Sourcing Bank Finance For Your Business Warren Power Bank of Ireland [email protected] 12th...

-

Upload

felicity-blanche-hutchinson -

Category

Documents

-

view

218 -

download

0

Transcript of Sourcing Bank Finance For Your Business Warren Power Bank of Ireland [email protected] 12th...

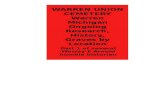

Sourcing Bank Finance For Your Business

Warren PowerBank of Ireland

12th September

Bank of Ireland is committed to lending to Small and Medium Sized Enterprises

In 2013, BoI approved €4bn in new and increased lending for SMEs and Farmers. This figure does not include restructures

H1 2014, 32,000 SME credit applications approved, up 7% year on year

We continue to approve in excess of 85% of all applications received

BOI providing over 50% of non-property SME lending in the market

Over 500 businesses and farmers p/w drew down credit with us in 2013

Content – Key Elements

1.The Business Plan 2.Credit Applications 3.Financials and Repayment Capacity

Purpose and Use Content

Key Questions - Promoter & Purpose Information Required and why

4.Security

Why it is needed Types of Security

5.The Decision and Appeals Process

Appeal Credit Review Office

6.Government SME Credit Initiatives

Government Initiatives

• Credit Guarantee Scheme

• Credit Review Office

Balance Sheet Profit and Loss Account Cashflow Statement Cashflow Forecast Working Capital Projections Calculation

1. Business Plan – Content

What Constitutes a good Business Plan?

Your Business Plan should contain the following sections: – Background and description of the business – Management and organisational structure – Market research and marketing plan – Channels of distribution and Sales Management – Operations plan – Financial plan

Points to note: – Business plans need to be realistic not overly optimistic – What If? ……….Sensitivity Analysis and Plan B

2. Credit Application Key Questions Promoter and Purpose

Background, experience, skillset of promoter

What is the purpose of the loan?

How much is required?

For how long is the facility required?

Owners’ cash input into the proposal

What asset is being financed?

What type of repayment schedule is required?

What is the source of the repayments?

Is the facility secured on the asset being financed?

What are the key market assumptions – based on the business plan?

2. Credit Application – Information Required

Financial information required by the bank:

Up to date Financial and Management Accounts

Cashflow forecast and working capital requirements

Financial projections

Confirmation of current tax status

Personal ‘Statement Of Affairs’ – which sets out the financial position of the owner

Any other financial information deemed necessary to that particular application

2. Why we seek financial information

Primary focus when analysing financial statements is to establish if repayment capacity exists at present and is likely to exist throughout the period of the borrowings

It helps to quantify the level of risk attaching to existing or proposed borrowings

While not the sole indicator of future performance we will review historic financial and trading figures as part of the application

We also seek financial forecasts to identify future revenue streams

What we are really assessing is the business’s ability to service the debt and ability to do so over the term of the loan

Stress testing will reflect the robustness of the business repayment capacity against future increases in interest rates

3.Financials and Repayment Capacity - Calculation

Profit before Tax 45,000

Plus:+ Depreciation 6,000+ Lease Interest Payments (from P & L) 2,000+ Bank Interest 4,000+ Non Recurring Expenses 10,000

Less: 67,000- Non Recurring Income -- Less Grant Amortisation -= Cash generated 67,000

Less:- Total Loan Repayments (current & proposed) 12,000- Overdraft/Stocking term loan interest 2,000- Leasing Payments (for the coming year) 10,000- Tax 8,000- Drawings/dividends (NB does the drawings figure include tax) 20,000

Amount (€)

Funds available to service debt 15,000

4. Security – Why is it required?

Bank takes security to mitigate risk but the most important question is whether the customer can repay the loan

Level of security dependent upon:

– Extent of the exposure

– Type of facility provided

– Term of facility

– Borrower’s own cash input

– Bank’s evaluation of the level of risk involved

4. Security – Types

Main Security Types:

– Personal Letters of Guarantee for Limited Company debt – demonstrates owners’ commitment

– Life Policy

– Debentures – Floating & Fixed

– Lien on Deposits

– Land – Fixed Legal Charge

– Charge on Debtors e.g. invoice discounting

– Asset as Security e.g. leasing

5. The Decision & Appeals Process – Appeal

We aim to have a decision within 3 working days of an application

If you are unhappy with the decision you can ask for the application to be reviewed and appealed on your behalf with any additional information which may not have been included at the original application submission (internal appeals process).

If the decline decision is upheld you should receive a letter outlining the reason(s) for the decline and advising you of your right to contact the Credit Review Office

The Credit Review Office was established to offer independent advice and arbitration to borrowers who have had their request for credit turned down by one of the two pillar banks. Businesses who have applied for credit facilities – (Minimum €1k up to a maximum of €3m). See www.creditreview.ie for eligibility criteria

A declined credit application does not negatively affect your or your company’s credit rating

6. Government Initiatives – the details

Credit Guarantee Scheme - The purpose of the scheme is to encourage additional lending to SMEs, not to substitute for conventional lending that will otherwise have taken place. Eligibility criteria: Viable SMEs that can demonstrate repayment capacity, but which do not fully meet the Bank’s credit policy and have been declined due to either:

- Insufficient security for the new/increased lending, or- Aspects of the SME sector, target market or business model which are deemed to be high risk under the Bank’s lending criteria

An annual 2% premium is paid to the Government by the borrower for availing of the scheme

13

Credit Review OfficeThe Credit Review Office was set up to ensure credit is not refused to viable businesses with valid propositionsCustomers must fully exhaust the Bank’s internal appeals process prior to invoking the CROQualifying customers, who have had their application for credit (or restructure of facilities) declined, reduced or are not happy with the terms of sanction, have a right to appeal the decision to the CRO.The CRO will undertake an independent and impartial re-evaluation of the bank’s decisionThe qualifying threshold for SMEs applying for a review by the CRO has increased to €3m (per transaction) since October 2013.The CRO has no regulatory or statutory powers to override the banks lending decisionThe CRO review process will provide an independent opinion on the lending decision with either an endorsement of the original outcome or a recommendation to overturn it and provide the fundsMore information is available at www.cro.ie

6. Government Initiatives – the details

Bank of Ireland and Your Business

The Next Steps: Talk to us – arrange a meeting one to one We want to develop a long term banking relationship with you We have a full range of business support services available to your business

and will ensure that all of your needs are met We want to provide all viable businesses with suitable credit facilities –

adequate funding is available to support all viable and sustainable businesses

We are committed to supporting customers in or facing financial difficulty

We are here to support your business and build relationships now and for the future

Disclaimer

This document has been prepared by Bank of Ireland Business Banking for informational purposes only. Not to be reproduced without prior permission. Any information contained herein is believed by the Bank to be accurate and true but the Bank expresses no representation or warranty of such accuracy and accepts no responsibility whatsoever for any loss or damage caused by any act or omission taken as a result of the information contained in this document. Unless specifically stated otherwise, no prices or rates mentioned are bids or offers by the Bank to purchase or sell any currencies, securities or financial instruments. Except as otherwise may be specifically agreed, the Bank has not acted nor will act as a fiduciary or financial or investment adviser with respect to any derivative transaction that it has or will execute. Any investment, trading and hedging decision of a party will be based on its own judgement and not upon any view expressed by the Bank and shall be based on an arms length negotiation with the Bank. You should obtain independent legal advice before making any investment decision.

For information on applying visit:http://businessbanking.bankofireland.com/To arrange an appointment contact:Warren Power, Business Banking, 2 College Green, Dublin 2Email: [email protected]