The Cayman Islands: An Extender of Value to the USA · The Cayman Islands: An Extender of Value to...

Transcript of The Cayman Islands: An Extender of Value to the USA · The Cayman Islands: An Extender of Value to...

The Cayman Is lands:An Extender of Value to the USA

www.cayman.f inance

December 2018

The Cayman Is lands: An Extender of Value to the USA

DEC

EMB

ER 2

01

8

www.cayman.f inance

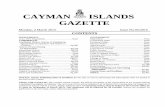

Table of contents

Foreword P1

Brief In t roduct ion to Cayman Finance and i ts leadership P5

Execut ive Summary P6

• International role of the Cayman Islands Financial Services Industry• The Cayman Model• As an Efficient neutral Hub, the Cayman Islands is an “extender of

value” for the USA and other G20 countries• Strong and Diverse Industry Sectors• Protecting the Global Economy• Best in class Global Ownership Standards• Not a tax haven• Tax neutral• Resilience of the Cayman Islands

Histor ic recogni t ion of the benef i ts of the Cayman Is lands P12

Appendices P13

A. Suppor t ing G20 Mul t i la tera l Aid to the Developing Wor ld

B. Impor tance of IFCs in the global economy

C. G20 P lus Global F inancia l Agreements

D. Cayman Is lands Ver i f ied Ownership Regime

E. Not a Tax Haven

The Cayman Is lands: An Extender of Value to the USA

DEC

EMB

ER 2

01

8

www.cayman.f inance 1

This document has been developed by Cayman Finance to share in format ion about the essent ia l ro le of the Cayman Is lands f inancia l ser v ices indus t r y in the global economy, and par t icu lar ly h ighl ight how the Cayman Is lands is an ex tender of value and an impor tant par tner to the Uni ted Sta tes of Amer ica at a t ime when the USA is in an era of evolv ing global t rade re la t ions and other impor tant changes in the global economy.

The Cayman Is lands is a premier g lobal f inancia l hub that e f f ic ien t ly connects law abiding users and providers of inves tment capi ta l and f inancing around the wor ld and has a long s tanding re la t ionship wi th the Uni ted Sta tes of Amer ica.

Global t rade is an impor tant corners tone of the USA’s economic pol icy and the Cayman Is lands is the wor ld’s mos t popular g lobal f inancia l hub for in ternat ional inves tment , providing a proven, t rus ted, s table, tax -neut ra l , and wel l regula ted envi ronment des igned to suppor t g lobal t rade. The Cayman Is lands is a ‘g lobal ex tender of value’ for the Uni ted Sta tes of Amer ica, i t s bus inesses, and i t s c i t izens to be compet i t ive through global t rade, inves t ing and f inancing act iv i t ies, providing the u l t imate p la t form that i s dynamic enough to suppor t the USA cur ren t ly and as i t en ters a new era of g lobal t rade re la t ions.

In order for the Cayman Is lands to be able to bes t ass is t the USA, and for the USA to take maximum advantage of the oppor tuni t ies avai lable in the evolv ing global economy, i t i s imperat ive that the Uni ted Sta tes of Amer ica unders tands fu l ly the benef ic ia l ro le p layed in g lobal f inancia l ser v ices by the Cayman Is lands.

The Cayman Is lands, th rough i t s pivota l ro le in in ternat ional inves t ing and f inancing, suppor ted by i t s robus t and wel l - regula ted f inancia l ser v ices indus t r y, can help the USA as i t prepares for the evolv ing changes in g lobal t rade and the global economy by providing unparal le led access to:

• Foreign Direct Investment or “FDI” (essential to save or grow US businesses and jobs)

• Inward infrastructure investing and financing

• Liquidity for the US economy

• US Job growth

• Increased US tax base

• Global diversified investments for US pensioners

• Free flow of global trade, capital, investing, financing, and services

In 2017, the OECD Global Forum on Transparency and Exchange of In format ion for Tax Purposes es t imated that in jus t one recent year, Cayman at t rac ted at leas t US$4.1 t r i l l ion in banking asse ts , di rec t inves tment and por t fo l io inves tment .

Because the Cayman Is lands is home to approximate ly 70% of g lobal hedge, pr ivate equi ty, and venture capi ta l funds, i t i s wel l pos i t ioned jus t l ike af ter the 2008 global credi t c r i s i s , to provide inward inves t ing, f inancing, and l iquidi ty in to economies dur ing t imes of need or uncer ta in ty, as might be expected wi th the evolu t ions in g lobal t rade re la t ions. The Cayman Is lands inves tment fund provides the vehic le to faci l i ta te t rade to, f rom and through

Foreword

The Cayman Is lands: An Extender of Value to the USA

DEC

EMB

ER 2

01

8

www.cayman.f inance 2

the Uni ted Sta tes of Amer ica br inging employment, exper t i se and tax receipts to the USA. The Cayman Is lands inves tment fund is the global col lec t ive inves tment vehic le, prefer red by inves tors in Nor th Amer ica, the Middle Eas t , China, Japan and many other count r ies. I t i s used by in ternat ional inves tors in those regions to aggregate overseas inves tment in to count r ies around the wor ld, inc luding the Uni ted Sta tes of Amer ica; to faci l i ta te co- inves tment by US inves tors wi th o thers f rom around the globe; and to enable asse t managers in the USA to provide ser v ices to in ternat ional inves tors. For example, Cayman-based funds are used to faci l i ta te in f ras t ruc ture developments such as hospi ta ls , schools, roads, power p lants, e tc. which help increase the qual i ty of l i fe in that count r y. Addi t ional ly, fa i l ing bus inesses are purchased, loans are provided to companies in di f f icu l ty, employees are re -employed and new jobs are created, increasing the tax base in that count r y. Among those inves t ing in Cayman funds are US pensions, which then have access to g lobal divers i f ied inves tments, potent ia l ly reducing r i sks associa ted wi th having these inves ted in one geographic area where disas ters and other fac tors could have a negat ive impact on the inves tments. In tu rn, these global ly divers i f ied inves tments cont r ibu te h igher re turns to US pensioners. Addi t ional ly, many ser v ice providers to Cayman Is lands funds are based in the USA and, in par t icu lar, US ci t ies such as New York, Bos ton, Chicago, and others which are global centers of excel lence for the al ternat ive inves tment management indus t r y. The income of such ser v ice providers, inc luding inves tment managers, i s dependent upon the fees generated f rom managing global pools of capi ta l which are assembled in the Cayman Is lands. This income creates addi t ional jobs and taxable revenue in the USA and helps preser ve US ci t ies ’ posi t ions as leading f inancia l centers by giv ing US-based managers the abi l i ty to manage global capi ta l that might not o therwise be inves ted in the USA.

The Cayman Is lands: An Extender of Value to the USA

DEC

EMB

ER 2

01

8

www.cayman.f inance 3

The Al ternat ive Inves tment Managers Associa t ion, headquar tered in the UK, has noted that the money inves ted in of fshore funds l ike those in the Cayman Is lands is not kept in an of fshore bank but inves ted in f inancia l markets around the wor ld. I t added that th is act iv i ty he lps to provide addi t ional sources of f inancing to bus inesses and in f ras t ruc ture projec ts in p laces l ike the UK, creat ing s igni f icant jobs and generat ing tax revenues for the government there.[ ‘Transparent , Sophis t icated, Tax Neut ra l : The Tru th About Of fshore Funds’ – AIMA Repor t Nov 2017]

Whi le Cayman adds no addi t ional tax to f inancia l ser v ices t ransact ions in i t s ju r i sdic t ion, inves tors ( indiv iduals and bus inesses ) are s t i l l subjec t to any taxes owed at home. This i s ensured by Cayman meet ing or exceeding al l g lobal ly -accepted s tandards for t ransparency and cross border cooperat ion wi th tax author i t ies and law enforcement inc luding through the US Foreign Account Tax Compl iance Act (FATCA).

