THE OTHER SIDE OF THE FENCE - Online Banking | ANZ · 2015. 11. 30. · remain but some local...

Transcript of THE OTHER SIDE OF THE FENCE - Online Banking | ANZ · 2015. 11. 30. · remain but some local...

-

NEW ZEALAND ECONOMICS

MARKET FOCUS

ANZ RESEARCH

30 November 2015

INSIDE

Economic Overview 2

Regional Output Gaps 6

Interest Rate Strategy 8

Currency Strategy 10

Data Event Calendar 12

Local Data Watch 14

Key Forecasts 15

NZ ECONOMICS TEAM

Cameron Bagrie Chief Economist Telephone: +64 4 802 2212 E-mail: [email protected] Twitter @ANZ_cambagrie Philip Borkin Senior Economist Telephone: +64 9 357 4065 Email: [email protected]

David Croy Senior Rates Strategist Telephone: +64 4 576 1022 E-mail: [email protected] Mark Smith Senior Economist Telephone: +64 9 357 4096 E-mail: [email protected] Sam Tuck Senior FX Strategist Telephone: +64 9 357 4086 E-mail: [email protected] Kyle Uerata Economist Telephone: +64 4 802 2357 E-mail: [email protected] Con Williams Rural Economist Telephone: +64 4 802 2361 E-mail: [email protected] Sharon Zöllner Senior Economist Telephone: +64 9 357 4094 E-mail: [email protected]

THE OTHER SIDE OF THE FENCE

ECONOMIC OVERVIEW

A case for cutting the OCR again next week is on good grounds. However, to us, the

justification for a cut as soon as next week is not that clear cut when we consider

the improving domestic growth backdrop, the less dire outlook for the terms of

trade, housing market considerations, ongoing falls in fixed mortgage rates, and the

need for more clarity on the global scene (read US Fed). That said, a cut next week

in itself wouldn’t be surprising (we still have further easing within our base-line

forecasts after all); we’re simply in more of a watch and wait mode. Global dairy

prices look set to bounce this week, while broader activity data should be solid.

REGIONAL OUTPUT GAPS

Our output gap measures captured a geographically widespread easing in capacity

pressures in Q3. The North-South divide was more apparent as pressures on

capacity in Canterbury ease. Output gap estimates are historical and are starting to

reflect the slowing in activity we have already observed. However, our focus – and

that of the RBNZ – needs to be on growth momentum and capacity going forward.

INTEREST RATE STRATEGY

We expect local markets to range trade ahead of the RBNZ and FOMC decisions. The

Fed remains on track to hike; the RBA should stand pat and maintain its easing bias;

and the Bank of Canada should also remain on hold this week. However, later this

week the ECB should follow through with further policy rate cuts and QE. While the

RBNZ could easily cut next week, our core view is that improving signs on the local

economic outlook should be respected, seeing a pause – a view that is notably out of

consensus. NZ interest rates have less upside potential than their US counterparts,

but are set to rise gradually even as the NZ/US spread narrows.

CURRENCY STRATEGY

This week is not about NZD; instead EUR and USD will dominate. We expect

NZD/EUR strength as the ECB boosts easing, although we acknowledge the risks of

a brief positioning-related dip. NZD/USD remains on an overall declining trend, but

we expect there to be opportunities for both importers and exporters this week; US

rate hike expectations are firming but NZ data is too, leaving directional signals

mixed. NZD/AUD is in the buy zone and the RBA and Australian Q3 GDP should

reinforce this view.

THE ANZ HEATMAP

Variable View Comment Risk profile (change to view)

GDP

2.5% y/y

for 2016

Q4

Domestic economic momentum is stabilising. Downside risks exist

(globe) and dairy challenges remain but some local upside risks

are now evident too.

Unemployment

rate

6.1% for

2016 Q4

The demand for labour is slowing, while labour supply remains

strong. Wage inflation contained.

OCR 2.50% by

Dec 2016

The RBNZ will reverse all of its 2014 hikes. However, the final 25bp cut will be delayed until

2016.

CPI

1.6% y/y

for 2016

Q4

Sub-1% annual inflation over 2015. Some impact of lower NZD,

but domestic pricing pressures contained so far.

Positive Negative

Neutral

Positive Negative

Neutral

Up Down

Neutral

Positive Negative

Neutral

mailto:[email protected]:[email protected]:[email protected]:[email protected]:[email protected]:[email protected]

-

ANZ Market Focus / 30 November 2015 / 2 of 18

ECONOMIC OVERVIEW

SUMMARY A case for cutting the OCR again next week is on

good grounds, particularly with inflation low and

market pricing for a cut now sitting slightly above

50%. However, to us, the justification for a cut as

soon as next week is not that clear cut when we

consider the improving domestic growth backdrop,

the less dire outlook for the terms of trade, housing

market considerations, ongoing falls in fixed

mortgage rates, and the need for more clarity on the

global scene (read US Federal Reserve). That said, a

cut next week in itself wouldn’t be surprising (we still

have further easing within our base-line forecasts

after all); we’re simply in more of a watch and wait

mode. Global dairy prices look set to bounce this

week, while data beyond the broader commodity

price picture should be solid.

FORTHCOMING EVENTS RBNZ Credit Aggregates – Oct (3:00pm, Monday, 30 November). Credit growth is running at a faster

pace than income growth. While this likely continued

in October, we will be watching for an early impact of

new LVR restrictions.

Overseas Trade Indexes – Q3 (10:45am, Tuesday, 1 December). Export and import prices should both

be higher (due to the lower NZD). However, the

terms of trade are expected to have fallen by around

3%.

QV House Prices – Nov (12:00pm, Tuesday, 1 December). Consistent with anecdotes, the data

should show that the Auckland market has peaked,

but other regions are strengthening.

GlobalDairyTrade Auction (early am, Wednesday, 2 December). We put recent lifts in NZX futures

prices down to volatility more than anything else,

with whole milk powder prices at the bottom of a fair-

value range. More broadly, the fundamental backdrop

is not yet conducive to a meaningful recovery in

prices.

ANZ Commodity Price Index – Nov (1:00pm, Wednesday, 2 December).

Building Work Put in Place – Q3 (10:45am, Thursday, 3 December). Consents data suggest a

reasonable lift in residential building work, although

non-residential work may retrace a touch. Overall

building work is expected to have risen 1.0% q/q.

WHAT’S THE VIEW? We’ve been asked a great deal about why we have not joined the chorus calling another OCR cut from the RBNZ next week. When you consider dairy sector challenges, uncertainty over the global

scene, low inflation, rising unemployment and a

growth picture that in some ways still looks mixed

and below trend, it is a valid question. This lot certainly includes some classic catalysts for more monetary medicine.

It is therefore tempting to go with the hordes and follow market pricing (which is currently placing just short of 60% odds for a 25bp cut). A case for easing can certainly be made.

However, the justification for a cut next week simply doesn’t look that clear to us considering the following:

Growth momentum is very clearly picking up. We can debate whether it’s sufficient to close the output gap, but what is irrefutable when you

consider signals from the likes of our Business Outlook survey, is that a turning point has been reached. Financial conditions have loosened, and an encouraging improvement in activity data is now ensuing. Forward indicators have responded and monetary policy works with a lag so there is more in the pipeline.

FIGURE 1. CONFIDENCE COMPOSITE VS GDP

Source: ANZ, Statistics NZ

The dairy scene is certainly still challenged. However, whole milk powder prices at $2,200 per tonne are not the $1,500 per tonne economic calamity that was projected by the RBNZ in September. Throw in lower oil prices (which are deflationary, to be fair) and you

have a much less extreme correction in the terms

of trade than the RBNZ’s previous forecasts were

built on. Recall, the weak outlook for the terms of

trade was a key motivation for the monetary

policy actions seen over the June to September

period.

Housing market concerns were secondary to dairying worries mid-year. However, there is now more balance between the two. While the Auckland market looks to be flat-lining after a

-6

-4

-2

0

2

4

6

8

-6

-4

-2

0

2

4

6

8

89 91 93 95 97 99 01 03 05 07 09 11 13 15

Sta

ndard

ised

Annual %

change

GDP (LHS) Confidence Composite (adv 5m, RHS)

-

ANZ Market Focus / 30 November 2015 / 3 of 18

ECONOMIC OVERVIEW

period of phenomenal growth, regional housing

markets have undeniably caught the bug. Our

own internal anecdotes tell us that pressures in

the dairy sector remain. However, extreme

negativity is no longer evident; farmers have

gotten over the initial shock factor, where denial

and anger were dominating a few months back.

More broadly, we noted two weeks ago that we

were starting to see upside risks to our economic

projections. Downside risks do still exist,

certainly. The change has simply been that upside risks were absent three months ago.

The NZD is admittedly a lot higher than the RBNZ assumed in its September projections (TWI 71.3 currently vs 67.9 forecast). However,

one cannot look at the level of the NZD in

isolation. Yes, it has implications for the

trajectory of inflation. But as mentioned, the

outlook for the terms of trade is, importantly, far

less dire as well.

