Utilities ME - Dec 2009

-

Upload

itp-business-publishing -

Category

Documents

-

view

253 -

download

1

description

Transcript of Utilities ME - Dec 2009

Middle East

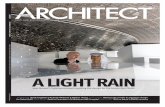

An ITP Business Publication

ESSENTIAL INSIGHTS FOR MIDDLE EAST WATER, GAS AND ELECTRICITY PROFESSIONALS December 2009 • Vol 3. Issue 12

An ITP Business Publication

INTERNATIONAL DESALINATION ASSOCIATION WORLD CONGRESSExperts discuss the hottest trends in the world’s biggest desalination market

ESSENTIAL INSIGHTS FOR MIDDLE EAST WAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAATETETEETEEEETEEEEEEEEEETEEEEEEEEEEETETETETETEEEETEEETETETETETETETEEEETETEEETETEETETETETETTTEEETETETETETETTTEETETETTTTEETETETETETETTTTTTTETETETETTTTTETETETETTTTTTTETETETETETTTTTTTETEETTTTTTTETETEETETTTTTTTTTTTETTTTETETEETTTEEEETTTTEEETTETTEETEETETETTETETETTEEEEEEETETEEETTTETETTTERRR,RR,R,RRR,R,RRR,RRRRR,RRRRR,R,RR,RR,R,RR,RRRRRRRR,RRRR,,RRRR,RR,R,RR,R,R,RRRR,R,R,RRRR,RRR,RRRRRRRRRRRRRR,RRRRRR,R,RR,RRRR,R,RRRRRRR,RRRR,RRRRR,R,R,,RR,,RRRRRRRRRRRR,, GG G GGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGG GGGGGGG GGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGGAAASSASASAAAAAAAAAAAASAAASAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAAASAASASASAAAAAAAAAASAAASASASAAAAAAAASASASAAAAASASASAAAAASASASAASASASASSSASASSSASASSSASAASSSSASASASASSSSSAASASASASASSSAASAAASASASSSASAASSSASASSSAAASSASAAASSSSAAASASSAASSSSAASAASASSSASAASSSSSASASAASAASSSSSSSAAAAAAASSSSSSASAAASSSSAASSSSSSASSSSSSS AND ELECTRICITY PROFESSIONALS,,,,,,,,,,,,,,,,,,,,,,,,,, December 2009 • Vol 3. Issue 12

BILLING ME SOFTLY Hi-tech metering rolls out in the Middle East

WATERDavid H Koch assesses the future prospects of membrane technology

UNLOCKING LIBYA An ERP giant’s experience in a fast-growing nation

DDDaaavviiiddd HHH KKKoooccchhh aaasssseesssssseeesssttthhhhee ffuuttuurree ppprrrooossssppppecttss oofffmembrane tecchhnolooggyy

WISDOMDAV

ID H

KO

CH

, PR

ESID

ENT,

KO

CH

MEM

BR

AN

E SY

STEM

S

World Leader in Innovative Power System Testing Solutions

OMICRON electronics GmbH | Oberes Ried 1 | 6833 Klaus | Austria | Phone: +43 5523 507-0 | www.omicron.at | [email protected]

...and OMICRON’s testing solutions make his job really easy!Pi

ctur

e: w

ww

.om

icro

n.at

/pai

ntin

gs

Go ask my father, because he knows

how to test power systems in an unique

and innovative way, to save you time and

money wherever you are in the world.

Whether it’s testing for protection,

transformers, partial discharge or

the measurement of power system

impedance - OMICRON has it all.

Trust in OMICRON, like dad and

customers in more than 130 countries

already do.

CONTENTS

www.utilities-me.com December 2009 ● Utilities Middle East 1

2 COMMENTCelebrating the new GCC inter-connection grid.

4 REGIONAL UPDATEA round-up of some of the biggest headlines in the region.

10 NEWS ANALYSISLocal companies are still hiring as infrastructure budgets rocket.

13 TECH FOCUSMegger’s new automatic relay test and the IEC 61850 standard.

14 COVER STORYBillionaire David H Koch has forged a strong link with the water industry.

18 NORTH AFRICA FOCUSAn ERP giant’s experience with GECOL, the state electricity pro-vider in Libya.

21 IDA FOCUSUtilities Middle East speaks to the world’s most important de-salination executives.

30 NEW TECHNOLOGIES Smart meter roll-outs are taking place across the UAE.

35 DISTRICT COOLINGDSI’s Tawfiq Abu Soud discusses the need for tighter regulation.

36 PROJECT TRACKERA select list of current regional utilities projects.

38 TENDERSOpportunities available in the Middle East.

40 PEOPLE METERABB’s Mohammed Samkari reviews his firm’s project activities in Saudi Arabia.

December 2009 Issue 12

18

10

14

Metito group human capital director Hisham Fadda Delegates at the IFS/GECOL event in Tripoli

Landis+Gyr’s E450 meter

ABB’s Moham-med Samkari

30 40

Koch Membrane Systems president David H Koch

COMMENT

2 Utilities Middle East ● December 2009 www.utilities-me.com

To subscribe please visit www.itp.com/subscriptions

D ecember sees the offi cial launch of the most important development to hit the GCC’s electricity markets in recent

years – the region-wide interconnection grid. The premise behind the grid – which is already opera-tional in Saudi Arabia, Kuwait and Qatar and Bah-rain – is simple; by utilising spare capacity from other countries, the GCC states will aim to avoid the blackouts that have become endemic.

The GCC Interconnection Authority (GCCIA) says that power demand is likely to rise from 32GW in 2003 to around 94GW in 2028, and believes that the cost-benefi t ratio of the scheme for all six countries weighs in at around 1.8. GCC countries will be able to trade around half the capacity of their biggest power plant – so around 1,200MW for Saudi Arabia, and so on.

However, one of the grid’s major problems is that the peak load for each GCC country falls simultaneously, meaning that spare capacity is at a premium. According to a state news agency, Kuwait’s load this summer was such that it asked gas-rich Qatar to cover a potential shortfall. In what is hopefully not a sign of things to come, Qatar refused, saying it had no power to spare.

But these are early days. Massive recent and ongoing investment in new power plants mean

that countries such as Saudi Arabia are sched-uled to have excess capacity in the beginning of next year, according to a recent report from BMI.

While peak load periods are the same for all GCC nations, connection to other regional power pools, such as EJLIST and the Arab Maghreb, will provide access to other key electricity markets. The grid will also provide an opportunity to cap-italise on any fi bre-optic excess capacity going spare. In addition, the GCCIA says that spinning reserves will be shared to cover emergency oper-ating conditions, and costs will be even further lowered by using the most economic generation unit in the connected systems. Another bonus is that there should, in theory, be a reduced need for new power plants.

No-one is expecting that the grid will solve everyone’s problems immediately. But with more power plants coming online and the slow introduction of nuclear power into the grid at some point towards the end of the next decade in the UAE, the optimists will believe that the ‘Shar-jah scenario’ will soon be an unpleasant footnote in the annals of GCC electricity history.

Ed Attwood, Editor E-mail: [email protected]

On the starting grid... Why the new interconnection should be celebrated

Middle East

Registered at Dubai Media CityPO Box 500024, Dubai, UAETel: 00 971 4 210 8000, Fax: 00 971 4 210 8080Web: www.itp.comOffices in Dubai & London

ITP Business Publishing LtdCEO Walid AkawiManaging Director Neil DaviesDeputy Managing Director Matthew SouthwellEditorial Director David InghamVP Sales Wayne LoweryPublishing Director Jason Bowman

Editorial

Group Editor Dan CantyTel: +971 4 435 6257 email: [email protected] Ed AttwoodTel: +971 4435 6258 email: [email protected] Ventures

Advertising

Commercial Director Jude SlannTel: +971 4 4356348 email: [email protected] Manager Raed KaedbeyTel: +971 4 4356168 email: [email protected]

Studio

Group Art Editor Daniel PrescottDesigner Angela Ravi

Photography

Director of Photography Sevag DavidianChief Photographer Nemanja Seslija Senior Photographers Efraim Evidor, Khatuna Khutsishvili Staff Photographers Thanos Lazopoulos, Jovana Obradovic, Rajesh Raghav, Ruel Pableo, Lyubov Galushko

Production & Distribution

Group Production Manager Kyle SmithProduction Manager Eleanor Zwanepoel Production Coordinator DevaprakashManaging Picture Desk Patrick LittlejohnGeneral Manager - Regional Distribution Shaded Ali ShadedDistribution Manager Karima AshwellDistribution Executive Nada Al Alami

Circulation

Head of Circulation & Database Gaurav Gulati

Marketing

Marketing Manager Daniel Fewtrell

ITP Digital

Director Peter Conmy

ITP Group

Chairman Andrew NeilManaging Director Robert SerafinFinance Director Toby Jay Spencer-DaviesBoard of Directors K.M. Jamieson, Mike Bayman, Walid Akawi, Neil Davies, Rob Corder, Mary Serafin

Circulation Customer Service Tel: +971 4 435 6000

Certain images in this issue are available for purchase. Please contact [email protected] for further details or visit www.itpimages.com.Printed by Atlas Printing Press LLC,

Subscribe online at www.itp.com/subscriptions

The publishers regret that they cannot accept liability for error or omissions contained in this publication, however caused. The opinions and views contained in this publication are not necessarily those of the publishers. Readers are advised to seek specialist advice before acting on information contained in this publication which is provided for general use and may not be appropriate for the reader’s particular circumstances.

