SquareFeet - Amazon S3...mobile apps, web-based data sources, software programs and social media is...

Transcript of SquareFeet - Amazon S3...mobile apps, web-based data sources, software programs and social media is...

SquareFeetPERIODICAL SUPPLEMENT TO THE JOURNAL RECORD · NOV. 10, 2017

Employing technology to bring success

* Offer valid until 12/31/17. Minimum service term, equipment, installation, fees, taxes, and other restrictions may apply. See coxbusiness.com. © 2017 Cox Communications, Inc. All rights reserved. QPA105162-0006

SWITCH TODAY. CALL 877-984-0161 OR VISIT coxbusiness.com

It’s time to upgrade your expectations. At Cox Business, you get scalable, reliable services backed by 24/7 business-class support from a trusted provider. That means less headache, less hassle and more time to focus

on what matters most, your business.

SWITCH TO COX BUSINESS.

YOU DESERVE LESSYOUR BUSINESS DESERVES MORELESS HASSLE LESS HEADACHE LESS REGRET

for 6 months with a 3-year agreement

25 Mbps INTERNET AND VOICE WITH UNLIMITED NATIONWIDE LONG DISTANCE

/mo* $ 84

okfidelitybank.com I 405.755.5330

It’s full of long days, longer nights and tough calls. But you know it’s worth it.

And so do we. We want to be your lender. We want to be your bank.

BUSINESS.RARELY EASY. ALWAYS WORTH IT.

There are more ways than ever to market your business, and The Journal Record is here to help!

We’ve added the power of ThriveHive® — everything you need to market your business online.

There’s a great big world of opportunity out there waiting for you. And it’s closer than you think.

Contact The Journal Record to get started today.

POWERFUL. DIGITAL. MARKETING.405-278-2830 | journalrecord.com

It’s Time to Add Digital to Your Marketing Mix.

FEATURES4 Employing technology to bring success

6 Women in commercial real estate

8 Senior suited: Building for the next phase

10 Tips to consider when applying for a commercial loan

OTHER12 Ask the industry

14 Top projects

16 Big deals: 16 Industrial 18 Office

17 Multifamily 19 Retail & other

20 Properties for sale or lease

23 Real Estate Development List

24 Sales Points

SQUARE FEET is a publication of The Journal Record produced quarterly

Oklahoma City Office: 101 N. Robinson Ave., Ste. 101, Oklahoma City, OK 73126 405.235.3100

For subscription information, call (800) 451-9998 or go to JournalRecord.com.

TABLE OF CONTENTS

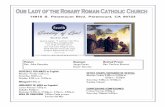

ABOUT THE COVER:Employing technologyto bring success. Photo by Brent Fuchs

NOVEMBER 2017

SquareFeetPERIODICAL SUPPLEMENT TO THE JOURNAL RECORD · NOV. 10, 2017

Employing technology to bring success

4 6 8 10

SQUARE FEET 3

BY JENNIFER SHARPETHE JOURNAL RECORD

In commercial real estate, evolving technology has enabled a level of speed and efficiency that has revolutionized the industry.

“The offerings made via technology have absolutely transformed the commercial real estate business and the role of real estate brokers,” said Stuart Graham, first vice president with CBRE Retail Services. “Verifiable data is the basis for making decisions about the value of property, and subsequently about buying, selling, or leasing property.”

Because of technology, Graham explained, access to the data is now easy

and efficient, and has thus “leveled the playing field” for brokers.

“‘Deals are harder to uncover because, frankly, the information is so readily available to everyone,” Graham said; therefore, “the brokers’ ability to leverage mobile apps, web-based data sources, software programs and social media is paramount to their success.”

The industry is saturated with many options for software. Alaina McGlothlin, a retail broker at CBRE, said she regularly receives marketing emails from companies trying to sell the latest program.

Within her company, McGlothlin said internal programs are developed and continuously evolving to meet brokers’ needs.

“The offerings made via

technology have absolutely transformed the

commercial real estate business

and the role of real estate

brokers.” — Stuart Graham, first vice

president with CBRE Retail Services

d ff d h h “l l d h

Employing technology to bring success

CBRE’s Alaina McGlothin and Stuart Graham. Photo by Brent Fuchs

4 November 2017

“CBRE has a database that they manage internally that we are constantly changing and updating,” she said.

The downside to new technology is that time spent learning new software means less time spent on a client or deal.

“We’re always talking about some new program or there’s a company trying to make our lives easier, but we don’t always want to jump into it because there’s a learning curve with any new technology,” McGlothlin explained.

Industry-specific programs such as APTO, Xceligent, Loopnet, and CoStar are all popular with commercial real estate brokers. Why so many software choices? Unlike residential real estate, which has the Multiple Listing Service, known as MLS for short, commercial real estate does not have one go-to listing site.

“There is not one central repository for all the real estate listings in commercial,” explained J. David Chapman, assistant professor at the University of Central Oklahoma and owner of Realty1 LLC.

According to Chapman, this huge market opportunity for “big data” in commercial real estate is what has sparked and fueled the ongoing feud between Xceligent and CoStar.

“What drives our business in CRE is knowing what is available to our customer,” he explained.

In addition to needing access to each database, a broker must also be prepared to field frequent, often weekly, calls from Xceligent and CoStar as they make every effort to maintain their databases with the most up-to-date information. As Chapman noted, CoStar will do flyovers with aircraft and drones to take pictures.

Even with the influx of sophisticated programs, there is still a place for basic technology in commercial real estate.

“Excel spreadsheets have been reliable and stood the test of time,” McGlothlin said. She also regularly uses Dropbox and Google, but laments that not all clients use them.

As with any industry, email has dramatically changed the way clients are contacted. In commercial real estate, particularly with the facets of the industry working on and around deals, a major advantage that technology has brought is increased efficiency.

Julie Whitman, zoning manager for Bock & Clark Corp., remembers earlier days when information was requested

by phone and by mail, which then led to waiting days or even weeks to receive materials.

“These days, we have the luxury of faster communication via email, the majority of codes and maps can be found online, and gathering information is generally a much easier process,” Whitman said. “We’ve also been able to drastically reduce the amount of paper waste. When a city’s municipal codebook or a 10-page property survey can be emailed and then reviewed electronically, it means that we’ve wasted less paper, saved postage, required less storage and workspace, and even saved labor.”

What about social media in commercial real estate?

“The adoption of social media has been slower than I might have expected in commercial real estate,” Graham said. “We will see an increase in the use of social media as the early adopters of social media move into their prime buying years. Today’s buying decisions are made by those who aren’t inclined to seek data through social media.”

McGlothlin said she does not use social media because her clients are not using it. Perhaps social media will be more of a factor as the client demographic switches more toward younger generations, as Graham suggests.

Even with all the benefits that technology has brought to CRE, there is not a program or app that has taken the place of human interaction.

