Tesla Gigafactory: Commercialization Analysis of a Lithium Ion Battery Pack

-

Upload

aditya-chaganti -

Category

Technology

-

view

110 -

download

5

Transcript of Tesla Gigafactory: Commercialization Analysis of a Lithium Ion Battery Pack

19-670Team 2 - Tesla Gigafactory: Final Report

Aditya Chaganti, Rebecca Ciez, Alessandro Giordano,Sakshi Goel, Shelly Hagerman, Fridtjof Melle

May 1st, 2015

1 Executive SummaryWe combined an analysis of the production of the battery cell and pack costs associated with the Tesla ModelS battery electric vehicle (BEV) with an analysis of consumer willingness to pay (WTP) for certain attributesof luxury vehicle: vehicle range, vehicle type 0-60 acceleration time, and warranty. Our production analysisshows that manufacturing reaches economies of scale well below both historical sales and predicted demand,at both the pack and cell level, with a cost of $287/kWh and a pack cost of approximately $33,000. Materialsare a main cost driver, but changes to the cell dimensions (height and diameter), electrode thickness, andduration of the formation cycle can reduce the cost per kWh. The analysis shows that consumers are willingto pay for larger cells and thinner electrodes, and small increases in warranty mileage are necessary to justifylonger formation cycles, but there is high level of uncertainty associated with these increased profits.

2 IntroductionTesla Motors, an auto manufacturer that specializes in BEVs, is currently producing the Model S, a BEVluxury sedan with vehicle range of 265 miles. Its vehicles are powered by battery packs, which are assembledby aggregating numerous cylindrical lithium-ion (Li-ion) cells. These batteries are produced by Panasonicand also have applications in the electronics industry. Tesla Motors and Panasonic are investing in theconstruction of a $5 billion battery production facility [1] in the state of Nevada. The facility is projected toachieve a production capacity of 35 GWh per year by 2020, doubling current world capacity.

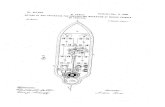

Our analysis combined a process-based cost model (PBCM) for four key steps of the cell manufacturingprocess with an analysis of pack assembly costs using Argonne National Lab’s BatPaC model with ananalysis of consumer WTP for different luxury BEV attributes. The analysis specifically focused on whetherincreases (up to 10%) in the cell dimensions (height and diameter), electrode thickness (50-150 µm), andthe duration of the formation cycle (5-8 hours) would be sufficient to achieve the 30% cost reduction Teslais predicting. A diagram of the Panasonic NCR18650A 3100mAh Cell and associated decision variables isdepicted in Figure 4 in Appendix II.I. The 17 manufacturing steps in the production of an individual cellare listed in Figure 5. Of these, we selected the mixing, electrode coating, electrode slitting, and formationcycle steps for analysis because of their sensitivity in changes to the decision variables and overall capitalexpenses. These four steps can also be seen with all steps involved in the process in Appendix II.I. Table1 in Appendix II.I lists the decision variables impacted, machinery required, and (raw material) inputs foreach of the four steps focused on in this report.

While our production analysis focuses on studying the effects of a change in battery design for Li-ionbattery production, our demand analysis focused on the vehicles themselves. Because Tesla is a luxuryvehicle, our analysis focused on the US luxury vehicle market, which has annual sales of 2.5 million[2][3].Attributes included to measure vehicle preferences are the 0-60 mph acceleration time, vehicle type (con-ventional or electric), vehicle warranty (in miles), price, and vehicle range (miles traveled before refueling).Other attributes considered for inclusion but were left out of the survey to reduce the length and complex-ity for respondents. Attribute inclusion and omission decisions were based on both preliminary responsesfielded during the Pittsburgh Auto Show and the relationship between the attributes and the decision vari-ables related to the individual battery cells. While each of these omitted attributes may gain relevance inspecific situations, we believe that modeling user preferences based on the selected attributes is likely toresult in a good estimate of clinic shares and WTP for the different attributes.

We explored the relationship between the cell dimensions and electrode thickness to the vehicle rangeand acceleration time and the relationship between the duration of the formation cycle and warranty. Wecombined WTP information with the results of the production model and data for existing vehicles to de-termine if modifications in the battery pack design would increase profits, and when data was unavailable,conducted a breakeven analysis to determine minimum vehicle attribute improvements required to justifyany increased production costs. Detailed description of the relationships is in Appendix I.

1

3 Production AnalysisOur production analysis has been split into two components: a PBCM on the four selected steps (mixing,coating, slitting, and formation cycle) and ANL’s BatPaC for an estimate of entire pack costs. Our PBCMof the per kWh cost of manufacturing individual battery pack cells with a focus on the four steps allowedus to conduct full uncertainty and sensitivity analysis, and the results are presented below. To supplementthis, outputs of the PBCM model were then combined with ANL’s BatPaC to provide an estimate of entirepack costs and to provide context with consumer WTP for BEV attributes. Using the BatPaC model didnot allow us to model uncertainty for all steps. Our analysis used the existing Li-ion cells as a baseline,and varied the design decisions from those values. The 18650 Li-ion cylindrical cells (1.8cm diameter and6.5cm height) have electrodes 70 µm thick, with a 6.5 hour assumed formation cycle. Our baseline for thelabor inputs and costs was based on manufacturing the cells in Nevada (US). Our analysis found that Teslahas already reached economies of scale, (the minimum efficient production volume is approximately 200vehicles, as shown in Figure 8 in Appendix II.III and the difference between dedicated and non-dedicatedcosts is minimal. Additional information is detailed in Appendix II.IV.

3.1 Cost Drivers and Cost LeversWe found that materials make up approximately 60% of total cell costs (about $287/kWh), a majority ofwhich can be attributed to the mixing and coating steps. Materials are also a significant component of thepack assembly cost, but we have not conducted an extensive analysis of these expenses. Materials costs inthe mixing process are estimated to be around $144/kWh. One third of this amount is due to the cathodeactive material (LiNiCoO2) and 15% is attributable to the synthetic graphite, which is the assumed activematerial in the anode. The remaining cost is incurred on a polymer used for binding together the activeanodic materials (PVDF). The aluminium and copper foil used as inputs in the coating process contribute toa fraction of the costs, around $14/kWh.

Figure 1: Unit cost break down for each process step.

The primary cost levers are the di-mensions of the cell (height, diame-ter and thickness of the electrode), andtype of graphite (natural versus syn-thetic). Auxiliary equipment (primar-ily the clean rooms necessary for theformation cycle) represents the secondlargest part of the unit cost, account-ing for about $31/kWh (10% of the to-tal). The formation cycle is also themost labor and capital intensive step(accounting for $25 of the $27/kWh inlabor costs, and $8 of the $10/kWh inmachinery costs). The duration of theformation cycle is a lever to reduce these costs. Tooling/fixtures account for 9% of the total cost, mostlyattributable to a recyclable solvent (NMP) used in the mixing step. Reducing the percentage of solventcould reduce this cost. Sensitivity analyses on the sources of uncertainty and cost levers (in Figure 9 in Ap-pendix II.III) shows= that at efficient production volumes, the cost of cell production is sensitive to changesin relevant decision variables like the cell dimensions, length of the formation cycle, and the graphite source.

3.2 Design and Production Costs and Sourcing RecommendationsKnowing that the cell dimensions could impact the per kWh cost, we compared multiple combinations ofcell height and diameter, at multiple production volumes (Figure 10 in Appendix II.III). However, we did notdetermine a set of final cell dimensions, but instead chose to focus on a pack-level analysis when integrated

2

with consumer preferences. We also found a significant difference in cost when switching from syntheticto natural graphite (Figure II.II.IV.i in Appendix II.III). However, we did not know how this might affectbattery performance, so do not utilize the less expensive material at this time. The Gigafactory’s projectedannual production volume will require vast amounts of graphite. A thorough discussion of possible sourcesand issues is developed in Appendix II.IV.

Our analysis shows that for all of the designs considered, both the cell and pack level manufacturingprocesses reach economies of scale at around 200 vehicles (Figure 8 in Appendix II.III), which is less than1% of Tesla’s 2014 sales, and is significantly less than the predicted market shares of the 2.5 million luxuryvehicle sales in the United States. Because of this, in-house manufacture is efficient, and there are limitedgains from having undedicated machinery, especially because many of the machines can be used for bothanode and cathode production (Figure 12 in Appendix II.IV).

China, Japan, and Korea dominate United States in total lithium-ion battery production, although the UShas a larger share of automotive lithium ion battery production (17%) than it has for the larger battery market(where it holds only 7% of the world production) [4]. We compared production costs with the assumptionslisted in Appendix II.V).Figures 13(a) and 14(a) in Appendix II.V suggest that production in Japan will leadto the lowest total unit cost. However, the differences in the unit costs are low, and the uncertainty (Figure14(b)) is high. Additionally, our PBCM does not include factors like shipping costs, or the additional stepsin the pack manufacturing process. Because of this, and because of simplicity of integration with the ANLBatPaC model that assumes US production costs, we chose to keep production in the United States.

