TTHIS ISHIS IS BBALTIALTI MMOREORE · 2016-07-16 · “debt” portfolio in 2011 17TH FLOOR –...

Transcript of TTHIS ISHIS IS BBALTIALTI MMOREORE · 2016-07-16 · “debt” portfolio in 2011 17TH FLOOR –...

BALTIBALTIMOREMORE

THIS ISTHIS IS

BALTIMOREBALTIMOREWE KNOWWE KNOW

DELOITTEDELOITTEWE KNOWWE KNOW

BALTIMORE

DELOITTE

540,000 SF540,000 SFof Deloitte transactions in the region

1.9 Million SF1.9 Million SFof transactions in the region in 2013

SingleSinglepoint of contact since 2008

BasedBasedin the Baltimore-Washington

marketplace

OFFICE TRENDS

10-YEAR TREND FIRST QUARTER 2014

VACANCY

13.1%Vacancy rate up

ABSORPTION

(487,000) SFMove-outs hamper gains

RENTAL RATE

$20.27 PSFSlight increase

OFFICE NET ABSORPTION AND VACANCY

SOURCE CoStar, Transwestern; March 2014.

4%

6%

8%

10%

12%

14%

16%

-0.8

-0.6

-0.4

-0.2

0.0

0.2

0.4

0.6

05 06 07 08 09 10 11 12 13 14*

NET ABSORPTION IN MILLIONS DIRECT VACANCY RATE

*At fi rst quarter 2014

BALTIMORE MARKET INFORMATIONQ1 2014

MARKET RENTS

CLIENT LOCATION

DRIVE TIMES

TALENT

LOCALSTAKEHOLDER

INPUT

MARKET INTELLIGENCE

COMPETITOR LOCATION

LANDLORD MEETINGS

EMINENCE

LEASE REVIEW

SPACE USAGE

RECOMMENDATIONS

SITE SELECTIONSCORECARD

QUALITATIVE &QUANTITATIVE

ANALYSIS

REFINED LOCATIONOPPORTUNITIES

PRELIMINARY LOCATION

OPPORTUNITIES

BASE CASE SCENARIO(DOWNSIZE & RENEW)LANDLORD EXPECTATIONS

PROJECT INITIATION/DATA COLLECTION

APPROACH & METHODOLOGY OF TRANSACTION

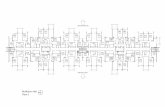

100 S. CHARLES STREET

Cornerstone purchased in “debt” portfolio in 2011

17TH FLOOR – 8,130 SFAVAILABLE

ELLIN & TUCKER(MOVING 10/1/14)

19,180 SF (DIVISIBLE)AVAILABLE

DELOITTE

Ellin&Tucker vacating 10.1.2014

Infrastructure renovations ongoing

Vintage 1980

Solid B+ Building

Excellent location, 2 blocks

from waterfront

Considerable turnoverin fi rst fl oor

retail tenancy

Nondescript curb appeal

Retail component shared with Tower II

Historically very low vacancy

PROPOSED EXPANSIONAREA

1,800 SF 10,883 SFCOMBINED

Exterior Entrance

PROPOSED RESTAURANT(NEW CONSTRUCTION)

