Unit 4 Price and Output Decisions Under Different Market Structures

-

Upload

jeganrajraj -

Category

Documents

-

view

39 -

download

10

description

Transcript of Unit 4 Price and Output Decisions Under Different Market Structures

Market• Market is a system in which buyers and

sellers bargain for price of the product,

settle the price and transact their

business-buy and sell a product

• Market does not necessarily mean a place.

Consumer Markets

A.Fast-moving consumer goods (“FMCG's”) – News Papers

B.Consumer durables

i. White goods (e.g. fridge-freezers; cookers;

dishwashers; microwaves)

ii. Brown goods (e.g. DVD players; games consoles;

personal computers)

iii. Soft goods - clothes, shoes

iv. Services - hairdressing, dentists, childcare

Industrial Markets (Sale of Goods Between Businesses)

• Selling Finished Goods - furniture, computer

systems

• Selling Raw Materials Or Components - steel, coal,

gas, timber

• Selling Services To Businesses - waste disposal,

security, accounting & legal services

Market Structure

• The competitive environment in which

the buyer and sellers of the product

operate.

Classification of the Market Structure

• Depending on the number of sellers and the degree of

Competition

• Perfect Competition

• Monopoly Competition

• Monopolistic Competition

• Oligopoly Competition

Perfect Competition

• The concept of Perfect Competition was

introduced by Dr. Alfred Marshall.

• Sometimes referred to as "pure

competition".

Perfect Competition

• Perfect degree of competition and single price

prevails

• No buyer or seller has market power.

• No single firm has influence on the price of the

product it sells.

Characteristics of Perfect Competition

• Large number of sellers and buyers

• Homogeneous Products

• Free entry and exit of firms

• Perfect mobility of factors of production

• Independent Decision making

• Perfect knowledge

• Indifference among the buyer towards sellers

• No Transport cost

• Price-taker not a Price-Maker

Perfect Competition

• Perfect competition is a theoretical market structure.

• It is primarily used as a benchmark against which

other market structures are compared.

• The industry that best reflects perfect competition in

real life is the agricultural industry

Perfect Competition• Perfect Competition is an Unrealistic

phenomenon

• Examples– Share market– Securities and bond market– Agricultural markets– Local Vegetable market

Does Perfect Competition Exist In The Real World?

• Most products have some degree of differentiation

• Many industries also have significant barriers to entry

• Consumer awareness has increased with the information

age

• Nothing is 100% perfect in this world.

• So, this states that perfect competition is only a

theoretical possibility and it does not exist in reality

Price-Output Determination

• Given the conditions of perfect competition, the market price is determined by the market forces (Market demand and Market Supply)

• The firm in a perfectly competitive market is a Price-taker not a Price-Maker

Price-Output Determination

• Price-Output Determination is analyzed

under perfect competition in two time

periods

A. Short Run

B. Long Run

Pricing in the Short-run (Super normal Profit Equilibrium)

• In the short-run, it is possible

for an individual firm to make a

profit.

Pricing in the Long-run (Normal Profit Equilibrium)

• In the long period, positive profit cannot be sustained.

• The arrival of new firms or expansion of existing firms in

the market causes the (horizontal) demand curve of each

individual firm to shift downward, bringing down at the

same time the price, the average revenue and marginal

revenue curve.

Pricing in the Long-run (Normal Profit Equilibrium)

• The final outcome is that, in the long run,

the firm will make only normal profit (zero

economic profit).

• Its horizontal demand curve will touch its

average total cost curve at its lowest point.

Short-run & Long-run Equilibrium of Perfectly competitive firms

Long-run Equilibrium

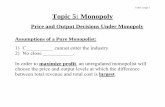

Monopoly

• Monopoly is the anti-thesis of Competition

• In monopoly market there is a single seller,

there are no close substitutes for the

commodities and there are barriers to entry

Reasons for Monopoly• Legal Restrictions (Indian Railways)

• Control over raw materials (Diamond company)

• Efficiency

• Patent over inventions

• High cost of establishing an efficient plant

Characteristics of Monopoly• Single seller and a number of buyers

• Absence of Competition

• No close substitutes

• Cross elasticity of demand is zero

• Difficult to enter

• Control over the supply of the commodity

Price Discrimination

• seller price discriminates when it charges

different prices to different buyers.

• The ideal form of price discrimination, from the

seller's point of view, is to charge each buyer

the maximum that the buyer is willing to pay.

Degrees of Price Discrimination

• First Degree Price Discrimination

• Second Degree Price Discrimination

• Third Degree Price Discrimination

First Degree Price Discrimination

• The discriminatory pricing that attempts to

take away the entire consumer’s surplus.