No doubt, the RBNZ would like to see a lower currency. However, it is what the Fed does a week after the RBNZ’s MPS that will be key for the NZD, not the RBNZ. With this in mind, wouldn’t it be better for the RBNZ to save

some of its bullets for the future once this key

milestone for markets is out of the way?

The credit channel of monetary policy is alive and well; witness fixed mortgage rates at 4%. Banking sector competition is still intense.

Part of the regional housing market story

represents a spill-over from Auckland strength.

However, we shouldn’t forget that fixed mortgage

rates have continued to fall over recent months

and this is playing a critical role too.

Inflation is clearly low, and that still remains something of a headache for the RBNZ. However, core inflation is not easing further; it’s actually been stable at around 1½% for a while, amidst growth technically falling

below trend (which should see core inflation fall).

Moreover, headline inflation will mathematically

lift from its current low level to around 1½% by

early 2016 once late 2014/early 2015 petrol price

cuts fall out, and being back within the target

band will provide some modest relief to policy

makers. We’re far from inflation phobic though;

we can’t see it ramping it. Consistently low

inflation outcomes flag something different is

going on in its evolution that needs more clarity.

The big uncertainty is whether signs of an improving growth backdrop will lift inflation towards 2%, and more broadly, what is going

on with inflation, given structural and cyclical

tensions. We simply don’t know. It’s pretty clear traditional demand-pull indicators or frameworks are not working. Our strategy in such a situation is to take our signals more so from inflation itself (rather than models of the inflation outlook), which means waiting for subsequent CPI reads. We don’t get the Q4 data until January.

December represents a communication quandary for the RBNZ. If the plan was to cut 100bps in total, one wonders how the market

(read NZD) would take a 25bp cut accompanied

by a flat-lined 90-day bank bill profile thereafter,

particularly as economic developments are

certainty not worse than in September. As the RBA taught us earlier this year, the prospects of further easing can be just as powerful for the currency as easing itself.

Of course, we could argue the other position too. Recall, we still have one further 25bp cut within our base-line forecasts (although not until March next

year), and so a cut next week in itself would not be

overly surprising or something to quibble about. If

the market begins to price in more than a 60%

chance of a cut, then it is quite possible the RBNZ

would choose to take what is being offered up to it,

given they prefer to avoid surprises. However, given

the factors listed above and the need to manage

expectations going forward, we think there is some

benefit for the RBNZ in “watching and waiting” a little

longer. But of course we are not the central bank so views and outcomes may well differ!

Turning to the week ahead, RBNZ credit aggregates for October will be released today. While numbers should remain solid overall and consistent with borrow-and-spend behaviour that’s been more evident of late, we will be watching for any early signs of an impact of the new LVR restrictions. In September, household and agricultural credit were running at a 3-month

annualised pace of 9.0% and 7.8% respectively.

While the latter might continue at this strong rate, it

is possible that the former moderates a touch, given

the new LVR restrictions. These restrictions weren’t

officially in place in October, but banks had been

asked to act within the “spirit” of them.

-

ANZ Market Focus / 30 November 2015 / 4 of 18

ECONOMIC OVERVIEW

FIGURE 2. SECTORAL CREDIT GROWTH

Source: ANZ, RBNZ

The results of the next GlobalDairyTrade auction will be watched closely as always, and we think the bottom for GDT prices has been reached in this particular downward cycle. That said, we are yet to see a catalyst for a strong upward

turn to US$3,000/tonne. NZX futures portray a

similar picture, with a circa 5% increase in WMP

prices expected and a slightly smaller rise for the rest

of the basket (GDT-TWI 4%). Relative value,

increasing supply pressure here and offshore, and a

reiteration by Fonterra that seasonal inventory levels

are normal are expected to provide support.

On the supply side, the continued turnoff of low-

performing cows this season is expected to have

lowered in-milk cows at the seasonal peak by 3½-

4%. This, combined with less supplementary feed

and other farm management changes, means New Zealand milk supply remains particularly vulnerable as we enter the summer months.

The other news that had created confusion amongst

buyers at recent auctions was the announcement of a

new WMP & SMP product to be offered at this week’s

auction. Some buyers thought this was an indication

of inflated New Zealand inventory levels. Additional

clarity has now been provided on the new product

offering (terms, quantities etc) and Fonterra has

reiterated that inventory levels are at normal levels

for this time of the year.

Offshore, Europe remains the focal point of dairy sector competition and it continues to generate surpluses. Farm-gate prices continue to hold up, supported by dairy consumable product

prices as opposed to bulk ingredients prices (milk

powders etc). However, weather conditions have

reportedly started to turn wintrier. Elsewhere there

are signs of easing milk flows, with the likes of the

US flat in October.

Support is also coming from the fact that GDT prices are now below other competing sources, especially for WMP and milkfat products. SMP pricing remains more challenging, with prices in

Europe again flirting with intervention levels. Current

prices are also very close to those struck via off-GDT

sale channels through the middle of the year, so this

is another sign bargain hunting buyers should help

provide support again.

For dairy farmers, international prices remain below the level required to deliver $4.60/kg MS. Fonterra have reiterated that US$3,000/tonne is required by February/March to deliver this. At this

stage we see this as a stretch and think $4.25-

$4.50/kg MS is more appropriate. An improvement at

this week’s auction will probably avoid a reduction in

forward guidance, but another drop would require

some downward adjustment at next week’s board

meeting.

For the broader New Zealand commodity price picture, our ANZ Commodity Price Index for November will provide a timely update. The headline world price index posted its second

consecutive monthly increase in October, rising

6.9%. However, this gain was dominated by a lift in

dairy prices. Excluding dairy, the index actually fell

for the sixth consecutive month (and the tenth month

of the past 12). But unlike the sharp reduction earlier

seen for dairy products, the price fall for other

commodities has been reasonably gradual, with ex-

dairy prices down 14% y/y. What is also important is

that in NZD terms, commodity prices excluding dairy

are still 0.8% above where they were 12 months

prior, highlighting the important shock-absorber role

that the lower NZD has played.

FIGURE 3. NON-DAIRY COMMODITY PRICES

Source: ANZ

This week also sees the release of a couple of key partial indicators for Q3 GDP. Overseas Trade Indexes data should show a reasonable fall in the

terms of trade over the quarter (we expect a fall of

-15

-10

-5

0

5

10

15

20

25

92 94 96 98 00 02 04 06 08 10 12 14

Annual %

change

Agriculture Business Household

50

100

150

200

250

300

88 90 92 94 96 98 00 02 04 06 08 10 12 14

World prices NZD prices

Index

-

ANZ Market Focus / 30 November 2015 / 5 of 18

ECONOMIC OVERVIEW

around 3% q/q) after showing surprising resilience

over the first half of the year. Over the March and

June quarters, the goods terms of trade posted gains

of 1.2% and 1.3% q/q respectively. To be fair, the

terms of trade is still sitting over 4% below its recent

June 2014 peak, but the gains over the first part of

the year were a mild surprise nonetheless. We feel

this resilience comes down to a combination of three

factors: 1) timing issues (particularly around export

price movements); 2) actual trade prices for dairy

production being above what is implied by the

GlobalDairyTrade results; and 3) a reminder that the

price of one of New Zealand’s key imports (oil) has

also fallen sharply year-to-date.

The lower NZD over the quarter will see both export and import prices post solid quarterly increases in NZD terms. However, we are expecting both to fall once currency movements are

taken into account (i.e. looking at world price

movements). “World” import prices will be weighed

down by ongoing crude oil price falls, while “world”

export prices are expected to play some catch-up to

movements already noted for New Zealand’s

commodity exports. Associated volume data should confirm solid increases in both export and import volumes, with the latter in part due to some large aircraft imports over the quarter.

FIGURE 4. EXPORT COMMODITY PRICES AND THE TERMS OF TRADE

Source: ANZ, Statistics NZ

Building Work Put in Place data is expected to show another modest increase in the overall volume of building activity in Q3. After recording a 1.6% q/q lift in Q2, we have pencilled in a further

1.0% q/q increase for Q3, led by a circa 3% q/q

increase in residential building activity. The strength

in residential work has been foreshadowed by the

improved trend (on a floor-area basis) in dwelling

consent issuance over recent quarters. This strength

is expected to be offset by a modest pull-back in non-

residential building work (after some solid gains),

with earlier released ready-mix concrete data a little

softer over the quarter. That said, given the

lumpiness of non-residential work and the ongoing

positive anecdotes we hear from the sector, and

increase in activity wouldn’t at all surprise us.

LOCAL DATA Overseas Merchandise Trade – Oct. A monthly unadjusted deficit of $963m was recorded, which was

$445m in seasonally adjusted terms.

ANZ Regional Trends – Q3. The nationwide composite posted a 0.4% q/q increase, with

Northland experiencing the strongest rate of growth.

Building Consents Issued – Oct. Total seasonally adjusted dwelling consents rose 5.1% m/m, with ex-

multi-unit dwellings broadly unchanged (-0.2%

m/m).

