The Financial Analysis Report on Hyundai Motor India Limited (HMIL)

-

Upload

mehul-gondaliya -

Category

Data & Analytics

-

view

1.384 -

download

0

description

Transcript of The Financial Analysis Report on Hyundai Motor India Limited (HMIL)

The Financial Analysis Report

On

“ Hyundai Motor India Limited (HMIL) "

1

Submitted By: Mehul B. Gondaliya (13052)

Roll No: 13052

2nd SEM - MBA.

Academic year: 2013-15

G H Patel Post Graduate Institute of Business Management

Vallabh Vidyanagar

Submitted To: Dr.P.K.Priyan.

Preface

As a part of our MBA curriculum we are assigned various projects under different subjects to impart practical know-how of the industry.

This report is a study of Hyundai Motor India Limited (HMIL) under the subject Financial Management.

In this report we have compiled the information pertaining to Hyundai Motor India Limited (HMIL), Profit & Loss A/C, Balance Sheet, Cash Flow statement and Ratio Analysis.

2

INDEX

Chapter Topic Page No.

Preface 02

Objectives of the study 03

1 Introduction

1.1 History 05

2 Data Analysis and Interpretation 08

3. Ratio analysis 11

3.1 Liquidity ratio 11

3.2 Leverage ratio 13

3.3 Activity ratio 14

3.4 Profitability ratio 16

3.5 Dividend payout 18

3.6 Du Pont 19

4. Conclusion 20

5. Annexure 21

6. Bibliography 23

3

The objective of study

The report contains the information of financial ratios of the Hyundai Motor India Limited (HMIL), a big name in auto mobile. The report is being prepared as a part of academic course that is financial management.

This report is basically prepared for knowing the financial strength and weakness of the company and the liquidity position of the company.

To know the financial strength and weakness of the company, the ratio analysis has been used as a key tool.

RESEARCH METHODOLOGY:

The data is collected through secondary sources namely Software (capita line

plus) and Reference book (I. M. Pandey).

4

Chapter 1.

INTRODUCTION

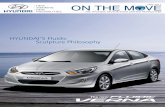

Hyundai Motor India Limited is a wholly owned subsidiary of the Hyundai Motor Company in India. It is the 2nd largest automobile manufacturer in India. Hyundai/Atos Prime is made only by Hyundai Motor India Limited.

Hyundai Motor India Limited was formed in 6 May 1996 by the Hyundai Motor Company of South Korea. When Hyundai Motor Company entered the Indian Automobile Market in 1996 the Hyundai brand was almost unknown throughout India. During the entry of Hyundai in 1996, there were only five major automobile manufacturers in India, i.e. Maruti, Hindustan, Premier, Tata and Mahindra. Daewoo had entered the Indian automobile market with cielo just three years back while Ford, Opel and Honda had entered less than a year back.

For more than a decade till Hyundai arrived, Maruti Suzuki had a near monopoly over the passenger cars segment because TELCO and M&M were solely utility and commercial vehicle manufacturers, while Hindustan and Premier both built outdated and uncompetitive products.

1.1 History

HMIL's first car, the Hyundai Santro was launched in 23 September 1998 and was a runaway success. Within a few months of its inception HMIL became the second largest automobile manufacturer and the largest automobile exporter in India. Hyundai Motor India Limited (HMIL) is a wholly owned subsidiary of Hyundai Motor Company (HMC), South Korea and is the largest passenger car exporter and the second largest car manufacturer in India. HMIL presently markets 10 models - Eon, Santro, i10, Grand i10, Xcent, i20, Verna, Elantra, Sonata and Santa Fe.

HMIL’s manufacturing plant near Chennai claims to have the most advanced production, quality and testing capabilities in the country. To cater to rising demand, HMIL commissioned its second plant in February 2008, which produces an additional 300,000 units per annum, raising HMIL’s total production capacity to 600,000 units per annum.

5

HMC has set up a research and development facility(Hyundai Motor India Engineering - HMIE) in the cyber city of Hyderabad.