“With technology, it is there and we use it, but it is not what we rely on the most,” McGlothlin said. “I always find out the most information when I pick up the phone and make a call.” The broker-to-broker calls, she said, are when she finds out the details on a property and ultimately builds relationships within the field.

Commercial real estate is an industry that finds success in relationships.

“The more experience you have, the less calls that you need to make, because you know what property would be the best fit for a company or client,” said McGlothlin.

Graham summarizes the link between technology and the commercial real estate broker, “The brokers’ role is to find and transfer critical information. The use of today’s technology is the most efficient means of accomplishing this task.”

“We will see an increase in the use of social media as

the early adopters of social media move

into their prime buying years. Today’s buying decisions are made by those who aren’t

inclined to seek data through social media.”— Stuart Graham, first vice president

with CBRE Retail Services

SQUARE FEET 5

BY JENNIFER SHARPETHE JOURNAL RECORD

When Vicki Knotts came into the commercial real estate business in the ‘80s, it was primarily male-dominated, much more than it is today.

“It was tough, and you were very much on your own,” said Knotts, who today is vice president with Newmark

Grubb Levy Strange Beffort. “In the brokerage community today, the larger companies have been more open in hiring women in this position and placing them in teams, which I believe is progressive.”

Commercial real estate has seen increasing numbers of women in the workforce across all aspects of the industry.

Gayle Bourdeau, a director on the CREW Network Board, has almost 20 years of experience in commercial real estate and is currently with Stewart Title Guaranty Co. in Boston.

“The amount of women in the industry has definitely increased; nearly equal to men,” Bourdeau said. “However, CREW Network data shows that women still have a long way to go

WOMEN IN COMMERCIAL REAL ESTATE

(Left to Right) Michelle Anderson, director of CBRE Asset Services; Julie Kriegel, vice president at Wiggin Properties; and Phillips Murrah director Sally Hasenfratz. Photo by Brent Fuchs

6 November 2017

before we reach parity with our male counterparts. There are nearly double the amount of men holding C-Suite positions, and a large income gap still exists.”

“Women have made significant leaps in commercial real estate,” said Michelle Anderson, director for CBRE Asset Services.

Women used to work in back-office, accounting or assistant roles, and few women were in charge of managing or leasing properties.

“Fast-forward 30 years, and women now dominate the field of commercial real estate management,” Anderson said.

Amanda Ward, owner and vice president of operations for Ward Investments and Ward Construction, said she was used to being the only female in the meeting for years.

“Now that is not the case,” Ward said. “Not only are more women in my meetings, but I am building more buildings for female business owners.”

Professional organizations, like the CREW Network, have allowed women to collaborate, network and grow.

CREW Network’s mission is to influence the success of the commercial real estate industry by advancing the achievements of women. CREW offers business networking opportunities at events and online, provides its members with ways to develop their leadership and negotiation skills, and is an industry leader in research on women in commercial real estate.

Sally Hasenfratz, director at Phillips Murrah, and Julie Kriegel, vice president at Wiggin Properties LLC, started CREW OKC in June 2016.

“For several years, Sally and I were the only CREW Network members-at-large in Oklahoma,” Kriegel said. “We had both benefited from out-of-state business through the network. Having spoken to other chapters about the benefits at the local level, and seeing no end to the growth in OKC, the timing seemed right to launch a chapter.”

CREW OKC has more than 70 members, from all areas of the commercial real estate industry.

“The diversity of CREW OKC is no accident,” Kriegel said. “It started with Sally and I discussing the makeup of our first board of directors. One of our priorities was to choose directors of different generations, and from different fields of commercial real estate including brokerage, law,

title, engineering, architect, lending, property management, development, construction, etc. The idea was to develop a leadership team that included different experiences, perspectives, and areas of knowledge.”

Members are pleased with what the group has brought to women locally.

“It is refreshing to have an organization like CREW which helps women do what men have been doing for each other all along, giving others a step up,” Knotts said.

CREW is not the only professional resource available to women in commercial real estate. As Anderson explains, there are professional affiliations for all of the areas of expertise within the commercial real estate industry.

Future directions for women in commercial real estate include more mentor programs, and educational programs aimed at high school and college women.

The CREW Network Foundation offers UCREW at the college level to introduce students to career opportunities in commercial real estate that they might not know of. As Bourdeau explained, typically a UCREW program happens at a university and involves a panel presentation with panelists from different fields in commercial real estate going through a simulated deal from start to finish.

Panelists also might speak to their career path and answer questions. The event might also include a networking reception where the students can meet with the panelists and work on networking fundamentals.

College-level women are encouraged to apply for a CREW Network Foundation Scholarship. In addition to $5,000 toward tuition and books, the scholarships come with paid internships, complimentary CREW Network at-large membership, and complimentary convention registration so they can attend and be recognized as a scholarship recipient.

For high school students, CREW Careers is typically an all-day, hands-on classroom program designed to introduce high school girls to the many career opportunities available in commercial real estate.

“Some might think high school girls might be too young to reach out to about careers in commercial real estate, but I feel it is the perfect time to bring our industry to their attention,” said Bourdeau, who spoke at CREW OKC’s annual meeting this fall.

Kriegel has expressed interest in bringing both UCREW and the CREW Careers programs to the metro through CREW OKC, as well as establishing local mentoring programs.

Cyndi Mullins, commercial real estate property manager and leasing broker at Waterford Properties and a member of Oklahoma City Metropolitan Association of Realtors, shared her story about the importance of mentorship back when she arrived in Oklahoma City in 1994.

“I had a mentor, Mary Lou Derrick, who introduced me to the industry,” Mullins said. “She was one of the best mentors I’ve had, and she was tough, but good. … She made me pull myself up by the boot straps, and helped me figure out how to succeed. Mary Lou knew how to rule the roost. She taught me that you have to do whatever you have to do, from picking up cigarette butts to inspecting the site to dusting. The training wasn’t easy, but it helped establish an industry baseline for me.

Mark Beffort, CEO of Newmark Grubb Levy Strange Beffort, also mentored Mullins.

“Mark made me go into commercial buildings, count parking spaces and verify how many tenants were on site,” she said. “It was great being mentored by both professionals, and they’re the top commercial real estate people in town. More mentoring is needed to attract and retain more female talent to the industry.”

“In the brokerage community

today, the larger companies have been more open in hiring women in this position and placing

them in teams, which I believe is

progressive.”— Vicki Knotts, Newmark Grubb Levy Strange Beffort

SQUARE FEET 7

BY MOLLY M. FLEMINGTHE JOURNAL RECORD

YUKON – In September, Spanish Cove Retirement Village had a groundbreaking for an expansion, and CEO

Don Blose is already thinking about the next phase.

“As soon as we start construction on Phase 1 in November, then we’ll start looking at the next phase,” he said.

Phase 2 will be more apartment-style living, he said, but it will have several activity areas, such as dining services, an event center, a pool hall, a woodshop, a sewing center, and a fitness center.

