Multi-Site-Correlated Surface Growths with Restricted Solid-on-Solid Condition

Semiconductors Europe Market...

Transcript of Semiconductors Europe Market...

Semiconductors Europe Market Statistics

m

Dataquest

Welcome to Dataquest's Semiconductors Europe

You are in the Source: Dataquest Market Statistics

binder

A collection of regularly updated market statistics on the European semiconductor market including product forecasts and company data.

Other Semiconductors Europe service binders are: Source: Dataquest—Guides and Reference Material This binder contains guides on how to use Dataquest; and research reference material which Dataquest does not plan to update regularly.

Dataquest Perspective This binder contains a series of regular multitopic publications that provide market research and analysis on the European semiconductor market.

Semiconductors Europe Source: Dataquest—Market Statistics

Table of Contents

Market Statistics European Semiconductor Consumption Forecast European MOS Memory Market Consumption Forecast and Market Share Rankings European ASIC Market Consumption Forecast and Market Share Rankings European ASIC Market Share Estimates European MOS Microcomponent Market Consumption Forecast and Market Share Rankings European Market Share Estimates European Fab Database

I

OoMotRemow* Final 1991 European Semiconductor Market Share Rankings and Revised 1990 Rankings

Dataquest Semiconductors Europe

Final 1991 European Semiconductor Market Share Rankings and Revised 1990 Rankings

Source: Dataquest

File inside the binder labeled

Market Statistics

Semiconductors Europe

Published by Dataquest Eurtpe Limited

The content of this report represents our interpretation and analysis of information generally available to the public or released by knowledgeable individuals in the subject industry, but is not guaranteed as to accuracy or completeness. It does not contain material provided to us in confidence by our clients.

Printed in the United Kingdom. All rights reserved. No part of this publication may be reproduced, stored in retrieval systems, w transmitted, in any form or by any means—mechanical, electronic, photocofjying, duplicating, microfilming, videotape, or otherwise—without the prior written permission of the publisher.

Dataquest is a registered trademark of A.C. Nielsen Company.

® 1992 Dataquest Europe Limited August 1992

0011973

Table of Contents

Page

INTRODUCTION 1 SUMMARY 1 WORLDWIDE MARKET SHARE RANKINGS

OF EUROPEAN COMPANIES 2 EUROPEAN MARKET SHARE RANKINGS

OF WORLDWIDE COMPANIES.: 3

List of Figures

Figure P^e

1 European Semiconductor Market Share by Vendor Base Region 1

2 Worldwide Semiconductor Market Share by Vendor Base Region 3

•

List of Tables Table Page

1 European Semiconductor Sales by Vendor Base Region 1977-1991 8

2 European Total Available Market Share 1991 by Product Category and Vendor Base Region 9

3 European Total Available Markets by Product Category 1989-1991 10

4 Worldwide Market Share Rankings of European Companies 1989-1991 11

5 European 1991 Serniconductor Market Share Rankings 12

6 European 1991 IC Market Share Rankings 14

7 European 1991 Monolithic Bipolar Digital IC Market Share Rarikings 16

8 European 1991 Monolitliic Bipolar Digital TTL IC Market Share Rankings 17

9 European 1991 Monolithic Bipolar Digital ECL IC Market Share Rankings 18

10 European 1991 Monolithic Bipolar Digital Memory IC Market Share Rankings... 19

11 European 1991 Monolithic Bipolar Digital Microcomponent IC Market Share Rankings 20

12 European 1991 Monolithic Bipolar Digital Logic IC Market Share Rankings 21

13 European 1991 Monolithic MOS Digital IC Market Share Rankings 22

14 European 1991 Monolitiiic NMOS Digital IC Market Share Rankings 24

Table Page

15 European 1991 Monolithic CMOS Digital IC Market Share Rankings 25

16 European 1991 Monolithic BiCMOS Digital IC Market Share Rankings 27

17 European 1991 Monolithic MOS Digital Memory IC Market Share Rankings.... 28

18 European 1991 Monolithic MOS Digital Microcomponent IC Market Share Rankings 29

19 European 1991 Monolithic MOS Digital Logic IC Market Share Rankings 30

20 European 1991 Analog IC Market Share Rankings 32

21 European 1991 Monolithic Analog IC Market Share Rankings 34

22 European 1991 Monolithic Linear IC Market Share Rankings 35

23 European 1991 Monolithic Mixed Signal IC Market Share Rankings 36

24 European 1991 Hybrid IC Market Share Rankings 37

25 European 1991 Discrete Semiconductor Market Share Rankings 38

26 European 1991 Transistor Market Share Rankings 39

27 European 1991 Diode Market Share Rankings 40

28 European 1991 Thyristor Market Share Rankings 41

29 European 1991 Other Discrete Serniconductor Market Share Rankings 42

30 European 1991 Optoelectronic Semiconductor Market Share Rankings 43

Final 1991 European Semiconductor Market Share Rankings and Revised 1990 Rankings

