Temporary Wage Subsidy Schememirror1.collsoft.ie/webinars/TWSS_Getting_Started_V2.pdf · 2020. 7....

Transcript of Temporary Wage Subsidy Schememirror1.collsoft.ie/webinars/TWSS_Getting_Started_V2.pdf · 2020. 7....

Temporary Wage Subsidy SchemeGetting Started

Operational Phase from 4th May

Temporary Wage Subsidy Scheme (TWSS)

• In response to the COVID 19 pandemic the Government introduced

the Temporary Wage Subsidy Scheme (TWSS) to provide financial

support to workers whose employers are affected by the pandemic

and unable to pay the employee. The scheme runs from 26th March

until the end of August 2020.

Temporary Wage Subsidy Scheme (TWSS)Employer Eligibility

• The scheme is available for eligible employees of eligible employers. Employers

must meet the eligibility criteria.

• 25% (or more) decrease in Q2 turnover

• Inability to pay employees

• Revenue Guidance Document

https://www.revenue.ie/en/corporate/communications/documents/guidance-on-

employer-eligibility-and-supporting-proofs.pdf

Employer Self Declaration

• Employer must submit a ROS My Enquiries enquiry

• Verify bank account details on Revenue

Employee Eligibility

• Employee must have been employed with you on 29th February

2020

• Employee must have been paid by employer in February 2020 and

those payments must have been reported to Revenue before 1st

April 2020.

Revenue TWSS FAQ

• Revenue maintain a comprehensive FAQ covering many aspects of the Temporary Wage Subsidy Scheme

• https://www.revenue.ie/en/employing-people/documents/pmod-topics/guidance-on-operation-of-twss.pdf

• Information for Employees https://www.revenue.ie/en/corporate/communications/documents/twss-guidance-for-paye-employees.pdf

Common Questions

• Are company directors eligible? - YES

• Do I have to put all of my employees on the scheme? - No

• Can I operate the scheme on a “Week on – Week Off” basis? – Yes

• One of my employees has just returned from maternity leave, can I

put them on the scheme? - Yes

How Does the Scheme Work?

• Each employee has an individual subsidy entitlement based on their “after tax” earnings in January and February 2020. This is called the “Average Revenue Net Weekly Pay” (ARNWP)

• Employers pay the subsidy as a tax free payment and can make an additional top up payment which is taxable.

• There is a limit to how much an employer can top up by before the subsidy gets reduced (this is called tapering).

• Generally speaking employers can make a top up payment up to the value of the employee’s ARNWP.

Average Revenue Net Weekly Pay(ARNWP)

• The ARNWP is the Average Revenue Net Weekly Pay that the employee earned in January & February 2020

• All subsidy calculations are made with reference to the ARNWP

𝐺𝑟𝑜𝑠𝑠 𝑃𝑎𝑦 −𝑃𝐴𝑌𝐸 −𝑈𝑆𝐶 −𝑃𝑅𝑆𝐼𝐼𝑛𝑠𝑢𝑟𝑎𝑏𝑙𝑒 𝑊𝑒𝑒𝑘𝑠

What is a J9 Payslip

• The employers pays the wage subsidy to the employee through payroll.

• CollSoft assigns a “J9” PRSI Class to the wage. This identifies that the payslip includes a wage subsidy payment.

• Employer submits “J9” payslips to Revenue by a normal Payroll Submission.

• Revenue refunds the employer for all the “J9” payslips on the next working day.

• Employer should receive refund in a two to three working days.

• “J9” payslips can be future dated by up to 4 days.

• “J9” payslips should not be submitted retrospectively.

• Users do not have to change any PRSI settings for the employee in CollSoft – The software will automatically assign J9 when required

Cash Flow Planning

• Take the example where an employer operates a weekly payroll and pays his employees on a Friday.

• The employer could process their payroll and report it to Revenue on Tuesday with a Friday payment date on the payslips.

• On Wednesday morning Revenue generates their bank file including all “J9” payslips submitted on Tuesday.

• The employer should receive the refund in their bank account on Thursday or Friday.

• There the employer can ensure that the wage subsidy is received from Revenue before the wages is paid to employees.

Revenue TWSS CSV File

• Revenue have prepared a CSV file for each employer listing all employees who are eligible for the scheme.

• The CSV file tells the employer how much subsidy is available for each employee.

• Download from ROS and import into CollSoft.

