Us industrial base_analysis_for_space_systems

-

Upload

dmitry-tseitlin -

Category

Documents

-

view

278 -

download

0

Transcript of Us industrial base_analysis_for_space_systems

U.S. Industrial Base Analysis for Space Systems Defense Manufacturing Conference 2011, Anaheim, CA

November 29, 2011

2

Purpose

ª Quick turnaround assessment of space industrial base ª Customer: Deputy Assistant Secretary of Defense for

Manufacturing and Industrial Base Policy ª This assessment is part of the initial phase of the sector-by-

sector tier-by-tier (S2T2) Department of Defense (DoD) assessment of the industrial base

ª The initial phase of S2T2 covers 8 sectors ª The Tauri Group assessed the space sector

ª Objective was to provide greater insight into supply chain tiers of the space industrial base, particularly lower tiers and interdependencies

ª This briefing is a preliminary overview only – Final assessments will be issued by MIBP

3

Eight study topics were specified

ª Topic 1 – U.S. space industry supply chain map ª Topic 2 – U.S. space industry sole suppliers, potential

bottlenecks, and workforce sensitivities ª Topic 3 – U.S. space industry supply chain interdependencies ª Topic 4 – U.S. space industry innovation and future design

capabilities ª Topic 5 – U.S. space industry supply chain working capital

and investment capital ª Topic 6 – U.S. space industry supply chain relationships

across military, civil, and commercial interests ª Topic 7 – Globalization of space industry supply chain ª Topic 8 – Other factors to consider

Methodology

ª Reviewed over fifty studies and relevant documents to identify risk areas and issues in the supply chain, components in the tiers of the supply chain, and companies in risk areas

ª Conducted approximately 90 targeted interviews ª Summarized previously identified supply chain concerns related to

the space industrial base and identified new risk areas ª Researched major space manufacturers and companies associated

with identified technology risk areas ª For each risk area, we identified suppliers, where the risk area was

in the supply chain, and mapped the risk area to rest of the supply chain

ª For suppliers in risk areas, we identified other lines of business that the company had and the degree of the company’s diversification outside the space business

4

5

ª At Risk – Parts of the supply chain that are dependent on a sole supplier or constrained competition, may become bottlenecks, or have potential financial or workforce issues.

ª Green – Multiple suppliers and suppliers that are financially healthy, have little or no potential to create bottlenecks, and have no workforce issues.

ª Yellow – Constrained competition due to limited (fewer than four) number of suppliers, suppliers with a potential to create bottlenecks, and those with workforce issues.

ª Red – Sole suppliers, suppliers with high potential to create bottlenecks, and those with significant workforce issues.

ª Black – Suppliers that are bankrupt, exiting the market, or supplies are no longer available.

Topic 1: Supply chain “at risk” categories

Alloys Ammonia Anodes Atmospheric nitrogen Atmospheric oxygen Capacitors Carbon fillers Carbonized cloth Cast metal parts Cathodes Coa8ngs Composite material Couplings Diodes Electrolytes (Li-‐ion) Fasteners FiAngs Gaskets Hoses HTPB Methane Nano-‐phase metals (Al, etc.) Natural gas Pipes Poten8ometers Precision ball bearings Rayon Resin Screws, bolts, and rivets Sodium perchlorate or chlorine Weave cloth Wires/wire harnesses

6

Topic 1: Overview of satellite supply chain elements from prime contractors to material suppliers

Satellite

Satellite Payload (Instrumenta8on)

Subsystems: Power Propulsion Structure Thermal A5tude control Telemetry and command

Satellite Bus

Atmospheric probes Balloons Ball screws Communica8ons feeds Communica8ons panels Communica8ons reflectors Dust meters Focal plane arrays Harmonic drive transmissions Hemispheric resona8ng gyros (HRGs) Ion counters Landing bags Laser resona8ng gyros (LRGs) Lidar op8cal sensors Momentum wheels Momentum wheels plaVorms Non-‐sensi8ve structural panels Op8cal encoders Orbital analysis soXware for GEO satellites Parachutes Passive RF filtering/coupling devices Rate sensors Reac8on wheels Resolvers RF transponder chains Sensors (pressure, temperature, etc) Slip ring assemblies Solar cells Torque Transformers Travelling wave tubes (TWT)

