Stodder WIR Study March 2010

description

Transcript of Stodder WIR Study March 2010

1

The Macro-Stability of Swiss WIR-Bank Spending: Balance versus Velocity Effects James Stodder, Rensselaer Polytechnic Institute, Hartford, CT, USA. March 31, 2010

Abstract: The Swiss Wirtschaftsring (“Economic Circle”) credit network, or WIR-Bank, founded in 1934, has been shown to provide residual spending power that is highly counter-cyclical. Individuals are cash-short in a recession, and economize by greater use of WIR-money. A money-in-the-production-function (MIPF) formalization implies that this increased spending power arises through the generation of new bank balances through reciprocal trade, rather than the increased velocity of such trade. This implication is confirmed using a new panel data set of WIR transactions by industrial sector. Such reciprocal credit networks play a stabilizing role that should be considered in monetary policy.

JEL Codes: E51, G21, P13.

I. Introduction

The Swiss Wirtschaftsring (Cercle Économique) or “Economic Circle,” founded in 1934, is

referred to nowadays as the WIR-bank. Those studying its reciprocal payment mechanism generally call

it a “social” or “complementary” currency. It is really a centralized credit system for multilateral

exchange, however, with no physical currency.

There are hundreds of alternative-currency examples in existence today, described in the

literature on Local Exchange and Trading Systems, or LETS (Williams, 1996; Greco, 2001; Gomez,

2008). Some, like the WIR, use a centralized credit system with no circulating currency. The Swiss

WIR-Bank is the largest such system, with almost 80,000 members throughout the country, mostly small

and medium enterprises (Studer, 1998; Stodder, 2009).

A recent paper (Stodder, 2009) shows that from 1948 to 2003, the turnover of transactions within

WIR bank has been highly counter-cyclical. That paper made some parenthetical comments on the role

of bank balances versus velocity in generating that turnover (where turnover = balances times velocity).

I conjectured (mistakenly) that it was WIR-velocity, rather than WIR-balances, that drove the counter-

cyclical result. But this conjecture was based on WIR-Bank loans to customers, rather than the ordinary

balances of those customers. With a new WIR data set in hand, I can now show that WIR balances are

indeed counter-cyclical, and much more so than WIR velocity. Since this data set (for the years 1994 to

2007) shows the transactions by industry, I can also show, within which sector WIR balances are most

counter-cyclical.

II. The WIR-Bank Exchange System: Reciprocal Trade Credits

The Swiss WIR-Bank or Wirtschaftsring ("Economic Ring"), founded in 1934 (Studer, 1998, p.

14), is the world's largest and oldest exchange based solely on a private or ‘club’ form of money. WIR

had more than 70,000 customers in 2008, most of them (over 80%) small and medium enterprises. The

rest are consumer-households and a very few large enterprises (WIR, 2009, 2010; Wenkler, 2010).

(Large enterprises cannot be registered members, under the by-laws of WIR (Stodder, 2009).)

2

According to the WIR-Bank (2010), its clients form a significant part of the Swiss total in several small-

to-medium enterprise sectors, as the following table makes clear. (Data are for 2005, the last year for

which nation-wide totals were available.) Notice that the number of Non-Registered Clients is two to

three times that of Registered Clients in all sectors besides Gastronomy. According to Stefan Winkler

(2010), a statistician for WIR –Bank, these numbers are conservative in the sense that several very large

corporations are counted among the Non-Registered group –they are too large to be formally registered

under the bylaws of WIR (Stodder, 2009). Registered Clients may be more “dedicated” to WIR. They

must take a fixed percent (typically 50%) of their first 2,000 SFr of customer invoices in WIR. We will

explore the implications of this in the econometric section of the paper.

Table 1: Number of WIR-Client Enterprises as Percent of Total Swiss, by Sector, 2005

INDUSTRY SECTOR Swiss Total WIR Total WIR / Swiss Percent

RETAIL Total, of which 62,380 14,275 22.9% Registered Clients 5,933 9.5%

Non-Registered Clients 8,342 13.4% SERVICES Total, of which 164,709 10,380 6.3%

Registered Clients 3,817 2.3% Non-Registered Clients 6,563 4.0%

GASTRONOMY Total, of which 28,006 3,438 12.3% Registered Clients 2,099 7.5%

Non-Registered Clients 1,339 4.8% CONSTRUCTION Total, of which 57,268 21,162 37.0%

Registered Clients 6,992 12.2% Non-Registered Clients 14,170 24.7%

MANUFACTURING Total, of which 38,421 7,310 19.0% Registered Clients 1,820 4.7%

Non-Registered Clients 5,490 14.3% WHOLESALE Total, of which 21,762 4,138 19.0%

Registered Clients 1,027 4.7% Non-Registered Clients 3,111 14.3%

TOTAL all sectors, of which 372,546 60,703 16.3% Registered Clients 21,688 5.8%

Non-Registered Clients 39,015 10.5% Source: WIR Panel Data, 2010

All types of goods and services can be exchanged – construction, house painting, hotel stays,

restaurant meals, vehicles, legal services – with offerings posted online and in publications like WIR-

Plus. Prices are quoted in units of WIR-credit, which for ease of comparison are denominated in – but

not redeemable for – Swiss Francs (SFr). The WIR-Bank keeps tabs on each household or firm in terms

of its account in WIR credits or debits. From the individual’s point of view, an account in WIR is much

like an ordinary checking account with clearing balances and limits on how large a negative balance can

be run. (WIR-Bank is a registered Swiss bank, and so provides ordinary banking services in SFr.)

3

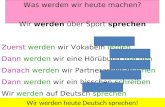

Figure 1a: Swiss Unemployed vs. WIR-Balances of Total, Registered, and Non-Registered WIR Clients (1994-2008). Total of All Industrial Sectors.

Figure 1b: Swiss Unemployed vs. WIR-Balances of Total, Registered, and Non-Registered WIR Clients (1994-2008). Retail, Gastronomy, and Manufactoring Sectors.

4

Figure 1c: Swiss Unemployed vs. WIR-Balances of Total, Registered, and Non-Registered WIR Clients (1994-2008). Services, Construction, and Wholesale Sectors.