• Step By Step Instructions -http://helpdesk.collsoft.ie/Helpdesk/GetAttachment.ashx?FileID=950926

• Demonstration Video - https://vimeo.com/415967447

Verify Employments Registered With Revenue

• It is important to verify that all employments are correctly

registered with Revenue before processing a wage subsidy

payment.

• Revenue will not pay the wage subsidy for a ceased employment.

Why do you need to check?

• Employments may appear as live in CollSoft, but ceased on Revenue because;

• The employee ceased their own employment via MyAccount without telling the employer.

• The Department Of Social Welfare may have contacted the employer and instructed them

to cease the employment.

• The employment may have been ceased manually on ROS without updating the software.

• Just to be 100% sure!!!!!!!

How to rehire an employee in CollSoft

• Open the employee details screen for the ceased employee.

• Press the “Rehire” button to create a new employment.

• When asked select to “Register With Revenue”.

• Wait until next working day for Revenue to update the Wage Subsidy CSV File.

• Do not process a wage subsidy payment for the employee until the Revenue CSV

file has been updated.

Skipping forward from last Pay Period

• You may not have processed wages since some time in March, for many employers their last payroll was around Week 12.

• Your first payroll after shutdown may be something like 3rd July which is Week 27.

• To skip forward to 3rd July simply do the following;

• Select the “Enter Weekly Wages” option from the “Payroll” menu

• Enter the payment date as 03/07/2020 and press OK

• You will be warned that you are skipping a number of weeks – press Ok and begin processing your wages for 3rd July

Update your RPNs

• Revenue issued new RPNs for 830,000 employees on Sunday 21st June to put them on a Week 1 taxation basis.

• Any employee who has been on the Social Welfare PUP payment or who has been paid a wage subsidy has been updated to Week 1.

• Employees will no longer receive a tax refund with the updated RPNs.

• Employee’s Net Pay will be reduced because of this change.

• Employees can ask to be put back on a cumulative basis by contacting Revenue though their Revenue MyAccount.

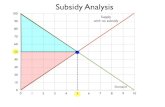

Calculation Examples

• The following slides explain the various levels of subsidy that is available.

• The amount of subsidy available depends on the value of the employee’s

ARNWP.

• The value of the ARNWP determines which band the employee belongs to.

• The following examples cover all values of ARNWP from zero to €586 per week.

ARNWP = €200(Subsidy is 85% of ARNWP)

• Maximum Subsidy • 85% of ARNWP

• = 85% of €200

• = €170

• Maximum Employer Pay Before Tapering • Employer can always top-up to €350 in this band irrespective of ARNWP

• = €350 – Wage Subsidy

• = €350 - €170

• = €180

ARNWP = €450(Subsidy is always €350 for ARNWP between €412.01 and €500)

• Maximum Subsidy = €350

• Maximum Employer Pay Before tapering is

• = ARNWP – Subsidy

• = €450 - €350

• = €100

ARNWP = €550(Subsidy is 70% of ARNWP)

• Maximum Subsidy

• 70% of ARNWP

• = 70% of €550

• = €385

• Maximum Employer Pay Before Tapering

• = ARNWP – Subsidy

• = €550 - €350

• = €165

Tapering

• Tapering occurs when the additional employer pay is greater that the “Maximum Employer Pay Before Tapering”

• Generally speaking Tapering occurs when the

• Subsidy + Pay > ARNWP

• But there are some exceptions to that rule

• ARNWP < €350 then Employer can top up to €350

• ARNWP > €960 then Tapering begins at €960

• Employers must always apply tapering.

ARNWP = €200Max Subsidy = €170, Max Employer Pay = €180

• No Tapering occurs for Employer Pay up to €180

• Employer Pay of €200

• Subsidy + Employer Pay

• €170 + €200 = €370

• €370 is greater than €350 by €20

• Subsidy is tapered (reduced) by €20

• Subsidy is €150

ARNWP = €550Max Subsidy = €385, Max Employer Pay = €165

• No Tapering occurs for Employer Pay up to €165

• Employer Pay of €250

• Subsidy + Employer Pay

• €385 + €250 = €635

• €635 is greater than €550 by €85

• Subsidy is tapered (reduced) by €85

• Subsidy is €300

Tiered Subsidy

• Tiered Subsidy applies to all cases where ARNWP > €586

• There are 3 Tiers

• Tier 1 has a maximum subsidy of €350

• Tier 2 has a maximum subsidy of €205

• Tier 3 has zero subsidy

Tiered Subsidy

• The Tier that applies depends on the value of Employer Pay compared to the ARNWP