ANZ Business Outlook – Nov. Headline confidence rose to a six month high of 15%, with firms’ own

activity expectations lifting 8 points to a net 32%.

0

50

100

150

200

250

300

350

400

700

800

900

1000

1100

1200

1300

1400

1500

1600

57 61 65 69 73 77 81 85 89 93 97 01 05 09 13

Index

Index

OTI Goods Terms of Trade (LHS)

ANZ Commodity Price Index (adv 3 months, RHS)

-

ANZ Market Focus / 30 November 2015 / 6 of 18

REGIONAL OUTPUT GAPS

SUMMARY Our output gap measures captured a geographically

widespread easing in capacity pressures in Q3. The

North-South divide was more apparent as pressures on

capacity in Canterbury ease. Output gap estimates are

historical and are starting to reflect the slowing in

activity we have already observed. However, our focus

– and that of the RBNZ – needs to be on growth

momentum and capacity going forward.

REGIONAL GAPS Our regional output gap measures for the September

2015 quarter provide a snapshot of the degree of

resource pressure throughout the regions.1 Regional

measures are prone to a larger degree of uncertainty

than nationwide data, so we focus on the broad trends.

But equivalently, focusing in regional measures adds

more clarity and more information about whether there

are aggregate pressures or not.

Key points from the updated analysis are:

Ten of 14 New Zealand regions were adjudged to have a positive output gap in the September

quarter. A North versus South divide is becoming increasingly evident, with all of the Regions in the top half of the North Island having a

positive output gap. Just three of the five South

Island regions had a positive output gap, with the

slightly positive gap for Canterbury the lowest in

nearly three years and below the nationwide

average for the second consecutive quarter.

Hawke’s Bay, Waikato and Auckland had the most positive output gaps. Manawatu/Whanganui,

Taranaki and Southland had the largest margin of

excess overall slack.

Our overall measure for each region quoted above is an average of three approaches: the activity

gap, the labour-based gap, and capacity-based

metrics. As figure 2 shows, the nationwide

estimates can differ at various points in time, but

all three nationwide measures showed pressures on capacity are easing.

The pace of nationwide activity remained sub-trend in Q3. Nationwide activity reported in

1 Our regional output gap estimates are generated using economic

activity data from the ANZ Regional Trends, unemployment rates from Statistics NZ’s HLFS, and capacity utilisation measures from the ANZ

Business Outlook survey. We chose a broad approach for two reasons. First, it minimises some of the error that typically surrounds statistics at

the regional level. Second, the RBNZ uses a similar combination to

derive its multivariate filter measure of the output gap for the entire

economy. For the unemployment rate and activity we use a band-pass

filter to derive trend estimates, with capacity compared to historical

averages. The regional unemployment rates are advanced two quarters

prior to filtering, as this is a lagging indicator. Individual activity,

unemployment and capacity utilisation gaps for each region are then

given an equal weighting.

the Q3 ANZ Regional Trends increased 0.4% in the quarter, with two of the 14 regions experiencing a

quarterly decline in economic activity. There was

considerable dispersion in activity readings, with

quarterly activity rising more than 1% in four

regions (Northland, Taranaki, Otago and

Southland), but two regions experiencing sizeable

falls (Wellington and the West Coast).

Mostly due to the legacy of strong growth rates over 2014, our estimates showed 11 regions still

having a positive activity gap. Northland, Gisborne and the Bay of Plenty led the regions. The activity

gap in Canterbury was on par with the nationwide

average. Activity gaps were in negative territory for

Taranaki, Southland and the West Coast.

FIGURE 1. REGIONAL OUTPUT GAPS

Source: ANZ

Note: NL = Northland, AK = Auckland, WK = Waikato, BP = Bay of

Plenty, GS = Gisborne, HB = Hawke’s Bay, TK = Taranaki, MW =

Manawatu-Whanganui, G = Wellington, NM = Nelson-Marlborough, WC

= West Coast, CT = Canterbury, OT = Otago, SL = Southland

FIGURE 2. MEASURES OF RESOURCE ALLOCATION

Source: ANZ

The easing in the unemployment rate gap was consistent with the measured increase in the nationwide unemployment rate. As unemployment rates tend to lag the economic

cycle, we advance the regional unemployment

-0.4

-0.2

0.0

0.2

0.4

0.6

0.8

NL AK WK BP GS HB TK MW WG NM WC CT OT SL NZ

% d

evia

tion fro

m p

ote

ntial outp

ut

Unweighted regional average

-4

-3

-2

-1

0

1

2

3

4

92 94 96 98 00 02 04 06 08 10 12 14

Activity Gap Labour Market Gap Capacity Gap

% o

f Tre

nd

-

ANZ Market Focus / 30 November 2015 / 7 of 18

REGIONAL OUTPUT GAPS

rates by two quarters prior to filtering. Our estimates suggested that labour-based gap metrics eased for nine regions in Q3, although only five regions displayed a negative

unemployment rate gap. Taranaki, the BOP, and

Northland had more spare capacity in the labour

market than other regions, while there were more

pressures on labour market capacity in Canterbury

and the Waikato than the nationwide average.

Pressures in surveyed capacity utilisation declined in nine regions, with particularly sharp falls in Southland and Canterbury. Previous strong

investment in the latter and more moderate

demand growth are helping to alleviate capacity

pressures. Surveyed capacity utilisation lifted

sharply in the Hawke’s Bay and Taranaki, the two

regions which had the most positive capacity utilisation gaps. Six regions had lower capacity utilisation relative to trend, with surveyed capacity

utilisation falling to a six year low in Canterbury.

FIGURE 3. CHANGE IN REGIONAL OUTPUT GAP

Source: ANZ

Averaging across our three metrics, our estimates suggest nine of the 14 regions experienced less pressure on overall capacity in Q3 than in the previous quarter. Nationwide activity, labour market and capacity utilisation gaps

declined in Q3, with weaker regional gaps in 11, 9

and 9 regions for these measures respectively.

Large declines for Southland, Nelson-Marlborough,

and Canterbury output gaps were driven by falls in

capacity utilisation and activity gaps.

While pressures on capacity are easing, our estimates show a wide range of estimates of the degree of starting point capacity pressure for our three methods. In only three of the regions (Auckland, Wellington, and Otago), all

three capacity metrics were positive. Other regions

showed either positive or negative output gaps

depending on the capacity measure used, reflecting

the offsetting shocks hitting the economy.

From peaking in the second half of last year, the overall degree of capacity pressure has continued

to decline in Canterbury, both in absolute terms

and relative to the rest of the country. The September quarter showed declines for all three capacity metrics for Canterbury, with the overall output gap close to zero. In terms of the regional rankings Canterbury was 8th in

terms of activity output gaps, 2nd in term of labour

utilisation gaps and 13th for its capacity utilisation

gap to be 9th overall. As figure 4 suggests, the focal

point for inflationary pressure has shifted north,

with modest overall declines in overall output gaps

for upper North Island regions.

FIGURE 4. REGIONAL OUTPUT GAP AND HOUSING GROUP INFLATION

Source: ANZ, Statistics NZ

THE UPSHOT A number of common themes emerge:

The economy is still in a position of excess demand, but only just. All three capacity gaps are on the positive side of the ledger, which is

mostly the legacy of a strong pace of economic

expansion last year. But a slower economy in the

first half of the year has seen pressures on capacity

abate, with declines evident in capacity utilisation

and activity gaps.

The reduction of capacity pressure has been more evident in the South Island, although even here there are exceptions. Pressures on

capacity are more evident in upper North Island

centres relative to much of the rest of the country.

Core inflation remains low overall, but the focal

point has shifted from Canterbury further north.

Output gap estimates are historical and are starting to reflect the slowing in activity we have already

observed. Our focus, and that of the RBNZ, is on

growth momentum going forward. Our proprietary gauges have highlighted a pending improvement in growth prospects overall, although some regions are expected to benefit more than others.

-1.2

-1.0

-0.8

-0.6

-0.4

-0.2

0.0

0.2

0.4

0.6

NL AK WK BP GS HB TK MW WG NM WC CT OT SL NZ

Perc

enta

ge p

oin

ts

1

2

3

4

5

0.00 0.05 0.10 0.15 0.20 0.25 0.30 0.35

Output Gap (Percent of trend)

Annual change in H

ousin

g C

PI

NZ

Wgtn

Other NI

Other SI

Canty

Akl

SINI

-

ANZ Market Focus / 30 November 2015 / 8 of 18

INTEREST RATE STRATEGY

SUMMARY We continue to expect local markets to range trade

ahead of the RBNZ and FOMC decisions. The Fed

remains on track to hike in December; the RBA should

stand pat and maintain its easing bias; and the Bank of

Canada should also remain on hold this week.

However, later this week the ECB should follow through

on its rhetoric with further policy rate cuts and QE.

While the RBNZ could easily cut next week, our core

view is that improving signs on the local economic

outlook should be respected, seeing a pause – a view

that is notably out of consensus. New Zealand interest

rates have less upside potential than their US

counterparts, but are set to rise gradually even as the

NZ/US spread narrows.