The ownership of trademarks is acknowledged. No part of this publication or any part of the contents thereof may be reproduced, stored in a retrieval system or transmitted in any form without the permission of the publishers in writing. An exemption is hereby granted for extracts used for the purpose of fair review.

Published by and © 2009 ITP Business Publishing, a member of the ITP Publishing Group Ltd. Registered in the B.V.I. under Company Registration number 1402846.

Blackouts in the GCC: Soon to be a thing of the past?

GETTY IM

AG

ES

Answers for energy.

E50

00

1-G

72

0-F

13

6-X

-4A

00

Will one solution do for all future tasks?

AMIS is the complete solution for future-proof metering and distribution network automation.

Global energy demand is rising, power distribution has to become more efficient and more productive – the current trends in the energy business are demanding. This means that distribution networks need to be simple, future-proof, and cost-efficient. That’s exactly what the AMIS system solution offers with a consistent integration of automation up to the transformer station, advanced metering systems, and central logging of power quality and asset management data. This integrated concept creates synergies, optimizes processes, and presents a total solution that is unique in the market – a future solution for Smart Grids. www.siemens.com/energy

AMIS_Ads_205x275_engl.indd 1 02.11.2009 18:32:25 Uhr

REGIONAL UPDATE

4 Utilities Middle East ● December 2009 www.utilities-me.com

Sembcorp: Salalah IWPP nears fi nancial close

IDA team examines Gulf pollutionTask force to consider fall-out from desalination; Bahrain offers to hold first meeting in 2010A task force will be set up to con-sider the effects of pollution in the Arabian Gulf caused by the desali-nation industry, according to speak-ers at the launch ceremony of the International Desalination Associa-tion (IDA)’s World Congress.

The issue of pollution in the Gulf has been raised before, particu-larly in light of the fact that water exchange in the inland sea is only full exchanged every eight or nine years, according to some experts.

Discussions were held over the make-up of the committee during the desalination industry’s mar-quee annual event, which took place at Dubai’s Atlantis Resort on the Palm Jumeirah.

The move was backed by GCC ministers present at the launch, who agreed that further action was needed in order to safeguard the industry in the region.

“Concentrated brines from these plants are discharged into the oceans without full treatment, which is of growing concern,” Bah-rain’s Minister of Electricity and Water, Fahmi Bin Ali Al Jowder told delegates. “There is a necessity to provide strict legislation on the dis-charge of effl uent from desalina-

tion facilities. In this context, we at the Electricity and Water Author-ity would be happy to hold the fi rst meeting of the task force in Bah-rain, and propose that this meet-ing should be held in the fi rst part of 2010,” Al Jowder added.

The long-running saga of the US$1 billion Salalah IWPP appears to be coming to a close, after Singapore’s Sembcorp, the initial preferred bidder on the project, claimed it had lined up the fi nancing.

“The financing is now in place, with all the banks lined up”, a source told local media.

The firm regained preferred bidder status in June after Oman Power & Water Procure-ment Company went back to the

second- and third-ranked consor-tiums as a result of Sembcorp’s decision to ask the GCC utility to provide more money for the deal.

The Salalah IWPP, which is now behind schedule, will produce 400MW of power and as well as 15 million gallons per day of desali-nated water.

“The thaw in the project finance market now is becoming evident - it has also reached the periph-ery of the Gulf-region market,

where Salalah is located both physically and business-wise (as financial risk after all is higher in Oman than in Abu Dhabi or Qatar, which hitherto have seen more of the project finance thaw),” said IHS Global Insight Middle East energy analyst Samuel Ciszuk.

“It is increasingly apparent that Middle Eastern actors are gain-ing market shares in the proj-ect finance market, thanks to improved oil prices.”

Fluids fi rm in Gulf expansionFluid systems technology designer Swagelok has expanded its sales and service teams by announcing fi ve new regional partnerships.

The representatives include Abu Dhabi Oilfi eld Services (UAE); Petroleum Technology Co. (Qatar); Purshottam Kanji Trad-ing Co. (Oman); and Supply & Proj-ect Services, a division of Dar Al Riyadh Holding Company (KSA).

Dr Rashid Ahmad Bin Fahad, the UAE Minister of Environment and Water, criticised what he described as “irresponsible practices in some sectors”, and added that water demand would increase from 5-7 billion cubic metres by 2020.

“A steering committee has been formed, primarily composed of individuals from the region rep-resenting utilities and IDA board members with global expertise,” IDA president Lisa Henthorne told Utilities Middle East.

IDA President Lisa Henthorne and local offi cials open the IDA World Congress in Dubai in November.

REGIONAL UPDATE

www.utilities-me.com December 2009 ● Utilities Middle East 5

Gas producers hurtingBut electricity production is still driving regional demandMiddle East gas producers are press-ing ahead with expansion plans despite fears that the market could suffer an oversupply of up to 15 per-cent, a new report has said.

The Booz & Company study said that there was no doubt that the region’s gas producers were feeling the effect of the economic crisis.

Demand destruction in Asian mar-kets, which are the traditional recip-ients of GCC gas, were challenging export schemes, it added.

But the report said many regional national oil companies (NOCs) including those in Iran, Qatar and the UAE, were still confi dent and were pressing ahead with their ambitious plans to increase gas output.

“Unlike developed countries, Middle Eastern markets are still hungry for gas, with demand expected to increase by at least 6 per cent per annum in the medium-term, the report added.

“The major driver for this growth is electricity production, which is con-tinuing to grow at a high rate, in part due to relatively low and subsidised electricity tariffs,” Booz & Company

partner George Sarraf said. “While NOCs might be struggling to fi nd new export markets for their gas or face challenges over pricing - domes-tic gas needs are signifi cant. This sit-uation is likely to keep projects on track for domestic supply, and also serve the region’s needs,” he added.

The report said the economic downturn had the potential to “pro-foundly change” global gas markets.

Deeply negative forecasts for industrial output in developed coun-tries will reduce worldwide demand for natural gas in 2009 and 2010 - the

fi rst time in history - while potentially setting back the market for up to 10 years, according to Booz & Com-pany’s report called ‘An Unprece-dented Market: How the recession is changing global gas markets’.

The report found that the market would be in a position of oversupply of between fi ve and 15 percent this year and the next. “This unprecedented worldwide drop in demand for natu-ral gas may well set back global nat-ural gas markets in terms of growth and profi tability, by as much as 10 years,” added Sarraf.

ABB INKS UAE PIPE DEALPower and automation gi-ant ABB has won a US$21 million contract with EPC contractor China Petroleum Engineering & Construc-tion Corporation to design and supply the integrated electrical system on the $1 billion Abu Dhabi Crude Oil Pipeline (ADCOP). As part of the agreement, ABB will supply a range of electrical equipment, including 33kV gas-insulated switchgear, ring main units, capacitor banks and resistors.

AQUATECH SEALS EGYPT DESAL CONTRACTAquatech has won a con-tract to design and supply a Multiple Effect Distillation (MED) desalination system for Abu Qir Thermal Power Plant, on Egypt’s Mediter-ranean coast. The deal was awarded by West Delta Electricity Production Com-pany. The Abu Qir facility comprises two MED with Thermal Vapor Compression (MED-TVC) units, which will supply fresh water to boil-ers and other users.

SQH BUILDS SYRIAN STPSSyrian-Qatari Holding (SQH) has signed an MoU with the Ministry of Housing and Construction for a BOT con-tract to build two sewage treatment plants in a Dama-scene suburb and in the city of Swuedah. The news was announced during the Pub-lic Private Partnership Con-ference being held in the Syrian capital, shortly after the ministry had indicated that the country needed around 183 new STPs to keep up with demand.

