UCLA IPS

Transcript of UCLA IPS

8/3/2019 UCLA IPS

http://slidepdf.com/reader/full/ucla-ips 1/13

Page 1- Approved by Investment

Committee on May 17, 20

- For approval by Board o

June 2, 2011

INVESTMENT POLICY STATEMENTFOR

THE UCLA FOUNDATION LONG-TERM ENDOWMENT POOL

The purpose of The UCLA Foundation's Endowment is to support the educational mission of theUniversity of California, Los Angeles by providing a reliable source of funds for current and futureuse. The Endowment assets have an indefinite time horizon that runs concurrently with theexistence of the University in perpetuity. As such, the investment portfolio assumes a time horizonthat may extend beyond a normal market cycle and therefore may assume an appropriate level of risk as measured by the standard deviation of annual returns. It is expected that professionalmanagement and portfolio diversification will smooth volatility and assure a reasonable consistencyof return. Investment of the Endowment is the responsibility of the Investment Committee and theInvestment Management Committee. Under the direction and approval of the Board of Directors,the Investment Committee recommends investment objectives and policies, recommends assetallocation and monitors the implementation and performance of the Foundation's investment

program. Under the direction and approval of the Board of Directors, the Investment ManagementCommittee is responsible for selection and termination of managers. The Committees are supportedby the office of the Vice President-Finance of The UCLA Foundation, which, with support fromindependent third party investment management consultants who analyze investment policies andmanagement strategies, makes recommendations to the Committees and supervises operations andinvestment activities. This Investment Policy should not change frequently. In particular, short-term changes in the financial markets should not require adjustments to this Investment Policy.

I. STATEMENT OF INVESTMENT OBJECTIVES

The Endowment will seek to maximize long-term total returns consistent with prudent levels of risk. Investment returns are expected to preserve or enhance the real value of the endowment to

provide adequate funds to sufficiently support designated University activities. TheEndowment is expected to generate a total annualized rate of return, net of fees, and 5% greaterthan the rate of inflation as measured by the Consumer Price Index (CPI for All UrbanConsumers, CPI-U) over a rolling 5-year period. In seeking to attain the investment objectives setforth, the Committees shall exercise prudence and appropriate care in accordance with the UniformPrudent Management of Institutional Funds Act (UPMIFA). UPMIFA requires fiduciaries to applythe standard of prudence “about each asset in the context of the portfolio of investments, as part of an overall investment strategy.” All investment actions and decisions must be based solely on whatis in the best interest of the Foundation.The Foundation's spending policy governs the rate at which funds are released to fund holders fortheir current spending. The Foundation's spending policy will be based on a target rate set as a

percentage of market value. The target rate will be reviewed annually by the Finance Committeefor recommendation to and approval by the Board of Directors.

II. ASSET ALLOCATION & REBALANCING

To achieve its investment objectives, the Endowment will be allocated among a number of assetclasses. These asset classes may include domestic equity, domestic fixed income, internationaldeveloped equity, international emerging markets equity, international fixed income, absolutereturn, private equity, venture capital, real estate, distressed debt, timber, energy, commodities andcash. The purpose of allocating the investment portfolio asset classes is to ensure the proper levelof diversification within the Endowment.

........................................................................................

........Approved by the Investment Committee (May 17

Approved by the Board of Directors (June 2, 201

8/3/2019 UCLA IPS

http://slidepdf.com/reader/full/ucla-ips 2/13

Page 2

The Investment Committee will review and recommend asset class allocation targets and minimum / maximum ranges no less frequently than annually. The Asset Allocation Policy Table attached tothis document defines the present policy target asset allocation percentages of the Endowmentportfolio. The Investment Management Committee may appoint Investment Managers (Managers)or select pooled investments with an objective to be fully invested at all times. The InvestmentManagement Committee shall report actions taken to the Investment Committee at the semi-annual

Investment Committee meetings. Managers are expected to diversify holdings consistent withprudent levels of risk.

Asset allocations shall be made among various asset classes including the following, subject to thelimitations stated in the Asset Allocation Policy Table.

A. DOMESTIC EQUITY PORTFOLIO

The domestic equity portfolio will be invested on the basis of total return, including dividendyield and capital appreciation.

The return, risk and cost dynamics of each sub-class/style (i.e., large cap, small cap, growth,

value, etc.) will be evaluated to determine whether active or passive management isappropriate under the circumstances existing at the time.