THEMES Central banks to shape direction with decisions this

week from the RBA (tomorrow), the ECB and Bank

of Canada (Thursday NZDT), ahead of the RBNZ

and BOE (Dec 10) and the FOMC (Dec 17 NZDT).

The ECB looks set to add to policy stimulus, in contrast to circa 70% market odds of a December

Fed hike. These diverging policy biases look set to

add to volatility over coming weeks.

Here at home, a December OCR cut still looks a coin toss. Our core view remains that the RBNZ will

(should) not cut.

We still take issue with the tick-shaped yield curve. But markets are in no mood to test longer-term

RBNZ expectations ahead of the first Fed hike.

Last week’s solid NZGB tender was a reminder of the appeal of New Zealand rates in a low-rate

world. There remains scope for our spreads with

global yields to narrow, yet local longer-term yields

to drift higher still and the curve to steepen.

PREFERRED STRATEGIES – INVESTORS KEY VIEWS – FOR INVESTORS

GAUGE DIRECTION COMMENT

Duration Neutral Low likely in. More about

spreads and curves.

2s10s Curve Steeper Short end biased lower with

OCR; long end following US.

Geographic

10yr spread Narrower

Divergent policy argues for

narrowing. NZ tends to

outperform on a sell-off.

Swap

spreads Neutral/wider Market poorly positioned.

“CHILL OUT” OVER SUMMER Global and local yields have eased, with earlier

geopolitical tensions prompting safe-haven flows and a

bull-flattening of the curve. Local yields have followed

suit, with larger falls for longer-term rates. Market odds

of an OCR cut have edged up of late, with OIS market

pricing suggesting approximately a 58% chance of a

25bp cut. This is contrast to market expectations of a less than 10% chance of an RBA cut tomorrow. Last week, Governor Stevens reiterated the

case to remain on hold was one he “happened to agree

with”, and that the market should “chill out” over the

Christmas period and look at the data next year to

assess the case for rate cuts. A sub-trend Australian Q3

GDP report is expected in light of last week’s soft

capital expenditure report. Our view is that the RBA will

cut a further 50bps, but not until early next year. Later

this week should see the Bank of Canada leave rates

on hold, with the focus on how effective

accommodative monetary conditions have been at

cushioning the economy from the hit provided by low

commodity export prices. This is a theme that should

resonate with local markets.

Our core view remains that the RBNZ does not need to cut this month. The economy looks to be in stabilisation mode; confidence has picked up of late,

with the pace of economic activity set to follow. The

NZD TWI is nearly 2½% lower than it was at the time

of the October OCR Review, and projected falls in the

terms of trade are clearly not as sharp as a few months

ago. Interest rate-sensitive pockets of the economy are

responding, with the services and construction sectors

leading the way, and the fixed-rate mortgage roll-off

profile points to more effective easing in the pipeline.

We see strong case for keeping some powder dry and waiting to see how developments pan out (i.e. another CPI read, the TWI post Fed lift-off etc) before

moving. Despite the best efforts of the Fed in signalling

it will tread carefully, there is some uncertainty over

how currencies, commodities and broader asset prices

will react to the beginning of US policy normalisation.

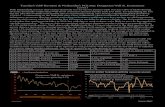

FIGURE 1. 12 MONTH AHEAD INTEREST RATE EXPECTATIONS

Source: ANZ, Bloomberg

Be that as it may, the December OCR decision looks to be a coin toss. If global developments sour this week and market pricing opens the door wider to

an OCR cut, the RBNZ may follow through given the

path of least resistance would be to go with the

-150

-125

-100

-75

-50

-25

0

25

50

75

100

125

150

Jun-12 Dec-12 Jun-13 Dec-13 Jun-14 Dec-14 Jun-15 Dec-15

RBNZ RBA

BPS

-

ANZ Market Focus / 30 November 2015 / 9 of 18

INTEREST RATE STRATEGY

market. As such, given the downward risk profile for

short-term rates, there is value to be had in receiving

on dips, with short-end (OIS and futures strip)

flatteners looking attractive. At the very least, we do not envisage short-end rates going up anytime soon. Indeed, there is the possibility that short-end rates move lower still. Looking beyond the question of

whether the RBNZ goes or not, we still take issue with

the tick-shaped yield curve that implicitly signals rate

hikes from H2 next year.

Policy divergence between the big two central banks – the ECB and Fed – is likely to be a cause of ongoing market volatility. Fed odds of a rate hike have been parked in the low-to-mid 70’s over the last

week. US data has been a little on the soft side of late,

with further signs of strengthening in the labour

market, modestly subdued signs for economic activity

but generally low inflation readings. This puts the

current situation in contrast to traditional tightening

cycles, when inflation picked up and the Fed had to

play catch-up.

Speeches by Evans, Brainard, Lockhart, Yellen,

Williams and Fischer, and the November ISM and

payroll reports will be closely watched, but we see little

potential for them to cause the Fed to deviate from its

signalled intent to move reasonably soon – but

gradually. Meanwhile, despite generally solid data of

late, there has been a chorus of downbeat ECB

comments on the Eurozone activity and inflation

outlook – last week it was ECB Vice President Victor

Constancio’s turn – which have reinforced market

expectations of further policy accommodation at this

week’s ECB meeting. Markets are expecting a further

15-20bps of deposit rate cuts and further QE.

FIGURE 2. NZ SWAP AND TREASURY YIELDS

Source: ANZ, Bloomberg

What does this mean for longer-term local yields? There is scope for further widening between US and Eurozone rates, although local rates have

historically taken their cues more from the US. We also

note that historically, local yields have outperformed

US ones at the start of a Fed tightening cycle (i.e.

spreads have narrowed) and we expect this to be the

case this time around also. Of late swaps have

outperformed government bonds, both here and

abroad. However, last week’s strong NZGB tender was a reminder that our best-in-class yields remain a magnet to offshore investors. This should contribute to further widening in local swap spreads

and a narrowing relative to global bond yields. Despite

this, local long-term yields are still expected to be

biased higher, which should see the curve steepen.

PREFERRED STRATEGIES – BORROWERS With New Zealand long-term rates looking likely to have troughed, borrowers may wish to consider adding to long-term hedges. However, floating is historically cheap, and short-term rates could

well fall further. As such, the key is to strike the right

balance between fixed and floating. With term rates set

to rise, we now see merit in wading in now to cover

long-term hedge requirements.

KEY VIEWS – FOR BORROWERS GAUGE VIEW COMMENT

Hedge ratio Majority

hedged

Could also add to cover via

options, or as part of a highly

disciplined strategy.

Value Cheap Look to be close to the trough.

Uncertainty Elevated The key reason for caution.

MARKET EXPECTATIONS A 25bp OCR cut in December is just under 60% priced,

with the OCR projected to bottom under 2.40% in Q3

next year. This is close to our core view and is

consistent with the (modestly downward) skew of the

risk profile. Not only is the OCR still likely to head

lower, there is little on the horizon to suggest it will be

going up anytime soon. A slow and gradual pace of

normalisation for local rates should help to temper the

climb in longer-term yields.

FIGURE 3. ANZ OCR FORECAST VERSUS MARKET-IMPLIED FORWARD 3MTH BILL RATES AND RBNZ 90-DAY BILL PROJECTIONS

Source: ANZ, Bloomberg

1.0

1.5

2.0

2.5

3.0

3.5

4.0

2.75

3.25

3.75

4.25

4.75

5.25

Jun-10 Jun-11 Jun-12 Jun-13 Jun-14 Jun-15

NZ 5 year (LHS) US 10 year (RHS)

%%

2.25

2.50

2.75

3.00

3.25

3.50

3.75

4.00

Nov 15 May 16 Nov 16 May 17 Nov 17 May 18

Rate

(%

)

ANZ's 90-Day Rate Forecasts

Market implied forward 3mth bill rates

RBNZ 90 day bill projections (Sep 2015 MPS)

-

ANZ Market Focus / 30 November 2015 / 10 of 18

CURRENCY STRATEGY

SUMMARY This week is not about NZD; instead EUR and USD

will dominate. We expect NZD/EUR strength as the

ECB boosts easing, although we acknowledge the

risks of a brief positioning-related dip. NZD/USD

remains on an overall declining trend, but we expect

there to be opportunities for both importers and

exporters this week; US rate hike expectations are

firming but NZ data is too, leaving directional signals

mixed. NZD/AUD is in the buy zone and the RBA and

Australian Q3 GDP should reinforce this view.

TABLE 1: KEY VIEWS CROSS WEEK MONTH YEAR

NZD/USD ↓↑ Entering a volatile period.

USD to strengthen

NZD/AUD ↑ Fairly valued Consolidating NZD/EUR ↔/↑ EUR data vs ECB EUR capped NZD/GBP ↔ UK wages key GBP resurgence NZD/JPY ↔ Risks lower Yen weakness

THEMES AND RISKS Markets are expecting the ECB to cut rates

further into negative territory and increase the

QE programme; NZD/EUR should lift overall, but

positioning warns on the short-term.