As HMC’s global export hub for compact cars, HMIL is the first automotive company in India to achieve the export of 10 lakh cars in just over a decade. HMIL currently exports cars to more than 120 countries across EU, Africa, Middle East, Latin America, Asia and Australia. It has been the number one exporter of passenger cars of the country for the eighth year in a row.

To support its growth and expansion plans, HMIL currently has 388 strong dealer network and more than 1000 strong service points across India, which will see further expansion in 2014. In July 2012, Arvind Saxena, the Director of Marketing and Sales stepped down from the position after serving the company for 7 long years.

Hyundai Motor India Limited (HMIL) is a wholly owned subsidiary of Hyundai Motor Company, South Korea and is the second largest car manufacturer and the largest passenger car exporter from India. HMIL presently markets eight passenger car models across segments - in the A2 segment it has the Eon, Santro, i10 and the i20, in the A3 segment the Accent and the Verna, in the A5 segment Sonata and in the SUV segment the Santa Fe. The company has a fully integrated state-of-the-art manufacturing plant near Chennai.The company was incorporated in the year 1996. In September 27, 1998, Hyundai Santro (Atos Prime) makes its world debut in India and in March 31, 1999 the company emerged as the second largest auto-manufacturer in the country. In October 14, 1999, the company launched 'Hyundai Accent' and in May 8, 2000, it launched 'SantrozipDrive'. In July 18, 200l, the company launched new luxury car 'Sedan Sonata'. In August 16, 2002, the company launched 'Accent VIVA' and in September 6, 2002, it launched Santro Automatic Transmission. In October 10, 2002, the company launched 'Accent CRDi'. During the year 2003-2004, the company increased the installed capacity of Motor Vehicle from 124,800 Nos to 160,000 Nos. During the year, the company was selected as the 'Car Maker of the Year' by ICIC Overdrive. During the year, the company commenced exporting car to Western Europe and Eastern Europe. During the year 2004-2005, the company increased the installed capacity of Motor Vehicle from 160,000 Nos to 250,000 Nos. During the year, the company launched 'Elantra' an 'Getz'. During the year 2005-2006,

6

the company performance evaluation setting done by benchmarking competitor model to improve fuel efficiency of Gets Models. During the year, the company expanded its exports markets to United Kingdom, Malta, Serbia, Africa, Turkey, Afghanistan, Qatarand Latin America.

During the year 2006-2007, the company launched new mid-size segment model 'Verna' and also introduced Sonata CRDi- Diesel variant & Getz prime with 1.1L. During the year, the company successfully started exporting Getz model to European Countries and in the same year, the company increased installed capacity of Motor Vehicle from 250,000 Nos to 300,000 Nos.During the year 2007-2008, the company introduced new service line and reduced the level of energy consumption to a greater extend. The company launched new car namely 'i10' during the year. During the year 2008-2009, the company introduced 'i20' model for domestic and export markets in the B+ segments and in the same year, the company brought out LPG version of Santro and Accent Automatic DSL and Sonata Transform. During the year 2009-2010, the company launched 1.4 litre diesel and 1.4 litre petrol Automatic variant of its premium hatchback, `i20', in addition to introducing Accent LPG variant and facelift Santro for domestic market. The company exported its products to over 110 countries compared to 100 countries during last year. The company crossed the milestone of 2.5 million cars production and sales during the current year.In 2010-2011, the company introduced Verna Transform and next generation `i10'. The company exported its vehicles to more than 120 countries. The company crossed the milestone of 3 million cars of production and sales during the year.

7

CHAPTER 2.

DATA ANALYSIS AND INTERPRETATION

2.1Financial Analysis

Financial analysis is the process of identifying the financial strengths and weaknesses of the firm by properly establishing relationships between the items of the balance sheet and the profit & loss account / Income statement.

Financial statement:

A financial statement is an organized collection of data according to logical and consistent accounting procedures. Its purpose is to convey an understanding of some financial aspects of a business firm. It may show a position at a moment of time as in the case of a balance sheet, or may reveal a series of activities over a given period of time, as in the case of an income statement.

