The Third Party Logistics Market in China: Opportunities ... · 3% 010 20 30 40% Reduce logistics...

Transcript of The Third Party Logistics Market in China: Opportunities ... · 3% 010 20 30 40% Reduce logistics...

The Third Party Logistics Market in China:Opportunities and Challenges

Mark Kadar, Vice PresidentDiana Huang, Principal

September 30, 2002

CLM 2002 ConferenceSan Francisco, September 30, 2002 and October 2, 2002

Contents

� Mercer Management Consulting Introduction

� Key findings from Mercer’s China 3PL Survey– Market overview– Customer requirements– 3PL provider tactics– Future trends

2

Mercer Management Consulting © 2002 3

Marsh & McLennan Companies

Marsh Inc. MercerConsulting Group Putnam Investments

Mercer DeltaOrganizational

Consulting

MercerManagementConsulting

MercerHuman Resource

Consulting

National EconomicResearch

Associates(NERA)

Lippincott& Margulies

Risk and insurance services

Organizationalarchitecture andchange

Investment management

Microeconomicconsulting

Identity and imagemanagement

Human capital consulting

Mercer Management ConsultingMercer Management Consulting is part of Marsh & McLennan Companies (MMC), a $10billion professional services firm.

Mercer Management Consulting © 2002 4

• Professionals of more than 1,400

• 22 offices in North America, Europe, Asia and Latin America

• Eight practice groups– Travel & Transportation– Communication, Information, Entertainment– Financial Institutions and Risk Management– Retailing, Consumer Goods, Healthcare– Process Flow Manufacturing– Discrete Manufacturing– Private Equity Institutions– MercerDigital

• Three capability groups– Supply Chain (logistics)– Value Growth and Implementation– Customer Strategy Team

• Leading edge thinking on Value Migration and Value-driven BusinessDesign

Mercer Management ConsultingMercer Management Consulting is a leading international strategy and generalmanagement consulting firm with deep industry and functional expertise.

Contents

� Mercer Management Consulting Introduction

� Key findings from Mercer’s China 3PL Survey– Market overview– Customer requirements– 3PL provider tactics– Future trends

5

Mercer Management Consulting © 2002 6

3PL Provider Interview List

Foreign logisticscompanies

� 8 companies

Traditionaltransportationcompanies� 6 companies

Emerging logisticscompanies

� 5 companies

Internal logisticsdepartments

� 3 companies

Shipper Interview List

IT & telecom

5 MNCs 3 Chinese

Consumer electronics

4 MNCs 4 Chinese

Automotive

5 MNCs 1 Chinese

Chemicals

2 MNCs 4 Chinese

Food & beverage

3 MNCs 3 Chinese

Apparel & textile

3 MNCs 3 Chinese

FMCG

3 MNCs 1 Chinese

Pharmaceutical

4 MNCs 0 Chinese

3PL Survey in ChinaFor our survey we interviewed about 20 major 3PL providers. Our shipper interviewsfocused on eight sectors with high potential for outsourcing. All the provider interviews wereface-to-face, the shipper interviews were both face-to-face and by telephone.

Mercer Management Consulting © 2002 7

Key findings (Overall market)

� The 3PL market in China is large, fast growing, in its early stage of development, andconcentrated in geography

– The China market for outsourced logistics was estimated to be just under RMB 40billion (US$4.8 billion) in 2001

– A large majority of the logistics providers we surveyed reported annual growth ratesin excess of 30% over the last three years

– 85% of providers’ revenue comes from basic services such as transportationmanagement and warehousing; nearly 70% of providers believe clients are notready for outsourcing, while almost half of the shippers surveyed cite obstacles foroutsourcing, especially 3PL service quality

– The market is very fragmented: No 3PL provider interviewed has a market shareover 2%. About 80% of providers’ revenues come from the Yangtse River and PearlRiver Delta regions

� The demands of multinational versus Chinese shippers are very different, suggestingtwo distinct market development paths

� Many providers are seeking partners to compliment their capabilities and meet thegrowing challenges

� Government initiatives are also stimulating the 3PL market in China

Mercer Management Consulting © 2002 8

Source: SG Securities Research

Forecast China domestic transportationand logistics expenditures

RMB

billions

1,9032,062

1,770

2,260

0

500

1,000

1,500

2,000

2,500

3,000

2000E 2001E 2002F 2003F

CAGR: 8%

Forecast China outsourced logisticsmarket size

39

48

31

61

0

20

40

60

80

2000E 2001E 2002F 2003F

CAGR: 25%RMB

billions

Overall market opportunityChina has a large and rapidly growing market for transportation and logistics. Theoutsourced transportation and logistics market is also big at RMB 40 billion (US$ 4.8 billion)in 2001, its growth is expected to be around 25% CAGR, faster than that of the US market.