US data before the December Fed ‘lift-off’ is expected to support USD.

The RBA outlook, AU Q3 GDP, and retail sales ensure AUD will remain capped.

NZD should find support on better data.

TABLE 2: KEY UPCOMING EVENT RISK

EVENT WHEN (NZDT) IMPACT

RISK USD Chicago PM Tue 03:45 NZD/USD ↓ NZD Q3 Terms of Trade Tue 10:45 NZD ↓ AUD Q3 Current account Tue 13:30 NZD/AUD ↔/↓ CNY Official PMIs Tue 14:00 NZD ↑ AUD RBA Tue 16:30 NZD/AUD ↔ GBP BoE FSR Tue 20:00 NZD/GBP ↔/↓ GBP Markit PMI Tue 22:30 NZD/GBP ↓ NZD GDT auction Wed am NZD/USD ↑ USD ISM Wed 04:00 NZD/USD ↑ AUD RBA Stevens Wed 12:30 NZD/AUD ↔/↓ NZD ANZ commodity prices Wed 13:00 NZD

AUD Q3 GDP Wed 13:30 NZD/AUD ↑ EUR Nov CPI Wed 23:00 NZD/EUR ↑ USD Fed Yellen Thu 06:25 NZD/USD ↔/↑ USD Fed Beige book Thu 08:00 NZD/USD ↓ AUD Trade balance Thu 13:30 NZD/AUD ↓ GBP Services PMI Thu 22:30 NZD/GBP ↓ EUR ECB Fri 01:45 NZD/EUR ↓ USD ISM (non-mfg) Fri 04:00 NZD/USD ↓ USD Fed Yellen Fri 04:00 NZD/USD ↔/↑ AUD Retail sales Fri 13:30 NZD/AUD ↓ USD Nonfarm Payrolls Sat 02:30 NZD/USD ↑

EXPORTERS’ STRATEGY Hedging at or below 0.65 looks prudent, with the use

of options particularly so. NZD/AUD at or under

0.9050 also looks attractive for hedging.

IMPORTERS’ STRATEGY Times of overt NZD strength should be used to extend

hedging, both in duration and size.

DATA PULSE NZD oscillated driven by external data. The New Zealand trade deficit was less than expected, but the

decline in import demand gives NZD warning. Building

permits rebounded, with the overall trend higher. ANZ

business confidence continued to lift, supporting NZD.

AUD found some support after RBA Stevens said markets should “chill out” until after Christmas.

However, the Q3 capital expenditure survey was much

weaker than expected and the soft outlook is symbolic

of the downside risks that remain for AUD.

The USD consolidated as data slowed on balance. The second read of Q3 GDP improved, durable goods

and the Markit Service PMI were better than expected.

But, consumer confidence and Michigan confidence

weakened, the Markit manufacturing PMI and

Richmond Fed declined against expectations for an

increase, and Black Friday sales were lower than 2014.

The EUR remained capped despite stronger German IFO and wider EU confidence results. News of a

possible two-tier system for interest rates capped EUR.

GBP weakened following EUR despite an optimistic autumn fiscal statement, which revealed strong tax

receipts and reversed planned fiscal tightening. The

second read of Q3 GDP was solid with strong details.

TABLE 3: NZD VS AUD: MONTHLY GAUGES GAUGE GUIDE COMMENT

Fair value ↔ FV is above long-run averages. Yield ↔/↑ Pricing inconsistent vs ANZ view Commodities ↔/↑ Milk more resilient than iron ore Data ↔/↑ NZ data still supportive Techs ↔/↑ Lower-range Sentiment ↔ Equivalent reaction functions. Other ↔/↓ Headline AUD employment strong On balance ↔/↑ At the start of the buy zone.

TABLE 4: NZD VS USD: MONTHLY GAUGES GAUGE GUIDE COMMENT

Fair value ↔ Closer to fair value. Yield ↔/↑ Yield advantage still present. Commodities ↓ Commodity markets warning. Risk aversion ↔/↓ Vol of vol still high. Data ↔/↑ US data is softening Techs ↔/↑ Sitting on pivot. Other ↑ USD positioning is at risk.

On balance ↔/↓ Overall skew of risks is still lower.

-

ANZ Market Focus / 30 November 2015 / 11 of 18

CURRENCY STRATEGY

TECHNICAL OUTLOOK FIGURE 1. NZD/USD DAILY CANDLES WITH RSI & MA

NZD/USD continues to build a pattern of consolidation. The 55 and 100dma remain pivotal as does the area just below 0.65. The failure to test too

much higher than the prior week does suggest this

cross will continue to track sideways.

FIGURE 2. NZD/AUD DAILY CANDLES WITH RSI & MA

NZD/AUD remains in the lower half of a broader range where it has traded since the beginning of 2014. Tests lower from here – especially below 0.90 – look like longer term buying opportunities, we also

note (non-technically) that forward points are in NZD’s

favour, so the bottom half of this broader range should

be favoured. Major support lies around the 0.89 level

and below, with final support below 0.88.

TABLE 5: KEY TECHNICAL ZONES CROSS SUPPORT RESISTANCE

NZD/USD 0.6400 – 0.6420

0.6330 – 0.6350

0.6750 – 0.6780

0.6880 – 0.6930

NZD/AUD 0.9000 – 0.9040

0.8910 – 0.8950

0.9320 – 0.9360

0.9480 – 0.9520

NZD/EUR 0.5800 – 0.5850 0.6280 – 0.6330

NZD/GBP 0.4170 – 0.4200 0.4550 – 0.4600

NZD/JPY 78.80 – 79.20

75.00 – 75.50

82.80 – 83.30 84.50 – 85.00

POSITIONING Due to the US holidays, positioning data has not been

published as yet. Anecdotes suggest markets remain

short EUR and long USD and are relatively neutral

NZD.

GLOBAL VIEWS Markets are priced for another 15bps of easing from

the ECB (taking the deposit rate to -35bps) and have a

70% probability of a 25bp increase from the Fed.

Divergence in the world’s two largest economic areas

(the combined European Union ranks above the US in

nominal GDP according to the IMF and World Bank) is

significant and will drive trends in currency markets.

We expect this divergence to help to ease the coming

USD liquidity withdrawal by providing an alternative

source of liquidity. However, with USD still the pre-

eminent source of liquidity and the strength of the

USD likely to continue, the Fed actions are more

important than the ECB’s actions. USD liquidity

withdrawal could cause stress in ASEAN currencies,

and thus their ability to purchase New Zealand

exports, which would translate into a weaker NZD.

EUR is likely to remain under pressure as the

increased liquidity provided by the ECB offsets the

demand for EUR’s and the cheap funding available in

EUR should ensure markets raise EUR’s for funding.

FORWARDS: CARRY AND BASIS FIGURE 3. NZD/USD SHORT BASIS CURVE

Basis has moved lower over the last week, but forward

markets are relatively quiet displaying a lack of

liquidity. With ANZ’s view of a December hold B/S two

month looks attractive on an outright basis.

