Tugas FM FuzzyTronic

-

Upload

anggit-tut-pinilih -

Category

Documents

-

view

502 -

download

3

Transcript of Tugas FM FuzzyTronic

[ ] August 2, 2010

I. CASE BACKGROUND

The Fuzztronic’s CFO has a real problem that he has to revise their firm’s four year financial

forecast. Fuzztronic has stood on the verge of becoming a major supplier of automotive

transmission software to virtually all the major automobile manufacturers. Fuzzytronic was

founded in 1990 by Wong Xau, with a dream of fuzzy logic, a new branch of mathematics that

promised to make elevator run faster, furnaces modulate air temperature more accurately and

automobile transmissions shift more smoothly.

In 1992, he collaborated with David Myers, his colleague, to comply the business with Myers’s

business expertise and professional skills in American Business Practices and international

marketing. Also in 1992, Fuzzy Tronic went IPO, supervised by Myers.

At 1992 – 1996, Firms achieved one success after another, selling fuzzy logic primarily to

Japanese and Hong Kong manufacturing firms. Fuzzy logic was tougher to be sold in American

firms because despite the odd name, fuzzy logic also used crisp and detailed math statements to

deal with approximations, concept such as many, most, few, and slightly. Both managers cursed

the phase of fuzzy because in American firms it tends to create negative connotations than a

continuous logic. But in Asia, it was accepted and respected.

In 1996, there is a threat upon the product from the Japanese. Fuzzytronic had a chance to

innovate and grow within their software control mechanism that would shift automobile

transmissions. But to the CFO, it was a big question, whether the company’s financial forecast that

he would prepare would allow the investment of US $ 175,000 necessary to fund the transmission

software project in 1997.

Myers knew that FT current financial forecast called for a healthy jump in dividend payments,

and also the firm’s stockholder expected this dividend increase. In 1992 – 1995, FT paid no

dividends. The earnings are reinvested to research needs and sales expansion. In 1995, Myers

work hard in 1995 to realign the firm’s capital structure in anticipation of its first dividend

payment in 1996. Myers uses the firm’s healthy 1995 profit to trim long-term debt and boost FT

capital base so that when the firm initiated dividend payment in 1996 the firms was operating

with an optimal capital structure. The firm optimal capital structure involved a very little debt

because of the substantial operating risks facing the firms. Myers know that the cost of equity was

14% which is high as well as future dividend burden imposed by the firm’s stockholder. The public

shareholder was known as patience shareholder because they know that it took several years for a

new company to pay dividend. But it has limit, in 1996 the shareholder expected the 0.90 dividend

1 Dividend Policy and Corporate Capital Structure|

[ ] August 2, 2010

payment and healthy divided boost in 1998 – 1999. In its projected sales revenue for 1997 – 2000

it shows that the firm has conservative growth, maintained the firm’s cap structure, and significant

dividend boost. Myers is afraid that the transmission project would upset the delicate balance. He

suspicious that the engineers may have understated the projects true cost and overestimated the

sale potential to win his support. But in the other side, FuzzyTronic really needs the new project.

According to Myers the sales and earnings growth only 5% while the programmers 16% without

increasing its operating risk. Myers knew that other pending capital projects outlined weren’t

nearly as promising as the transmission software project.

II. MAIN ISSUE

a. How to maintain the optimal capital budget when the company decides to

include the transmission project?

b. How to determine dividend forecast?

c. How to finance both in order to stay in line with the optimal capital structure

and to maximize the value of the firm?

2 Dividend Policy and Corporate Capital Structure|

[ ] August 2, 2010

III. QUESTIONS & ANSWERS

1. Based on information on text, in 1996 FuzzyTronic already operated with optimal capital structure.

Thus, we will point to 1996 for optimal capital structure.

Long term debt $ 55,000 5.21%

Common equity $ 1,000,000 94.79%

Total $ 1,055,000 100%

Short term debt didn’t use in calculation because doesn’t come from investor, it is more about

operating relationship within employee and supplier. Fund from retained earnings used for

investment from equity (no new share issued)

Based on the calculation above, it showed that the current capital structure is 5.21% for long term

debt, and 94.79% for common equity. Thus, the firm’s current weighted average cost of capital

(WACC) is:

WACC = wd rd (1-T) + wce rs = (5.21% * 7%) + (94.79% * 14%) = 0.3647% + 13.2706% = 13.64%

2. The total dividend expense that Fuzzy Tronic will face in 1997, 1998, 1999, and 2000 based on the

data available are:

Table 1 Dividend Expense

1996 1997 1998 1999 2000

Share outstanding 150.000,00 150.000,00 150.000,00 150.000,00 150.000,00

Dividend per share $ 0,90 $ 1,00 $ 1,25 $ 1,50 $ 1,57

Total dividend expense $ 135.000,00 $ 150.000,00 $ 187.500,00 $ 225.000,00 $ 235.500,00

3. If the firm want to mantain its optimal capital structure over the 1997-2000 period, then most of

the project will be financed by equity. - it should be cash. Thus in the data we knew that the cash

is always exceed the expense so from this assumption we may say that the company can pay

dividends as its projected.