Counter-cyclical activity of WIR is shown in the empirical study of Stodder (2009). The data set

for the present study examines this activity on a sector-by-sector basis, and suggests that the counter-

cyclical impetus comes from WIR balances, not their velocity. This countercyclical pattern is

suggested, although not established, by the Figures 1a-1c above. These show balances (WIRBAL, in

blue) tracking with numbers of Swiss Unemployed (UE, in Red). This counter-cyclical linkage appears

somewhat tighter for Non-Registered WIR Clients. We will explore this in the econometric section.

Following the argument of Studer (1988) about self-financing trade, WIR-money can be seen as

a form of reciprocal trade-credit, an extension of the trade credits widely used between firms today.1 In

the US, for example, trade credits are commonly given by a seller on terms of “2% 10, net 30,” whereby

the buyer gets a 2% discount by repaying within 10 days, with full settlement due in 30 days (Nilsen,

1 This trade credit connection is mentioned by other writers on alternative currencies (Greco 2001, p. 68).

5

2002). The main use of demand deposits for most businesses, according to Clower and Howitt (1996,

pp. 26-28), is to clear such trade credits:

…firms that organize markets in real life typically function on the basis of trade credit, and no modern exchange system exists in which the stock of bank and fiat money is not swamped by other media of exchange… indeed, it appears that bank deposits serve mainly as clearing ‘reserves’ for settling interbusiness trade debts, not as a means of payment as traditionally conceived.

Clower and Howitt are unusual in this stress. In a Philadelphia Fed publication, Mitchel Berlin

(2003) notes that there has been little work on trade credits. This despite the findings of Petersen and

Rajan (1994, 1997) that an average of between 11 and 17 percent of large-firm assets in each of the G7

countries is dedicated to accounts payable, and between 13 and 29 percent of their accounts receivable –

a measure of such trade credits. As Petersen and Rajan note (1997), accounts receivables exceed

accounts payable for most large firms, so they are in effect extending trade credit. Contrariwise,

receiving trade credits is most important for smaller firms, in their role as customers or distributors.

Nilsen (2002) finds that use of trade credits is counter-cyclical for small firms, since they are

more likely to be credit-rationed by banks when money is tight, and trade credits are often the only form

of credit left to them. This is consistent with the central finding of the present paper: that turnover in the

WIR network – limited to small and medium businesses by its constitution (Defila, 1994) – is also

highly counter-cyclical.

There are two crucial differences between ordinary trade credits, and WIR-credits, however.

First, unlike an ordinary trade credit, which would be payable in Swiss Francs, a WIR-credit is itself

final payment. Thus, a firm getting WIR-credits for its product sold can never see its check “bounce.”

Second, the WIR-bank is a system of multilateral, not bilateral credits. That is, a WIR-creditor’s value

is ensured, not by her debtors’ ultimate willingness to settle in cash, but by the immediate willingness of

thousands of small firms and households to accept her WIR-money as final payment. To repeat Studer’s

formulation (1998, p. 32), “every franc of WIR credit automatically and immediately becomes a franc of

WIR payment medium.” 2

2 Silvio Gesell, the German-Argentine economist whose ideas inspired the founding of the WIR-Bank, would have been familiar with trade credits from his decades of international trade experience in Buenos Aires. Gesell’s use of the term demurrage was borrowed directly from international shipping, where it denotes a reduction in payment to compensate for an unscheduled delay in the delivery of goods. Gesell applied a demurrage charge to the holding of money, with the aim of increasing its velocity.

Most trade credits provide discounts for early payment (Nilsen 2002, Berlin 2003), rather than fines for paying late, but the opportunity cost is the same. A form of bank-mediated trade credit particularly common in international trade is the banker’s acceptance, which allows the exporter to be paid upon embarkation, while the importer does not have to pay until taking possession of the goods. Credits from the WIR-bank can be seen to extend the banker’s acceptance principle in time, and from bilateral to multilateral.

6

Since every WIR-credit is matched by an equal and opposite debit, the system as a whole must

net to zero. Individual traders will have either positive or negative balances (“overdrafts”), the latter, in

effect, a loan from the WIR-Bank. Short-term overdrafts are interest-free, with limits “individually

established” (Studer, 1998, p. 31). As long as the average value of these limits is maintained, the WIR-

Bank can be quite relaxed about variations in its total bank balances. The system is also highly

flexible: while the individual’s debit position is set by overdraft limits, the absolute value of all credits

and debits is determined only by economic need. The net of this total, meanwhile, is identically zero.3

This balancing of excess demands – at least within WIR – is of macroeconomic significance,

since it implies an identity of notional and effective demand. Robert Clower’s best-known essay, “The

Keynesian counterrevolution: a theoretical appraisal” (1965), raised this distinction between notional

and effective demand to explain the contradiction between Keynesian aggregate demand and Walras’

law. Walras’ law states that as long as each individual budget constraint holds with equality, all excess

demands must sum up to zero. This law must hold even at disequilibrium prices, so long as traders are

still at the bidding stage, each putting forward a planned excess demand. But these notional demands,

as Clower calls them, cannot all be effective (backed by actual spending power) if prices are not in fact

market-clearing. This, says Clower, is the idea behind the Keynesian consumption function, with

demand contingent on currently realized income.

An early attempt to build micro-foundations for macro used this “Clower constraint,” or more

simply, the “cash-in-advance constraint,” giving rise to a family of disequilibrium models associated

with Lucas (1980). Clower himself, along with Peter Howitt (1996), however, criticized this cash-in-

advance literature as empirically vacuous, since it ignores alternative means of payment, specifically

trade credits. They have proposed models based on the market-making and payment-form-instituting

activity of merchants (2000).

The WIR, an association of small businesses, suggests itself as an empirical test of Clower’s

ideas. For WIR members in good standing, there is no distinction between notional and effective

demand.4 Thus, if Clower is right that too little (too much) aggregate demand means effective demand

is less than (greater than) notional demand, then economic activity carried out in WIR should be more

stable than that effected in SFr. Indeed, if WIR are a substitute for SFr, then transactions in the former

should be counter-cyclical. The credit flexibility and macroeconomic stability of WIR are our chief

interests here.

3 This balanced flexibility of an “automatic plus-minus balance of the system as a whole” (Studer 1998, p. 31) is also shown in a pedagogical experiment by LETS founder Michael Linton and IT specialist Eric Harris-Braun (2007), available at www.openmoney.org/letsplay/index.html. 4 To be sure, there is an issue of trust whenever a member asks for credit, and persistent defaulters will see their credit frozen.