FIGURE 4. RELATIVE ATTRACTION OF THE FWD CURVE

Source: ANZ, Bloomberg, Reuters

-10

-5

0

5

10

15

O/N 2m 4m 6m 8m 10m 12m

Basis

MonthsBasis Last Week

0.95

1.00

1.05

1.10

O/N 1m 2m 3m 4m 5m 6m 7m 8m 9m 10m 11m 12m

Rela

tive V

alu

e

MonthsRelative Value Last Week

-

ANZ Market Focus / 30 November 2015 / 12 of 18

DATA EVENT CALENDAR

DATE COUNTRY DATA/EVENT MKT. LAST NZ TIME

30-Nov AU Private Sector Credit MoM - Oct 0.6% 0.8% 13:30

AU Private Sector Credit YoY - Oct 6.6% 6.7% 13:30

NZ Money Supply M3 YoY - Oct -- 8.5% 15:00

GE Retail Sales MoM - Oct 0.4% 0.0% 20:00

GE Retail Sales YoY - Oct 2.9% 3.4% 20:00

UK Net Consumer Credit - Oct £1.3B £1.3B 22:30

UK Net Lending Sec. on Dwellings - Oct £3.4B £3.6B 22:30

UK Mortgage Approvals - Oct 69.9k 68.9k 22:30

UK Money Supply M4 MoM - Oct -- -1.0% 22:30

UK M4 Money Supply YoY - Oct -- -0.6% 22:30

UK M4 Ex IOFCs 3M Annualised - Oct 3.0% 4.0% 22:30

1-Dec GE CPI MoM - Nov P 0.1% 0.0% 02:00

GE CPI YoY - Nov P 0.4% 0.3% 02:00

GE CPI EU Harmonized MoM - Nov P 0.1% 0.0% 02:00

GE CPI EU Harmonized YoY - Nov P 0.3% 0.2% 02:00

US ISM Milwaukee - Nov 48.00 46.66 03:00

US Chicago Purchasing Manager - Nov 54 56.2 03:45

US Pending Home Sales MoM - Oct 1.0% -2.3% 04:00

US Pending Home Sales NSA YoY - Oct 4.5% 2.5% 04:00

US Dallas Fed Manf. Activity - Nov -10 -12.7 04:30

NZ Terms of Trade Index QoQ - Q3 -2.6% 1.3% 10:45

AU ANZ-RM Consumer Confidence Index - 29-Nov -- 114.5 11:30

AU AiG Perf of Mfg Index - Nov -- 50.2 11:30

NZ QV House Prices YoY - Nov -- 14.0% 12:00

AU BoP Current Account Balance - Q3 -16.5B -19.0B 13:30

AU Building Approvals MoM - Oct -2.5% 2.2% 13:30

AU Building Approvals YoY - Oct 5.7% 21.4% 13:30

CH Manufacturing PMI - Nov 49.9 49.8 14:00

CH Non-manufacturing PMI - Nov -- 53.1 14:00

CH Caixin PMI Mfg - Nov 48.3 48.3 14:45

CH Caixin PMI Composite - Nov -- 49.9 14:45

CH Caixin PMI Services - Nov -- 52 14:45

AU RBA Cash Rate Target - Dec 2.0% 2.0% 16:30

AU Commodity Index AUD - Nov -- 79.1 18:30

AU Commodity Index YoY - Nov -- -19.80% 18:30

GE Unemployment Change (000's) - Nov -5k -5k 21:55

GE Unemployment Claims Rate SA - Nov 6.4% 6.4% 21:55

GE Markit/BME Manufacturing PMI - Nov F 52.6 52.6 21:55

EC Markit Manufacturing PMI - Nov F 52.8 52.8 22:00

UK Markit PMI Manufacturing SA - Nov 53.6 55.5 22:30

EC Unemployment Rate - Oct 10.8% 10.8% 23:00

2-Dec US Markit Manufacturing PMI - Nov F 52.6 52.6 03:45

US Construction Spending MoM - Oct 0.6% 0.6% 04:00

US ISM Manufacturing - Nov 50.5 50.1 04:00

US ISM Prices Paid - Nov 40 39 04:00

NZ ANZ Commodity Price - Nov -- 6.9% 13:00

AU GDP SA QoQ - Q3 0.7% 0.2% 13:30

AU GDP YoY - Q3 2.3% 2.0% 13:30

Continued on following page

-

ANZ Market Focus / 30 November 2015 / 13 of 18

DATA EVENT CALENDAR

DATE COUNTRY DATA/EVENT MKT. LAST NZ TIME

2-Dec UK Markit/CIPS Construction PMI - Nov 58.5 58.8 22:30

EC PPI MoM - Oct -0.4% -0.3% 23:00

EC PPI YoY - Oct -3.2% -3.1% 23:00

EC CPI Estimate YoY - Nov 0.2% 0.1% 23:00

EC CPI Core YoY - Nov A 1.1% 1.1% 23:00

3-Dec US MBA Mortgage Applications - 27-Nov -- -3.2% 01:00

US ADP Employment Change - Nov 190k 182k 02:15

US Nonfarm Productivity - Q3 F 2.2% 1.6% 02:30

US Unit Labor Costs - Q3 F 1.0% 1.4% 02:30

US ISM New York - Nov -- 65.8 03:45

US Federal Reserve releases Beige Book -- -- 08:00

NZ Value of All Buildings SA QoQ - Q3 1.8% 1.6% 10:45

AU AiG Perf of Services Index - Nov -- 48.9 11:30

AU Trade Balance - Oct -2600m -2317m 13:30

GE Markit Services PMI - Nov F 55.6 55.6 21:55

GE Markit/BME Composite PMI - Nov F 54.9 54.9 21:55

EC Markit Services PMI - Nov F 54.6 54.6 22:00

EC Markit Services PMI - Nov F 54.6 54.6 22:00

EC Markit Composite PMI - Nov F 54.4 54.4 22:00

UK Official Reserves Changes - Nov -- $16M 22:30

UK Markit/CIPS Services PMI - Nov 55 54.9 22:30

UK Markit/CIPS Composite PMI - Nov 55 55.4 22:30

EC Retail Sales MoM - Oct 0.2% -0.1% 23:00

EC Retail Sales YoY - Oct 2.6% 2.9% 23:00

4-Dec EC ECB Main Refinancing Rate - Dec 0.1% 0.1% 01:45

EC ECB Deposit Facility Rate - Dec -0.3% -0.2% 01:45

EC ECB Marginal Lending Facility - Dec 0.3% 0.3% 01:45

US Initial Jobless Claims - 28-Nov 270k 260k 02:30

US Continuing Claims - 21-Nov 2188k 2207k 02:30

US Markit Composite PMI - Nov F -- 56.1 03:45

US Markit Services PMI - Nov F 56.7 56.5 03:45

US ISM Non-Manf. Composite - Nov 58 59.1 04:00

US Factory Orders - Oct 1.4% -1.0% 04:00

US Durable Goods Orders - Oct F -- 3.0% 04:00

US Durables Ex Transportation - Oct F -- 0.5% 04:00

US Cap Goods Orders Nondef Ex Air - Oct F -- 1.3% 04:00

US Cap Goods Ship Nondef Ex Air - Oct F -- -0.4% 04:00

AU Retail Sales MoM - Oct 0.4% 0.4% 13:30

GE Factory Orders MoM - Oct 1.2% -1.7% 20:00

GE Markit Construction PMI - Nov -- 51.8 21:30

GE Markit Retail PMI - Nov -- 52.4 22:10

EC Markit Retail PMI - Nov -- 51.3 22:10

5-Dec US Change in Nonfarm Payrolls - Nov 200k 271k 02:30

US Unemployment Rate - Nov 5.0% 5.0% 02:30

US Average Hourly Earnings MoM - Nov 0.2% 0.4% 02:30

US Average Hourly Earnings YoY - Nov 2.3% 2.5% 02:30

US Trade Balance - Oct -$40.50B -$40.81B 02:30

Key: AU: Australia, EC: Eurozone, GE: Germany, JN: Japan, NZ: New Zealand, UK: United Kingdom, US: United States, CH: China. Source: Dow Jones, Reuters, Bloomberg, ANZ Bank New Zealand Limited. All $ values in local currency. Note: All surveys are preliminary and subject to change

-

ANZ Market Focus / 30 November 2015 / 14 of 18

LOCAL DATA WATCH

Domestic activity is showing signs of reaccelerating after slowing below trend. Low domestic inflation will keep future

OCR moves biased to the downside, although we expect the RBNZ to remain on hold until March 2016.

DATE DATA/EVENT ECONOMIC SIGNAL COMMENT

Mon 30 Nov

(3:00pm) RBNZ Credit Aggregates LVR impact?

Credit growth is running at a faster pace than income growth.

We will be watching for an impact of new LVR restrictions.

Tue 1 Dec

(10:45am)

Overseas Trade Indexes –

Q3 Down

While export and import prices should be higher (due to the

lower NZD), the terms of trade should have fallen around 3%.

Tue 1 Dec

(12:00pm) QV House Prices – Nov Regional focus

The Auckland market is peaking, but regions are now

strengthening.

Wed 2 Dec

(early am) GlobalDairyTrade Auction Consolidating

The fundamental backdrop is not conducive to a meaningful

recovery in prices despite recent lifts in NZX futures prices.

Wed 2 Dec

(1:00pm)

ANZ Commodity Price

Index – Nov -- --

Thu 3 Dec

(10:45am)

Building Work Put in Place –

Q3 Solid

Consents data suggest a reasonable lift in residential building

work, although non-residential work may retrace a touch.

Tue 8 Dec

(10:00am) ANZ Truckometer – Nov -- --

Tue 8 Dec

(10:00am)

Government Financial

Statements – Oct A few headwinds

While still ahead of Budget forecasts, we suspect a few more

headwinds will see that gap close further.

Tue 8 Dec

(10:45am)

Economic Survey of

Manufacturing – Q3 Modest lift

Weaker meat & dairy production to be offset by higher core

volumes, with the latter linked to rising construction activity.

Tue 8 Dec

(1:00pm)

ANZ Monthly Inflation

Gauge – Nov -- --

9 Dec Fonterra Board meeting Status quo While spot prices imply downside risk to Fonterra’s $4.60/kg MS

milk price forecast, we expect it to maintain it for now.

10-14 Dec REINZ Housing Statistics –

Nov

Regional

divergence

Auckland has cooled, but many other regions are experienced

strong activity levels.

Thu 10 Dec

(9:00am)

RBNZ Monetary Policy Statement Pause

We expect the RBNZ will “watch and wait” a little longer,

maintaining the OCR at 2.75%.

Thu 10 Dec

(10:45am)

Electronic Card

Transactions – Nov Modest

There are a number of offsetting forces. However, softer income

growth should win out, resulting in modest spending growth.

