Solutions for Taxing Times - MassMutual · New marginal tax rate of 39.6% 4.6% tax increase on the...

Transcript of Solutions for Taxing Times - MassMutual · New marginal tax rate of 39.6% 4.6% tax increase on the...

Needs-based Strategies

FOR FINANCIAL INTERMEDIARIES ONLY. NOT FOR USE WITH PLAN SPONSORS OR PARTICIPANTS.

Solutions for Taxing TimesHelp business owners help themselves with non-traditional retirement plan designs

Retirement Strategies

A Retirement Strategy Guide for Financial Advisors

Updated for 2014

FOR FINANCIAL INTERMEDIARIES ONLY. NOT FOR USE WITH PLAN SPONSORS OR PARTICIPANTS.

Rising Taxes.

Rising Costs.

Revenue Threats.

Healthcare Reform.

Operational Concerns.

Protecting and Growing Assets.

Business owners are in a

precarious position.

1

Taxing new challenges call for non-traditional solutions

1 US Trust, Insights on Wealth and Worth, 2012.

Get started: Get educated

Our core brochure helps clients and prospects better understand how they can protect – and even grow – their assets in this challenging tax environment.

Needs-based Strategies

FOR USE WITH PLAN SPONSORS ONLY

Solutions for Taxing TimesTake control with a non-traditional retirement plan design

Retirement Strategies

A Retirement Strategy Guide for Plan Sponsors

Updated for 2014

“Solutions for Taxing Times” Plan sponsor brochure RS2047

In 2013, new taxes were introduced that pose ongoing threats to asset accumulation and protection for business owners.

Many are confused about what these tax laws mean

to them and what potential solutions are available.

That’s where you and qualified retirement plans come

in. Using advanced retirement plan designs, you may be

able to help successful business owners reduce their

current taxable income.

Why act now?

• It’s timely. Many business owners face a quarterly

tax bill and have already felt the additional pain in

2013. They are looking for relief now.

• You know these people. Many of them are

your clients today and many others are in

your territory.

• Your solutions may help you keep clients you already

have and possibly generate new opportunities.

• We’ll make it easy to get educated, access plan

design experts, and identify opportunities for

client retention and the growth of your business.

FOR FINANCIAL INTERMEDIARIES ONLY. NOT FOR USE WITH PLAN SPONSORS OR PARTICIPANTS.

27% of high net worth individuals have no one advising them on

investment strategies.1

2 FOR FINANCIAL INTERMEDIARIES ONLY. NOT FOR USE WITH PLAN SPONSORS OR PARTICIPANTS.

Source: irs.gov, The American Taxpayer Relief Act , Patient Protection and Affordable Care Act.

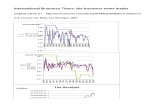

Scaling the fiscal cliffThis chart outlines some of the tax law changes that were introduced in 2013 and underscores the cumulative effect of these taxes at rising income levels. The impact to your clients and prospects may vary depending upon their particular situations.

Cum

ulat

ive

Effe

ct

Income level: $406,750 (tax filing status: single) $457,600 (tax filing status: married filing jointly) includes taxes applicable to all income levels below, plus

Talking point: Tax Component Impact

In 2013, the top tax rate returned to 39.6% from 35% and the capital gains tax rate returned to 20% from 15%.

New marginal tax rate of 39.6% 4.6% tax increase on the top rate of adjusted modified income in excess of the $406,750/$457,600 threshold

Capital gains and qualified dividends maximum rate increased to 20%

5% tax increase on investment income from outside of a qualified retirement plan

Income level: $254,200 (tax filing status: single) $305,050 (tax filing status: married filing jointly) includes taxes applicable to all income levels below, plus

Talking point: Tax Component Impact

Currently, popular deductions with limits include mortgage interest, property taxes, and medical expenses.

Deduction limitations Some itemized tax deductions are now limited; also impacts standard deductions

Personal exemption phaseout The total dollar amount allowed for exemptions begins phasing out for dependents such as qualifying children

Income level: $200,000 (tax filing status: single) $250,000 (tax filing status: married filing jointly) includes taxes applicable to the income level below, plus

Talking point: Tax Component Impact

These taxes, first introduced in 2013, are aimed at both earned and investment income.