Table 'Dible

31 European 1990 Seiniconductor Market Share Rankings 44

32 European 1990 IC Market Share Rankings 46

33 European 1990 Monolithic Bipolar Digital IC Market Share Rarikings 48

34 European 1990 Monolithic Bipolar Digital TTL IC Market Share Rankings 49

35 European 1990 Monolithic Bipolar Digital ECL IC Market Share Ranlcings 50

36 European 1990 Monolithic Bipolar Digital Memory IC Market Share Rankings 51

37 European 1990 Monolithic Bipolar Digital Microcomponent IC Market Share Rankings 52

38 European 1990 Monolithic Bipolar Digital Logic IC Market Share Rankings 53

39 European 1990 MonoUtiiic MOS Digital IC Market Share Rankings 54

40 European 1990 Monolithic NMOS Digital IC Market Share Ranlcings 56

41 European 1990 Monolithic CMOS Digital IC Market Share Rankings 57

42 European 1990 Monolithic BiCMOS Digital IC Market Share Rankings 59

43 European 1990 Monolithic MOS Digital Memory IC Market Share Ranlcings... 60

44 European 1990 Monolithic MOS Digital Microcomponent IC Market Share Rankings 6I

45 European 1990 Monolithic MOS Digital Logic IC Market Share Rankings 62

46 European 1990 Analog IC Market Share Rankings 64

47 European 1990 Monolithic Analog IC Market Share Rankings 66

48 European 1990 Monolithic Linear IC Market Share Ranlcings 68

49 European 1990 Monolithic Mixed Signal IC Market Share Rankings 69

50 European 1990 Hybrid IC Market Share Rankings 70

51 European 1990 Discrete Semiconductor Market Share Rankings 71

52 European 1990 Transistor Market Share Rankings 72

53 European 1990 Diode Market Share Rankings 73

54 European 1990 Thyristor Market Share Rankings 74

55 European 1990 Other Discrete Semiconductor Market Share Rankings 75

56 European 1990 Optoelectronic Semiconductor Market Share Rankings 76

©1992 Dataquest Europe Limited August—Reproduction Prohibited

Final 1991 European Semiconductor Market Share Rankings and Revised 1990 Rankings

Introduction This booklet contains Dataquest's final estimates of semiconductor market shares by company in Europe for the calendar year 1991. These final estimates replace preliminary estimates made in January 1992 and published in Research Newslet-ter 1992-01, "Preliminary 1991 European Semicon-ductor Market Share Estimates: Intel Leapfrogs the Pack." Also contained in this booklet are restated final European market share estimates for the calendar years 1990 and 1989.

For background information on methodology, sales channels, exchange rates, companies, prod-uct categories, geographic regions and application segments please refer to the booklet entitled Semiconductor Market Definitions 1992,

contained in the Semiconductors Europe, Guides and Reference Material binder.

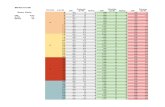

Summary European semiconductor sales by vendor base region over the last 15 years are shown in Table 1 (see page 8). The table shows that over this time period, Japanese and Asia/Pacific companies have generally gained share while European and North American companies have lost share. Figure 1 illustrates this point. It is interesting to note that European companies have never held a majority share in their domestic market over this time period, although they did come close to overthrowing North American suppliers in 1987.

Figure 1

European Semiconductor Market Share by Vendor Base Region

Percent of Market

EiffopMn

North Am^rlcftn

JapAT^M

A S * PacHlc/ROW

Total UsHaK

60.0

50.0

40.0

30.0

20.0

10.0

0.0

.

^ ^ " " ^ ' ' " ^ ^ ^ ^ ^ ^ ^ ^ -~

^^^^ - '--v^^

^^y^

Ifl77

*»» SI.S

1.S

0,0

loo.a

1B78

43.5

K . I

2.4

0.0

100.0

IS7S

•0 .3

63.7

3.0

0.0

1O0.0

i9ao 1BS1

40.4 i 42.3

BS.r

a.s

0.0

100.0

62.4

£.3

0.0

1DO.0

isaz

41.0

62.2

OJ

0.0

100.0

1083

40,3

49.e

o.»

0,0

100.0

-cr IOM

35.a

51J

19BS

3SJ

60.4

I Z T I I I J

0.010.0

100.(^100.0

IMG

42.0

46^

fM7

42.7

43.2

•MH 13.3

0.1 0.8

lOo.qIDO.o

iese

37.B

43.2

17.3

1.B

100.0

n m Fl n n-t;!