4 Market AnalysisWe designed a randomized choice-based conjoint (CBC) survey that incorporates 13 questions with vari-ations in vehicle attributes’ levels and with 3 alternatives for each question. The attributes considered arevehicle type, acceleration time, range, warranty coverage and price (Ref. Table 13 in Appendix III for lev-els). The choice of the attributes is supported by a survey on consumers’ preferences conducted at PittsburghAuto Show 2015 (see Appendix III). We included vehicle type attribute to explore possible biases respon-dents may have regarding vehicle range and refueling of electric vehicles. Accordingly, we consideredpossible interactions between vehicle type and vehicle range but found that these interactions were negligi-ble. Looking at design decisions for the electric vehicle battery, acceleration depends on electrode thickness,which is a key battery characteristic that affects the overall power a battery pack may produce. Cell heightand width affect the capacity of individual cells. Collectively, this determines the potential vehicle range.The formation cycle duration (part of the production process) affects the overall quality and endurance ofthe battery, which will determine the possible warranty on how the battery pack is expected to perform.

Using the Tesla characteristics as a standard, we wanted to include levels both below and above ourproduct’s specifications in order to assess its performance among competitor’s with both higher and lowerperformance. A major concern was being able to find a large enough respondent pool of luxury car buyers.About 3/4 of our resondents came from MTurk, which tends to have few high-income respondents. Foradditional respondents, we also contacted various people to take the survey using similar filters.

4.1 Willingness to PayWe used a logit model with both linear and part-worth utility function forms when analyzing the resultsof our survey. Initially, we modeled all variables as part-worth entities. However, we later found thatprice and acceleration have approximately linear utility (see Appendix III.III in Market Analysis Appendix,Appendix III). Figure 2(a) shows the WTP estimates for all attributes (except price) with estimated 95%confidence intervals. The results of our survey suggest that luxury car buyers are moderately sensitive toreductions in the acceleration time, and to increases in warranty mileage and range. Respondents showan average WTP of about $6,000 for either a car that can accelerate from 0-60 miles-per-hour 3 seconds

3

(a)

0

20

40

60

80

100

120

10

15

20

25

30

35

40

45

50

55

60

65

70

75

80

85

90

95

100

105

110

115

120

Rev

enue

(Bill

ions

of D

olla

rs)

Vehicle Price (Thousands of Dollars)

(b)

Figure 2: (a)WTP for vehicles attributes excluding price, and (b) Tesla’s revenue curve for different ModelS prices, assuming a market size of 2.5 million cars.

quicker, or has an increase of 50,000 miles in the warranty. WTP for an additional 25 miles of range isinstead valued around $4,000.

4.2 Demand PredictionsThe simulated market scenario considers a competing BEV, the BMW i3, and a vehicle to typify conven-tional luxury vehicles, the Corvette Coupe Z06 (see Table 14 in Appendix III.I). From our survey data,we calculated the simulated market shares (clinic shares) of each of these vehicles. The target market isassumed to be all luxury vehicles, whose market size in the U.S. amounts to about 2.5 million cars[2][3].

At the beginning of the survey, we asked respondents to choose their favorite generalized luxury carimage to remove associations with brand, but to help illustrate that the options in the CBC analysis wouldnot change the appearance of the car. Further, we excluded consumer perception of the environmentalfriendliness of vehicle technologies (BEVs over conventional vehicles). Measuring average responses toBEVs without quantifying subjective driving forces behind their choices could also lead to bias in the re-sults.The expected mean market shares and 95% confidence interval for each of the two models used (logitnot considering interaction and partworth) are summarized in Table 15 in Appendix III.I.

The model suggests that Tesla Model S presents higher market shares than its direct competitors. Itsdominance over the other BEV, the BMWi3, might be explained in terms of higher range, warranty andfaster acceleration. Preference over the conventional luxury car model, the Corvette Z06, is attributable tohigher warranty and the vehicle type.

The revenue-maximizing price at the baseline values is $75,000, which is slightly lower than the currentTesla Model S price, and well within the uncertainty bound. At this price, Tesla motors revenue would notbe significantly higher than keeping current prices and assuming the market shares in this scenario.

4.2.1 Sensitivity AnalysisThe attributes that most directly affect the manufacturing decision variables are acceleration time, vehiclerange, and warranty. Sensitivity analyses were conducted by varying existing Tesla price, $85,000 pervehicle, in market scenarios including BMWi3 and different conventional luxury vehicles as competitors.

Table 15 in Appendix III shows the Tesla Model S simulated market share in these different scenarios.Results reveal that Model S share increases when competing with higher-end luxury vehicles.

As seen in the tornado plots in Figure 2(a), a shift from a range of 75 to 265 miles is always statisticallysignificantly different, but a shift from 265 to 300 miles is not. This is important because the expectedredesign of the cells will likely produce a vehicle with a range between these two levels. Similarly, varyingfrom an acceleration time of 9 seconds to 5.4 seconds (the current Tesla specification) is significant at all

4

price points, but further reductions from 5.4 seconds do not produce significant differences in clinic share orrevenue, at any price considered.

For both clinic share and simulated revenue, variations in the vehicle range from the baseline of 265miles resulted in the largest changes. Variations in acceleration time also resulted in significant changesin the clinic share and simulated revenue. Changes in the length of the warranty did not produce anystatistically significant changes in the clinic share or simulated revenue.+ In terms of the uncertainty on theannual revenue, historical sales figures for the Tesla Model S can provide a lower bound. In 2014, 35,000Model S vehicles were delivered. At our clinic share, expected sales are approximately 90,000 vehiclesper year. It should be noted that this is less than Tesla’s predicted sales figures of 100,000 vehicles in2015 [5]. Every additional 10,000 vehicles sold translates into an additional $850 million in revenue. Theactual 2014 revenue was $3.4 billion, though the clinic predicted revenue is $7.65 billion. However, Tesla’s2015 prediction for 100,000 vehicles sold would result in $8.5 billion revenue. For both vehicle range andacceleration time, the clinic share and simulated revenue were plotted as a function of price, with their 95%confidence intervals (Appendix Figures 4,5,6,7).4.2.2 Market SegmentationThe survey we designed targets U.S. luxury car buyers. Respondents are filtered according to their incomelevel, combining the number of people in their household with their annual family income, and taking intoaccount their preferences in terms of the type of vehicle they are willing to purchase next (car, SUV, ortruck). The luxury car market is considered a small segment of the U.S. automotive market. Our results andtheir interpretation are already centered on a particular niche, and further segmentation is not required.

5 Integrated AnalysisBecause our production and market demand models focused on different final products (battery packs andTesla luxury BEVs, respectively), the focus of our integration analysis was to determine threshold valuesfor profitability, excluding the additional costs of manufacturing a vehicle, and how consumer WTP for theattributes that are affected by the battery performance could increase profits.

Figure 3: Cost of manufacturing the unmodeled vehicle compo-nents to breakeven as price varies

To account for the uncertainty insimulated market share and size, we an-alyzed a number of production volumes,and found that the unit production costsof each battery pack are relatively con-stant (roughly $33,000) for annual pro-duction volumes of 5,000 to 2.5 million(which spans from below current Teslaannual sales figures to the entire US lux-ury vehicle market). Using these valuesfor vehicle price and battery pack costs,we were able to compute the unit costthat the rest of the car would have to beto simply break even as a function of price, as shown in Figure 3. The components included in this breakevenvalue include the remaining steps not modeled completely in the cell production model, the remaining com-ponents of the power train (electric motors, etc.), and all of the other vehicle components (body, interior,passenger heating and cooling systems, etc.).

Our decision variables had a direct impact on the attributes modeled in the market analysis. The di-mensions of the cell (height and diameter) influence the electricity storage capacity of the cell. Since thenumber of cells is fixed, the increased capacity influences both acceleration time and vehicle range. In theabscence of more complete data, we assumed a linear relationship between capacity and these attributes

5

(based on existing Tesla models). The WTP for reduced acceleration time and increased vehicle range werecombined, because a change in the cell size will influence both parameters (Figure 22 in Appendix IV), andthen compared to the additional pack-level costs associated with the 3 different cell configurations consid-ered. Then, the potential profits associated with each configuration were computed (Figure 22 in AppendixIV). The cells where both the height and diameter are increased by 10% (20720) have the highest profit,while the potential profits associated with the cells that are taller, but not wider (20650), have potentiallynet losses. Electrode thickness also influences both the acceleration time and vehicle range. Figure 23(a)(Appendix IV) shows how much consumers are willing to pay for vehicle range and acceleration time, alongwith the changes in production cost for varying the thickness of the electrode. The net change in profit wasthen computed, and is also shown in Figure 23(a) (in Appendix IV).

The relationship between the duration of the formation cycle and the increase in the vehicle warrantyis unknown. In the absence of additional information, a break-even analysis was conducted to determinehow much additional warranty would be necessary to justify longer duration cycles. A 5 hour cycle wasused as a baseline, and then the additional warranty mileage required to justify increasing the formationcycle duration was determined based on the measured consumer preferences, and is plotted in Figure 23(b)(Appendix IV). .

5.1 Uncertainty and LimitationsThe most important limitation of this model is that it only accounts for the battery pack costs. While weknow that economies of scale have already been reached for these packs, we have no information on whetherit is possible to manufacture the total vehicle for that cost.

The factors that are most uncertain in the integration analysis stem from a lack of data on the relationshipbetween consumer WTP for certain attributes, and the exact relationship between cell design variables andthe actual vehicle performance. Linear models were used to relate acceleration time and vehicle rangeto capacity, and to relate electrode thickness to acceleration time. A break-even analysis was completedbecause there is no data to model the relationship between the duration of the formation cycle and vehiclewarranty. A more robust analysis would gather more information, and would use multiple models for therelationship between cell attributes and vehicle performance.