Within the guidelines and restrictions, Managers have discretion over the timing and selectionof equity securities and are expected not to time the market.

B. INTERNATIONAL EQUITY PORTFOLIO

The Foundation’s international equity portfolio will be invested in stocks of internationalissuers on the basis of total return, including dividend yield and capital appreciation. No morethan one third of the international equity portfolio may be invested in emerging markets (i.e.,countries in the Morgan Stanley Capital International Emerging Markets Free Index and other

non-EAFE markets.) Currency hedging as a defensive strategy is permitted in global orinternational equity portfolios.

C. ALTERNATIVE INVESTMENTS

Alternative Investments involve investing in non-traditional asset classes and in traditional assetclasses structured in a non-traditional manner. Managers are expected to use their specificinvestment skills to generate long-term equity-like returns that are not highly correlated totraditional asset classes. Absolute Return (marketable) alternative investment strategies, such as,long versus short, tactical asset allocation, distressed securities, and arbitrage strategies, may beused to enhance investment returns and overall portfolio diversification. Investmentcommitments to alternative asset Managers will be made to attempt to achieve an averageinvestment in subclasses of alternative investments at or below the individual target levelsestablished for each subclass. The Foundation’s non-marketable alternative investment portfoliowill be invested in venture capital, leveraged buyouts, distressed debt, timber, energy and otherinvestments approved by the Investment Management committee in order to produce thecombined or individual effects of reducing overall portfolio risk or to generate expected returnsthat exceed those available from domestic and international equities. Non-marketablealternative investments in aggregate will be valued at cost for purposes of determining whetherthey are within the permitted allocation target level. Investments in alternative assets will bemade primarily in partnerships where the Foundation is a limited partner relying upon theexpertise of experienced general partners.

8/3/2019 UCLA IPS

http://slidepdf.com/reader/full/ucla-ips 3/13

Page 3

The alternative investment portfolio will be invested across a broad spectrum of underlyinginvestments up to the target level for each asset subclass that should realize expected returnsover a period of ten years. Net commitments (total commitments minus distributions) to asingle manager may not represent more than 15% of the asset allocation target for alternativeinvestments.

Managers for alternative investments shall provide in writing, the policies and procedures used

in periodic portfolio valuation. These policies and procedures along with portfolio compositionare to be reviewed with the Foundation at least annually. At a minimum, the Manager willaddress the following:- Nature of underlying investments, including factors such as complexity, liquidity, volatility

and frequency of trading- Methodology and assumptions used in valuation- Role of advisory committee in valuations- Current membership and experience of advisory committee members- Checks and balances in place to ensure a fair evaluation process

Specific guidelines for marketable alternative investments are listed in Appendix I.

D. FIXED INCOME PORTFOLIO

Fixed income Investments may be managed to pursue opportunities presented by changes ininterest rates, credit ratings, and maturity premiums, with the objective of meeting orexceeding the results of the fixed income market as represented by the annualized returns of specific indices over an annualized moving three- and five-year time period. The fixedincome portfolio may include high-yield bonds, Treasury Inflation Protected Securities(TIPS), and non-U.S., or emerging market fixed income instruments.

E. REAL ESTATE PORTFOLIO

A portion of the portfolio will be invested by Managers who are expected to use theirspecific investment skills to generate returns that have lower correlations to the U.S. stock market. Real Estate investments may be made in a broad spectrum of investments includingpublicly traded Real Estate Investment Trusts (REITs), open- or closed-end funds, andlimited partnerships. Direct investments in real estate and non-publicly traded REITs arenot permitted.

F. ASSET ALLOCATION REBALANCING

Marketable asset classes that exceed tolerance ranges will be rebalanced to target levels

quarterly. Excess allocations intended for non-marketable asset categories will be carried,prior to their investment in non-marketable assets, in one or more other asset classes afterconsultation with the Investment Consultant and approval from the Chair of the InvestmentCommittee.

The Russell 3000 will be used as a proxy for the domestic equities market. Domestic equityportfolios and strategies selected for the portfolio will be chosen with the goal of forming adomestic equity portfolio that is style and capitalization neutral relative to the Russell 3000index.

