SPECIAL SECTION - Joseph Sullivan

Transcript of SPECIAL SECTION - Joseph Sullivan

w w w . t e d m a g . c o m ◆ A U G U S T 2 0 0 1 ◆ T H E E L E C T R I C A L D I S T R I B U T O R 49

Disposing of your unprofitable customers

Learn to identify the businessrelationships that work to yourbenefit and get rid of the ones thatdon’t, by Joe Sullivan . . . . . . . . . .49

West Side Store

Design Mart condo bridges the gapbetween wholesale and retail, byMichael DeFilippo . . . . . . . . . . . . .52

Best of the Best Winners

Find out who the winners were inTED’s Best of the Best MarketingAwards . . . . . . . . . . . . . . . . . . . . . .55

TED’s Marketing Tools Guide

Check out this section to see whatmarketing tools manufacturers haveto help you sell . . . . . . . . . . . . . . . .60

Merchandising Tips

See what the experts say onimproving sales through bettermerchandising . . . . . . . . . . . . . . . .69

Web kiosksRetailers bring the Web into thestores . . . . . . . . . . . . . . . . . . . . . . . .72

SPECIAL SECTION

Disposing of yourunprofitable customers

Would it surprise you to learnthat electrical distributors allover the country are investing

time and money into serving markets thatdo not now—and never will—makedecent money for them? Would itsurprise you even more to learn that youmight be in danger of being one of thosedistributors? Just as surely as the old-fashioned general store passed intomemory, general distributors will find itharder and harder to make a go of it. Yetthere are plenty of opportunities to makemoney in this industry. It takes focus.However profitable you may be today, one

of the best business investments you canmake is the time and effort to identify themarkets you can serve most profitably,and clarify your approach, or valueproposition, to those markets.

As we discussed in an article in themarket planning issue of TED (July 2001),stripped to the basics, there are only threefundamental value propositions:◆ Convenience; ◆ Lowest delivered cost; ◆ High service/knowledge.

The convenience value propositionin electrical distribution offers customersrapid and easy access to the items they

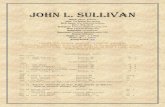

BY JOSEPH SULLIVAN

50 T H E E L E C T R I C A L D I S T R I B U T O R ◆ A U G U S T 2 0 0 1 ◆ w w w . t e d m a g . c o m

use the most, just as 7-11 does forcustomers who need milk, coffee ortoothpaste. Inventories are not deep andlocation is important. The conveniencemodel may involve job-site trailers ormobile sales units, and possibly kitting.

Lowest delivered cost is a valueproposition that requires buying powerand considerable logistical skill. It is themost difficult of the value propositions,especially for smaller distributors wholack economies of scale. Lowestdelivered cost includes features thatreduce the customer’s cost of purchasingor receiving including the as-yet-to-be-realized promise of both EDI and theInternet. Efficient warehousing, very lowerror rate shipping, and reduced paperordering and receiving can play a big rolein lowest delivered cost.

The high service/knowledge valueproposition, on the other hand, relies onvalue-added services to attract customersand develop bonds between them and thedistributor. The key to success in the highservice/knowledge value proposition is toprovide expertise not easily developed,on which customers will depend, andwhich is not sold primarily on price.

Show me the money

So fine—but how do you decide which isthe most profitable for you, not just now,but for the foreseeable future? Begin byclearing your mind of pre-set notions ofwhat it means to be a full-line distributor.The objective is to take a cool-eyed,analytical look at your present andpotential customer base, and see wherethe money is.

If you already have the ability todetermine profitability by customer, youare way ahead of the game, if theapproach is valid. Every brand of businesssystem is different. Some, with the best ofintentions, offer customer profitabilitycomputations based on algorithms thatreally do not do the job. They can be quitemisleading. Be sure that you know, indetail, exactly what computations arebeing done to generate the report.

If you do not have the built-incapability, try creating a custom report.Begin with gross profit, and add in suchspecific variable costs as you can identify.

At worst, you may be able to downloadvarious bits of the data you need andcreate your reports using a spreadsheetand a database program, such asMicrosoft Excel and Microsoft Access. Ineither case, beware of averaging of costs,and be especially worried about allocationof fixed overhead. Tip: Contributionanalysis based on variable costs andreasonable assignment of certain fixedpersonnel costs (like inside sales), is almostalways more meaningful than profitabilityanalysis based on full allocation.

Once you have developed or verified aprofitability/contribution report, tryrunning what we call a Pareto ranking—that is, most to least—of your accountsby profitability. If you already haveaccounts identified in the computer bytype, such as industrial, commercialMRO, residential contractor and the like,so much the better. If not, look intocreating such categories. Run your Paretoranking within each category, and ask thecomputer to also give you a summaryprofitability figure for each.

