The next chapter of Asia’s growth story...For Institutional Use Only The next chapter of Asia’s...

Transcript of The next chapter of Asia’s growth story...For Institutional Use Only The next chapter of Asia’s...

For Institutional Use Only

The next chapter of Asia’s growth story Asian Equities Outlook April 2018

Catherine Yeung Investment Director, Asian Equities

839319.1.0 © 2018 Fidelity Investments Canada ULC. All rights reserved

| 1 Asian Equities Outlook

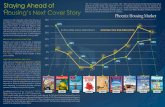

Three drivers of the market: Sentiment

Fund Flows to Developed Markets

Source: EPFR, Morgan Stanley Asia/GEM Strategy Research, January 2018

Fund Flows to Asia Pacific ex Japan 2016-2017

2016-2017 2013-2015 2013-2015

-20

-15

-10

-5

0

5

10

15

Jan-

08Ju

l-08

Jan-

09Ju

l-09

Jan-

10Ju

l-10

Jan-

11Ju

l-11

Jan-

12Ju

l-12

Jan-

13Ju

l-13

Jan-

14Ju

l-14

Jan-

15Ju

l-15

Jan-

16Ju

l-16

Jan-

17Ju

l-17

Jan-

18

-80

-60

-40

-20

0

20

40

60

80

Jan-

08Ju

l-08

Jan-

09Ju

l-09

Jan-

10Ju

l-10

Jan-

11Ju

l-11

Jan-

12Ju

l-12

Jan-

13Ju

l-13

Jan-

14Ju

l-14

Jan-

15Ju

l-15

Jan-

16Ju

l-16

Jan-

17Ju

l-17

Jan-

18

| 2 Asian Equities Outlook

Three drivers of the market: Valuations

0.60

0.70

0.80

0.90

1.00

1.10

1.20

1.30

Forward PE – Asia ex Japan vs. Developed World 10 years to 28 February 2018

Forward PB – Asia ex Japan vs. Developed World 10 years to 28 February 2018

Asia ex-Japan relative to developed markets

Source: Thomson Reuters DataStream, 28 February 2018. MSCI Asia ex Japan Index vs. MSCI World Index.

0.50

0.60

0.70

0.80

0.90

1.00

1.10

1.20

1.30

| 3 Asian Equities Outlook

40

50

60

70

80

90

100

110

120

130

140

Jun Aug Oct Dec Feb Apr Jun Aug Oct DecEPS09E EPS10E EPS11E EPS12E EPS13E EPS14E EPS15E EPS16E EPS17E EPS18E

0

40

80

120

160

200

Jun Aug Oct Dec Feb Apr Jun Aug Oct Dec

Source: IBES Aggregate, Thomson Financials DataStream, February 2018. These forecasts are not a reliable indicator of future performance .

Three drivers of the market: Fundamentals

Asia ex Japan earnings estimates

Sustained EPS upgrades Asia ex Japan IT sector earnings estimates

Asia ex Japan Energy sector earnings estimates

2010

2017

2017

406080

100120140

Jun Aug Oct Dec Feb Apr Jun Aug Oct Dec

2017

2018

2018

2018

| 4 Asian Equities Outlook

Fighting political battles Pushing for reform vs.

Political stability – Is Asia a relative safe haven? Uncertainty causes market nervousness

For illustrative purposes only.

| 5 Asian Equities Outlook

Asia: Strong governance in motion

Source: Fidelity International, 31 August 2017.

Asian political leadership has a strong mandate for driving reforms

Growth-oriented political backdrop in Asia

China Status Supply Side Reforms Mixed Ownership Reforms India Goods & Services Tax (GST) Demonetization South Korea Improving corporate governance Thailand Stability of the new government Long term economic policies

| 6 Asian Equities Outlook

China’s “Belt and Road” initiative is gaining momentum

Source: AsiaOne, April 2015

Will all roads lead back to China?

| 7 Asian Equities Outlook

Source: WIPO, The Global Innovation Index 2015; OECD; Macquarie Equity Strategy Research, January 2016. Investors should note that the views expressed may no longer be current and may have already been acted upon.

R&D as % of GDP; 25 largest countries

-

0.5

1.0

1.5

2.0

2.5

3.0

3.5

4.0

4.5

%

2005 Current

CHINA

The ‘Made in China 2025’ Strategy Aiming to graduate from copycat to innovator

| 8 Asian Equities Outlook

Year Flagship Smartphone Models Selling Price for flagship models

(in USD) Annual total sales volume

(mn units)

2010 U8500 175~206 1.8

2011 U8800 286~349 17.1

2012 P1 349~444 29.1

2013 P6 Mate 349~429; 349~430 49.0

2014 P7 Mate 7 286~458; 407~587 73.8

2015 P8 Mate 8 301~458; 436~791 107.0

2016 P9 Mate 9 468~811; 499~1,323 139.3

2017 P10 Mate 10 577~821 150.0

Source: Company data, Morgan Stanley. Investors should note that the views expressed may no longer be current and may have already been acted upon