More fundamentally, there are many factors in both the production model and the simulated marketshare analysis that could be improved to reduce uncertainty. A more thorough analysis of the unmodeledcell manufacturing steps and the costs of battery pack assembly could confirm that economies of scale forbattery pack assembly have been reached. Additional analysis of the market prices for input materials,particularly the active materials, would also be important, especially since the production of these batteriesis expected to more than double current global production volumes. Analysis could include factors like newmaterial sources, improvements in mining technologies, or improved recycling for spent batteries.

6 Recommendations and ConclusionThe PBCM suggests that material costs, auxiliary equipment and tooling costs are our major cost drivers andcell dimensions, electrode thickness, source of graphite, duration of cell formation and percentage of NMPsolvent are our major cost levers at the cell level. The pack-level analysis with ANL BatPaC shows thatmaterials are also a significant factor in these manufacturing processes. Both production analyses show thateconomies of scale have already been reached in the Tesla battery pack manufacturing process. Location hasno significant impact on cost for the steps considered and therefore manufacturing in USA is recommended.High uncertainty on design changes but we see that consumers are more willing to pay for larger cells,thinner electrodes offer slightly higher profits and only small increases in warranty are required to justifyincreases to formation cycle time.

6

References

[1] Trefis Team, 2014. “Gigafactory will cost tesla $5 billion but offers significant cost reductions”.Forbes.com.

[2] Mintel, 2014. Luxury cars - us - october 2014 report.

[3] The Detroit News, 2014. U.s. auto sales expected to rise modestly in 2015.

[4] Donald Chung, E. E., 2015. Automotive lib supply chain and usa competitiveness. Tech. rep., NationalRenewable Energy Laboratory, February.

[5] http://www.teslamotors.com/.

[6] Panasonic, 2010. “Ncr18650 data sheet”.

[7] Gareth Hatch, 2014. “Going natural: The solution to tesla’s graphite problem”. Technology MetalsResearch.

[8] Jay Whitacre, 2015. Discussions on gigafactory analysis project for 19-670.

[9] Simon Moores, Andrew Miller, 2014. “Tesla battery plant will need 6 new flake graphite mines”.Industrial Minerals.

[10] Gareth Hatch, Jack Lifton, 2014. “Tmr advanced graphite projectes index”. Technology MetalsResearch.

[11] Wilmont Howard, 2014. “Lithium-ion batteries part 1: Raw materials to production”. Seeking Alpha.

[12] Fuchs, Erica, and Randolph Kirchain, 2010. Design for location? the impact of manufacturing offshoreon technology competitiveness in the optoelectronics industry.

[13] Harold Sirkin, Michael Zinser, Doug Hohner, 2011. Made in america, again: Why manufacturing willreturn to the u.s.

[14] Knesuke Nakura, Kingo Ariyoshi, H. Y. T. O., 2015. “Characterization of the lithium insertion elec-trodes and its verification: Prototype 18650 batteries consisting of lto and lamo”. Journal of theElectrochemical Society, 162(4), pp. A622–A628.

[15] Apurba Sakti, Jeremy J. Michalek, Erica R.H. Fuchs, Jay F. Whitacre, 2015. “A techno-economicanalysis and optimization of li-ion batteries for light-duty passenger vehicle electrification”. Journalof Power Sources.

7

I Model Relationships Tables

8

9

10

II Production Analysis

II.I Process Description

Figure 4: Diagram of the Panasonic NCR18650A 3100mAh Cell, and associated decision variables consid-ered in analysis [5].

Figure 5: Process steps for Li-ion battery production with steps detailed in this report in bold.

11

12

II.II Unit Cost Breakdown

Figure 6: Breakdown of per kWh cost for fixed and variable costs by process step and total.

Figure 7: Visualization of cost breakdown.

13

II.III Sensitivity Analysis

Figure 8: Sensitivity analysis on minimum efficient plant size

14

70%

0.2

$125,000

$600,000

5

50

Natural

5

1.8

6.5

90%

0.25

$250,000

$725,000

25

150

Synthetic

8

2.0

7.15

$250 $260 $270 $280 $290 $300

%NMP Slurry

Formation Cycle Fraction of Labor

Formation Cycle Machine Price

Formation Cycle Aux. Equip. Price

Energy Use Formation [kW]

Electrode Thickness [um]

Graphite

Duration of Formation Cycle [hours]

Cell Diameter [cm]

Cell Height [cm]

Cos

t Driv

ers

Dec

isio

n V

aria

bles

Figure 9: Sensitivity analysis on major cost drivers and key decision variables measured as per kWh.

Figure 10: Decision variables sensitivity (cell diameter and height).

15

II.IV Sourcing Strategy Analysis

Based on the current battery pack, the 18650 batteries indicates that each cell weighs 45 g which implies thatthe 7,104 cells totalling approximately 320kg, effectively using approximately 0.62 kg of graphite/kWh, orabout 54 kg of graphite per 85 kWh vehicle[6][7], noting that a Tesla Model S holds about four times thecapacity of a ”standard” battery EV.

II.II.IV.i Cost Estimate of Graphite Composition

Evaluating the cost estimate for the GigaFactory graphite requirements, we will evaluate projected needs,suppliers and compositions. From a general perspective, battery-grade graphite requires very high puritylevels, typically more than 99.9% carbon-as-graphite (Cg)[7]. Smaller particles are preferred and purityincreases with flake size. Traditionally, graphite is produced synthetically or mined naturally with differentattributes and purity. Manufacturers will perform post-processing and use a secret blend to satisfy thegraphite need[8]. Uncoated spheriodal graphite typically sells for $3,000-4,000/t[7]. By example are FOBprices of Chinese uncoated spheroidal graphite with 99.95% purity stands at $3,400/t today[9]. Coatedspheroidal graphite sells for $9,000-10,000/t and finally synthetic spheroidal graphite has the highest purityand sells for about $19,000-20,000/t. A per gram range is outline in Table 1.

Table 1: Graphite Price Range by Type ($/gram)

Base Low HighNatural uncoated spheroidal 0.0035 0.003 0.004Natural coated spheroidal 0.0095 0.009 0.010Synthetic 0.0195 0.019 0.020

Figure 11: Comparison of cost per kWh for annual production volume between natural and syntheticgraphite

16

Figure 12: Comparison of cost per kWh for annual production volume between dedicated and undedicatedmachinery.

II.II.IV.ii Sources of Graphite for Gigafactory

An estimate predicts that 21,600 tons of graphite is required to produce 500,000 batteries[7] and 3,000 tonsof graphite roughly corresponds to 500,000 million (Japan projected 2016) cells annually[4]. Battery-gradegraphite has in general a 30% yield rate[7] which renders the necessary 21,600 tons to 72,050 tons actuallyrequired. The Gigafactory will consume a minimum 28,000 t/year if operating at capacity[7] looking onlyat the requirements for projected EV production, equalling 93,000 t/year with current battery-grade graphiteyield rate[7]. While a composition is expected, in a pure natural graphite scenario, the needs for the projectedGigafactory exceeds current global natural graphite market according to production estimates of 80-85,000t/year[7] and 83,000 t/year[9].

According to these estimates, the Gigafactory will need the equivalent of 6 new graphite mines[9]. TMRlists mining projects potentially having the capacity to deliver the necessary graphite and of these severalfulfill the criteria Tesla currently are stating, imposing more production in North America[10].

Of these the following are especially interesting with the time-frame in mind[7]:

• Lac Knife Project, Quebec, Canada, Focus Graphite Inc.

• Bissett Creek Project, Ontario, Canada, Northern Graphite Corp.

Evaluating the two, Northern Graphite projects that the cost for high-purity batter-grade is less than$1,000/t; however additional costs will be required in a post-processing step to achieve the final purity thatcan be attributed to the total procesing costs as the inital purity levels are around 98%.

II.II.IV.iii Sources for Lithium and Cobalt

Tesla battery packs uses Li-ion cobalt in their cells[6]. A significant challenge with this cathode is the highcost. Primary cobalt mines are in Africa, while some also are found in Asia, with battery-grade productionmostly in Asia and Europe[11]. Although the Democratic Republic of Congo currently has 45% of the globalcobalt reserves and supplies the majority, several options for cobalt mining and production exist in NorthAmerica[11]. Companies include OM Group, Caledonia Mining, PolyMet Mining and several others[11].Cathode production although currently takes place in Europe with Umicore, Merck and BASF as the major

17

player[11]. Tesla seeks to source its cathode from mining and production in North America, but this industryis not developed and price estimates for this material is not available at present time.

II.V Location Strategy

$0

$50

$100

$150

$200

$250

$300

$350

US w/ incen0ves US w/o incen0ves

Japan China

Material Labor Energy Main Machine Auxiliary Equipment Tooling/Fixture Building Maintenance Fixed Overhead

(a)

Figure 13: Unit cost break down for different locations.