Fri 11 Dec

(10:30am)

BNZ-Business NZ

Manufacturing PMI – Nov Offsetting forces

Despite dairy sector strains and a fickle global scene, a lower

NZD and solid domestic demand are supporting activity.

Fri 11 Dec

(10:45am) Food Price Index – Nov Flat to down

Prices should be flat to down, driven by seasonal falls in fruit

and vegetable prices.

Fri 11 Dec

(1:00pm)

ANZ-Roy Morgan Consumer

Confidence – Dec -- --

Mon 14 Dec

(10:30am)

BNZ-Business NZ Services

PSI – Nov Outperforming

Low interest rates, a high net migration inflow and housing

market strength are supporting services sector activity.

Tue 15 Dec

(1:00pm)

Half-Year Economic and

Fiscal Update Tight

Ongoing fiscal improvement will be forecast, but given low

nominal growth, there is likely to be little room to work with.

Wed 16 Dec

(10:45am) Balance of Payments – Q3 Wider

A larger trade deficit should contribute to a further widening in

the current account deficit.

Thu 17 Dec

(10:45am) GDP – Q3 Improving

We expect an improved pace of quarterly activity growth versus

the subdued pace experienced over the first half of the year.

Fri 18 Dec

(10:00am) ANZ Job Ads – Nov -- --

Fri 18 Dec

(1:00pm)

ANZ Business Outlook –

Dec -- --

Mon 21 Dec

(10:45am)

International Travel &

Migration – Nov No turn yet

Despite a softer labour market, net inflows have accelerated

over recent months. Strong net inflows should continue.

Wed 23 Dec

(10:45am)

Overseas Merchandise

Trade – Nov Deterioration

Deterioration remains a key theme of the trade balance outlook,

although we expect the pace of that deterioration to slow.

On balance Data watch Improvement is evident, with risks. Inflation is low.

-

ANZ Market Focus / 30 November 2015 / 15 of 18

KEY FORECASTS AND RATES

Jun-15 Sep-15 Dec-15 Mar-16 Jun-16 Sep-16 Dec-16 Mar-17 Jun-17 Sep-17

GDP (% qoq) 0.4 0.5 0.5 0.5 0.6 0.7 0.7 0.7 0.7 0.6

GDP (% yoy) 2.4 2.0 1.7 1.9 2.1 2.3 2.5 2.7 2.8 2.7

CPI (% qoq) 0.4 0.3 -0.2 0.5 0.4 0.5 0.2 0.6 0.4 0.7

CPI (% yoy) 0.4 0.4 0.4 1.1 1.0 1.2 1.6 1.7 1.7 1.9

Employment

(% qoq) 0.1 -0.4 0.2 0.2 0.3 0.3 0.3 0.4 0.4 0.4

Employment

(% yoy) 3.0 1.5 0.5 0.1 0.3 1.0 1.1 1.4 1.4 1.6

Unemployment Rate

(% sa) 5.9 6.0 6.2 6.3 6.2 6.2 6.1 6.0 5.8 5.6

Current Account

(% GDP) -3.5 -3.8 -4.4 -5.3 -6.0 -6.2 -6.0 -5.8 -5.6 -5.6

Terms of Trade

(% qoq) 1.3 -7.9 -5.1 0.2 3.6 1.6 0.1 0.1 0.2 0.0

Terms of Trade

(% yoy) -4.4 -7.8 -10.4 -11.3 -9.3 0.1 5.6 5.5 2.0 0.3

Feb-15 Mar-15 Apr-15 May-15 Jun-15 Jul-15 Aug-15 Sep-15 Oct-15 Nov-15

Retail ECT (% mom) 1.0 0.7 -0.6 1.2 0.5 0.4 0.4 0.9 0.0 --

Retail ECT (% yoy) 4.0 3.7 3.9 3.2 5.0 5.6 4.2 6.1 5.6 --

Credit Card Billings

(% mom) 0.1 0.7 0.1 1.8 0.3 1.8 1.4 -1.9 -- --

Credit Card Billings

(% yoy) 5.8 5.4 7.2 7.3 6.7 9.8 10.4 7.3 -- --

Car Registrations

(% mom) -0.2 2.5 -1.4 -0.2 5.4 0.5 -2.1 0.2 -1.4 --

Car Registrations

(% yoy) 12.1 11.8 11.2 6.8 11.2 10.7 7.8 5.0 3.8 --

Building Consents

(% mom) -5.6 10.7 -1.6 0.7 -3.6 20.0 -5.3 -5.7 5.1 --

Building Consents

(% yoy) -0.4 7.6 2.6 6.6 -4.0 21.7 12.0 17.2 14.2 --

REINZ House Price

Index (% yoy) 7.1 8.5 9.3 11.8 14.8 14.9 17.3 20.1 14.1 --

Household Lending

Growth (% mom) 0.5 0.5 0.5 0.6 0.6 0.7 0.6 0.7 -- --

Household Lending

Growth (% yoy) 4.9 5.0 5.2 5.5 5.6 6.0 6.3 6.7 -- --

ANZ Roy Morgan

Consumer Conf. 124.0 124.6 128.8 123.9 119.9 113.9 109.8 110.8 114.9 122.7

ANZ Business

Confidence 34.4 35.8 30.2 15.7 -2.3 -15.3 -29.1 -18.9 10.5 14.6

ANZ Own Activity

Outlook 40.9 42.2 41.3 32.6 23.6 19.0 12.2 16.7 23.7 32.0

Trade Balance ($m) 84 661 184 367 -182 -730 -1087 -1140 -963 --

Trade Bal ($m ann) 51172 51287 51298 50976 51371 51643 52446 52287 52178 --

ANZ World Commodity

Price Index (% mom) 4.2 4.6 -7.4 -4.8 -3.1 -5.5 -5.2 5.5 6.9 --

ANZ World Comm.

Price Index (% yoy) -15.8 -11.9 -15.3 -18.0 -19.7 -22.1 -23.5 -18.2 -11.8 --

Net Migration (sa) 4840 5020 4820 5140 4920 5740 5510 5600 6210 --

Net Migration (ann) 55121 56275 56813 57822 58259 59639 60290 61234 62477 --

ANZ Heavy Traffic

Index (% mom) -0.5 -0.5 -0.4 -1.1 1.9 -0.1 -0.3 1.8 0.9 --

ANZ Light Traffic

Index (% mom) 0.6 -0.2 0.1 -0.5 0.9 -1.0 -0.5 2.6 -0.3 --

Figures in bold are forecasts. mom: Month-on-Month qoq: Quarter-on-Quarter yoy: Year-on-Year

-

ANZ Market Focus / 30 November 2015 / 16 of 18

KEY FORECASTS AND RATES

ACTUAL FORECAST (END MONTH)

FX RATES Sep-15 Oct-15 Today Dec-15 Mar-16 Jun-16 Sep-16 Dec-16 Mar-17 Jun-17

NZD/USD 0.638 0.678 0.652 0.65 0.62 0.60 0.59 0.59 0.59 0.59

NZD/AUD 0.908 0.950 0.908 0.97 0.95 0.94 0.92 0.92 0.92 0.92

NZD/EUR 0.569 0.616 0.617 0.62 0.58 0.56 0.53 0.51 0.51 0.51

NZD/JPY 76.76 81.76 80.13 78.0 72.5 69.0 67.9 67.9 66.1 64.9

NZD/GBP 0.420 0.439 0.434 0.42 0.39 0.38 0.37 0.36 0.36 0.36

NZ$ TWI 68.5 72.9 71.1 71.7 68.3 65.9 64.0 63.3 63.1 62.9

INTEREST RATES Sep-15 Oct-15 Today Dec-15 Mar-16 Jun-16 Sep-16 Dec-16 Mar-17 Jun-17