The impor tance of Cayman’s tax neut ra l s ta tus can be i l lus t ra ted by cons ider ing what would happen were Cayman to in t roduce di rec t corporate tax on prof i t s , e.g. hedge funds. This would reduce re turns to the US inves tors in those funds and, consequent ly, reduce the taxes that those inves tors would in tu rn be l iable to pay at home. Accordingly, Cayman’s ef f ic ien t tax neut ra l p la t form provides the opt imum outcome for inves tors, inves tees, and home tax ju r i sdic t ions.

History of par tnering with the US to fight financial crime

• 1986: Agreed the Mutual Legal Assistance Treaty (MLAT) with the USA, one of the first in the world

and has been proven highly effective in the restraint and forfeiture of the proceeds of crime as well

as the repatriation of assets to the USA for restitution to victims of crime.

• 2001: The first UK Overseas Territory to sign a Tax Information Exchange Agreement with the USA.

• 2013: The first UK Overseas Territory to sign the FATCA Model 1 Intergovernmental Agreement with

the USA, complementing a leading number of bilateral tax information exchange agreements with

other jurisdictions with a view to tax transparency and cooperation.

• Implemented the US FATCA regime so that Cayman financial institutions are obliged to report through

the Cayman Tax Information Authority details of financial accounts held by US citizens and residents.

The US Government Accountabi l i ty Of f ice Repor t to the Chai rman and Ranking Member, Commi t tee on F inance, US Senate ( Ju ly 2008):

• The IRS official also told us that the Cayman Islands government has provided the requested information

in a timely manner for all TIEA requests.

• Officials from Treasury and the SEC reported that the Cayman Islands has been cooperative in

sharing information and SEC reported that several of the SARs have led to U.S. investigations.

• A senior official from DOJ’s Office of International Affairs indicated that the Cayman Islands is the

busiest United Kingdom overseas territory with regard to requests for information, but also the most

cooperative. She also said that the Cayman Islands is one of DOJ’s “best partners” among offshore

jurisdictions.

• A DOJ official reported that the Cayman Islands has an agreement to share proceeds of criminal-asset

forfeitures with the US government, and has been a very cooperative partner.

The Cayman Is lands: An Extender of Value to the USA

DEC

EMB

ER 2

01

8

www.cayman.f inance 4

Summary

With the Cayman Is lands being a premier g lobal hub for inves tment capi ta l and f inancing, the Uni ted Sta tes of Amer ica s tands to benef i t on three impor tant f ron ts :

F i rs t ly, the USA, i t s bus inesses, and i t s people having access to par t ic ipate in g lobal ly divers i f ied inves tment and f inancing oppor tuni t ies resu l t ing in benef i t s such as greater re turns for US pensioners on pension fund inves tments.

Secondly, wi th the subs tant ia l inves t ib le asse ts pooled in Cayman funds f rom around the wor ld, Cayman ent i t ies are uniquely posi t ioned to provide subs tant ia l fore ign di rec t inves tment , in f ras t ruc ture f inancing, and l iquidi ty which can be used to save or grow US bus inesses, jobs and tax base.

Las t ly, as the USA wi l l look to oppor tuni t ies around the globe to secure i t s fu tu re, the Cayman Is lands is wel l pos i t ioned to work hand in hand wi th Washington DC, New York, Bos ton, Chicago, and other US ci t ies to connect the Uni ted Sta tes of Amer ica to the ef f ic ien t f low of g lobal t rade, capi ta l , inves t ing, f inancing, and ser v ices around the wor ld.

The Cayman Islands: A snapshot of strength in numbers

• Top jurisdiction for Alternative Investment Funds: Two-thirds of global hedge funds with over US$2.3

trillion in assets under management (AUM).

• Number 2 jurisdiction for Insurance Captives (Number 1 jurisdiction for Healthcare Captives and

Group Captives).

• IPOs: Cayman companies accounted for 83% of firms listed on the Main Board of the Hong Kong

Stock Exchange and the Hong Kong Growth Enterprise Market.

• A leading Specialized International Financial Centre (The Banker Magazine).

• Cayman entities support the US Government by being among the top 10 jurisdictions investing in and

holding US treasuries.

• The Cayman Islands is the largest domicile in the world for US healthcare captives, thereby supporting

lower US healthcare costs and better access to affordable reinsurance premiums in the global

marketplace.

The message in th is document about the Cayman Is lands is a compel l ing one. I t h igh l igh ts the great work that has been done through col laborat ive ef for t s over many years to es tabl i sh the Cayman Is lands as the premier g lobal f inancia l hub.

We remain commi t ted to cont inu ing our work to promote and protec t the Cayman Is lands f inancia l ser v ices indus t r y and i t s impor tant ro le in the global economy and ex tending value to the Uni ted Sta tes of Amer ica throughout the evolu t ion of g lobal t rade and the global economy. We look forward to work ing together to ensur ing th is impor tant re la t ionship wi th the USA cont inues to be mutual ly benef ic ia l .

The Cayman Is lands: An Extender of Value to the USA

DEC

EMB

ER 2

01

8

www.cayman.f inance 5

Brief In troduct ion to Cayman Finance and i ts Leadership

Cayman Finance

Cayman Finance is a pr ivate sector not for prof i t organisat ion that represents the ent i re Cayman Is lands f inancia l ser v ices indus t r y, inc luding 15 indus t r y associa t ions.

Cayman Finance’s miss ion is to protec t , promote, develop and grow the Cayman Is lands f inancia l ser v ices indus t r y th rough cooperat ion and engagement wi th domest ic and in ternat ional pol i t ica l leaders, regula tors, organizat ions and media; to promote the in tegr i ty and t ransparency of the indus t r y by legis la t ive and regula tor y enactment and to encourage the sus ta inable growth of the indus t r y th rough excel lence, innovat ion and balance.

Leadership of Cayman Finance

The Chairman of Cayman Finance is Conor O’Dea. Since 1989, Mr O’Dea worked for But ter f ie ld Bank (Cayman) L imi ted in var ious capaci t ies. He ended his execut ive career wi th a s t in t as Managing Di rec tor Cayman and Pres ident & Chief Operat ing Of f icer, BNTB Group. In Apr i l 2016, he re t i red f rom execut ive responsibi l i t ies wi th But ter f ie ld Group and assumed a non-execut ive ro le as Di rec tor of BNTB Board and Chairman of But ter f ie ld’s Board. Throughout h is career, Mr O’Dea has also ser ved in var ious associa te and government posi t ions, inc luding Pres ident a t the Cayman Is lands Banker ’s Associa t ion and the Chamber of Commerce.

Jude Scot t , CEO of Cayman Finance s ince 2014, is wel l respected local ly and global ly having spoken in ternat ional ly on f inancia l ser v ices topics and featured on a number of occasions in the in ternat ional media. He re t i red as an Audi t Par tner in 2008 af ter spending over 23 years wi th Erns t & Young. As the Global CEO of Maples and Calder ( the larges t Cayman Is lands law f i rm, he took an act ive ro le in the s t ra tegic growth and development of the f i rm. Having ser ved on var ious Cayman Is lands Government and pr ivate sector commi t tees, inc luding the Cayman Is lands F inancia l Ser v ices Counci l , Cayman Ai rways, Minis ter ia l Counci l for Tour ism and Development, the Cayman Is lands Socie ty of Profess ional Accountants, the Educat ion Counci l , the Inso lvency Ru les Commi t tee and the Stock Exchange, Jude has at ta ined ex tens ive exper ience wi th in the Cayman Is lands’ f inancia l ser v ices indus t r y.