Mercer Management Consulting © 2002 9

Breakdown of revenues1

Note: 1Straight average of all responses (not weighted by size of each 3PL provider)Source: Mercer China 3PL Survey, 2002

53%

32%

15%

0

10

20

30

40

50

60

70

80

90

100%

Transportationmanagement

Warehousemanagement

Logistics IS and VAS

% o

f rev

enue

s1

24%

41%

35%

0

10

20

30

40

50%

<30% 30%-50% >50%

% o

f res

pond

ents

Annual growth rate of 3PL providers(1999-2001)

China 3PL market featuresThe supply side of 3PL in China is growing fast, with over 70% of companies surveyedreporting over 30% growth. However, 85% of revenue still comes from basic services.

Mercer Management Consulting © 2002 10

79%

93%

76%

47%

79%

37%

0

20

40

60

80

100%

Administrative costs Transportationand warehousing

costs

Inventory costs

MNCs Chinese

% o

f res

pond

ents

Costs tracked by shippers

Source: Mercer China 3PL Survey, 2002

China 3PL market featuresLogistics costs are not well tracked, especially by Chinese shippers. Only about 30% ofshippers (all multinational corporations) calculate total logistics costs.

Mercer Management Consulting © 2002 11

Clients are ready

“Clients are ready for outsourcing,especially MNCs. They are trying tooutsource as much as possible.”

“ In China the customers still needsome education on logistics, butChinese companies will accept thisidea much faster in comparison withother countries’ customers, becausethey can learn from other experiencesand they have more external pressureto improve current products andservices to survive.”

“Domestic manufacturers willoutsource more and need moresophisticated services.”

“Customers in East China are moreeducated and willing to outsource.”

Clients are not ready

“ What do they do with thousands ofemployees and tens of millions oflogistics assets if logistics servicesare outsourced.”

“ I agree that the market potential ishuge, but it will take time for domesticcompanies to outsource more.”

“ Many customers are willing tooutsource, but only a small part. Theyare looking for 3PL providers toprovide simple services.”

“Customers are ready for outsourcingdirect transportation services.However, for more complicatedservices, they need more externalpressure to push them to moveforward.”

3PL providers’ views of shippersNearly 70% of providers think that clients, particularly Chinese clients, are not ready foroutsourcing.

Mercer Management Consulting © 2002 12

Note: 1Top three responses weighted by order of importance (#1 = X3; #2 = X2; #3 = X1) and calculated as % of total weighted responses.Source: Mercer China 3PL Survey, 2002

33%

24%

21%

7%

6%

4%

2%

2%

1%

0 10 20 30 40%

Reasons for not outsourcing logistics

% of respondents (weighted1)

Lack of IT system

Wrong concept/ mindset

Too expensive

Not convinced of benefits

Fragmented entities throughoutsupply chain

Good providers not available

No confidence in service level

In-house capabilities already

Bad experience in past

Shippers’ view of 3PL providersShippers lack confidence in service levels and have difficulty finding good providers. Manyproviders are good at marketing but fall short on delivery, especially in delivering high-quality and consistent services across geographies.

Mercer Management Consulting © 2002 13

Gross revenues1

31%

46%

23%

0

10

20

30

40

50

60%

<RMB 50 million

(<US$6.3 MM)

50-200 million

(US$ 6.3 MM to $25 MM)

>200 million(>US$ 25 MM)

% o

f res

pond

ents

Note: 1Gross revenues includes purchased transportation and warehousing.Source: Mercer China 3PL Survey, 2002

China 3PL market featuresThe market is highly fragmented, with no one player achieving more than a 2% marketshare.