Al8meters Antennas Beacon tracking and ranging systems Chemistry analyzers Clocks Command & Control Systems Command receivers and telemetry transmi[ers Commercial encryp8on devices Diaphragm propellant tanks Gamma ray telescopes Gimbal assemblies GPS receivers Heat exchangers Heaters Hold-‐down and deployment systems Interferometers Infrared imagers Lithium Ion ba[eries Low-‐thrust propulsion devices and components Magnetometers Microscopes Microwave telescopes Mul8spectral op8cal sensors Nickel cadmium ba[eries Nickel hydrogen ba[eries Non-‐diaphragm propellant tanks On-‐board computers Op8cal imagers/telescopes (pan/hyper/mul8) Plasma detectors Power distribu8on assemblies Power regula8on electronics Preamplifiers Pressurant tanks Processors, routers/hubs for data distribu8on Radio frequency receivers Radiometers Sample retrievers Solar array assemblies Spectrometers Spinner motor drivers Sta8onary plasma thrusters Star trackers Sun sensors Travelling wave tube amplifiers (TWTA) TTC&R antennas Ultraviolet telescopes X-‐ray telescopes

Tier 5 Tier 4 Tier 3 Tier 2 Tier 1

Amplifiers Atmospheric probes Balloons Ball screws Clocks Communica8ons feeds Communica8ons panels Communica8ons reflectors Comparators Converters Dust meters Focal plane arrays Harmonic drive transmissions Hemispheric resona8ng gyros (HRGs) Ion counters Landing bags Laser resona8ng gyros (LRGs) Lidar op8cal sensors Momentum wheels Momentum wheels plaVorms Non-‐sensi8ve structural panels Op8cal encoders Orbital analysis soXware for GEO satellites Parachutes Passive RF filtering/coupling devices Rate sensors Reac8on wheels Resolvers RF transponder chains Sensors (pressure, temperature, etc) Slip ring assemblies Solar cells Switches Torque rods Transformers Travelling wave tubes (TWT)

Alloys Anodes Cadmium zinc telluride detectors Capacitors Cast metal parts Cathodes Coa8ngs Composite materials Crystal scin8llators Couplings Diodes Electrolytes (Li-‐ion) Fasteners FiAngs Gaskets Hoses Mercury cadmium thelluride detectors Op8cal solar reflectors Photomul8pliers Pipes Poten8ometers Precision ball bearings Pressure transducers Propellants: Dinitrogen Tetroxide (MON-‐3) Propellants: Monomethylhydrazine (MMH) Propellants: Oxidizers Propellants: Pressurants Readout integrated circuits Resistors Screws, bolts, and rivets Solar cell cover glass Thermal blankets Thermal insula8on Thermistors Transistors Wires/wire harnesses

Al8meters Antennas Beacon tracking and ranging systems Chemistry analyzers Command & Control Systems Command receivers and telemetry transmi[ers Commercial encryp8on devices Diaphragm propellant tanks Gamma ray telescopes Gimbal assemblies GPS receivers Heat exchangers Heaters Hold-‐down and deployment systems Interferometers Infrared imagers Lithium Ion ba[eries Low-‐thrust propulsion devices and components Magnetometers Microscopes Microwave telescopes Mul8spectral op8cal sensors Nickel cadmium ba[eries Nickel hydrogen ba[eries Non-‐diaphragm propellant tanks On-‐board computers Op8cal imagers/telescopes (pan/hyper/mul8) Plasma detectors Power distribu8on assemblies Power regula8on electronics Preamplifiers Pressurant tanks Processors, routers/hubs for data distribu8on Radio frequency receivers Radiometers Sample retrievers Solar array assemblies Spectrometers Spinner motor drivers Sta8onary plasma thrusters Scaleable accuracy star trackers Sun sensors Travelling wave tube amplifiers (TWTA) TTC&R antennas Ultraviolet telescopes X-‐ray telescopes 7

