T10 Tax Teaching Notes · ! 3! Slide7$ $...

Transcript of T10 Tax Teaching Notes · ! 3! Slide7$ $...

1

Teaching Notes Script for PowerPoint presentation The text in the right-‐hand boxes provides a possible script/set of questions with some possible student responses. However, it is probably preferable to use your own words and elaboration. When questions are asked, time for discussion in pairs/groups should be provided. Ensure that learners are given the opportunity to explain their reasoning in response to these questions. All learners need to understand the concepts in order to make progress with the task. Some key questions are given in bold. Slide 1

Keep this slide on the screen until you are ready to start the presentation

You may wish to discuss the quotes.

Slide 2

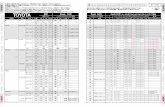

In 2014 up to 24 million workers in the UK received a letter showing how much tax they had paid for the year April 2013 to April 2014. This letter would have been sent to someone who earned £15,000 before tax. This chart was on the back of their letter.

• What does it show? It gives a breakdown of how much of our taxes is spent on each area.

• What words do you need to have explained? • Do you have any comments about how our taxes are spent? • How much did this person pay in tax? • How would a letter to someone earning £60,000 a year before tax be

different from this? • Would the £60,000 chart look different?

Tax and National Insurance

!"#$%&'#()#*+,#(+

-'./#0

1%(2#(2'34#"#56

,#7%8%$%9+(%):/;#<

!"#$%&'(%)*%""'+

,"-%.'/&01

!=2'#2+>?'.(#(2%:@#%:#(2'#A)>$?#()#

6:?'>.(+:?#%.#(2'#%:7)3'#(+-/;0

2"3%&4'5#).4%#)0"I believe we should all pay our tax bill with a smile.

I tried but they wanted cash." Anonymous

“The invention of the teenager was a mistake.

Once you identify a period of life in which people get to stay out

late but don't have to pay taxes – naturally, no one wants to live

any other way.”

Judith Martin

Tax and National Insurance

Source: www.gov.uk

Contextualised task 10

Tax and National Insurance

2

Slide 3

The chart looks the same, only the actual numbers are different – not the proportions spent on different areas.

Slide 4

These cards show some jobs people do, and the average (mean) salary they receive (in 2014). Try to match the salary with the jobs! You have 5 minutes for this. The results are on the next slide.

Slide 5

• Are there any results you find surprising? Allow for some discussion about these results.

• Do all of these workers pay tax? • If not, which ones do not pay tax? • Roughly how much tax would you expect these workers to pay? (Select

as appropriate).

Slide 6

At this point, hand out the sheets ‘Income Tax Allowances and Rates’ and the cards on this slide. The next task is to use these cards as headings. Organise your other cards and salaries under these headings. You can use this information sheet about tax allowances to help you. 5 minutes should be enough.

Tax and National Insurance

Source: www.gov.uk

TYPES OF WORK

How much are these jobs paid? You have 9 cards of different types of work, and 9 cards of their average salaries. Try to match the work with the salary.

Childcare services

Air traffic controller Train driver

Animal care services

Dental practitioner Plumber

Senior Fire Officer Bar staff Marketing and

sales director

£27,832 £45,489 £7,317

£84,377 £49,684 £11,466

£69,068 £16,158 £53,567

Adapted from data from the Office for National Statistics licensed under the Open Government Licence v.3.0.

TYPES OF WORK AND THEIR SALARIES

These are the solutions.

Childcare services

£11,466

Air traffic controller

£69,068

Train driver

£45,489

Animal care services

£16,158

Dental practitioner

£53,567

Plumber

£27,832

Senior Fire Officer

£49,684

Bar staff

£7,317

Marketing and sales director

£84,377

Adapted from data from the Office for National Statistics licensed under the Open Government Licence v.3.0.

Which tax bracket?

Cut these headings out, and organise your cards under them.

Pays no tax

Pays 20% tax on earnings above £10,000, up to £41,865

Pays 20% tax on earnings above £10,000, and 40% tax on earnings above £41,866

Pays45% tax on some earnings

3

Slide 7

It’s time for a bit of calculation. I want you to look at the tax allowances sheet again, and look at this question. Try to show how the tax is calculated. I want you to be able to explain it fully in a few minutes. After a few minutes, take some explanations from the class.