Mercer Management Consulting © 2002 14

Key findings (Shippers)The demands of multinational versus Chinese shippers are very different, suggesting twodistinct market development paths.

� Reducing costs and cycle times, and improving service levels are the mainchallenges for shippers

� About 70% of multinational shippers outsource logistics services; but only 15%of Chinese shippers do

� MNC shippers prefer MNC providers for their IT systems, industry/operationalexpertise, and standardized operations

� Chinese shippers prefer Chinese providers for their lower prices, localknowledge and national network coverage

� About 80% of shippers state that they will increase the use of 3PL providers, butthe outsourcing process will be incremental and slow

Mercer Management Consulting © 2002 15

88%

48%

0

20%

40

60

80

100%

Directtransportation

Logistics

Source: Mercer China 3PL Survey, 2002

Outsourcing rate

% o

f res

pond

ents

Rate of outsourcing oflogistics by type of shipper

16%

69%

0

20

40

60

80

100%

Chinese Multinationalcorporations

% o

f res

pond

ents

Current outsourcing of logisticsAlthough almost 90% of shippers surveyed outsource direct transportation services, onlyabout 50% of shippers outsource logistics, and the rate drops to slightly above 15% forChinese shippers.

Mercer Management Consulting © 2002 16

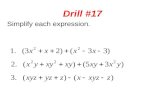

33%

27%

24%

13%

3%

0 10 20 30 40%

Reduce logisticscosts

Ability to focus oncore business

Improve customerservice and quality

Simplify complexoperations

Improve logisticschain flexibility

Reasons for outsourcing logistics

% of respondents (weighted1)

Note: 1 Top three responses weighted by order of importance (#1 = X3; #2 = X2; #3 = X1) and calculated as % of total weighted responses.Source: Mercer China 3PL Survey, 2002

31%

18%

16%

16%

9%

4%

4%

2%

0 10 20 30 40

Industry/operationsexperience

Network coverage

Lower price

Reputation

Own strategic assets

Integrated logisticscapabilities

Good IT system

Strategic fit

Criteria for selection of 3PL providers

% of respondents (weighted1)

Current outsourcing of logisticsUnder pressure to reduce costs, many shippers look to their 3PL providers for industry andoperations experience in order to reduce logistics costs.

Mercer Management Consulting © 2002 17

75%

45%

34%

27%

14%

9%

5%

020406080100%

79%

51%

44%

31%

13%

10%

0 20 40 60 80 100%Note: The charts show the advantages cited by all shippers who expressed a view, including those shippers who preferred to outsource to a different nationality of provider.Source: Mercer China 3PL Survey, 2002

Advantages of Chinese providersAdvantages of foreign providers

Integrated logisticscapabilities

Logistics talent

Financial position

International network

Standardized operations

Industry/operationalexpertise

IT system Lower price

Local knowledge

Domestic networkcoverage

Relationship with central / local government

Ownership of somestrategic assets

Policy protection

Flexibility of operations

No preference48%

Preferforeign

provider30%

PreferChineseprovider

22%

• 30% of all shippers• 37% of MNCs• 15% of Chinese

shippers

• 22% of all shippers• 19% of MNCs• 31% of Chinese

shippers

Who prefersforeign

providers?

Who prefersChineseproviders?

5%

Current outsourcing of logisticsAbout 30% of shippers, particularly MNCs, would prefer to outsource to foreign providers,while more than 20% of shippers, particularly Chinese, would prefer Chinese providers.

Mercer Management Consulting © 2002 18

Key findings (Providers)Providers are seeking partners to compliment their capabilities and meet the growingchallenges.

� Large SOEs such as Sinotrans and COSCO, are facing problems such as highlevels of redundant employees, a limited customer service mindset, andineffective performance measures

� Emerging logistics companies in China, e.g., EAS, PGL are facing challengessuch as limited financial support, poor management talent, and lack of aneffective organization structure to sustain growth

� Foreign companies have limited operations in China, having typically enteredChina with their MNC customers in an effort to provide global services

� Providers cite subcontractor management and client expectation managementare the key challenges in execution

� About 80% of providers, domestic and foreign, are looking for partnerships andjoint ventures to help achieve growth targets