“Our objective is to keep people healthy and independent for as long as they can be,” he said.

The addition at Spanish Cove is a microcosm for what types of products are defined as senior housing. With the phase that started in September, Spanish Cove is adding 14 memory-care assisted-living units, nine assisted-living one-bedroom apartments, and 20 skilled-nursing rooms. The $20 million project will be complete in 2019.

Blose doesn’t expect the demand to dwindle. He said he already has people on a waiting list who are ready to move into senior housing when the time comes.

Spanish Cove offers the full gamut of senior care. People can move into an apartment and stay on the same property as their health digresses.

“It’s been described as the best long-term care insurance that someone can buy,” he said. “This type of environment can save people money in

the long-run. They can move in, then spend 13 to 14 years here.”

Between 2015 and 2035, the demand for housing suited for seniors is expected to grow dramatically, especially as the population’s health dwindles and they demand more services. By 2035, one-in-three U.S. households will be headed by someone 65 years old and older, according to a 2015 study by the Harvard University Joint Center for Housing. The same study found that by 2035, nearly 20 million older-adult households will have someone with mobility issues.

But the existing housing stock isn’t built for those millions of people. People with mobility issues need a home with zero-step entrances, single-floor living, wide halls and doorways that are wheelchair-accessible, lever-style handles, and easily accessible

Senior suited: Building for the next phase

Construction is underway on the Laurel Springs senior community in Mustang. Photos by Brent Fuchs

8 November 2017

electrical controls. Only 1 percent of the housing stock has all five of those options, the Harvard study found.

Oklahoma City developer Ron Walters has been increasing the metropolitan’s senior housing stock with his projects that are from Edmond to Moore, and even west to Mustang. He bought the Westbury Golf Course and construction will begin by year’s end on 105 units in a development called the Oak Haven at Westbury. It will have two dining areas and a swimming pool.

His developments are small cottage-style homes. People can come and go as they please, but Walters’ staff takes care of all their needs, such as picking up groceries and even doing their taxes. He said it’s targeted to people age 50 and older.

His properties include Laurel Springs in Mustang, Grace Point Living in Moore, and Mon Abri in Edmond.

“We’re the alternative to assisted living and nursing homes for people that are still healthy and active,” he said. “We fill the largest niche in our area, but it’s an unknown lifestyle opportunity. Whenever people say senior living, they think its assisted living, but it’s not.”

While senior housing developments are popping up nationwide, the properties are not trading hands frequently, said David Dirkschneider, broker with Price Edwards & Co. He works in multifamily housing.

In his terms, senior housing is apartments that are built specifically for an older age group. It’s not assisted living or other properties that have a medical staff attached.

He said he gets calls from investors wanting to purchase senior housing, but owners are not selling, and he understands why.

“They’re much easier to operate,” he said. “The turnover is low and the

maintenance is low. They’ll put minimal wear and tear on it. (The owner) will have to do little to no work when someone moves out.”

He said when a typical Class-C apartment resident moves out, maintenance is immediately required. But when a senior leaves a unit at a senior-specific property, there’s not much that has to be done.

Brokers see that, and so do the owners, he said. For the 13 years he’s been working in multifamily housing, he said he’s never seen a senior-specific property that was new construction have a different owner.

He said he thinks sales activity will likely pick up in the property type. With the constant talk about senior housing, investors are looking at it more now than in the past, he said.

“You’re starting to see private capital get into that space,” he said.

There’s also the need for more affordable-type senior housing, according to the Harvard study. Many seniors live on a fixed income. Federal and state grants are available to construct senior housing. Statewide, some developers are looking at existing buildings for senior affordable housing because there’s a multi-avenue finance package available. If the building gets listed on the National Register of Historic Places, the developer would not only get federal Low Income Housing Tax Credits, but could also qualify for state historic tax credits and federal historic tax credits. A former hospital in Guthrie and an old elementary school in Enid are being redeveloping using those financing options.

“Most senior citizens are on a fixed income, so most seniors would meet the requirement to get subsidized housing,” Dirkschneider said.

SQUARE FEET 9

BY JENNIFER SHARPETHE JOURNAL RECORD

A clear and detailed business plan is critical for success when applying for a commercial

real estate loan. Lenders are looking at a developer’s overall business financial strength, which requires a detailed history of all financials for the company. Additionally, personal financial information may also be required.

“There’s significant upfront due diligence, but a lot of that is typically done by the developer when they are bringing in a financing request,” said Victor Guarry, senior vice president for BOKF NA’s Commercial Lending department. Experienced developers know what the banks are going to be looking at, and “they’re typically looking at that, too, because their

equity dollars are more at risk, because their equity dollars are behind the loan.”

Financial information for investors and sponsors will also be examined.

“We want sponsorship financial information as well as the developer’s, and to feel comfortable that they have the wherewithal to support the transaction in the event that there are cost overruns or delays of any kind,” Guarry said.

Patrick Lippmann, senior vice president at BancFirst, said, “We are primarily looking for good sponsorship, and that means strong developers with some liquidity, but we are also looking for pre-leasing. Most smart developers come to the table with some pre-leasing in terms of long-term national credit tenants.”

These high-quality tenants that occupy a large space in a retail project

help strengthen the financials on the project.

“We want to know information about the tenant or tenants that are either in the deal or going to be in the project,” Guarry said.

As lenders, “we also will do our homework, and obtain information on the tenants. The large national tenants are easier to get information on because they are publicly traded,” he said.

Not having large national tenants is not a deal-breaker, though. As Guarry explained, when the tenant roster is smaller or more locally based, that is when the lender relies more on instinct and the strength of the sponsorship to cover the risk of tenant turnover.

“You’re going to be focused even more on the strength of the sponsor if the tenant roster is not financially strong,” Guarry said. “You always

TIPS TO CONSIDER WHEN APPLYINGFOR A COMMERCIAL LOAN

10 November 2017

want a good sponsor, but you are going to focus on the sponsors even harder if you have a higher risk of tenant turnover.”

The right amount of cash equity can also help make up for lack of financial history with tenants.

“We want to see a minimum level of cash equity or it can be contributed equity if they already own the land,” Guarry said.

“If you don’t have some form of pre-leasing that you can bring to the table, perhaps you can bring a lower loan to value,” Lippmann said. Typically, commercial real estate loan-to-value ratios are 65 to 80 percent.

Additionally, the debt-service coverage ratio, or DSCR, compares the annual net operating income to its annual mortgage debt service, and basically acts to show how well cash flow will cover the loan costs.

“When we are lending money, our primary focus is income-producing properties,” Guarry said.

He said a common part of underwriting is to make sure there is some margin coverage on what the net operating income can service. The net operating income is the tenant income less the operating expenses, and is used to service loan payments of principal and interest.

“As lenders, we want to know that there’s coverage, and that coverage is the DSCR,” Guarry said. “Typically we want to see a DSCR of anywhere from no less than 1.2 times to as much as 1.5 times dependent on loan type and product.”

Lenders also want to examine how well risks are being managed in the developer’s overall plan.

“Bankers evaluating a loan want to make sure there is some good sensitivity to downside shocks,” Guarry said.

Examples of these downside shocks include loss of tenants, interest rate spikes, and cost overruns.

“The more experienced developers look at downside closely because their equity dollars are subordinate to the loan,” Guarry said.

Construction cost overruns are usually not an issue, because lenders require building plans to be complete upfront, and “usually within any construction budget, they’re going to build in some contingency factor,” Guarry said. Ground-up construction typically has fewer surprise expenses than building acquisition-rehab projects, and remodel construction is deemed to be typically riskier than straight-up acquisition financing.

Another factor that weighs heavily with lenders is relationship history.

“We deal a lot with customers that we do a lot of repeat business with,”

Lippman said. “People that have proven abilities to get a project built on budget, on time, without cost overruns. We have done a lot of refinancing where our customers have purchased properties from other developers or other loaners.”

Market trends matter. Guarry said that, as a lender, he will always look at the overall market to be sure that a developer’s proposal falls in line with what is going on in the market at the time. Developers need to run comparisons of their project to what is going on with other buildings in terms of rent and the overall project budget.

Mark Beffort, CEO of Investments for Newmark Grubb Levy Strange Beffort, describes the three key components that he evaluates as a developer when bringing a project to a lender.

“First is the project itself; does it have merit?” he said. “Second is capital structure; what is the structure of the financial terms? Third is the sponsor. Any loan needs to marry those three things together to really have success.”

Ultimately, the industry is not going to fit in just one mold when it comes to obtaining a commercial real estate loan. As Guarry states, “Every deal is a little unique, but there are general underwriting guidelines.”

While Lodge said he and his team were able to get a good deal on the building, other developers may not be as lucky, which could keep them from wanting to buy an industrial space. The district’s rent is relatively lower than what a redeveloper would charge in today’s market, he said.

“The biggest challenge is to make it work financially,” Lodge said.

“There’s significant upfront due

diligence, but a lot of that is

typically done by the developer when

they are bringing in a financing

request.”— Victor Guarry, senior vice

president for BOKF NA’s Commercial Lending department

SQUARE FEET 11

As we examine today’s Tulsa retail market, we must acknowledge that the climate is changing. In 2017, nine national retail companies filed for bankruptcy. The bankrupt companies included Gymboree, rue21, Payless Shoe Source, Gordman’s Stores, Gander Mountain, Radio Shack, hhgregg, Wet Seal, and The Limited. Furthermore, multiple retailers announced

major store closures, including Macy’s, J.C. Penney, Sears, and Kmart. According to CoStar, the Tulsa retail vacancy has increased to 4.1 percent from 3.9 percent in the previous

quarter. Retail net absorption was negative at (96,806) square feet. This number did not consider the recent closures of Class A big boxes including Gordman’s, Macy’s, and Gander Mountain, which added 309,700 square feet of empty storefronts. Because of these closures, retail vacancy will increase as we close out 2017. These boxes will be absorbed in 2018; however, there will be a lag time as landlords and tenants find their equilibrium.”

Caitlin ShoresVice President, Retail Advisory & Transaction Services

CBRE, Tulsa

QUESTION:

Do you expect Oklahoma’s RETAIL vacancy rates to go up or down to close out 2017? Why or why not?

Overall market vacancy improved during the first half of the year to slightly below 10 percent. I don’t believe we will close 2017 with any significant changes in the vacancy rate.

Certain pockets of the market are considerably more attractive to new retail and Oklahoma City continues to add retailer names to its roster that have not

been in our market previously – these are predominantly the higher-end properties such as Classen Curve and Nichols Hills Plaza. The redevelopment of Bryant Square and the newer parts of Chisolm Creek have also attracted new names, albeit mostly restaurant concepts.

The grocery market continues to grow with WinCo opening two additional locations by year-end. Aldi is remodeling existing stores as well as expanding their presence

with new locations. Fashion and houseware discounters such as Home Goods, TJ Maxx and Ross continue to do well with new locations opening this year. On the flip side, we’ve experienced the demise of department stores as they continue to struggle to remain relevant – and finding good replacements for these vacancies will not be an easy task.

Local retailers have to step up their game with well-thought-out marketing plans and merchandising in addition to creating an exciting shopping experience to get customers through their doors. Those who don’t will continue to fail. So, there is good news and not-so-good news for the second half of 2017 – not a tremendous amount of change.”

Susan BrinkleyBroker Associate

Price Edwards & Co., Oklahoma City

“We are seeing retail become a little more sluggish, which means we may see our vacancy rates go up during the last quarter of the year. Several new developments are under construction, which of course will require continued positive absorption. There are positive pockets that are, of course, showing good rates. This would include locations around Tinker on

Douglas with the new employment opportunities with the Tinker developments. Campus Corner in Norman is healthy,

especially with OU on a winning streak. We are enjoying NW 23rd improvements anchored by the Tower Theatre. Jones Assembly is really making a phenomenal difference in the Film Row activity. OKC continues to get positive branding nationally and the Thunder team certainly helps our economy.”

Judy J HatfieldFounding Principal

Equity Commercial Realty II LLC, Norman

ASK THEINDUSTRY

12 November 2017

Shawnee, Where Business Just Makes Sense

Property Located in the Central Part of the United States.Serving the SOUTHWEST, SOUTHEAST & GREAT PLAINS AREA.

» 50k sq. ft. Shell Building » Expandable to 150k+ sq. ft. » 8.14 acre site » 31’ minimum interior clear height » 50’ x 66’ 8” column spacing

» Dock Height Ready » Zoned 1-2 » 3 minutes to I-40 » Customize to your needs » Asking $1,750,000

Industrial Building NOW AVAILABLE

8032 Industrial Drive, Shawnee OK

405-273-7490www.SEDF.biz

Purchase or Refinanceyour commercial investment property

with a long-term, fixed rate loan and

take advantage of historically low

interest rates.

For all of your Real Estate needs,contact Steven Burrus,

Executive Vice President and CLO

Commercial Real Estate Loans

Long TermFixed Rates

American Heritage Bank

is uniquely positioned

to offer 5 to 15 year terms

and is looking for financing

opportunities in the

Tulsa area.

ahb-ok.com

(918) 248-3257

Industrial - Office - Retail - Multifamily

Disclaimer: This document shall not be construed as a formal offer to provide financing or a commitment on projects, terms, or rates.

All loans are subject to normal due diligence ofAmerican Heritage Bank at it’s sole discretion. Dated January 20, 2017.

MemberFDIC

405.608.4500 | myfirstliberty.com

9601 N. May Avenue | Oklahoma City, OK 73120

Building Together

Great things happen when First Liberty Bank gets involved.