1 E. Pratt St.

100 E. Pratt St. 500 E. Pratt St.

CBD OPTIONS

111 S. CALVERT ST.Strengths:• Location/Image• Amenity base • Hotel attached

Challenges:• Floor plate design

401 E. PRATT ST.Strengths:• On Waterfront• Views• Proximity to Amenities

Challenges:• No on-site parking• Pentagon shape• State tenancy

1

2

12

4

5

6

7

8

400 E. Pratt St.

100 S. Charles St.

RELOCATION ALTERNATIVES

12

100 International Drive621 E. Pratt St.

SOUTH EAST OPTIONS

650 S EXETER ST.Strengths:• Live/Work/Play• Effi cient Floor plate

Challenges:• Emerging Location• Ingress/egress

1001 FLEET ST.Strengths:• Live/Work/Play• 1 block to waterfront

Challenges:• Emerging Location• Ineffi cient fl oor plate

100 INTERNATIONAL DR.Strengths:• Premiere Offi ce Tower• Views

Challenges:• Cost• Floor plate jogs

1300 THAMES ST.Strengths:• Newest construction• Full height glass

Challenges:• Pioneering location• 1st fl oor availability

111 MARKET PL.Strengths:• Location• Views

Challenges:• Class B+• Floor plate size

100 LIGHT ST.Strengths:• Completely renovated• Location/views

Challenges:• Curb appeal• Limited building amenities

1 SOUTH ST.Strengths:• Iconic Market Image• Value rental

Challenges:• Punch Windows• Neighborhood

500 E. PRATT ST.Strengths:• Location • Penthouse Opportunity

Challenges:• Local Competitor • Retail component

7 ST. PAUL ST.Strengths:• Atop Metro stop• Market Image

Challenges:• Distance from waterfront • Floor-plate design

323-351 W. CAMDEN ST.Strengths:• Signage Opportunity• Signature Identity

Challenges:• Location• Window-line

3

4

5

6

7 9

10

11

12

10

9

11

3

8

CBD OPTIONS

1

2

3

4

111 S. CALVERT ST.Stories: 28Total Building: 544,453 SFAvailable:15th Floor: 8,639 SF23rd Floor: 8,293Parking: 0.67/1,000 SFLL Rep: Cushman & Wakefi eld

401 E. PRATT ST.Stories: 30Total Building: 296,139 SFAvailable:4th Floor: 5,000 – 11,300 SF8th Floor: 5,000 – 11,300 SF18th Floor: 5,000 – 11,300 SF23rd Floor: 8,140 SF28th Floor: 11,300 SFParking: No on-siteLL Rep: MD Port Authority

111 MARKET PL.Stories: 12Total Building: 559,996 SFAvailable:10th Floor: 13,000 SFParking: 20 free Surface Spaces are availableLL Rep: JLL

100 LIGHT ST.Stories: 35Total Building: 686,947 SFAvailable:25th Floor: 4,000 – 15,614 SF26th Floor: 4,000 – 15,614 SFParking: 0.50/1,000 SFLL Rep: JLL

1

2

3

4

5

6

71 SOUTH ST.Stories: 30Total Building: 478,968 SFAvailable:12th Floor: 3,000 – 20,917 SF18th Floor: 11,905 SFParking: 1/1,000 SFLL Rep: JLL

500 E. PRATT ST.Stories: 13Total Building: 279,716 SFAvailable:E PENT: 10,605 SFParking: 3.20/1,000 SFLL Rep: Cushman & Wakefi eld

7 ST. PAUL ST.Stories: 24Total Building: 377,181 SFAvailable:7th Floor: 2,000 – 20,237 SF8th Floor: 2,000 – 13,127 SF12th Floor: 9,859 SF15th Floor: 19,656 SFParking: 209 Covered Spaces are availableLL Rep: Cassidy Turley

5

6

7

SOUTH EAST OPTIONS

650 S EXETER ST.Stories: 12Total Building: 243,540 SFAvailable:10th Floor: 10,290 SFParking: 3/1,000 SFLL Rep: Cassidy Turley

1001 FLEET ST.Stories: 9Total Building: 213,000 SFAvailable:7th Floor: 9,500 – 28,735 SFParking: 1/1,000 SFLL Rep: Cassidy Turley

100 INTERNATIONAL DR.Stories: 24Total Building: 623,000 SFAvailable: 15th Floor: 26,842 SF16th Floor: 27,594 SF17th Floor: 11,500 – 26,129 SF18th Floor: 11,500 – 24,665 SF21st Floor: 8,090 SF24th Floor: 11,587 SFParking: 1/1,000 SFLL Rep: Cassidy Turley

1300 THAMES ST.Stories: 7Total Building: 260,000 SFAvailable:1st Floor: 34,111 SFParking: 3/1,000 SFLL Rep: CBRE

9

10

11

12

9

10

12

11

“WILD CARD” OPTION - THE WAREHOUSE

• Owned by Maryland Stadium Authority

• 10,000 SF available

• Limited glass line but loaded with personality

• 1st building off I-95 exit

• “Signage opportunity”

• Average of 30,000 spectators per game

8

TRANSWESTERN & DELOITTE

A TRUE SERVICE PARTNERSHIP

Presented To:

JOHN CONNOLLY JOVI MCANDREW TOM GENTNERSenior Vice President Senior Vice President301.896.9122 [email protected] [email protected]

Presented By: