The Potash Outlook - FIRTGiasson_Potash_Outlook... · The Potash Outlook Al Mulhall Director,...

-

Upload

nguyencong -

Category

Documents

-

view

216 -

download

0

Transcript of The Potash Outlook - FIRTGiasson_Potash_Outlook... · The Potash Outlook Al Mulhall Director,...

The Potash OutlookThe Potash Outlook

AlAl MulhallMulhallDirector, Market ResearchDirector, Market Research -- PotashCorpPotashCorp

TFI Outlook MeetingTFI Outlook Meeting

November 2, 2005November 2, 2005

ForwardForward--Looking StatementsLooking StatementsThis presentation contains forwardThis presentation contains forward--looking statements, which involvelooking statements, which involve

risks and uncertainties, including those referred to in the Comprisks and uncertainties, including those referred to in the Companyany’’ss

annual report to shareholders for 2003 and in filings with the Uannual report to shareholders for 2003 and in filings with the U.S..S.

Securities and Exchange Commission and Canadian provincialSecurities and Exchange Commission and Canadian provincial

securities commissions. A number of factors could cause actualsecurities commissions. A number of factors could cause actual

results to differ materially from those in the forwardresults to differ materially from those in the forward--lookinglooking

statements, including, but not limited to, fluctuation in supplystatements, including, but not limited to, fluctuation in supply andand

demand in fertilizer, sulfur and petrochemical markets; changesdemand in fertilizer, sulfur and petrochemical markets; changes inin

competitive pressures, including pricing pressures; risks associcompetitive pressures, including pricing pressures; risks associatedated

with natural gas and other hedging activities; changes in capitawith natural gas and other hedging activities; changes in capitall

markets; changes in currency and exchange rates; unexpectedmarkets; changes in currency and exchange rates; unexpected

geological or environmental conditions and government policygeological or environmental conditions and government policy

changes.changes.

The Potash OutlookThe Potash Outlook

Global FundamentalsGlobal Fundamentals

Global PotashGlobal Potash

US FundamentalsUS Fundamentals

US PotashUS Potash

N, P & K OutlookN, P & K Outlook

Declining land per capitaDeclining land per capita

Strong economic growthStrong economic growth

Tight global grain supply/demand balanceTight global grain supply/demand balance

China having a strong impact on demand forChina having a strong impact on demand forgrains, oilseeds and ocean freightgrains, oilseeds and ocean freight

Recent commodity price growthRecent commodity price growth

Good FundamentalsGood Fundamentals

Source: FAO, PPI, PotashCorpSource: FAO, PPI, PotashCorp

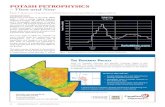

Hectares of Arable Land Per PersonHectares of Arable Land Per Person

Land Available to Agriculture is DecliningLand Available to Agriculture is Declining

0.0

0.1

0.2

0.3

0.4

1970 1980 1990 2000 2010F 2020F

Source: IMFSource: IMF

World Economic GrowthWorld Economic Growth

0

1

2

3

4

5

6

1997 1998 1999 2000 2001 2002 2003 2004E

Strongest GrowthStrongest Growthin Over 30 Yearsin Over 30 Years

% Annual Real GDP Growth% Annual Real GDP Growth

Source: IMFSource: IMF

World Economic GrowthWorld Economic Growth

0

1

2

3

4

5

1999-2002 2003-2006 2007-2010

Real GDP GrowthReal GDP Growth -- % CAGR% CAGR

3.5%

4.5%4.3%

Source: USDA, PotashCorpSource: USDA, PotashCorp

World Grain Production & ConsumptionWorld Grain Production & Consumption

1.0

1.1

1.2

1.3

1.4

1.5

1.6

1.7

1980/81 1985/86 1990/91 1995/96 2000/01 2005/06F 2010/11F1.0

1.1

1.2

1.3

1.4

1.5

1.6

1.7

Production Consumption

Billion TonnesBillion TonnesRecord ProductionRecord ProductionAbove Normal WeatherAbove Normal Weather

ProductionProductionGapsGaps

PossiblyPossiblyMoreMore

CommonCommon

Production GapProduction Gap

Wheat and Coarse GrainsWheat and Coarse Grains

Source: USDASource: USDA

World Grain StocksWorld Grain Stocks

0

100

200

300

400

500

600

73/74 77/78 81/82 85/86 89/90 93/94 97/98 01/02 05/06F

10

15

20

25

30

35

40

Year-End Grain Stocks Stocks-to-Use Ratio

Million TonnesMillion Tonnes PercentPercent

Wheat and Coarse GrainsWheat and Coarse Grains

17.9%

Source: USDA, PotashCorpSource: USDA, PotashCorp

ChinaChina’’s Grain Production & Consumptions Grain Production & Consumption

80

120

160

200

240

280

98/99 00/01 02/03 04/05 06/07F 08/09F

Production Forecast Use

Production Gap

Wheat and Coarse GrainsWheat and Coarse Grains

Million Tonnes

Source: USDASource: USDA

0

40

80

120

160

200

240

61/62 65/66 69/70 73/74 77/78 81/82 85/86 89/90 93/94 97/98 01/02 05/06F

0

20

40

60

80

100

120Stocks Stocks-to-Use Ratio

ChinaChina’’s Grain Ending Stocks*s Grain Ending Stocks*

StocksStocks--toto--Use RatioUse RatioMillion TonnesMillion Tonnes

* Wheat and corn* Wheat and corn

Source: World BankSource: World Bank

60

70

80

90

100

110

120

130

140

150

160

3Yrs

Ago

1Yr Ago

Q3 2005

3Yrs

Ago

1Yr Ago

Q3 2005

3Yrs

Ago

1Yr Ago

Q3 2005

3Yrs

Ago

1Yr Ago

Q3 2005

3Yrs

Ago

1Yr Ago

Q3 2005

Index 1990 =100Index 1990 =100

Agricultural Commodity PricesAgricultural Commodity Prices

Grains-rice-wheat-maize-sorghum

-

Oilseeds-soybeans-palm oil-coconut oil

Beverages-coffee-cocoa-tea

OtherFood-bananas-oranges-sugar

Other RawMaterials-cotton-rubber-wool

Source: USDA August 2005Source: USDA August 2005

US $BillionsUS $Billions

US Net Cash Farm IncomeUS Net Cash Farm Income

9.2 13.47.9 7.3 7.3 7.5 12.2

20.6 22.9 20.711.2

17.2 13.321.4

46.045.9

43.2 45.3 50.2 51.0 43.334.0 33.8 39.4

38.3

54.472.2

63.8

0

10

20

30

40

50

60

70

80

90

1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005E

Net Cash Income Before Gov,t Payments

Direct Government Payments

US farmers are beginning to feel the pinchof rising costs but have enjoyed recordnet cash farm income over the past fewyears and 2005 should be another recordor near record year.

85.285.5

71.6

The Potash OutlookThe Potash Outlook

Global FundamentalsGlobal Fundamentals

Global Potash OutlookGlobal Potash Outlook

N, P & K OutlookN, P & K Outlook

Industry government ownershipIndustry government ownership

The global playersThe global players

Global potash demand growthGlobal potash demand growth

Regional potash demand growthRegional potash demand growth

Global potash production growthGlobal potash production growth –– FSU & ChinaFSU & China

World supply/demand balanceWorld supply/demand balance

PotashPotash –– Key PointsKey Points

Source: PotashCorpSource: PotashCorp

Industry StructureIndustry Structure -- Ownership TypeOwnership Type

86%

14%

Publicly Traded orPublicly Traded orJointly Held Stock CompaniesJointly Held Stock Companies

StateState--ControlledControlled

2005200534%

66%

19801980

Government OwnershipGovernment Ownership

NonNon--GovernmentGovernmentOwnershipOwnership

Source: FerteconSource: Fertecon

Million Tonnes KClMillion Tonnes KCl

World Potash ExportersWorld Potash Exporters -- 20042004

0

2

4

6

8

10

12

14

16

18

Canada Russia Belarus Germany Israel Jordan Others

Top 3 Exporters (2004)Top 3 Exporters (2004)= 75% of total exports= 75% of total exports

40%

18%17%

10%8%

4% 3%

By Country

Source: FerteconSource: Fertecon

Million Tonnes KClMillion Tonnes KCl

World Potash ImportersWorld Potash Importers -- 20042004

0

1

2

3

4

5

6

7

8

9

10

US China Brazil India France Malaysia

87%

84%91%

100%

100%100%

Top 3 Importers (2004)Top 3 Importers (2004)= 53% of total imports= 53% of total imports

Imports as a % of a country’s total sales

By Country

Source: IFA, PotashCorpSource: IFA, PotashCorp

World Potash Demand GrowthWorld Potash Demand Growth

0

4

8

12

16

20

24

28

32

36

40

44

1999 2000 2001 2002 2003 2004 2005E 2006F 2007F 2008F 2009F 2010F

Cumulative YOY Percentage GrowthCumulative YOY Percentage Growth

8.3%

3.8%-0.6%

10.0%

3.0%

3.6% 1H 2005

3% Growth Rate

2% Growth Rate

Source: FerteconSource: Fertecon

Million Tonnes KClMillion Tonnes KCl

Asia and Latin America Potash DemandAsia and Latin America Potash Demand

0

2

4

6

8

10

12

1999 2000 2001 2002 2003 2004

Asia Latin America

Cumulative Growth

+3.5 MMT+3.5 MMT

+1.1 MMT+1.1 MMT

+2.8 MMT+2.8 MMT

Source: Fertecon, PotashCorpSource: Fertecon, PotashCorp

0

1

2

3

4

5

6

7

8

9

10

2001

2003

2005

F20

0120

03

2005

F20

0120

03

2005

F20

0120

03

2005

F

Million Tonnes KClMillion Tonnes KCl

China

Potash Imports for Selected CountriesPotash Imports for Selected Countries

Brazil Other Asia

India

2005E

Source: Oanda.comSource: Oanda.com

0.20

0.25

0.30

0.35

0.40

0.45

0.50

Jul-03 Oct-03 Jan-04 Apr-04 Jul-04 Oct-04 Jan-05 Apr-05 Jul-05 Oct-05

Real per US Dollar

Brazilian Real per US DollarBrazilian Real per US Dollar

Exchange rates are those in effect on the first day of the month

Source: USDA, Doane, PotashCorpSource: USDA, Doane, PotashCorp

0

50

100

150

200

250

300

Brazil (2005) US(2005)

Seed Fertilizer Costs Other Variable Land Costs Depn&Other Fixed Costs

Cost of Producing Soybeans in Brazil and US

US$/Acre

Labor, taxes andmachinery costs arecheaper in Brazil

Excludes apossible extra$25/acre cost forfungicide to fightAsian Rust

Chemicals, fuel costmore than the US …including $50/ha tofight Asian Rust

Land costs haverisen sharply withthe price ofsoybeans but arestill a fraction ofthe US

Fertilizer costshave risen andare more thanthe US

$215/acre

$255/acre

Source: Fertecon, PotashCorpSource: Fertecon, PotashCorp

0

1

2

3

4

5

6

7

8

9

10

2001

2003

2005

F20

0120

03

2005

F20

0120

03

2005

F20

0120

03

2005

F

Million Tonnes KClMillion Tonnes KCl

China

Potash Imports for Selected CountriesPotash Imports for Selected Countries

BrazilOther Asia

India

2005E

Source: Fertecon, PotashCorpSource: Fertecon, PotashCorp

ChinaChina’’s Potash Demand Growths Potash Demand Growth

0

1

2

3

4

5

6

7

8

9

10

11

2000 2001 2002 2003 2004 2005F

Production Imports

Million Tonnes KClMillion Tonnes KCl

Source: CanpotexSource: Canpotex

0

1

2

3

4

5

6

7

8

9

1978 1981 1984 1987 1990 1993 1996 1999 2002 2005F

Million Tonnes KCl

CanpotexCanpotex’’s Sales Volumes Sales Volume

Records

Source: Fertecon, PotashCorpSource: Fertecon, PotashCorp

FSU Potash Sales and CapacityFSU Potash Sales and Capacity

0

4

8

12

16

20

1988 1990 1992 1994 1996 1998 2000 2002 2004

Domestic Sales Export Sales New Capacity

Million Tonnes KCl

Source: Fertecon, IFA, PotashCorpSource: Fertecon, IFA, PotashCorp

FSU KCl ProductionFSU KCl Production

0

1

2

3

4

5

6

7

8

9

20022003

20042005F

20022003

20042005F

20022003

20042005F

Million Tonnes KClMillion Tonnes KCl

Silvinit

Belarus

Uralkali

Source: PPISource: PPI

0.5

1.0

1.5

2.0

2.5

3.0

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

Million Tonnes KCl

North American ProducersNorth American Producers’’ Ending KCl InventoryEnding KCl Inventory

5-YearAverage

2004

22 % Below 5-Year Average

2005

2003

Source: Fertecon, ANDA, PPISource: Fertecon, ANDA, PPI--PPICPPIC

Million Tonnes KClMillion Tonnes KClSelected NationsSelected Nations’’ Potential Potash GrowthPotential Potash Growth

China

0

2

4

6

8

10

12

Current Potential

India Brazil

0

2

4

6

8

10

12

Current Potential0

5

10

15

20

25

30

Current Potential

Note: KNote: K22O tonnes divided by .61 to convert to KCl tonnesO tonnes divided by .61 to convert to KCl tonnes

