Sensitivity and Scenario Analysis

description

Transcript of Sensitivity and Scenario Analysis

Sensitivity and Scenario Analysis

Financial Modeling

Any model we use has the potential to have errorHow do we account for the uncertainty associated with our inputs into the model?

Three Types of Risk

Stand Alone RiskViews project in isolationWith-in firm (Corporate Risk)Looks at the firms portfolio of projects and how they interactMarket RiskRisk from the view of a well diversified investor.

Definitions

RiskExposure to a chance of injury or lossProbabilityThe likelihood an event occursRisk vs. UncertaintyRisk – the probability of the outcome is knownUncertainty – includes judgment concerning

the probability

Definitions and Terms Continued

Objective Prob –can measure prob. preciselySubjective Prob. – Includes judgment or opinionVariation Risk – We want to look at a range of possible outcomes

Issues in Risk Measurement

1. Stand Alone Risk is the easiest to measure2. Market Risk is the most important to the

shareholder3. To evaluate risk you need three things

i. Standard deviation of the projects forecasted returns

ii. Correlation of the projects forecasted returns with the firms other assets

iii. Correlation of the projects forecasted returns with the market

Issues in Risk Management con’t

4. Using the numbers in 3) you can find the corporate beta and market beta coefficient (equal to ((

5. ost projects have a + correlation with other projects and a coefficient < 1

6. Most projects are positively correlated with the market with coefficient < 1

7. Corporate risk should also be examined1. More important to small business2. Investors may look at things other than market risk3. Firm Stability is important to creditors, suppliers etc

Stand Alone Risk (Review)

The easiest approach to measuring stand alone risk is to use the standard deviation of the projects returns.Just like security analysis you need to be careful looking at only standard deviation – don’t forget coefficient of variation

Measuring Stand Alone Risk

Sensitivity Analysis

Scenario Analysis

Monte Carlo Simulation

Sensitivity Analysis

Looks at the change in your decision variable when one input changes. Examples:

what happens to the value of a project if sales are 10% higher than expected.What happens to the cost of capital if the risk free rate increases.

Example 1

Basic time value of money problem.Assume you believe you need 2,000,000 when you retire and you are now 25 years old. How much will you need to deposit each year at the end of the year if your account earns 8% each year?

$27,357.56

Example 1 Change ONLY Expected return

What if your estimated rate of return is of by 10% of the base (What if your account earns 8.8% each year? Or 7.2% each year)?

Rate Payment

7.2% $24,322.44

8% $27,357.56

8.8% $30,724.44

Example 2: change ONLYAmount Needed for Retirement

Now assume that the amount you need for retiremetn may be off either way by 10%

Savings Needed Payment

1,800,000 $24,621.80

2,000,000 $27,357.56

2,200,000 $30,093.31

Sensitivity Analysis

Usually the results are represented in a table where the response of the decision variable to changes in more than one individual variable are reported.Then you can compare across variables to see which one has the largest impact on your decision

Example Results

Change in Payment needed for Retirement

Savings Needed Expected Return

+10% $24,621.80 $24322.44

Base $27,357.56 $27,357.56

-10% $30,093.31 $30,724.49

Sensitivity Analysis

Benefitsa. Easy to Calculate and Understandb. Measures risk associated with individual

inputsWeaknesses

a. Ignores probability of eventb. Ignores interaction among the variablesc. Ignores gains from diversification

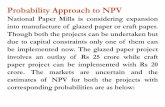

Scenario Analysis

Differences from Sensitivity AnalysisAllows you to change more than one variable at a timeLook at a group of scenarios (best case, base case, and worst case) for example worst case – what if all variables change against us by 20%….Includes probability estimates of each scenario

Scenario Analysis

Now let both the future cash flows and the cost of capital change. Worst Case Scenario Best Case Scenario

(SavingsReturn) (SavingsReturn)

Need $2,200,000 Need $1,800,000

Return = 7.2% Return = 8.8% PMT = 33,796.89 PMT = $21,890.20

Scenario Analysis

Given the NPV and Probability you can find the expected NPV and standard deviation

Scenario NPV Prob. NPV(Prob)Worst $33,796.89 .33 $11,265.63 Base $27357.56 .33 $ 9,119.17Best $21,890.20 .33 $ 7,296.73 Expected NPV $27,681.55

Standard Deviation $ 5,959.95

Interpreting the Results

The project has an expected return on 4204.94 with standard deviation of 741.38This implies a 68 % confidence interval of (3463.56 to 4946.32) a large range of possible outcomesThe coefficient of variation would be .1763 (you are accepting .1763 units of risk for each unit of return)

Scenario Analysis

Benefits1. More than one variable changes at a time2. Accounts for probability3. Easy to perform

Weaknesses1. Small number of scenarios is unrealistic2. Probability distributions difficult to

estimate

Monte Carlo Simulation

A more advanced form of scenario analysisUtilizes the computer to make random choices for each variable input then calculate the expected return and standard deviation

Mont Carlo Simulation

1. Construct a model of the firms cash flows and NPV’s

2. Specify a probability distribution for each uncertain variable (characterized by mean and standard dev) and correlation among variables.

3. Allow computer to select a random draw form the distribution for each variable

4. Calculate NPV (this is one scenario).5. Repeat 3) an 4) (10,000 or 100,000 times)

equal chance of each scenario –Calculate expected NPV and standard deviation.

Monte Carlo Simulation

Benefits1. More realistic selection of variables2. Easy to understand results

Weaknesses1. Only as good as probability estimate and

correlation of variables

Quick Review

Sensitivity Analysis Scenario Analysis and Monte Carlo Simulation were all used to measure stand alone riskEach is designed to provide more information about the uncertainty associated with the project – they do not provide a clear cut decision rule.