canadian Undergraduate Mathematics Conference 2005.

Valuation of Financial Options

Ahmad AlananiCanadian Undergraduate

Mathematics Conference 2005

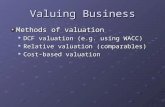

2

Topics Covered

1. Introduction

2. Option Payoffs at Expiration

3. The Put-Call Parity

4. Factors that Affect Option Prices

5. The Binomial ModelThe Tracking Portfolio approach

The Risk Neutral Valuation method

Generalization of the Binomial model

7. Black-Scholes

8. Summary

3

Introduction

The Option Contract:

A contract in which the writer (seller) of the option grants the holder (buyer) the right, but not the obligation, to buy from or to sell to the writer an underlying asset at a fixed strike (exercise) price at or before an exercise date.

Call Option- Grants its holder the right to buy the underlying asset- Writer (seller) of the call option makes a commitment to

sell the underlying asset at the strike price if the option is exercised.

4

Put Option- Grants its holder the right to sell the underlying asset- Writer (seller) of the put option makes a commitment to buy the

underlying asset at the strike price if the option is exercised

Options may be:Exercised, traded in the market or allowed to expire

European vs. American Options- European options can be exercised only at the exercise date- American options can be exercised anytime between the date

they are written and the exercise date

5

Terminology

“In the Money” An option whose exercise would generate a profit, given the

current market price of the underlying asset. Calls (puts) with exercise prices lower (higher ) than the

current price of the underlying

“Out of the Money” An option whose exercise would generate a loss.

Calls (puts) with exercise prices lower (lower ) than the current price of the underlying

“At the Money” • The exercise price is roughly equal to the current price of the

underlying

6

Option payoffs at expiration

Payoff Graph: Graph of the profit and loss positions for each possible price of the underlying asset at the exercise date

A. Call OptionsValue of the call option at expiration:

Payoff to call owner = ST - X if ST > X

= 0 if ST < X

where:ST = value of the underlying at expiration

X = Strike price

7

Call option on Nortel: X =$4.0:

Stock Price $3.2 $4.0 $4.2 $4.4 $4.6Option Payoff $0.0 $0.0 $0.2 $0.4 $0.6

Payoff to call writer = –(ST – X) if ST > X

Payoff to call writer = 0 if ST < X

X Underlying price

BUY CALLOptionPayoff

WRITE CALL

Underlying priceX

OptionPayoff

0

0

8

•B. Put Options

Value of the put option at expiration:

Payoff to put owner = 0 if ST > X

Payoff to put owner = X – ST if ST < X

Option

PayoffOptionPayoff

X

X

0

0 Underlying price

Underlying price

BUY PUT WRITE PUT

9

Put-Call Parity

• Consider a European call and a European put with the same strike price X and the same expiration date T

• Buy the call and write the put: What is the payoff from this portfolio at ?

Examine the two possible scenarios:

ST < X ST > X

Payoff from call owner 0 ST – X

Payoff from put written – (X – ST ) 0

Total ST – X ST – X

• So this position always nets a payoff of ST – X

10

What is the value of this option portfolio? Find a tracking portfolio that replicates the future payoffs. The

value of the option portfolio must equal the price of the tracking portfolio if there is no arbitrage

The tracking portfolio (levered equity):

• Borrow today and repay X at maturity

• Buy one share of stock

The payoff of the tracking portfolio at time T is ST – X The tracking portfolio perfectly replicates the payoff of the

option portfolio Hence the tracking portfolio and the option portfolio must have

the same value at date 0

Tfr )1(

X

11

value of the option portfolio at date 0

Purchase the call option for price C0

Write (sell) the put option for price P0

Total cost of establishing the position is C0– P0

The value of the tracking portfolio at date 0:

Borrowed funds: , Buy one share of stock: S0

The value of the tracking portfolio is then

The option portfolio and the tracking portfolio must have the same value:

Put-Call Parity:

Tfr )1(

X

Tfr )1(

XSPC 000

Tfr )1(

XS0

12

Factors that affect call option values

1. Stock price (+)

2. Exercise price (–)

3. Stock price volatility (+)

The options captures the upside potential, and avoids the downside risk. Therefore an increase in risk increases option value

4. Time to expiration (+)

- Present value of exercise price is reduced- Longer horizons increase the probability of extreme events

5. Interest rates (+) - Higher interest rates reduce the present value of the strike price

6. Dividend payout (–) - Higher dividend payout limits the rate of growth of the stock price

13

The Binomial Model

Consider a stock and a European call on the stock one period before expiration:

S0

S

S

Current stock price

Stock price in the up state

Stock price in the down state

C0

]0 , XSmax[C

Want to find the current option price

Option payoff in the up state

Option payoff in the down state]0 , XSmax[C

14

The Tracking Portfolio Approach

Value the call option on: S0 = $100; X =$125 and rf = 8%

Binomial model: At year-end stock price can take only two values: = $200 or

= $50

So the call payoffs are

= $75 if stock price goes up, = $0 if it goes down

Alternatively consider the following portfolio: (i) buy one share of stock + (ii) borrow $46.30 at 8%

