Systematic Approach in Global and Regional Markets Approach in Global and Regional Markets NOMURA...

Transcript of Systematic Approach in Global and Regional Markets Approach in Global and Regional Markets NOMURA...

Systematic Approach in Global and Regional Markets

NOMURA CONFERENCE JUNE 3rd 2015 - LONDON

RANI PIPUTRI, CFA, CAIA Portfolio Manager

page 2

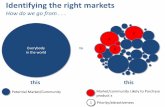

Amidst the era of globalization and big data, where are the best places for systematic approach

in stock selection?

page 3

Backdrop The majority of equity investment worldwide has been in the US. Whereas the AuM of US and Japan has exceeded the pre-crisis level, Europe is still lagging.

Source: Towers Watson, 2013

page 4

Backdrop In the US, home bias is still very much alive.

page 5

Backdrop Despite increasing flows into index funds, the great majority of assets are still held in non-index funds.

The case for international investing relies predominantly on the notion of diversification; there has been little emphasis on alpha opportunities.

Percentage of Assets in Index versus Non-Index Funds by Region

Does the availability of alpha opportunities justify this US-centric investing? Where to find alpha in global equity markets?

page 6

Return drivers

Cheap stocks have outperformed expensive stocks for nearly a century. Investors overpay for themes, high growth and underestimate stocks that are cheap now. Companies that are profitable now, pay out a lot of dividends and have a lot of assets relative to their share price will – on average – post better returns for investors as the world constantly changes.

VALUE

MOMENTUM

QUALITY

Buying the winners over the last 9 to 12 months and selling the losers has proven to be a successful investment strategy within equities, though arguably, price momentum has become more volatile. Investors exhibit herding behavior as they all buy into the same trends and success stories. This is often the opposite of Value investing, which is why combining Value AND Momentum works well.

Investors pay too much for stocks with lottery type upside. As long only investors are unable to short (risky) stocks or borrow money to buy more market upside, higher Beta names will trade at a premium as they offer short term upside when markets go up. Other Quality type strategies such as profitability, debt reduction, share buybacks and accruals offer positive quantitative pay-offs.

The approach is to utilize these return drivers in a systematic way to select stocks.

page 7

Investable Universe Median daily volume in the last 6 months > 1 million EUR Free float adjusted market cap > 200 million EUR If free float data is unavailable, use market cap > 400 million EUR

2,685

1,269 1,023

159

1,902

320

-

500

1,000

1,500

2,000

2,500

3,000

-

2,000

4,000

6,000

8,000

10,000

12,000

DMAMERICA

DM APAC DM EMEA EMAMERICA

EM APAC EM EMEA

Average Mcap (million EUR) Number of Companies

DM AMERICA

46%

DM APAC15%

DM EMEA22%

EM AMERICA

2%EM APAC

11%

EM EMEA4%

Global Universe (percentage based on aggregate market cap)

There are more stocks in the US than anywhere else, but the largest concentration of large and liquid stocks are in DM EMEA. EM APAC are a crowded place with many small companies.

Investable Universe as of May-2014. Source: Saemor Research, Factset

page 8

Developed versus Emerging Markets Applying systematic approach in emerging markets is challenging due to:

Short history of data, limited data coverage and lower data quality

Relatively high trading costs

Limited possibility to sell short stocks

page 9

Data Availability Reliable global dataset is only available after 1999. Data coverage in emerging markets is particularly scarce.

Source: Saemor Research, Factset

page 10

Trading Costs Investing in emerging markets incurs higher trading costs.

page 11

Shorting Selling short stocks in emerging markets is expensive and often highly regulated. The availability of shortable stocks in these markets is limited.

Although these have been improving in the recent years, the levels of lending fee in emerging markets are still well above those in developed markets.

Source: Saemor Research, Markit. Data from Jan-2007 to Mar-2015. Left chart: Lower figures indicate the median, upper figures indicate the mean. Right chart: Percentage of stocks in the universe where there are available shares on loan.

page 12

What Works?

Monthly Rebalancing, Jan-2000 to April 2015, 15bp transaction costs. Source: Saemor Research

page 13

Return drivers in regional markets Value factors work everywhere. Cyclical value factors, such as Book to Price, works best in Developed Asia Pacific, but they performs meagerly in Developed Europe.

Momentum factors work in Developed Europe and US, but they are less effective in Developed Asia Pacific.

Source: Saemor Research

page 14

Return drivers in regional markets Some factors behave differently in different markets and in different times.

Source: Saemor Research

page 15

Model Construction In-sample data from Jan-1994 to Jun-2007, out-of-sample data from Jul-2007 to Apr-2015.

Factors grouped into Value, Momentum and Quality clusters.

A multifactor model is constructed for each (developed) region separately, and for the global universe. The model takes into account that some factors are inapplicable for Financials.

The multifactor model is created by optimizing factors as to maximize its predictive power. Each cluster is constrained to carry a weight between 25% and 50%.

page 16

Model Composition

Source: Saemor Research

page 17

Financials vs. Non Financials

Source: Saemor Research

page 18

Results Among the three regional models, the models for Europe and Asia Pacific delivered the best performance: higher (risk adjusted) return, higher Information Coefficient and higher Omega Ratio (average positive returns / average negative returns).