Thus, the term financial statement generally refers to the basis statements;

1. The income statement

2. The balance sheet

3. A statement of retained earnings

4. A statement of charge in financial position in addition to the above two statement.

Financial statement analysis :

It is the process of identifying the financial strength and weakness of a firm from the available accounting data and financial statement. The analysis is done by properly establishing the relationship between the items of balance sheet and profit and loss account the first task of financial analyst is to determine the information relevant to the decision under consideration from the total information contained in the financial statement. The second step is to arrange information in a way to highlight significant relationship. The final step is interpretation and drawing of inferences and conclusion. Thus financial analysis is the process of selection relating and evaluation of the accounting data or information.

8

Analysis of Profit and loss account:

From annexure 4.1 the profit and loss account is the one of the basic statement of the company showing the financial position of the company.

The profit and loss account of Hyundai Motor India Ltd shows the profit of the firm year by year as follow.

Financial Year 2003 – 164.75crs

Financial Year 2004 –378.85crs

Financial Year 2005 –406.92crs

Financial Year 2006 –525.1crs

Financial Year 2007 –466.74crs

Financial Year 2008 –514.12crs

Financial Year 2009 –195.63crs

Financial Year 2010 –375.53crs

Financial Year 2011 –794.28crs

Financial Year 2012 –836.2crs

9

201203 (12)

201103 (12)

201003 (12)

200903 (12)

200803 (12)

200703 (12)

200603 (12)

200503 (12)

200403 (12)

200303 (12)

0

200

400

600

800

1000

Net Profit

Reported Net Profityear

amou

nt

Interpretation:

The net profit after tax increased in the initial years but came down in year 2009 and 2010 because of booming in the economy. The company’s profit fell to almost its half in years because of slowdown in economy across the globe. The company reached to its pick in year 2011 because of recovery of economy.

10

Chapter- 3

The Ratio analysis

Ratio analysis is a powerful tool for the interpretation of the financial statement. A ratio can be defined as “the indicated quotient of two mathematical expressions” in financial analysis the ratio is used as the benchmark for evaluating the financial position and performance of a firm.

The relation between two accounting figures, expressed mathematically, is known as financial ratios.

The types of ratios

1. Liquidity Ratios – Measure the firm’s ability to meet current obligations.

2. Leverage Ratios – Measure the proportion of debt and equity in financing the assets.

3. Activity Ratios – Measure the firm’s efficiency in utilizing its assets.

4. Profitability Ratios – Measure overall performance and effectiveness of the firm.

3.1 Liquidity ratios

Liquidity is a crucial aspect of the financial management of the company because the bed liquidity condition can damage the image of the firm. If the firm is not able to pay the debts in time, it will result in to the loss of creditworthiness in the market, loss of creditors’ confidence. On the other hand the excessive liquidity is also not favourable because idle asset earn nothing.There are two types of liquidity ratios

1. Current ratio = current assets/current liabilities2. Quick ratio = (current assets-inventory)/ current liabilities

Ratios 2012 2011 2010 2009 2008 2007 2006 2005 2004 2003

Current ratio 1.45 1.42 1.48 1.16 0.99 1.36 1.27 1.14 1.25 1.67

Quick ratio 2.09 2.17 1.61 2.03 1.86 2.37 2.26 2.55 2.34 1.69

Table 1: liquidity ratios

11

201203

201103

201003

200903

200803

200703

200603

200503

200403

2003030

0.20.40.60.8

11.21.41.61.8

Current Ratio

Current Ratio

current ratio

times

Figure 3.1: current ratio (source: capita line database)

201203

201103

201003

200903

200803

200703

200603

200503

200403

2003030

0.5

1

1.5

2

2.5

3

Quick ratio

Quick ratio

quick ratio

times

Figure 3.2: Quick ratio

Interpretation:

The current ratio is considered to be satisfactory if it is 2:1. But it differs from the industry to industry. The current ratio represents the margin of safety. The greater the current ratio, the greater is the ability of the firm to meet its current obligations. The current ratio of the Hyundai Motor India Ltd reflects the satisfactory current position of the firm.