Topic 1: Satellites – Red and yellow risk areas in supply chain

Satellite

Power Propulsion Structure Thermal AAtude control Telemetry and command

Satellite Bus

Satellite Payload (Instrumenta8on)

Tier 5 Tier 4 Tier 3 Tier 2 Tier 1

Accelerometers Ammonium perchlorate Amplifiers Ball screws Comparators Converters Engine actuators Engine filters Engine gimbal actuators Engine gimbal assemblies Engine igniters and catalysts Engine injectors Engine sensors Engine valves Fairing separa8on devices Hydraulic reservoir Hydraulic filters Hydraulic quick disconnects Hydraulic accumulator Hydraulic valves Hydraulic system electric heaters Hydraulic actuators Hydraulic pump Hydraulic flow restrictor Hydraulic connectors Hydraulic plumbing Hydraulic system insula8on Hydraulic water spray boiler GPS receivers Gyroscopes Ini8ators Lithium-‐ion cells Nickel-‐cadmium cells Rayon-‐carbon cloth phenolic Ring laser gyros Silver-‐zinc cells Stage separa8on devices Vehicle sensors

Airframes Auxiliary power units Ba[eries Computers Control electronics Doors and panels Engine combus8on chambers Engine controllers Engine heat exchangers Engine manifolds Engine nozzles Engine preburners Engine propellant pumps Fairing sec8ons Fairings Fins Flight control surfaces Flight termina8on systems Iner8al flight systems Interstages Landing gears Moun8ng structures Parachutes Pressurants (N, He, etc.) Pressurant tanks Propellant tanks Propellant: Fuel (LH, etc.) Propellant: Oxidizers (LOX, etc.) Propellant: Solid (ammonium perchlorate composite propellant) Range safety systems Radar al8meters Skirts Solid motor casings Star trackers Telemetry electronics Wings

Alloys Ammonia Anodes Atmospheric nitrogen Atmospheric oxygen Capacitors Carbon fillers Carbonized cloth Cast metal parts Cathodes Coa8ngs Composite material Couplings Diodes Electrolytes (Li-‐ion) Fasteners FiAngs Gaskets Hoses HTPB Methane Nano-‐phase metals (Al, etc.) Natural gas Payload clamp bands Pipes Poten8ometers Precision ball bearings Rayon Resin Screws, bolts, and rivets Sodium perchlorate or chlorine Weave cloth Wires/wire harnesses

8

Topic 1: Overview of launch vehicle supply chain elements from prime contractors to material suppliers

Flight controls

Guidance, naviga8on and control (GNC)

Payload fairing

Payload adapter

Power

Propulsion

Structures

Liqu

id ro

cket engines

Tier 5 Tier 4 Tier 3 Tier 2 Tier 1

Accelerometers Ammonium perchlorate Amplifiers Ball screws Comparators Converters Engine actuators Engine filters Engine gimbal actuators Engine gimbal assemblies Engine igniters and catalysts Engine injectors Engine sensors Engine valves Fairing separa8on devices Hydraulic reservoir Hydraulic filters Hydraulic quick disconnects Hydraulic accumulator Hydraulic valves Hydraulic system electric heaters Hydraulic actuators Hydraulic pump Hydraulic flow restrictor Hydraulic connectors Hydraulic plumbing Hydraulic system insula8on Hydraulic water spray boiler GPS receivers Gyroscopes Ini8ators Lithium-‐ion cells Nickel-‐cadmium cells Rayon-‐carbon cloth phenolic Ring laser gyros Silver-‐zinc cells Stage separa8on devices Vehicle sensors

9

Topic 1: Launch vehicles – Red and yellow risk areas in supply chain

Flight controls

Guidance, naviga8on and control (GNC)