Cayman’s role in the global economy

The facts about the Cayman Is lands impor tance to the global ly economy, the wor ld c lass t ransparency and cooperat ion s tandards i t has had in p lace for many years, and the benef ic ia l ro le the Cayman Is lands cont inues to p lay in suppor t ing the success of the Uni ted Sta tes of Amer ica, is not wel l unders tood. Cayman Finance is uniquely wel l pos i t ioned to share these fac ts and ass is t wi th th is unders tanding.

The Cayman Is lands: An Extender of Value to the USA

DEC

EMB

ER 2

01

8

www.cayman.f inance 6

Execut ive Summar y

This document contains the fo l lowing impor tant sec t ions that should be read in thei r en t i re ty to have a fu l l and accurate unders tanding of the Cayman Is lands f inancia l ser v ices indus t r y and i t s benef i t s to the Uni ted Sta tes of Amer ica. The s t rong his tor ic and ongoing connect ion between the USA and the Cayman Is lands is tes tament to the fac t that both count r ies value th is impor tant re la t ionship. Given the prominent ro le that the Cayman Is lands plays in f inancia l markets g lobal ly and in par t icu lar Nor th Amer ican and Asian f inancia l markets , the Cayman Is lands wi l l be wel l p laced to ass is t the USA as s igni f icant change takes p lace in economies and t rade re la t ionships around the wor ld. In order for the Cayman Is lands to be able to ass is t the USA fu l ly, and for the USA to take maximum advantage of the oppor tuni t ies avai lable in the evolv ing global economy, i t wi l l be cr i t ica l that the USA unders tands c lear ly the benef ic ia l ro le p layed by the Cayman Is lands in g lobal f inancia l ser v ices today.

• International role of the Cayman Islands Financial Services Industry

• The Cayman Model

• As an Efficient neutral Hub, the Cayman Islands is an “extender of value” for the USA and other G20 countries

• Strong and Diverse Industry Sectors

• Protecting the Global Economy

• Best in class Global Ownership Standards

• Not a tax haven

• Tax neutral

• Resilience of the Cayman Islands

*Note: For purposes of th is document, when the phrases “Cayman”, “ the Is lands”, “ the Ju r i sdic t ion”, “us”, or “we” are used, they al l re fer to the Cayman Is lands.

The fo l lowing is detai led evidence to suppor t the impor tance of the Cayman Is lands to the Uni ted Sta tes of Amer ica and the global economy.

International role of the Cayman Islands Financial Services Industry

The Cayman Is lands is a premier g lobal f inancia l hub, ef f ic ien t ly connect law-abiding users and providers of inves tment capi ta l and f inancing around the wor ld, benef i t ing developed and developing count r ies.

As a t rus ted, ef f ic ien t neut ra l hub, Cayman suppor ts e f f ic ien t f ree f low of t rade, capi ta l , inves t ing, f inancing and ser v ices around the wor ld.

One of the bes t examples of Cayman’s ro le as a premier g lobal f inancia l hub is how the jur i sdic t ion ef f ic ien t ly suppor ts funding by global mul t i la tera l organizat ions l ike the Wor ld Bank Group’s In ternat ional F inance Corporat ion in to development projec ts to promote growth in emerging markets .

Mul t i la tera l development organizat ions l ike the IFC choose to inves t resources us ing Cayman-domici led inves tment vehic les because they of fer an ef f ic ien t and ef fec t ive neut ra l p la t form that enables par t ies f rom around the wor ld wi th di f fe r ing laws, regula t ions, tax ru les and cus toms to benef i t f rom doing bus iness wi th each other.

Cayman is one of the few jur i sdic t ions that meets the IFC’s s t r ingent s tandards for inves tments in In termediate Ju r i sdic t ions.

The Cayman Is lands: An Extender of Value to the USA

DEC

EMB

ER 2

01

8

www.cayman.f inance 7

In 2015 alone, the IFC inves ted more than $400 mi l l ion in ten di f feren t Cayman-based inves tment vehic les to suppor t cr i t ica l te lecom, energy, agr icu l tu re, technology, venture capi ta l and manufactur ing development projec ts in more than 24 developing count r ies (see Appendix A).

A recent s tudy per formed by Capi ta l Economics es t imates that fore ign inves tment mediated through the Cayman Is lands was around US$4.5 t r i l l ion and suppor ts in the region of 5 mi l l ion jobs global ly. Addi t ional ly, the research found that inves tment th rough the Cayman Is lands suppor ts es t imated tax revenues for the Uni ted Sta tes government of approximate ly US$60 bi l l ion. ( see Appendix B)

The Cayman Model

The Cayman Model demons t ra tes how a jur i sdic t ion can make a leading cont r ibu t ion to f igh t ing global f inancia l cr ime, protec t ing i t se l f and s t rengthening the global economy in the process. The Cayman Model combines mul t i la tera l cooperat ion wi th indiv idual ju r i sdic t ional leadership and i t ex tends across seven key areas:

• Serving as a Premier Global Financial Hub

• Meeting or Exceeding Highest Global Financial Standards

• Operating a Transparent Jurisdiction

• Managing a Responsible, Effective Tax Regime

• Maintaining Professional Leadership

• Supporting Industry Diversification

• Encouraging Industry-Government Collaboration

The Cayman Model not on ly he lps to def ine our ju r i sdic t ion as a responsib le f inancia l center, i t has earned us a place among the leading in ternat ional f inancia l centers and G20 count r ies who adhere to the highes t g lobal ly implemented s tandards for combat ing f inancia l cr ime.

As an ef f ic ien t neut ra l hub, the Cayman Is lands is an “ex tender of value” for the USA and other G20 count r ies.

Cayman is a great ex tender of value for G20 and developing count r ies, thei r bus inesses and thei r people to par t ic ipate in t rade, inves tment and f inancing oppor tuni t ies around the wor ld.

In addi t ion, because the Cayman Is lands is the home to a s igni f icant propor t ion of the wor ld’s a l te rnat ive funds, inc luding in f ras t ruc ture funds and venture capi ta l funds, the Cayman Is lands is wel l pos i t ioned, much as we did af ter the global credi t c r i s i s , to provide inward inves t ing, f inancing, and l iquidi ty in to economies dur ing t imes of need or uncer ta in ty, inc luding evolu t ions in g lobal t rade re la t ions.

This inward inves t ing, f inancing, and l iquidi ty he lps save or grow bus iness, create jobs, and expand the tax base wi th in those count r ies.

At the same t ime, the Cayman Is lands upholds the same global s tandards as the G20 count r ies do (see Appendix C).

Par t ies f rom di f feren t count r ies who have di f feren t laws, regula t ions, tax ru les, and cus toms are able to do bus iness wi th each other in a t rus ted and ef f ic ien t neut ra l ju r i sdic t ion.

Using a neut ra l ju r i sdic t ion l ike Cayman, no par ty i s a t a disadvantage of being subjec ted to another par ty ’s laws, regula t ions, tax ru les or cus toms.