(a) (b)

Figure 14: Cost per kWh at different production volumes and sensitivity analysis for different locations

18

Table 2: Location Inputs

USA Japan ChinaLabor $28.23/hour $16/hour $0.77/hourDays Per Year 260 260 360Unpaid Breaks 3 hours 3 hours 1.5 hoursPaid Breaks 1.5 hours 1.5 hours 1.5 hoursNo Shift 0 hours 0 hours 0 hoursUnplanned Downtime 2% 2% 10%Energy $0.06 /kWh $0.16 /kWh $0.09 /kWhBuilding Costs $30/ m2 $144/ m2 $10/ m2

Discount Rate 5% 5% 14%

The inputs values for the initial location strategy have been obtained from published journals and reports.The Optoelectronics report [12] was very similar to our study and the inputs for the labor wages, days peryear, unpaid breaks, paid breaks, no shift and unplanned downtime for have obtained from there. The dataon energy was obtained from public sources about industrial energy costing. The data for the buildingcosts has been obtained from a published report from Boston Consulting Group[13]. The paper discussedmanufacturing in USA vs. developing nations and provided average and range values for per sq. feet costs.The model assumes that the data obtained from these journals is a fair approximation to the required.

19

II.V

IPr

oduc

tion

Mod

elIn

puts

Tabl

e3:

Exo

geno

usIn

puts

Inpu

tU

nits

Var

iabl

eN

ame

Bas

eC

ase

Ran

geA

nnua

lPro

duct

ion

Volu

me

num

ber

APV

134,

900,

000

134,

900,

000

710,

000,

000

Faci

lity-

Wid

eO

pera

ting

Para

met

ers

Wor

king

days

/yea

rda

ysD

PY26

026

031

2N

oSh

ifts

hour

sN

S PL

AN

T0

08

Unp

aid

Bre

aks

hour

sU

B3

32

Paid

Bre

aks

hour

sP

B1.

51.

51

Unp

lann

edD

ownt

ime-

Faci

lity

perc

enta

geU

DPL

AN

T2%

2%10

%Fa

cilit

y-W

ide

Pric

esD

irec

tWag

e:M

ixin

gdo

llars

/hou

rP L

AB

OR

,MIX

$23.

23$8

.33

$23.

23D

irec

tWag

e:E

lect

rode

Coa

ting

dolla

rs/h

our

P LA

BO

R,C

OA

T$2

8.28

$8.3

3$2

8.28

Dir

ectW

age:

Slitt

ing

dolla

rs/h

our

P LA

BO

R,S

LIT

$28.

28$8

.33

$28.

28D

irec

tWag

e:Fo

rmat

ion

Cyc

ledo

llars

/hou

rP L

AB

OR

,FO

RM

$28.

28$8

.33

$28.

28Pr

ice

ofE

lect

rici

tydo

llars

/kW

hP E

LE

CT

RIC

ITY

$0.0

6$0

.05

$0.0

8Pr

ice

ofB

uild

ing

Spac

edo

llars

/m2

P BL

D$3

0.00

$20.

00$5

0.00

Dis

coun

tRat

ePe

rcen

tage

r5%

3%15

%Fa

ctor

Lif

etim

esPr

oduc

tLif

eY

ears

NPR

OD

UC

T8

510

Cap

italR

ecov

ery

Peri

odY

ears

NC

API

TAL

2015

25B

uild

ing

Rec

over

yPe

riod

Yea

rsN

BL

D30

2040

Faci

lity-

Wid

eA

dditi

onal

Cos

tsA

uxila

ryE

quip

men

t:M

ixin

gPe

rcen

tage

mA

UX

.EQ

UIP

,MIX

10%

5%15

%A

uxila

ryE

quip

men

t:C

oatin

gPe

rcen

tage

mA

UX

.EQ

UIP

,CO

AT

15%

10%

20%

Aux

ilary

Equ

ipm

ent:

Slitt

ing

Perc

enta

gem

AU

X.E

QU

IP,S

LIT

10%

5%15

%A

uxila

ryE

quip

men

t:Fo

rmat

ion

Perc

enta

gem

AU

X.E

QU

IP,F

OR

M.

10%

5%15

%M

aint

enan

ceC

osts

:Mix

ing

Perc

enta

gem

MA

INT,

MIX

10%

5%15

%M

aint

enan

ceC

osts

:Coa

ting

Perc

enta

gem

MA

INT,

CO

AT

10%

5%15

%M

aint

enan

ceC

osts

:Slit

ting

Perc

enta

gem

MA

INT,

SLIT

10%

5%15

%M

aint

enan

ceC

osts

:For

mat

ion

Perc

enta

gem

MA

INT,

FOR

M10

%5%

15%

Ove

rhea

dC

osts

Perc

enta

gem

OH

33%

30%

35%

20

Tabl

e4:

Proc

ess

Inpu

ts:M

ixin

g

Inpu

tU

nits

Var

iabl

eN

ame

Bas

eC

ase

Ran

geM

ain

Mac

hine

Pric

eD

olla

rsP M

AC

H,M

IX$1

,000

,000

$500

,000

$2,0

00,0

00A

uxila

ryE

quip

men

tPri

ceD

olla

rsP A

UX

,MIX

$100

,000

$25,

000

$300

,000

Fixt

ure/

Tool

ing

Pric

eD

olla

rsP T

OO

L,M

IX0

Tool

ing

Usa

geN

umbe

rU

TOO

L,M

IX0

Ele

ctri

city

Usa

gekW

UE

LE

C,M

IX6.

123.

6245

Mix

erVo

lum

ecm

3V M

IXE

R30

,000

5,00

020

0,00

0To

olin

gL

ife

Yea

rsN

TOO

L,M

IX1

Foot

prin

tm

2U

BL

D,M

IX1.

60.

781.

6L

oad

+U

nloa

dTi

me

seco

nds

T SE

TU

P,M

IX15

001,

000

2,00

0C

ycle

Tim

ese

cond

sT C

YC

LE

,MIX

1950

1500

2400

Scra

pR

ate

perc

enta

ges M

IX9%

5%12

%R

ejec

tRat

epe

rcen

tage

r MIX

6%3%

8%D

edic

ated

(Y/N

)N

/AY

Scra

pR

ate-

Solv

entR

ecyc

ling

s RE

CY

CL

ING

5%2%

10%

Tabl

e5:

Mat

eria

lInp

uts:

Mix

ing

Inpu

tU

nits

Var

iabl

eN

ame

Bas

eC

ase

Ran

geG

raph

itePr

ice

$/g

P GR

0.01

950.

019

0.02

PVD

FPr

ice

$/g

P PV

DF

0.06

2N

MP

Solv

entP

rice

$/g

P NM

P0.

1018

4Pe

rcen

tage

Gra

phite

perc

enta

ge(b

ym

ass)

95%

Perc

enta

gePV

DF-

anod

epe

rcen

tage

(by

mas

s)5%

Perc

enta

geN

MP-

Slur

rype

rcen

tage

(by

mas

s)90

%70

%90

%L

iNiC

oO2

Pric

e$/

gP L

NC

0.03

1Pe

rcen

tage

LiN

iCoO

2pe

rcen

tage

(by

mas

s)95

%Pe

rcen

tage

PVD

F-ca

thod

epe

rcen

tage

(by

mas

s)5%

Gra

phite

Den

sity

g/cm

3ρ

GR

2.16

2.09

2.23

PVD

FD

ensi

tyg/

cm3

ρPV

DF

1.78

NM

PD

ensi

tyg/

cm3

ρN

MP

1.02

8L

iNiC

oO2

Den

sity

g/cm

3ρ

LN

C2.

4

21

Tabl

e6:

Proc

ess

Inpu

ts:C

oatin

g

Inpu

tU

nits

Var

iabl

eN

ame

Bas

eC

ase

Ran

geM

ain

Mac

hine

Pric

eD

olla

rsP M

AC

H,C

OA

T$3

,000

,000

$2,0

00,0

00$3

,000

,000

Aux

ilary

Equ

ipm

entP

rice

dolla

rsP A

UX

.EQ

UIP

,CO

AT

$450

,000

$200

,000

$600

,000

Fixt

ure/

Tool

ing

Pric

edo

llars

P TO

OL

,CO

AT

$0.0

0To

olin

gU

sage

Num

ber

UTO

OL

,CO

AT

0E

lect

rici

tyU

sage

kWU

EL

EC

,CO

AT

120

120

120

Coa

ting

surf

ace

wid

thcm

WFO

IL80

8050

Foot

prin

tm

2U

BL

D,C

OA

T5

55

Loa

d+

Unl

oad

Tim

ese

cond

sT S

ET

UP,

CO

AT

200

200

200

Coa

ting

Mac

hine

Spee

dm

/min

DC

OA

T30

100

20Sc

rap

Rat

e-a

ctiv

em

ater

ial

perc

enta

ges C

OA

T5%

5%5%

Rej

ectR

ate

(per

unit

leng

th)

perc

enta

ger C

OA

T0.

082%

0.04

9%0.

131%

Ded

icat

ed(Y

/N)

N/A

Y

Tabl

e7:

Mat

eria

lInp

uts:

Coa

ting

Inpu

tU

nits

Var

iabl

eN

ame

Bas

eC

ase

Alu

min

umFo

ilPr

ice

(Cat

hode

)do

llars

/gP F

OIL

,CA

TH

$0.0

1C

oppe

rFoi

lPri

ce(A

node

)do

llars

/gP F

OIL

,AN

OD

E$0

.03

Alu

min

umD

ensi

tyg/

cm3

ρFO

IL,C

AT

H2.

7C

oppe

rDen

sity

g/cm

3ρ

FOIL

,AN

OD

E8.

