U. P. HOTELS LIMITED · 1 Revenue from Operation 141.11 2806.62 1845.11 9753.54 ... with the...

Transcript of U. P. HOTELS LIMITED · 1 Revenue from Operation 141.11 2806.62 1845.11 9753.54 ... with the...

CLARKS

GROUP OF

HOTELS

U. P. HOTELS LIMITED Registered Office & Operations Head Quarters 1101, Surya Kiran Building, 19, K. G. Marg, New Delhi - 110 001 Phone No.: 011-23722596-8, 011-41510325-6 * Fax : 011- 3312990 Email : [email protected] * Web: www.hotelclarks.com CIN: L55101DL1961PLC017307 * GSTIN: 07AADCS1783J3Z2 PAN: AADCS1783J

Clarks Shiraz, Agra * Clarks Avadh, Lucknow * Clarks Amer, Jaipur * Clarks Khajuraho, Khajuraho

Date: 11.09.2020 BSE Limited Phiroze Jeejeebhoy Towers, Dalal Street, Fort, Mumbai – 400 001 Scrip Code: 509960 Subject: Unaudited Financial Results – Quarter ended June’2020 Dear Madam/Sir, Pursuant to Regulation 30 & 33 of the Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations, 2015, the Board in its meeting held today inter alia considered, approved and taken on record the un-audited financial results for the quarter ended 30" June, 2020. Please find enclosed the copy of the unaudited financial results along with Limited Review Report for the quarter ended 30" June, 2020. The meeting of the Board was commenced at 11.15 am and concluded at 11.35 a.m. This is for your information and record. Please take the same on record. Thanking you, For U. P. Hotels Limited Prakash Prusty Company Secretary

Encl.: As above

U. P. HOTELS LIMITED

Registered Office: 1101, Surya Kiran, 19, Kasturba Gandhi Marg, New Delhi -110 001.

CIN: L55101 DL 1961PLC017307, Website: www.hotelclarks.com, email:[email protected]

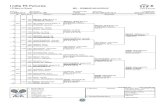

STANDALONE UNAUDITED FINANCIAL RESULTS FOR THE QUARTER ENDED 30TH JUNE, 2020

(Figures in Rs. lakh)Quarter ended Year ended

Particulars 30.06.2020 31.03.2020 30.06.2019 31.03.2020

(Un-audited) (Audited) (Un-audited) (Audited)

1 Revenue from Operation 141.11 2806.62 1845.11 9753.54

other Income 69.13 129.30 134.74 522.53

Total Revenue 210.24 2935.92 1979.85 10276.07

2 Expensesa. Cost of materials consumed 25.11 383.91 315.73 1487.57

b. Purchase of stock-in-trade -- - -

c. Changes in inventories of finished goods, work-in -progress - - - -

and stock-in-trade

d. Employees benefits expense 197.34 873.69 787.28 3259.53

e. Finance Cost 0.52 0.79 0.91 4.30

f. Depreciation and amortisation expense 169.36 82.79 183.08 699.73

g. Power & Fuel 82.35 224.72 307.29 1165.56

h. Repair & Maintenance 23.19 311.11 81.01 694.45

i. other expenses 159.69 800.84 524.99 2597.78

Total expenses 657.56 2677.85 2200.29 9908.92

3 Profit before exceptional items and tax (1-2) (447.32) 258.07 (220.44) 367.15

4 Exceptional Items -- - -

5 Profit before tax (34) (447.32) 258.07 (220.44) 367.15

6 Tax Expense -

Current Tax-

81.77 - 109.22

Tax (earlier years) -- - 0.43

Deferred Tax Liability/ (Asset) (112.58) (113.40) (61.33) (113.40)Total Tax expense (112.58) (31.63) (61.33) (3.75)

7 Net Profit for the period (5-6) (334.74) 289.71 (159.11) 370.90

8 Other Comprehensive Income

A. (i). Items that will not be reclassified to profit or loss 60.79 0.23 41.70 96.49

(ii). Income tax relating to items that will not be reclassified 15.30 0.06 11.60 24.29

to profit or loss

B. (i). Items that will be reclassified to profit or loss- - - -

(ii). Income tax relating to items that will be reclassified to

profit or loss- - - -

Total other comprehensive income (Net of Tax) 45.49 0.17 30.10 72.21

9 Total comprehensive Income for the period (7+8) (289.25) 289.88 (129.01) 443.11

10 Paid up equity share capital 540.00 540.00 540.00 540.00

(face value Rs. 10/- per share)11 Reserves excluding revaluation reserves 9,160.17

12 Earnings Per Share in Rupees- Basic (6.20) 5.36 (2.95) 6.87

- Diluted (6.20) 5.36 (2.95) 6.87

2

3

Notes:

The above results are reviewd by the Audit Committee and approved by the Board of Directors of the Company at their

meeting held on 11th September 2020. A limited review of the same has been carried out by the statutory auditors.

The company has only one business segment i.e. hotel business.

