Summary of Consolidated Financial Results for the Nine ...There will not be a convening briefing of...

Transcript of Summary of Consolidated Financial Results for the Nine ...There will not be a convening briefing of...

This summary is a translation of ‘KESSAN TANSHIN’ which is an unaudited report.

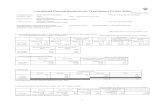

Summary of Consolidated Financial Results

for the Nine-Month Period ended December 31, 2014〔Japanese GAAP〕

January 21, 2015

Company name: SOGO MEDICAL CO., LTD.

Stock exchange listings: Tokyo 1st Section

Securities code: 4775 URL: http://www.sogo-medical.co.jp/english/

Representative: (Title) President & Representative Director (Name) Itsuo Tashiro

Inquiries: (Title) Director & Executive Managing Officer (Name) Makoto Kuroda

Tel: +81-92-713-7611 E-mail: [email protected]

Quarterly securities report filing date (as planned): February 10, 2015

Dividend payable date (as planned): -

Supplemental material of quarterly results is available.

There will not be a convening briefing of quarterly results for institutional investors and analysts.

(Amounts are rounded down.)

1.Consolidated Financial Results (from April 1, 2014 to December 31, 2014)

(1)Consolidated operating results (% indicates changes from the same period of the previous year. )

Net sales Operating income Ordinary income Net income

Nine-month period ended Millions of Yen % Millions of Yen % Millions of Yen % Millions of Yen %

December 31, 2014 79,011 6.1 2,828 (7.7) 3,001 (3.7) 1,658 (5.3)

December 31, 2013 74,484 21.4 3,063 16.5 3,115 16.6 1,750 12.3

Notes: Comprehensive income

Nine-month period ended December 31, 2014 ¥ 1,803 million (-0.6%)

Nine-month period ended December 31, 2013 ¥ 1,814 million (19.3%)

Net income

per share

Diluted net income

per share

Nine -month period ended Yen Yen

December 31, 2014 229.76 -

December 31, 2013 242.50 -

(2)Consolidated financial positions

Total assets Net assets Capital adequacy

ratio

Millions of Yen Millions of Yen %

As of December 31, 2014 66,352 25,130 37.9

As of March 31, 2014 66,982 23,934 35.7

References: Owner’s equity

As of December 31, 2014 ¥ 25,130 million

As of March 31, 2014 ¥ 23,905 million

2.Dividends

Dividend per share

First quarter Second quarter Third quarter Fiscal Year end Total

Yen Yen Yen Yen Yen

FY2013 - 40.00 - 40.00 80.00

FY2014 - 40.00

FY2014(Forecast) - 40.00 80.00

Note: Correction of dividend forecast from the most recent dividend forecast : None

3.Consolidated forecasts for FY2014 (from April 1, 2014 to March 31, 2015)

(% indicates year-on-year change.)

Net sales Operating income Ordinary income Net income Net income

per share

Millions of Yen % Millions of Yen % Millions of Yen % Millions of Yen % Yen

Full-year 111,027 7.5 5,214 4.0 5,111 0.8 2,929 2.6 405.80

Notes: Correction of financial forecast from the most recent financial forecast: None

4.Others

(1)Material changes in subsidiaries during this period

(Changes in scope of consolidations resulting from change is subsidiaries): None

(2)Applying of specific accounting of the consolidated quarterly financial statements: None

(3)Changes in accounting policies and accounting estimates, retrospective restatement

① Changes in accounting policies based on revisions of accounting standard: None

② Changes in accounting policies other than ones based on revisions of accounting standard: None

③ Changes in accounting estimates: None

④ Retrospective restatement: None

(4)Number of issued and outstanding shares (common stock)

① Number of issued and outstanding shares at

the end of fiscal year (including treasury stock) December 31, 2014: 7,670,078 shares March 31, 2014: 7,670,078 shares

② Number of treasury stock at the end of fiscal year December 31, 2014: 451,121 shares March 31, 2014: 450,921 shares

③ Average number of shares December 31, 2014: 7,219,060 shares December 31, 2013: 7,219,158 shares

※Implementation status of quarterly review procedures

This summary is not subject to quarterly review procedures based on “The Financial Instruments and Exchange Law” of

Japan. The quarterly review procedures for quarterly financial statements have not been completed.

※ Notes for using forecasted information and others

These forecasts are based on currently available information. Actual financial results could differ from the forecast due to

various factors. Please refer to page 6 “(3) Qualitative Information on Consolidated Financial Forecasts for FY2014” for

assumptions and cautions on the use of these financial forecasts.