Payload fairing

Payload adapter

Power

Propulsion

Structures

Launch vehicle

Airframes Auxiliary power units Ba[eries Computers Control electronics Doors and panels Engine combus8on chambers Engine controllers Engine heat exchangers Engine manifolds Engine nozzles Engine preburners Engine propellant pumps Fairing sec8ons Fairings Fins Flight control surfaces Flight termina8on systems Iner8al flight systems Interstages Landing gears Moun8ng structures Parachutes Pressurants (N, He, etc.) Pressurant tanks Propellant tanks Propellant: Fuel (LH, etc.) Propellant: Oxidizers (LOX, etc.) Propellant: Solid (ammonium perchlorate composite propellant) Range safety systems Radar al8meters Skirts Solid motor casings Star trackers Telemetry electronics Wings

Alloys Ammonia Anodes Atmospheric nitrogen Atmospheric oxygen Capacitors Carbon fillers Carbonized cloth Cast metal parts Cathodes Coa8ngs Composite material Couplings Diodes Electrolytes (Li-‐ion) Fasteners FiAngs Gaskets Hoses HTPB Methane Nano-‐phase metals (Al, etc.) Natural gas Payload clamp bands Pipes Poten8ometers Precision ball bearings Rayon Resin Screws, bolts, and rivets Sodium perchlorate or chlorine Weave cloth Wires/wire harnesses

Liqu

id ro

cket engines

Tier 5 Tier 4 Tier 3 Tier 2 Tier 1

Topic 2: Summary of space technology risk areas

ª Reviewed 135 companies that manufacture space hardware, focusing on 117 U.S. companies that provide technologies identified as supply chain risks ª There are 11 areas of high risk due to absence of U.S. suppliers or single U.S. supplier

ª 6 were previously identified in reports and are or have been addressed under Title III authority

ª 5 are newly identified ª There are 17 areas at risk due to limited suppliers, suppliers with a potential to create bottlenecks, those with workforce issues, and anticipated cost increases

ª 8 were previously identified in reports and are or have been addressed under Title III authority

ª 9 are newly identified ª Workforce was rarely identified as a supply chain risk ª Over three-quarters of at risk technologies are due to limited number of U.S.

suppliers (2-3)

10

Executive Summary – Topic 2 Table of high risk (red) technologies

11

Technology Satellite or Launch Vehicle

Workforce Sensitivities/Bottlenecks

No U.S. Supplier U.S. Sole Suppliers

Degree of Diversification

Optical solar reflectors* SAT U.S. stockpile;

one foreign supplier

Solar cell cover glass* SAT U.S. stockpile;

one foreign supplier

Space-qualified cadmium-zinc telluride detectors* SAT V

Space-qualified harmonic drive transmissions SAT and LV V

Space-qualified optical encoders SAT and LV V

Space-qualified potentiometers SAT and LV Long lead time V

Space-qualified slip ring assemblies SAT and LV V

Space-qualified torque rods SAT V

Space-qualified travelling wave tubes* SAT V

Ammonium perchlorate (AP)* LV V

Rayon-based carbon cloth phenolic* LV Stockpile

*Technologies previously iden3fied in industrial base reports and surveys.

Reliant on space business Significant space business Significant non-space business

Executive Summary – Topic 2 Table of at risk (yellow) technologies

12

Technology Satellite or Launch Vehicle

Constrained Competition (<4 U.S. Suppliers)

Workforce Sensitivities/Bottlenecks Cost Issues

Precision ball bearings SAT and LV V Long lead time

Reaction wheels SAT High cost compared to non-U.S. providers

Scaleable accuracy star trackers* SAT V

Space-qualified (SQ) ball screws SAT and LV V High cost compared to non-U.S. providers

SQ diodes* SAT and LV Long lead time

SQ focal plane arrays* SAT V

SQ GPS receivers SAT and LV V High cost compared to non-U.S. providers

SQ lithium-ion batteries* SAT and LV Insufficient U.S.-space-qualified Li-ion processing

SQ mercury-cadmium telluride detectors* SAT V

SQ readout integrated circuits* SAT V

SQ resolvers SAT and LV V High cost compared to non-U.S. providers

SQ solar cells* SAT V

SQ transistors SAT and LV V Long lead time

Sun sensors (type of optical imager)* SAT High cost compared to non-U.S. providers

Liquid rocket engines LV V Workforce Questions about future costs after Shuttle

Liquid rocket engine propellant pumps LV V

Metal powder for solid propellant LV V

*Technologies previously iden3fied in industrial base reports and surveys.