The Cayman Is lands: An Extender of Value to the USA

DEC

EMB

ER 2

01

8

www.cayman.f inance 8

Through Cayman, US pensions and endowments have access to g lobal divers i f ied inves tments, potent ia l ly reducing geographic and cur rency r i sk and cont r ibu t ing to h igher re turns to US pensioners and endowments. As a resu l t o f US univers i ty endowment funds being inves ted in Cayman funds, th is cont r ibu tes to lower educat ion cos ts for Amer ican s tudents. Many ser v ice providers to Cayman Is lands al ternat ive funds are based in the USA and, in par t icu lar, US ci t ies such as New York, Bos ton, Chicago, and others are global centers of excel lence for the al ternat ive inves tment management indus t r y. The income of such ser v ice providers, inc luding inves tment managers, i s dependent upon the fees generated f rom managing global pools of capi ta l which are of ten assembled in the Cayman Is lands. This income generated creates addi t ional jobs and taxable revenue in the USA and helps preser ve US ci t ies ’ posi t ions as leading f inancia l centers by giv ing US-based managers the abi l i ty to manage global capi ta l which would not o therwise inves t in a US-based vehic le.

Strong and Diverse Industry Sectors The Cayman Is lands F inancia l Ser v ices indus t r y i s led by f i r s t ra te ser v ice providers wi th in inves tment funds and asse t management, banking, insurance, capi ta l markets , and t rus ts sec tors and wor ld c lass f iduciar y, legal, and account ing ser v ice providers across the indus t r y.

The combined ef for t s of the Cayman Is lands Government, the Cayman Is lands Monetar y Author i ty and Cayman Finance ensure that the f inancia l products and ser v ices are cons is ten t ly del ivered to meet or exceed in ternat ional s tandards through excel lence, innovat ion and balance.

Protecting the US and global economies

Both the Cayman Is lands and the Cayman Is lands f inancia l ser v ices indus t r y have been recognised for decades as a s t rong in ternat ional par tner in combat ing cor rupt ion, money- launder ing, ter ror ism f inancing and tax evasion.

Cayman has gained a reputa t ion as a t ransparent , cooperat ive ju r i sdic t ion by meet ing or exceeding al l g lobal ly -accepted s tandards for t ransparency and cross border cooperat ion wi th law enforcement.

Cayman cooperates wi th in ternat ional author i t ies th rough 3 pla t forms:

• Regulatory matters – Cayman Islands Monetary Authority (CIMA)

• Tax matters – Department of International Tax Cooperation (DITC)

• Anti-Money Laundering matters – Financial Reporting Authority (FRA).

The OECD recent ly ra ted Cayman as “ largely compl iant” wi th the in ternat ional s tandard for t ransparency and exchange of in format ion – the same ra t ing given to G20 count r ies l ike UK, Germany, Canada and Aus t ra l ia.

Cayman has adopted at leas t as many global s tandards for t ransparency as any G20 count r y – and more, when agreements speci f ic to In ternat ional F inancia l Centers ( IFCs) and UK Overseas Ter r i tor ies are inc luded.

The Cayman Is lands: An Extender of Value to the USA

DEC

EMB

ER 2

01

8

www.cayman.f inance 9

Best in class Ownership Standards

The Cayman Is lands has had a wor ld c lass ver i f ied ownership regime in p lace for more than 15 years (see Appendix D).

Al l companies es tabl i shed in the Cayman Is lands mus t be formed us ing a l icensed Cayman Is lands corporate ser v ice provider, and annual main tenance cos ts for a basic company are in the region of US$2,000 per annum. There is no abi l i ty for the general publ ic to form Cayman Is lands companies onl ine.

The in format ion in the Cayman Is lands ownership regime is col lec ted and ver i f ied by these l icensed Cayman Is lands corporate ser v ice providers under exis t ing ant i -money launder ing and know-your -cus tomer laws and regula t ions.

Those same l icensed Cayman Is lands corporate ser v ice providers are responsib le for submiss ion of benef ic ia l ownership regis t r y in format ion to the Cayman Is lands Government, and that in format ion forms par t of the Cayman Is lands’ cur ren t enhanced in format ion exchange ar rangements wi th the UK* (see below).

This c lose ly regula ted company format ion s i tuat ion cont ras ts wi th the s i tuat ion in the UK. Companies House in the UK of fers on l ine company format ion ser v ices to the general publ ic wi th no format ion agent involvement for as l i t t le as GBP12.00 per company, and does not requi re submiss ion of the ant i -money launder ing and know-your -cus tomer documentat ion which has been s tandard pract ice in Cayman for 15 years.

The in format ion Cayman requi res to be col lec ted is avai lable to the author i t ies making proper reques ts to Cayman Is lands author i t ies th rough exis t ing in format ion shar ing channels between the Cayman Is lands government and the USA as wel l as o ther count r ies.

The Cayman Is lands does not permi t bearer shares or anonymous numbered bank accounts.

*The Cayman Is lands commenced new laws on 1 Ju ly 2017 that in troduced technology-based sys tem enhancements to i t s exis t ing informat ion sharing arrangements wi th the UK, improving the speed at which requested informat ion, inc luding benef ic ia l ownership informat ion can be provided to UK law enforcement.

Not a tax haven

Cayman is a t ransparent , tax neut ra l ju r i sdic t ion and is not a tax haven (see Appendix E) .

In ternat ional pol icymakers cont inue to recognize the v i ta l ro le Cayman’s f inancia l ser v ices indus t r y p lays as a s t rong in ternat ional par tner in combat ing cor rupt ion, money- launder ing, ter ror is t f inancing and tax evasion.

Cayman meets or exceeds al l g lobal ly -accepted s tandards for t ransparency and cross border cooperat ion wi th law enforcement. This commi tment to g lobal t ransparency s tandards makes Cayman a ver y unat t rac t ive des t inat ion for would -be tax evaders.

The def in i t ions of tax havens by leading in ternat ional organisat ions do not apply to the Cayman Is lands as the legal, regula tor y and legis la t ive basis for the Cayman Is lands f inancia l ser v ices indus t r y c lear ly demons t ra tes Cayman is a t ransparent , tax neut ra l ju r i sdic t ion and not a tax haven.

The Cayman Is lands: An Extender of Value to the USA

DEC

EMB

ER 2

01

8

www.cayman.f inance 10

Tax neutral

The Cayman Is lands is tax neut ra l and adds no addi t ional tax to f inancia l ser v ices t ransact ions in i t s ju r i sdic t ion. Inves tee ent i t ies and inves tors are s t i l l subjec t to repor t ing and paying thei r home jur i sdic t ions’ re levant taxes. In addi t ion, the Cayman Is lands meets or exceeds global ly accepted s tandards for t ransparency and cross border cooperat ion wi th tax author i t ies and law enforcement.

The impor tance of main tain ing Cayman’s tax neut ra l s ta tus can be i l lus t ra ted by cons ider ing what would happen were Cayman to in t roduce di rec t corporate tax on prof i t s of e.g. Cayman Is lands al ternat ive funds. This would reduce re turns to inves tors ( inc luding US inves tors ) in those funds and, consequent ly, reduce the taxes that those inves tors ( inc luding US inves tors ) would in tu rn be l iable to pay in thei r home jur i sdic t ion ( inc luding in the USA). I t would also unfai r ly disadvantage the many inves tors in Cayman Is lands al ternat ive funds who are pr ivate and government pens ion funds, char i t ies and not - for -prof i t organizat ions that are not subjec t to tax in thei r home jur i sdic t ion ( inc luding in the USA).

Cayman has adopted automat ic exchange of tax in format ion wi th re levant author i t ies in o ther count r ies. Under the OECD’s Common Repor t ing Standard (“CRS”) and US FACTA regimes, both of which have been implemented in the Cayman Is lands, Cayman proact ive ly shares tax in format ion wi th o ther governments – a leve l of t ransparency which essent ia l ly ass is t s them in the col lec t ion of thei r own taxes, regardless of what thei r unique tax laws are.