As a way of assessing their understanding, offer another fairly simple calculation – e.g.

• Explain how your method works if the salary was £12,000 a year. How much tax will be paid? How about for £10,100?

• How do you go about working out how much they pay in a month? • What if their pay was paid weekly? • Does anybody know of other deductions taken from your salary?

Slide 8

Hand out the sheets with the National Insurance information. Has anyone received their card? National Insurance contributions count towards certain benefits. These are just some of them:

• Your State pension • Jobseeker’s allowance • Maternity benefits

You pay these contributions on top of your tax. • We found that the bar staff wouldn’t pay tax on £7,317. Would they pay

any National Insurance contributions? • How do we work this out?

No. They start paying NI at £7,956 per year. Multiply £153 by 52 weeks.

• What is different about calculating National Insurance contributions compared to calculating tax?

Calculating tax

• Look at the information sheet ‘Income tax allowances and rates’.

• Explain why someone who earns £11,000 per year will have to pay £200 in tax.

• How much a month would that person pay in tax?

• What other deductions are taken from this person’s earnings?

National Insurance

• You may have your National Insurance Card already. It usually arrives in the post before your 16th birthday.

• It is your unique number for life.

• It ensures that your tax and NI contributions are recorded on your name.

4

Slide 9

• This person will pay National Insurance. Try to work out how much. • How much does this work out to each month? • So what are their total deductions, including tax and NI? • So if they are earning £11,000, what do they actually take home? • Explain to me how you worked it out.

Expect other members of the group to check the solutions and the methods. • Is this working correct? • Is the answer correct?

Solutions below

Slide 10

• What are the steps you have to take in solving these problems? • How should you present your answers? (Annually, weekly, monthly?) • Tell me your answers, and how you worked them out.

Expect other members of the group to check the solutions and the methods. • Is the answer to the third question just 32% (tax and National Insurance

rates added together), or is it asking you to calculate something different? If so, what, and how do you go about it?

Solutions below

Slide 11

• A person’s ‘Personal Allowance’ is lost at what wage? • What is the overall proportion of deductions due on this salary?

Solutions below

Calculating National Insurance contributions

• Look at the information sheet ‘National Insurance contributions’.

• How can we work out if someone earning £11,000 a year will pay National Insurance contributions (NI)? What is the first calculation we could do?

• How much a year will this person pay in NI?

• How much does this work out each month?

• How much in total is deducted each month from this person?

Calculating Tax and National Insurance contributions

How much tax and National Insurance would you pay if you earned £200 each week?

How much tax and National Insurance would you pay if you earned £400 each week?

What percentage of your gross earnings would you pay in tax and National Insurance for each of these wages?

Do you think that is fair?

Calculating Tax and National Insurance contributions

Let’s go to the other extreme: • The average Premiership footballer is paid £2.3 million per

year. • How much of this should be paid in tax and National

Insurance? What proportion of his whole wage is this?

• Note: He will not have a personal allowance at this rate of pay. His threshold would therefore be

o £0 to £31,865: 20% tax rate o £31,865 to £150,000: 40% tax rate o Above £150,000: 45% tax rate

5

Slide 12

• You now have the opportunity to explore the range of salaries given in the cards you have. Try to set out your work clearly, making sure you write down your calculations. Make sure you display the salary, the tax and national insurance each person pays, and then calculate an overall percentage of deductions as evidence for your arguments. Fair or not?

• Check your work carefully and compare your answers with others so that you make sure your working is correct. We will share your answers later. See how far you get in 20 minutes.

• When you finish those nine, there is a challenge for you in red at the bottom of the slide.

Remaining slides The remaining slides are extra resources for teachers to use at their discretion. Some slides give the same details as on the resource sheets for tax and NI, another shows further websites to explore.

Calculating Tax and National Insurance contributions

• Look at each of the 9 workers in your cards. • Calculate the tax and National Insurance they should pay. • Calculate the proportion each person pays in tax and NI

from their gross salary. • Is the tax burden shared fairly or not in your view? • If you want to explore further, investigate salaries around

the thresholds – e.g. the difference between earning £9,900 and £10,100, then £41,800 and £41,900, and again at £100,000 to £120,000.

!