96A

lum

inum

Foil

Rol

lLen

gth

cmL F

OIL

10,0

00C

oppe

rFoi

lRol

lLen

gth

cmL F

OIL

10,0

00Fo

ilT

hick

ness

µm

t FO

IL15

Sepa

rato

rThi

ckne

ssµ

mt S

EP

25Fo

ilL

engt

h:A

node

cmL A

NO

DE

58.1

2Fo

ilL

engt

h:C

atho

decm

L CA

TH

63.9

3B

atch

Size

:Ano

dean

odes

BC

OA

T,A

NO

DE

2064

Bat

chSi

ze:C

atho

deca

thod

esB

CO

AT,

CA

TH

1872

22

Tabl

e8:

Proc

ess

Inpu

ts:S

littin

g

Inpu

tU

nits

Var

iabl

eN

ame

Bas

eC

ase

Ran

geM

ain

Mac

hine

Pric

edo

llars

P MA

CH

,SL

IT$4

5,00

0$4

0,50

0$4

9,50

0A

uxila

ryE

quip

men

tPri

cedo

llars

P AU

X.E

QU

IP,S

LIT

$4,5

00$2

,025

$7,4

25Fi

xtur

e/To

olin

gPr

ice

dolla

rsP T

OO

L,S

LIT

0To

olin

gU

sage

num

ber

UTO

OL

,SL

IT0

Ele

ctri

city

Usa

gekW

UE

LE

C,S

LIT

1.2

1.08

1.32

Foot

prin

tm

2U

BL

D,S

LIT

10.

61.

6L

oad

+U

nloa

dTi

me

seco

nds

T SE

TU

P,SL

IT90

6012

0C

ycle

Tim

ese

cond

sT C

YC

LE

,SL

IT20

0Sl

ittin

gm

achi

nesp

eed

m/m

inD

30.0

0Sc

rap

Rat

e-f

oil

perc

enta

ges S

LIT

2.60

%R

ejec

tRat

epe

rcen

tage

r SL

IT0

00

Ded

icat

ed(Y

/N)

N/A

Y

Tabl

e9:

Proc

ess

Inpu

ts:F

orm

atio

nC

ycle

Inpu

tU

nits

Var

iabl

eN

ame

Bas

eC

ase

Ran

geM

ain

Mac

hine

Pric

edo

llars

P MA

CH

,FO

RM

$135

,000

$125

,000

$250

,000

Aux

ilary

Equ

ipm

entP

rice

dolla

rsP A

UX

.EQ

UIP

,FO

RM

$662

,500

$600

,000

$725

,000

Fixt

ure/

Tool

ing

Pric

edo

llars

P TO

OL

,FO

RM

$-To

olin

gU

sage

num

ber

UTO

OL

,FO

RM

0E

lect

rici

tyU

sage

kWU

EL

EC

,FO

RM

105

25B

atch

Size

BFO

RM

506

512

500

Foot

prin

tm

2U

BL

D,F

OR

M3

24

Frac

tiona

lUse

ofL

abor

N/A

L FO

RM

0.23

0.2

0.25

Loa

d+

Unl

oad

Tim

ese

cond

sT S

ET

UP,

FOR

M15

,592

Cyc

leTi

me

seco

nds

T CY

CL

E,F

OR

M52

,200

Scra

pR

ate

perc

enta

ges F

OR

M%

Rej

ectR

ate

perc

enta

ger F

OR

M5.

75%

5.00

%6.

50%

Ded

icat

ed(Y

/N)

YN

/AY

23

II.VII Equations

cr f =δ (1+ r)N

(1+ r)N−1(1)

Where r is the discount rate, and N is the number of years

C =AC

APV(2)

Where C is the unit cost, AC is the annual cost, and APV is the annual production volume.

Table 10: Decision Variables

Name Symbol Baseline Low HighCell height xh 6.5 cm 6.5 cm 7.15 cmCell diameter xd 1.82 cm 1.82 cm 2.00 cmElectrode thickness xt 70µm 50 µm 150 µmDuration of Formation Cycle x f 6.5 hours 5 hours 8 hours

II.II.VII.i Battery Dimensions

Table 11: Battery Dimension Model Inputs

Name Symbol Baseline Low HighFoil thickness tFOIL 15µm - -Separator thickness tSEP 25µm - -Percentage NMP γ 90% 70% 90%Graphite Density ρGR 2.16 g/cm3

PVDF Density ρPVDF 1.78 g/cm3

LiNiCoO2 Density ρLiNiCoO2 2.4 g/cm3

NMP Density ρNMP 1.03 g/cm3

Foil Length LFOIL 10,000cmFoil Width WFOIL 80 cm

For any arbitrary cell size, the ratio of graphite to PVDF binder within the anode is 95:5 by mass, (about15.5:1 by volume). Similarly for any arbitrary cell size, the ratio of LiNiCoO2 to PVDF binder is also 95:5by mass, or 14:1 by volume.

The total cell volume:

VCELL = π(xd/2)2xh (3)

Of the total cell volume, approximately 85% is anode material, cathode material, or separator/electrolyte,and the cathode is approximately 10% longer than the anode. [14]

24

Table 12: Battery Dimension Model Outputs

Name SymbolCell volume VCELLAnode length LANODECathode length LCATHAnode active material volume VANODECathode active material volume VCATHRequred Graphite, Anode XGR, ANODERequired PVDF, Anode XPVDF, ANODERequired LNC, Cathode XLNC, CATHRequired PVDF, Cathode XPVDF, CATHRequired NMP, Anode XNMP, ANODERequired NMP, Cathode XNMP, CATHRequired Foil, Anode XFOIL, ANODERequired Foil, Cathode XFOIL, CATHODEBatch Size, Anode (Coating & Slitting) BANODE, COAT = BANODE, SLITBatch Size, Cathode (Coating & Slitting) BCATH, COAT = BCATH, SLITScrap Rate, Slitting, Anode sSLIT, ANODEScrap Rate, Slitting, Cathode sSLIT, CATH

Each cell is composed of an anode and cathode sheet, with two separators between them, rolled into acylindrical shape. Both the cathode and anode are formed on a metal foil, with active material coating bothsides.

LANODE =VCELL/(h(2xt + tFOIL +1.1(2xt + tFOIL +2tSEP))) (4)

LCATH = 1.1LANODE (5)

With the length of both the anode and cathode, it is possible to find the volume of electrode material for boththe anode and cathode:

VANODE = LANODE(2xt) (6)

VCATH = LCATH(2xt) (7)

The volume of electrode material for both anode and cathode can be combined with the volumetric ratiosof active material to binder to determine the volume of active material and binder in each electrode. Usingthe material densities, these can be converted to grams.

25

VGR, ANODE = 94%VANODE (8)

XGR, ANODE =VANODEρGR (9)

VPVDF, ANODE = 6%VANODE (10)

XPVDF, ANODE =VANODEρPVDF (11)

VLNC, CATH = 6%VCATH (12)

XLNC, CATH =VCATHρPVDF (13)

VPVDF, CATH = 6%VCATH (14)

XPVDF, CATH =VCATHρPVDF (15)

Each gram of PVDF binder that is used requires a certain ratio of NMP solvent to create a γ % solutionof NMP.

XNMP, ANODE = XPVDF, ANODE/(1− γ) (16)

XNMP, CATH = XPVDF, CATH/(1− γ) (17)

Cathodes are formed by coating rolls of copper (anode) and aluminum (cathode) foil. Each electrode mustbe whole (no fractional electrodes), so the electrodes per sheet (also the batch sizes for the coating andslitting steps) are given by:

BANODE, COAT = BANODE, SLIT = bWFOIL/hc×bLFOIL/LANODEc (18)

BCATH, COAT = BCATH, SLIT = bWFOIL/hc×bLFOIL/LCATHc (19)

Scrap rate for the slitting step is then the remaining foil area not covered in electrode material:

sSLIT, ANODE =WFOILLFOIL−BANODEhLANODE

NANODEhLANODE(20)

sSLIT, CATH =WFOILLFOIL−BCATHhLCATH

NCATHhLCATH(21)

VFOIL, ANODE = xhLANODEtFOIL (22)

XFOIL, ANODE =VFOIL, ANODEρFOIL, ANODE (23)

VFOIL, CATHODE = xhLCATHODEtFOIL (24)

XFOIL, CATHODE =VFOIL, CATHODEρFOIL, CATHODE (25)

26

II.II.VII.ii Mixing

e f f PVMIX, ANODE =APV

(1− rMIX, ANODE)(1− rCOAT,ANODE)(1− rSLIT,ANODE)(1− rFORM)(26)

e f f PVMIX, CATH =APV

(1− rMIX, CATH)(1− rCOAT,CATH)(1− rSLIT,CATH)(1− rFORM)(27)

The mixing step is really two parallel processes, one for both the anode and cathode materials. Whilethe equipment can be shared for either electrode mixing, it cannot be used for other processes.