Additional Medicare tax New 0.9% tax on earned income on amounts in excess of the $200,000/$250,000 threshold

Net Investment income tax New 3.8% tax imposed on investment income such as capital gains, dividends and interest

Earned income of all levels:

Talking point: Tax Component Impact

In 2013, the employee portion of Social Security taxes returned to 6.2% from 4.2% on wages up to the first $117,0001.

Social Security tax holiday ends 2% increase in payroll taxes up to $117,0001

This chart reflects updated figures for 2014

1 May be subject to annual wage base limit changes.

3

Think tax-deferred qualified plans

Dr. Pat Smith, M.D.

Age: 45 Tax Status: Married filing jointly, 1 child Self-Employment Income: $500,0001

Single Employer, No Employees

In this hypothetical illustration2, Dr. Pat Smith is an affluent business owner. The chart below shows the impact of some of the tax law changes that were introduced in 2013 and the benefits of contributing the maximum allowable amount into a qualified retirement plan.

FOR FINANCIAL INTERMEDIARIES ONLY. NOT FOR USE WITH PLAN SPONSORS OR PARTICIPANTS.

1 Assumes one-income household, self-employment income of $500,000 prior to any contributions to a qualifying tax-deferred retirement plan 2 The hypothetical illustration is not intended to provide tax, accounting or legal advice. As with all matters of a tax and legal nature, clients should consult their

tax or legal counsel for advice. The illustration is not intended to reflect the actual performance of any specific investment. Individual experience will likely vary. 3 Earned income is based on wages, salaries, tips, and other taxable employee and self-employment income 4 Based on standard deductions and exemptions including income-based phaseout rules introduced in 2013 5 Based on standard deduction limitation of 3% of adjusted gross income in excess of IRS stated income thresholds and personal exemption phased out, as

introduced in 2013

This hypothetical illustration covers tax impacts to Dr. Smith’s household income

2014

Earned income3 Without a qualifying plan contribution

With a qualifying plan contribution ($52,000)

Taxable self-employment income $500,000 $448,000

Social Security tax on self-employment income

$14,508 (12.4% on first $117,000)

same

Medicare tax on self-employment income

$14,500 (2.9% rate)

$12,992 (decrease of $1,508) (2.9% rate)

Additional Medicare tax on self-employment income

$2,016 (0.9% above $250,000)

$1,555 (decrease of $461) (0.9% above $250,000)

Income tax and AMT on self-employment income4

$134,479 (39.6% rate)

$115,765 (decrease of $18,714)

(35% rate)

Total federal taxes on self-employment income

$165,5035 $144,8205

Reduction in current taxes on self-employment income by implementing a qualifying plan: $20,683 (12.5%)

Bottom line: $20,683 (12.5%) savings

by using the power of a tax-deferred qualified plan

4 FOR FINANCIAL INTERMEDIARIES ONLY. NOT FOR USE WITH PLAN SPONSORS OR PARTICIPANTS.

Make your point with a tax-deferred advanced plan design illustration

Generate a targeted list of clients and prospects who need you

Four ways to start providing a solution for your clients right now

Tap into MassMutual’s network of local third party administrators (TPAs) to create a custom plan design illustration

for your client or prospect, often for little or no expense. Advanced retirement plan designs can be structured to

allow business owners to contribute a larger percentage of eligible compensation.1

Put MassMutual’s CUSTOMCONSUlTANT to work generating new opportunities

for you. Within seconds, our pre-set Larkspur queries can identify businesses in

your territory that may benefit from a discussion about advanced plan designs.

There are no plan or minimum asset requirements and the service is free.

1. Visit MassMutual’s advisor website and log in.2

2. Click “Larkspur Data Lead Generator”

to generate a list of local prospects such as:

– Businesses without an advanced plan design

– Plans with an existing advanced plan design

Plan Type Benefit Consideration

Integrated Allocation

A defined contribution plan with an allocation formula based on a Social Security taxable wage which allows for larger contributions for highly compensated business owner(s)/partner(s).