NZ OCR 2.75 2.75 2.75 2.75 2.50 2.50 2.50 2.50 2.75 3.25

NZ 90 day bill 2.84 2.96 2.83 2.90 2.60 2.60 2.70 2.70 3.10 3.40

NZ 10-yr bond 3.28 3.30 3.53 3.60 3.70 3.70 3.70 3.70 3.70 3.70

US Fed funds 0.25 0.25 0.25 0.50 0.75 1.00 1.25 1.25 1.25 1.25

US 3-mth 0.33 0.33 0.41 0.66 0.91 1.16 1.33 1.33 1.33 1.33

AU Cash Rate 2.00 2.00 2.00 2.00 1.75 1.50 1.50 1.50 1.50 1.50

AU 3-mth 2.18 2.11 2.27 2.20 2.20 2.20 2.20 2.20 2.30 2.30

27 Oct 23 Nov 24 Nov 25 Nov 26 Nov 27 Nov

Official Cash Rate 2.75 2.75 2.75 2.75 2.75 2.75

90 day bank bill 2.87 2.87 2.86 2.88 2.87 2.87

NZGB 12/17 2.59 2.72 2.72 2.73 2.71 2.73

NZGB 03/19 2.71 2.88 2.88 2.89 2.87 2.90

NZGB 04/23 3.31 3.56 3.56 3.59 3.57 3.60

NZGB 04/27 3.61 3.91 3.91 3.95 3.92 3.95

2 year swap 2.74 2.73 2.73 2.72 2.72 2.71

5 year swap 2.91 2.95 2.95 2.96 2.95 2.95

RBNZ TWI 73.5 70.62 70.73 71.11 71.36 71.01

NZD/USD 0.6845 0.65 0.65 0.65 0.66 0.65

NZD/AUD 0.9441 0.91 0.91 0.91 0.92 0.91

NZD/JPY 82.61 79.70 79.78 80.41 81.00 80.26

NZD/GBP 0.4442 0.43 0.43 0.43 0.43 0.43

NZD/EUR 0.6157 0.61 0.61 0.61 0.61 0.61

AUD/USD 0.7250 0.71 0.71 0.72 0.72 0.72

EUR/USD 1.1118 1.07 1.06 1.07 1.07 1.06

USD/JPY 120.69 123.40 123.41 123.23 122.92 123.16

GBP/USD 1.5410 1.52 1.52 1.53 1.53 1.52

Oil (US$/bbl) 44.90 41.68 40.73 40.75 40.55 39.39

Gold (US$/oz) 1169.09 1082.35 1066.80 1076.60 1083.80 1071.00

Electricity (Haywards) 5.65 6.38 6.18 6.51 6.32 7.19

Baltic Dry Freight Index 739 516 528 546 562 581

Milk futures (USD) 44 43 44 44 -- 43

-

ANZ Market Focus / 30 November 2015 / 17 of 18

IMPORTANT NOTICE

The distribution of this document or streaming of this video broadcast (as applicable, “publication”) may be restricted by law in certain jurisdictions. Persons who receive this publication must inform themselves about and observe all relevant restrictions.

1. Disclaimer for all jurisdictions, where content is authored by ANZ Research: Except if otherwise specified in section 2 below, this publication is issued and distributed in your country/region by Australia and New Zealand Banking Group Limited (ABN 11 005 357 522) (“ANZ”), on the basis that it is only for the information of the specified recipient or permitted user of the relevant website (collectively, “recipient”). This publication may not be reproduced, distributed or published by any recipient for any purpose. It is general information and has been prepared without taking into account the objectives, financial situation or needs of any person. Nothing in this publication is intended to be an offer to sell, or a solicitation of an offer to buy, any product, instrument or investment, to effect any transaction or to conclude any legal act of any kind. If, despite the foregoing, any services or products referred to in this publication are deemed to be offered in the jurisdiction in which this publication is received or accessed, no such service or product is intended for nor available to persons resident in that jurisdiction if it would be contradictory to local law or regulation. Such local laws, regulations and other limitations always apply with non-exclusive jurisdiction of local courts. Certain financial products may be subject to mandatory clearing, regulatory reporting and/or other related obligations. These obligations may vary by jurisdiction and be subject to frequent amendment. Before making an investment decision, recipients should seek independent financial, legal, tax and other relevant advice having regard to their particular circumstances. The views and recommendations expressed in this publication are the author’s. They are based on information known by the author and on sources which the author believes to be reliable, but may involve material elements of subjective judgement and analysis. Unless specifically stated otherwise: they are current on the date of this publication and are subject to change without notice; and, all price information is indicative only. Any of the views and recommendations which comprise estimates, forecasts or other projections, are subject to significant uncertainties and contingencies that cannot reasonably be anticipated. On this basis, such views and recommendations may not always be achieved or prove to be correct. Indications of past performance in this publication will not necessarily be repeated in the future. No representation is being made that any investment will or is likely to achieve profits or losses similar to those achieved in the past, or that significant losses will be avoided. Additionally, this publication may contain ‘forward looking statements’. Actual events or results or actual performance may differ materially from those reflected or contemplated in such forward looking statements. All investments entail a risk and may result in both profits and losses. Foreign currency rates of exchange may adversely affect the value, price or income of any products or services described in this publication. The products and services described in this publication are not suitable for all investors, and transacting in these products or services may be considered risky. ANZ and its related bodies corporate and affiliates, and the officers, employees, contractors and agents of each of them (including the author) (“Affiliates”), do not make any representation as to the accuracy, completeness or currency of the views or recommendations expressed in this publication. Neither ANZ nor its Affiliates accept any responsibility to inform you of any matter that subsequently comes to their notice, which may affect the accuracy, completeness or currency of the information in this publication. Except as required by law, and only to the extent so required: neither ANZ nor its Affiliates warrant or guarantee the performance of any of the products or services described in this publication or any return on any associated investment; and, ANZ and its Affiliates expressly disclaim any responsibility and shall not be liable for any loss, damage, claim, liability, proceedings, cost or expense (“Liability”) arising directly or indirectly and whether in tort (including negligence), contract, equity or otherwise out of or in connection with this publication. If this publication has been distributed by electronic transmission, such as e-mail, then such transmission cannot be guaranteed to be secure or error-free as information could be intercepted, corrupted, lost, destroyed, arrive late or incomplete, or contain viruses. ANZ and its Affiliates do not accept any Liability as a result of electronic transmission of this publication. ANZ and its Affiliates may have an interest in the subject matter of this publication as follows: They may receive fees from customers for dealing in the products or services described in this publication, and their staff and introducers

of business may share in such fees or receive a bonus that may be influenced by total sales. They or their customers may have or have had interests or long or short positions in the products or services described in this

publication, and may at any time make purchases and/or sales in them as principal or agent. They may act or have acted as market-maker in products described in this publication. ANZ and its Affiliates may rely on information barriers and other arrangements to control the flow of information contained in one or more business areas within ANZ or within its Affiliates into other business areas of ANZ or of its Affiliates. Please contact your ANZ point of contact with any questions about this publication including for further information on these disclosures of interest.

2. Country/region specific information: Australia. This publication is distributed in Australia by ANZ. ANZ holds an Australian Financial Services licence no. 234527. A copy of ANZ's Financial Services Guide is available at http://www.anz.com/documents/AU/aboutANZ/FinancialServicesGuide.pdf and is available upon request from your ANZ point of contact. If trading strategies or recommendations are included in this publication, they are solely for the information of ‘wholesale clients’ (as defined in section 761G of the Corporations Act 2001 Cth). Persons who receive this publication must inform themselves about and observe all relevant restrictions. Brazil. This publication is distributed in Brazil by ANZ on a cross border basis and only following request by the recipient. No securities are being offered or sold in Brazil under this publication, and no securities have been and will not be registered with the Securities Commission – CVM. Brunei. Japan. Kuwait. Malaysia. Switzerland. Taiwan. This publication is distributed in each of Brunei, Japan, Kuwait, Malaysia, Switzerland and Taiwan by ANZ on a cross-border basis. Cambodia. APS222 Disclosure. The recipient acknowledges that although ANZ Royal Bank (Cambodia) Ltd. is a subsidiary of ANZ, it is a separate entity to ANZ and the obligations of ANZ Royal Bank (Cambodia) Ltd. do not constitute deposits or other liabilities of ANZ and ANZ is not required to meet the obligations of ANZ Royal Bank (Cambodia) Ltd. European Economic Area (“EEA”): United Kingdom. ANZ in the United Kingdom is authorised by the Prudential Regulation Authority (“PRA”). Subject to regulation by the Financial Conduct Authority (“FCA”) and limited regulation by the PRA. Details about the extent of our regulation by the PRA are available from us on request. This publication is distributed in the United Kingdom by ANZ solely for the information of persons who would come within the FCA definition of “eligible counterparty” or “professional client”. It is not intended for and must not be distributed to any person who would come within the FCA definition of “retail client”. Nothing here excludes or restricts any duty or liability to a customer which ANZ may have under the UK Financial Services and Markets Act 2000 or under the regulatory system as defined in the Rules of the PRA and the FCA. Germany. This publication is distributed in Germany by the Frankfurt Branch of ANZ solely for the information of its clients. Other EEA countries. This publication is distributed in the EEA by ANZ Bank (Europe) Limited (“ANZBEL”) which is authorised by the PRA and regulated by the FCA and the PRA in the United Kingdom, to persons who would come within the FCA definition of “eligible counterparty” or “professional client” in other countries in the EEA. This publication is distributed in those countries solely for the information of such persons upon their request. It is not intended for, and must not be distributed to, any person in those countries who would come within the FCA definition of “retail client”. Fiji. For Fiji regulatory purposes, this publication and any views and recommendations are not to be deemed as investment advice. Fiji investors must seek licensed professional advice should they wish to make any investment in relation to this publication. Hong Kong. This publication is distributed in Hong Kong by the Hong Kong branch of ANZ, which is registered at the Hong Kong Monetary Authority to conduct Type 1 (dealing in securities), Type 4 (advising on securities) and Type 6 (advising on corporate finance) regulated activities. The contents of this publication have not been reviewed by any regulatory authority in Hong Kong. If in doubt about the contents of this publication, you should obtain independent professional advice.

-

ANZ Market Focus / 30 November 2015 / 18 of 18

IMPORTANT NOTICE