Table 2 Dividend Expense, Retained Earnings, and Net Income

1996 1997 1998 1999 2000

Net income $ 189.000,00 $ 201.000,00 $ 213.000,00 $ 222.000,00 $ 238.000,00

Retained earnings $ 578.000,00 $ 629.000,00 $ 654.000,00 $ 651.000,00 $ 653.000,00

Total dividend expense $ 135.000,00 $ 150.000,00 $ 187.500,00 $ 225.000,00 * $ 235.500,00

We need additional equity can be a form of cash or stock

3 Dividend Policy and Corporate Capital Structure|

[ ] August 2, 2010

From the Table above, we can see the dividend expense is almost 80% of net income. Thus, firm

migh consider to use its retained earnings to pay dividend. By doing so, it will be possible to give

shareholders the projected dividend payment as above. But in long term, this policy will harm the

company because it will burden their opportunity in investing the project, because fund for

investment will be most absorbed to pay dividend.

4. The dividend payment will need cash to expense. By comparing the total dividend expense and the

firm cash, the firm seems can pay the dividend expense. However, it is not appropriate to use this

method, because cash will be used to pay operating activities as well. Comapny should projected

the FCF therefore information in Table 1 is needed.

Table 3 Dividend Expense and FCF

1996 1997 1998 1999 2000

Non operating profit $ 287,00 $ 300,00 $ 317,00 $ 332,00 $ 360,00

Taxes (40%) $ 114,80 $ 120,00 $ 126,80 $ 132,80 $ 144,00

NOPAT $ 172,20 $ 180,00 $ 190,20 $ 199,20 $ 216,00

Total current asset $ 921,00 $ 963,00 $ 1.007,00 $ 1.062,00 $ 1.115,00

Total current liabilities $ 66,00 $ 72,00 $ 104,00 $ 163,00 $ 227,00

Net Fixed Asset $ 100,00 $ 140,00 $ 147,00 $ 170,00 $ 180,00

Total net operating

capital

$ 955,00 $ 1.031,00 $ 1.050,00 $ 1.069,00 $ 1.068,00

Net investment in

operating capital

$ 76,00 $ 19,00 $ 19,00 $ (1,00)

FCF $ 104,00 $ 171,20 $ 180,20 $ 217,00

Total dividend expense $ 135,00 $ 150,00 $ 187,50 $ 225,00 $ 235,50

assuming current asset-other represents short term investment and current liabilities-other represents note payables

Based on the Table above, company will face diffculties paying the projected dividend expense

because it is higher than the FCF.

5. The optimal capital budget should maximize the firm value. Because of limitation in information,

we will choose the project who will maximiza the firm value based on project rate of return, in this

case, the return should higher than the WACC which is 13% except for acquisition of material

supplier which has 15% return. Thus, for Fuzzy Tronic in 1997, the profittable project will be:

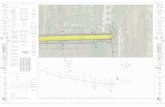

- Automotive transmission software project $175,000 ( Table 3 )

- New marketing plan $ 100,000

4 Dividend Policy and Corporate Capital Structure|

[ ] August 2, 2010

$275,000

6. The market value of firm’s common stock is:

D2000=D1999(1+g) 1.57 = 1.5 (1+g) g = 4.67%

D1999=D1998(1+g) 1.5 = 1.25 (1+g) g = 20%

D1998=D1997(1+g) 1.25 = 1 (1+g) g = 25%

To calculate dividend for 2001, we have to use assumption as showed in above calculation, the

dividend growth is not constant. So, we’re taking close value to 2000 dividend which is 5%.

D2001=D2000(1+g) = 1.57 (1+5%) = 1.65

P2000 = D2001

(r s−g) =

1.65(14%−5%)

= $ 18.33

P0 = D1¿¿

= $ 18.8

Book value per share = $1,000,000/150,000 = $ 6.67

Market to book ratio = Market value per share / Book value per share =

= $ 18.8 / $ 6.67 = 2.82x

Price earning ratio = Price per share / EPS = Price per share / (NI/share outstanding)

= $ 18.8 / ($ 189,000 / 150,000) = 14.92x

As the market price is higher than book value, market see positively to FuzzyTronic prospect. In the

industry typical M/B ratio is 1.7x and P/E ratio is 12.5x. FuzzyTronic still have higher ratio compare

to industry so market still look the company positively.