The ability to weight contributions towards higher compensated employees is more limited than in other advanced plan designs.

New Comparability Allocation

A defined contribution plan that provides business owner(s)/partner(s) the flexibility to provide larger contributions to preferred groups of employees based on business classifications (typically owners and/or highly compensated individuals).

A business owner needs to consider the number of employees and whether enough benefits can be weighted to the owner(s)/partner(s) to justify the added administrative costs of this type of plan.

Cash Balance /Defined Benefit

A defined benefit plan can be designed to allow business owner (s)/partner(s) to weight plan benefit towards themselves1, potentially realize significant business tax deductions and accelerate their accumulation potential. A Cash Balance defined benefit plan may allow a business owner to contribute significantly more than a traditional defined contribution plan.

A business owner needs to consider the company’s profit history and whether the business can meet its annual mandatory employer funding requirement. In addition, the sponsor must consider its responsibility to achieve the stated investment return as defined in the plan document.

1 Based on the design, Cash Balance plans can allow the business to provide larger contributions to fund a hypothetical benefit for preferred groups of employees based on business classification. Plan sponsors should consider the implications to all participants before choosing an advanced plan structure.

2 You must be registered to access MassMutual’s custom queries through larkspur. May be subject to Broker/Dealer firm approval.

“A customized roadmap to prospecting and client retention” CUSTOMCONSUlTANT RS1696

Simple. Specific. Insightful.

An Instruction Guide for Financial Professionals

FOR FINANCIAL INTERMEDIARIES ONLY. NOT FOR USE WITH PLAN SPONSORS OR PLAN PARTICIPANTS.

CUSTOMCONSULTANT:A solution for prospecting and client retention

5FOR FINANCIAL INTERMEDIARIES ONLY. NOT FOR USE WITH PLAN SPONSORS OR PARTICIPANTS.

Show sponsors how to estimate their business tax savings and personal account balance

Engage centers of influence

MassMutual’s Impact Calculator1 helps

business owners instantly estimate

their annual tax savings and projected

retirement account balance, based on

actual or hypothetical scenarios. This

can be a great tool for showing your

clients and prospects how they can

work toward protecting their assets.

Connect with the business community and other experts who serve it.

These influencers have direct access to the business owners you want

to reach and can offer expertise that makes your job easier. They also

may be a rich source of referrals.

• Connect with the experts. Certified Public Accountants (CPAs)

and TPAs can be important conduits to business owners and

partners of professional practices.

• Maximize networking opportunities with groups such as Chambers

of Commerce, Rotary Clubs, and other business exchanges.

1 May be subject to Broker/Dealer firm approval.

Call our Retirement Sales Desk at 1-800-874-2502, option 4 for more information on this program and to order copies of these materials.

Business owners can view potential benefits from both a business and individual perspective.

“Solutions for Taxing Times” Impact Calculator RS1609

Business Owner (front)

Business tax savings

Individual (back)

Retirement savings

accumulation

©2014 Massachusetts Mutual Life Insurance Company, Springfield, MA 01111. All rights reserved. www.massmutual.com. MassMutual Financial Group is a marketing name for Massachusetts Mutual Life Insurance Company (MassMutual) [of which Retirement Services is a division] and its affiliated companies and sales representatives.

©2014 Massachusetts Mutual Life Insurance Company, Springfield, MA 01111. All rights reserved. www.massmutual.com. MassMutual Financial Group is a marketing name for Massachusetts Mutual Life Insurance Company (MassMutual) [of which Retirement Services is a division] and its affiliated companies and sales representatives.

RS1610 214 C:31813-00

* Assumes hypothetical 6% interest rate, compounded annually, with contribution made at year-end.

Cash Balance plan designs are complex and require the assistance of your financial professional and third-party administrator. Additionally, Cash Balance plans require annual employer funding and they may not be suitable for some businesses. MassMutual materials highlight Cash Balance plan advantages, but certain restrictions and limitations will apply based on plan design and retirement plan rules, among other factors. These restrictions and limitations may affect tax deductions, funding levels and distribution of plan benefits.