Cayman’s Globally Responsible, Effective Tax Regime

L ike a l l o ther ju r i sdic t ions, Cayman has the r igh t to es tabl i sh a tax regime that col lec ts the r igh t taxes f rom the r igh t people at the r igh t t ime wi th in i t s ju r i sdic t ion. Unl ike other ju r i sdic t ions, Cayman has chosen to use fees and other taxes ins tead of an across - the -board corporate income tax.

Cayman’s g lobal ly responsib le tax regime meets or exceeds the revenue targets used by other leading count r ies around the wor ld, generat ing government taxat ion revenue equal to approximate ly 22% of our GDP (2016). I t ’s a taxat ion revenue rais ing sys tem that works wel l for our ju r i sdic t ion and ver y adequate ly funds our government operat ions and keeps our debt - to -GDP ra t io modes t .Tax evasion is un lawfu l and the Cayman Is lands does not suppor t i t .

Cayman has in place globally-accepted standards for transparency and cross border cooperation with tax

authorities and law enforcement.

Cayman does not have any double taxat ion agreements (or t reat ies ) that could be used to unfai r ly sh i f t tax base f rom another count r y to Cayman. ( I t should be noted that , technical ly, Cayman has s igned a DTT wi th the UK, but i t i s mere ly the form in which the UK prefer red to have i t s tax in format ion exchange agreement wi th Cayman executed and the agreement provides no tax benef i t s to Cayman as Cayman does not have any taxes covered by the agreement. )

Th is responsib le approach to taxat ion is cent ra l to The Cayman Model and a dis t inguish ing feature of our ju r i sdic t ion among In ternat ional F inancia l Centers (“ IFCs” ) many of which have ex tens ive double tax t reaty networks.

Resilience of the Cayman Islands

The Cayman Is lands has h is tor ical ly a lways been se l f - funded and does not requi re funding f rom the Uni ted Kingdom or o ther g lobal bodies. This has been the case even in the af termath of s igni f icant natura l events such as hur r icane Ivan that impacted the Is lands in 2004.

The Cayman Is lands: An Extender of Value to the USA

DEC

EMB

ER 2

01

8

www.cayman.f inance 11

Cayman has a s table and f i scal ly responsib le government.

Caymans s t rong legal f ramework is based on UK Common Law wi th a speci f ic div is ion of the Cayman Cour ts focused on f inancia l ser v ices cases that has the UK Pr ivy Counci l as the u l t imate cour t o f appeals. The Cayman Cour ts have, over the years, developed benef ic ia l legal precedents that are impor tant to the cer ta in ty and predic tabi l i ty of g lobal f inancia l ser v ices t ransact ions and ar rangements.

The f inancia l ser v ices indus t r y i s wor ld c lass and is the engine that dr ives the Cayman Is lands economy, cont r ibu t ing over US$300 mi l l ion (>50%) in revenue to the local government, and over US$1.5 bi l l ion toward GDP (again, more than 50%). F inancia l ser v ices is a lso the sector providing the larges t number of jobs, wi th approximate ly 4,000 Caymanians work ing in the indus t r y.

The same way that technology is now essent ia l g lobal ly, inves tment capi ta l and f inancing have been, and wi l l cont inue to be, cr i t ica l to the success fu l growth and development of economies around the wor ld. The Cayman Is lands is wel l pos i t ioned to cont inue to ef f ic ien t ly suppor t that g lobal growth and development as a t rus ted premier g lobal f inancia l hub that i s proud to be a Br i t i sh Overseas Ter r i tor y that suppor ts the success of the Uni ted Sta tes of Amer ica in the global economy.

The Cayman Is lands: An Extender of Value to the USA

DEC

EMB

ER 2

01

8

www.cayman.f inance 12

His tor ic recogni t ion of the benef i t s of the Cayman Is lands

A leading in ternat ional publ icat ion, the UK-based F inancia l Times said the fo l lowing about the Cayman Is lands and other in ternat ional f inancia l centers: “They are cent res of exper t i se that can al low legi t imate in ternat ional t ransact ions to take place under a sound legal sys tem and wi thout unpick ing a tangle of c lashing in ternat ional regula t ions.” [A s t rong tax sys tem doesn’t re ly on naming and shaming, F inancia l Times, Apr i l 2016]

The Uni ted Kingdom Government noted that “Bermuda, the Br i t i sh Vi rgin I s lands and the Cayman Is lands have developed impor tant n iche posi t ions in in ternat ional f inancia l markets . The UK Government s t rongly bel ieves that Ter r i tor ies which meet f inancia l sec tor in ternat ional s tandards should be f ree to cont inue to compete in in ternat ional markets wi thout discr iminat ion.” [The Overseas Ter r i tor ies – Secur i ty, Success and Sus tainabi l i ty, Foreign & Commonweal th Of f ice, June 2012]

The US Government Accountabi l i ty Of f ice Repor t to the Chai rman and Ranking Member, Commi t tee on F inance, US Senate ( Ju ly 2008):

• Factors that attract U.S.-related financial activity to the Cayman Islands include its reputation for

stability and compliance with international standards, its business-friendly regulatory environment and

its prominence as an international financial center.

• Officials from the Export-Import Bank of the United States (“Ex-Im”) stated that Cayman Islands law

gives them confidence that they will have less dif ficulty reclaiming assets if a party in an Ex-Im-backed

transaction defaults.

• [The Cayman Islands] has a robust financial services sector, which includes several major law firms and

other locally based service providers, as well as prominent international accounting and audit firms,

fund administrators, and banking institutions. The high volume of existing Cayman-based financial

activity may also be responsible for drawing additional business. Finally, U.S. persons may carry out

activity in the Cayman Islands because of its reputation as a neutral jurisdiction for structuring deals

with foreign partners.

The Cayman Is lands have always been a s t rong par tner of the Uni ted Sta tes of Amer ica, i t s People, and the USA’s Economy and wi l l cont inue to be a s t rong par tner for many years to come.

The Cayman Is lands: An Extender of Value to the USA

DEC

EMB

ER 2

01

8

www.cayman.f inance 13

Appendices

A. Suppor t ing G20 Mul t i la tera l Aid to the Developing Wor ld

B. Impor tance of IFCs in the global economy

C. G20 Plus Global F inancia l Agreements

D. Cayman Is lands Ver i f ied Ownership Regime

E. Not a Tax Haven

The Cayman Is lands: An Extender of Value to the USA

DEC

EMB

ER 2

01

8

www.cayman.f inance 14

Appendix ASuppor t ing G20 Mul t i la tera l Aid to the Developing Wor ld

The Cayman Is lands: An Extender of Value to the USA

DEC

EMB

ER 2

01

8

www.cayman.f inance 15

CA

YM

AN

-BA

SED

FIN

AN

CIN

G

fund

s sm

all a

nd m

ediu

m-s

ized

agr

icul

ture

pro

ject

s in

A

rgen

tina,

Bol

ivia

, Bra

zil,

Chi

le, C

olom

bia,

Ecu

ador

, Pa

ragu

ay, P

eru,

and

Uru

guay

.

$70

MIL

LIO

N

DEV

ELO

PMEN

T LO

AN

fr

om t

he W

orld

Ban

k G

roup

s’ In

tern

atio

nal

Fina

ncin

g C

orpo

ratio

n to

Cay

man

-bas

ed

inve

stm

ent

fund

.