COMMERCIAL REAL ESTATE • LAND DEVELOPMENT • BUSINESS BANKING • PERSONAL MORTGAGES

14 TOP PROJECTS • November 2017

TOP PROJECTS - APRIL-JUNE 2017

The Cosmopolitan Apartments

Bomasada Tulsa LLC is developing a 264-unit, upscale urban apartment community at the corner of Denver Avenue and Riverside Drive. The four-story complex is at 1717 S. Riverside Dr., within walking distance to the River Parks’ highly anticipated A Gathering Place for Tulsa project.

Features will include a fitness center, club room and swimming pool on top of a parking garage. Architect is Lord Aeck Sargent.

Expected completion date is early 2019.

Tulsa ClubRoss Group, a Tulsa-based development, engineering,

and construction management firm, has teamed up with Promise Hotels and TYTO Realty Advisors to redevelop the 11-story Tulsa Club in downtown Tulsa.

The Tulsa Club renovation encompasses the entirety of the building and will maintain and restore as much of the historic art deco building’s original architectural as possible. The repurposed high-rise will serve primarily as a 96-room boutique hotel – Tulsa Club, Curio Collection by Hilton.

The first and second floors will accommodate the hotel’s grand lobby, as well as a restaurant and bar space, fitness area, and back-of-house support. Floors three through eight will consist of unique, modern hotel accommodations. The ninth and 10th floors will feature the restored grand ballroom and mezzanine. Finally, the top floor will serve as event space, including a large outdoor terrace, much like that featured in the original iteration of the Tulsa Club. Booking has started for January 2019.

The construction management team is consulting with the Oklahoma State Historical Preservation Offices and the National Park Service to ensure all aspects of construction meet historical renovation guidelines.

Ross Group is familiar with historic renovation, having completed several in downtown Tulsa, including their own headquarters in the historic International Harvester Building at E. Second Street and S. Frankfurt Avenue. Like Ross Group’s past historic renovations, the $22 million total development of Tulsa Club will be completed and made possible by the use of both state and federal historic rehabilitation tax credits. The project is subject to historic eligibility approval by Oklahoma State Historical Preservation Offices and the National Park Service, as well as final tax abatement approval.

Architect on the project is Lilly Architects PLLC.

Courtesy rendering

Courtesy renderings

SQUARE FEET • TOP PROJECTS 15

TOP PROJECTS - APRIL-JUNE 2017

Name of PropertyAddress, City Value Owner Type of Property

General ContractorArchitect/Engineering Firm

The Cosmopolitan Apartments1717 S. Riverside Dr. West, Tulsa

$ 32,278,959 Multifamily Bomasada Tulsa Construction LLC

Union Elementary #14 Phase 212000 E. 31st St. South, Tulsa

$ 15,000,000 Union Public Schools Gymnasium/classroom Flintco LLCHollis and Miller Architects

Tulsa Club Building115 E. Fifth St. South, Tulsa

$ 14,221,000 Hotel/office space The Ross GroupLilly Architects PLLC

Residence Inn by Marriott4522 E. Skelly Dr. South, Tulsa

$ 9,556,214 Sunny Investment Properties Hotel Sunny Investment Properties

Holiday Inn Express Hotel310 E. Archer St. North, Tulsa

$ 9,000,000 Holiday Inn Hotel The Ross Group

Putnam City North - Stadium11800 N. Rockwell Ave., OKC

$ 7,500,000 Putnam City Public Schools Stadium Globe Construction Co.

Camping World9005 E. Skelly Dr. South, Bldg. B, Tulsa

$ 6,500,000 Commercial/vehicle sales UEBSisemore Weisz & Associates

St. John Medical Center - Floors 4 and 51923 S. Utica Ave., Tulsa

$ 5,600,000 St. John Health System Medical/exam/office space Manhattan Construction

Legacy Plaza East Tower5330 E. 31st St. South, Tulsa

$ 5,600,000 Commercial/business offices Key Construction Oklahoma LLCKKT Architects Inc.

Aloft OKC North13111 Highland Park Blvd., OKC

$ 5,000,000 DJ Patel Hotel

Ustorage OK14000 N. I-35 Service Rd., OKC

$ 4,000,000 Ustorage OK Store John Gravitt Homes LLC

Sleep Inn12520 NW 10th St., OKC

$ 4,000,000 Star Lodging LLC Hotel Grubbs Consulting LLC

Radisson Hotel4716 W. I-40 Service Rd., OKC

$ 4,000,000 L.S. Multani HotelBieberly Architects

Fairfield Inn & Suites2812 S. Fourth St., Chickasha

$ 3,500,000 Aston Management - Atul Patel Hotel

Oklahoma Heart Hospital South5200 E. I-240 Service Rd., OKC

$ 3,190,000 Oklahoma Heart Hospital LLC Buildings/parking lots McCarthy Building Co.

IDO Centergate Building B13120 E. 59th St. South, Tulsa

$ 3,047,500 Commercial/Warehouse Fleming Construction Group LLCGH2 Architects LLC

OU Medical Center Expansion Enabling 2E01 Demolish and Construct Improvements OU Medical Center700 NE 13th St., OKC

$ 3,000,000 Casey Woods Medical

Warren Equipment Co.3601 N. Garnett Rd. East, Tulsa

$ 2,535,000 Warren Equipment Co. Rental shop expansion Landmark Construction Grp. LLC

Kingsgate Elementary Add-on1400 Kingsgate Rd., OKC

$ 2,500,000 Moore Public Schools Buildings Timberlake Construction Co. Inc.

Red Oak Elementary School Gym-Storm Shelter11224 S. Pennsylvania Ave., OKC

$ 2,500,000 Moore Public Schools Gym/storm shelter Omni Construction LLC

Ross Dress For Less #20387120 S. Memorial Dr. East, Tulsa

$ 2,417,864 Ross Dress for Less #2038 Commercial/Retail Crossland Construction Co. Inc.Olsson Associates Inc.

Switzer's Locker Room Buildings 3-815201 Lleytons Ct., OKC

$ 2,360,400 Switzer's Locker Room Buildings Sooner Traditions

Performing Arts Center110 E. Second St. South, Tulsa

$ 2,317,762 Remodeled lobby spaces

IDO Centergate Building A13404 E. 59th St. South, Tulsa

$ 2,100,000 Concrete warehouse building Fleming Construction Group LLCGH2 Architects LLC

Moore Public Schools (New Ag Building)300 N. Eastern, Moore

$ 2,000,000 Moore Public Schools New Agricultural Building Boldt ConstructionKFC Engineering

St. Francis of Assisi Catholic Church Campus Improv. Phase1901 NW 18th St., OKC

$ 2,000,000 Archbishop Paul Coakley Church/school Caston Construction

Southeast OKC RNG7001 S. Bryant St., OKC

$ 1,800,000 Southeast OKC RNG LLC Process building Aria Energy LLC

Bryant Square Shopping Center - Building C11532 E. Second St., Edmond

$ 1,800,000 IA Edmond Bryant LLC Building EMJ ConstructionLawrence S. Levinson

Kum & Go9610 E. 61st St. South, Tulsa

$ 1,666,450 Kum & Go Convenience store

Xanthus Medical Office Building2845 E. Skelly Dr. South, Tulsa

$ 1,530,000 Commercial/office/medicalAAB Engineering LLC

Resolution Legal Add-On and Remodel1214 N. Hudson Ave., OKC

$ 1,475,000 Pivot Project Office Smith & Pickel

Garage Condos of Oklahoma3200 Technology Dr., B5, Edmond

$ 1,416,667 Garage Condos of Oklahoma Building Garage Condos of Oklahoma

Warren Center Bldg. 1 Floors 18 and 196100 S. Yale Ave., Tulsa

$ 1,400,000 Offices Paradigm GroupSubcon Inc.