On the other hand the quick ratio shows the liquidity position of the company. This ratio is considered to be favourable if it is approximately 1:1. The quick

12

ratio shows the test of the quality of the current assets while the current ratio shows merely the test of quantity of the current assets. The quick ratio of the Hyundai Motor India Ltd shows the favourable liquidity condition.

3.2 Leverage ratios

Leverage is a factor which can be used to magnify the income of the owner i.e. Equity shareholder of the company. This is done through introduction of debt or fixed interest bearing capital in to the capital structure of the company. On the other hand the financial leverage becomes burden when the company is not able to earn the rate of return on the capital employed which is equal to the rate of interest on the debt.

The leverage ratios of the Hyundai Motor India Ltd is as follows

Formulas:1. Long term debt – equity ratio = long term debt /net worth2. Total debt – equity ratio = total debt /net worth

Ratios 2012 2011 2010 2009 2008 2007 2006 2005 2004 2003Long term debt / Equity 1.67 1.71 1.68 2.38 2.02 1.75 1.25 1.27 1.47 1.56Total debt/equity 1.67 1.71 1.68 2.38 2.02 1.72 1.22 1.29 1.53 1.64Interest coverage ratio 13.69 27.71 6.82 2.35 5.47 51.84

241.26 47.26 39.89 16.29

Table 2: Leverage ratios

201203

201103

201003

200903

200803

200703

200603

200503

200403

2003030

0.5

1

1.5

2

2.5

Net Worth

Net Assets/Net Worth

Figure 3.3: net worth (source: capita line database)

13

Interpretation:

The above ratios show that in the year 2012, the proportion of debt is less than the proportion of the equity in the capital structure of the company. Company is conservative in nature and hence do not apply debt in business. This reduces burden of external debt but simultaneously company loses tax shield benefit. Company has to pay higher tax.

3.3 Activity Ratios

Activity ratios are employed to evaluate the efficiency with which the firm manages and utilizes its assets. These ratios are also called turnover ratios because they indicate the speed with which assets are being converted or turned over into sales. Activity ratios, thus, involve a relationship between sales and assets. A proper balance between sales and assets generally reflects that assets are managed well.

The activity ratios of Hyundai Motor India Ltd. are as follows:

Formulas:

1. Inventory Turn Over Ratio = Sales / Average Inventory

2. Debtors Turn Over Ratio = Credit Sales / Average Debtors

3. Fixed Assets Turn Over Ratio = Sales / Fixed Assets

4. Total Assets Turn Over Ratio = Sales / Total Assets

5. Current Assets Turn Over Ratio= Sales / Current Assets

Ratio 2012 2011 2010 2009 2008 2007 2006 2005 2004 2003Inventory Turn

Over Ratio13.93 16.17 15.51 7.29 6.60 6.84 9.89 9.94 10.28 12.14

Debtors Turn Over Ratio

27.78 14.62 10.44 12.04 17.83 30.23 31.82 34.92 67.4 50.7

Fixed Assets Turn Over Ratio 2.89 2.71 2.73 2.52 2.5 3.01 2.88 2.77 2.55 2.18

Total Assets Turn Over Ratio 3.52 3.44 3.25 2.48 2.15 2.84 3.74 3.86 3.31 2.36Current Assets

Turn Over Ratio 1.45 1.42 1.48 1.16 0.99 1.36 1.27 1.14 1.25 1.67Table 3: Activity Ratios

14

201203 201103 201003 200903 200803 200703 200603 200503 200403 200303

Fixed As-sets

2.89 2.71 2.73 2.52 2.5 3.01 2.88 2.77 2.55 2.18

In-ventory

17.36 17.06 12.25 9.07 8.08 9.81 12.29 13.35 15.85 15.55

Debtors

27.78 14.62 10.44 12.04 17.83 30.23 31.82 34.92 67.4 50.7

5

25

45

65

Turnover ratiosti

mes

Figure 3.4: Activity Ratios (Source: capital line database)

Interpretation:

The figure 3.4 highlights the activity ratios in which, Assets turnover ratio measures how efficiently assets are used to maximize sales. A firm’s ability to produce a large volume of sales for a given amount of net assets is the most important aspect of its operating performance. The net assets turnover should be interpreted cautiously. The net assets in the denominator of the ratio include fixed assets net of depreciation. Thus old assets with lower book values may create a misleading impression of high turnover without any improvement in sales. For Hyundai Motor India Ltd., the asset turnover ratio is increasing uniformly over the period from 2008. The assets of the company are properly used for generating sales.

