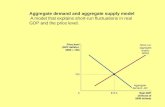

Unit 3 Aggregate Demand and Aggregate Supply: Fluctuations in Outputs and Prices.

-

Upload

ami-watkins -

Category

Documents

-

view

219 -

download

0

Transcript of Unit 3 Aggregate Demand and Aggregate Supply: Fluctuations in Outputs and Prices.

Keynesian ModelPurpose of this lesson is to develop a simple model of the economyGDP = C+Ig+G+Xn

Planned consumption, Gov’t spending, & net exports always occurPlanned investment does not necessarily occur

Sometimes inventories accumulate more than businesses plan, and sometimes businesses draw down inventories more than planned

What to do with your income?

You can do three thingsConsume or SaveY = C + S

Y = IncomeC = ConsumptionS = Savings

What about taxes?Disposable Income = Income - Taxes

Propensities to Consume or Save

Average Propensity to Consume (APC)APC = C / DI

Average Propensity to Save (APS)APS = S / DI

Marginal Propensity to Consume (MPC)MPC = ΔC / ΔDI

Marginal Propensity to Save (MPS)MPS = ΔS / ΔDI

APC + APS = 1 and MPC + MPS = 1

Multiplier EffectEffect on equilibrium GDP of a change in aggregate expenditures or aggregate demand (caused by a change in the consumption schedule, investment, government purchases, or net exports)

InvestmentTo an economist, investment is

Spending on plant and equipment: the machinery and the buildings that a firm uses to produce output

Investment is not the purchase of stocks and bonds or any other financial instrument

Determinants of Investment

OutputReal GDP determines investment because it is a measure of the level of demand for a productBusinesses will calculate expected profitability of the investment alternatives

Interest RateRepresents the opportunity cost of using the money to buy investment goods

When should businesses invest?

Expected profit > Interest Rate INVESTExpected profit < Interest Rat DON’T INVEST

As the interest rate goes down, the level of investment goes up. (Investment is an inverse function of the interest rate)

Aggregate DemandAggregate Demand

The sum of planned consumption, investment, government and export minus import expenditures on final goods and services

The aggregate demand function is an inverse function between the price level and output

As the price level rises, the level of output demanded decreasesAs the price level falls, the level of output demanded increases

Factors that affectAggregate Demand

Interest-rate effectTendency for increases in the price level to increase the demand for money, raise interest rates, and as a result, reduce total spending and real output

Wealth effect (Real-Balances Effect)Tendency for increases in the price level to lower the real value of financial assets with fixed money value and, as a result, to reduce total spending and real GDP, and conversely for decreases in the price level

Net export effect (Foreign Purchase Effect)The inverse relationship between the net exports of an economy and its price level relative to foreign price levels

Determinants of Aggregate Demand:Factors that shift the Aggregate Demand

Curve

Changes in expectations of future income, inflation or profitsChanges in government spending or taxesChanges in the money supplyChanges in the foreign exchange rate or foreign income

Aggregate SupplyAggregate Supply

The total supply of all goods and services in the economy

Aggregate Supply CurveShows the relationship between total quantity of output supplied by all firms and the overall price levelIt is NOT the sum of individual firm supply curvesSometimes called a price-output adjustment curve

Aggregate Supply (con’t)Aggregate Supply depends on the quantity of labor, the quantity of capital and the level of technologyIn the short-run, the capital & level of technology are fixed, and only the quantity of labor changesA short-run aggregate supply (SRAS) curve assumes the money wage, resource prices & potential GDP are constant With these items being constant, as the overall price level rises, firms will produce more output

Shapes of short-runaggregate supply curve

(SRAS)Horizontal Line

Price level remains constant as real output varies

Vertical LineReal output is constant at full capacity & only the price level can vary

Positively sloped (*usually draw it this way)

Real output and the price level are variable

Long-run aggregatesupply (LRAS) curve

Vertical at full employment, or potential GDPIf there is an increase in the overall price level that is matched by equal percentage increases in the money-wage rate and other resource prices, the economy will remain at potential GDPFollowing adjustments, the SRAS and AD curves will intersect along the LRAS curve