Mercer Management Consulting © 2002 19

Foreign logistics companies

• APL• Maersk• HTB• Panalpina• Exel• Danzas• TNT• Schenker

Emerging logistics companies

• EAS• St-Anda• PGL• Hurry Top• China overseas logistics• Jiuchuan logistics

Internal logistics departmentsof Chinese companies

• Annto logistics• Haier logistics• Attend logistics• Ding Xin logisitcs• TCL• Bright Dairy & Food• Konka

Traditional Chinesetransportation companies

• COSCO• Sinotrans• CMST• China Shipping• China Resources• China Post• CRMLC• CRE

• FedEx• UPS• DHL

Example

China 3PL ProvidersCompetition in logistics is intensifying with players from different origins entering the market.

Mercer Management Consulting © 2002 20

Features

Objectives

Traditional transportation companies

• Large standalone firms with nationalnetwork and significant transportation andwarehousing assets

• Good relationships with central and localgovernment

• High proportion of excess employees andlow efficiency

• Internally focused culture rather thancustomer- and performance-focused

• Leverage extensive network and assetadvantage to accelerate logistics growthand seize first-mover advantage

• Upgrade capabilities to enhancecompetitiveness (potentially viapartnerships)

• Restructure to improve efficiency andeconomics

Emerging logistics companies

• Private or joint ventures with morefocused geographies, services, andcustomers

• Very high growth and relatively highproductivity

• Limited ownership of fixed assets• Lack strong financial support for market

expansion• Lacking internal management

mechanisms and effective organization tosupport high growth

• Maintain high growth by introducingstrategic partner or investor

Source: Mercer China 3PL Survey, 2002

Features of each category’s 3PL providers (1)

Mercer Management Consulting © 2002 21

Features

Objectives

Internal logistics departments

• Provide services for some externalcustomers, but internal customers stilldominate

• Expertise in certain sectors• Limited assets but good network coverage• Weak in sales and marketing• Strategy and future position strongly

influenced by the parent company

• Either strengthen or spin off logisticsdepartments

Foreign logistics companies

• International providers with strongoverseas network

• Industry expertise and experiencedoperations

• Good relationships with global accounts• Advanced IT systems• Strong financial support from

headquarters• Limited presence in China and relatively

high cost structure

• Strengthen market position throughacquisition or partnership

Source: Mercer China 3PL Survey, 2002

Features of each category’s 3PL providers (2)

Mercer Management Consulting © 2002 22

Note: 1Straight average of all responses (not weighted by size of each 3PL provider)Source: Mercer China 3PL Survey, 2002

Revenue split between import, export and domestic

% o

f rev

enue

s1

Domestic

Export

Import

Foreign providersChinese providers

88%

31%

58%

11%7%5%

0%

20%

40%

60%

80%

100%

3PL providers’ operationsChinese providers focus more on domestic logistics opportunities due to lack of overseasnetwork; foreign providers draw most of their revenue from import and export logistics asthey focus on serving their global accounts.

Mercer Management Consulting © 2002 23

33%44%

67%56%

98%

0

20

40

60

80

100%

All Providers ChineseProviders

ForeignProviders

Revenue by client nationality

Chinese clients2Foreign clients

“Some of them still regardlogistics as only transportation

and warehousing.”“Internal restructuring isrequired before they can

outsource.”

“MNCs understand thelogistics concept. It’s not

necessary to spend lots of timeto educate them.”

“They are less price-sensitive.”

Foreign clients

Chinese Clients

Note: 1Straight average of all responses (not weighted by size of each 3PL provider) ; 2 Including internal customersSource: Mercer China 3PL Survey, 2002

% o

f rev

enue

s1

2%

3PL providers’ operationsMultinational companies with national logistics requirements are the main target clients forall 3PL providers, although Chinese providers have a higher proportion of Chinese clients.

Mercer Management Consulting © 2002 24

Note: 1Top three responses weighted by order of importance (#1 = X3; #2 = X2; #3 = X1) and calculated as % of total weighted responses. 2 Other three less important sources are: management problems and client organization(4%); contract problem (3%) and pricing problem (3%)

Source: Mercer China 3PL Survey, 2002

24%

21%

16%

13%

9%

7%

0 10 20 30%

Subcontractor management

Lack of agreement concerning requirements/

expectations

Poor infrastructure

Client resistanceto change

Staffing problems

Poor client data

Main sources of execution problems2

% of respondents (weighted1)

3PL providers’ views on executionProviders feel the toughest execution challenge is finding reliable subcontractors and havingcontrol over their service quality. Managing clients’ expectations is also an issue since theyare not experienced in using external logistics services.