Source: FAO, FerteconSource: FAO, Fertecon

0

5

10

15

20

25

30

35

61/62 67/68 73/74 79/80 85/86 91/92 97/98 '03/04 09/10F

NAmerica Asia LAmerica WE Africa Oceania EE FSU

Million Tonnes KMillion Tonnes K2200

World Potash Fertilizer ConsumptionWorld Potash Fertilizer Consumption

North America

FSU

EE

Asia

L AmericaWE

Actual Forecast

Source: Fertecon, IFA, PotashCorpSource: Fertecon, IFA, PotashCorp

World Potash Operating Rate (%)World Potash Operating Rate (%)

% of Capacity

50

60

70

80

90

100

1980 1983 1986 1989 1992 1995 1998 2001 2004 2007 2010

Actual With PotashCorp Forecast With PotashCorpActual Without PotashCorp Forecast Without PotashCorp

* excludes capacity additions in planning stage for Thailand, Ur* excludes capacity additions in planning stage for Thailand, Uralkali, and Mosaicalkali, and Mosaic

Source: Fertecon, PotashCorpSource: Fertecon, PotashCorp

0123

45

678

910

11121314

2005E 2006F 2007F 2008F 2009F 2010F

PotashCorp: Available CapacityPotashCorpProjects Under ReviewUralkaliJordanBrazilGermanyIsraelChinaMosaicAgrium3% Demand Growth2 % Growth

Cumulative GrowthCumulative Growth -- Million Tonnes KClMillion Tonnes KCl

Potash Demand Growth versus Capacity:Potash Demand Growth versus Capacity:Assumes All Capacity Announcements CompletedAssumes All Capacity Announcements Completed

The Potash OutlookThe Potash Outlook

Global FundamentalsGlobal Fundamentals

Global PotashGlobal Potash

US FundamentalsUS Fundamentals

Source: USDA and Doane's ForecastSource: USDA and Doane's Forecast

US Crop Acreage ForecastUS Crop Acreage ForecastMillion AcresMillion Acres

2002 2003 2004 2005 2006 +/-Corn 78.9 78.6 80.9 81.6 79.8 -1.8All Wheat 60.3 62.1 59.7 57.1 59.2 2.1Soybean 74.0 73.4 75.2 72.2 74.0 1.8Cotton 14.0 13.5 13.7 14.2 13.8 -0.4

Doane’s 2006 ForecastMore wheat and soybeans … lesscorn and cotton due to rising costsand the higher returns to soybeans.Also there is so far little evidence ofAsian Rust.

The Potash OutlookThe Potash Outlook

Global FundamentalsGlobal Fundamentals

Global PotashGlobal Potash

US FundamentalsUS Fundamentals

US Potash OutlookUS Potash Outlook

Source: TFI, Fertecon, PotashCorpSource: TFI, Fertecon, PotashCorp

Ammonia Costs Depend on Gas CostsAmmonia Costs Depend on Gas Costs

US$/ST

Gas Cost per Million Btu

0

50

100

150

200

250

300

350

400

450

500

2.00 4.00 6.00 8.00 10.00 12.00 14.00

Gas Costs Conversion Costs

Current Tampa Ammonia Price ($328/st)

Source: AAPFCO and PotashCorp 2004/05 Estimates and 2005/06 ForeSource: AAPFCO and PotashCorp 2004/05 Estimates and 2005/06 Forecastcast

US Fertilizer Consumption ForecastUS Fertilizer Consumption ForecastMillion Tons NutrientMillion Tons Nutrient

2003/04 YOY% 2004/05 YOY% 2005/06 Range

K2O 5.498 11.1% 5.445 0 to -2% 5.250 -3 to -5%

Sharp Increase in2003/04 … Due toexceptionalweather, favorablecrop prices andbetter reporting

Down slightly in2004/05 … Due tomore normalweather and adecline in cropprices

Down 3 - 5%… Due to high gasprices, US marketresistance to nitrogenprices, and reducedcorn acreage.

The Potash OutlookThe Potash Outlook

Industry government ownership is lowIndustry government ownership is low

Industry operating rates are highIndustry operating rates are high

Global potash demand growth to average 2Global potash demand growth to average 2--3%3%

US market carries risk of 3US market carries risk of 3--5% drop from last year5% drop from last year

Market outlook is for continued tight supply/demandMarket outlook is for continued tight supply/demand

ConclusionConclusion