Topic 3: Space supplier interdependencies

ª Prime contractors for satellites and launch vehicles depend on the same sole source supplier for components ª For satellites there are 8 single suppliers providing

components to a variety of buses and payloads ª For launch vehicles there is a single supplier for

ammonium perchlorate and no supplier of rayon-based carbon cloth phenolic

ª Four U.S. sole suppliers of space-qualified components common to both satellites and launch vehicles

ª Launch facilities and test facilities are shared

13

Topic 4: Innovation and future design capabilities

ª A complete look at this question was beyond the scope of this project. Our analysis did result in several observations:

ª Historically, R&D developments related to satellite manufacturing are conveyed from DoD satellite projects to the commercial satellite sector through the supply chain ª DoD leads the commercial sector in innovation in areas such as imagery,

ruggedization, and miniaturization ª The commercial sector leads in innovation in consumer-driven areas, such

as value-added services and hand-held devices ª Innovation in the launch vehicle sector is largely driven by process or

material improvements arising in the commercial sector (often non-space commercial sector) rather than from DoD

ª Lower tier companies have indicated that the U.S. Government and Tier 1 companies are less willing to take risk on innovative or unproven technologies

14

Topic 5: Supply chain working capital and investment capital

ª Space sector less affected by the credit crunch and financial crisis than other industries ª Space has historically been a less attractive investment for most equity firms

ª Low margins ª Capital intensive ª Low industry growth ª Few consumer markets

ª Less benefit for space from financial booms, less exposure to financial retractions ª Exception – commercial satellite services ª Working capital

ª Asset-based (rather than cash-flow-based) financing is typical for space industry ª Credit crunch hit cash-flow businesses significantly harder

ª Financing issues in various tiers ª No company specifically identified working capital, credit crunch, or financial crisis

as a concern ª Because Tier 1 and sometimes Tier 2 companies typically hold the government

prime contract, less money flows to the lower tiers when government budgets tighten.

ª Dynamics of contract relationships can be less favorable for lower tier companies ª Tier 1: very effective contracting offices; paid by the U.S. Government quickly ª Lower tier suppliers are more likely to have cash flow issues ª Possible working capital deficit for low tier suppliers

15

Topic 6: Relationships across military, civil, and commercial interests ª Satellites

ª Satellite manufacturers typically serve multiple markets ª Boeing, Lockheed Martin, Orbital Sciences manufacture military, civil, and commercial satellites ª SS/Loral makes satellites for the commercial and civil sectors ª ATK, Ball, and Northrop Grumman manufacture government civil and military satellites

ª Military, civil, and commercial satellites generally use the same standard buses ª Satellite instrumentation/payloads are differentiated across sectors, reflecting specialized

needs ª There are significant areas of cross-over usage of satellite services between sectors

ª DoD purchases commercial communication satellite bandwidth ª Commercial users rely on DoD GPS satellites

ª Of the 264 satellites and spacecraft made by major U.S. manufacturers and launched from 2001 to 2010, 132 (50%) were commercial, 59 (22%) government civil, and 73 (28%) military

ª Launch vehicles ª None of the U.S. launch vehicles are strictly for commercial launches

ª The supply chain for U.S. launch vehicles is integrated; essentially the same configurations are used for military, civil, and commercial launches (with the exception of payload-specific elements)

ª Of the 150 launches (2001-2010) by major U.S. launch providers (excluding NASA-operated Shuttle launches) 27 (18%) carried commercial payloads, 53 (35%) government civil payloads, and 70 (47%) military payloads

ª Space Shuttle retirement and the cancellation of the Constellation Program ª Department of Commerce and NASA extensively studied the effects of the above on

the supply chain

16

Topic 7: Globalization of space industry supply chain

17

Discuss the level of globalization among suppliers and potential suppliers in the space sector. Highlight any especially desirable or undesirable features of globalization in this sector.