What’s the impact to my business?

Employer’s contribution made to the plan on behalf of employees, including you.

Sponsoring a retirement plan may help reduce the amount of money you pay in taxes each year and may provide additional flexibility to address other financial priorities for your business, including:

• Funding for other employee benefits, such as medical, health care and disability coverage

• New marketing initiatives focused on growing your client base

• Technology to improve business efficiency

Ask your financial professional or your third party administrator for additional information, including an illustration customized to your plan.

* This amount does NOT include any employee salary deferral contributions to the plan, if applicable.

This information is written in connection with the promotion of marketing of the matter(s) addressed in this material. It is not intended or written as specific legal or tax advice and may not be relied on for purposes of avoiding any federal tax penalties. Neither MassMutual nor any of its employees or representatives are authorized to give legal or tax advice. You must rely on the advice of your own independent tax counsel.Many tax planning strategies emphasize the deferral of current income taxes, on the basis that your federal income tax rate may be lower at retirement. Please keep in mind that federal income tax rates are unpredictable and may be higher when you take a distribution than at the time of deferral. Other factors, including state tax rates and your income, may also affect your overall tax rate upon distribution. Please consult with your tax advisor for individual tax planning strategy and advice. MassMutual does not predict or in any way guarantee favorable tax results.

Choose your hypothetical Annual Plan Contribution

View your Projected Account Balance based on your Years to Retirement*1 2

What’s the impact to me?

Your personal contribution to the retirement plan.

The following illustrations are based on a defined contribution plan and assume a maximum annual contribution amount of $52,000 (based on IRS limits for 2014 and indexed thereafter; limits may change annually). The specific retirement plan design and nondiscrimination rules may limit the actual contribution.

In addition, other plan designs, such as Cash Balance, may provide opportunities for accelerating retirement plan savings and accumulation beyond that of a standard defined contribution plan.

Talk with your financial professional about the retirement plan design structure that may be right for your business.

Future value of annual contribution

Years to retirement: 5 10 15 20 25 30

Annual contribution:

Choose the hypothetical Annual Plan Contribution the business will make on behalf of all employees.*

1View the potential Annual Tax Savings, depending on your Anticipated Business Tax Rate.

2

Annual tax savingsAnnual

contribution: Tax rate: 15% 25% 28% 33% 39.6%

FOR PLAN SPONSOR USE ONLY. NOT FOR USE WITH PLAN PARTICIPANTS.

ovals part of diecut to reveal

numbers in slider INSERT file that

is 3.6875x8.5

Calculator FINISHED SIZE is 3.75 x 8.5

gluefoldfold

©2014 Massachusetts Mutual Life Insurance Company, Springfield, MA 01111. All rights reserved. www.massmutual.com. MassMutual Financial Group is a marketing name for Massachusetts Mutual Life Insurance Company (MassMutual) [of which Retirement Services is a division] and its affiliated companies and sales representatives.

©2014 Massachusetts Mutual Life Insurance Company, Springfield, MA 01111. All rights reserved. www.massmutual.com. MassMutual Financial Group is a marketing name for Massachusetts Mutual Life Insurance Company (MassMutual) [of which Retirement Services is a division] and its affiliated companies and sales representatives.

RS1610 214 C:31813-00

* Assumes hypothetical 6% interest rate, compounded annually, with contribution made at year-end.

Cash Balance plan designs are complex and require the assistance of your financial professional and third-party administrator. Additionally, Cash Balance plans require annual employer funding and they may not be suitable for some businesses. MassMutual materials highlight Cash Balance plan advantages, but certain restrictions and limitations will apply based on plan design and retirement plan rules, among other factors. These restrictions and limitations may affect tax deductions, funding levels and distribution of plan benefits.

What’s the impact to my business?

Employer’s contribution made to the plan on behalf of employees, including you.