8/3/2019 UCLA IPS

http://slidepdf.com/reader/full/ucla-ips 4/13

Page 4

Tolerance ranges for portfolio rebalancing will be established by multiplying target ranges2.0 times the expected volatility (standard deviation) updated annually by the InvestmentConsultant for each portfolio target allocation, rounded up to the closest whole percentagepoint. (Example: An asset class with an expected volatility of 17% and a portfolio targetallocation of 10% would result in 17% times 2.0 times 10% equals 3.4%, rounded up to4.0%. The asset class will be rebalanced quarterly when the tolerance exceeds plus or minus

4.0%, i.e., when the actual portfolio allocation to that asset class is over 14% or below 6%,the asset class is rebalanced to 10 %.) During periods of high volatility, the Chair of theInvestment Committee with the concurrence of the Investment Consultant may temporarilyauthorize rebalancing to within-the-stated- ranges in lieu of rebalancing to the target assetallocation.

G. POLICIES FOR NON-ENDOWED ASSETS

Investment policies for assets not included in the Long Term Endowment Pool are maintainedin separate documents for the “Unendowed Investment Pool” (to support current expenditures)

and “Kaspick & Company Investment Guidelines for Planned Gift Assets.”

III. GUIDELINES FOR THE SELECTION OF FIXED-INCOME SECURITIES

A. DIVERSIFICATION

Except for the U.S. government, its Federal Agencies or instrumentalities, no more than 5% of the fixed-income portfolio at cost, or 8% at market value, shall be invested in any oneguarantor, issuer, or pool of assets. In addition, Managers are expected to exercise prudence indiversifying the Foundation’s investment by sector and industry.

B. INVESTMENT QUALITY

U.S. FIXED INCOME - All fixed income obligations (excluding high yield bonds) must berated investment grade BBB/Baa or better by either Standard & Poor's or Moody's InvestorsService, except that bonds not receiving a rating may be purchased under the followingcircumstances:

- The issue is guaranteed by the U.S. government, its Federal Agencies or instrumentalities.

- Other comparable debt of the issuer is rated investment grade by Standard & Poor's orMoody's Investors Service.

For funds invested with a Manager in a separately held account, the average quality rating of theassets held by such Manager must be A or better. Securities downgraded in credit quality ratingsubsequent to purchase, resulting in the violation of the policy guidelines, may be held at theManager's discretion. This is subject to immediate notification to the Investment ManagementCommittee of such a change in rating.

NON-U.S. FIXED INCOME- For funds invested with a Manager in a separately held account,the non-U.S. assets held by such Manager must be investment grade fixed income securities (orsecurities deemed of comparable quality by the Manager) of issuers located outside the UnitedStates. All fixed income obligations must be rated investment grade BBB/Baa or better. Theaverage quality rating of the non-U.S. fixed income portfolio must be A or better.

8/3/2019 UCLA IPS

http://slidepdf.com/reader/full/ucla-ips 5/13

Page 5

GLOBAL HIGH YIELD FIXED INCOME – The Global High Yield asset class will becomprised of non-investment grade fixed income securities and may be comprised of domesticor global issues. All bonds must be rated CCC or better.

CORE-PLUS FIXED INCOME - Strategies for this asset category will be comprised of U.S. fixed income instruments and may include high yield, emerging market and non-U.S.

fixed income instruments. U.S. fixed income instruments shall be at least 60% of any core-plus fund portfolio investment.

C. DURATION

In the aggregate, the average duration of managed fixed income assets (excluding global highyield fixed income) will be maintained within the range of the average duration of the currentBarclay Aggregate Bond Index plus or minus one and one-half years.

IV. GUIDELINES FOR SELECTION OF EQUITY INVESTMENTS

DIVERSIFICATION FOR EACH MANAGER

No more than 5% at cost, or 7% at market value, shall be invested in any single issuer. Inaddition, Managers are expected to exercise prudence in diversifying the Foundation’sinvestments by sector and industry.

V. STANDARDS OF PERFORMANCE

A. PERFORMANCE RELATIVE TO RISK

The stated goal for the total portfolio is to generate an average annualized rate of return, net of

fees, 5% greater than the rate of inflation as measured by the Consumer Price Index (CPI-U)over rolling 5-year periods.

Broad portfolio diversification is expected to provide an aggregate risk (volatility) for the totalEndowment portfolio that is lower than that of a market index weighted to match the asset mixof the portfolio.

The disciplined approach to investment is intended to be consistent over time and amongasset classes. Incremental changes to asset class allocation will be proposed or new classesadded when such actions are anticipated to improve returns and/or reduce risk.