Isao

39.6

42a

1B.7

2,5

1O0.O

leso

35.0

42.9

16,5

tz

100.0

1091

37.5

43.5

16.9

3.0

too.o

- h * -B-

European

North American

Japanese

As ia Padllc/FlOW

Source: Daraquest (August 1992 Estimates)

Final 1991 European Semiconductor Market Share Rankings and Revised 1990 Rankings

Referring again to Table 1, European sales of European companies grew by only 2.0 percent in US dollars in 1991, the lowest rate since 1981. In contrast, Japanese and Asia/Pacific companies managed a reversal of fortunes in 1991 following poor growth in 1990.

The poor performance of European companies in 1991 can be mainly attributed to their product portfolios, which are typically dominated by mature and slow-growth products. Table 2 describes European semiconductor market share by major product category in 1991 by vendor base region. As can be seen from this table, European companies have majority shares in the European markets for analog ICs and discretes. These are large markets, together representing 38.0 percent of the total European semiconductor market in 1991, but with low growths of 1.5 percent and minus 3.5 percent respectively for that year. It is difficult for European companies to achieve strong growth while at the same time dominating these low-growth product markets.

In contrast to European companies' dorninance of low-growth markets, North .American companles dominate the high-growth markets of MOS microcomponents and MOS logic, which together represented 338 percent of the total European semiconductor market in 1991. The MOS microcomponent market saw growth of 15.5 percent and 19.7 percent in 1991, and helped to lift North American companies' semiconductor market share in Europe.

Japanese companies dominate the MOS memory market, although they also have a significant share of the MOS microcomponent market. The MOS memory market represented 19.3 percent of the total European sernlconductor market in 1991 but saw growth of only 39 percent. This slow growth was caused by continuing price erosion of memory devices.

It is important to recognize that in 1990, the product markets of analog and discrete experienced strong growth, while memory and logic experienced a decline. This is opposite to the trends seen in 1991. Table 3 shows European total available markets (TAMs) for 1989 to 1991 by major product category and demonstrates the relative sizes and growth rates of each product mar-ket. Year-to-year fluctuations in growth rates of product markets are caused by short-term changes in supply and demand. The long-term growth trends of each product market are shown in

Table 3 by the five-year compound armual growth rate (CAGE).

These long-term growth rates confirm that European companies do dominate low-growth product markets while North American, Japanese and Asia/Pacific companies dominate high-growth product markets. Therefore it appears that European companies' share of the European market is set to decline unless they can successfully establish market share in high-growth product markets.

Worldwide Market Share Rankings of European Companies Table 4 shows worldwide 1991 semiconductor market share rankings of European companies. Heading up these rankings is Philips Seinlconduc-tors. It is the only European company to appear in the worldwide top 10 hall of fame. It briefly rose to ninth position in 1990 following strong growth in its MOS digital, analog and discrete sales, but moved back down to tenth position again in 1991. In each case, it exchanged positions with Matsushita. Philips' sales to Japan and Asia/Pacific have seen strong growth in 1991, particularly in MOS digital ICs and analog ICs, but this has been offset by poor sales performances in North America and Europe.

SGS-Thomson Microelectronics lags behind Philips Semiconductors at number 13 worldwide, having lost one place in 1991 to Samsung. Its revenue in 1991 was flat compared with 1990, balancing increased sales to Japan and Asia/ Pacific with a decline in North America and Europe. SGS-Thomson's MOS digital ASIC and analog IC sales have been healthy despite an erosion in its MOS memory IC, MOS microcomponent IC, and discrete device businesses.

Siemens follows at number 16 worldwide in 1991, moving down two positions from 1990 after being overtaken by Sanyo and Sharp. Its semiconductor revenue grew in all world markets, but its revenue base in Europe representing 76.8 percent of its total sales grew the least. This was largely caused by price erosion in DRAMs and a decline in its analog and discretes sales.

GEC-Plessey Semiconductors stands at number 29 worldwide in 1991, slipping down three positions from 1990. It was overtaken by Analog Devices,

©1992 Dataquest Europe Limited August—Reproduaion Prohibited

Final 1991 European Semiconductor Market Share Rankings and Revised 1990 Rankings

Micron Technology, and VLSI Technology. Its seinlconductor sales declined in all world markets except Asia/Pacific, with the bmnt of this decline mainly in its bipolar digital IC and discrete prod-uct areas. However, its MOS digital and mixed signal ASIC product lines have seen strong sales growth.