7

A centralized credit exchange like the WIR-Bank combines the functions of both a commercial

bank, and for its own WIR-currency, a central bank. It will thus have more detailed knowledge of credit

conditions in its own currency than either a commercial or a central bank alone. Of course it can still

make mistakes, extending too much in overdrafts or in direct loans. Such credit "inflation" has occurred

in WIR’s history (Defila, 1994; Stutz, 1984; Studer, 1998), but now appears contained by sensible

overdraft limits.

The WIR was inspired by the ideas of an early 20th-century economist, Silvio Gesell (Defila

1994, Studer 1998), to whom Keynes devoted a section of his General Theory (1936; Chapter 23, Part

VI). Despite his criticisms, Keynes saw Gesell as an “unduly neglected prophet” who anticipated some

of his own ideas as to why the money rate of interest might exceed the marginal efficiency of capital.5

This link between Keynesian and Gesellian theory might have made a Gesellian institution like

the WIR-Bank of more interest to economists.6 Only one, however, seems to have studied the

macroeconomic record of WIR. Studer (1998) finds a positive long-term correlation between WIR

credits and the Swiss money supply – a correlation I also find (Stodder, 2009). But Studer's data (1998)

stops in 1994, and he does not test for cointegration, or for the short-term effects of changes in the Swiss

money supply. The present study uses Error Correction Models (ECMs) to show that WIR turnover is

strongly counter-cyclical, and thus negatively correlated with the Swiss money supply in the short run.

Figure 1: The Failure of Double-Coincidence

5 Keynes noted (1936, p. 355) that “Professor Irving Fisher, alone amongst academic economists, has recognised [this] significance,” and makes a prediction that “the future will learn more from the spirit of Gesell than from that of Marx.” 6 Gerhard Rösl of the German Bundesbank (2006) does looks at Gesellian currencies – with zero interest rates and explicit holding costs. These holding costs were called demurrage by Gesell, a term he borrowed from his experience in commercial shipping. Rösl uses the German term Schwundgeld, or ‘melting currency’. Demurrage currencies have grown in popularity in low inflation environments like the current Euro area (as Rösl documents), but especially in deflationary environments like Argentina or the US in the 1930s, as previously mentioned. Rösl’s criticisms of demurrage do not apply to the Swiss WIR, however, since (a) the WIR stopped charging demurrage in 1948, and (b) charges interest on large overdrafts and commercial loans (based on one’s credit history), (Studer 1998, pp. 16, 31). Interestingly, Rösl uses a “money in the production function” (MIPF) model, as in the current paper.

A

BC

a

c

b

8

For a simple model of informationally centralized barter, consider firms, A, B, and C, each of

which lacks one good -- a, b, and c, respectively. Let us say that A currently holds c, B holds a, and C

holds b. This failure of the “Double Coincidence of Wants” (Starr, 1989) is shown in Figure 1 above.

If units are chosen so that competitive equilibrium prices are unity, Pa = Pb = Pc = 1, then the

direction of mutually improving trade is shown by the arrows in the picture: A gives a unit of c to C, C a

unit of b to B and, and B a unit of a to A. If these are the only goods of interest for each firm, then there

are no bilaterally improving barter trades. The formal conditions for the failure of bilaterally improving

barter (Eckalbar, 1984; Starr, 1989) are: (i) no single good is held in sufficient quantity by all agents to

be used as a “money”, (ii) no single agent holds sufficient quantity of all goods to serve as a central

“storehouse”, and (iii) cyclical preferences exist for at least three agents over at least three goods; e.g.,

firm A prefers cba ff , B prefers acb ff , and C prefers bac ff .

These conditions for the failure of mutually improving bilateral trade are almost certain to be met

in an economy with a modest diversity of endowments, preferences, and specialization (Stodder, 1995a).

Non-bilateral trade can still take place, but only if the economy is simple enough to allow all

transactions to be accounted for in a centralized credit system, such as a traditional gift economy where

everyone’s credit score is, in effect, common knowledge (Mauss, 1923; Stodder, 1995a). In larger and

more complex economies, however, the historic and anthropological literature shows a virtual

coincidence of decentralized monetary exchange and decentralized markets (Davies, 2002; Stodder,

1995b). Modern information technology, however, may be weakening this link – completely centralized

credit accounting again being feasible in decentralized markets.

III. Some Formalization: Money in the Production Function

In my earlier study (Stodder, 2009), I formalize the interaction of WIR-money and national

currency via a “money in the production function” (MIPF) specification. This is directly analogous to

“money in the utility function” (MIUF) formalizations, and similarly derived by the implicit function

theorem. Both the MIPF and MIUF are justified by the transactions-cost-saving role that money plays,

moving economy closer to its efficiency frontier. There is a large literature on this idea (Patinkin, 1956;

Sidrauski, 1967; Fischer, 1974, 1979; Short, 1979; Finnerty, 1980; Feenstra, 1986; Hasan and Mahmud,

1993; Handa, 2000; Rösl, 2006).

I formalize the basic result by showing a profit-maximizing firm as minimizing its direct and

transactional costs of producing quantity Q , exogenously determined by the market.

Min: cpKp + csKs + rpmp + rsms (1)

s.t.: Q = pQ + sQ ≤ f(Kp, mp, Ks, ms) = fp[( sp KK , ), mp] + fs[( sp KK , ), ms].

9

Here the primary national, mp, and the secondary social currency, ms, with interest rates/opportunity

costs of rp and rs, are used to pay the market costs, cp and cs, of purchasing the required inputs, Kp and

Ks, respectively. Capital inputs are considered divisible, since in reality goods and services are often

posted as available for purchase at a mix of WIR and SFr, usually at least 30% in the former. In the

production/transaction functions pQ = fp[( sp KK , ), mp] and sQ = fs[( sp KK , ), ms], the bars indicate that

the output quanties Q are set exogenously, while the input quantities K are set separately, in the sense

that sK is not a variable within fp[ ], nor is pK within fs[ ]. The Marginal Rates of Substitution (MRS)

derevied from (1) show that inventories of money and physical inputs can be substitutes. Kp and Ks

however, are considered perfect substitutes; subscripts are only to account for their means of purcahse.

It is assumed that rp > rs and cp ≤ cs. The first inequality arises because primary money is more

useful than secondary, and thus has a higher opportunity cost. The second arises because, given this

unequal usefulness, items for sale are usually posted at higher prices in WIR than in SFr., even though

these are considered to be comparable units (Stodder, 2009).