B. PEER GROUP

Performance of the Endowment portfolio will also be compared to the endowment universe withsimilar investment allocations. It is expected that the total portfolio will perform above themedian performance in the comparable fund universe provided by the Investment Consultant(s).

Managers are expected to equal or exceed the return of the agreed benchmark and generallyperform in the top 40th percentile (40%) or better of their respective peer group over a marketcycle (3-5 years), as measured by a broad performance database that evaluates Managers as tostyle, risk and return.

8/3/2019 UCLA IPS

http://slidepdf.com/reader/full/ucla-ips 6/13

Page 6

C. INDICES1. Performance of the Endowment (net of fees) and its component asset classes will be

measured against benchmark returns of comparable portfolios as follows:

Total Endowment Aggregated weighted return equal to the actual assetclass composite market value as a percentageof total portfolio market value multiplied

times the selected benchmarks for the assetclass composites.

U.S. Equity Composite Russell 3000 Index

International Equity Composite MSCI ACWI Ex-U.S. Index

Absolute Return Composite HFRX Directional IndexHFRX Absolute Return Index

Non-Marketable Composite Total Non-Marketable actual return

Inflation Hedge Composite (Timber,Energy, and Commodities) Total Inflation Hedge Actual Return

Real Estate Composite Public REITS: FTSE NAREIT U.S. IndexValue Add & Opportunistic: Actual

ReturnsCore Real Estate: NCREIF ODCE Index

Fixed Income Composite Barclay Aggregate Bond Index

Investment performance will be compared with one of the following equity market indicesbased on each Manager’s specific investment style:

Large Cap Core Equities S&P 500 or Russell 1000 Index Small - Mid Cap Value Equities –Russell 2500 Value Index Small - Mid Cap Growth Equities – Russell 2500 Growth Index International Large Cap Equities – MSCI World Index (Ex U.S.) International Emerging Markets Equities MSCI Emerging Markets Free Index Public REIT Equities – NAREIT Index International Small Cap Equities – MSCI EAFE Small Cap Index International Large Cap and Emerging Combination

– MSCI ACWI (All Country World Index) Ex U.S. Index

2. MARKETABLE ALTERNATIVE INVESTMENTS - Performance will be comparedto the aggregate of the components of 50% HFRX Directional Index and 50% HFRXAbsolute Return Index

3. NON-MARKETABLE ALTERNATIVE INVESTMENTS - The primary objective is

8/3/2019 UCLA IPS

http://slidepdf.com/reader/full/ucla-ips 7/13

Page 7

to obtain equivalent or higher U.S. equity returns over multi year periods, with reducedvolatility and lower risk (standard deviation) for the equity portfolio. Actual non-marketable alternative investment returns will be used as the benchmark. Non-Marketable alternative investment performance will also be compared to the Russell3000 plus three hundred basis points per annum to assess relative asset class movementand volatility.

4. REAL ESTATE - Investments will be compared to the aggregate of the componentsweighted by their actual market value percentage within the total real estate portfoliotimes the respective public and private indices.

5. U.S. FIXED INCOME - Fixed income performance will be compared to the total returnof the Barclay Aggregate Bond Index.

6. INTERNATIONAL FIXED INCOME - Performance will be compared to the total returnof the Salomon WGBI Non-U.S. Unhedged Index

7. TREASURY INFLATION PROTECTED SECURITIES (TIPS) – Performance will becompared to the Merrill Lynch U.S. Treasury Inflation Index.

8. GLOBAL HIGH YIELD

A. HIGH YIELD FIXED INCOME – Performance will be compared to the MerrillLynch BB-B High Yield Bond Index.

B. INTERNATIONAL EMERGING MARKETS DEBT – Performance will becompared to the J.P. Morgan Emerging Markets Bond Index.

The benchmark will be a weighted average of A. + B. based on the overall allocation inthe Global High Yield Category.

9.

CASH INVESTMENTS – Performance will be compared to the Lipper InstitutionalMoney Market Funds Index.