Figures of the quarter ended March 31, 2020 are the balancing figures between audited figures in respect of full financial

year and the year to date figure up to the third quarter of the relevant financial year which were subjected to Limited

Review by the Auditors.

4 The business has been severely impacted during the current quarter on account of Covid-19. As a result, all, except some

maintenance and other necessary staff at one of the hotels of the company has resigned/left. The company has settled

with such staff members. Impact of staff benefits like gratuity and leave encashment of this hotel could not be reworked

and provided during this quarter. The same will be provided in the next quarter. The management feels its impact on

above quarterly results will not be material.

5 The Company continues to monitor the impact of Covid-19 on its operations, recoverability of carrying amounts of

financial and non-financial assets, impact on revenues and costs and going concern assumption. Due care has been taken

in applying significant accounting judgments and estimates, including in relation to recoverability of receivables and

inventory, in preparing the company's financial results for the quarter ended June 30, 2020. However, as the impactassessment of Covid-19 is continuing process, the company will continue to monitor any material changes to future

economic conditions.

6 There were disputes/disagreement between the promoters during the period. The management feels that these

disputes/disagreement, do not have have material financial impact on the above financial results.

Place: New Delhi

Date: 11.09.2020

APURV KUMAR RUPAK GUPTA

JOINT MANAGING DIRECTORS & CFO

ICAISatinder Goyal & Co.

Chartered Accountants

Review Report to

The Board of Directors

U. P. Hotels Limited

Limited Review Report

506, Ambadeep Building, 14, K.G. MargNew Delhi-I IOOOI Ph.: 011-49425734

mail : [email protected]

1. We have reviewed the accompanying statement of standalone unaudited financial

results of U. P. Hotels Limited (the "Company") for the quarter ended June 30, 2020

(the "Statement"), being submitted by the Company pursuant to the requirements of

Regulation 33 of the SEBI (Listing Obligations and Disclosure Requirements)

Regulations, 2015, as amended (the "Listing Regulations").

2. This Statement, which is the responsibility of the Company's management and

approved by the Company's Board of Directors, has been prepared in accordance

with the recognition and measurement principles laid down in Indian AccountingStandard 34, (Ind AS 34) "Interim Financial Reporting" prescribed under Section

133 of the Companies Act, 2013 as amended, read with relevant rules issued

thereunder and other accounting principles generally accepted in India. Our

responsibilityis to express a conclusion on the Statement based on our review.

3. We conducted our review of the Statement in accordance with the Standard on

Review Engagements (SRE) 2410 "Review of Interim Financial Information

Performed by the Independent Auditor of the Entity" issued by the Institute of

Chartered Accountants of India. This standard requires that we plan and perform the

review to obtain moderate assurance as to whether the Statement is free of material

misstatement. A review of interim financial information consists of makinginquiries, primarily of persons responsible for financial and accounting matters, and

applying analytical and other review procedures. A review is substantially less in

scope than an audit conducted in accordance with Standards on Auditing and

consequently does not enable us to obtain assurance that we would become aware of

all significant matters that might be identified in an audit. Accordingly, we do not

express an audit opinion.

Basis for Qualified Conclusion

4. We draw attention to Note 4 to the Standalone Unaudited Financial Results, which

indicates that all, except some maintenance and other necessary staff at one of the hotels

of the company has resigned/left. The company has settled with such staff members.

Impact of staff benefits like gratuity and leave encashment of this hotel could not be

reworked and provided during this quarter. The same will be provided in the next quarter.

The management feels its impact on above quarterly results will not be material. We are

1a:·?.:::??0 Y' J!J:;:s: t:

?">! ,JJ'i

'$reefAcc0?<:-

SATIN DER

unable to comment on the impact of the above non-provision on these Standalone

Unaudited Financial Results.

Qualified Conclusion

5. Based on our review conducted as above, except for the matters described in the

'Basis for Qualified Conclusion' section above, nothing has come to our attention

that causes us to believe that the accompanying Statement, prepared in accordance

with the recognition and measurement principles laid down in the aforesaid Indian

Accounting Standards ("Ind AS") specified under Section 133 of the CompaniesAct, 2013 as amended, read with relevant rules issued thereunder and other

accounting principles generally accepted in India, has not disclosed the information

required to be disclosed in terms of the Listing Regulations, including the manner in

which it is to be disclosed, or that it contains any material misstatement.

6. Attention is drawn lo the fact that the figures for the quarter ended March 31, 2020

as reported in these financial results are the balancing figures between audited

figures in respect of the full financial year and the published year to date figures up

to the third quarter of the previous financial year, which were subject to limited

review by us.

For Satinder Goyal & Co.

Chartered Accountants

Firm's Regn. No: 027334N

Digitallysigned bySATINDER KUMAR GOYAL

KUMAR GOYAL ??????.020.091111:3911

Date : 11111September 2020

Place : New Delhi

CA S.K Goyal(Partner)Membership No. : 084613

UDIN:20084613AAAAAS1202

SATINDER KUMAR GOYAL

Digitally signed by SATINDER KUMAR GOYAL Date: 2020.09.11 11:39:11 +05'30'