Lemma 1: For a cost minimizing firm, the marginal productivity of Ks is at least as great as that

for Kp, and that of ms is less than mp.

Proof: Using the above inequalities and the constraint in (1), the first order conditions of (1)

yield (cs/cp) = (∂f/∂Ks)/(∂f/∂Kp) ≥ 1 > (rs /rp) = (∂f/∂ms)/(∂f/∂mp).

Consider the implications of this Lemma. The WIR data show that average WIR balances are

greater for Registered than for Non-Registered clients. Furthermore, as previously mentioned, the

average size of Non-Registered client firms is larger than Registered clients, since the former include

many large corporations. Thus WIR balances are probably even greater for Registered than for Non-

Registered clients, more so than in absolute terms, relative to their regular cash balances.

If Registered clients, mostly smaller firms, face more restricted credit conditions than larger

Non-Registered clients (that is, a higher interest rate on primary money, rp) then these larger relative

holdings of ms balances for Registered clients can be seen to be optimal. In the following Lemma,

consider Registered clients to be firms of type 1 and the Non-Registered to be type 2:

Lemma 2: If firm 1 is more credit constrained than firm 2 for primary currency, , then

ceteris paribus, 1’s holdings of secondary currency will be relatively larger: . Proof: The ratio rs /rp will be lower for the credit constrained firm 1, and similarly its marginal

product of ms compared to mp, by the first order conditions shown in Lemma 1. With the same

production/transformation function f( ), firm 1 must hold a larger ratio of secondary to primary currency.

Most Registered clients (firm 1, in the previous Lemma) may never have much access to credit

for primary currency, even without a recession. And as we have seen in the recent recession, many

10

firms become severely credit constrained in a severe downturn, if they do not loose access altogether.

Thus it is reasonable to suppose that the rise in interest rates for a larger Non-Registered clients (type 2)

may actually be greater than that for the Registered clients (type 1), who never had good access. This

would lead to a larger increase in WIR balances for the larger Non-Registered clients (type 2):

Lemma 3: If the business cycle brings a larger change in primary currency credit for firm 2 than

for firm 1, ∆ ∆ 0, then the increase in holdings of secondary currency will be greater for firm

2: ∆ ∆ 0. Proof: Immediate from the previous Lemmas.

These results imply that WIR balances drive counter-cyclical activity, but say nothing about

changes in velocity. Similarly, the description of Studer (1988, p. 31) – as well as a simulation trading

game by LETS founder Michael Linton and his associate, Eric Harris-Braun (2007) – show that WIR

balances build (and are built by) increased reciprocal trade. Thus it is balance that we should se grow

during a recession. We now set out to test these results.

III. Econometric Tests

Although the relation with other indicators is interesting, I will focus here on the linkage between

Numbers of Unemployed and WIR activity. Previous estimates (Stodder, 2009) have shown this to be

the cyclical indicator most closely tied to WIR, and there are good reasons why this should be so.

Employees in smaller, less diversified firms are more subject to unemployment risk in Switzerland

(Winter-Ebmer and Zweimüller, 1999; Winter-Ebmer, 2001), as in most other countries. Smaller firms

also have less access to formal credit institutions (Terra, 2003), and their owners must rely

disproportionately on self-financing (Small Business Administration, 1998) and, as we have seen, trade

credits (Nilsen, 2002; Petersen and Rajan, 1997).

Vector Error Correction (VEC) models are a natural way of checking both stability and counter-

cyclical activity. If both are growing in an expanding economy, then the long-term relationship

between Number of Unemployed and WIR activity – as shown in the Error Correction (EC) equation –

should be positive. If WIR activity is countercyclical, then the relationship between changes in the

Number of Unemployed and changes in WIR activity – as shown in the Vector portion of the VEC –

will also be positive. But this is positive in a very different sense – a positive relation between short-

term or “cyclical” deviations, as opposed to long-term “secular” growth.

Table 2: Notation for Tables 3-6 LRWirBal(‐t) Natural Log of Real WIR Balances, lagged t period(s) LRWirVel(‐t) Natural Log of Real WIR Velocity, lagged t period(s)

LUE(‐t) Natural Log of Unemployment, lagged t period(s) D( ) First Difference of any of the previous variables

11

Table 3: Panel Vector Error Correction Model: All Registered WIR Clients –

WIR Balances and Velocity Regressed on Number of Unemployed t-statistics in [ ]; P-Values in { };***: p-val < 0.01, ** : p-val < 0.05, *: p-val <0.10, ○: p-val <0.15

Method: Panel Least Squares, Fixed Effects White cross‐section (no d.f. correction) Sample (adjusted): 1994 2007 COINTEGRATING EQUATION Periods included: 14 Depend Var: Depend Var: Cross‐sect included: 7 LRWIRBAL_Reg LRWIRVEL_Reg Variable Coefficient Coefficient Constant 9.7055 0.9574 [41.9365] *** [5.5993] *** LUE 0.3124 0.1148 [6.7383] *** [3.0025] *** @TREND ‐0.0544 ‐0.0176 [‐12.2255] *** [‐3.9625] ***

Method: Panel Least Squares, Fixed Effects White cross‐section (no d.f. correction) Sample (adjusted): 1997 2007

VECTOR ERROR‐CORECTION EQUATION Periods included: 11 Cross‐sect included: 7 D(LRWIRBAL_Reg) D(LRWIRVEL_Reg) Variable Coefficient Coefficient Constant ‐0.0674 ‐0.0173 [‐2.4635] ** [‐0.8749] Resid. Coint.Eq. (‐1) ‐0.2933 ‐1.3257 [‐1.0493] [‐7.7412] *** D(Depend Var(‐1)) 0.0446 0.1744 [0.3557] [1.4036] D(Depend Var(‐2)) ‐0.2879 0.0053 [‐1.0464] [0.0882] D(LUE(‐1)) 0.3021 0.0255 [2.3173] ** [0.2761] D(LUE(‐2)) ‐0.1959 ‐0.0456 [‐1.6285] ° [‐0.6459] R‐squared 0.3168 0.7350 Adjusted R‐squared 0.2012 0.6902 S.E. of regression 0.4800 0.1461 Sum squared resid 14.9751 1.3866 Log likelihood ‐46.2176 45.3955 F‐statistic 2.7400 16.3907 Prob(F‐statistic) 0.0057 0.0000 Mean depend, var ‐0.0506 ‐0.0319 S.D. depend. var 0.537034 0.262393 Akaike info crit. 1.5121 ‐0.8674 Schwarz crit. 1.8774 ‐0.5021 Wooldridge AR (p): 0.0000 0.0000 Granger Causality (p): 0.6777 0.1486 Johansen‐Fisher (p): 0.0000 0.0000

Note: The last 3 (p) values are based on null hypotheses of: (Wooldridge AR) - No first-order serial correlation, (Granger Causality) - no Granger Causality, and (Johansen-Fisher) - no Cointegration. For this last, the p-value is always the Johansen trace test.