SOGO MEDICAL CO., LTD. (4775)

Summary of Consolidated Financial Results

for the Nine-Month Period ended December 31, 2014

1

Contents

1. Qualitative Information on Financial Results ....................................................................... 2

(1) Qualitative Information on Consolidated Operating Results ................................................. 2

(2) Qualitative Information on Consolidated Financial Position ................................................. 5

(3) Qualitative Information on Consolidated Financial Forecasts for FY2014 ............................. 6

2. Summary Information .......................................................................................................... 6

3. Quarterly Consolidated Financial Statements ....................................................................... 7

(1) Quarterly Consolidated Balance Sheet ............................................................................... 7

(2) Quarterly Consolidated Statement of Income and Quarterly Consolidated Statement of

Comprehensive Income .................................................................................................. 9

(3) Notes to quarterly consolidated financial statements........................................................... 11

(Note on the Going-Concern Assumption) ........................................................................ 11

(Note on Significant Changes in Shareholders’ Equity) ...................................................... 11

SOGO MEDICAL CO., LTD. (4775)

Summary of Consolidated Financial Results

for the Nine-Month Period ended December 31, 2014

2

1. Qualitative Information on Financial Results

(1) Qualitative Information on Consolidated Operating Results

(in millions, except percentages)

3Q FY2013 Margin 3Q FY2014 Margin Change Change

Sales ¥ 74,484 ¥ 79,011 ¥ 4,526 6.1%

Higashinihon 26,134 28,815 2,680 10.3

Medical practice support 6,637 6,194 (443) (6.7)

Pharmacies 19,496 22,620 3,124 16.0

Nishinihon 19,896 20,750 854 4.3

Medical practice support 7,162 6,191 (970) (13.6)

Pharmacies 12,733 14,558 1,825 14.3

Kyushu 27,004 27,763 759 2.8

Medical practice support 6,072 5,630 (441) (7.3)

Pharmacies 20,931 22,133 1,201 5.7

Others 1,449 1,681 231 15.9

Operating Income 3,063 4.1% 2,828 3.6% (235) (7.7)

Higashinihon 617 2.4 312 1.1 (304) (49.4)

Nishinihon 814 4.1 767 3.7 (47) (5.8)

Kyushu 1,776 6.6 1,739 6.3 (37) (2.1)

Others 213 14.7 444 26.5 230 108.0

Reconciliation (358) - (435) - (77) -

Ordinary Income 3,115 4.2 3,001 3.8 (114) (3.7)

Net Income 1,750 2.4 1,658 2.1 (91) (5.3)

Starting April 2014, Sogo Medical initiated its new three-year medium-term management plan

entitled “Further Challenge—Toward a better society in which people can live with a sense of

security” and defined medium-range goals and specific priority initiatives. Along with enhancing

and promoting ongoing efforts, Sogo Medical has been developing new services eagerly awaited by

people while taking up the challenges and resolving the issues facing society.

As to the operating results for the 3rd-quarter period under review (the period from April 1 to

December 31, 2014), net sales increased to ¥79,011 million (+6.1% compared with the year-earlier

period) reflecting the effects of new pharmacy openings.

SOGO MEDICAL CO., LTD. (4775)

Summary of Consolidated Financial Results

for the Nine-Month Period ended December 31, 2014

3

Earnings, affected by the NHI drug price standards revision and the increase in the consumption tax

rate enforced in April 2014, marked operating income of ¥2,828 million (–7.7%) with ordinary

income of ¥3,001 million (–3.7%), and net income of ¥1,658 million (–5.3%).

Medical practice support in the 3rd-quarter period under review increased by 56 instances compared

with the year-earlier period to 245 instances (including succession start-ups and health care malls),

connecting to transactions such as lease agreements and new pharmacy openings, etc. Additionally,

the number of facility leases, etc., in health care malls also increased.

Dispensing pharmacy openings in the 3rd-quarter period under review totaled 39 (21 in East Japan, 8

in West Japan, and 10 in Kyushu) raising the number of dispensing pharmacies at the end of the

3rd-quarter period under review to 530. Out of the 39 dispensing pharmacy openings, 17 are new

openings at recipients of our start-up support.

