Systemic risk in micro level: the case of “ cheques-as-collateral ” network

description

Transcript of Systemic risk in micro level: the case of “ cheques-as-collateral ” network

Systemic risk in micro level: the case of “cheques-as-collateral”

network

Michalis Vafopoulos, vafopoulos.org

joint work with D. Soumpekas and V. Angelis21/10/2011

Aristotle University, Mathematics Department Master in Web Science

supported by Municipality of Veria

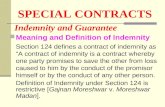

outline① Financial crisis: a network explanation② Why networks? ③ Systemic risk and financial contagion④ The “cheques-as-collateral” network⑤ Data and model⑥ Results ⑦ Further extensions

2

Financial crisis: a network explanation

• 2007: Started from US sub-prime and disseminated rapidly to the global real economy

A reality: Regulation based on binary relations – Government & bank– Bank & customer

and a dogma: “too big to fail”

• Research on correlation and market risk (VaR-like metrics)

3

We cannot do…

Current risk systems cannot:• Predict failure cascades. • Account for linkages. • Determine counterparty losses.

4

Financial crisis: a network explanation

But the financial system (+info) is:A global networked system

So, + “too interconnected to fail”

How to model it?Networks!

5

Why networks? • Easy to model and visualize relations• Easy to calculate major statistics • The study of the Web network help us to

conclude that most of real networks are:– Self-similar (Scale-free)– Small worlds

6

NETWORK THEORY

Financial Network Analysis

Biological Network Analysis

Graph & Matrix Theory

Web Science

Social Network Analysis

Computer Science

Network theory and related fields

how? • Define:1. Node (e.g. person, business)2. Link [directed or not] (e.g. friendship, commerce)

And if necessary:3. Evaluation of node (e.g. score, potential)4. Evaluation of link (weight) (e.g. trust)

8

4 50.54

Federal fundsBech, M.L. and Atalay, E. (2008), “The Topology of the Federal Funds Market”. ECB Working Paper No. 986. Iori G, G de Masi, O Precup, G Gabbi and G Caldarelli (2008): “A

network analysis of the Italian overnight money market”, Journal of Economic Dynamics and Control, vol. 32(1), pages 259-278

Italian money market

Financial networksFocused on banks, financial institutions etc.

Financial Systemic risk from grass-roots

What about trying model systemic risk directly from bank customers?

Financial systemic risk (definitions)• The risk of disruption to a financial entity

with spillovers to the real economy.• The risk that critical nodes of a financial

network fail disrupting linkages.• Financial contracts with externalities.

10

The “cheques-as-collateral” network

• Nodes: cheque issuers & recipients • Link ij : customer i issues cheque to customer

j• Weight of link: the fraction of the value of

cheques that customer i have issued to customer j, to the total value of cheques in euros received by the bank

Cheque recipients use their incoming cheques as collateral to working capital credit.

11

Data

The model-1(based on Martínez-Jaramillo et al., 2010). Step 01. Assume a set of criteria for the

failure of every customer (c). Here it is assumed that c=50% of the total amount of the unpaid cheques that drives every customer to failure. 2. For a given “cheques-as-collateral” network, calculate the weighted adjacency matrix (W).

The model-2Step 03. Calculate the failure threshold for every customer j:

It is assumed that this threshold remains constant in every stage k.

4. Assume a set of customers that initially fail to pay their cheques (Dk=0).

This set can be chosen by some relevant criterion. In our case, five customers with the highest weighted out-degree have been selected to collapse at stage k=0.

The model-3Step 11. Calculate the sum of the defaulted

exposures of failed customer i to j:

The model-4Step 12. Compare the calculated defaulted exposure failure threshold of customer j.

3. Update Dk with the failed customers.

The model-5Step 2• Repeat Step 1 until Dk=Dk+1.

Results-1

18

Stage 0 Number of failed nodes: 5Decrease in total value: 17%

Results-2

19

Stage 1Number of failed nodes: 4Decrease in total value: 27%

Results-3

20

Stage 2Number of failed nodes: 3Decrease in total value: 38%

Results-4

21

Stage 3Number of failed nodes: 2Decrease in total value: 41%

Results-5

22

After the shock

Number of failed nodes: 14Decrease in total value: 41%

23

Evaluating the systemic risk of a bank customer

• Assume that only a customer fails• Ceteris paribus• Calculate financial contagion• Compare to others• Weight factors like stage, sector etc• So, variety of hypothesis for the

stage-by-stage loss function

24

Evaluating the systemic risk of a bank customer

1. decreasing stage-by-stage loss2. composite loss (e.g. weight) 3. systemic risk assessment (e.g. cheque

issuer)

25

Further extensions• More data and metrics• Model the initial shock• Reverse logic: business development

“multiplier” for banks• and other sectors…

Thank you.More at www.vafopoulos.org

Questions?26

Our model is based on the idea of the Systemic Risk Network Model that accounts for bank failures in the financial system (Martínez-Jaramillo et al., 2010).

Decreasing stage-by-stage loss

29

the total adjusted loss is calculated by weighting stage 0 loss with 0.5, stage 1 loss with 0.25 and stage 2 loss with 0.125.

composite loss (e.g. weight)

30

taking into account her weight in the network.

systemic risk assessment

31