Inventory turnover ratio measures the efficiency of inventory management. Therefore ideally an increasing trend is expected. Inventory turnover ratio is more stabilize one with less fluctuation over a period of time which indicates effective inventory management. The chart reflects there is declining trend till 2008. We can see an improvement in ratio in 2012 which is 17.36 which indicates better management of inventories. Hence we can say that inventory is converted into sales at a faster pace from previous year.

15

Debtors turnover ratio and collection period measure the speed with which the accounts receivable are collected. A reduction in collection period would mean faster conversion of debtors into cash and so the company can meet its working capital requirement in a better manner. The chart shows slowly fluctuating trend of Hyundai Motor India Ltd. debtor turnover ratio up to 2012.

3.4 Profitability ratios

The above sentence clearly states the importance of profitability. If the firm is not making the profit then it becomes the burden for the society. Everything starts with profit in the business. Unless and until the company is able to make profit it cannot meet the expectation of the stakeholders of the company and the share pricing will be falling. So the share price will not be there where it

The profitability of the company can be measured by following ratios.

3.4.1Return on Net worth:

Definition: It is the relationship between profit after tax and net worth.

Formula: EBIT (1-tax rate) / Net Worth

3.4.2 Return on capital employed:

Definition: It is the relationship between profit after tax and total capital employed.

Formula: EBIT (1-tax rate) / Capital employed

16

201203 201103 201003 200903 200803 200703 200603 200503 200403 200303

ROCE (%)

19.66 20.55 10.33 7.94 7.87 20.86 35.72 32.8 34.01 16.35

RONW (%)

20.53 21.99 11.85 6.43 8.63 20.4 29.29 29.15 33.19 15.23

2.5

12.5

22.5

32.5

profitablity ratioPe

rcen

tage

Figure: 3.5 Profitability Ratios (Source: capital line database)

Interpretation:

Figure 3.5 indicates that profitability ratios in which, Return on equity is calculated to see the profitability of owner’s investment. RONW indicates how well the firm has used the resources of owners. Here we can see that the RONW has decreased from 2006 to 2008, at 2012 its recovered profitability level, so which is a good indication for the company and the overall profitability ratios we can see that the profitability of the company is increasing.

Return on capital employed is obtained by dividing EBIT (1-tax rate) by capital employed. Capital employed represents pool of funds supplied by shareholders and lenders. This ratio therefore measures what actually a firm has earned in comparison to the investments made. The movement of this ratio is almost similar to the trend of return on net worth ratio.

17

3.5 DIVIDEND PAYOUT

Definition: Dividend pay-out shows how much percentage of earning to be

distributed to shareholders in the form of dividends.

Formula: Dividend per Share / Earning Per Share

201203 201103 201003 200903 200803 200703 200603 200503 200403 200303

Payout (%)

64.39 15.74 34.3 69.68 0 0 0 31.26 33.58 73.98

515253545556575

Payout (%)

Perc

enta

ge

Figure 3.6: payout ratio (Source: capital line database)

Interpretation:

In the figure 3.6, the payout ratio shows how much rupees available to shareholders from net profit. From chart we can interpret that payout ratio has a decreasing trend from 2003 to 2005 and company not paid dividend in year 2006, 2007 and 2008 then after paid in 2009. it has showed decreasing trend 2010to2011. And again it increasing in 2012, so we can say the company is not paying regular dividend to its shareholders.