SOGO MEDICAL CO., LTD. (4775)

Summary of Consolidated Financial Results

for the Nine-Month Period ended December 31, 2014

4

Segment financial results were as follows:

① Higashinihon (East Japan)

Net sales increased to ¥28,815 million (+10.3% compared with the year-earlier period) reflecting

contributions from the dispensing-pharmacy subsidiary acquired last fiscal year and the effects of

new pharmacy openings, among other factors. However, operating income decreased to ¥312 million

(–49.4%) due to higher selling, general, and administrative expenses such as head-office levies.

② Nishinihon (West Japan)

While the rental division posted lower sales and the lease and installments division was affected by

the backlash from the demand rush preceding the consumption tax rate increase in the year-earlier

period, contributions to sales came in the pharmacy division from the dispensing-pharmacy

subsidiary acquired last fiscal year. Additionally, sales were buoyed by the effects of new pharmacy

openings. As a result, net sales posted ¥20,750 million (+4.3% compared with the year-earlier

period). Operating income, however, declined to ¥767 million (–5.8%).

③ Kyushu

Net sales rose to ¥27,763 million (+2.8% compared with the year-earlier period) on contributions

from new pharmacy openings at the pharmacy division. However, operating income fell to ¥1,739

million (–2.1%).

SOGO MEDICAL CO., LTD. (4775)

Summary of Consolidated Financial Results

for the Nine-Month Period ended December 31, 2014

5

(2) Qualitative Information on Consolidated Financial Position

(in millions except ratios)

March 31, 2014 December 31, 2014 Change

Total Assets ¥ 66,982 ¥ 66,352 ¥ (630)

including Cash and Deposits 5,873 6,202 328

Liabilities 43,048 41,221 (1,827)

including Interest-Bearing Debts *1 15,552 17,699 2,147

Net Assets 23,934 25,130 1,196

Shareholders' Equity Ratio (%) 35.7 37.9 2.2

Net Debt-to-Equity Ratio (times) *2 0.40 0.46 0.05

*1.Interest-Bearing Debts include lease obligations and accounts payable-installment purchases.

*2. Net Debt-to-Equity Ratio

=( Interest-Bearing Debts-Cash and Deposits) / Shareholders' Equity

Total assets at the end of the 3rd-quarter period under review were ¥66,352 million, which was ¥630

million less than at the end of the previous fiscal year.

Current assets declined ¥1,571 million from the end of the previous fiscal year to ¥35,476 million.

Main factors were a ¥2,860 million decrease in notes and accounts receivable-trade and a ¥1,182

million increase in inventories. Noncurrent assets increased ¥940 million from the end of the

previous fiscal year to ¥30,875 million. The main factor was a ¥748 million increase in buildings and

structures.

Total liabilities decreased ¥1,827 million to ¥41,221 million. Current liabilities declined ¥3,117

million to ¥27,240 million. The main factor was a ¥2,570 million decrease in notes and accounts

payable-trade. Noncurrent liabilities increased ¥1,290 million to ¥13,980 million. Main factors were

a ¥2,543 million rise in long-term loans payable, a ¥231 million decrease in lease obligations, and a

¥975 million decrease in long-term accounts payable-installment purchases. Interest-bearing debt

(including lease obligations and accounts payable-installment purchases) increased ¥2,147 million to

¥17,699 million. The net debt-to-equity ratio (interest-bearing debt less cash and deposits divided by

shareholders’ equity) rose 0.05 points to 0.46.

Net assets increased ¥1,196 million to ¥25,130 million. Main factors were a ¥1,658 million increase

provided by net income recognized for the period and a ¥577 million decrease due to payment of

dividends. As a result, the equity ratio rose to 37.9% reflecting an increase of 2.2 percentage points

from 35.7% at the end of the previous fiscal year.

SOGO MEDICAL CO., LTD. (4775)

Summary of Consolidated Financial Results

for the Nine-Month Period ended December 31, 2014

6

(3) Qualitative Information on Consolidated Financial Forecasts for FY2014

There are not any changes in consolidated financial forecasts for FY2014 which were announced

on April 17, 2014.