China’s IT companies are challenging global market leaders Annual sales volume of Huawei’s smartphones

Reference to specific securities is for illustration only and should not be construed as a recommendation to buy or sell these securities.

| 9 Asian Equities Outlook

In the long-term, what should investors focus on when it comes to investing in China? A different mindset and focus - Free Cash Flow Yield and Dividend Yield

-3

-2

-1

0

1

2

3

4

5

6

Jan-07 Jan-08 Jan-09 Jan-10 Jan-11 Jan-12 Jan-13 Jan-14 Jan-15 Jan-16 Jan-17 Jan-18 Jan-19

%

Free Cash Flow Yield Dividend Yield

Source: Fidelity International and Factset, July 2017

| 10 Asian Equities Outlook

Innovation from Korean biotech companies

-50%-40%-30%-20%-10%

0%10%20%30%40%50%60%

1Q14

2Q14

3Q14

4Q14

1Q15

2Q15

3Q15

4Q15

1Q16

2Q16

3Q16

4Q16

1Q17

2Q17

3Q17

4Q17

Volume mkt shr of Celltrion's biosimilarRevenue yoy % of original drug

Biosimilar disruption in Europe Biosimilar disruption in US

-20%

-15%

-10%

-5%

0%

5%

10%

15%

20%

1Q14

2Q14

3Q14

4Q14

1Q15

2Q15

3Q15

4Q15

1Q16

2Q16

3Q16

4Q16

1Q17

2Q17

3Q17

4Q17

Revenue yoy % of original drug

Source: Fidelity International, February 2018

| 11 Asian Equities Outlook

Source: Department of Industrial Policy & Promotions (DIPP), Ministry of Commerce & Industry, December 2017

India: The ease of doing business could further underpin levels of foreign direct investments

6.1 9.0

22.8

34.8

41.9 37.7

34.8

46.6

34.3 36.0

45.1

55.6 60.1

48.2

0

10

20

30

40

50

60

70FY

05

FY06

FY07

FY08

FY09

FY10

FY11

FY12

FY13

FY14

FY15

FY16

FY17

FY18

(upt

oD

ec 2

017)

Net

flow

s in

US$

bill

ion

| 12 Asian Equities Outlook

ASEAN – Asia’s next FDI magnet Five strong pull factors to encourage FDI into ASEAN

Large and growing domestic markets

More infrastructure, reforms and the ease of doing business

More open and liberal FDI regimes

Sound economic management and relative political stability

The availability of low-cost labour

Source: Nomura, as of 1 August 2017.

Pull Factors

| 13 Asian Equities Outlook

Asia has structurally underperformed and global investors remain underweight yet…

The region tends to outperform during periods of rising US interest rates

Earnings momentum is building and non-earnings based valuation measures remain attractive

Structural reform is evident in pockets across Asia such as China and India

To conclude…

| 14 Asian Equities Outlook

Issued by Fidelity Investments Canada ULC (“FIC”). Read this important information carefully before making any investment. Speak with your relationship manager if you have any questions.

FIC has prepared this presentation for, and only intends to provide it to, consultants and institutional and/or sophisticated investors in one-on-one or comparable presentations. Do not distribute or reproduce this report.

Risks

Past performance is no guarantee of future results. An investment may be risky and may not be suitable for an investor's goals, objectives and risk tolerance. Investors should be aware that an investment's value may be volatile and any investment involves the risk that you may lose money. Performance results for individual accounts will differ from performance results for composites and representative accounts due to factors such as portfolio size, account objectives and restrictions, and factors specific to a particular investment structure.

The value of a strategy's investments will vary day to day in response to many factors, including in response to adverse issuer, political, regulatory, market or economic developments. The value of an individual security or a particular type of security can be more volatile than the market as a whole and can perform differently from the value of the market as a whole. Nearly all accounts are subject to volatility in foreign exchange markets.

Derivatives may be volatile and involve significant risk, such as, credit risk, currency risk, leverage risk, counterparty risk and liquidity risk. Using derivatives can disproportionately increase losses and reduce opportunities for gains in certain circumstances. Derivatives may have limited liquidity and may be harder to value, especially in declining markets. Derivatives involve leverage because they can provide investment exposure in an amount exceeding the initial investment. Leverage can magnify investment risks and cause losses to be realized more quickly. A small change in the value of an underlying asset, instrument, or index can lead to a significant loss. Assets segregated to cover these transactions may decline in value and are not available to meet redemptions. Government legislation or regulation could affect the use of these transactions and could limit the ability to pursue such investment strategies.

These materials may contain statements that are “forward-looking statements,” which are based on certain assumptions of future events. Forward-looking statements are based on information available on the date hereof, and Fidelity Investments Canada ULC (“FIC”) does not assume any duty to update any forward-looking statement. Actual events may differ from those assumed by FIC when developing forward-looking statements. There can be no assurance that forward-looking statements, including any projected returns, will materialize or that actual market conditions and/or performance results will not be materially different or worse than those presented.

Important Information