18

3.6 DUPONT ANALYSIS

Return on Net Asset (RONA) or Return on Capital Employed (ROCE) is the measure of the firm’s operating performance. It indicates the firms earning power. It is a product of the asset turnover, gross profit margin and operating leverage. All the firms would like to improve their RONA. In practice competition puts a limit on RONA. Also, firms may have to trade-off between asset turnover and gross profit margin. To improve profit margin, some firms resort to vertical integration for cost reduction and synergic benefits.

RONA = Asset turnover * Gross profit margin * Operating Leverage

A firm can convert its RONA into an impressive ROE through financial efficiency. Financial leverage and debt-equity ratios affect ROE and reflect financial efficiency. ROE is thus a products of RONA (reflecting operating efficiency) and financial leverage ratios (reflecting financial efficiency).

ROE = Operating Performance * Leverage Factor

The firm can convert its ROE into growth in equity through retention.

Equity Growth = ROE * Retention Ratio

The combined effect of three aspects - operating efficiency, financial efficiency and retention shows the overall performance. The computation of ratios clearly shows the interaction between operating ratios, profitability ratios and leverage ratios for obtaining return on the shareholder’s earnings.

RATIOS – DUPONT MODEL OF Hyundai Motor India Ltd

Particular 2012 2011 20010 2009 2008 2007 2006 2005 2004 2003

PBIDT/Sales (%) 38.52 49.54 43.33 43.54 39.94 44.38 44.45 49.93 43.35 43.85

Sales/Net Assets 0.56 0.55 0.58 0.59 0.68 0.73 0.74 0.73 0.83 0.63

PBDIT/Net Assets 0.22 0.27 0.25 0.25 0.27 0.32 0.33 0.36 0.36 0.28

PAT/PBIDT (%) 65.21 65.95 63.62 63.96 63.14 62.58 61.83 59.91 64.12 60.75

Net Assets/Net Worth 1.19 1.23 1.22 1.18 1.2 1.17 1.24 1.23 1.2 1.27

ROE (%) 17.63 23.87 20.48 20.2 21.59 25.2 27 28.63 29.71 22.72

Table 4: Du Pont Analysais (Source: capital line data base)

19

CONCLUSION:

From financial analysis we can conclude that Hyundai Motor India Ltd. is having a poor financial capacity. From all the interpretation from Current ratios, activity ratios, liquidity ratios, profitability ratios, EPS, Dividend payout, DuPont analysis and leverage analysis it is clear that Hyundai Motor India Ltd. is financially poor financial capacity. Therefore, it is advised not to invest in this company because this company not giving regular dividend to its shareholders.

20

4. Annexure:

4.1 Balance Sheet of Hyundai Motor India Ltd.

2.3 FINANCE - BALANCE SHEET - Hyundai Motor India Ltd (Curr: Rs in Cr.) As on 25-04-2014»0¤CmbCommonsize»0

201203 201103 201003 200903 200803 200703 200603 200503 200403 200303

SOURCES OF FUNDS :

Share Capital 812.54 812.54 812.54 812.54 812.54 812.54 812.54 812.54 812.54 812.54

Reserves Total 3395.12 3125.172472.54

2239.13 2219.85

1709.22

1242.48 717.38 449.43 208.39

Equity Share Warrants 0 0 0 0 0 0 0 0 0 0

Equity Application Money 0 0 0 0 0 0 0 0 0 0

Total Shareholders' Funds 4207.66 3937.713285.08

3051.67 3032.39

2521.76

2055.02

1529.92

1261.97

1020.93

Secured Loans 48.27 48.27 0 0 0 0 0 0 0 0

Unsecured Loans 2458.14 2508.752220.18

4222.92 3104.72

1889.67 521.95 418.09 596.33 571.54

Total Debt 2506.41 2557.022220.18

4222.92 3104.72

1889.67 521.95 418.09 596.33 571.54

Other Liabilities 318.37 242.88 0 0 0 0 0 0 0 0

Total Liabilities 7032.44 6737.615505.26

7274.59 6137.11

4411.43

2576.97

1948.01 1858.3

1592.47

APPLICATION OF FUNDS :