2. Summary Information

None

SOGO MEDICAL CO., LTD. (4775)

Summary of Consolidated Financial Results

for the Nine-Month Period ended December 31, 2014

7

3. Quarterly Consolidated Financial Statements

(1) Quarterly Consolidated Balance Sheet

(in millions)

As of

March 31, 2014

As of

December 31, 2014

Assets

Current assets

Cash and deposits ¥ 5,873 ¥ 6,202

Notes and accounts receivable-trade

18,326

15,466

Accounts receivable-installment sales 1,687 1,782

Lease receivables and investment assets

2,014

1,778

Inventories

6,475

7,658

Other 2,696 2,613

Allowance for doubtful accounts

(26)

(24)

Total current assets 37,047 35,476

Noncurrent assets

Property, plant and equipment

Property for lease, net

6,871

5,964

Buildings and structures, net 7,418 8,166

Other, net 5,143 5,514

Total property, plant and equipment

19,433

19,645

Intangible assets

Goodwill

5,294

5,177

Other 953 900

Total intangible assets 6,248

6,077

Total investments and other assets 4,252

5,151

Total noncurrent assets 29,934 30,875

Total assets 66,982

66,352

SOGO MEDICAL CO., LTD. (4775)

Summary of Consolidated Financial Results

for the Nine-Month Period ended December 31, 2014

8

(in millions)

As of

March 31, 2014

As of

December 31, 2014

Liabilities

Current liabilities

Notes and accounts payable-trade ¥ 20,372 ¥ 17,801

Short-term loans payable

350

360

Current portion of long-term loans payable 2,155 2,982

Lease obligations

503

395

Income taxes payable

1,333

399

Other

5,644

5,300

Total current liabilities 30,358 27,240

Noncurrent liabilities

Long-term loans payable 5,191 7,734

Lease obligations

944

713

Long-term accounts payable-installment purchase

4,450 3,474

Other

2,103

2,057

Total noncurrent liabilities 12,689 13,980

Total liabilities 43,048

41,221

Net assets

Shareholders' equity

Capital stock 3,513 3,513

Capital surplus

4,136

4,136

Retained earnings 17,058

18,139

Treasury stock

(1,043)

(1,044)

Total shareholders' equity 23,665 24,745

Accumulated other comprehensive income

Valuation difference on available-for-sale securities

240 385

Total accumulated other comprehensive income 240

385

Minority interests 28

-

Total net assets 23,934 25,130

Total liabilities and net assets 66,982

66,352

SOGO MEDICAL CO., LTD. (4775)

Summary of Consolidated Financial Results

for the Nine-Month Period ended December 31, 2014

9

(2) Quarterly Consolidated Statement of Income and Quarterly Consolidated Statement of

Comprehensive Income

(Quarterly Consolidated Statement of Income)

(in millions)

Nine-Month Period Ended

December 31, 2013

Nine-Month Period Ended

December 31, 2014

Net sales ¥ 74,484 ¥ 79,011

Cost of sales

64,457

68,806

Gross profit 10,027 10,204

Selling, general and administrative expenses

6,963

7,376

Operating income 3,063 2,828

Non-operating income

Dividends income 16 20

Rent income 26 28

Insurance premiums refunded cancellation - 83

Other

106

158

Total non-operating income 149 291

Non-operating expenses

Interest expenses 42 55

Other

55 62

Total non-operating expenses 97 117

Ordinary income 3,115

3,001

Extraordinary income

Gain on sales of investment securities 41 -

Contributed income

7

-

Total extraordinary income 48

-

Extraordinary loss

Impairment loss

20

22

0

22

2978

1174

22

Loss on sales of investment securities 26 -

Total extraordinary loss 46 22

Income before income taxes 3,117

2,978

Income taxes-current 1,015 1,174

Income taxes-deferred

350

145

Total income taxes 1,366 1,320

Income before minority interests 1,751

1,658

Minority interests in income (loss) 1 0

Net income 1,750

1,658

SOGO MEDICAL CO., LTD. (4775)

Summary of Consolidated Financial Results

for the Nine-Month Period ended December 31, 2014

10

(Quarterly Consolidated Statement of Comprehensive Income)

(in millions)

Nine-Month Period Ended

December 31, 2013

Nine-Month Period Ended

December 31, 2014

Income before minority interests ¥ 1,751 ¥ 1,658

Other comprehensive income

Valuation difference on available-for-sale securities

62 144

Total other comprehensive income

62

144

Comprehensive income 1,814 1,803

Comprehensive income attributable to

Comprehensive income attributable to owners of the parent 1,813 1,803

Comprehensive income attributable to minority interests

1

0

SOGO MEDICAL CO., LTD. (4775)

Summary of Consolidated Financial Results

for the Nine-Month Period ended December 31, 2014

11

(3) Notes to quarterly consolidated financial statements

(Note on the Going-Concern Assumption)

None

(Note on Significant Changes in Shareholders’ Equity)

None