Stock Analysis: Priceline

-

Upload

kara-stessl -

Category

Business

-

view

218 -

download

1

Transcript of Stock Analysis: Priceline

Stock AnalysisKara Stessl

1

Agenda

Overview Quality Growth Momentum Valuation

Overview

•Business

•Industry

•Management

•Financial

Quality

•Historical

•Expected

Growth

•Price

•Earnings

Momentum

•Intrinsic

•Analyst Comparison

Valuation

Target Price

Summary

2

Overview Quality Growth Momentum Valuation

Business DescriptionHistory Industry

Fast Facts

• Founded 1997 by Jay S. Walker

• Headquartered in Norwalk, CT

• Went public in March 1999

• Online travel company

• “Name your own price.” feature

• Dot-com bubble trouble

• Listed on the NASDAQ Exchange

• IWF Ranking: 50

• Market Cap: $59.7+ billion

• Current Price: $1206.21

• Shares Out: 52,448,000

• 52 Week Range: $1017.12 - 1378.96

• Market share: 4% global travel

bookings

Consumer Discretionary

Online Travel Agency

3

Data from Factset

Price History

Overview Quality Growth Momentum Valuation

Business Description4

Data from Priceline 10-K 2013

Overview Quality Growth Momentum Valuation

THE PRICELINE GROUP

5

Overview Quality Growth Momentum Valuation

Business Description6

Data from Priceline 10-K 2013

• Priceline buys product and resells to customer

• Mark-up around 20%

• Customers pay when they book

Merchant Model

• Merchants pay Priceline a fee of 12-15%

• COGS virtually non-existant

• Accounts for ~2/3 of revenue

• Booking.com main revenue driver

Agency Model

Merchant

Agency

* % of 2013 Revenue

Other

Overview Quality Growth Momentum Valuation

Business Description7

Data from Priceline 10-K 2013

Overview Quality Growth Momentum Valuation

Business Description8

Data from Priceline 10-K 2013

Overview Quality Growth Momentum Valuation

Business Quality9

Competitive Advantage

Network Effects

Once a network of service providers is in place, the customers

tend to come, attracting more service providers, which should attract more customers

International Markets

Priceline Established

International Leader

Expedia and other competitors would

have to invest heavily just to catch

up to Priceline’s current position

Strategic Alliances

Ctrip

Financial and strategic alliance. China poised to surpass US as largest business travel market

this year.

Overview Quality Growth Momentum Valuation

Business Quality10

Overview Quality Growth Momentum Valuation

Management Quality

1994 -1998: Engagement Manager

1998 – 2003: SVP Branded Projects and New Ventures

2003 – 2005: VP US Small MM Solutions and Partners

2005 – 2008: CEO Microsoft Japan

2008 – 2011: VP Global Consumer & Online

2011 – Present: CEO Booking.com

2014 – Present: CEO Priceline GroupDarren Huston

11

Data from LinkedIn

Overview Quality Growth Momentum Valuation

Industry Analysis

Entrants

• Medium: current and new competitors can launch new

sites at a relatively low cost

Substitutes

• Low: offline travel agents or directly with suppliers, often more costly

Suppliers• Medium: can choose other online sites to sell excess inventory

Customers

• High: looking for bargains, willing to switch for lower prices, search engines allow maximum comparability

Rivalry• Highly competitive industry: competing mainly on price

12

Overview Quality Growth Momentum Valuation

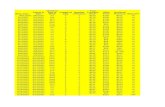

Financial Quality: Profitability and Liquidity

13

Data from Factset

Overview Quality Growth Momentum Valuation

Financial Quality: Profitability Peers

0

10

20

30

40

50

60

70

80

Gross

Margin %

Operating

Margin %

Net

Margin %

ROA ROE

Priceline

Expedia

Orbitz

14

Data from Factset

Overview Quality Growth Momentum Valuation

Financial Quality: Dupont Analysis

0

10

20

30

40

50

60

70

Asset

Turnover

Operating

Margin

Interest

Burden

Tax Burden ROA Equity

Leverage

ROE

Priceline

Expedia

Orbitz

15

Data from Factset

Overview Quality Growth Momentum Valuation

Historical16

Data from Factset

Overview Quality Growth Momentum Valuation

FCF Growth

17

Data from Carlson Wagonlit Travel and Statista

$0

$500

$1,000

$1,500

$2,000

$2,500

(millions)

Overview Quality Growth Momentum Valuation

Expected18

Data from Factset

Overview Quality Growth Momentum Valuation

Opportunities

19

OpentableAcquisition

Growing at 18%

Potential synergies, immediately accretive ,

Booking.comreaching out to existing suppliers

Dominantly based in US – Priceline has capability to take

worldwide

Successful history with past

acquisitions

Rising Agency Sales

No inventory risk,

Spread fixed costs across growing revenue base = better margins

Popular in international

markets

Growing International

Market

Asia and Latin American markets expected to grow

substantially

Mobile bookings to catalyze growth

Higher growing consumer

discretionary budget in Asia

Increased online penetration of travel bookings

Ctrip Partnership

$0.5 billion invested in Ctrip partnership,

reserves right to increase stake

China is world’s biggest outbound travel market; only 15% travel booked

online

Booking.com will advertise Ctrip's

inventory of hotels in China.