HIGHLIGHTS

17The number of sta-tions being built on Saudi Arabia’s Prin-cess Nura University’s new railway network

Tabreed sees strong improvement in Q3 fi guresAbu Dhabi’s National Central Cooling Company (Tabreed) posted gross profi ts of 9% in the third quarter, although non-cash fi nance costs associated with the 2011 convertible sukuk menat that net profi ts overall slid by around 4% year-on-year.

Total revenue rose by a strong 15% to US$155.4 million, while chilled water revenue rose by 27% year-on-year.

“We have also been making progress on improving our oper-ational effi ciencies for existing operations,” said Sujit S. Parhar,

Tabreed CEO. “Our priority con-tinues to be reducing our costs and corporate overheads and improv-ing our operational effi ciencies so that we can continue to meet the region’s infrastructure needs.”

The results are a welcome improvement on Tabreed’s sec-ond-quarter fi gures, which saw revenue dip by 2.7% in comparison to the fi rst quarter, according to UME’s calculations.

Reported net income dropped by around 4% in the fi rst half in comparison to the same period a year earlier.

See interview on page 40

Booz & Company’s George Sarraf says electricity production continues to grow.

REGIONAL UPDATE

6 Utilities Middle East ● December 2009 www.utilities-me.com

Giant regional solar project takes another stepThe Desertec Industrial Initiative, a plan to ship electricity to Europe via a vast solar array network in the deserts of the MENA region, has taken its latest step through the signing of articles of assocation to create a limited company.

Twelve companies signed the documents that have established DII GmbH, and Paul Van Son has been elected as CEO. Van Son has previously held roles as manag-ing director of companies such as Deutsche Essent and Econcern.

“We recognise and strongly sup-port the Desertec vision as a pivotal part of the transition to a sustainable energy supply in the MENA coun-tries and Europe,” said Van Son.

“Now the time has come to turn this vision into reality. That implies intensive cooperation with many parties and cultures to create a sound basis for feasible investments into renewable energy technologies and interconnected grids.

“Since an announcement in July that launched Desertec, the proj-

Areva EPR in safety row Concerns raised as UAE $40bn nuclear plant contract nears

Areva chief executive offi cer Anne Lauvergeon.

A number of issues raised by safety agencies in the UK, France and Fin-land about Areva’s latest nuclear reactor are coming at the worst pos-sible time for a French consortium hoping to win a US$40bn contract to build power plants in Abu Dhabi.

European regulators have argued that there is insuffi cient indepen-dence between day-to-day safety sys-tems and emergency systems on the brand new European Pressurised Reactors (EPR).

“Independence is important because, if a safety system provides protection against the failure of a con-trol system, then they should not fail together,” the British, French and Finnish agencies said in a joint state-ment, according to AFP.

Areva is already facing serious problems at the Olkiluoto nuclear plant in Finland, which was initially planned to open this year. Instead, the facility will now open at 2012, at the earliest, with extra costs adding another 50% to the initial price tag.

“The EPR technology has not been called into question,” said French prime minister Francois Fillon in a local paper, according to Reuters.

ect has been working to win support from Middle Eastern and European countries,” Van Son said.

Shareholders of the DII include ABB, ABENGOA Solar, Cevital, the DESERTEC Foundation, Deutsche Bank, E.ON, HSH Nordbank, MAN Solar Millennium, Munich Re, M+W Zander, RWE, SCHOTT Solar and Siemens.

Questions have been raised as to whether the project is viable, espe-cially given the estimated US $550 billion price tag.

“There needs to be extreme rigour in terms of safety. I have no doubt that the problems raised by the Authority will be resolved and that French reac-tors will be among the world’s best and safest,” Fillon added

Earlier this year, the French con-sortium consisting of Areva, GDF Suez and Total was considered to be in pole position for the Abu Dhabi contract, which is expected to be awarded before end-2009. But other consortiums are also heavily backed.

The United Arab Emirates is currently in the advanced stage of evaluating the bids, according to Hamad Al Kaabi, the country’s rep-resentative to the IAEA, who spoke to Reuters back in October.

Other consortiums vying for the contract are the Japanese-US alliance between Hitachi and GE and a South Korea-led partner-ship consisting of Korea Electric Power, Samsung, Hyundai and US company Westinghouse.

SIEMENS EYES SAUDI EXPANSIONSiemens sees the Saudi mar-ket as a key area in which to expand its operations, particularly in light of the government’s decision to invest US $400 billion in a fi ve-year programme to increase energy production.“The Saudi gas programme is attractive. They have a lot of gas and want to make energy out of it,”Ali Hamdani, the vice-president of the energy, oil and gas division of Siemens in Saudi Arabia told Bloomberg.

QATAR DEMAND RISESQatar has spent $1.9bn on upgrading and expanding electricity and water net-works in the nine months to September 30 this year as demand for power in-creased by 14%. Kahramaa (Qatar Electricity and Water Corporation) said despite the sharp rise in consump-tion in 2009, compared to the previous year, it was capable of coping with it.

DOW’S NEW ELEMENTSDow Water & Process Solutions (DW&PS) has announced the launch of four new DOW FILMTEC elements for seawater treatment. Dow says the new 440i seawater ele-ments offer high rejection, low energy requirements and exceptional fl ow rates. The SW30XHR-440 AND SW30XHR-440i elements have the highest seawater rejection in the company’s FILMTEC range, enabling quality requirements to be met with single-pass seawater systems in most normal situations.

HIGHLIGHTS

REGIONAL UPDATE

www.utilities-me.com December 2009 ● Utilities Middle East 7

SWCC clarifi es project detailsExclusive: Governor outlines plans for Yanbu and Ras Al Zour megaprojects

Yanbu will produce 1,700MW and 550,000 cubic metres of desalinated water.

Saudi Arabia’s Saline Water Con-version Corporation (SWCC) has released details about its Ras Al Zour and Yanbu megaprojects. The state desalination agency was handed responsibility for the two sites in September after the Saudi government stepped in to pull the former IWPPs earlier this year.

“The capacity for Ras Al Zour is 2,400MW and 1,025,000 cubic metres of desalinated water, which covers the needs of SWCC (1,000,000 cubic metres) and Maaden (25,000 cubic metres,” SWCC governor Fehied Al-Sha-reef told Utilities Middle East. “On the power side, 1,350MW is for

Maaden, with a total of 1,050MW for SEC.”

Ras Al Zour is expected to cost around 20-25% less than initial US $6 billion estimates.

Al-Shareef confi rmed that docu-ments were expected to be submit-ted by mid-November, with offers earmarked for submission by the end of the fi rst half of 2010.

The SWCC governor says that the former Yanbu IWPP will now have a 1,700MW capacity (650MW for Marafi q Yanbu and 1,050 for SEC) and 550,000 cubic metres of desalinated water (400,000 cubic metres for SWCC and 150,000 for Marafi q Yanbu).

Taking on the responsibility of risk is what we do at ACE. With our expertunderwriting, superior claims handling and local market experience in the MENAregion, you can focus on the possibilities, not the liabilities, to make progressin your business. For more on the ACE group of insurance and reinsurancecompanies please visit www.ace-mena.com or email [email protected]

ENERGY PROPERTY & CASUALTY ACCIDENT & HEALTH MARINE CONSTRUCTION FINANCIAL LINESRINSURING PROGRESS

©2009 Coverages underwritten by one or more of the ACE Group of Companies. Not all coverages available in all jurisdictions.

INSURINGPROGRESS.

MAKE PROGRESS.

WEB HIGHLIGHTS

www.utilities-me.com December 2009 ● Utilities Middle East 9

39.4%

ONLINE ANALYSIS

GE puts emphasis on wastewaterGE’s chief executive has outlined plans to bolster research and technology development in wastewater reuse by 50% in the next two to three years as it tries to gain a larger foothold in what is estimated to be a US$5 bil-lion sector globally.

ONLINE ANALYSIS

Most popular headlines1. Will safety row affect UAE nuclear decision?2. Exclusive: SWCC clarifi es project details3. Bapco signs turbine deal with Technip4. World’s biggest PV project secures land deal5. Giant MENA project secures land deal6. Questions remain over new 1,500MW ADWEA plant7. Ice thermal storage becoming ‘hot ticket’8. Technology focus: GE Energy’s Frame 7FA gas turbine9. Taqa CEO to leave company after reshuffl e10. King of Jordan inaugurates power plant

BREAKING NEWS AND VIEWS FIRST

WorleyParsons signs nuclear deal in Jordan

SPOT POLL

Will the GCC interconnection grid solve the Gulf’s outage problems?