12

Because our time series is fairly short, just 15 years, we are not so concerned about the “long-

term” secular relationship – the error-correction portion of the VEC. As long as this relationship is

cointegrated, we can concentrate on the coefficients of the lagged, first-differenced values of these terms

– the vector portion of the ECM, where any counter-cyclical effects will show up.

In Table 3 above, it is seen that the coefficients on first-differenced Unemployment (highlighted

for convenience) are both larger and much more significant when the dependent variable is balances, as

opposed to velocity. Note that the sign on these coefficients is positive when the difference is lagged

one period, and negative for a two period lag. Thus WIR balances give a countercyclical stimulus in the

short term, and then balance out after a longer period. The other regression results are encouraging with

the exception (i) of the p values on the null of no Granger-causality; and (ii) the p-values on the

Wooldridge (2000) null for no first-order auto-regression. The first p-value is too high for us to reject

that null, while the second can be comfortably rejected.

Thus there is a likely problem of serial correlation. Things may not be as bad as they seem,

however. Note that in Tables 3 and 4, we are using White (1980) period estimators, robust to within-

cross-section serial correlation (Arellano, 1982). This means that our coefficient estimates are unbiased,

even though they are not efficient; i.e., do not have standard errors as small as possible (Arellano, 1982).

Thus the coefficient estimates above are reasonable approximations, despite serial correlation. The fact

that they are highly significant in most cases allows us to feel fairly confident about the results.

When we compare the results of Table 3 to that of Table 4 below, we see that once again, the

unemployment coefficients are larger and more significant for the regression on balance, as opposed to

that on velocity. But now we have another interesting comparison to make. Table 4 is for all Non-

Registered WIR clients, as opposed to the Registered in Table 3. We see that one-period lagged

counter-cyclical coefficient is almost four times as large for the Non-Registered clients in Table 4 as it is

for Registered clients in Table 3 (1.1809 > 0.3021). Why might this be?

Recall from the introduction that Registered clients have agreed to accept a fixed percentage of

WIR-money for the first 2,000 SFr. of their invoices, whereas the Non-Registered do not. In exchange,

Registered clients face smaller transaction fees from their dealings with WIR-Bank. Recall from

Lemma 1, our counter-cyclical result is driven by the fact that the WIR is a ‘secondary’ currency, with a

marginal productivity that is lower than that of the primary or national currency. Thus WIR money is, in

a very natural sense, a ‘second-best’ currency. I will advance a conjecture: Non-Registered WIR clients

are less integrated into the WIR network, and thus face a lower opportunity cost for holding balances in

this secondary currency (rs, in our formalization) than do Registered clients. (A statistician working for

WIR, Stefan Winkler (2010), informs me that there are many large corporations among the Non-

13

Registered Clients. These cannot be registered by the bylaws of WIR-Bank itself. It could be that such

Non-Registered clients switch into WIR transactions only when it is necessary or convenient – and

especially during an economic downturn. We will attempt to develop this formalization later. At this

point, the empirical evidence is fairly clear.

Table 4: Panel Vector Error Correction Model: All Non-Registered WIR Clients - WIR Balances and Velocity Regressed on Number of Unemployed

t-statistics in [ ]; P-Values in { };***: p-val < 0.01, ** : p-val < 0.05, *: p-val <0.10, ○: p-val <0.15

Method: Panel Least Squares, Fixed Effects White cross‐section (no d.f. correction) Sample (adjusted): 1994 2007 COINTEGRATING EQUATIONPeriods included: 14 Depend Var: Depend Var: Cross‐sect included: 7 LRWIRBAL_NonReg LRWIRVEL_NonRegVariable Coefficient Coefficient Constant 8.0085 0.1099 [10.2042] *** [0.1371] LUE 0.6950 0.1396 [4.1434] *** [0.781]

Method: Panel Least Squares, Fixed Effects White cross‐section (no d.f. correction) Sample (adjusted): 1997 2007 VECTOR ERROR‐CORECTION EQUATIONPeriods included: 11 Cross‐sect included: 7 D(LRWIRBAL_NonReg) D(LRWIRVEL_NonReg) Variable Coefficient Coefficient Constant ‐0.0652 ‐0.0173 [‐1.0032] [‐0.8749] Resid. Coint.Eq. (‐1) ‐0.7004 ‐1.3257 [‐1.4624] ° [‐7.7412] *** D(Depend Var(‐1)) ‐0.0921 0.1744 [‐0.2486] [1.4036] D(Depend Var(‐2)) ‐0.0741 0.0053 [‐0.3099] [0.0882] D(LUE(‐1)) 1.1809 0.0255 [4.9865] *** [0.2761] D(LUE(‐2)) ‐1.2774 ‐0.0456 [‐3.171] *** [‐0.6459] R‐squared 0.4544 0.6002 Adjusted R‐squared 0.3621 0.5326 S.E. of regression 0.8995 0.6733 Sum squared resid 52.5902 29.4670 Log likelihood ‐94.5791 ‐72.2777 F‐statistic 4.9219 8.8724 Prob(F‐statistic) 0.0000 0.0000 Mean depend, var ‐0.0455 ‐0.0707 S.D. depend. var 1.1262 0.9848 Akaike info crit. 2.7683 2.1890 Schwarz crit. 3.1336 2.5543 Wooldridge AR (p): 0.0001 0.0007 Granger Causality (p): 0.1882 0.0221 Johansen‐Fisher (p): 0.0003 0.0000

14

Note: The last 3 (p) values are based on null hypotheses of: (Wooldridge AR) - No first-order serial correlation, (Granger Causality) - no Granger Causality, and (Johansen-Fisher) - no Cointegration. For this last, the p-value is always the Johansen trace test.