Sponsoring a retirement plan may help reduce the amount of money you pay in taxes each year and may provide additional flexibility to address other financial priorities for your business, including:

• Funding for other employee benefits, such as medical, health care and disability coverage

• New marketing initiatives focused on growing your client base

• Technology to improve business efficiency

Ask your financial professional or your third party administrator for additional information, including an illustration customized to your plan.

* This amount does NOT include any employee salary deferral contributions to the plan, if applicable.

This information is written in connection with the promotion of marketing of the matter(s) addressed in this material. It is not intended or written as specific legal or tax advice and may not be relied on for purposes of avoiding any federal tax penalties. Neither MassMutual nor any of its employees or representatives are authorized to give legal or tax advice. You must rely on the advice of your own independent tax counsel.Many tax planning strategies emphasize the deferral of current income taxes, on the basis that your federal income tax rate may be lower at retirement. Please keep in mind that federal income tax rates are unpredictable and may be higher when you take a distribution than at the time of deferral. Other factors, including state tax rates and your income, may also affect your overall tax rate upon distribution. Please consult with your tax advisor for individual tax planning strategy and advice. MassMutual does not predict or in any way guarantee favorable tax results.

Choose your hypothetical Annual Plan Contribution

View your Projected Account Balance based on your Years to Retirement*1 2

What’s the impact to me?

Your personal contribution to the retirement plan.

The following illustrations are based on a defined contribution plan and assume a maximum annual contribution amount of $52,000 (based on IRS limits for 2014 and indexed thereafter; limits may change annually). The specific retirement plan design and nondiscrimination rules may limit the actual contribution.

In addition, other plan designs, such as Cash Balance, may provide opportunities for accelerating retirement plan savings and accumulation beyond that of a standard defined contribution plan.

Talk with your financial professional about the retirement plan design structure that may be right for your business.

Future value of annual contribution

Years to retirement: 5 10 15 20 25 30

Annual contribution:

Choose the hypothetical Annual Plan Contribution the business will make on behalf of all employees.*

1View the potential Annual Tax Savings, depending on your Anticipated Business Tax Rate.

2

Annual tax savingsAnnual

contribution: Tax rate: 15% 25% 28% 33% 39.6%

FOR PLAN SPONSOR USE ONLY. NOT FOR USE WITH PLAN PARTICIPANTS.

ovals part of diecut to reveal

numbers in slider INSERT file that

is 3.6875x8.5

Calculator FINISHED SIZE is 3.75 x 8.5

gluefoldfold

FOR FINANCIAL INTERMEDIARIES ONLY. NOT FOR USE WITH PLAN SPONSORS OR PARTICIPANTS.

©2014 Massachusetts Mutual life Insurance Company, Springfield, MA 01111. All rights reserved. www.massmutual.com. MassMutual Financial Group is a marketing name for Massachusetts Mutual life Insurance Company (MassMutual) [of which Retirement Services is a division] and its affiliated companies and sales representatives.

RS1606 314 C:31936-01

This information is written in connection with the promotion or marketing of the matter(s) addressed in this material. It is not intended or written as specific legal or tax advice and may not be relied on for purposes of avoiding any federal tax penalties. Neither MassMutual nor any of its employees or representatives are authorized to give legal or tax advice. You must rely on the advice of your own independent tax counsel.

Cash Balance plan designs are complex and require the assistance of legal and tax advisors and third party administrators. Additionally, Cash Balance plans, like defined benefit plans, generally require annual employer funding and they may not be suitable for some businesses. MassMutual’s materials highlight Cash Balance plan advantages, but certain restrictions and limitations will apply based on plan design and retirement plan rules, among other factors, which may affect tax deductions, funding levels and distributions of plan benefits. For a more complete picture of Cash Balance plans, please contact MassMutual at 1-800-874-2502, option 4.

Many tax planning strategies emphasize the deferral of current income taxes on the basis that your federal income tax rate may be lower at retirement. Please keep in mind that federal income tax rates are unpredictable and may be higher when you take a distribution than at the time of deferral. Other factors, including state tax rates and your income, may also affect your overall tax rate upon distribution. MassMutual does not predict or in any way guarantee favorable tax results.

MassMutual. We’ll help you get there.®