$70

MIL

LIO

N

The

Caym

an Is

land

s is

a p

rem

ier

glob

al f

inan

cial

hub

, con

nect

ing

law

-abi

ding

use

rs a

nd p

rovi

ders

of

inve

stm

ent

capi

tal a

nd f

inan

cing

aro

und

the

wor

ld. W

e pl

ay a

cri

tica

l rol

e in

the

suc

cess

of

the

glob

al f

inan

cial

eco

nom

y, b

enef

itin

g bo

th d

evel

oped

and

dev

elop

ing

coun

trie

s. O

ne o

f th

e be

st

exam

ples

of

this

rol

e is

Cay

man

’s ef

fici

entl

y su

ppor

ting

fun

ding

by

glob

al m

ulti

late

ral o

rgan

izat

ions

like

the

Wor

ld B

ank

Gro

up’s

Inte

rnat

iona

l Fin

ance

Co

rpor

atio

n (IF

C) in

to d

evel

opm

ent

proj

ects

to

prom

ote

econ

omic

gro

wth

in e

mer

ging

mar

kets

aro

und

the

wor

ld.

In 2

015

alon

e th

e IF

C in

vest

ed

mor

e th

an $

400

mill

ion

in t

en d

iffe

rent

Cay

man

-bas

ed in

vest

men

t ve

hicl

es t

o su

ppor

t cr

itic

al t

elec

om, e

nerg

y, a

gric

ultu

re, t

echn

olog

y, v

entu

re c

apit

al

and

man

ufac

turi

ng d

evel

opm

ent

proj

ects

in m

ore

than

24

deve

lopi

ng c

ount

ries

. O

ne o

f th

ose

inve

stm

ents

was

a $

70 m

illio

n lo

an f

rom

the

IFC

to

supp

ort

smal

l- an

d m

ediu

m-s

ized

agr

icul

ture

pro

ject

s in

Lat

in A

mer

ica.

Thi

s is

par

ticu

larl

y im

port

ant

as, a

ccor

ding

to

the

IFC,

“A

grib

usin

ess

sect

ors

gene

rally

do

not e

njoy

goo

d ac

cess

to fi

nanc

e an

d fin

anci

ng fo

r sm

alle

r- an

d m

ediu

m-s

ized

com

pani

es in

Em

ergi

ng M

arke

t cou

ntrie

s is

espe

cial

ly in

sho

rt s

uppl

y.”

An

exam

ple

of t

he C

aym

an

Isla

nds

supp

orti

ng a

cces

s to

fi

nanc

ing

for

smal

ler

and

med

ium

-siz

ed c

ompa

nies

in

Emer

ging

Mar

kets

Prem

ier

Glo

bal

Fin

anci

al H

ub

eff

icie

ntl

y su

pp

ort

ing

G20

Mu

ltil

ater

al A

id t

o t

he

Dev

elo

pin

g W

orl

d

ww

w.c

aym

anfinance

.ky |

345

-623

-672

5

Wh

y C

aym

an?

Mul

tila

tera

l dev

elop

men

t or

gani

zati

ons

like

the

IFC

choo

se

to in

vest

res

ourc

es u

sing

Cay

man

as

an e

ffec

tive

fin

anci

al h

ub.

beca

use

it o

ffer

s an

eff

icie

nt &

eff

ecti

ve n

eutr

al p

latf

orm

tha

t en

able

s pa

rtie

s fr

om a

roun

d th

e w

orld

wit

h di

ffer

ing

law

s,

regu

lati

ons,

tax

str

uctu

res

and

cust

oms

to b

enef

it f

rom

doi

ng

busi

ness

wit

h ea

ch o

ther

.

Caym

an’s

str

engt

hs:

• T

he Q

ualit

y an

d Ex

peri

ence

of

our

Prof

essi

onal

Ser

vice

Pro

vide

rs.

• T

he C

aym

an Is

land

s G

over

nmen

t’s c

omm

itm

ent

to t

he F

inan

cial

S

ervi

ces

indu

stry

. •

Has

tak

en a

lead

ersh

ip r

ole

in in

tern

atio

nal r

egul

ator

y is

sues

• O

ur In

nova

tive

App

roac

h to

dev

elop

ing

Prod

ucts

and

Ser

vice

s

t

hat

bene

fit

the

glob

al m

arke

t. •

Neu

tral

pla

tfor

m t

hat

does

not

add

add

itio

nal t

ax f

rict

ions

to

int

erna

tion

al in

vest

men

ts a

nd f

inan

ces.

Caym

an is

als

o on

e of

the

few

pla

ces

that

mee

t th

e IF

C’s

stri

ngen

t st

anda

rds

for

inve

stm

ents

in In

term

edia

te J

uris

dict

ions

:

• R

ecog

nize

d fo

r de

cade

s as

a s

tron

g in

tern

atio

nal p

artn

er in

com

bati

ng c

orru

ptio

n, m

oney

-laun

deri

ng a

nd t

ax e

vasi

on.

• M

eets

or

exce

eds

all g

loba

lly-a

ccep

ted

stan

dard

s fo

r tr

ansp

aren

cy

a

nd c

ross

bor

der

coop

erat

ion

wit

h la

w e

nfor

cem

ent,

incl

udin

g

tho

se o

f O

ECD

. •

Tra

nspa

rent

juri

sdic

tion

as

was

mos

t re

cent

ly r

ecog

nize

d by

its

incl

usio

n on

the

Ital

ian

“goo

d ta

x go

vern

ance

” W

hite

Lis

t.

The Cayman Is lands: An Extender of Value to the USA

DEC

EMB

ER 2

01

8

www.cayman.f inance 16

Appendix BImpor tance of IFCs in the global economy

The Cayman Is lands: An Extender of Value to the USA

DEC

EMB

ER 2

01

8

www.cayman.f inance 17

© Capital Economics Limited, 2018

The importance of international finance centres in the global economy

Key points

International finance centres (IFCs) have developed to facilitate cross-border activities in a world in which global trade is increasingly significant

IFCs serve an important role in the global economy. By providing efficient and effective neutral platforms for facilitating cross-border investment, parties around the world with differing laws, regulations and tax systems can do business with each other

The economic and fiscal benefits of the investment mediated by IFCs are clear. They facilitate trillions of dollars of investment, which supports jobs, growth, and consequent tax revenues around the globe

1. International finance centres have developed to provide services that facilitate cross-border

activities in a world where global trade is increasingly significant

International finance centres (IFCs) are part of a global economic system that facilitates more efficient trade in goods and services between nations, and helps to increase overall levels of wealth and prosperity in both developed and developing economies.

The world’s economies continue to move closer together. Over recent decades, global prosperity has been boosted by greater trade and investment across borders, with international trade growing from 25% of global GDP in the 1970s to 60% today.1 This is positive for the global economy. Trade is a mutually beneficial process that has enriched almost every nation on Earth in recent decades and centuries.

In a world where national boundaries have ever-decreasing significance to people and to businesses, it should come as no surprise that there is demand for services that facilitate efficient and secure cross-border transactions. Exports are strongly correlated with possessing more developed financial markets, with countries where banks lend 100% more of GDP to business exporting 6.5 times as many product lines internationally.2 However, with many countries lacking the financial infrastructure to facilitate that lending, IFCs have evolved to meet the needs of global businesses and investors.

Increased cross-border trade and mobility isn’t restricted to goods, services, or people. Capital markets are increasingly global – with investors seeking diversification beyond national borders to reduce risk and borrowers accessing wider sources of finance to reduce borrowing costs. IFCs play a vital role in helping these global investment flows. 1 Robert Feenstra, Robert Inklaar, and Marcel Timmer (2015): “The Next Generation of the Penn World Table”. American Economic Review 105(10), pp.3150-3182 2 Kalina Manova (2013): “Credit Constraints, Heterogeneous Firms, and International Trade”. The Review of Economic Studies 80(2), pp711-744

The Cayman Is lands: An Extender of Value to the USA

DEC

EMB

ER 2

01

8

www.cayman.f inance 18

1 © Capital Economics Limited, 2018

Substantial investments by businesses and governments in new housing, industrial and commercial premises, airports and roads, computers and telecoms infrastructure, or plant and equipment – as well as softer intangibles like research and development – are increasingly financed internationally. Meanwhile, the local banks and financial services firms that offer the credit cards, overdrafts, mortgages, and lease agreements to support consumers’ purchases of their cars, consumer goods, and homes increasingly depend upon international capital markets to provide liquidity and keep costs down.