NO

YES

Eventually

Empower launches sub-metering facility

ABB signs US$120mn contract at Saudi university– see story on page 10

Country hopes to sign fi nal strategic partner by end-2012 and will establish three uranium mines to provide feedstock for the nuclear power plant.

Power specialist to provide three substations at the Riyadh site of the US$5 bil-lion Princess Nourah bint Abdulrahman University.

District cooling major pioneers product in Business Bay, which will allow end-users to control consumption at the Dubai development.

EDITOR’S PICK

SWCC report details future projectsSaudi Arabia’s Saline Water Conversion Cor-poration (SWCC) has provided a review of its current and future projects in its latest annual report, which includes details of three expan-sions to existing desalination plants in various locations around the country.

15.2%

45.5%

re

NEWS ANALYSIS

10 Utilities Middle East ● December 2009 www.utilities-me.com

Recruitment market to stabilise, say expertsLocal companies still hiring staff as regional infrastructure budgets rocket

Regional infrastructure compa-nies believe that the recruitment market has matured as a result of the economic crisis, and that there is still a strong pool of profes-sionals available for hire. Earlier this year, a Dubai-based recruit-ment website claimed that while the number of vacancies being posted in most verticals had shrunk considerably, the demand for infrastructure-related functions had rocketed by nearly 150% on the back of ongoing government investment in this crucial segment.

Although this was a review by one particular agency – and not indicative of recruitment patterns across all sectors and all countries of the GCC – to the casual observer, the premise seems obvious. While certain sectors, particularly the real estate sector in Dubai, for example, have been fl ayed by the economic crisis, governments and local authorities across the region have been putting money where their collective mouths are.

Saudi Arabia, for example, has set aside a whopping 16% of its total capital spending (around US$9.35 billion) on the water, agriculture and infrastructure sector in its budget for this, an increase of 25% on last year. Abu Dhabi is set to apportion 17.5% of its $11.9 billion budget for 2010 on the segment. All of this is surely means safe jobs and strong prospects for infrastruc-ture professionals, including those working and recruiting in the utili-ties industries.

evaluate their options and main-tain job security. Firms have now ceased fi ghting over potential staff and raising salaries to unsus-tainable levels, leading to a more responsible approach. “The out-come points towards a more ratio-

nal market, like in the UK, where the difference in salary for certain clerical staff only varies by a few hundred pounds per annum from different agencies,” Fadda said.

Companies based in Saudi Arabia have long envied Dubai’s

But behind the headlines, what is the reality on the ground? “There is some truth in the statement that this sector has remained strong from the recruitment side,” said Hisham Fadda, group human cap-ital director at water company Metito. “But one of the major changes has been the fact that the whole recruitment business had descended into a price war before the economic crisis hit. This has now stabilised and the market has become more realistic.”

Fadda’s belief is that the switch in psychology has led to decisions on the part of some staff to stay put,

“We are actually undergoing a recruit-ment drive for approximately 150 new engineering and technical personnel”

Government backing for the infrastructure segment is leading to normalisation in the recruitment fi eld, according to local HR directors.

NEWS ANALYSIS

www.utilities-me.com December 2009 ● Utilities Middle East 11

attractions for the expatriate work-force. “The key recruitment issue we face at present is convincing pro-spective new staff to leave current employment often to a new region, with many new SETE Energy staff coming from Europe and the US,” indicated George Antonopoulous, CEO of SETE Energy. “As a result of the business environment, the major challenge we have is fi nding staff who are willing to relocate full-time to the Kingdom and to retain them in-Kingdom.”

SETE Energy is creatively combating this problem mainly by recruiting through word-of-mouth within the Latsis Group (the owning group), a diverse company that has the necessary technical personnel contacts in oil, energy and infrastructure within the EU to refer new staff. “But generally speaking, infrastructure projects

and recruiting for them within the region and specifi cally KSA will always remain strong due to sev-eral factors, the most signifi cant of which is that state expenditure on infrastructure remains a promi-nent part of national budgets year-on-year,” Antonopoulos added.

The key question is whether local companies are still hiring. Metito, which says its staffi ng levels were not affected as a result of the crisis, thinks that the out-look is positive. “I believe we’ll be in a position to hire more staff soon,” said Fadda. “There are a lot of proj-ects for us in the pipeline, but we’re being very selective.”

The Metito executive believes that a measured approach to com-pany growth in the boom years has helped it through the last 12 months or so, and that the issue of motivation has come to the fore. “We haven’t stopped our bonus schemes and rewards to our staff, and we have been able to afford to continue to do this precisely because we didn’t go wild in the fi rst place,” he added.

For SETE Energy, an expanded team is defi nitely on the horizon.

SETE Energy's George Antonopoulos.

Metito's Hisham Fadda.

“Specifi cally for 2008-2009, this has been a very positive period for us in terms of signing off new proj-ects and we are actually undergo-ing a recruitment drive for approx-imately 150 new engineering and technical personnel in the medium term,” Antonopoulos stated.

TECH FOCUS

www.utilities-me.com December 2009 ● Utilities Middle East 13

Testing to a new protocolMegger product manager Stan Thompson reviews the IEC 61850 standard

INTRODUCTION TO IEC 61850The latest developments in the fi eld of protection testing encompass the testing of relays and protection schemes which use the IEC 61850 protocol, but what is IEC 61850? The International IEC 61850 standard is relatively new. It was developed to control and protect power systems by standardising the exchange of information between all intelligent electronic devices (IED) within an automated substation and a remote control link. Some of the benefi ts of the IEC 61850 standard are:

• Reduce dependence on multiple protocols• Reduce construction cost by eliminating most copper wiring• Automate substations• Real Time Distributed Computing• Advanced Management Capability

TESTING RELAYS USING THE IEC 61850 “GOOSE “The substation high speed per-to-peer messaging is accomplished using what is called the “GOOSE” Generic Object Oriented Substation Event message. When we speak of peer-to-peer messaging we are talk-ing about the exchange of informa-

of testing IEC 61850 applications. Enhancements to the software and hardware provide an extremely user-friendly package for testing the protection and control applications in an IEC61850 substation environ-ment. This is achieved by basically changing the analogue outputs of the test set in response to GOOSE messages at high speed. The user associates a specifi c GOOSE from a specifi c device to a specifi c Binary Input (as if physically monitoring a relay trip contact or logic output).

The MPRT fi rmware provides for the simultaneous capture of multiple GOOSE messages. While physically the MPRT has a limited number of Binary Inputs (10) and Outputs (6), the user can assign up as many as to 16 Soft Binary Inputs and 16 Soft Binary Outputs. This allows the user to monitor up to 16 GOOSE messages simultaneously. Similarly, the user can also assign and publish multiple GOOSE mes-sages using the multiple Soft Binary Outputs, which provides more test-ing fl exibility and faster response times. One of the applications is the use for interoperability tests of mul-tiple relays.

Stan Thompson’s full article is avail-able on www.utilities-me.com

Megger's automatic relay test offers the option of testing IEC 61850 applications.

December 7-9

ME Wastewater Treatment & Reuse

Abu Dhabi, UAE

www.meed.com/events/wastewater

December 9

MEP Awards

Dubai, UAE

www.constructionweekonline.com

January 7-9

7th Everything About Water Expo

Chennai, India

www.eawater.com/expo

January 19-20

1st MENA Water Resource World

Dubai, UAE

www.cmtevents.com

January 18-21

World Future Energy Summit

Abu Dhabi, UAE

www.worldfutureenergysummit.com

February 9-11

Middle East Electricity 2010

Dubai, UAE

www.iirme.com

February 9-11

Industrial Automation Middle East

Dubai, UAE

www.iirme.com

February 14-16

Middle East Project Finance 2010

Manama, Bahrain

www.meedconferences.com/

projectfi nance

March 9-11

WETEX Exhibit

Dubai, UAE

www.wetex.ae

March 22-25

WSTA 9th Gulf Water Conference

Muscat, Oman

www.wstagcc.org

March 29-31

Arabian Power & Water Summit

Abu Dhabi, UAE

www.arabianpowerandwater.com

April 12-15

Project Qatar

Doha, Qatar

www.eventseye.com

EVENT HORIZON

tion between relays and other pro-tective devices in the substation. In the traditional substation, copper wires run from the trip contacts of a relay to the trip coil on a circuit breaker. In an IEC 61850 substa-tion instead of copper wires the trip GOOSE message will be sent via the Ethernet cable or similar fi ber-op-tic communication cable to trip the circuit breaker. This message will be used extensively when perform-ing tests. The fi rst step in testing a relay or a protection scheme, which operates using IEC 61850 protocol, is the ability to “read” these mes-sages and respond accordingly at high speed. There are different

types of GOOSE messages that we work with. The relay being tested will “publish” or send a trip GOOSE to tell the breaker to trip. The test set “subscribes” to the GOOSE issued by the relay under test. When the test set reads the trip GOOSE, it will “publish” a GOOSE message telling the relay that the breaker tripped. In a trip and reclose scheme, the relay may “publish” another GOOSE tell-ing the breaker to Close, the test set will read the close GOOSE, and then publish a GOOSE back to the relay saying that the circuit breaker has closed, and so on.