Table 5: Vector Error Correction Model: Registered and Non-Registered Clients, CONSTRUCTION Sector – WIR Balances Regressed on Number of Unemployed

t-statistics in [ ]; P-Values in { };***: p-val < 0.01, ** : p-val < 0.05, *: p-val <0.10, ○: p-val <0.15

Method: Vector Error Correction Model Sample (adjusted): 1997 2007 COINTEGRATING EQUATION

Depend Var: Depend Var: LRWIRBAL_Reg LRWIRBAL_NonReg

Variable Coefficient Coefficient LUE 0.92900 0.726843 [49.6469] *** [5.4511] *** TREND 0.0288 Constant 6.4915 0.726843 VECTOR ERROR‐CORECTION EQUATION

D(Depend Var) D(Depend Var)

Variable Coefficient Coefficient Residual of Coint.Eq. (‐1) 0.60602 1.086749 [ 5.5467] *** [3.7691] *** D(Depend Var(‐1)) ‐1.27551 ‐2.74764 [‐4.0032] *** [‐6.7653] *** D(Depend Var(‐2)) ‐0.58646 ‐3.70904 [‐2.1631] * [‐3.5931] *** D(LUE(‐1)) 0.12231 0.302804 [1.5365] [1.9381] * D(LUE(‐2)) 0.29704 0.762587 [3.5774] ** [2.9791] ** Constant ‐0.17508 ‐0.22721 [‐3.8063] *** [‐5.1260] *** TREND 0.02452 [4.2950] *** R‐squared 0.9400 0.9253 Adj. R‐squared 0.8500 0.8507 Sum sq. resids 0.0034 0.0482 S.E. equation 0.0293 0.0982 F‐statistic 10.4433 12.3933 Log likelihood 28.7868 14.2581 Akaike AIC ‐3.9612 -1.5015 Schwarz SC ‐3.7080 -1.2844 Mean dependent 0.0135 -0.0112 S.D. dependent 0.0757 0.2541 Lagrange Multiplier AR (p): 0.3219 0.5041 Granger Causality (p): 0.0006 0.0003 Johansen (p): 0.0001 0.0395

Note: The last 3 (p) values are based on null hypotheses of: (Lagrange Multiplier AR) - No serial correlation at the number of lags specified (2), (Granger Causality) - no Granger Causality, and (Johansen) - no Cointegration. For this last, the p-value is always the Johansen trace test.

15

In Table 5 above, we turn to the largest sector in the WIR network, Construction. Comparing the

unemployment coefficients in the two numerical columns, we see that Non-Registered clients in the

second column have coefficients that are more than twice as large as those in the first. Note that unlike

Tables 3 and 4, which were based on panel data, Table 5 is a simple time series. Most of the statistical

tests are similar to the preceding tables, with the exception of the test for Autoregressive errors. We

now use a Lagrange Multiplier test gauged for the specified number of lags – two in this paper. As

opposed to the Wooldridge test on the previous panel data, we now cannot reject the null hypothesis of

no serial correlation – thus allowing us considerably more confidence in the results.

Table 6 below, which aggregates all sectors, gives results highly similar to that of Table 5. As

seen before in Tables 3 and 4, the coefficient sign switches for the second lagged term. But once again,

the size of the coefficient is almost twice as large for the Non-Registered as for the Registered clients.

IV. Conclusions and Discussion

Petersen and Rajan (1997) estimate that the total volume of trade credits for large US companies,

their accounts payable and receivable, are one-third of their total assets. Like trade credits, WIR are a

lifeline for small firms, those most likely to be credit-rationed in a recession (Nilsen, 2002). It is clear

from Table 1 that WIR is a highly important part of the credit picture for Small to Medium Enterprises

in Switzerland. And not only for these, but also for several large Non-Registered companies. The

official position of the WIR-Bank is that these non-registered companies cannot be listed, because of

Swiss banking secrecy laws (Winkler, 2010).

Just as trade credits are more likely on a national than international scale for small businesses,

the WIR-Bank does not have foreign branches. Nevertheless, the best evidence for this type of

network’s viability elsewhere may be its very “pan-Swiss” nature. That is, unlike many other Swiss

cooperatives (Ostrom, 1990), the WIR does not exist solely in one region, or language. It has long

functioned across the country, with German, French, and Italian-speaking members in rough proportion

to their regional populations. This suggests that similar institutions can work in different countries.

Rather than highly pro-cyclical and actively de-stabilizing to the larger economy, as many of the world’s

largest investment banks have shown themselves, WIR-Bank seems to have a natural tendency to

stabilize the economy, and especially to provide credit for small businesses. This counter-cyclical

activity can be shown using 60 years of collected data (Stodder, 2009). If that stabilization is due to an

ability to create new balances autonomously – from the counter-cyclical ebb and flow of reciprocal trade

itself, rather than from any deliberate bank policy – then this suggests that the WIR-bank is an institution

deserving of much further study.

16

Table 6: Vector Error Correction Model: Registered and Non-Registered Clients, ALL SECTORS WIR Balances Regressed on Number of Unemployed

t-statistics in [ ]; P-Values in { };***: p-val < 0.01, ** : p-val < 0.05, *: p-val <0.10, ○: p-val <0.15

Method: Vector Error Correction Model Sample (adjusted): 1997 2007 COINTEGRATING EQUATION

Depend Var: Depend Var: LRWIRBAL_Registered LRWIRBAL_NonRegist.

Variable Coefficient Coefficient LUE 17.06913 ‐3.64679 [6.1967] *** [‐1.3689] Constant ‐68.5843 3.75979

VECTOR ERROR‐CORECTION EQUATION

D(Depend Var) D(Depend Var)

Variable Coefficient Coefficient Residual of Coint.Eq. (‐1) ‐0.19318 ‐0.48446 [‐1.8481] ° [‐1.8527] D(Depend Var(‐1)) ‐0.24828 ‐0.41873 [‐0.8857] [‐1.7005] D(Depend Var(‐2)) ‐0.52884 ‐0.07386 [‐1.9165] ° [‐0.3687] D(LUE(‐1)) 3.992727 10.21234 [ 2.5334] *** [4.4698] ***D(LUE(‐2)) ‐4.2926 ‐8.45766 [‐1.8279] ° [‐3.6094] ***Constant ‐0.55817 ‐0.22721 [‐1.6680] ° [‐5.1260] *** R‐squared 0.7362 0.8867 Adj. R‐squared 0.4725 0.8112 Sum sq. resids 5.0912 10.6888 S.E. equation 1.0091 1.3347 F‐statistic 2.7914 11.7435 Log likelihood ‐11.3712 ‐15.4505 Akaike AIC 3.1584 3.7183 Schwarz SC 3.3754 3.8991 Mean dependent ‐0.2856 ‐0.2537 S.D. dependent 1.3894 3.0720 Lagrange Multiplier AR (p): 0.7764 0.6531 Granger Causality (p): 0.0157 0.0000 Johansen (p): 0.0072 0.1486

Note: The last 3 (p) values are based on null hypotheses of: (Lagrange Multiplier AR) - No serial correlation at the number of lags specified (usually 2), (Granger Causality) - no Granger Causality, and (Johansen-Fisher) - no Cointegration. For this last, the p-value is always the Johansen trace test.

