Third Quarter 2018 NCREIF Indices Revie...•NPI return down slightly for quarter •Volatility of...

Transcript of Third Quarter 2018 NCREIF Indices Revie...•NPI return down slightly for quarter •Volatility of...

Third Quarter 2018NCREIF Indices Review

November 14, 2018

Panelist Overview

Jeff Fisher

NCREIF Data, Research & Education Consultant

William Maher

Head of Americas Research & Strategy

LaSalle Investment Management

Special thanks to Kevin Scherer, NCREIF Consultant for Slides from NCREIF Analytics

Disclaimer

Today we will be presenting what we see in the NCREIF data, trends and changes; all comments about future expectations are the personal views of the speakers (and could be wrong!) and not a reflection of a NCREIF opinion or forecast.

Overview

• NPI return down slightly for quarter

• Volatility of total returns continue at a historic low

• Cap rates at all time (for NPI) low

• Occupancy highest since before 2001 tech bust

• Industrial still the leader of the Pac; retail struggling to keep up

• Strong Industrial NOI growth; others small to negative

4

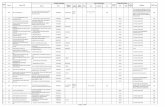

NCREIF OverviewThird Quarter 2018 Index Composition

5

NCREIF Property Index

(NPI)

NPI Leveraged Property Index

NFI-ODCE (Fund Index – Gross of

Fees)

Farmland Properties

Timberland Properties

Leverage Unlevered 42% 22% Unlevered Unlevered

Quarterly Return

1.7% 1.9% 2.1% 1.3% 1.0%

1 Year Return

7.1% 8.3% 8.7% 6.9% 4.0%

2.1% 1.7% 1.9%1.3% 1.0%

0.5%

7.7%8.7%

7.1%8.3%

6.8%

4.0% 4.3%

17.9%

5.6%6.5%

7.0%

11.6%

4.0%

7.8%

12.0%

0%

2%

4%

6%

8%

10%

12%

14%

16%

18%

20%

NFI-ODCE NPI NPI Levered Farmland Timberland NAREIT S&P 500

Tota

l Ret

urn

9/30/2018 1-Yr 10-Yr Avg

Total Returns by Asset Class

Chart: E-001-1811

Question

• What will be the best performing asset class in 2019?• A. NCREIF Leveraged Returns

• B. Farmland

• C. S&P 500 Stocks

• D. Corporate Bonds

• E. NAREIT Index

7

-12%

-10%

-8%

-6%

-4%

-2%

0%

2%

4%

6%

8%

1983 1987 1991 1995 1999 2003 2007 2011 2015

Income Return Appreciation Return Total Return

NPI Returns

Quarterly

Chart: C-261-1810

Recession due to over building

Great recession due to financial crisis

Calm before the next storm?

Tech bust and 9-11

12Note: The Market Value Index (MVI) is an equal-weighted index and excludes expansion capital expenditures.

Prices Still Rising

• SPREAD BELOW LONG-TERM AVERAGE

Real Estate Spread to Corporate Bonds

• Source: NCREIF, LaSalle Investment Management, Moody’s Economy.comBaa Yields as of 7 Novemberr 2018, NCREIF data through 3Q 2018.

• Note: Past performance is not indicative of future results. There is no guarantee that any trends shown herein will continue.

NPI Income Yield Spread to Baa Corporate Bonds

15 Year Average Spread= 31 bps

-300

-250

-200

-150

-100

-50

0

50

100

150

200

3%

4%

5%

6%

7%

8%

9%

10%

1997 1999 2001 2003 2005 2007 2009 2011 2013 2015 2017

Sp

read

(b

ps)

Yie

ld

Spread NPI Income Yield Baa Corp. Yield

Q3 Est Spread-58 bps

15 Year Average Spread = 1 bps

• CPPI UP 7.2% Y/Y IN SEPTEMBER

Moody’s/RCA Price Index Continues to Increase

Y/Y Change in Moody’s / RCA Commercial Property Price Index

-25%

-20%

-15%

-10%

-5%

0%

5%

10%

15%

Ju

n-0

8

Jun

-09

Ju

n-1

0

Ju

n-1

1

Ju

n-1

2

Ju

n-1

3

Ju

n-1

4

Ju

n-1

5

Ju

n-1

6

Ju

n-1

7

Ju

n-1

8

% C

han

ge Y

ear-

over-

Year

• Source: Moody’s/RCA Commercial Property Price Index (CPPI).Data to September 2018

• Note: Past performance is not indicative of future results. There is no guarantee that any trends shown herein will continue.