In this way, what appears to be the obscure and remote world of international finance provides the ‘financial investment’ that helps to deliver the ‘economic investment’ that matters to the real lives of employees, families, and businesses. Globalisation of capital brings material advantages to investors, firms, and consumers. These include:

Reducing the cost of borrowing by providing access to deeper capital markets and increasing competition between lenders

Increasing returns to investment by facilitating the pooling of investments and their diversification across a wider range of international assets: reducing risk

Providing investors with greater opportunities to match their portfolios of investments to their desired profiles of risks and expected returns

Making insurance cheaper by allowing risks to be reinsured cost-effectively around the world by investing in geographies or assets with differing risks

Preventing domestic credit crunches by facilitating borrowing from abroad to offer respite during temporary recessions or natural disasters

Providing investment into less developed countries with limited domestic capital, thereby promoting economic growth in countries with low savings potential

At the global level, international capital markets channel the world’s savings to their most productive uses – irrespective of location. IFCs have developed the expertise and specialisation to foster these cross-border flows.

2. International finance centres offer a wide array of benefits, and serve an important role in the global economy

IFCs offer this wide array of benefits by providing highly-specialised environments that are tailored to cater for the needs of international commerce and the pooling of international investments:

Jurisdictional neutrality. A location that is independent of the home jurisdictions of the various counterparties where transactions can be conducted, whilst adding little or no additional cost. This can be important, for example, when forming joint venture vehicles between organisations from different countries.

Tax neutrality. Tax neutrality means that investments do not pay additional taxation just because they are pooled in such a neutral jurisdiction, although they still pay taxes where funds are invested and where the investor is based. Assets and investment funds can be

The Cayman Is lands: An Extender of Value to the USA

DEC

EMB

ER 2

01

8

www.cayman.f inance 19

2 © Capital Economics Limited, 2018

pooled, grown, and distributed across borders without imposing any additional taxation. This is important, for example, when developing fund structures to attract international investors and/or to invest in a portfolio of assets across borders.

Regulatory specialisation. Bespoke regulation that allows specific sectors located in IFCs to avoid the unintended inefficiencies of ‘catch-all’ regulation of larger jurisdictions that are often aimed at protecting retail investors that are based there. IFCs may be able to concentrate resources on regulating specific types of financial sector activity effectively, while larger countries have to spread regulatory resources across a wider range of activities.

Country risk mitigation and protection of wealth. Keeping assets protected from potential loss, damage, or sequestration resulting from socio-political instability or delinquent legal, regulatory, or enforcement institutions in a particular country.

Specialist and expert services. Many IFCs offer particular niche services, such as private banking, asset management, and reinsurance. These centres often focus in a particular business sector and even market segment, providing a high degree of specialisation and expertise attractive to clients and providing a neutral location for administrative tasks

Access to capital markets. IFCs have strong links with capital markets across the globe. Banks, trust companies, legal practices, and accountancy firms are closely networked into their counterparts in major cities across the world, and can provide their clients with access to these centres’ liquidity and expertise.

3. International finance centres support jobs and economic activity. Governments around the world benefit significantly from the economic activity that is supported by international investment mediated through these centres

The investment mediated by IFCs supports economic activity, jobs and incomes around the world. It provides the underlying finance that enables real world economic investment in housing, businesses, or infrastructure – or the essential liquidity for the secondary markets that underpin and provide confidence in these real world primary investments.

We examine the global value of the British Virgin Islands (BVI), the Cayman Islands, and Jersey’s finance centres as examples. We estimate that the foreign investment mediated through the BVI, the Cayman Islands, and Jersey in 2016 was $1.5 trillion, $4.5 trillion, and $1.8 trillion respectively. The investment mediated by the BVI and Jersey supports 2.2 and 2.3 million jobs respectively, while the investment mediated by the Cayman Islands supports in the region of 5.0 million jobs (see Figure 1).

The economic activity and jobs supported by the investment mediated by these jurisdictions will generate tax revenues for governments around the world. Governments benefit significantly from the economic activity that is supported by international investment mediated through these jurisdictions.

For example, our estimates suggest that investment through the Cayman Islands, supports tax revenues for the United States government to the tune of roughly $60 billion, while the United Kingdom government benefits in the region of $20 billion from Jersey’s activities.3

3 These are indicative estimates based on the best evidence available and are intended to provide an idea of the broad scale

of the benefits rather than be precise estimates.

The Cayman Is lands: An Extender of Value to the USA

DEC

EMB

ER 2

01

8

www.cayman.f inance 20

3 © Capital Economics Limited, 2018

Figure 1: Investment mediated by the BVI, the Cayman Islands and Jersey’s international finance centres by location of underlying asset ($ billion) and employment related to investment (thousand people), 2016

Source: Capital Economics. *Note: The investment mediated through Jersey from China and Kong Hong is included in the Rest of World estimates.

Disclaimer: This note has been commissioned by IFC Forum from Capital Economics, an independent macroeconomics research consultancy. The views expressed remain those of Capital Economics and are not necessarily shared by IFC Forum. While every effort has been made to ensure that the data quoted and used for the research behind this document is reliable, there is no guarantee that it is correct, and Capital Economics Limited and its subsidiaries can accept no liability whatsoever in respect of any errors or omissions. This document is a piece of economic research and is not intended to constitute investment advice, nor to solicit dealing in securities or investments.

BVI + Cayman Islands + Jersey

United KingdomInvestment Jobs

BVI 170 150Cayman Islands 590 520Jersey 1,000 840

United States and CanadaInvestment Jobs

BVI 90 80Cayman Islands 3,100 2,810Jersey 180 170

Latin America includingthe CaribbeanInvestment Jobs

BVI 110 330Cayman Islands 100 280Jersey 40 130

Rest of worldInvestment Jobs

BVI 150 440Cayman Islands 380 1,140Jersey 270* 820*

Europe excluding the United KingdomInvestment Jobs

BVI 330 290Cayman Islands 200 170Jersey 380 330

China and Hong KongInvestment Jobs

BVI 610 870Cayman Islands 140 140Jersey* - -

The Cayman Is lands: An Extender of Value to the USA

DEC

EMB

ER 2

01

8

www.cayman.f inance 21

Appendix CImpor tance of IFCs in the global economy

The Cayman Is lands: An Extender of Value to the USA

DEC

EMB

ER 2

01

8

www.cayman.f inance 22

Both the Cayman Islands and the Cayman Islands financial

services industry have been recognised for decades as strong

partners with other leading jurisdictions and industries in

promoting transparency to combat corruption, money-

laundering, terrorism financing and tax evasion. These leading

jurisdictions – G20 countries and a few select International

Financial Centres such as the Cayman Islands, Bermuda,

Jersey and Guernsey – make up the G20 Plus.

The Cayman Islands has earned its place among G20 Plus

jurisdictions because it is a premier global financial hub,

connecting law-abiding users and providers of investment

capital and financing around the world - benefitting both

developed and developing countries. The Cayman Islands

has also built a reputation for transparency by meeting or

exceeding globally-accepted standards for transparency and

cross border cooperation with law enforcement.

“G20 PLUS” GLOBAL FINANCIAL AGREEMENTS

The Cayman Is lands: An Extender of Value to the USA

DEC

EMB

ER 2

01

8

www.cayman.f inance 23

countries such as the UK, Germany, Canada and Australia.

