Structured Mortgage-Backed Securities (MBS) Xiaofeng Zheng October 2004.

-

date post

21-Dec-2015 -

Category

Documents

-

view

219 -

download

1

Transcript of Structured Mortgage-Backed Securities (MBS) Xiaofeng Zheng October 2004.

2Contents

Contents• Structured MBS overview

• Prepayment benchmark model

• Sequential-pay CMO tranches

• PAC CMO tranches

• Stripped MBS

• Structured MBS pricing

3

Structured MBS Overview

Structured MBS Overview

A special purpose vehicle (SPV) set up by a financial institution redistributes the cash flows of mortgage pass-through (PT) securities into various classes, or tranches.

• Sequential-pay tranches

• Planned amortization classes

• Stripped MBS

4

Prepayment Benchmark Model

Prepayment benchmark model

• The benchmark model is provided by the Public Securities Association (PSA).

• The PSA model measures the prepayment speed by specifying the conditional prepayment rate (CPR).

• The PSA standard model assumes that, for a 30-year mortgage, the CPR linearly rises to 6% during the first 30 month and remains at that level through the maturity.

6

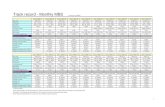

Average Life of MBS

• Average lives are the weighted average of the MBS’s payment time periods, with weights being the principal payments.

• Example: The original average life of a 30-year, 9%, 100% PSA mortgage portfolio is 12. 08 years.

• The prepayment risk can be measured as the sensitivity of the average life w.r.t. PSA.

Prepayment benchmark model

7

Sequential-Pay CMO Tranches

• Sequential-pay tranches are the most basic CMO structures.

• The CMO collateral is divided into several classes. • Each tranche receives the interest payments. • Principal payments, both scheduled and prepaid,

are distributed to the different classes according to the predetermined priority schedule.

• Each tranche has a different average life to meet the needs of investors.

Sequential-pay CMO tranches

8

Sequential-Pay CMO Example

• Suppose the collateral is a 30-year, $100M, 9% coupon mortgage portfolio with 100% PSA.

Sequential-pay CMO tranches

9

Sequential-Pay CMO Tranches

• The average lives of the tranches are distributed according to their priority. The more junior the tranche, the shorter the average life.

• A short average life means less exposed to the interest risk and the prepayment risk.

• The prepayment risk of the junior tranches is reduced, but not eliminated.

Sequential-pay CMO tranches

10

Z-Tranche (or Accrual Tranche)

• Many sequential-pay CMOs include a Z-tranche or accrual tranche.

• Both principal and interest of the Z-tranche are deferred. The deferred principal and interest are used to pay down other tranches.

• The existence of a Z-tranche reduces the average life of other tranches.

• The price of Z-tranches is very volatile.

Sequential-pay CMO tranches

12

(Inverse) Floating-Rate Tranche

• A floating-rate tranche and an inverse floating-rate tranche are created to attracted certain investors.

• A pair of floating-rate and inverse floating-rate tranche are created out of a standard tranche.

Sequential-pay CMO tranches

13

(Inverse) Floating-Rate Tranche Example

• Example: A 9%-PT standard tranche can be split into a floating-rate tranche (FT) and an inverse floating-rate tranche (IFT) as follows.

• The floating-rate tranche and inverse floating-rate tranche are created out of the C tranche from the previous example.

Sequential-pay CMO tranches

14

Planned Amortization Class (PAC)

• A PAC tranche has a predetermined redemption schedule. It is created to largely eliminate the prepayment risk for investors.

• The irregularity of cash flows caused by faster- or slower-than-expected prepayment is absorbed by a support or companion tranche.

• A PAC tranche stipulates a upper-bound and lower-bound of PSA speeds. When the realized prepayment speed is within the band, the prepayment risk is completely eliminated.

• PAC tranches have proven very popular.

PAC CMO tranches

15

PAC Tranche Example• A PAC tranche meets the principal redemption schedule as long as

the realized prepayment speed is between 100% PSA and 250% PSA.