The Megger Model MPRT auto-matic relay test sets offer the option

It’s not often that Utilities Middle East fi nds itself jostling for space on a meeting schedule

that includes former US President George Bush and Dubai ruler HH Sheikh Mohammed Bin Rashid Al Maktoum, but then David H Koch is no ordinary interviewee.

As the joint owner and executive vice president of Koch Industries

– one of the largest privately held companies in the US - Koch has interests in a number of ver-

ticals, not least the oil and gas and petrochemicals sectors, but it is soon obvious that the water industry is where his heart lies.

Koch developed his keen inter-est in membranes at the Mas-sachusetts Institute of Tech-nology (MIT) and after joining Koch Industries in 1970, took over as president of technol-ogy outfi t Abcor, which eventu-ally changed its name to Koch Membrane Systems (KMS) in 1981. It was this breadth of experience that led the Inter-

national Desalination Asso-ciation (IDA) to invite

Koch to be the key-

INTERVIEW

www.utilities-me.com

Better known as one of the world’s most generous philanthropists,

Koch Industries joint owner David H Koch has forged a strong link with

the water industry

14 Utilities Middle East ● December 2009

Water George BusSheikh MohMaktoum, buno ordinary i

As the joinvice presid

– one ofheld comhas intere

ticals, notand petroit is soon i d

Better known as one of the world’smost generous philanthropists,

Koch Industries joint owner David H

Wisdom

INTERVIEW

www.utilities-me.com December 2009 ● Utilities Middle East 15

note speaker at last month’s World Congress, held in Dubai. In front of a cast of luminaries, which included a number of the GCC’s electricity and water ministers, the KMS pres-ident was unrestrained in his praise for the desalination sector and its importance with regard to future global stability.

In person, David Koch cuts an imposing fi gure, but his enthusi-asm for the sector and affability are somewhat infectious. And when the interview turns to the new products being rolled out by his company in the water market, he seems clearly in his element.

On the new technologies front, Koch is keen to stress the merits of KMS’ newly re-engineered large-diameter seawater membrane, which was ably demonstrated with the presence of an 18-inch Mega-Magnum element that took pride of place at the fi rm’s stand during IDA week. “It’s a perfect example of the economies of scale, and large ele-ments and larger housing in prin-ciple should cost less on a square-foot basis,” he explains. “I think that when we start getting large orders and volumes through, we can make these large elements a lower cost on the square-foot basis than the smaller elements. We’ve built a highly automated membrane manu-facturing line, and we can push a lot of volume through it.”

Another benefi t, says Koch, is that the housing weighs a third less than an equivalent number of 8-inch sea-water housings at the same rated operating pressure. Furthermore, KMS is working on a confi guration that will allow the company to assem-ble the housings together, which

“There are still tremendous opportunities in the MBR area and all sorts of modifi cations that can reduce the cost of MBR cartridges”

that, you can reduce the operating energy and, as a result, the cost.”

KMS’ automated manufacturing line has been designed to create membranes that have a wide range of properties, from high rejection and high pressure to low rejection and low pressure. “We can then dial in the properties of the membrane that our mathematical model pre-dicts will give us the lowest operat-ing cost,” observes Koch. “Gener-ally speaking, reverse osmosis (RO) systems will operate more econom-ically of the purity of the raw water going into the system is improved, so we’re also in the fi nal stages of

KMS’S LARGE-DIAMETER MEGAMAGNUM ELEMENT• Pressure vessel that houses 18-inch diameter, 60-inch length element• The active membrane area has been increased by 12% to 3,500 square feet• The housing is made from a glass-reinforced epoxy, which is stronger than previ-ous vessels• The new MegaMagnums will be available in Q1 2010

A more holistic approach to system design will provide greater cost effi iciencies.

could reduce costs even further. “Depending on how the old 8-inch system was confi gured, you’re look-ing at savings of between 15-25%,” says Koch. “If you’re talking about a system that costs around US$30-50 million, that’s serious money.”

In addition, the use of large ele-ments has the potential to lower facility footprints by as much as half, a point that is useful not only from a cost point of view, but also where systems are largely constrained by space, such as in urban areas, marine vessels or oil platforms. “I think that in order to be really suc-cessful in the large-element busi-ness, you have to offer the whole system; you can’t just sell the ele-ments to the client and tell them to incorporate the products into their next project,” Koch explains. “Everything has to be integrated in a very systemic way.”

It’s no secret that demand for water in the Middle East is skyrock-eting and the demands for the kind of systems that KMS manufactures are also rising steadily. The chal-lenge is therefore on to look for dif-ferent ways to improve existing tech-nology, particularly as sustainability starts to play a more important role. Using less energy is clearly going to be a core requirement. So what tech-nologies has KMS been examining?

“We’ve been doing analysis on a two-pass system; if you vary the performance of the seawater mem-brane, you can substantially reduce the pressure of the feedwater going to the fi rst pass,” Koch indicates. “You then take the permeate that has a higher concentration of salt and feed it to a brackish water system. Depending on how you confi gure

INTERVIEW

16 Utilities Middle East ● December 2009 www.utilities-me.com

David Koch and the KMS

MegaMagnum large-diameter

element..

developing an ultrafi ltration (UF) system that can more economically purify that water.”

While some observers have in the past claimed that RO technology may have reached its peak, Koch begs to differ. “I still think it’s pos-sible to make up fl at-sheet mem-branes that give you higher rejec-tion with lower trans-membrane pressure – that would be wonder-ful,” he says. “Another area that I’m interested in is making seawater RO membranes out of hollow fi bre, not fl at sheet rolled into spirals.”

With recent advances in the textile industry enabling fi bres to be spun at immense speed, with hundreds of fi bres simultaneously, Koch thinks the scope for development is sig-nifi cant. A major factor here is that the cost of hollow textile fi bres per foot is much lower than it is for UF membrane applications. “It’s just an engineering problem to make com-posite RO membrane in a hollow-fi -bre geometry; I think it ought to be possible to spin these RO hollow fi bres at high speed and with great numbers simultaneously to gain a higher consistency and therefore a higher rejection,” the KMS pres-ident states. “That, I think, is the next great challenge in the mem-brane business.”

But KMS doesn’t see the drive for new technologies ending with just changes to the mem-brane. A holistic approach to system design, fouling and pre-treatment, and all the other variables that play a role in the membrane process, is likely to provide the best options, in terms of capital cost, to the end-user.

“There are still tremendous opportunities in the membrane bio-reactor (MBR) area and all sorts of engineering modifi cations that can reduce the capital cost of MBR car-tridges,” Koch explains. “We also have lots of ideas about reducing the amount of air used

to scour the fouling off the mem-brane. We’re a long way from having optimisation of all the variables that go into the MBR fi eld, which is prob-ably the most under-developed area in RO desalination.” Koch also says that the biggest improvement on the UF side is the potential use of a fi bre reinforced with a braid enabling it to be super-strong, thus solving break-age problems.

As the industry has grown, it has come in from some strong criticism

seen in the general body of the sea,” he argues. “I think it’s an inaccurate criticism and we need to use facts and data to disprove that as a serious concern. Long term, the general public will come to realise that that’s a criticism without any merit.”

Another major issue that is affect-ing the Middle East is that of priva-tisation, and Koch remains a strong advocate of the process as providing the greatest competitive benefi ts to the end-user. “The way it ought to work is that investment groups and companies like ours should build the plants, operate them and then sell the water over the fence to the municipality or industry,” he contin-ues. “The more plants you build, the better you can operate them, and the cheaper the cost you can deliver to the municipality or client.”

Much of what Koch says high-lights his appreciation of the value of cost to the client, and his confi dence in the technologies that his company can provide. “I think the membranes have been proved to be theoretically the lowest-cost way to purify water,” he concludes. “And as the industry gets bigger and bigger and more people invest in development proj-ects, the cost of the systems will con-tinue to decrease.”