Portfolio payoffs

$150 if stock price goes up, $0 if it goes down

The price of the portfolio = $100 – $46.30 = $53.70, hence, by no-arbitrage:

C0 = (1/2) $53.70 = $26.85

S S

C C

15

• To form the tracking portfolio we need the hedge ratio (H):

S S

C CH

• In the example: 5.050$200$

0$75$H

Consider the payoffs to buying H units of stock and writing a call:

Buy H units of stock: 100 25

Write a call: -75 0 2525

In the example In generalHS HS

C-C- CHS CHS

16

•

This portfolio creates a hedged position and results in a certain payoff in the future. Therefore the cost of holding the portfolio must equal the present value of the certain payoff:

Value of hedged position = PV of certain payoff0.5S0 – C0 = $23.15

$50 – C0 = $23.15

C0 = $26.85

CHSCHSM

r1

MCHS

f00

In the example

In general

PV of $25 at 8% = $25/1.08 = $23.15

CHSCHSM

r1

MHSC

f00

where

General formula for the price of a European call

17

Risk-Neutral Valuation Method

• We have thus far ignored the investor’s risk preference

• Regardless of how risk averse investors are, tracking portfolio approach gives the same answer for the option value

• In particular, even if investors were risk-neutral (i.e., if they did not require a risk premium), we would get the same option value

• This suggests the following alternative valuation technique:

-Assume investors are risk-neutral (therefore they discount future expected payoffs at the risk-free rate)

- Find out the probabilities of the up and down states that justify the current stock price given that investors are risk-neutral

- Calculate the expected option payoff given these probabilities

- Discount the expected option payoff at the riskless rate

18

Example continued:

Value the call option on: S0 = $100; X =$125 and rf = 8%

At year-end stock price can take only two values: = $200 or = $50

Step 1 - Compute the “risk-neutral probabilities”: The stock return is %100 in the up state and –50% in the down state. In a risk-neutral world, investors would discount all future expected payoffs at the risk-free rate, therefore the expected return on any security, including the stock, would be equal to the risk-free rate, 8% in this case: %8%)50()p1(%100p =return stock Expected

Solving for p, we get p = 0.3867

S S

19

Step 2 - Use the risk neutral probabilities to calculate the expected

option payoff, and discount the expected payoff at the risk-free

rate: The option pays $75 in the up state and $0 in the down state.

Hence

Expected option payoff= 0.3867 X 75 + (1- 0.3867) X 0= $29

C0= 29/ 1.08= $26.85

20

Generalization of the binomial model

S0 , C0

C,S

C,S

C,S

C,S

C,S

C,S

C,S

C,S

C,S

…and so on

21

•The tracking portfolio and risk-neutral pricing approaches apply in multi- period setting by choosing the time interval short enough and closely approximating actual stock price movements

- The necessary input is the stock price volatility, measured by the size of the up and down jumps

• Binomial tree approach is very flexible:

-Can incorporate different risk-free rates or different volatilities at different branches of the tree

-Can be used to value any derivative security.

- American options: Start from the end of the tree. At each node, calculate the value of waiting (i.e., not exercise), compare it to

the payoff from exercising, then choose the payoff that is higher. Record this payoff at the decision node and proceed backward

22

Black-Scholes Formula

•Black-Scholes formula gives the value of a European call option in the continuous-time case

• Same as the option price given by the binomial tree approach, where the time intervals are taken to be very small

)(X)(SC 2100 dNedN Tr f

where:

Tdd

T

Tr

df

12

20

1

2XS

ln

23

Elements of Black-Scholes Formula

C0 = Current call option value

X= Exercise price

S0 = Current stock price

e = 2.71828

rf = Annual risk-free rate

T= Time to maturity (in years)

ln=Natural logarithm N(d) = Probability that a

random draw from a standard normal distribution will be less than d

σ= Standard deviation of stock’s annualized continuously compounded return

24

Remarks:

1. Assumptions required for Black-Scholes formula

-European call option without dividends

-Both rf and σ are constant

-Stock price changes are continuous (this could be violated if big announcement effects are likely,

e.g. a takeover announcement may occur)

2. σ that makes observed call option price consistent with Black-Scholes formula is called implied volatility

25

A summary on financial option valuation

(1) European Call, no dividends• Black-Scholes formula or Binomial method

(2) American Call, no dividends• Never optimal to exercise early (same value as in (1))• Black-Scholes formula or Binomial method applies

(3) European put, no dividends•Use Put-Call parity + Black-Scholes or binomial for Call•Can use binomial method directly

26

(4) American Put, no dividends Black-Scholes does not apply Early exercise is possible More valuable than (3) Use binomial method

(5) European Call, with dividends Black-Scholes (corrected): reduce the stock price by the

present value of dividends paid before maturity Can also use binomial method

27

(6) American Call, with dividends• May be optimal to exercise early if the dividend one gains by exercising is more than the interest lost by paying the strike price early• Use Binomial method

(7) European Put, with dividends•Use Put-Call parity adjusted•Also can use binomial method

(8) American Put, with dividends• Black-Scholes does not apply• Early exercise is possible• Use binomial method