• This is also known as “TAKE-IT-OR-LEAVE-

IT”

Second Degree Price Discrimination

• It is practiced when there are many

customers with different tastes and

with varying income levels.

Third Degree Price Discrimination

• Under this form, different prices are charged

for the same homogeneous good for different

customers, depending upon various factors

(age, gender)

When Price Discrimination is Possible?

• If there is an imperfection in the market

• Different elasticity of demand in the market

• Different nature of the product (haircut)

• Distance and frontier barriers

Monopolistic Competition • Monopolistic competition is a common market

form.

• Monopolistic competition is a situation which a large number of firms are offering similar but not identical products.

• It is a blend of Competition and Monopoly.

Monopolistic Competition

• Many markets can be considered

monopolistically competitive, often including

the markets for restaurants, clothing, shoes

and service industries in large cities.

Characteristics of Monopolistic Competition

• Almost the same as in perfect competition,

with the exception of heterogeneous

products

• Great deal of non-price competition (based

on slight product differentiation).

Characteristics of Monopolistic Competition

• Large number of sellers

• Product differentiation

• Non-price competition (More importance to Advertisements)

• Free entry and exit

• Independent behavior (independent pricing policy)

• Producers have a degree of control over price

Short-run Pricing Equilibrium in Monopolistic Competition

(Super Normal Profit)

• A monopolistically competitive firm

acts like a monopolist in that the firm is

able to influence the market price of its

product by altering the rate of

production of the product.

Short-run Pricing Equilibrium in Monopolistic Competition

(Super Normal Profit)• Unlike in perfect competition, monopolistically

competitive firms produce products that are not perfect substitutes.

• As such, brand X's product, which is different from all other brands' products, is available from only a single producer.

• Hence in the short-run a monopolistically competitive firm may get profit or loss.

Short-run Pricing Equilibrium in Monopolistic Competition

(Super Normal Profit)

• In the short-run, the monopolistically competitive firm can exploit the heterogeneity of the market to reap positive economic profit

Long-run equilibrium of the firm under monopolistic competition – Normal Profit

• In the long-run, one firm to reap

monopoly profits will be duplicated by

competing firms.

• In the long-run, the monopolistically

competitive firm will make zero

economic profit

Oligopoly

Oligopoly

• An oligopoly is a market form in which a market or

industry is dominated by a small number of sellers.

• An oligopoly is competition among the few.

• An oligopoly selling either homogeneous or

differentiated products.

Unique Characteristics of An oligopoly

• Few Sellers ( to 5 to 10)

• Lack of uniformity in the size of the firm

• More importance for Advertisement and Selling cost

• Uncertainty in the rival behavior

• Interdependence in price fixation

• Constant war between firms on price

Outcome of the Unique Characteristics of An oligopoly

• Because there are few participants in this type of market, each oligopolist is aware of the actions of the others.

• The decisions of one firm influence, and are influenced by the decisions of other firms.

• oligopolists always consider the responses of the other market participants (Competitors).

Behavior Of An Oligopoly In Price And Output Determination

• The rival firms do not follow the leader if they increase

the price

• The rival firms are forced to follow the leader if they

decrease the price

• Kinked Demand curve and Rigid Prices in the Industry

Kinked Demand curve of An oligopoly

• Above the kink, demand is relatively elastic because all other firm’s prices remain unchanged.

• Below the kink, demand is relatively inelastic because all other firms will introduce a similar price cut, eventually leading to a price war.

• Therefore, the best option for the oligopolist is to produce at point E which is the equilibrium point and the kink point.

Price And Output Determination In Oligopoly Competition

• The kinked demand curve theory suggests that there will be price stickiness in these markets and that firms will rely more on non-price competition to boost sales, revenue and profits.

• If marginal costs (MC) fall in the gap of the MR curve P* will remain the profit maximizing price and Q* will be the profit maximizing output.

Pricing policy and Practices• One of the four major elements of the marketing

mix is price.

• Pricing is an important strategic issue because it is related to product positioning.

• Furthermore, pricing affects other marketing mix elements such as product features, channel decisions, and promotion

Pricing Objectives

• The firm's pricing objectives must be identified in order to determine the optimal pricing.

• The pricing objective depends on many factors including production cost, existence of economies of scale, barriers to entry, product differentiation, rate of product diffusion, the firm's resources, and the product's anticipated

Pricing Objectives• Current profit maximization • Current revenue maximization• Maximize quantity• Maximize profit margin• Quality leadership• Partial cost recovery• Survival• Status quo (Price Stabilization)• Preventing competition • Maintain market share

Current profit maximization

• It seeks to maximize current profit, taking into account revenue and costs.