Determinants of Aggregate Supply:Factors that shift the SRAS Curve

Per-unit production costs (average production cost of of a particular level of output)

Changes that decrease per-unit production costs shift the SRAS curve to the rightChanges that increase per-unit production costs shift the SRAS curve to the left

Determinants of Aggregate Supply:Factors that shift the SRAS Curve (con’t)

Change in input pricesDomestic Resource Availability

Land , Labor, Capital, Entrepreneurial Ability

Price of imported resourcesMarket Power

Change in productivityChange in legal-institutional environment

Business Taxes & Subsidies, Gov’t regulations

Short-Run EquilibriumShort-run macroeconomic equilibrium occurs when real GDP demanded equals real GDP supplied

Unit III Lesson 5

If the price level is above equilibrium, then aggregate supply is greater than aggregate demand

Firms experience an accumulation of inventory; they cut production & employment; output decreases towards equilibrium level

Unit III Lesson 5

If the price level is below equilibrium, then aggregate demand is greater than aggregate supply

Firms experience Inventory reduction; they increase production & employment; output increases toward equilibrium level

Unit III Lesson 5

Use Visual 3.12 to illustrate

AD and AS shifts and the effects on Price Level and

Real GDP

Unit III Lesson 5

Review Beginning of Activity 26 w/ students

Complete Activity 26 and review answers

Unit III Lesson 5

Review:Aggregate Supply and Aggregate Demand

Analysis ContinuedFactors that shift AD

*Changes in expectations of future income, inflation or profits

*Changes in government spending or taxes

*Changes in the money supply

*Changes in the foreign exchange rate or foreign income

Factors that shift SRAS*Change in input prices

Domestic Resource AvailabilityPrice of imported resourcesMarket Power

*Change in productivity*Change in legal-

institutional environmentBusiness taxes & subsidies, Gov’t regulations

Unit III Lesson 6

The Long-Run EconomyHere we explore the LRAS and it’s relationship with the economy’s PPCFactors that will shift he LRAS curve to the right

Productivity of labor (education)Increases in technology (research & development expenditures)Increases in capital stock of the economy (low, stable interest rates)

Unit III Lesson 7

Government SpendingGov’t spending affects the economy directly by increasing the demand for goods and servicesAs soon as the gov’t increases its spending, it initiates a multiplier process that results in a greater increase in total spending than the initial increase in gov’t spendingThe increase in gov’t spending increases aggregate demand, shifting the AD curve to the rightIn the short run, the usual effects are an increase in real GDP and the price level

Unit III Lesson 8

TaxesChanges in taxes do not directly change real GDPChanges in taxes affect the disposable income of households or businessesThese changes are felt through consumption and investment spendingAn increase in taxes decreases disposable income, a decrease in disposable income decrease consumption, but by less than the increase in taxesSome of the additional tax bill is paid from savings

Unit III Lesson 8

Automatic StabilizersTools in the economy that respond to different phases of the business cycleThey are automatic, because they adjust without an action by Congress or the presidentThey serve as stabilizers because they limit the increase in real GDP during expansions and reduce the decrease in real GDP during a recession

Unit III Lesson 8

Income tax systemAs an individual’s nominal income increases, he or she moves into higher tax brackets and pays more taxes, thus limiting the increase in disposable income and consumption

Unit III Lesson 8

Unemployment compensation

As the economy slows and unemployment increases, the income of the unemployed does not fall to zero, which would leave a significant negative effect on the economyUnemployment compensation provides a base level of income, and the negative impact on real GDP is lessened

Unit III Lesson 8

Stock and Bond returnsMany corporations establish the dividends they pay on shares of stock and maintain this payout for several years. Thus dividends do not follow the swings of the business cycleBond payments are established at the time the bond is issued and remain throughout the life of the bond

Unit III Lesson 8