16 BIG DEALS - INDUSTRIAL • November 2017

BIG DEALS - INDUSTRIAL 3RD QUARTER 2017

This property at 4210 Will Rogers Pkwy. is one of 17 buildings Sealy & Co. purchased in Oklahoma City. Photo by Brent Fuchs

Property Address CountySellingPrice

SquareFeet

Priceper SF Year Built

BuyerSeller Professional Services

Multiple parcels OK $26,648,000 Not listed Sealy OKC Metropolitan I LLCGIJV OKC 1 LLC

Chicago Title Oklahoma

3601 Thomas Rd. OK $9,162,000 240,000 $38.17 1981 Sealy OKC Airport I LLCGIJV OKC 3 LLC

Chicago Title Oklahoma

A tract of land part of S33-T11N-R2W OK $9,000,000 Not listed Mreic Oklahoma City OK II LLCKCI Mid America 109 LLC

First American Title Insurance Co.

A part of S16-T11N-R4W OK $6,091,000 Not listed D & J Land LLCHL Campus LLC

Trustmark Title

4200 SE 59th St. OK $6,000,000 153,130 $39.18 2001 OKC 59th Street LLCTad & Jeff Enterprises LLC

First American Title & Trust Co.

5001 SW 36th St. OK $5,933,500 125,000 $47.47 1982 Sealy OKC Airport I LLCGIJV OKC 2 LLC

Chicago Title Oklahoma

4343 Beacon Dr. OK $4,550,000 78,320 $58.09 2005 HL American Investments LLCD & J Land LLC

Trustmark Title

5500 SW 36th St. OK $4,331,500 76,161 $56.87 1983 Sealy OKC Airport I LLCGIJV OKC 4 LLC

Chicago Title Oklahoma

4000 NW 39th St. OK $3,700,000 152,092 $24.33 1960 BJS Properties LLCConsolidated Industries LLC

Oklahoma City Abstract & Title Co.

1220 SE 82nd St. OK $2,400,000 11,750 $204.26 2012 Monomoy Properties OK 2 SPV LLCWelbros Co. LLC

First American Title

9260 E. Broken Arrow Tulsa $2,250,000 47,698 $47.17 1975 ABM Wilshire Square LLCMary C. Alexander Trust Estate

Commercial Title & Escrow Services Inc.; Tulsa Abstract & Title Co.

13401 Railway Dr. OK $2,200,000 23,360 $94.18 1984 ROK Properties LLCPanda Properties LLC

Trustmark Title

7704 E. 38th St. South Tulsa $2,100,000 40,000 $52.50 1979 10545 South Memorial LLCZahn Properties Inc.

Commercial Title & Escrow Services Inc.; Tulsa Abstract & Title Co.

5701 E. I-240 Service Rd., Ste. A OK $1,991,000 40,560 $49.09 1986 McKenna Properties LLCLeMay Partners LP

Chicago Title Oklahoma

8151 N. Owasso Expressway East Tulsa $1,600,000 6,560 $243.90 1980 M&R Interests Inc.Patricia L. Thompson Revocable Trust

Firstitle & Abstract Services LLC

SQUARE FEET • BIG DEALS - MULTIFAMILY 17

BIG DEALS - MULTIFAMILY 3RD QUARTER 2017

The 368-unit WatersEdge apartments on SW 22nd Street in Oklahoma City sold for $20.06 million. Photo by Brent Fuchs

Property Address CountySellingPrice

SquareFeet

Priceper SF Year Built

BuyerSeller Professional Services

4317 SW 22nd St. OK $20,060,000 259,726 $77.24 1986 Marina Westshore Partners II LLCCornerstone - Watersedge LLC

Secure Title & Escrow LLC

Multiple parcels Tulsa $13,500,000 2009 Bixby's Delaware LLCMarquis on Memorial Holdings LLC

Firstitle & Abstract Services LLC

6326 S. 107th Ave. Tulsa $13,000,000 1984 Juniper Mingo Ltd. and Frill Mingo LLCWW Southport LLC, 1701 N. Palo Verde Dr. LLC and RAM Southport LLC

Bluestem Escrow & Title

1433 S. 107th Ave. Tulsa $12,350,000 1,034,514 $11.94 1968 AMG Bridgeport LLCBrighton Place LC

6900 London Way OK $10,000,000 330,372 $30.27 1973 Republic Tuscany Village LPTuscany Village Apartments LLC

Trustmark Title

4328 SE 46th St. OK $6,100,000 164,256 $37.14 1974 Winfield Mosaic LLCRRE Forest Park Holdings LLC

First American Title & Trust

4742 S. Harvard Ave. East Tulsa $5,845,000 Not listed AE French Villa LLCFrench Villa Apartments SMO-PO LLC

First American Title & Trust Co.

5700 S. Agnew Ave. OK $2,965,000 121,962 $24.31 1962 OKC Creekside LLCCountry Club Apartment Homes LLC

Oklahoma City Abstract & Title Co.

600 NW 29th St. OK $2,295,000 24,018 $95.55 1966 2017 Paseo LLC600 Paseo Partners LLC

Trustmark Title

6321 E. Ninth St. Tulsa $1,600,000 1968 Eric A. Manriquez and Juan M. Rivera GonzalezTSS Properties LLC

Commercial Title & Escrow Services Inc.; Tulsa Abstract & Title Co.

6100 MacArthur Park OK $1,300,000 32,200 $40.37 1984 VGJ Holdings LLCLiving Investments Building LLC

Oklahoma City Abstract & Title Co.

839 East Dr. OK $980,000 14,430 $67.91 1947 Tom Elliott SpectorHuxley Estate East LLC

Trustmark Title

4320 NW 39th Expy. OK $580,000 3,688 $157.27 1925 Benham GolesorkhiRobert D. and Lori Francisco Trust

2232 E. 12th St. South Tulsa $425,000 Not listed Truco Development Co. LLCSohail Zoha and Tania Zoha

3336 E. Marshall St. North Tulsa $350,000 7,268 $48.16 1975 Borderless Investments LLCMarshall Street Apartments LLC

Guaranty Abstract Co.