PAC CMO tranches

17

PAC Variants

• A PAC II tranche can be formed out of the cash flows of the support tranche.They offer prepayment protections within another, narrower band.

• PAC III tranches can be created similarly.• Target Amortization Class (TAC) tranches

offer one-sided protection. They only eliminate the risk of high prepayment speed.

PAC CMO tranches

18

Stripped MBS• Interest only (IO) and principal only (PO)

CMO tranches are created by separating the interest and principal cash flows of the mortgage collateral.

• POs tend to have very high durations, while IOs tend to have a negative durations.

• Because of their negative durations, IOs are often used to hedge the interest rate risk.

Stripped MBS

19

POs• When the interest rate drops, the prepayment

accelerates.• Since POs are priced at deep discount, the

value of POs increases as the prepayment accelerates.

• Combining the effects of a lower interest rate and a high prepayment speed, the value of POs is more sensitive to the interest rate than the mortgage pass-through.

Stripped MBS

20

IOs• When the prepayment accelerates, the cash

flows received reduce.• The effect of a higher prepayment speed

usually outweighs the effect of a lower interest rate.

• The price of IOs decreases as the interest rate drops.

• If the prepayment speed is high, the investors might receive less cash than they invested.

Stripped MBS

21

Structured MBS Pricing

• The main issue in pricing MBS securities is to correctly model the prepayment rate.

• There are two schools of prepayment models:

1. Econometric models,

2. Option-based models.

Structured MBS Pricing

22

Econometric Models

• An econometric model is a regression model with econometric parameters, fitted to the historical data.

• Macro economic parameters: interest rate changes, house price inflation, GDP growth, employment levels, etc.

• Loan specific parameters: age of loan, loan to value ratio, prepayment charges, etc.

• Borrower specific parameters: age of borrower, marital status, occupation, loan to salary ratio, etc.

Structured MBS Pricing

23

Econometric Models (Cont’d)

• There are noises in the empirical data.• The relationship between the economic

parameters and the prepayment speed is not time stationary.

• As a result, the parameter estimates display instability.

• The econometric models are still widely used for pricing MBS and mortgage derivatives. They have been continuously improved and have grown very complicated.

Structured MBS Pricing

24

Option-Based Models

• There are rapid, recent theoretical developments in the MBS pricing models under the arbitrage-free framework.

• The intensity process of prepayment is modeled.• The Monte Carlo simulations are used to generate

the paths of cash flows and interest rate evolution. The average of the PV of all paths is the price for the MBS or the mortgage derivatives.

• The parameters of the prepayment model are calibrated to market MBS prices.

Structured MBS Pricing

25

Option-Based Models (Cont’d)

• Because the option-based models fit to the arbitrage-free framework like the pricing models of other derivatives, the model is more justified than the empirical models

• However, the existing option-based models are not flexible enough to explain and match the market prices of MBS’s.

• Currently, there are few working implementations of option-based MBS models.

Tailoring a structure

26

CFC Company Disclaimer

The entirety of this presentation is covered by the CFC disclaimerThe above information is intended for information purposes only. It does not constitute an offer, recommendation, or solicitation to buy or sell, nor is it an official confirmation of terms. The above is based on information generally available to the public from sources believed to be reliable. CFC Securities makes no representation that the above information is accurate or complete, or that any returns indicated will be achieved. Changes in assumptions may have a material impact on any returns indicated. Past performance may not be indicative of future returns.

Disclaimer

27

Your Contacts at CFCXiaofeng Zheng

Tel: +852 2868 1588

Email: [email protected]

Contacting CFC Securities

28

CFC Securities

Avenue C-F Ramuz 60, CH-1009 PullyLausanne, SwitzerlandTel + 41 21 721 5121

14/F Entertainment Building, 30 Queen’s Road CentralHong KongTel + 852 2868 1588

812, Tower W1 Oriental Plaza , No.1 East Chang An Ave Dongcheng District, Beijing China Tel: +86 10 8518 8850

Bloomberg CFCS

Contacting CFC Securities