Electrode material is lost as scrap in both the mixing process and the coating process, so the materialsused per product are:

UGR, ANODE =XGR, ANODE

(1− sMIX)(1− sCOAT, MIXTURE)(28)

UPVDF, ANODE =XPVDF, ANODE

(1− sMIX)(1− sCOAT, MIXTURE)(29)

ULNC, ANODE =XLNC, ANODE

(1− sMIX)(1− sCOAT, MIXTURE)(30)

UPVDF, CATH =XPVDF, CATH

(1− sMIX)(1− sCOAT, MIXTURE)(31)

ACGR, ANODE = PGR× e f f PVMIX,ANODE×UGR, ANODE (32)

ACPVDF, ANODE = PPVDF× e f f PVMIX,ANODE×UPVDF, ANODE (33)

ACLNC, CATH = PLNC× e f f PVMIX,CATH×ULNC, CATH (34)

ACPVDF, CATH = PPVDF× e f f PVMIX, CATH×UPVDF, CATH (35)

ACMATERIALS, MIX = ACGR, ANODE +ACPVDF, ANODE +ACPVDF, CATH +ACLNC, CATH (36)

Mixing also requires NMP solvent to dissolve the PVDF binder. Most of this solvent can be recoveredlater in the production process. Because of this, NMP was treated as a tool. The amount of NMP requiredper batch includes the scrap losses incurred when it is part of the electrode slurry (mixing and coating steps)

XNMP, ANODE =XPVDF, ANODE

1− γ(37)

UNMP, ANODE =XNMP, ANODE

(1− sMIX)(1− sCOAT)(38)

XNMP, CATH =XPVDF, CATH

1− γ(39)

UNMP, CATH =XNMP, CATH

(1− sMIX)(1− sCOAT)(40)

The NMP that needs to be replaced for each batch includes the scrap losses (incurred with the rest of theanode and cathode slurries) and the recycling losses incurred after the scrap losses in the mixing and coatingsteps.

27

XNMP, ANODE, REP = (UNMP, ANODE−XNMP, ANODE)+ sRECYCLINGXNMP, ANODE (41)

XNMP, CATH, REP = (UNMP, CATH−XNMP, CATH)+ sRECYCLINGXNMP, CATH (42)

AUNMP, ANODE =UNMP, ANODEBMIX, ANODE︸ ︷︷ ︸Initial Solvent

+e f f PVANODE, MIX

BANODE, MIXXNMP, ANODE, REP︸ ︷︷ ︸

Replacement Solvent

(43)

AUNMP, CATH =UNMP, CATHBMIX, CATH︸ ︷︷ ︸Initial Solvent

+e f f PVCATH, MIX

BCATH, MIXXNMP, CATH, REP︸ ︷︷ ︸

Replacement Solvent

(44)

ACTOOL, MIX = (AUNMP, ANODE +AUNMP, CATH)PNMP (45)

BMIX, ANODE =VMIXER

UGR, ANODE +UPVDF, ANODE +UNMP, ANODE(46)

BMIX, CATH =VMIXER

UGR, CATH +UPVDF, CATH +UNMP, CATH(47)

availLTMIX = DPY × (24−NS−UB−PB)× (1−UDFACILITY) (48)

reqLTMIX, ANODE =e f f PVMIX, ANODE(TCYCLE, MIX +TSETUP, MIX)

BMIX, ANODE(49)

reqLTMIX, CATH =e f f PVMIX, CATH(TCYCLE, MIX +TSETUP, MIX)

BMIX, CATH(50)

LRMIX, ANODE = reqLTMIX, ANODE/availLTMIX (51)

LRMIX, CATH = reqLTMIX, CATH/availLTMIX (52)

LRMIX = dLRMIX, ANODE +LRMIX, CATHe (53)

LMIX =TSETUP, MIX

TCYCLE, MIX +TSETUP, MIX(54)

APTMIX = DPY × (24−NS−UB)(LRMIX×LMIX) (55)

ACLABOR, MIX = PLABOR, MIX×APTMIX (56)

ACENERGY, MIX =UELECTRICITY, MIXLRMIXavailLTMIXPELECTRICITY (57)

ACMACH, MIX = LRMIX×PMACH, MIX× cr f (58)

ACAUX.EQUIP, MIX = mAUX. EQUIP, MIX×ACMACH, MIX (59)

ACBLD, MIX = UBLD, MIX×LRMIX (60)

ACMAINT., MIX = mMAINT, MIX× (ACMACH, MIX +ACAUX. EQUIP, MIX + ... (61)

ACTOOLING, MIX +ACBLD, MIX)

ACOH, MIX = mOH, MIX× (ACMACH, MIX +ACAUX. EQUIP, MIX + ... (62)

ACTOOLING, MIX +ACBLD, MIX)

28

II.VIII Coating

e f f PVCOAT, ANODE =APV

(1− rCOAT)(1− rSLIT)(1− rFORM)(63)

e f f PVCOAT, CATH =APV

(1− rCOAT)(1− rSLIT)(1− rFORM)(64)

TCYCLE, COAT = LFOIL/DCOAT (65)

availLTCOAT = DPY × (24−NS−UB−PB)× (1−UDFACILITY) (66)

reqLTANODE =e f f PVANODE(TCYCLE, COAT +TSETUP, COAT)

BANODE, COAT(67)

reqLTCATH =e f f PVCATH(TCYCLE, COAT +TSETUP, COAT)

BCATH, COAT(68)

LCOAT =TSETUP, COAT

TCYCLE, COAT +TSETUP, COAT(69)

LRCOAT, ANODE =reqLTANODE, COAT

availLTCOAT(70)

LRCOAT, CATH =reqLTCATH, COAT

availLTCOAT(71)

LRCOAT = dLRCOAT, ANODE +LRCOAT, CATHe (72)

ACFOIL, ANODE = e f f PVANODE, COAT×UFOIL, ANODE×PFOIL, ANODE (73)

ACFOIL, CATH = e f f PVCATH, COAT×UFOIL, CATH×PFOIL, CATH (74)

ACMATERIAL, COAT = ACFOIL, ANODE +ACFOIL, ANODE (75)

APT =DPY (24−NS−UB)(LCOATLRCOAT) (76)

ACLABOR, COAT = APT ×PLABOR, COAT (77)

ACENERGY, COAT = UELECTRICITY, COAT×PELECTRICITY×LRCOAT×availLTCOAT (78)

ACMACH, COAT = LRCOAT×PMACH, COAT (79)

ACAUX. EQUIP, COAT = mAUX. EQUIP, COAT×ACMACH, COAT (80)

ACBLD, COAT = UBLD, COATPBLDLRCOATcr fBLD (81)

ACMAINT, COAT = mMAINT, COAT(ACMACH, COAT +ACAUX. EQUIP, COAT + ... (82)

ACTOOLING, COAT +ACBLD, COAT)

ACOH, COAT = mOH, COAT(ACMACH, COAT +ACAUX. EQUIP, COAT + ... (83)

ACTOOLING, COAT +ACBLD, COAT +ACMAINT, COAT)

29

II.II.VIII.i Slitting

e f f PVSLIT, ANODE =APV

(1− rSLIT,ANODE)(1− rFORM)(84)

e f f PVSLIT, CATH =APV

(1− rSLIT,CATH)(1− rFORM)(85)

availLTSLIT = DPY × (24−NS−UB−PB)× (1−UDFACILITY) (86)

reqLTANODE =e f f PVANODE(TCYCLE, SLIT +TSETUP, SLIT)

BANODE, SLIT(87)

reqLTCATH =e f f PVCATH(TCYCLE, SLIT +TSETUP, SLIT)

BCATH, SLIT(88)

LRSLIT, ANODE =reqLTANODE, SLIT

availLTSLIT(89)

LRSLIT, CATH =reqLTCATH, SLIT

availLTSLIT(90)

LRCOAT = dLRSLIT, ANODE +LRSLIT, CATHe (91)

LSLIT =TSETUP, SLIT

TCYCLE, SLIT +TSETUP, SLIT(92)

ACMACH, SLITS = LRSLIT×PMACH, SLITcr f (93)

ACAUX. EQUIP, SLIT = mAUX. EQUIP, COATACMACH, SLIT (94)

ACBLD, SLIT = UBLD, SLITLRSLITPBLDcr fBLD (95)

ACMAINT, SLIT = mMAINT, SLIT(ACMACH, SLIT +ACAUX. EQUIP, SLIT + ... (96)

ACTOOLING, SLIT +ACBLD, SLIT)

ACOH, SLIT =mOH, SLIT(ACMACH, SLIT +ACAUX. EQUIP, SLIT + ... (97)

ACTOOLING, SLIT +ACBLD, SLIT +ACMAINT, SLIT)

APT = DPY (24−NS−UB)(LSLITLRSLIT) (98)

ACLABOR, SLIT = APT PLABOR, SLIT (99)

ACENERGY, SLIT = LRSLITavailLTSLITPELECTRICITYUELECTRICITY, SLIT (100)

30

II.II.VIII.ii Formation Cycle

e f f PVFORM, ANODE =APV

(1− rFORM)(101)

availLTFORM = DPY × (24−NS−UB−PB)× (1−UDFACILITY) (102)

reqLTFORM =e f f PVFORM(TCYCLE, FORM +TSETUP, FORM)

BFORM(103)

LFORM =TSETUP, FORM

TCYCLE, FORM +TSETUP, FORM(104)

(105)

ACMACH, FORM = LRFORMPMACH, FORM(cr f ) (106)

ACAUX. EQUIP, FORM = LRFORMPAUX. EQUIP(cr f ) (107)

ACBLD, FORM = UBLD, FORMLRFORMPBLD(cr fBLD) (108)

ACMAINT, FORM = mMAINT, FORM(ACMACH, FORM +ACAUX. EQUIP, FORM + ... (109)

ACTOOLING, FORM +ACBLD, FORM)

ACOH, FORM = mOH, FORM(ACMACH, FORM +ACAUX. EQUIP, FORM + ... (110)

ACTOOLING, FORM +ACBLD, FORM +ACMAINT, FORM)

APT = DPY (24−NS−UB)(LFORMLRFORM) (111)

ACLABOR, FORM = APT PLABOR, FORM (112)

ACENERGY, FORM = LRFORMavailLTFORMPELECTRICITYUELECTRICITY, FORM (113)

31

III Market Analysis

Table 13: Attributes with associated levels used in the survey to map demand.