10. COMMODITIES – Investment performance will be compared with one of the followingindices based on each Manager’s specific investment style:

Goldman Sachs Commodity Index Dow Jones – UBS Index

11. TIMBER – Performance will be compared to the NCREIF Timber Index.

D. TRADING AND EXECUTION GUIDELINES

Manager(s) shall have the discretion to execute securities transactions with brokerage firms of their choosing, based upon the quality of execution rendered, the value of research informationprovided, the financial health and integrity of the brokerage firm, and the overall efficiency intransacting securities trades. In the case of separate accounts, the Investment ManagementCommittee retains the right to direct brokerage commissions subject to best execution. Whenthe Manager(s) directs commissions on behalf of the Foundation, the direction will becontingent upon the institution being competitive in both price and execution for the specific

8/3/2019 UCLA IPS

http://slidepdf.com/reader/full/ucla-ips 8/13

Page 8

transaction. Transition management firms will be consulted and utilized for new or transferredportfolios when cost-efficient.

E. FIDUCIARY STANDARDS / CONFLICT OF INTEREST

Governors, foundation officers, faculty and staff all serve the educational and publicpurposes to which the University is dedicated. Accordingly, all such members of theUniversity community (Members) have a clear obligation to conduct the affairs of theUniversity in a manner consistent with those purposes and to make all decisions solely onthe basis of a desire to promote the best interests of the institution.

Further, to avoid any possibility of conflict of interest, Members, Investment Consultant(s),Managers or mutual fund advisors shall immediately disclose to the Chair of the InvestmentCommittee, at the time of its discussion of the policy or of matters related to the investmentof University funds, any actual or perceived conflict of interest that could be reasonablyexpected to impair, or could be reasonably interpreted as impairing, his/her ability to renderunbiased and objective advice to fulfill his/her fiduciary responsibility to act in the best

interests of the funds.

A Member is considered to have a conflict of interest when he or she or any of his or herfamily or associates (to his or her present knowledge) either (1) has an existing or potentialfinancial or other material interest which impairs or might appear to impair the individual'sindependence and objectivity of judgment in the discharge of responsibilities to theUniversity, or (2) may receive a financial or other material benefit from knowledge of information confidential to the University.

The family of an individual includes his or her spouse, parents, siblings, children and anyother blood relative if the latter resides in the same household. An associate of an individualincludes any person, trust, organization or enterprise (of a business nature or otherwise) with

respect to which the individual or any member of his or her family (1) is a director, officer,employee, member, partner, or trustee, or (2) has a significant financial interest or any otherinterest which enables him or her to exercise control or significantly influence policy.

No Member who has or is required to make a disclosure as contemplated in this Policy shallparticipate in any discussion, decision or vote relating to any proposed investment ortransaction in respect of which he or she has made or is required to make disclosure, unlessotherwise determined permissible by the Chair of the Investment Committee.

F. INVESTMENT MONITORING

At least annually, the Investment Committee will review performance at the total Endowment,asset class, and individual Manager levels. At the total Endowment level, the InvestmentCommittee will analyze results relative to the objectives, the real rate of return and thebenchmark indices for the total Endowment. Further, investment results will be reviewedrelative to the effects of policy decisions and the impact of deviations from policy allocationsthat may require portfolio rebalancing.

On the asset class and individual Manager levels, results will be evaluated relative tobenchmarks (net of fees) assigned to Managers and selected pooled investments. Thesebenchmarks are a vital element in the evaluation of individual and aggregate Managerperformance within each asset class.

8/3/2019 UCLA IPS

http://slidepdf.com/reader/full/ucla-ips 9/13

Page 9

G. SELECTION OF INVESTMENT CONSULTING SERVICES

The Investment Committee and the Investment Management Committee mayutilize the services of consultants for due diligence, screening/evaluation of Managers, performance monitoring, asset allocation, and other services that the

Committees may deem necessary. The Investment Committee will determineappropriate criteria and experience levels based on current needs for the selectionof the Foundation Generalist Consultant to be recommended to the Board of Directors for final approval. The Investment Management Committee willdetermine and select Specialist Consultants for advisory roles for alternativeinvestment asset classes.

H. CUSTODIAL SERVICES / RISK

All assets held by any custodian on behalf of the Foundation shall be registered in the name

of The UCLA Foundation. “Street names” or “nominee names” may not be used withoutspecific written approval by an authorized officer of the Foundation.

Custodians may only lend securities within the terms and conditions of specific writtenagreements executed by an authorized officer of the Foundation.