The Cayman Islands has been delivering on its prior

commitments to cooperate with the EU as well as the OECD

as one of the 120-member jurisdictions in the BEPS Inclusive

Framework. That has included advancing legislation to meet an

evolving global business framework in compliance with OECD

global standards.

As the chart below shows, the Cayman Islands has adopted

at least as many global standards for transparency and cross-

border cooperation as any G20 country – and more, when

agreements specific to International Financial Centres (IFCs)

and UK Overseas Territories are included. The OECD’s latest

assessment rated the Cayman Islands as “largely compliant”

with the international standard for transparency and exchange

of information – the same rating given to other G20 Plus

The Cayman Is lands: An Extender of Value to the USA

DEC

EMB

ER 2

01

8

www.cayman.f inance 24

Appendix DCayman Is lands Ver i f ied Ownership Regime

The Cayman Is lands: An Extender of Value to the USA

DEC

EMB

ER 2

01

8

www.cayman.f inance 25

Honest People

Verified ownership regime

Verified ownership regime

Honest people will follow the law so an ownership register isn’t really targeted at them. However, a verified ownership regime will ensure all information is accurately collected and available to authorities.

Protected by:self-reporting publicownership register

self-reporting publicownership register

Verified ownership regime self-reporting publicownership register

Opportunistic PeopleOpportunistic people will likely follow the law but may choose to cut corners if they see an advantage and there are no consequences for doing so. A self-reporting ownership regime enables them to report information inaccurately with little likelihood of consequences, even if the information is public. A verified ownership regime acts as a deterrent because it requires an independent evaluation of the information they provide, which will encourage – and enforce – honest reporting.

Criminals have no intention of following the law. They also have no intention of reporting their illegal activities. So, they will provide false information under a self-reporting ownership regime with very little likelihood that it is discovered, even if the information is public. And if it is discovered, there may be no way to determine who is behind it. A verified ownership regime requires an independent evaluation of the information they provide, which will serve as a greater deterrent to illegal activity and will identify potentially questionable activity if it is attempted.

Criminals

Does a verified ownership regime or a self-reporting public register provide a jurisdiction with the best protection from criminal and illicit use of the juris-diction and its financial system?

*Cayman has had in place for over 15 years AML/KYC/CFT and verified ownership regulations. By law the information is available for legitimate cross-border regulatory, tax and money laundering investigations.

www.cayman.finance

Protected by:

Protected by:

?

The Cayman Is lands: An Extender of Value to the USA

DEC

EMB

ER 2

01

8

www.cayman.f inance 26

Appendix ENot a Tax Haven

November 07, 2017 1

www.caymanfinance.ky | 345-623-6725

The Cayman Islands is a premier global financial hub efficiently connecting law abiding users and providers of investment capital and financing around the world — benefiting developed and developing countries which use this investment capital to finance economic activity which helps create jobs and taxable revenue and improved infrastructure in those countries.

International policymakers continue to recognise the vital role Cayman’s financial services industry plays as a strong international partner in combatting corruption, money-laundering, terrorist financing and tax evasion. Cayman has an effective and predictable globally responsible tax system, and meets or exceeds all globally-accepted standards for transparency and cross border cooperation with law enforcement. This commitment to global transparency standards makes Cayman a very unattractive destination for would-be tax evaders or aggressive tax avoiders.

A review of the definitions of a tax haven used by leading transparency organizations contrasted with the real legal, regulatory and legislative basis for the Cayman Islands financial services industry clearly demonstrates Cayman is a transparent, tax neutral jurisdiction and not a tax haven.

WHAT IS A TAX HAVEN?WHY THE CAYMAN ISLANDS

IS NOT A TAX HAVEN

Levies “no or nominal tax on the relevant income” though it’s important to note that “no or nominal tax is not sufficient in itself to classify a country as a tax haven.” (OECD)

Cayman:

– Has an effective tax system whereby total government tax revenues as a percentage of GDP are similar to tax rates in G20 countries and sufficient to fund government operations. Therefore additional taxes such as corporate income taxes have never been necessary.

– Has transparent effective tax rates.

– Does not have differing tax rates for foreign entities.

– Does not have legal mechanisms or treaties (such as double taxation agreements) in place with other countries to legally transfer tax bases from one country to another in order to aggressively reduce taxes.

– Does not promote itself as a jurisdiction for aggressive tax planning.

THE CAYMAN ISLANDS IS A TRANSPARENT, TAX NEUTRAL JURISDICTION, NOT A TAX HAVEN

November 07, 2017 2

www.caymanfinance.ky | 345-623-6725

WHAT IS A TAX HAVEN?WHY THE CAYMAN ISLANDS

IS NOT A TAX HAVEN

Grants “favourable tax treatment which can benefit non-residents.” (Transparency International)

Cayman:

– Offers no tax incentives designed to favour non-resident individuals or businesses.

Has a “lack of effective exchange of information” (OECD)

Cayman:

– Signed its first Mutual Legal Assistance Treaty with the USA in the 1980s.

– Has tax information exchange agreements with 36 jurisdictions; the Multilateral Convention on Mutual Administrative Assistance in Tax Matters, which allows tax information exchange with more than 90 countries; automatic data exchange as part of the European Union Savings Directive; and has adopted US FATCA, UK FATCA and was an early adopter of the OECD’s Common Reporting Standard.

A “secrecy jurisdiction” that encourages “the relocation of otherwise foreign economic and financial transactions through strong privacy protection rules” and ensures “that the identity of those relocating their money through them cannot be disclosed.” (Transparency International)

Provides “facilities that enable people or entities [to] escape (and frequently undermine) the laws, rules and regulations of other jurisdictions elsewhere, using secrecy as a prime tool.” (Tax Justice Network; emphasis in original)

Cayman:

– Has operated a verified beneficial ownership regime for over 15 years that provides for due diligence and know-your-customer checks by licensed regulated Corporate Service Providers that are critical to proper law enforcement authorities conducting legitimate investigations and is superior to self-reporting systems adopted by other countries.

– Adheres to the same high global standards for transparency and cross border cooperation as G20 countries and other top International Financial Centres (IFCs) - together the “G20 Plus.” It has been rated “Largely Compliant” by the OECD’s Global Forum on Transparency and Exchange of Information for Tax Purposes, the same rating given to the UK, Germany, Italy and the USA.

– Does not have numbered accounts.

– Does not have bearer shares.

– Does not have shell companies.

THE CAYMAN ISLANDS IS A TRANSPARENT, TAX NEUTRAL JURISDICTION, NOT A TAX HAVEN

To protect, promote, develop and grow the Cayman

Islands financial services industry through cooperation and

engagement with domestic and international political leaders,

regulators, organisations and media; to promote the integrity

and transparency of the Industry by legislative and regulatory

enactment and to encourage the sustainable growth of the

Industry through excellence, innovation and balance.

MISSION STATEMENT

SCAN OR CLICK BELOW TO LEARN MORE ABOUT HOW THE CAYMAN ISLANDS IS A

PREMIER GLOBAL FINANCIAL HUB AND AN EXTENDER OF VALUE TO THE USA

Connect with us

www.cayman.finance | [email protected] | 1(345)623-6725

![CAYMAN ISLANDS - assets.kpmg€¦ · Cayman Islands CRS Guidance Notes Version 2.0 Release Date: [] March 2017 4 F. The Cayman Islands Competent Authority The Cayman Islands Competent](https://static.fdocuments.net/doc/165x107/5f63986e8b3dfd5eb1349e01/cayman-islands-cayman-islands-crs-guidance-notes-version-20-release-date-.jpg)