Low Middle High0-60 Acceleration Time (seconds) 3 6 9Vehicle Type Conventional or ElectricVehicle Range (miles between refuel) 75 250 300Price (thousand USD) 30 60 100Warranty (thousands of miles) 50 100 200

Figure 15: Attribute frequency Pittsburgh Auto Show

32

III.I Demand Predictions

Table 14: Attributes of the vehicles considered in the base scenario.

Attributes/Direct Competitors Tesla Model S BMW i3 Corvette Z06Acceleration 0-60 mph (s) 5.4 7.2 3.0Vehicle Type Electric Electric ConventionalWarranty (miles) 200,000 50,000 36,000Price ($) 85,000 43,000 80,000Range (miles) 250 75 280

Table 15: Simulated Market Share (Mean and 95% confidence interval).

Clinic shares Tesla Model S BMW i3 Corvette Z06Logit (No Interactions) 43% 25% 32%CI: 39% to 48% 19% to 31% 27% to 36%Partworth 46% 26% 28%CI: 40% to 52% 20% to 33% 22% to 24%

0% 10% 20% 30% 40% 50% 60% 70% 80% 90%

100%

10

15

20

25

30

35

40

45

50

55

60

65

70

75

80

85

90

95

100

105

110

115

120

Mar

ket S

hare

Vehicle Price (Thousands of Dollars)

Figure 16: Sensitivity of Tesla Model S simulated market share to changes in car price when competingagainst BMWi3 and Corvette Z06.

33

III.II Sensitivity Analysis

.

Figure 17: Tesla Model S market share when competing against BMWi3 and various conventional luxuryvehicles.

III.III Utility Analysis

The utility graphs below show a linear utility function for both price and acceleration, while reveal a non-linear pattern for warranty attribute and a potentially non-linear utility function for high ranges.

-0.4

-0.3

-0.2

-0.1

0

0.1

0.2

0.3

0.4

3 6 9 Util

ity

Acceleration (sec)

Figure 18: Linearity in acceleration attribute.

-1.5

-1

-0.5

0

0.5

1

1.5

$30,000 $50,000 $70,000 $90,000 $110,000 Util

ity

Price

Figure 19: Linearity in price attribute.

34

Storage Capacity 0-60 Acceleration Time (s) Vehicle Range (miles)70 5.2 24085 4.4 270

Table 16: Existing Tesla Model S specifications (via Tesla Motors)

-1.2

-1

-0.8

-0.6

-0.4

-0.2

0

0.2

0.4

0.6

0.8

75 125 175 225 275

Util

ity

Vehicle Range

Figure 20: Non-linearity in vehicle range attribute.

-0.5

-0.4

-0.3

-0.2

-0.1

0

0.1

0.2

0.3

0.4

50,000 100,000 150,000 200,000

Util

ity

Warranty (mi)

Figure 21: Non-linearity in warranty attribute.

IV Model Integration Calculations

IV.I Cell Dimensions and WTP for Range and Acceleration

From existing Tesla Model S information, the relationships between vehicle range and acceleration weredetermined:

yACC =−0.053xCAP +8.93 (114)

yRANGE = 2xCAP +100 (115)

Where yACC is the acceleration time, yRANGE is the vehicle range, and xCAP is the total battery packelectricity storage capacity in kWh.

IV.II Electrode Thickness and WTP for Range and Acceleration

The relationship between the electrode thickness and vehicle range was modeled in the same way as thechanges to the cell dimensions. For the change to acceleration time, the following relationship (establishedby Sakti et. al. [15] was used to calculate the power capability, which was again integrated using a linearmodel of existing data for 2 Tesla models.

P(x) = xNxM

(xTc(x)

β1 +β2xβ3T

−β4xTc(x)

)(116)

Where: xN is the number of cells per module, xM is the number of modules per pack, xT is the electrodethickness, and c(x) is the capacity of the individual cell.

35

Figure 22: Impact of willingess to pay for vehicle range and acceleration time on net profits for differentcell configurations

From the Tesla data, we established the following relationship between power capability and accelerationtime:

yACC =−0.004P(x)+8.63 (117)

36

(a)

(b)

Figure 23: (a) Impact of electrode thickness on willingnes to pay for vehicle range and acceleration time,and (b) Minimum additional warrant mileage required to offset costs of longer formation cycle

37

Vehicle Survey

How did you hear about this survey?

Amazon Mechanical Turk

Other

Start

SurveySource

SurveySource=1

SurveySource=2

Vehicle Survey

About this Survey

This survey aims to collect information about preferences when purchasing personal vehicles through a series ofvehicle choice questions. The survey also asks for some demographic information. The survey should takebetween 10-15 minutes to complete, and upon completion, you can enter to win a $50 Amazon gift card.

Confidentiality

The information provided in this survey will be used for the purpose of this study only. Responses will remainconfidential, and we have no way to personally identify any respondent. Contact information for the Amazon giftcard raffle will be collected separately.

OtherIntro

0% 100%

Vehicle Survey

Where do you live?

China

Europe

United States

India

Other

How many people are in your household?

1

2

3

4

5 or more

What is your annual household income before taxes in USD?

Less than $20,000

$20,000-$40,000

$40,001-$60,000

$60,001-$80,000

$80,001-$120,000

$120,001-$200,000

$200,001-$300,000

More than $300,000

Prefer not to answer.

whichCountry

whichCountry=1

whichCountry=2

whichCountry=3

whichCountry=4

whichCountry=5

householdSize

householdSize=1

householdSize=2

householdSize=3

householdSize=4

householdSize=5

annualIncome

annualIncome=1

annualIncome=2

annualIncome=3

annualIncome=4

annualIncome=5

annualIncome=6

annualIncome=7

annualIncome=8

annualIncome=9

0% 100%

Vehicle Survey

Please tell us about your vehicle purchase date.

I purchased a vehicle within the last 3 years.

I plan to purchase a vehicle in the next 2 years.

Both of the above.

None of the above.

What kind of vehicle do you plan on purchasing next?

Car (Sedan, Coupe, Hatchback)

SUV

Truck

purchaseTime

purchaseTime=1

purchaseTime=2

purchaseTime=3

purchaseTime=4

nextVehicleType

nextVehicleType=1

nextVehicleType=2

nextVehicleType=3

0% 100%

Vehicle Survey

Please select your favorite car style from the options below. Throughout the survey, you will choose

among different combinations of car attributes, but the vehicle will look the same.

PickACar

PickACar=1

PickACar=2

PickACar=3

PickACar=4

0% 100%

Vehicle Survey

In this section, we will ask questions about vehicle features (explained below). Please read these descriptionscarefully before continuing with the survey.

Attributes & Explanation

0-60 Acceleration Time: This is the amount of time that it would take to accelerate from 0 to 60 miles per hour

(mph). As a reference, it may be helpful to consider acceleration times as follows:

3 seconds: typical for sports/racing cars 6 seconds: typical for sport sedans 9 seconds: typical for regular sedans/small SUVs

Vehicle Type: Conventional vehicles are those that operate on gasoline or diesel only. Electric vehicles are

those that operate only on an electric motor (must be plugged into electrical outlet for refueling).

Warranty: The total distance traveled (miles) under which the manufacturer agrees to cover necessary repairs

and maintenance.

Price: The purchase price of a vehicle (USD).

Vehicle Range: The distance (miles) a vehicle can travel before refueling.

For this section, we will show you three different combinations of attributes for your selected vehicle

style. Please select only the one combination you are most likely to buy, assuming that these are the

only options available on the market and that all of these options are available.