• Tier 1 applies where Employer Pay is 60% or less of ARNWP

• (This is 40% or more reduction below ARNWP)

• Tier 2 applies where Employer Pay is between 60% and 80% of ARNWP

• (This is a 20% to 40% reduction below ARNWP)

• Tier 3 applies where Employer Pay is more than 80% of ARNWP

ARNWP = €800

• Tier 1 applies to all Employer Pay from zero to €480

• Subsidy is €350, tapering occurs after €450 (€800 - €350)

• Tier 2 applies to all Employer Pay from €480.01 to €640

• Subsidy is €205, tapering occurs after €595 (€800 - €205)

ARNWP = €1200, Employer Pay = €1000

• Not eligible for subsidy as drop in pay is only 17% (€200 / €1200)

ARNWP = €1200 Employer Pay = €800

• Drop in Pay is 33% therefore maximum subsidy €205

• Maximum Employer Pay = €755 (€960 - €205)

• With Pay of €800 then tapering of €45 applies

ARNWP = €1200 Employer Pay = €600

• Drop in Pay 50%

• Maximum Subsidy €350

• Maximum Employer Pay before Tapering €610 (€960 - €350)

Revenue Calculator Spreadsheet

• Revenue have an Excel Calculator to download from

https://www.revenue.ie/en/corporate/communications/documents

/twss-sample-subsidy-calculator.xlsx

CollSoft TWSS Spreadsheet

• Download from http://mirror1.collsoft.ie/twss/twss.xlsm

• The new Excel Formulas are explained in the next couple of slides

• This is a Macro Enabled Spreadsheet so you will be shown a

security warning, the Macros will be disabled and you will have to

“Enable Content”

=CalculateWageSubsidy()

• This function calculates the wage subsidy available for a particular ARNWP

• This function requires at least one parameter (ARNWP) but has some other optional parameters.

• ARNWP – Always Required

• Employer Pay - Optional, defaults to zero

• Pay Frequency - Optional, defaults to “W” for weekly, other values are “M” for monthly, “TW” for Two Weekly (Fortnightly) and “FW” for Four Weekly

• Taper - Optional, defaults to 1 to automatically taper, or can be 0 to switch tapering off)

• Payment Date – Optional, defaults to 4th May 2020, determines which calculations to use

Examples follow on next page

Examples=CalculateWageSubsidy()

• =CalculateWageSubsidy(550) - calculates the weekly subsidy available for ARNWP = €550 and zero employer pay – this gives maximum subsidy under the new scheme.

• =CalculateWageSubsidy(1000, 780) – calculates the weekly subsidy for ARNWP = €1000 and Employer Pay €780 with automatic tapering.

• =CalculateWageSubsidy(1000, 3400,”M”) - calculates the monthly subsidy for ARNWP = €1000 and monthly employer pay €3400 with tapering

• =CalculateWageSubsidy(1000, 3400,”M”,0) – as above but without tapering

• =CalculateWageSubsidy(1000, 3400,”M”,0,01/04/2020) – as above but under Temporary Phase calculations

=CalculateMaxEmployerPay()

• This function calculates the maximum employer payment before tapering occurs for a particular ARNWP

• This function requires at least one parameter (ARNWP) but has some other optional parameters.• ARNWP – Always Required

• Employer Pay - Optional, defaults to zero

• Pay Frequency - Optional, defaults to “W” for weekly, other values are “M” for monthly, “TW” for Two Weekly (Fortnightly) and “FW” for Four Weekly

• Taper - Optional, defaults to 1 to automatically taper, or can be 0 to switch tapering off)

• Payment Date – Optional, defaults to 4th May 2020, determines which calculations to use

Examples follow on next page

Examples=CalculateMaxEmployerPay()

• =CalculateMaxEmployerPay(550) - calculates where tapering begins for ARNWP = €550

• =CalculateMaxEmployerPay(1000, 780) – calculates where tapering begins for ARNWP = €1000 and Employer Pay €780 with automatic tapering.

• =CalculateMaxEmployerPay(1000, 3400,”M”) - calculates where tapering begins for ARNWP = €1000 and monthly employer pay €3400 with tapering

• =CalculateMaxEmployerPay(1000, 3400,”M”,0) – as above but without tapering

• =CalculateMaxEmployerPay(1000, 3400,”M”,0,01/04/2020) – as above but under Temporary Phase calculations