• Current profit maximization may not be the best objective if it results in lower long-term profits.

Current revenue maximization

• It seeks to maximize current revenue with no regard to profit margins.

• The underlying objective often is to maximize long-term profits by increasing market share and lowering costs.

Maximize quantity

• It seeks to maximize the number of units sold or the number of customers served in order to decrease long-term costs as predicted by the experience-curve

Maximize profit margin

• It attempts to maximize the unit profit margin, recognizing that quantities will be low.

Quality leadership

• use price to signal high quality in an attempt to position the product as the quality leader.

Partial cost recovery

• An organization that has other revenue sources may seek only partial cost recovery.

Survival

• In situations such as market decline and overcapacity, the goal may be to select a price that will cover costs and permit the firm to remain in the market.

• In this case, survival may take a priority over profits, so this objective is considered temporary.

Price Stability

• The firm may seek price stabilization in order to avoid price wars and maintain a moderate but stable level of profit.

Pricing Objectives For new products

• For new products, the pricing objective often is either to maximize profit margin or to maximize quantity (market share).

• To meet these objectives, skim pricing and penetration pricing strategies often are employed.

• Joel Dean discussed these pricing policies in his

article entitled, “Pricing Policies for New Products”

Skim pricing

• It attempts to "skim the cream" off the top of the market by setting a high price and selling to those customers who are less price sensitive.

• Skimming is a strategy used to pursue the objective of profit margin maximization.

Penetration pricing

• Penetration pricing pursues the objective of quantity maximization by means of a low price

Pricing Methods

• To set the specific price level that achieves their pricing objectives, managers may make use of several pricing methods.

Pricing Methods• Full cost pricing

• Marginal cost pricing

• Going rate pricing

• Peak-Load pricing

• Charm pricing

• Cyclical pricing

• Product-Tailoring

• Refusal Pricing

• Cost-plus pricing

• Target return pricing

• Value-based pricing

• Psychological pricing

• Loss-Leader Tactics • Pricing

• Resale Price maintenance

Marginal Cost Pricing

• The policy of setting the price of a good

or service equal to the marginal cost of

producing it.

Going-Rate-Pricing

• Establishing the price for a product

or service based on prevalent

market prices.

Peak Load Pricing

• It is a pricing strategy that implies price

will

be set at the highest level during times

when demand is at a peak.

Cyclical Price

• A single cycle has an upside during

which prices rise to a peak and a

downside when prices fall to a bottom

Product-Tailoring

• Tailoring Products to Customer

Preferences

• customized products to specific

needs

Economy Pricing

• This is a no frills low price. The cost of marketing

and manufacture are kept at a minimum.

• Supermarkets often have economy brands for

soups, spaghetti, etc.

Product Line Pricing

• Where there is a range of product or services the

pricing reflect the benefits of parts of the range.

• For example car washes. Basic wash could be $2,

wash and wax $4, and the whole package $6.

Optional Product Pricing• Companies will attempt to increase the amount customer

spend once they start to buy.

• Optional 'extras' increase the overall price of the product

or service.

• For example airlines will charge for optional extras such

as guaranteeing a window seat or reserving a row of

seats next to each other.

Captive Product Pricing

• Where products have complements, companies will charge a premium price where the consumer is captured.

• For example a razor manufacturer will charge a low price and recoup its margin (and more) from the sale of the only design of blades which fit the razor.

Product Bundle Pricing

• Here sellers combine several products in

the same package.

• This also serves to move old stock.

• Videos and CDs are often sold using the

bundle approach.

Promotional Pricing

• Pricing to promote a product is a very

common application.

• There are many examples of promotional

pricing including approaches such as

BOGOF (Buy One Get One Free).

Geographical Pricing

• Geographical pricing is evident where there are

variations in price in different parts of the world.

• For example scarcity value, or where shipping

costs increase price.

Value Pricing

• This approach is used where external factors

such as recession or increased competition

force companies to provide 'value' products

and services to retain sales

• e.g. value meals at McDonalds.

Pricing Methods• Cost-plus pricing

• set the price at the production cost plus a certain profit margin.

• Target return pricing • set the price to achieve a target return-on-

investment

Pricing Methods• Value-based pricing

• based the price on the effective value to the customer relative to alternative products.

• Psychological pricing • base the price on factors such as signals of

product quality, popular price points, and what the consumer perceives to be fair