VI. PERMISSIBLE AND NON-PERMISSIBLE ASSETS

The following types of assets are permitted in the Endowment portfolio:Equities Fixed IncomeCommon Stocks U.S. Government Treasury and Federal AgencyConvertible Securities Obligations

Preferred Stocks Mortgage-backed securities of U.S. GovernmentMoney market fundsWarrants Short-Term Investment Fund accountsRights (corporate action) Certificates of DepositRule 144a stock Bankers AcceptancesAmerican Depositary Commercial Paper

Receipts (ADRs) Repurchase AgreementsPrivate Equities Asset-Backed Securities/Collateralized Bond ObligationsMutual Funds Investment-Grade Bonds(Registered in the State of Collateralized Mortgage ObligationsCalifornia with assets in excess UCLA Mortgage Programof $100 million) International BondsExchange Traded Funds High-Yield BondsEuropean Depository Receipts (EDRs)Global Depository Receipts (GDRs)

First Trust Deeds of gift propertiesIndex Funds

Currency hedging as a defensive strategy is permitted in global and international portfolios.

Derivative securities may be used within asset portfolios provided that investments in suchinstruments do not cause the portfolio to be exposed to an asset class not otherwise expresslyapproved in this policy. Derivatives may not be used in non-alternative asset portfolios to add

8/3/2019 UCLA IPS

http://slidepdf.com/reader/full/ucla-ips 10/13

Page 10

additional risk or leverage, but may be used to control risk or establish exposures to asset classesapproved for those portfolios.

Except for Relaxed Short Constraint (130/30 or similar funds that maintain a 100% net longexposure), Absolute Return funds and other hedge fund strategy investments, the Managers will notemploy short selling as a primary strategy without the prior written approval of the Board of Directors. However, the Investment Management Committee may authorize Managers to hedge

existing risk or authorize the use of appropriate measures as a risk reduction tool.

The following types of assets or transactions are expressly prohibited without prior writtenapproval from the Board of Directors:

Equities: Fixed-Income:Short Selling

* **

Commodities* Unregistered securities, except Rule144-A Securities

Future Contracts* Tax-Exempt SecuritiesMargin Purchases* Any asset not specifically permittedPut & Call Options

*

Direct Oil & Gas Participations*

Direct Investments in Real Estate* Any asset not specifically permitted

* Asset classes with an asterisk are permitted for Alternative Investment Managers

** Relaxed Short Constraint (130/30 or similar funds that maintain a 100% net long exposure) may employ short selling

VII. SELECTION OF MANAGERS

The Investment Management Committee may select and appoint Managers or commit investmentsto limited partnerships for a specific investment style or strategy provided that the overall objectivesof the Endowment are satisfied. Managers are expected to be profitable and demonstrate provenearnings, have a minimum of $100 million in assets under management, an investment record of 5years1and strong relative performance against style-based benchmarks, and must provide aquarterly statement of assets and quarterly investment performance evaluation statements.Managers must provide annual audit statements prepared by a recognized independent audit firm.

1Historic performance may include the Manager’s experience at a former investment firm.

8/3/2019 UCLA IPS

http://slidepdf.com/reader/full/ucla-ips 11/13

Page 11

VIII. RESPONSIBILITIES OF MANAGERS

A. ADHERENCE TO STATEMENT OF INVESTMENT OBJECTIVES AND POLICYGUIDELINES

1. All Managers are expected to observe the specific limitations, guidelines, and philosophies

stated herein or in any amendments hereto, or other written instructions from an officer of the Foundation. Where commingled funds are utilized in the Endowment (including, butnot limited to partnerships, commingled trusts, and mutual funds), the InvestmentCommittee recognizes the Manager’s duty to manage the investments in the commingledvehicle consistent with the commingled funds prospectus or other operative document.

2. The Manager's acceptance of the responsibility of managing a portion of the Endowmentwill constitute a ratification of this statement, affirming its belief that it is realisticallycapable of achieving the Endowment's investment objectives within the guidelines andlimitations stated herein.

B. COMMUNICATION AND REPORTING

All consultants shall communicate on a regular basis with the committees and staff on allsignificant matters pertaining to this Investment Policy and the management of the Foundation’sportfolio.

All consultants must provide quarterly valuation reports, and quarterly and annual investmentperformance reports.

Committees and Consultants will meet at least quarterly to review this Investment Policy andthe continued feasibility of achieving the stated investment objectives and goals.

Specific areas of review shall include:

1. Asset allocation and portfolio performance;2. Evaluation of each fund/Manager’s results;3. Fund/Manager’s adherence to the investment policy guidelines; and4. Material changes in the Manager’s organization, ownership, investment philosophy and / or

personnel.