Mercer Management Consulting © 2002 25

Note: 1Top three responses weighted by order of importance (#1 = X3; #2 = X2; #3 = X1) and calculated as % of total weighted responses.Source: Mercer China 3PL Survey, 2002

Findingqualified

People

Governmentrestrictions

IT systems/development costs

Ambiguity of policy

Client rigidity/unrealistic

expectations

Challenges for Chinese providers

29%

23%

23%

17%

8%

0 10 20 30 40%

0%Incompatibleculture

40%

24%

20%

12%

2%

2%

010203040%

Challenges for foreign providers

Finding qualifiedpeople

Governmentrestrictions

IT systems/development costs

Ambiguity of policy

Client rigidity/unrealistic expectations

Incompatible culture

% of respondents (weighted1) % of respondents (weighted1)

3PL providers’ views on challenges to growthWhile government restrictions is clearly the top issue for foreign providers, all players arefacing the challenge of finding qualified people at all levels.

Mercer Management Consulting © 2002 26

Expansion strategy of 3PL players in China(% of players of each type pursuing specific expansion strategy)

Organic growth Acquisition Partnership/JV

Chineseproviders

Foreignproviders

All providers

50%

43%

47%

42%

71%

53%

83%

71%

79%

Type

of 3

PL p

rovi

der

Chinese providers are lookingfor partners who can provide

– Overseas network– Financial support– Management experience– Complementary functions

Foreign providers are looking forpartners who can provide

– Customer relationships– Resources, strategic assets– Operational skills– Domestic network coverage

Source: Mercer China 3PL Survey, 2002

3PL providers’ views on growth strategyMost providers are looking for partnerships to help them achieve their growth targets.

Mercer Management Consulting © 2002 27

Driving forces for outsourced logisticsGovernment initiatives are also beginning to encourage the outsourcing of logistics.

� A Logistics Development Plan is included in the “10th five-year plan.”MOFTEC/MOR/MOC/MII/CAAC issued “Suggestions to Speed up China LogisticsDevelopment” in March 2001.

� Once implemented, China’s WTO commitments regarding liberalization of foreigninvestment in logistics will dramatically change the landscape through multiple newentrants.

� As many foreign companies make China a manufacturing center for Asian and globalmarkets, logistics demands and shipper characteristics will change rapidly.

� Retail consolidation and the emergence of national chains will also change the role oflogistics providers.

� Emerging high-quality providers will start to set industry standards.

Mercer Management Consulting © 2002 28

TrendsThe 3PL market in China will change, but not rapidly.

� Industry consolidation will result in a few larger players.– Large SOE providers will quickly develop restructuring strategies and some will

become strong players.– In the flood of new entities, well-capitalized and specialized players will likely

succeed, while many less focused, small players won’t survive.– Multinationals will play a larger role, strengthening their domestic capabilities to

leverage global client resources and gain market share.� Providers will become more specialized in industries served and services provided.� New practice industry standards will be set soon.� Existing customers will reduce the number of providers used and begin to demand

higher standards of reliability and quality.� Customers will have higher requirements for providers’ IT systems.

But

� Progress will be slow and profits likely meager in the near to medium term, given highcompetition and investment requirements.

Mercer Management Consulting © 2002 29

� For additional information regarding the survey or Mercer capabilities, please contact:

Mark H. KadarVice President33 Hayden AvenueLexington, MA 02421781-674-3764fax: [email protected]

Paul CliffordVice PresidentSuite 6, 35th FloorChina World Tower 1No. 1 Jianguomenwai AvenueBeijing 100004, P. R. China8610/ 6505 9628 vm3313fax: 8610/ 6505 [email protected]

Diana HuangPrincipalSuite 6, 35th FloorChina World Tower 1No. 1 Jianguomenwai AvenueBeijing 100004, P. R. China8610/ 6505 9628 vm2303fax: 8610/ 6505 [email protected]