Ctrip will be able to offer its users a

wider array of deals from Priceline's

platforms

Overview Quality Growth Momentum Valuation

Economic Impacts

20

35.90%

37.10%

38.90%

40.40%

42.30%

44.20%

46.20%

2010

2011

2012

2013

2014

2015

2016

Percentage of Worldwide Online

Travel Sales

309

340

374

408

446

483

523

2010

2011

2012

2013

2014

2015

2016

Worldwide Online Travel Sales

Volume

Data from Barclays and Statista

($ billions)

Overview Quality Growth Momentum Valuation

Online International Travel Sales Volume

21

Data from Barclays and Statista

0

50

100

150

200

250

300

350

400

2010 2011 2012 2013 2014 2015 2016

Europe Asia Pacific Latin America ($ billions)

Overview Quality Growth Momentum Valuation

Economic Impacts: Catalyst

22

Overview Quality Growth Momentum Valuation

Risks and Concerns

23

Threat of business disruption

•Google licensing deal with Room 77 software

•Apple iTravel patent app

•Facebook?

Supplier Dependence

•Broad hotel, rental car, airlines, etc. selection necessary to remain competitive

Unpredictable Global Events

•Ebola, SARS, and other epidemics

•Terrorism

•Natural Disasters: Katrina, Icelandic Volcanic Eruption, etc

Global Growth Slowing

•Consumer Discretionary, luxury expense

Strength of US Dollar

•Majority of revenue derived from international operations

Security Concerns

•Personal information

•Credit information

•Security breaches

Consumer Preferences

•Seasonality: highest profitability quarters 2 and 3;

• US Opaque reservations becoming more competitive

Overview Quality Growth Momentum Valuation

Momentum: Price (10 years)

24

Data from Factset

Overview Quality Growth Momentum Valuation

Momentum: Price (5 years)

25

Data from Factset

0

100

200

300

400

500

600

700

800

H22009

H12010

H22010

H12011

H22011

H12012

H22012

H12013

H22013

H12014

H22014

(INDEX) Priceline Group Inc - Price (INDEX) S&P 500 - Price

(INDEX) MSCI The World Index - Price (INDEX) MSCI AC World / Consumer Discretionary -SEC - Price

Priceline Group Inc

1138.43 0.00 0.00% 4:00:00 PM VWAP: High: 1378.96 Low: 154.12 Chg: 542.67%

Overview Quality Growth Momentum Valuation

Earnings Surprises

26

Data from Factset

Overview Quality Growth Momentum Valuation

Valuation: DCF

27

TerminalValueMatrix

Growth

Rate 2.0% 2.5% 3.0% 3.5% 4.0%

WACC

10.62% 120,840 128,279 136,694 146,290 157,335

11.12% 114,217 120,840 128,279 136,694 146,290

11.62% 108,282 114,217 120,840 128,279 136,694

12.12% 102,933 108,282 114,217 120,840 128,279

12.62% 98,088 102,933 108,282 114,217 120,840

EquityValuePerShareMatrix

Growth

Rate 2.0% 2.5% 3.0% 3.5% 4.0%

WACC

10.62% 1,558.22 1,613.96 1,677.03 1,748.94 1,831.72

11.12% 1,457.99 1,505.60 1,559.07 1,619.56 1,688.54

11.62% 1,368.58 1,409.51 1,455.18 1,506.48 1,564.50

12.12% 1,288.37 1,323.76 1,363.03 1,406.85 1,456.07

12.62% 1,216.05 1,246.81 1,280.77 1,318.46 1,360.51

Overview Quality Growth Momentum Valuation

Recommendation: Analysts

28

Analyst Ratings

Buy 23

Hold 4

Sell 0

Analyst Return Estimates

12m Target Price $1488.08

Last Price $1206.21

Return Potential 23.37%

Range $1250 - 1600

Data from Factset

Overview Quality Growth Momentum Valuation

Recommendation

29

STRONG BUY

• My Target Price: $1455.18

• Analyst Target Price: $1488.08

• Current Price: $1206.21

• Return: 20.64%

Overview Quality Growth Momentum Valuation

Questions?

30