6

Possible working and solutions Slide 9 solutions: A person earning £11,000 will pay £200 in tax and £365.28 in National Insurance per year. This totals £565.28 and represents 5.1% of their gross salary. Per month, they would pay roughly £16.67 in tax and £30.44 in NI, totalling £47.11 in deductions. Gross pay per month is £916.67, after deductions this falls to £869.56. Slide 10 solutions: A person earning £200 a week (£10,400 a year) will pay £80 in tax and £293.28 in National Insurance per year. This totals £373.28 and represents 3.6% of their gross salary. Per week their deductions will be £7.18, leaving them £192.82 per week. A person earning £400 a week (£20,800 a year) will pay £2,160 in tax and £1,541.28 in National Insurance per year. This totals £3,701.28 and represents 17.8% of their gross salary. Per week their deductions will be £71.18, leaving them £328.82 per week. Slide 11 solutions: A Premiership footballer earning £2,300,000 a year could pay £6,373 at 20% tax, then £47,254 at 40% tax, then £967,500 at 45% tax. This totals £1,021,127 to be paid in tax. The National Insurance to be paid would be £4,068.48 for earnings up to £805 per week (£41,860) at the 12% rate, and then £45,162.80 at the 2% rate after that. This totals £49,231.28. The total in tax and National Insurance deductions is £1,070,358.28 per year. This represents 46.5% of his gross salary.

7

GCSE Subject Content GCSE Mathematics – Numeracy and GCSE Mathematics GCSE Mathematics only

Understanding number and place value • Reading and writing whole numbers of any magnitude expressed in figures or words. • Understanding place value and decimal places • Rounding decimals to the nearest whole number or a given number of decimal places

Understanding number relationships and methods of calculation • Using the facilities of a calculator, including the constant function, memory and brackets, to plan

a calculation and evaluate expressions. • Using calculators effectively and efficiently. • Reading a calculator display correct to a specified number of decimal places • Estimating and approximating solutions to numerical calculations. • Finding a fraction or percentage of a quantity. • Expressing one number as a fraction or percentage of another.

Solving numerical problems • Interpretation and use of mathematical information presented in written or visual form when

solving problems. • Money: The basic principles of personal and household finance, including taxation, wages and

salaries. • Giving solutions in the context of a problem, selecting an appropriate degree of accuracy,

interpreting the display on a calculator. Knowing whether to round up or down as appropriate.

Key: Foundation Tier: plain text Intermediate Tier: underlined text Higher Tier: bold text

8

Assessment Guidance

The following progression applies to learners undertaking the final investigation of the impact of tax and National Insurance on a range of wages, including those given on the cards.

Progression in reasoning

Identify processes and connections

Calculate accurately the tax paid on a few salary examples. Begin to calculate the proportion of tax paid on the overall salary for each salary amount.

Organise a systematic way of analysing the impact of tax on a sequence of salaries – e.g. every £10,000 up to £160,000. Calculate the proportion of tax paid on the overall salary for each salary amount.

Systematically analyse the impact of tax on both a sequence of salaries, and some specific salaries that may be affected by different tax rules – such as from £100,000 to £120,000 where the personal allowance is removed. Explore also the impact of National Insurance, to give an overall view of the impact of deductions on various groups of earners.

Represent and communicate

Present calculations clearly, explaining how they have made these calculations and what they show.

Present calculations in an efficient clear way. Present findings about the proportions of tax paid on different salary amounts in a clear organised way, and explain these results.

Present an argument about the fairness of the impact of tax on different groups of earners, using evidence. This evidence may be presented in different forms – graphs, charts, tables.

Review Offer a conclusion or a view about the proportion of tax paid for the different amounts they have explored. Begin to evaluate their work – e.g. have they produced enough results to make a judgment. Check work for accuracy. Evaluate methods.

Evaluate their work, noting that they may draw conclusions from their data, but they may have not explored all the different salaries, and the tax thresholds may have unseen effects on other results. Evaluate their presentation of work – are the charts/graphs/ tables they use effective in presenting their arguments.

Reflect on how they have worked, and consider ways of improving their methods. Consider particular salary brackets, and explore further.

9

Progression in skills

Understand and calculate income tax

Calculate accurately the tax paid on a few salary examples.

Calculate accurately the tax paid on examples of salaries from each tax band.

Calculate accurately the tax paid on examples of salaries from each tax band, and those salaries that are also affected by the reduction of the personal allowance. Calculate the effect of NI in addition.