“Another area that I’m interested in is mak-ing seawater RO membranes out of hollow

fi bre, not fl at sheet rolled into spirals”

from environmentalists about its effects on marine life and the harm-ful effects caused by brine discharge into the oceans. But Koch, like other company executives at IDA, is unequivocal in his assertion that the sector is doing its best to counter these accusations. “Modelling stud-ies have shown that concentrated salt is very rapidly dissipated – if you go out a hundred metres away from the discharge pipe, salt con-centration is reduced to the levels

ADVERTISEMENT FEATURE

www.utilities-me.com November 2009 ● Utilities Middle East 21

Drake & Scull International PJSC (DSI), a leading UAE-based end-to-end service provider of mechanical, electrical and

plumbing (MEP) contracting, infrastructure, water and power (IWP) and civil contracting services, is undertaking a new strategy to assist developers in the design and early stages of projects.

Through its IWP operations, DSI has become a local pioneer for the design and build of district cooling units; sewage treatment plants; water treat-ment systems and projects infrastructure.

It is now offering a consultancy service to assist developers from the outset, helping to plan and pre-pare for all the requirements of development – from conception, through to delivery. Under the new format DSI IWP is working with the client to develop the best way forward for all the project infrastructure and utilities need .

“We’re providing a proactive approach to the con-struction phase of a project, which creates a win-win situation for both our clients and ourselves,” says DSI Executive Director of IWP, Tawfi q Abu Soud.

“We are investing in value engineering and advi-sory services which aid the client from the begin-ning, providing all solutions for the infrastructure and utilities of a project.”

DSI’s IWP operations provide for detailed study of a project, so advisors work with the client to estab-lish the best way forward covering design, tech-nical, commercial and fi nancial considerations.

The company is currently working on a number of projects under this new format, including a project in Dubai, where DSI IWP is working with the client and consultants to estab-lish a central cooling plant.

In the fi rst half of 2009, the company’s MEP works constituted 56% of all business; civil engineering 25% and IWP 19%. However, as DSI moves forward, it will shift its focus from MEP to IWP operations, as these services and skills are currently in more demand in the region. IWP is not labour intensive which means we can easily move to this area. Also, because DSI works on an EPC (engi-neering, procurement and construction) basis, the operational margins are relatively high.

DSI was awarded its fi rst IWP contract in 2004, in the form of the largest District Cooling Scheme in the world at the time - the creation of the AED 300 million Jumeirah Beach Residence (JBR) Dis-trict Cooling Scheme. The Contract required the highest level of attention from DSI, the design-

and-build contractor, in order to fi nish the proj-ect on time and to meet the expectations of the client.

Again in 2004, DSI was awarded its second contract - the AED 440 million District Cooling scheme for Dubai Festival City (DFC). The DFC District Cooling plant was considered to be the

Drake & Scull International’s IWP operations create a win-win situation for both the client and the company itself by offering services to assist from conception through to delivery

second largest in the world, after the JBR district Cooling Scheme, at its time; therefore the build-up of the project needed the highest level of com-petence and experience.

Since these two initial projects, DSI has expanded its IWP works into the MENA region

and is again working on some of the largest and most important district cooling projects in the region, while continuing to expand its expertise and knowledge of the industry.

“DSI is in the process of developing new schemes to use renewable energy sources to supply district cooling units with the neces-sary power,” Abu Soud says. “As an estimate, over 60 percent of the total power consumed within the GCC is for environmental condi-

tioning. District cooling can help to change that ratio and allow for more effi cient utilization of the power network.”

“There is always room for improvement and we at DSI are well aware of the responsibility placed upon us to safeguard the environment and pro-vide commercially viable solutions.”

DSI - A Proactive Approach to Utilities & Infrastructure

“WE’RE PROVIDING A PROACTIVE APPROACH TO THE CONSTRUCTION

PHASE OF A PROJECT, WHICH CREATES A WIN-WIN SITUATION FOR BOTH OUR

CLIENTS AND OURSELVES,”

JBR District Cooling Piping Culvert (under the Marina Channel)

A ny roll-out of an ERP solu-tion is a tough proposition. But when you’re imple-

menting a country’s fi rst ever ERP product, and the client is one of that country’s largest employers, the problems can start to stack up even further. The fact that the country in question is Libya might be enough to convince many players that the

task was beyond them. Not so

Unlocking project. Presentations from the IFS team were made by company CEO Alastair Sorbie, CTO Dan Mat-thews and regional managing direc-tor for Africa, the Middle East and South Asia Ian Fleming, while on the GECOL side, chairman Abul-gasem Uneas and IT project man-ager Hazem Zentani explained how the implementation had worked from their perspective.

GECOL saw the requirement for a strong ERP provider in 2000 and spent the next three years defi n-ing specifi c needs. Among the chal-lenges that the fi rm faced were an adherence to manual procedures, excessive paperwork and a host of variable legacy systems, none of which were integrated. Combined with Libya’s large size, the end-re-sult was a dissatisfi ed customer base and delays in book closing.

IFS quickly saw that this was an ideal opportunity to gain a foot-hold in what is now a fast-expanding

NORTH AFRICA FOCUS

18 Utilities Middle East ● December 2009 www.utilities-me.com

Software giant IFS is understandably proud of its association with state infrastructure fi rm GECOL

IFS regional managing

director Ian Fleming speaks

to a packed crowd.

IFS, which celebrated in October its long-running partnership with the state-run utilities giant in the North African nation, General Electricity Company of Libya, or GECOL.

The relationship between the Libyan fi rm and IFS is undoubtedly a strong one; at a conference held in Tripoli, around 150 of Libya’s most prominent businessmen were in the audience to see fi rst-hand a number of senior executives from both com-panies discuss the success of the

Libya

market. “We carried out multiple presentations in-country, and I vis-ited Libya on an exploratory basis,” says Fleming. “Following on from that, we sent experts from our util-ities industry team in Scandinavia to meet with GECOL, and we also arranged a reciprocal visit so that GECOL representatives could take a look at our utilities reference cus-tomers in Sweden.”

A major challenge initially was to provide a consulting team that could operate in-country. IFS brought in staff from locations such as Johan-nesburg, Poland and Scandinavia, with the project being managed

“Any time you go into a new country, you have to accept that there will be some unknowns and a steep learning curve”

NORTH AFRICA FOCUS

www.utilities-me.com December 2009 ● Utilities Middle East 19

GECOL FAST FACTS:The state of play in Libya’s growing electricity market

Arabic-language software; although IFS provides this as standard, the product supplied to GECOL needed to take into account the nuances of the local dialect.

“The fact that we were going into a country where there was no knowl-edge of ERP was also tough,” adds Fleming. “But a lot of people on the GECOL side had been involved in the evaluation process and were absolutely dedicated to the project. The push came right from the top of the company and the ethos to suc-ceed fl owed right through.”

On the GECOL side, there were other obstacles to overcome. “We had three major challenges to cope with as a result of this implantation,” says Mohamed Ali Madi, GECOL’s technical support manager on the ERP project. “There was the data trail, end-user preparation and the building out of the infrastructure network. IFS helped us with our data cleansing and qualifi cation strategy, and also with the migration to the system and our end-user training.”

IFS also recommended a phased roll-out of the system, another factor that contributed towards its success.

from Dubai. But other challenges manifested themselves as time pro-gressed. “Any time you go into a new country, you have to appreciate that there will be unknowns and that there is going to be a steep learning curve,” explains Fleming. “We spent a lot of time with the GECOL team in-country looking for peculiari-ties, localisations that were particu-larly unusual.” One of those require-ments was the need for a pricing sim-ulation and modelling capability to allow GECOL to determine the opti-mum future pricing bands or tariffs based on both historical and current data. Another requirement was for

“One of the key points was strong management on both sides, which certainly helped us a lot,” contin-ues Madi. “We really started to see the benefi ts from day one, which is when we took overall control of the decision-making process.”

A watchword for both companies was training, both on and off-site. This was set up to hammer home a detailed understanding of the system and ensure that it was used after the ‘go-live’. For IFS, it was cru-cial that even those employees at the lower reaches at the GECOL organ-isation understood the implications of every item that was entered into the system. “The go-live was man-aged well, from our perspective,” says Fleming. “It can be tricky because there can be a reluctance – on the part of any fi rm, not just GECOL – to go live as companies then have to accept they are fully responsible for what’s happening. The reality is that for any ERP imple-mentation, the partnership contin-ues for a longer time thereafter.”

In total, there are now around 3,000 named users for GECOL’s ERP, out of a total 37,000 employees.