Gross Block 8887.67 7896.937649.93

7560.52 5619.19

3470.53

3107.57

2759.27

2548.84

1926.18

Less : Accumulated Depreciation 5031.32 4272.643586.69

2844.16 2178.69 1721.9

1371.42

1079.03 839 662.55

Less: Impairment of Assets 0 0 0 0 0 0 0 0 0 0

Net Block 3856.35 3624.294063.24

4716.36 3440.5

1748.63

1736.15

1680.24

1709.84

1263.63

Lease Adjustment 0 0 0 0 0 0 0 0 0 0

Capital Work in Progress 457.69 480.27 79.42 172.1 1241.17 1809.4 167.21 14.67 0 0

Producing Properties 0 0 0 0 0 0 0 0 0 0

Investments 138.01 138.01 138 134.96 63.16 19.5 0 0 11.73 11.9

21

Current Assets, Loans & Advances

Inventories 1586.54 1203.731264.66

2126.47 1532.24

1280.59 741.54 634.15 466.9 253.98

Sundry Debtors 928.38 815.3 2064.81915.04 842.99 431.06 224.88 306.34 114.76 54.79

Cash and Bank 1906 1811.27 450.42 561.94 661.6 240.29 535.1 146.32 543.92 548.51

Loans and Advances 1947.98 1550.81179.78

1141.31 862.67

1287.99 949.21 788.45 163.36 85.71

Total Current Assets 6368.9 5381.14959.66

5744.76 3899.5

3239.93

2450.73

1875.26

1288.94 942.99

Less : Current Liabilities and Provisions

Current Liabilities 3038.36 2475.013070.64

2821.44 2090.68

1365.13 959.62 798.14 760.49 416.16

Provisions 737.84 273.37 445.54 387.11 173.03 883.22 630.87 595.93 223.06 38.09

Total Current Liabilities 3776.2 2748.383516.18

3208.55 2263.71

2248.35

1590.49

1394.07 983.55 454.25

Net Current Assets 2592.7 2632.721443.48

2536.21 1635.79 991.58 860.24 481.19 305.39 488.74

Miscellaneous Expenses not written off 0 0 0 0 0 0 0 0 0 0

Deferred Tax Assets 28.24 16.43 18.8 21.77 15.31 13.14 18.19 14.83 17.6 0.91

Deferred Tax Liability 203.73 213.84 237.68 306.81 258.82 170.82 204.82 242.92 186.26 172.71

Net Deferred Tax -175.49 -197.41 -218.88 -285.04 -243.51 -157.68 -186.63 -228.09 -168.66 -171.8

Other Assets 163.18 59.73 0 0 0 0 0 0 0 0

Total Assets 7032.44 6737.615505.26

7274.59 6137.11

4411.43

2576.97

1948.01 1858.3

1592.47

Contingent Liabilities 377.24 235.64 81.66 120.57 88.7 69.35 74.07 49.96 115.45 0

22

4.2 FINANCE - PROFIT AND LOSS - Hyundai Motor India Ltd (curr: Rs in cr.) as on 25-04-2014COMPANY/FINANCE/PROFIT AND LOSS/16486/ »0¤CmbAnnual»0

2012-03 (12)

2011-03 (12)

2010-03 (12)

2009-03 (12)

2008-03 (12)

2007-03 (12)

2006-03 (12)

2005-03 (12)

2004-03 (12)

2003-03 (12)

INCOME :

Sales Turnover 24221.4921050.5

1 20771.916599.4

611357.3

3 9915.88 8450.94 7351.9 5713.74 3955.86

Excise Duty 2118.01 1585.09 1149.36 1076.91 1238.46 1153.39 1111.8 1046 913.26 870.72

Net Sales 22103.4819465.4

219622.5

415522.5

510118.8

7 8762.49 7339.14 6305.9 4800.48 3085.14

Other Income 396.51 397.32 646.82 573.51 777.72 356.86 470.49 349.13 191.87 104.6