C. DISCRETIONARY AUTHORITY

Each Manager will be responsible for making all investment decisions including proxy votingfor all assets placed under its management and will be held accountable for achieving theinvestment objectives stated herein. Such "discretion" includes decisions to buy, hold and sellsecurities (including cash and equivalents) in amounts and proportions that are reflective of theManager's current investment strategy and are compatible with the Endowment's investmentguidelines.

8/3/2019 UCLA IPS

http://slidepdf.com/reader/full/ucla-ips 12/13

Page 12

Appendix I

MARKETABLE ALTERNATIVE PORTFOLIO

INVESTMENT GUIDELINES

The purpose of portfolio guidelines is to clearly define performance objectives, state the

investment approach, and to control risk. Portfolio guidelines should be subject to ongoingreview. A change in the allocation to the strategy or the Investment Committee’s risk tolerance can be among the reasons for a guideline review.

Performance Objective:

The strategic objective of the Marketable Alternative (“Hedge Fund” or “HF”) portfolio is toearn an annualized return that exceeds the annualized rate of return of the three-month USTreasury bill by 5.0%. The HF portfolio should also provide diversification benefits to theoverall portfolio by offering returns that have low correlation to the performance of other assetclasses.

Portfolio Guidelines

1. Permissible investments include funds that invest primarily in a combination of a. Long/Short strategies (including U.S., dedicated Non-U.S., short bias, and global

equities),b. Relative Value strategies (including equity market neutral, convertible bond

arbitrage, and fixed income),c. Event Driven strategies (including distressed securities, special situations, capital

structure arbitrage, relative value credit, and risk arbitrage strategies), andd. Directional strategies (including global asset allocation, CTA and global macro).

2. Target rebalance range and maximum allocation for the strategies are:Target Range MaxLong/Short Equity 20 - 40% 50%Event Driven 20 - 40% 50%Relative Value 20 - 40% 50%Directional 5 – 20% 25%

3. Direct single strategy, multi-strategy and fund-of-funds investments are permitted.

4. No investment with any single manager can represent more than 15% of the HFportfolio.

5. No investment with any single fund may exceed 20% of that fund’s total assets undermanagement.

6. Total HF portfolio forecast downside risk shall be maintained at a level of no more than7.5% of total invested HF capital based on realized and pro forma risk measuredquarterly.

7. No more than 15% of the total HF portfolio risk budget may be derived from any singlemanager.

8/3/2019 UCLA IPS

http://slidepdf.com/reader/full/ucla-ips 13/13

Page 13

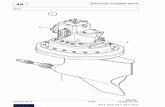

Asset Allocation Policy TableRevised May 2011

International

Developed Equity

Emerging Markets

Equity

Total Traditional

Equities

Minimum

TargetMaximum

5%

8%13%

Minimum

TargetMaximum

2%

6%10%

Minimum

TargetMaximum

15%

27%41%

U.S Equity

MinimumTarget

Maximum

8%13%18%

Real Estate – Long

Bias (Core)

Real Estate –

Hedged

Real Estate – Non-

Core Total Real Estate

MinimumTarget

Maximum

1%2%3%

MinimumTarget

Maximum

0%2%3%

MinimumTarget

Maximum

2%4%6%

MinimumTarget

Maximum

3%8%12%

Market Directional

HedgeAbsolute Return

Total Marketable

Alternative Investments

MinimumTarget

Maximum

12%16%20%

MinimumTarget

Maximum

9%11%13%

MinimumTarget

Maximum

21%27%33%

Private Equity Opportunistic

Total Non-Marketable

Alternative

Investments*

MinimumTarget

Maximum

3%10%17%

MinimumTarget

Maximum

2%5%8%

MinimumTarget

Maximum

5%15%25%

Natural Resources –

Long Bias

Natural Resources -

Hedged

Natural Resources –

Private Total Natural

Resources

MinimumTarget

Maximum

1%3%5%

MinimumTarget

Maximum

0%3%4%

MinimumTarget

Maximum

3%6%9%

MinimumTarget

Maximum

4%12%18%

High Yield Bonds

Core / Core Plus

Fixed Income Total Fixed Income

MinimumTarget

Maximum

0%0%8%

MinimumTarget

Maximum

9%11%13%

MinimumTarget

Maximum

9%11%21%

*Non-Marketable Alternative investment targets and maximums are measured at cost.