Power Stations 20 with 62 Units(Steam-Gas-Combined)

Installed Capacity 6,196 MW Peak Load 4,420 MWEmployees 37,000Number of Customers 1,190,942

Voltage (KV)

Substations Transmission Lines (KM)

400 3 442

220 70 13,631

30\66 530 22,258

11 11,602 42,760

Substations and Transmission Lines

NORTH AFRICA FOCUS

20 Utilities Middle East ● December 2009 www.utilities-me.com

The component-based structure of the IFS ERP means that different products are still being added to the GECOL portfolio some four years on. The fi rm has augmented the ini-tial roll-out with IFS’ Project Man-agement, Maintenance and Busi-ness Performance components.

During the Tripoli conference, GECOL listed a number of ‘lessons learnt’, which was of particular inter-est to the assembled delegates. The utility recommended full and contin-uous support from senior manage-ment, the establishing of a well-pre-pared support organisation, trans-parent information exchange and

budget and was GECOL happy with the end results? One of the great things about the conference from our perspective was that GECOL gave a positive response to each of these questions to the audience.”

Theoretically speaking, the GECOL success story should lead to other companies opting to take the ERP route. But Fleming also has a quick word of warning. “There’s still a lot of education required about ERP – some companies think they need a solution without really know-ing what the technology is all about, and this is not just in Libya,” he says. One of IFS’ next steps is to establish an education programme in-coun-try that will help people understand why ERP systems are implemented.

“So far, we’re still on same track, we understand each other and we have a lot of respect for their recom-mendations,” concludes Madi. “We are planning to implement more IFS products as well, now that we have an ERP solution. We defi nitely see our future with IFS.”

the selection of a qualifi ed and com-mitted project team as being the major tools for success.

So where does the partnership go from here? Both parties are keen to continue, particularly as IFS rolls out its new user interface, Enter-prise Explorer, which will be avail-able next year. “In terms of where we going now, we are constantly provid-ing new products that GECOL will evaluate and determine whether they are relevant to its require-ments,” Fleming observes. “What we’re focusing on right now is the key performance indicator informa-tion that is provided to the top man-

agement of the company. The tariff addition has been another impor-tant step; tariff computations and simulation models are not part of standard ERP functionality, but it made sense to work with GECOL on this as it’s tightly integrated with the rest of its system.”

For Fleming, the conference was a benchmark for the future of ERP in the country. “Some of the questions that the meeting sought to answer were critical to the success of simi-lar roll-outs in Libya,” he explains. “Among these questions were: did the go-live occur on time, was the project completed within the initial

GECOL chairman Abulgasem Uneas (centre) alongside IFS CEO Alastair Sorbie (right).

PREVENT TRANSFORMER EXPLOSION AND FIRE

TRANSFORMER PROTECTOR

During a transformer short circuit, the TRANSFORMER PROTECTOR (TP) is activated within milliseconds by the first dynamic pressure peak of the shock wave, avoiding transformer explosions before static pressure increases.

The TRANSFORMER PROTECTOR:

Works with all oil-filled transformersup to 1,000 MVA and more

Tel: +33 (0) 1.39.22.48.40

Compensates several thousand times theinvestmentSharply reduces plant outages andassociated high costsAvoids oil fire to transformer andsurrounding equipmentRenders impossible environmentalpollution by containing the oilAllows transformer repair after internalfaultEliminates risk to human life

TRANSFORMER PROTECTORThe only solution against transformer explosions

DESALINATION FOCUS

December 2009 ● Utilities Middle East 21

GM Ian Barbour reveals which technologies his company is now exploring

Optimising performance is the phrase of the day for Dow Water & Process

Solutions (DW&PS), which sees the meteoric rise of membrane technology as a great opportunity to garner greater market share. The company is already very active in the Middle East and is particularly proud of its partici-pation in the Shoaiba Barge project, the larg-est desalination plant in the world (see box on this page).

As part of its drive to improve its research and development into the unique challenges of the local desal market, Dow recently announced an investment into the King Abdul-

lah University of Sci-ence and Technology (KAUST) in Riyadh. Part of that research will involve tweaking the properties of the membrane with differ-ent chemistries. “We’ll

also have rolling capabil-ities to look at changing the dimensions and con-

fi gurations of the element itself, to make it more suited

Dow Water & Process Solutions

Who was at IDA 2009?

technology as a great opportunity to garner greater market share. The company is already very active in the Middle East and is particularly proud of its partici-pation in the Shoaiba Barge project, the larg-est desalination plant in the world (see box on this page).

lah University ence and Te(KAUST) inPart of that will involve the propertimembrane went chemistri

also have rollinities to look at the dimensions

fi gurations of theitself, to make it mo

to the Middle East’s particular water quality,” says DW&PS general man-ager Ian Barbour. “We’re also look-ing at pre-treatment so we can see the effects of ultrafi ltration (UF) on different water qualities.”

Barbour explains that custom-ers tend to look at the various water

technologies – pre-treatment, UF and desalination – separately, but that the plan right now is to inte-grate those technologies to drive the cost of water lower. “For exam-ple, if we know the kind of water quality we’re getting from our pre-treatment, we can change the con-fi guration of the reverse osmosis (RO) membrane allowing us to use a thinner feed space, for example,” he remarks. “If the fouling potential has dropped because of the quality of the pre-treatment, using a thinner feed spacer allows you to put more membrane into the canister, which gives you more surface area and more productivity.”

DW&PS has expertise in four fun-damental water technologies – UF membranes, RO membranes, nano-fi ltration (NF) membranes and ion exchange membranes. “Our cus-tomers build the actual system, but they require multiple technologies so we’re trying to build up a portfo-lio,” Barbour states. “Each of our products are world-class in their own right, but we’re trying to work

Membranes: FILMTEC SW30HRLE-400i and FILMTEC BW30-440iTwo-pass designQuantity: 5,656 (8-inch elements)Capacity: 52,000 m³/day OEM: WETICO Saudi Berkefeld

SHOAIBA BARGE: FAST FACTS The largest sea-based desalination plant in the world

Dow Water & Process Solutions general manager Ian Barbour.

“We’re looking at pre-treatment so we can see the effects of ultrafi ltration on different

water qualities around the world”

DESALINATION FOCUS

22 Utilities Middle East ● December 2009 www.utilities-me.com

out how they can be used together and understand their interactions.”

In terms of new technologies that would rework the way the water industry sees desalination, Bar-bour doesn’t see a ‘magic bullet’ on the horizon. “If we could disrupt our own technologies to drive the cost of water down, we’d do it,” he says. “But generally, what you’ll see in the future is added growth of large-di-ameter modules, improvements in fl ow and fl ux due to polymer chem-istry, and improvements to the membrane itself.” The Dow execu-tive says that many technologies are being discussed, such as biological cell-type fi ltration, but that a new dis-ruptive technology within the next fi ve-10 years is unlikely.

is sustainable, as the power is offset by building a wind farm.”

But solving the world’s water problems is not something seawa-ter desalination alone can achieve, and Barbour believes it would be irresponsible to say that it could. The next move is to clean wastewa-ter to the point where it is potable, as is the case in the US and Europe, for example, but the Middle East is still behind in this respect.

In wider terms, Barbour says that the issue of wastage remains a key issue and claims that there are three solutions. “One is to use less, another is to reuse water - which is a massive issue right now - and the third is to develop new water sources, because in some cases, we are removing water from our aqui-fers, using it ineffi ciently and then just fl ushing it into the ocean.”

In tandem, the industry has to answer its critics on the environ-mental side. “Perth [the Southern Seawater Desalination Plant, which uses Dow elements] is a fantastic example of doing it right,” explains Barbour. “They had a lot of environ-mental activism, and used under-water cameras and other technol-ogies to examine the issue of brine discharge and its impacts. Further-more, the energy used in that plant

Singapore International Water Week (SIWW) SIWW managing director Michael Toh assesses one of the biggest events in the industry’s calendar

How has SIWW pro-gressed in recent years? As a global platform for water solu-tions, the event fi rst started as a project undertaken by the national water agency of Singapore, Public Utilities Board, as well as the min-istry of environment and water resources. It was organised with the intention of bringing the who’s who of water industry to Singa-pore. It’s an annual event, and we’ve had two shows, which were both very successful due to the support we have had from various partners, including IDA, for which we are thankful.

What sort of attendance fi gures have you registered? For the fi rst show, we had 8,500 people from 79 countries, and in 2009 - in spite of H1N1 and the eco-nomic crisis, we had more than 10,000 people from 82 countries.