CBCIntro

0% 100%

Vehicle Survey

[SSI Script]

If these were your only options, which would you choose? Choose by clicking one of the buttons below:

(1 of 13)

0-60mph

Acceleration Time

3 seconds 9 seconds 6 seconds

Vehicle Type Conventional Conventional Electric

Price $30,000 $60,000 $100,000

Vehicle Range 75 miles 250 miles 300 miles

Warranty 200,000 miles 50,000 miles 50,000 miles

cbc_Random1

cbc_Random1=1 cbc_Random1=2 cbc_Random1=3

0% 100%

Vehicle Survey

[SSI Script]

If these were your only options, which would you choose? Choose by clicking one of the buttons below:

(2 of 13)

0-60mph

Acceleration Time

6 seconds 9 seconds 6 seconds

Vehicle Type Conventional Electric Conventional

Price $30,000 $60,000 $100,000

Vehicle Range 300 miles 75 miles 250 miles

Warranty 200,000 miles 100,000 miles 100,000 miles

cbc_Random2

cbc_Random2=1 cbc_Random2=2 cbc_Random2=3

0% 100%

Vehicle Survey

[SSI Script]

If these were your only options, which would you choose? Choose by clicking one of the buttons below:

(3 of 13)

0-60mph

Acceleration Time

3 seconds 3 seconds 9 seconds

Vehicle Type Electric Conventional Electric

Price $100,000 $30,000 $30,000

Vehicle Range 250 miles 300 miles 250 miles

Warranty 200,000 miles 50,000 miles 100,000 miles

cbc_Random3

cbc_Random3=1 cbc_Random3=2 cbc_Random3=3

0% 100%

Vehicle Survey

[SSI Script]

If these were your only options, which would you choose? Choose by clicking one of the buttons below:

(4 of 13)

0-60mph

Acceleration Time

3 seconds 6 seconds 9 seconds

Vehicle Type Electric Conventional Electric

Price $60,000 $60,000 $100,000

Vehicle Range 75 miles 75 miles 300 miles

Warranty 100,000 miles 50,000 miles 50,000 miles

cbc_Random4

cbc_Random4=1 cbc_Random4=2 cbc_Random4=3

0% 100%

Vehicle Survey

[SSI Script]

If these were your only options, which would you choose? Choose by clicking one of the buttons below:

(5 of 13)

0-60mph

Acceleration Time

9 seconds 3 seconds 6 seconds

Vehicle Type Conventional Conventional Conventional

Price $100,000 $30,000 $60,000

Vehicle Range 250 miles 300 miles 250 miles

Warranty 100,000 miles 200,000 miles 50,000 miles

cbc_Fixed1

cbc_Fixed1=1 cbc_Fixed1=2 cbc_Fixed1=3

0% 100%

Vehicle Survey

[SSI Script]

If these were your only options, which would you choose? Choose by clicking one of the buttons below:

(6 of 13)

0-60mph

Acceleration Time

9 seconds 3 seconds 9 seconds

Vehicle Type Electric Conventional Conventional

Price $60,000 $60,000 $100,000

Vehicle Range 250 miles 300 miles 75 miles

Warranty 50,000 miles 100,000 miles 200,000 miles

cbc_Random5

cbc_Random5=1 cbc_Random5=2 cbc_Random5=3

0% 100%

Vehicle Survey

[SSI Script]

If these were your only options, which would you choose? Choose by clicking one of the buttons below:

(7 of 13)

0-60mph

Acceleration Time

6 seconds 6 seconds 3 seconds

Vehicle Type Electric Electric Conventional

Price $30,000 $60,000 $30,000

Vehicle Range 300 miles 75 miles 250 miles

Warranty 100,000 miles 200,000 miles 200,000 miles

cbc_Random6

cbc_Random6=1 cbc_Random6=2 cbc_Random6=3

0% 100%

Vehicle Survey

[SSI Script]

If these were your only options, which would you choose? Choose by clicking one of the buttons below:

(8 of 13)

0-60mph

Acceleration Time

3 seconds 9 seconds 6 seconds

Vehicle Type Electric Conventional Electric

Price $60,000 $30,000 $100,000

Vehicle Range 300 miles 75 miles 250 miles

Warranty 100,000 miles 50,000 miles 200,000 miles

cbc_Random7

cbc_Random7=1 cbc_Random7=2 cbc_Random7=3

0% 100%

Vehicle Survey

[SSI Script]

If these were your only options, which would you choose? Choose by clicking one of the buttons below:

(9 of 13)

0-60mph

Acceleration Time

9 seconds 3 seconds 3 seconds

Vehicle Type Conventional Conventional Electric

Price $30,000 $100,000 $100,000

Vehicle Range 300 miles 250 miles 75 miles

Warranty 50,000 miles 200,000 miles 50,000 miles

cbc_Random8

cbc_Random8=1 cbc_Random8=2 cbc_Random8=3

0% 100%

Vehicle Survey

[SSI Script]

If these were your only options, which would you choose? Choose by clicking one of the buttons below:

(10 of 13)

0-60mph

Acceleration Time

9 seconds 6 seconds 3 seconds

Vehicle Type Electric Electric Electric

Price $100,000 $60,000 $30,000

Vehicle Range 75 miles 250 miles 300 miles

Warranty 100,000 miles 50,000 miles 200,000 miles

cbc_Fixed2

cbc_Fixed2=1 cbc_Fixed2=2 cbc_Fixed2=3

0% 100%

Vehicle Survey

[SSI Script]

If these were your only options, which would you choose? Choose by clicking one of the buttons below:

(11 of 13)

0-60mph

Acceleration Time

6 seconds 9 seconds 6 seconds

Vehicle Type Conventional Electric Conventional

Price $60,000 $30,000 $100,000

Vehicle Range 250 miles 300 miles 75 miles

Warranty 100,000 miles 200,000 miles 100,000 miles

cbc_Random9

cbc_Random9=1 cbc_Random9=2 cbc_Random9=3

0% 100%

Vehicle Survey

[SSI Script]

If these were your only options, which would you choose? Choose by clicking one of the buttons below:

(12 of 13)

0-60mph

Acceleration Time

9 seconds 6 seconds 3 seconds

Vehicle Type Conventional Electric Electric

Price $60,000 $30,000 $30,000

Vehicle Range 300 miles 250 miles 300 miles

Warranty 200,000 miles 100,000 miles 50,000 miles

cbc_Random10

cbc_Random10=1 cbc_Random10=2 cbc_Random10=3

0% 100%

Vehicle Survey

[SSI Script]

If these were your only options, which would you choose? Choose by clicking one of the buttons below:

(13 of 13)

0-60mph

Acceleration Time

9 seconds 6 seconds 3 seconds

Vehicle Type Electric Conventional Conventional

Price $100,000 $60,000 $30,000

Vehicle Range 75 miles 300 miles 250 miles

Warranty 100,000 miles 100,000 miles 200,000 miles

cbc_Random11

cbc_Random11=1 cbc_Random11=2 cbc_Random11=3

0% 100%

Vehicle Survey

You are almost done with the survey.

Questions in this section seek to identify attributes important in vehicle purchase decisions, driving patterns,access to parking facilities, and your perception of battery electric vehicles.

FollowUpIntro

0% 100%

Vehicle Survey

Please select a ranking for the following attributes in making your next vehicle purchasedecision:

Unimportant Somewhat Unimportant Neutral Somewhat Important Important

Price

Styling

Safety

Reliability

Brand

Power &

Performance

importanceRankings

importanceRankings_r1=1 importanceRankings_r1=2 importanceRankings_r1=3 importanceRankings_r1=4 importanceRankings_r1=5

importanceRankings_r2=1 importanceRankings_r2=2 importanceRankings_r2=3 importanceRankings_r2=4 importanceRankings_r2=5

importanceRankings_r3=1 importanceRankings_r3=2 importanceRankings_r3=3 importanceRankings_r3=4 importanceRankings_r3=5

importanceRankings_r4=1 importanceRankings_r4=2 importanceRankings_r4=3 importanceRankings_r4=4 importanceRankings_r4=5

importanceRankings_r5=1 importanceRankings_r5=2 importanceRankings_r5=3 importanceRankings_r5=4 importanceRankings_r5=5

importanceRankings_r6=1 importanceRankings_r6=2 importanceRankings_r6=3 importanceRankings_r6=4 importanceRankings_r6=5

0% 100%

Vehicle Survey

How often do you drive long distances with your vehicle (more than 350 miles) in a year?

0

1

2

3

4 or more

I don't know.

How many miles do you drive per year, on average?

Less than 5,000

5,000-10,000

10,001-15,000

15,001-20,000

More than 20,000

I don't know.

Of the places you have available parking, which have access to an electric outlet where you could plug in a vehiclefor charging. Please select all that apply.

At home, in my personal garage

At home, in a community parking garage

At home, in my driveway

At home, on the street

At home, at another location

At work, in a community parking garage

At work, in a driveway/parking lot

At work, on the street

At parking meters in town

None of the above

longDrives

longDrives=1

longDrives=2

longDrives=3

longDrives=4

longDrives=5

longDrives=6

annualMileage

annualMileage=1

annualMileage=2

annualMileage=3

annualMileage=4

annualMileage=5

annualMileage=6

electricityAccess

electricityAccess_1

electricityAccess_2

electricityAccess_3

electricityAccess_4

electricityAccess_5

electricityAccess_6

electricityAccess_7

electricityAccess_8

electricityAccess_9

electricityAccess_10

0% 100%

Vehicle Survey

Do you have access to fast charging stations in your city?

Yes

No

I don't know

In your view, how does an electric vehicle compare to conventional gasoline vehicles for thefollowing attributes:

Worse The same Better It depends

Price

Quality & Reliability

Vehicle Design

Styling

Power &Performance

Approximately, what is the current federal subsidy for battery electric vehicles?

$0

$2,000

$7,500

$10,000

I don't know

What is your annual household income before taxes in USD?

Less than $20,000

$20,000-$40,000

$40,001-$60,000

$60,001-$80,000

$80,001-$120,000

$120,001-$200,000

$200,001-$300,000

fastCharging

fastCharging=1

fastCharging=2

fastCharging=3

EVperceptions

EVperceptions_r1=1 EVperceptions_r1=2 EVperceptions_r1=3 EVperceptions_r1=4

EVperceptions_r2=1 EVperceptions_r2=2 EVperceptions_r2=3 EVperceptions_r2=4

EVperceptions_r3=1 EVperceptions_r3=2 EVperceptions_r3=3 EVperceptions_r3=4