Level of globalization of satellite and launch vehicle manufacturing Military Civil Commercial

Satellite Manufacturing

LOW MODERATE MODERATE-HIGH Military satellites almost

entirely U.S.-built. Exceptions include cover glass and

optical solar reflectors made in the U.K.; IHI Aerospace

(Japan) liquid apogee engine on AEHF satellite.

Often, NASA satellites and spacecraft will feature

collaborative systems with Europe, Japan, and other

countries.

Payload electronics or entire payloads are often made by European and/or

Japanese companies. U.S.-built satellite buses provided for satellites primed by European, and, historically, Canadian

and Japanese companies.

Launch Vehicle Manufacturing

MODERATE MODERATE MODERATE Atlas V and Delta IV are used for military, civil, and commercial missions. Atlas V incorporates Russian

RD-180 engines and components from Europe. Delta IV incorporates engine valves from Japan and components from Europe.

Minotaur has a few European components.

Taurus XL and Pegasus (rarely used for military missions) incorporate some non-U.S. components. Taurus II core stage built in Ukraine. Pegasus

and Taurus vehicles available for commercial missions. Falcon 9 series almost entirely U.S.-built. New Athena may feature foreign-built parts.

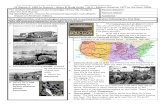

Topic 7: Possible foreign components of a generic U.S. commercial satellite

Saft batteries (France)

Bus: Boeing, Lockheed Martin, Orbital Sciences, SS/L

(USA)

QST solar cell cover glass (UK)

Thales Alenia payload (France)

Thomson/Meggitt ball screws (UK)

18

QST optical solar reflectors (UK)

Fairchild/BAE or Teledyne/Dalsa focal plane arrays (UK/Canada)

IHI Aerospace liquid apogee engines (Japan)

Only some U.S. satellites use foreign components. Those satellites that use foreign components would typically use the components listed here.

19

Topic 7: EELV foreign suppliers

RUAG fairing (Switzerland)

SNECMA nozzle extension on RL10-B (France)

CASA interstage structure and adaptors (Spain)

SAAB payload adaptors (Sweden)

RD AMROSS RD-180 (Russia-USA partnership) Mitsubishi RS-68 propellant

valves (Japan)

Delta IV Atlas V

Saft lithium-ion batteries (France)

RUAG payload clamp bands (Switzerland)

Mitsubishi tank dome development (Japan)

Closing notes

ª Prime contractors and second tier subcontractors noted that they are frequently involved in space industrial base studies

ª Companies in the lower tiers of the supply chain typically had not participated in space industrial base studies and were eager to participate

ª Study identified a number of lower tier sole source suppliers and areas of limited competition across the space industrial base, including four U.S. sole suppliers of space-qualified components common to both satellites and launch vehicles

ª There appears to be significant potential benefit from deeper study of lower tiers and cross sector relationships

20

Contact information: Carissa Christensen, Managing Partner

703-647-8070 [email protected]

The Tauri Group 6363 Walker Lane Suite 600 Alexandria, VA 22310 www.taurigroup.com

21

22

BACKUP SLIDES

Topic 8: Other factors to consider

ª New companies in commercial spaceflight sector ª Private entrepreneurs with personal interest in space invest significant

capital in commercial spaceflight ª Both orbital and suborbital ª Intent to use these vehicles for human spaceflight and research

ª NASA is providing funding for the development of crew and cargo transportation capability to low Earth orbit. NASA has contracted for commercial cargo services from some of these new companies, and expects to purchase more services in the future, including crew

ª NASA’s commercial cargo and crew development programs: ª Cargo: Commercial Orbital Transportation Services (COTS) and

Commercial ISS resupply (CRS) ª Crew: Commercial Crew Development (CCDev)

ª DoD provides funding to some of these firms ª Hosted payloads ª Operationally Responsive Space (ORS) ª Nano-satellites and micro-satellites

23