Watch for patterns

When you eyeball the finished report,look for patterns among all categories,and within each of them. Those mostprofitable categories/customers at the topof the report—why are they there? Whatmakes them more profitable for you thanthe others? How about the ones at thebottom? What is different about them?Look also at the spread—how muchmore profitable are the most than theleast? If the spread is big, it mightsimplify decision-making. On the otherhand, if all your customers are within acouple of points of one another, thepatterns are harder to see. You also—but

to a much lesser extent—care aboutvolume. If you are getting 30% marginsin hospitality lighting, but only have onesmall customer, what does that tell you?

Take notes

Make notes of your observations, anddevelop an overall idea of the who’s andwhy’s of customer profitability. Forexample, you might decide somethinglike this: “We tend to have good salesvolume, and make good money withmedium-sized residential and commercialmaintenance contractors, and in ourcommercial and hospitality lightingbusiness. We get good sales volume inthe commercial construction business, butthe profits are low. Our industrial MRObusiness is nicely profitable, but thevolume is low. Our big commercial andsmall residential contractor businesses donot make much money at all.”

Show the reports and your findings toother people in your organization. Askthem for their observations. Ask if youare missing anything. You might learnthat some apparently profitable customersuse a lot of unallocated management andpurchasing department time, are slowpaying, or are always asking for returnauthorizations. You might learn thatcustomers with certain profiles are muchhigher credit risks than others, or that youhave two or three extra people in thecredit department just to handle all thejob filings and related issues. All of thesekinds of information must be taken intoaccount. Try to fit the resulting conceptinto the framework of the three funda-mental value propositions.

Good business profile

With everything in the mix, your “goodbusiness” profile might change a bit.Continuing the example above, youmight now find that: “We tend to havegood sales volume, and make goodmoney with medium-sized residential andcommercial maintenance contractors, andin our commercial and hospitalitylighting business, because we know andstock the items most frequently used byour customers, and have locations that areclose to their operations. We sell to themon a day-to-day basis, and will special

If sales go down and profits goup you are simply seeing

incontrovertible evidence thatsome of your customers were

not good for you.

w w w . t e d m a g . c o m ◆ A U G U S T 2 0 0 1 ◆ T H E E L E C T R I C A L D I S T R I B U T O R 51

order parts as needed. This particularcustomer profile tends to have and keepgood credit ratings and be reasonable inits demands for service. Our smallnumber of industrial MRO customers fit asimilar pattern, in that they buy their day-to-day needs from our nearby counter.We do not get their project business,however, because we lack the technicalsupport staff, expertise and lines. We getgood sales volume in the commercialconstruction business, but the margins arelow, because of the intense competitivelybid nature of the business. Furthermore,we do not process volumes of big-jobcorrespondence very well. This leads toexpensive errors and issues. Despitedecent margins, our small residentialcontractor business does not make muchmoney at all, due to the cost of handling.It also involves higher credit risk.”

A profile like this one fits prettysquarely into the convenience valueproposition. Customers come in becauseyou are reliably providing most of thestuff they need at convenient locations.You do not have high-tech lines orexperts, and you do not handle the low-margin/high-volume commodity businessespecially well.

Now it is time to work up a businessplan that plays to your strengths.Convenience has a value, and your targetmarket is credit-worthy contractors andMRO buyers who are willing to pay areasonable price for it. Some actions youmight consider if you had a profile likethe one in the example are:

• Using DUNS data or some othersource, develop a marketing databaseof prospects in your coverage area who fitthe profile of your better customers, andfocus sales efforts on those prospects;

• Re-profile your inventory to morespecifically meet the needs of profitablecustomers, and don’t worry aboutkeeping stock for those who do not makeyou money;

• Through customer feedback,explore the use of mobile sales vehicles,jobsite trailers, kitting, and other low-rentways to make it easy for them to buyfrom you—at good margins;

• Raise your floor gross marginpercentage on bid business;

• Using an artfully managed pricingmatrix, raise the prices for risky or high-handling-cost customers;

• Tighten up your credit standards;• Pull out of the big-project business.

With a different profile, you wouldbuild a different business plan. Forexample, if you made good money in thecommercial/hospitality lighting business,but always got beaten up by contractors,you might develop deep expertise inlamps and fixtures, and specialize in thatwhile cutting back severely on yourcontractor business. If you were an Allen-Bradley house with other complementarylines and a staff of specialists, you might

do best to focus on the industrial marketsand sell training and expertise as well asparts. One distributor on the East Coasthas a remarkably profitable niche in partsfor municipal overhead trolley cars. It isnot his whole business, by far, but it is agood example of niche identification.

You only stand to gain by marketanalysis and focus. What you will gain isprofit, the ultimate business scorecard.You might actually (but certainly notnecessarily) lose sales, but who cares. Ifsales go down and profits go up you aresimply seeing incontrovertible evidencethat some of your customers were notgood for you. They needed to go. Cry allthe way to the bank. ◆

Joe Sullivan is president of Joseph SullivanLLC & Associates, which helps electricaldistributors build top performance, plan forthe future, and buy and sell companies andbranches. He can be reached at 972-463-1125 or at [email protected].

Circle 116 on Direct Info Card

Now it is time to work up a business plan that plays

to your strengths.