What about the inflationary potential of such a network? There is a considerable literature

(Mankiw, 1993; Mankiw and Summers, 1986; Bernanke and Gertler, 1995; Gavin and Kydland, 1999)

showing that the broad money supply is highly pro-cyclical. Even less controversial is the finding that

the velocity of money is pro-cyclical (Tobin, 1970; Goldberg and Thurston, 1977; Leão 2005).

17

Two points seem worth making here. First, and most obviously: if WIR Turnover is counter-

cyclical and ordinary national currency is pro-cyclical, then changes in WIR should be less inflationary

than those in national currency itself. Second, and more interestingly: the automatic net balancing of

WIR balances – where new credits are matched by new debits – allows short-term fluctuations in real

output to be matched by gross balances. This is consistent with price neutrality. In terms of the quantity

equation (for the WIR system itself), Turnover MV PY. If V (velocity) is unchanged, and the

change in M (money) is matched by a change in Y (real goods and services), then the change in P (price)

must be zero. Thus we glimpse the “practically unlimited potential” (Studer, 1998, p. 31) for self-

balancing credit creation. (The above identity would, of course, only be strictly true within a closed

WIR-type system.)

In fact, however, WIR coexists with SFr., as a secondary or “residual” currency. Our estimates

show that it is most likely to be accepted when ordinary (pro-cyclical) money is in short supply. Thus,

WIR turnover is likely to be concentrated most where its inflationary potential is the least. WIR money

does not ‘top up’ the supply of Swiss Francs – it substitutes for Swiss Francs that are otherwise

unavailable. If this is true, then the effect of increased WIR Turnover on prices is not inflationary, but

rather anti-deflationary.

References

Arellano, M. (1987) "Computing Robust Standard Errors for Within-groups Estimators," Oxford Bulletin of Economics and Statistics, Vol. 49, pp. 431-434. Azariadis, C., Chakraborty, S. 1998. Asset price volatility in a nonconvex general equilibrium model. Journal of Economic Theory, 12, 649-665. Berlin, M., 2003. Trade credit: why do production firms act as financial intermediaries? Federal Reserve Bank of

Philadelphia, Business Review, 3rd Quarter, 21-28. http://www.philadelphiafed.org/research-and-data/publications/business-review/2003/q3/brq303mb.pdf

Bernanke, B., Gertler, M., 1995. Inside the black box: the credit channel of monetary policy transmission. Journal of Economic Perspectives, 9, 27-48. Chichilnisky, G., Gorbachev, O. 2004. Volatility in the knowledge economy. Journal of Economic Theory, 24, 531-547. Clower, R., 1965. The Keynesian counterrevolution: a theoretical appraisal. In: F.H. Han and F.P. Brechling, (Eds.). The Theory of Interest Rates, London: MacMillan, 103-125. Clower, R., Howitt, P., 1978. The transactions theory of the demand for money: a reconsideration. Journal of Political Economy, 86, 449-466. Clower, R., Howitt, P., 1996. Taking markets seriously: groundwork for a post Walrasian macroeconomics. In: Colander, (Ed.), Beyond Micro-foundations: Post Walrasian Macroeconomics. Cambridge: Cambridge University Press, 21-

37. Clower, R., Howitt, P., 1998. Keynes and the classics: an end of century view. In: Ahiakpor, J.C.W. (Ed.), Keynes and the Classics Reconsidered, Boston: Kluwer Academic Press, 163-178. Clower, R., Howitt, P., 2000. The emergence of economic organization. Journal of Economic Behavior & Organization, 41,

55-84. Colander, D., (Ed.), 2006. Post Walrasian Macroeconomics: Beyond the Dynamic Stochastic General Equilibrium Model. Cambridge: Cambridge University Press. Colander, D., (Ed.), 1996. Beyond Micro-foundations: Post Walrasian Macroeconomics. Cambridge: Cambridge University Press. Davies, G., 2002. A History of Money from Ancient Times to the Present Day, 3rd. ed. Cardiff: University of Wales Press. Defila, H., 1994. Sixty years of the WIR economic circle cooperative: origins and ideology of the Wirtschaftsring. WIR Magazin. (Translated from the German by Thomas Geco.) http://www.ex.ac.uk/~RDavies/arian/wir.html.

18

Economist Magazine, 2000a. Economics focus: who needs money? January 22, 78. Economist Magazine, 2000b. Economics focus: e-money revisited. July 22, 76. Eckalbar, J., 1984. Money, barter and convergence to the competitive allocation: Menger's problem. Journal of Economic

Theory, 32, 201-211. Feenstra, R., 1986. Functional equivalence between liquidity costs and the utility of money. Journal of Monetary Economics,

17, 271-291. Finnerty, J., 1980, Real money balances and the firm's production function: a note. Journal of Money, Credit, and Banking, 12, 666-671. Fischer, S., 1974. Money and the production function. Economic Inquiry, 12, 517-533. Fischer, S., 1979. Capital accumulation on the transition path in a monetary optimizing model. Econometrica, 47, 1433-1440. Fisher, I., 1934. Mastering the Crisis - With Additional Chapters on Stamp Script. London: Kimble & Bradford. Gavin, W.T., Kydland, F.E., 1999. Endogenous money supply and the business cycle. Review of Economic Dynamics, 2, 347-369. Goldberg, M., Thurston, T.B., 1977. Monetarism, overshooting, and the procyclical movement of velocity. Economic Inquiry, 15, 26-32. Gomez, G.M., 2008. Making markets: the institutional rise and decline of the Argentine red de trueque. Hague: Institute of Social Studies. Greco, Thomas H., Jr., 2001. Money: Understanding and Creating Alternatives to Legal Tender. White River Junction, Vermont: Chelsea Green Publishing. http://www.reinventingmoney.com/documents/MoneyEbook.pdf. Handa, J., 2000. Monetary Economics, London: Routledge. Hasan, M.A., Mahmud, S.F., 1993. Is money an omitted variable in the production function? Some further results. Empirical Economics, 18, 431-445. International Monetary Fund (IMF), 2007. International Financial Statistics, http://imfstatistics.org. International Reciprocal Trade Association (IRTA), 2009. http://www.irta.com/ReciprocalTrade.aspx. Keynes, J.M., 1964 [1936]. The General Theory of Employment, Interest, and Money. New York: Harcourt Brace