18 BIG DEALS - OFFICE • November 2017

BIG DEALS - OFFICE 3RD QUARTER 2017

This property at 7017 N. Robinson Ave. Oklahoma City sold for $970,000. Photo by Brent Fuchs.

Property Address CountySellingPrice

SquareFeet

Priceper SF Year Built

BuyerSeller Professional Services

3105 E. Skelly Dr. South Tulsa $1,854,000 55,326 $33.51 1975 Richard C. Gardner Real Estate LLCPecan Properties Inc.

Commercial Title & Escrow Services Inc.; Tulsa Abstract & Title Co.

1220 Sovereign Row OK $1,050,000 16,776 $62.59 1981 RP Oklahoma City LLCSovereign of Oklahoma

First American Title Insurance Co.

222 S. Kenosha Ave. Tulsa $1,050,000 9,670 $108.58 1940 BAT 71 LLCHolston Group LLC

Bluestem Escrow & Title

7017 N. Robinson Ave. OK $970,000 5,840 $166.10 2003 MOJO Management LLCROP LLC

Chicago Title Oklahoma

809 SW 89th St., Suites A-G OK $809,000 6,324 $127.93 1985 Cambrian Capital LLCBrian K. Lepley Trust

Oklahoma City Abstract & Title Co.

909 E. Britton Rd. OK $775,000 4,428 $175.02 2006 Murphy Watson LLCBritton East Partners LLC

Chicago Title Oklahoma

16212 Sonoma Park Dr. OK $740,000 4,769 $155.17 2012 Atlas Realty LLCPelham Partners LLC

American Eagle Title Group

9060 Harmony Dr., Ste. D OK $700,000 38,480 $18.19 1975 7901 NE 10th LLCMidwest Square Office Park LLC

1600 Medical Center Dr. OK $675,000 5,068 $133.19 1997 1600 Medical Center LLCHenry J. Pearce Revocable Trust

Old Republic Title Co. of Oklahoma

721 W. Queens St. North Tulsa $635,000 6,442 $98.57 2001 Pla-Mor Properties LLCLNL Services Inc.

Tulsa Abstract & Title Co.

6271 E. 120 Ct. South Tulsa $605,000 3,028 $199.80 2012 James Ross Enterprises LLCChasteen Commercial Properties LLC

Tulsa Abstract & Title Co. and Commercial Title & Escrow Services Inc.

9106 N. Kelley Ave. OK $600,000 3,343 $179.48 2012 Jean Warren Young C-2 TrustTier Properties LLC

Chicago Title Oklahoma

4436 S. Harvard Ave. East Tulsa $575,000 5,949 $96.65 1982 Management WorldWide LLCHill/Gray Seven LLC

Commercial Title & Escrow Services Inc.; Tulsa Abstract & Title Co.

500 W. Seventh St. South Tulsa $570,000 6,404 $89.01 1955 Courthouse Properties LLC500 West Seventh LLC

Firstitle & Abstract Services LLC

SQUARE FEET • BIG DEALS - RETAIL & OTHER 19

BIG DEALS - RETAIL & OTHER 3RD QUARTER 2017

The Platt College property at 2727 W. Memorial Rd. in Oklahoma City sold for $3.98 million. Photo by Brent Fuchs.

Property Address CountySellingPrice

SquareFeet

Priceper SF Year Built

BuyerSeller Professional Services

Multiple parcels (8130 E. Skelly; 3001 & 3003 S. Memorial Dr. East)

Tulsa $14,100,000 90,507 $155.79 Not listed CARS-DB10 LPJEG LLC

510 S. MacArthur Blvd. OK $9,225,000 74,495 $123.83 2008 Bastrop Hotel LLCMeridian Investments LLC

Chicago Title Oklahoma

2360 W. Kenosha St. West Tulsa $8,735,000 39,784 $219.56 2008 Genesis Health Clubs Broken Arrow LLCCole GG Broken Arrow OK LLC

Security 1st Title LLC

4525 E. 51st South Tulsa $5,500,000 7,812 $704.05 1978 BER Real Estate Investments IV LLCARCP RL Portfolio IV LLC

Commercial Title & Escrow Services Inc.; Tulsa Abstract & Title Co.

5608 W. Memorial Rd. OK $5,250,000 6,930 $757.58 2013 Charter Oak Prod. Co. LLCHDH Property Investors LLC

American Eagle Title Group

2000 S. Meridian Ave. OK $4,900,000 7,440 $658.60 1996 Charter Oak Prod. Co. LLC2000 S. Meridian LLC

American Eagle Title Group

1122 N. Ninth St. East Tulsa $4,756,500 17,780 $267.52 2013 Emerald Glen Building I LLCLynn Lane Development Partners LLC

Firstitle & Abstract Services LLC

13819 Pawnee Dr. OK $4,400,000 Not listed North Church Inc.Memorial Enterprises LLC

First American Title & Trust Co.

2727 W. Memorial Rd. OK $3,985,000 30,360 $131.26 1995 MRP #1 LLC2727 Memorial LLC

Chicago Title Oklahoma

13320 N. Pennsylvania Ave. OK $3,300,000 7,462 $442.24 2003 Sangeeta Singh, Raj Khew et alHOA Restaurant Holder LLC

American Eagle Title Group

5950 W. Memorial Rd. OK $3,089,000 6,166 $500.97 2012 Hideaway Properties LLCL&M Hideaway Properties LLC

12903-A E. 96th St. North Tulsa $3,086,000 5,241 $588.82 Not listed Hideaway Properties LLCL&M Hideaway Properties LLC

9010 E. 71st St. Tulsa $2,900,000 30,142 $96.21 1995 WHM Hospitality LLCH.E. Heritage Inn of Tulsa LP

14831 S. Casper St. Tulsa $2,567,000 87,718 $29.26 1982 OM SAI Hotels LLCTushar Enterprises Inc. LLC

Executives' Title & Escrow Co.

19401 N. Portland Ave. OK $2,327,500 21,420 $108.66 2014 BISI Properties Inc.The Plaza at Deer Creek

First American Title & Trust Co.