7. If David Myers uses the residual dividend model, thus the company should use about 94.79% *

$175,000 = $165,883 from net income to fund the transmission software project. Thus, the

dividend available to shareholders will be $201,000 - $165,883 = $35,117.

(a) Thus, the dividend available for each share will be $23,117 / 150,000 = $0.23.

(b) This means, the dividend will be lower than 1996 dividend, which shareholders might see as

negative signal that company might out of cash or start having trouble in paying dividend, thus

stock price more likely will decline.

8. Fuzzy Tronic wants to mantain its dividend because they want to avoid the negative signals to the

shareholders. As inform in the text shareholders was concern to has increase in dividend. In

Question 7, the net income used in calculation was not consider the 16% increase in sales if they

5 Dividend Policy and Corporate Capital Structure|

[ ] August 2, 2010

took the project. This number should be changed before we really calculate the dividend using

residual model. The firm stock price will depend on this new dividend calculation, increase in

dividend will increase stock price due to positive signalling.

9. Important detail needed: affect from the project to firm net income including sales and expense,

and how you’re going to finance the project.

Cash 1997 = % from sales – (we * $ cost of investment) – Dividend expense 1997

Cash 1998 – 2000 = % from sales – Dividend expense

Other assets 1997 – 2000 = % from sales + $ cost of investment

Long term debt 1997 – 2000 = Debt 1996 + (wd * $ cost of investment)

If forecasted total asset is not balanced with forecased total liabilities and equity, thus AFN is

needed. If AFN is positive means additional fund is needed, thus Current liabilities-other will

increase as much as the AFN. If negative, the current assets-other will increase as much as AFN.

Retained earnings 1997-2000 = Previous retained earnings + NI – Dividend Expense

Sales 1997-1999 = increase 16% from previous year

Sales 2000 = increase 5% from previous year

Depreciation expense = % depreciation in 1996 * Revised net fixed asset

Interest expense = % interest rate in 1996 * revised long term debt

Non operating revenue = as per projected

10. If we compare Table 2 with our pro forma balance sheet, the difference only come in amount of

liabilities, asset, and equity. Meanwhile the capital structure remain same in those two balance

sheet. This is because we keep mantain the capital structure in the optimal.

Table 4 Capital structure calculation (in thousands)

Before 1996 1997 1998 1999 2000

Total long term

debt

$ 55,00 5,21% $ 55,00 4,97% $ 55,00 4,86% $ 55,00 4,88% $ 55,00 4,87%

Total equity $ 1.000,00 94,79% $ 1.051,00 95,03% $ 1.076,00 95,14% $ 1.073,00 95,12% $ 1.075,00 95,13%

$ 1.055,00 100% $ 1.106,00 100% $ 1.131,00 100% $ 1.128,00 100% $ 1.130,00 100%

WACC 13,64% 13,65% 13,66% 13,66% 13,66%

Revised 1996 1997 1998 1999 2000

Total long term

debt

$ 55,00 5,21% $ 64,12 5,66% $ 64,12 5,37% $ 64,12 5,10% $ 64,12 4,86%

Total equity $ 1.000,00 94,79% $ 1.068,39 94,34% $ 1.130,74 94,63% $ 1.192,08 94,90% $ 1.256,16 95,14%

$ 1.055,00 100% $ 1.132,51 100% $ 1.194,86 100% $ 1.256,20 100% $ 1.320,28 100%

WACC 13,64% 13,60% 13,62% 13,64% 13,66%

6 Dividend Policy and Corporate Capital Structure|

[ ] August 2, 2010

11. FuzzyTronic should accept the project because it increases the NI, ROE, TIE, and the return is

higher than cost of capital.

Dividend available = ($218,39 - $175)/150 = $0.29

Thus, the drawback of accepting this project is the dividend paid will be lower because the fund

from net income will be used to pay the project. The benefit is the increase in ROE will neutralize

the negative signal because of dividend cut.

IV. CONCLUSION AND RECOMMENDATION

Company should mantain its dividend paid to avoid negative signalling. Thus, company should

projected since the beginning their capabalities in paying dividend. Based on residual theory, you

should projected the payout ratio after deducted the investment fund needed. The capabilities of

company paying the dividend also determined from their FCF.

If you mantain the corporate capital structure, the WACC will be stable, thus your company risk

will be stable which is good for shareholders.

Myers is suggested to accept the software project because eventhough company can not pay

dividend in full, but they have increase in ROE, TIE, and net income which give good signal to

shareholders that company is growing. One alternative is to distribute smaller amount dividend and

stock repurchases which will keep the good signal toward the stockholder and therefore the value of

the firm would still high.

7 Dividend Policy and Corporate Capital Structure|