Stock Adjustments 233.92 54.1 -469.68 314.35 67.49 252.22 62.99 97.77 33.96 -3.6

Total Income 22733.9119916.8

419799.6

816410.4

110964.0

8 9371.57 7872.62 6752.8 5026.31 3186.14

EXPENDITURE :

Raw Materials 18218.6115876.5

215897.9

313118.5

9 8234.49 6941.66 5678.32 4931.09 3531.86 2191.16

Power & Fuel Cost 154.16 132.67 121.02 113.09 87.89 68.68 63.86 56.53 42.2 36.75

Employee Cost 476.2 401.02 344.17 318.49 245.04 188.64 161.36 133.26 106.83 89.18

Other Manufacturing Exp. 456.6 455.21 394.03 309.29 234.68 236.97 217.43 163.89 92.71 54.99

Selling and Admi. Exp. 1004.18 939.37 1625.82 1234.37 867.06 796.48 628.62 562.12 373.96 317.02

Miscellaneous Expenses 287.59 146.09 3.95 109.86 38.57 51.28 19.79 31.58 113.37 54.99

Less: Pre-operativeExpenses Capitalised 0 0 0 0 0 0 0 0 0 0

Total Expenditure 20597.3417950.8

818386.9

215203.6

9 9707.73 8283.71 6769.38 5878.47 4260.93 2744.09

Operating Profit 2136.57 1965.96 1412.76 1206.72 1256.35 1087.86 1103.24 874.33 765.38 442.05

Interest 98.88 45.4 96.79 226.51 75.89 14.06 3.35 13.21 14.71 16.82

Gross Profit 2037.69 1920.56 1315.97 980.21 1180.46 1073.8 1099.89 861.12 750.67 425.23

Depreciation 783.2 707.73 752.9 674.53 461.1 358.95 295.01 250.01 178.55 168.02

Profit Before Tax 1254.49 1212.83 563.07 305.68 719.36 714.85 804.88 611.11 572.12 257.21

23

Tax 440.22 440.2 253.7 63.31 112.5 273.6 316.82 144.75 190.05 84.75

Fringe Benefit tax 0 -0.18 0 5.21 5.11 3.46 4.42 0 0 0

Deferred Tax -21.93 -21.47 -66.16 41.53 87.63 -28.95 -41.46 59.44 3.22 7.71

Reported Net Profit 836.2 794.28 375.53 195.63 514.12 466.74 525.1 406.92 378.85 164.75

Extraordinary Items -0.48 -0.34 0.11 0.07 274.55 -0.93 0.1 -0.04 0.03 0.95

Adjusted Net Profit 836.68 794.62 375.42 195.56 239.57 467.67 525 406.96 378.82 163.8

Adjst. below Net Profit 0 0 0 0 -3.49 0 0 0 0 0

P & L Balance brought forward 3028.25 2415.33 2200.7 2157.45 1646.82 1180.08 654.98 407.43 0 0

Statutory Appropriations 0 0 0 0 0 0 0 0 0 0

Appropriations 650.23 181.36 160.9 152.38 0 0 0 159.37 378.85 164.75

P & L Balance carried down 3214.22 3028.25 2415.33 2200.7 2157.45 1646.82 1180.08 654.98 0 0

Dividend 487.52 121.88 121.88 121.88 0 0 0 121.88 121.88 121.88

Preference Dividend 0 0 0 0 0 0 0 0 0 0

Equity Dividend % 60 15 15 15 0 0 0 15 15 15

Dividend Per Share(Rs) 600 150 150 150 0 0 0 0 0 0

Earnings Per Share-Unit Curr 931.78 953.2 437.26 215.26 632.73 574.42 646.25 479.77 446.65 202.76

Book Value-Unit Curr 5178.4 4846.17 4042.98 3755.72 3731.99 3103.55 2529.13 1882.89 1553.12 1256.47

Bibliography

Financial management Book:

I.M.Pandey, Tenth edition, Vikas Publishing House Pvt. Ltd. New Delhi – 110 014

Software:

Capita line plus

24

Websites:

www.moneycontrol.com

www.wikipedia.com

25