20 FOR SALE OR LEASE • November 2017

FOR SALE OR LEASEExchange Center4606-4608 S. Garnett Road, Tulsa

• High visibility

• Immediate access to Broken Arrow Expressway &

Highway 169

• Terrific location

• Ample Parking

• On-site property managementWarren Stewart(918) 508-2803

Oklahoma Tower210 W. Park Avenue

• For Lease

• Convenient adjacent parking

• High-speed communications provided by multiple providers

• 24-hour on-site security personnel and video surveillance

• On-site restaurants, salon, florist and men’s clothing storeMark Beffort(405) 879-4757

Robinson Renaissance119 N. Robinson, Oklahoma City

• Flexible Floor Design

• Beautiful Open Space Atrium

• Food Court in Lower Level

• Full Service Bank

• Quick Print Copy Store

• Various Size Suites AvailableVicki Knotts and Ben Knotts(405) 840-1500

The Oil Center2601 NW Expressway

• For Lease

• Beautiful lobbies on all floors

• Building conference room

• On-site property management and maintenance

• Covered and surface parking available

• On-site restaurant and salonVicki Knotts(405) 879-4761

Valliance Tower1601 NW Expressway

• For Lease

• Covered and surface parking available

• On site bank, restaurant and hair salon

• 24 hour on-site security

• On-site management

• Conference room

• High speed communications provided by multiple providers

Mark Beffort(405) 879-4757

SQUARE FEET • FOR SALE OR LEASE 21

Corporate Tower101 N. Robinson Ave., Oklahoma City, OK

• For Lease

• Responsive on-site management

• Easy access to downtown retailers and restaurants

• Convenient adjacent parking

• High speed communications provided by multipleproviders

• Dual electrical feeders provide ample reliable electricity

• Storage space available in the building’s basementMark Beffort(405) 879-4757

2021 Lewis Center2021 S. Lewis Avenue, Tulsa • Free covered parking garage

• Midtown location - close to Utica Square

Shopping Center

• Close to restaurants, shopping, banking and

downtown Warren Stewart(918) 508-2803

11400 N I-35Oklahoma City, OK

• 29,775 – 62,775 SF available for lease

• $5.50/SF/YR (NNN)

• New Class A Warehouse

• 50’ x 50’ column spacing

• 30’ clear height

• I-35 frontage

• Located off E Hefner Rd. & N I-35Brett Price, CCIM, SIOR (405) 613-8380 Kris Davis, SIOR (405) 202-9525

110 W 7th

• 44,100 SF available for lease

• $4.50/SF/YR (NNN)

• 7 dock high doors

• 1 grade level door

• T5 motion sensor lighting

• 1,500 SF new office space

• New interior and exterior paint

• Within one mile of I-40

22 FOR SALE OR LEASE • November 2017

Wilshire Court8001-8031 N. Wilshire

•For Lease

•Total building: 50,400 SF

•Office/warehouse and bulk warehouse

•12X12 grade level overhead doors

•Ample parking

•$4.66 s/f/y plus CAM - MG

• Fenced yards available

• New concreteMichael Biddinger Real Estate (405) 236-4747 Ext. 23

The Village Shopping Ctr4718-4754 S.E. 29th St.

• For Lease

•

• 4% commission paid for closed leases

• Close to Tinker Air Force Base and I-40

• Great frontage on SE 29th Street

• Glass and brick veneer building

• Fire suppression system throughout

• High traffic area in the heart of Del City

• $7.00 s/f/y plus CAM – MG

Michael Biddinger Real Estate (405) 236-4747 Ext. 23

S.E. 44th St. Warehouses1201-1209 S.E. 44th St.

• For Lease• 4,750 SF available• 4% commission paid for closed leases• Great South OKC location with easy access

to I-35 and I-40• Front and back pedestrian doors• Front and back grade level overhead doors• Secure, insulated steel buildings• Small office and bulk warehouse in each space• Skylights and gas heaters • $5.00 s/f/y plus CAM – MG

Michael Biddinger Real Estate (405) 236-4747 Ext. 23

Waterford6303 Waterford Boulevard

• Excellent restaurants

• World class hotel

• Easy access to major arteries and interstates

• 24-hour manned security control center

• Abundant covered parking

• On-site bankingWaterford Properties(405) 843-4900

Boulevard Plaza 33rd and Boulevard, Edmond

SQUARE FEET • REAL ESTATE - DEVELOPMENT LIST 23

24 SALES POINTS • November 2017

EMPLOYMENTSTATEWIDE August 2017 ...................... August 2016Labor Force 1,819,326 ............................1,823,438Employment 1,737,850 ............................1,731,928Unemployed 81,476 .................................91,510Unemployment rate 4.5% ................................... 5.0%Total Nonfarm jobs 1,669,000 ............................1,649,100Manufacturing jobs 131,000 ...............................127,500Services Producing jobs 1,409,400 ......................... 1,401,000Government jobs 353,900 ...............................353,900Trade, Trans. & Utilities jobs 301,000 ...............................307,000

OKC MSA August 2017Labor Force 669,604Employment 641,085Unemployed 28,519Unemployment rate 4.3%Unemployment rate (August 2016) 4.4%

TULSA MSA August 2017Labor Force 473,379Employment 449,958Unemployed 23,421Unemployment rate 4.9%Unemployment rate (August 2016) 5.4%

TOTAL RETAIL TRADEJune 2017 .......................... June 2016

Statewide $3,385,747,977 ............... $3,330,341,564 OKC MSA $1,115,575,014 ................ $1,190,520,385Tulsa MSA $838,221,939 ................. $858,064,397

BANKRUPTCIES2017 (Jan.-Sept.) ...............2016 (Jan.-Sept.)

Western District of OK Filings 3,975 ...................................4,001Northern District of OK Filings 1,953 ...................................1,811Eastern District of OK Filings 1,140 ...................................1,063

AIR TRAFFICWill Rogers World Airport2017 (Jan.-Sept.) ............2016 (Jan.-Sept.)Enplanements 1,431,976 ............................1,375,895Deplanements 1,435,542 ............................1,390,858Total Passengers 2,867,518 ............................2,766,753

Tulsa International Airport2017 (Jan.-Aug.).............2016 (Jan.-Aug.)Enplanements 937,782 ............................. 892,176

REAL ESTATEOKC Area Residential September 2017 ................September 2016Closed Listings 1,896 ...................................2,080Pending Listings 1,456 ...................................1,638Median Sale Price $165,000 .............................$156,450List Price to Selling Price 98% .................................... 98%Average Days on Market 54 ........................................57End-of-Month Inventory 8,179 ...................................8,305

Tulsa Area Residential September 2017 ................September 2016Closed Listings 1,187 ...................................1,313Pending Listings 1,242 ...................................1,170New Listings 1,997 ...................................2,054Median Sale Price $154,250 .............................$152,000Median % List Price to Selling Price98.55%............................... 98.62%Median Days on Market 26 ........................................27End-of-Month Inventory 5,974 ...................................5,301Months of Supply of Inventory 4.98 .....................................4.50

Sources: Oklahoma Employment Security Commission; The Center for Economic and Management Research at the University of Oklahoma’s Price College of Business; U.S. Bankruptcy Courts of Western, Northern and Eastern Districts of Oklahoma; Will Rogers World Airport; Tulsa International Airport; Oklahoma City Metropolitan Association of Realtors and Greater Tulsa Association of Realtors

SALES POINTS

HOW WE STACK UP.

405.840.1500 | Oklahoma City913.481.3200 | Tulsa

1905 Year Founded

148 Professionals

8.5M SF Management Portfolio

5.8M SF Properties Sold | Leased in '16

investments | brokerage | management

newmarklsb.com