The global model was applied in the global universe, as well as the global excluding emerging markets. In the latter case, the Information Ratio improved due to lower volatility.

page 19

Results The return distribution of the regional models for Europe and US is quite similar, with Europe having a slightly taller and narrower distribution. Asia Pacific is less positively skewed and platykurtic.

When the global model is applied to the global universe excluding emerging markets, its return distribution become less positively skewed and more peaked.

page 20

What does it mean? One single global model for global equities does not seem to be optimal. Dedicated regional models work better for developed markets, except for US and Canada. DM America regional model has been optimized to work within US, but the alpha opportunities appear to be limited.

This meagre alpha can be associated with highly efficient market in the US, due to: single language, single currency, uniform accounting standard, more timely reporting, single regulation framework and the proliferation of high frequency trading.

In contrast, different countries in Europe and Asia Pacific have different export/import profile, dissimilar political environment and diverging local sentiments. Mispricings are also plentiful due to the fact that there are still many local brokers covering only local stocks.

page 21

Reporting Frequency While most companies in the US reports their numbers quarterly, this is not the case for Europe and Asia.

Source: Saemor Research

page 22

Reporting Frequency Most notable improvements on country level are in Asia Pacific and EMEA.

Source: Saemor Research

page 23

Broker coverage: global versus local There are more local brokers in Europe and Asia Pacific that cover only their own homegrown stocks.

Opportunity for alpha arises when local analysts, bound by their home country limitation, fail to include a proper sector/peer comparison of the stocks they cover.

Source: Starmine

129 brokers in Dev Asia Pacific 104 brokers in Dev Europe 75 brokers in North America 22 brokers in Emerging Markets

page 24

High Frequency Trading Growth of High Frequency Trading is also associated with shorter alpha decay in the US.

Reliable numbers on the aggregate HFT activities in Asia Pacific are not available. Most activities are concentrated in Japan and Singapore, which start seeing strong growth in HFT.

High Frequency Trading as a % of Equity Turnover by Volume, U.S. and by Value, Europe

page 25

What next? We extend the research by creating a global model that recognized the local return drivers, by combining the three regional models. Asian stocks are scored based on factors that work in Asia, European stocks are scored based on European model, etc. After all the stocks are scored, we hold long the best 20% and short the worst 20% of the universe, regardless of the region.

This composite approach does not improve the performance of the global model. It appears that, even using a “smarter” global model, the result is still dragged by the nearly 60% of the weight of US stocks in the investable universe.

Source: Saemor Research

page 26

Conclusion If one is to invest in the US, passive investing makes sense, because alpha is hard to come by.

Developed Europe and Developed Asia still offer plenty of alpha, but one needs to be cognizant of local drivers. Developed Europe, in particular, presents superior risk adjusted return.

Emerging market is a promising ground for systematic approach, but a lot of sauce will be required in the recipe.

Global approach with sufficient tilt towards developed markets in Europe and Asia provides the best alpha opportunities.

page 27

Saemor Capital B.V. has compiled this publication. Saemor Capital B.V. is a management company and in that capacity avails of a license pursuant to section 2:65 of the Act on Financial Supervision of the Netherlands (Wft) as that section reads following the incorporation of the AIFM Directive in the Wft. Although the information contained in this publication is composed with great care and although we always strive to ensure the accuracy, completeness and correctness of the information, imperfections due to human errors may occur, as a result of which presented data and calculations may vary. Therefore, no rights may be derived from the provided data and calculations. All information is provided "as is" and is subject to change without prior notice. Saemor Capital B.V. does not warrant the adequacy, accuracy or completeness of any information and expressly disclaims any liability for errors or omissions therein. The recipients of this publication are responsible for evaluating the accuracy, completeness or usefulness of this information. The information contained in this publication does not constitute any recommendation, investment proposal, offer to provide a service, nor a solicitation to buy or sell any security or other investment product. The publication of this information may be subject to restrictions imposed by law in some jurisdictions. Saemor Capital B.V. requests any recipient of this publication to become acquainted with, and to observe, all restrictions. Saemor Capital B.V. accepts no liability for infringement of such restrictions. The recipient shall not distribute, forward or publish this information. No rights may be derived from the provided information, data and calculations. Also by risks inherent to this investment fund, the value of the investments may fluctuate. Past performance is no guarantee or guide to future performance. Source of securities financing data: Markit. Neither Markit, its Affiliates nor any third party data provider makes any warranty, express or implied, as to the accuracy, completeness or timeliness of the securities financing data contained herein (“Markit Data”) nor as to the results to be obtained by recipients of the Markit Data. Neither Markit, its Affiliates nor any data provider shall in any way be liable to any recipient of the Markit Data for any inaccuracies, errors or omissions in the Markit Data, regardless of cause, or for any damages (whether direct or indirect) resulting therefrom. Without limiting the foregoing, Markit, its Affiliates, or any third party data provider shall have no liability whatsoever to you, whether in contract (including under an indemnity), in tort (including negligence), under a warranty, under statute or otherwise, in respect of any loss or damage suffered by you as a result of or in connection with any opinions, recommendations, forecasts, judgments, or any other conclusions, or any course of action determined, by you or any third party, whether or not based on the Markit Data herein. Copyright © 2015, Markit Group Limited”

Disclaimer