We are certainly happy with how the show is developing and it is turning out to be a must-attend event for the global water industry. Moving for-ward, we’re working hard to improve content and deliver-ies, with much more network-ing, and hopefully many more deals. A testament to our suc-cess has been the nom-inations for the Lee Kuan Yew Water Prize, which is one of the highlights of the week. In 2009, we had 39 nominations for the prize; this year, we have more than 50 nominations from a total of 32 coun-tries.

What can Singapore share with regions such as the GCC?Although we are a small coun-try – an island state - I think what we can really share is our holis-tic approach to treating water. We treat every drop as precious – in fact some people say we are treat-ing the issue with a lot of para-noia. We’re just taking care of our resources, and we have an integrated way of managing our system, right from the collection of the rain, to the treatment, distribu-tion, and even the education of the end-user. At the same time, when water is discharged, we’ve put a lot of effort into recycling, because that’s the way forward. Water to us is essential. When we gained inde-pendence we had to ensure the security of our water supply. So over time we have turned a disad-vantage to a strength that we can share with the rest of the world.

ly happy with how eveloping and it to be a must-or the global. Moving for-rking hard to nt and deliver-more network-

fully many more ment to our suc-he nom-e Lee

Water one htsIn39 r

Singapore Water Week managing director

Michael Toh.

Dow launches four new FILMTEC elementsDow opens R&D centre at Saudi universitywww.utilities-me.com

DOW IN THE NEWS

“What you’ll see in the future is the growth of large-diameter modules”

services for life

DESALINATION FOCUS

24 Utilities Middle East ● December 2009 www.utilities-me.com

The Sulaibiya reclamation facility in Kuwait.

The US giant explains why pre-treatment is so critical to the success of RO

• GE helped build the Sulaibiya facility in Kuwait, the world’s largest membrane-based wa-ter reclamation facility. This plant treats 375,000 m³/day (99 MIGD) of municipal wastewa-ter from Kuwait City and the surrounding area.• The company has provided a fl eet of mobile water treat-ment systems to Al Tamimi Group for the rapid deploy-ment of onsite treatment

systems for both sea water and brackish water

treatment, water reuse and water fi ltration with

emergency response time of as little as 72 hours.• GE has supplied the Interna-tional Medical Centre in Jeddah with an advanced membrane bioreactor wastewater treat-ment system to treat and recy-cle 250m³/day of wastewater, reducing freshwater usage.• GE supplied advanced re-verse osmosis solutions for the Hamma Seawater Desalination Plant in Algeria to purify up to 200,000 cubic metres of seawa-ter per day - providing as many as two million residents with a reliable and drought-proof sup-ply of fresh water.

GE’S MIDDLE EAST EXPERIENCE

A s an attendee at IDA con-ferences over the last 20 years, Upen Bharwada

can track better than most the shift-ing trends in the worldwide desali-nation market. As executive – busi-ness general manager, fi lters and membranes, at GE Water & Pro-cess Technologies, Bharwada is at the forefront of the sector’s evolu-tion. So what are the technologies that are driving the market today? “I sense that there has been an ‘a-ha’ moment at IDA this week,” the GE executive says. “Whereas the real estate industry has the phrase ‘location, loca-tion, location’, this sector is recognis-ing that the secret to managing sea-water reverse osmosis (RO) as a unit process that delivers what it promises relies on the phrase ‘pre-treatment, pre-treat-ment, pre-treatment’.

All of the challenges associated with making an RO membrane work are traced back or are endemic in the pre-treatment process.”

Bharwada adds that there were two particular sessions during the course of the week that particularly caught his eye. One was on seawater intakes, which covered the mechan-ical technologies that assist with the understanding of micro-organ-isms, location of intake points and analysis of marine life. Another was a session on pre-treatment for sea-water RO ultrafi ltration (UF) tech-

nology, which discussed the understanding

of total organic carbon (TOC), turbidity of bac-teria and other kinds of sub-micron organ-isms, which he believes will go a long way towards making UF the

preeminent treat-ment technology.

With regard to GE’s own technol-ogies, the emphasis appears to be on integration. “What we’ve done is take our UF technology and inte-grated it with RO, all in one uni-fi ed design,” says Ralph Exton, GE Water & Process Technologies global sales executive. “It’s a solu-tion set that’s pre-engineered, pre-designed and on one skid. In today’s market you often can’t wait 12-18 months for a seawater RO system, but we’ve got solutions that we can deliver in less than half that time

GE Water & Process Technologies

• GE helped buildfacility in Kuwait,largest membraneter reclamation faplant treats 375,0MIGD) of municipter from Kuwait Csurrounding area.• The company haa fleet of mobile wment systems to AGroup for the rapment of onsite tre

systems for band brac

treatmreusefiltra

GE’S MIDDLestate industry has the phrase ‘location, loca-tion, location’, this sector is recognis-ing that the secret to managing sea-water reverseosmosis (RO)as a unit processthat delivers what it promises relieson the phrase ‘pre-treatment, pre-treat-ment, pre-treatment’.

nology, which discussed the understanding

of total organic carbon (TOC), turbidity of bac-teria and other kinds of sub-micron organ-isms, which he believes will go a long way towards making UF the

preeminent treat-ment technology.

period. In some cases we have con-tainerised systems that are on the shelf and ready to deploy.”

“On the equipment front, a number of our pre-engineered sys-tems allow for a shorter lead time, so from start to fi nish our clients can almost have a plug-and-play option,” continues Bharwada. “A truly integrated multi-unit process allows for a single control panel, one type of software and a true integra-tion of synergies, and that’s what we’re introducing.” The expert

Upen Bharwada, executive - business general manager,

fi lters and membranes.

DESALINATION FOCUS

www.utilities-me.com December 2009 ● Utilities Middle East 25

DegremontCEO Remi Lantier is hoping to build on his fi rm’s long relationship in the Middle East

What are your reasons for optimism with regard to the regional desalination market? Firstly, we are especially active in reverse osmosis (RO). Initially the thermal process was more active in the Gulf, but RO is relatively new in this segment. Our experi-ence at the Fujairah IWPP proved that we could operate in very diffi -cult water, and overall, I’m proud to say that plants built by Degre-mont worldwide are now providing more than a million cubic metres of desalinated water a day.

What’s your history in the region? We have three major achievements here. Firstly, there’s Fujairah 1, which was the largest seawater RO plant on the planet when it was built. In addition, the Barka II plant is under commissioning, and that facility will eliminate or mitigate

certain environmental elements in terms of discharge. Lastly there’s the Al Dur IWPP, which is the big-gest seawater RO plant in the Gulf. It’s a challenge for Degremont, but

we’re very much looking forward to meeting the needs of the Bah-raini community.

What challenges does the desalination industry face? You have to be able to match tech-nologies of a very different nature. If we start from the beginning of the treatment chain, pre-treatment is crucial and there are a number of different processes, including dual-media fi lters, membranes, dissolved air fl otation systems for all types of water. We’ve also mas-tered the RO process, so we can adapt the best products of several large suppliers of RO membranes to suit client needs, and last but not least, the energy recovery prod-ucts are hugely important. Even if here the cost of energy is not as high as other parts of the world, it’s incumbent on the client to have a minimal carbon emission foot-

print. Therefore, it’s clear that energy consumption should be as low as possible.

How important is sustain-ability to your company? It’s absolutely central to us. We want to bring to the client exactly what they want in terms of pro-cesses, guarantees and competi-tiveness, but we need to support the client on the sustainable side as well. Why? Because our cli-ents are communities – minis-ters, states, municipalities, and so – all of which have a responsibility towards their citizens. We can also provide a long-term guarantees for these processes as we are also an operator, not just a builder, of these systems. Even if the client doesn’t want us to operate the system we build, the fact that we carry out operating work all over the world is proof of our experience.

Degremont CEO Remi Lantier.

adds that for conventional older sys-tems where the water chemistry has changed since the system was put in, GE has introduced cartridge fi lters that can assist when the pre-treatment for conventional media fi ltration malfunctions. Lastly, the company is also introducing new chemicals into its analytical system portfolio. “So it’s not old wine and new bottles; we are either adding line extensions or delivering truly new products,” Bharwada says.

The GE executive believes that some of the biggest opportunities in the desalination market currently reside within Saudi Arabia, and it’s clear that the fi rm has close ties with the Saline Water Conversion Corpo-ration (SWCC). “Saudi Arabia has been somewhat special if not unique

in its use and endorsement of hol-low-fi bre RO,” Bharwada observes. “Now, as the local industry evolves, they are using spiral-wound com-posite, an area in which GE is more active.” GE has also been working closely with the Tamimi Group, sup-plying a number of containerised seawater systems.