Jovanovich. Leão, P., 2005. Why does the velocity of money move pro-cyclically? International Review of Applied Economics, 19, 119- 135. Linton, M., Harris-Braun, E, 2007. LETSplay: simulation of WIR-type system. www.openmoney.org/letsplay/index.html. Mankiw, N.G., (Ed.) 1993. Symposium on Keynesian economic theory today. Journal of Economic Perspectives, 7, 3-4. Mankiw, N.G., Summers, L., 1986. Money demand and the effects of fiscal policies. Journal of Money Credit and Banking, 18, 415-429. Mauss, M., 1923 [1967]. The Gift: Forms and Functions of Exchange in Archaic Societies. Translated by Gunnison, I. New

York: Norton. Meierhofer, L., 1984. Volkswirtsaftliche analyse des WIR-wirtschaftsrings. Basel: WIR. Nilsen, J., 2002. Trade credit and the bank lending channel. Journal of Money, Credit and Banking, 34, 226-253. Ostrom, E., 1990. Governing the Commons: The Evolution of Institutions for Collective Action. New York: Cambridge University Press. Patinkin, D., 1956. Money, Interest and Prices: An Integration of Monetary and Value Theory. Evanston: Row, Peterson and Co. Petersen, M., Rajan, R, 1994. The benefits of lending relationships: evidence from small business data. Journal of Finance, 49, 3-37. Petersen, M., Rajan, R, 1997. Trade credit: theories and evidence. Review of Financial Studies, 10, 661-691. Polanyi, K., 1947. The Great Transformation: The Political and Economic Origins of Our Time. Boston: Beacon Press, 1957. Romer, P., 1986. Increasing returns and long-run growth. Journal of Political Economy, 94, 1002-1037. Rösl, G., 2006. Regional currencies in Germany – local competition for the euro? Economic Studies No 43/2006. http://www.bundesbank.de/download/volkswirtschaft/dkp/2006/200643dkp_en.pdf. Short, E.D., 1979. A new look at real money balances as a variable in the production function. Journal of Money, Credit, and Banking, 11, 326-39. Sidrauski, M., 1967. Rational choice and patterns of growth in a monetary economy. American Economic Review, 62, 534- 544. Small Business Administration, 1998. Financing patterns of small firms: findings from the 1998 survey of small business finance. Small Business Notes. http://www.smallbusinessnotes.com/fedgovernment/sba/financingpatterns03.html. Starr, R.M., (Ed.), 1989. General Equilibrium Models of Monetary Economies: Studies in the Static Foundations of

Monetary Theory. San Diego: Academic Press. Sterman, J., Henderson, R.M., Beinhocker, E., Newman, L.I., 2006. Getting big too fast: strategic dynamics with increasing returns and bounded rationality. MIT Sloan Research Paper No. 4595-06. Stodder, J., 1995a. The evolution of complexity in primitive economies: theory. Journal of Comparative Economics, 20, 1- 31. Stodder, J., 1995b. The evolution of complexity in primitive economies: empirical tests. Journal of Comparative Economics,

19

20, 190-210. Stodder, J., 1998. Corporate barter and macroeconomic stabilization. International Journal of Community Currency Research, 2, http://www.uea.ac.uk/env/ijccr/abstracts/vol2(1)stodder.html. Studer, T., 1998. WIR in Unserer volkwirtschaft. Basel: WIR. Translation: Beard, P.H. (trans.), 2006. WIR and the Swiss

National Economy. Rohnert Park, CA: Sonoma State University. Available as e-book at http://www.lulu.com/content/301348.

Stutz, E., 1984. Le cercle économique-societé coopéreative WIR - une retrospective historique. Basle: WIR. Terra, M.C., 2003. Credit constraints in Brazilian firms: evidence from panel data. Revista Brasilera de Economia, 57, 443-

464. Tobin, J., 1970. Money and income: post hoc ergo propter hoc? Quarterly Journal of Economics, 84, 301-317. Weitzman, M.L., 1982. Increasing returns and the foundations of unemployment theory. Economic Journal, 92, 787-804. White, Halbert. 1980 "A Heteroskedasticity-Consistent Covariance Matrix and a Direct Test for

Heteroskedasticity," Econometrica, 48, 817-838. Williams, C.C., 1996. The new barter economy: an appraisal of local exchange and trading Systems (LETS). Journal of Public Policy, 16, 85-101. Winkler, Stefan (WIR Statistician), 2010. Email correspondence, March 2010. Winter-Ebmer, R., Zweimüller, J. 1999. Firm size wage differentials in Switzerland: evidence from job changers. American

Economic Review: Papers and Proceedings, 89, 89-93. Winter-Ebmer, R., 2001. Firm size, earnings, and displacement risk. Economic Inquiry, 39, 474-486. WIR-database on Balances and Turnover, 1994-2008, Courtesy of Mr. Stefan Winkler, Statistician for WIR-Bank. WIR-Plus magazine, various issues, 2000-2007, http://www.wir.ch. WIR-Bank, 2005a. E-mailed statistics from Office of Public Relations, December. WIR-Bank, 2005b. Rapport de Gestion, Various Years, Basle: WIR Wooldridge, Jeffrey M. (2002) Econometric Analysis of Cross Section and Panel Data, Cambridge, MA: MIT Press. World Bank, 2000. Future of Monetary Policy and Banking Conference: Looking Ahead to the Next 25 Years. Papers listed at http://iang.org/money/goodhart_economist.html. World Bank, 2008. World Development Indicators, http://www.worldbank.org/data/wdi2008/index.htm.