YOY Increase as of 9/18

All Property 7.2%

Apartment 10.7%

Retail 1.8%

Industrial 6.2%

Office 7.9%

Question

• When will the Market Value Index (MVI) peak for this cycle?• A. Peaked this quarter

• B. Next quarter

• C. 2019

• D. 2020 or later

16

Current Quarter Basis Point Total Return Impact by Metro

Apartment Industrial

Office Retail

21

Question

• What will be the best performing property sector in 2019?• A. Apartment

• B. Hotel

• C. Industrial

• D. Office

• E. Retail

22

NPI Income Returns Vs. History (as of 3Q 2018)

• Source: NCREIF, LaSalle Investment Management.

• As of 3Q 2018.

• Note: Past performance is not indicative of future results. There is no guarantee that any trends shown herein will continue.

Value Weighted

NPI Trailing Four-

Quarter Income

Return

15-Year

Income ReturnDifference

Apartment 4.3% 5.1% -0.8%

Hotels 8.2% 7.5% 0.7%

Industrial 4.9% 6.3% -1.4%

Office 4.5% 5.7% -1.2%

CBD 4.2% 5.3% -1.1%

Suburban 5.0% 6.2% -1.2%

Retail 4.6% 6.1% -1.5%

Open Air 4.9% 6.3% -1.4%

Malls 4.4% 5.9% -1.5%

All Property 4.6% 5.8% -1.2%

• RETAIL YIELDS FURTHEST FROM LONG TERM AVERAGE

Question

• What will cap rates be for the nation by the end of 2019?• A. Below 4%

• B. 4% to 5%

• C. 5% to 6%

• D. Above 6%

35

Question

• Which property type will have the highest NOI growth in 2019?• A. Apartment

• B. Industrial

• C. Office

• D. Retail

44

Needs updated

• MAJOR PROPERTY TYPE REITS TRADE AT DISCOUNT

Niche REIT Sectors Continue to Outperform Core Types

• Current Premium/ Discount to Gross Asset Value by Sector

19.1%

10.3%

4.3%

-0.6% -0.7% -1.8% -2.1% -3.7%-8.2% -8.3% -9.6%-10.4%

-12.8%-14.2%-20%-15%-10%

-5%0%5%

10%15%20%25%

Ne

t Le

ase

Man

uf.

Ho

me

s

He

alth

Car

e

Ind

ust

rial

Lab

Sp

ace

Dat

a C

ente

r

Self

Sto

rage

All

REI

Ts

Ho

tel

Stri

p C

en

ter

Ap

artm

ent

Mal

l

Stu

de

nt

Ho

usi

ng

Off

icePre

miu

m/D

isco

un

t to

GA

V20Y All REIT Average:

+1.0%

• Source: Green Street Advisors. Pricing as of November 1, 2018.

• Note: Past performance is not indicative of future results. There is no guarantee that any trends shown herein will continue.

Question

• What will the annual NPI total return be for 2019? (Current rolling annual return 7.1%)• A. Below 5%

• B. 5%-to-7%

• C. 7%-to-9%

• D. Above 9%

55

Summary

• National returns below average and holding steady

• But continued disparity of returns across property sectors

• Cap rate drop slightly to all time low

• NOI growth good for industrial; weak to negative for all others

• Overall occupancy driven by industrial to highest since before tech bust

56

Upcoming NCREIF Events

NCREIF Winter Conference 2019Arizona BiltmoreMarch 18 – 20

NCREIF Certificate Education ProgramSMU - DallasSummer, 2019

Visit www.ncreif.org for more information

57