Collectively, worldwide sales of European companies grew by only 3.7 percent compared with a total worldwide market growth of 9.6 percent. European companies' market share of the world-wide market stands at 10.6 percent in 1991. Figure 2 shows worldwide semiconductor market shares by vendor base region. The trends are similar to those of European semiconductor market shares; namely the rise of Japanese and Asia/Pacific vendors, and the fall of European and North American suppliers. However, the market share of Japanese suppliers reached a plateau in 1991, following a decline in 1990 caused partly by dramatic price erosion in memories.

European companies' sales to their own domestic markets account for 65.4 percent of their total

worldwide sales. This can be compared with the same figures for: Japanese companies at 69.8 per-cent; North American companies at 51.7 percent; and Asia/Pacific companies at 58.5 percent. Therefore, it appears that European companies are more dependent upon their own domestic market for sales growth than are most of their competitors. The European semiconductor market grew by 58 percent in 1991 compared with a total worldwide average growth of 9.4 percent. This is believed to be a factor in the below-average growth of European companies' worldwide sales in 1991.

European Market Share Rankings of Worldwide Companies

Total Semiconduc tor

Total European semiconductor market share rankings in 1991 show no change in the names of companies appearing in the top 10. However,

Figure 2

Worldwide Semiconductor Market Share by Vendor Base Region

Pei^ent of Market 60.0

5 0 . 0 ^ -

40.0

30.0 -

20.0 -

European Nortt) American Japanese AsIa Paclflc/ROW TotaI MarIiet

-•— European

• + - North American

- ^ Japanese

•S- Asia Paclflc/ROW

Source; Dataquest (August. 1992 Estimates)

©1992 Dataquest Europe Limited August—^Reproduction Prohibited

Final 1991 European Semiconductor Market Share Rankings and Revised 1990 Rankings

there has been some position swapping. Intel has overtaken Texas Instruments and NEC has overtaken National Semiconductor

The leader of the top 10 is Philips Semiconductors with a meagre 1.4 percent growth in sales. This can be compared with the 22.6 percent growth in European sales it saw last year As already discussed, its semiconductor business is dominated by analog ICs and discretes, which saw poor growth generally in 1991. Added to this, Pliilips sells over half of its semiconductors to end users in the consumer electronics segment, which was also depressed in 1991. These two factors combined did not help Philips grow its semiconductor sales in that year.

Siemens has seen better growth than Philips in 1991, but only just, at 2.2 percent. The product lines which exliibited significant growth were MOS microcontrollers, analog telecoms ICs and optoelectronic devices. However, the strong growth of Siemens' optoelectronics business has been partly caused by the discovery of previously overlooked sales channels in 1991. Siemens' European sales in ICs and discretes declined in 1991, and it is only the growth in optoelectronics sales that prevented Siemens' overall semiconductor business from declining.

SGS-Thomson Microelectronics suffered from a 4.7 percent decline in total European sales in 1991. In fact, its European sales suffered more than its business in any other world region. Much of the sales decline was in the area of MOS microcomponent ICs, EPROMs, and discrete devices where price erosion has taken its toll. There was some positive growth for SGS-Thomson in MOS digital logic ICs and analog ICs, which currentiy account for half of its sales volume in Europe. The company has plans for new manufacturing facilities in Italy and France.

Motorola's growT;h was below market average in its European semiconductor sales. Product lines that saw high growth in 1991 were SRAM and MOS ASIC However, declining sales in bipolar digital ICs, analog ICs and small signal discrete devices pulled down its overall growth to just 2.0 percent. Motorola has plans to expand its manufacturing base in Scotiand.

The highest growth in the top 10 was experienced by Intel, with a 23.0 percent increase in its sales over 1990. Its microprocessor business, representing 54.9 percent of its European serniconductor

business, grew by an impressive 32.5 percent. Sales in other product sectors, including microcontrollers and flash memory, also grew. This enabled Intel to overtake Texas Instruments in the European rankings. Intel is in the process of completing a new microprocessor manufacturing facility in Ireland.

Texas Instruments suffered a mild 0.8 percent decline in sales in 1991. Strong growth in its MOS microcomponent IC and MOS ASIC product lines was outweighed by declines in its bipolar standard logic, nonvolatile MOS memory IC, and analog IC product lines. However, its investment in memory manufacturing in Italy should have a positive effect on its market share in Europe.

Toshiba has held onto its position in the European semiconductor rankings despite a 2.0 percent drop in its sales. Toshiba's MOS memory IC and MOS ASIC sales slipped, largely due to price erosion in these areas. All its other major product lines saw healthy growth, particularly MOS microcomponent ICs, discretes and optoelectronic devices.

NEC has overtaken National Semiconductor to attain eighth position in the rankings. This was achieved with a 4.9 percent growth in its semiconductor sales. Product lines which contributed to this positive growth were MOS inicrocontroller ICs, MOS logic ICs and discrete devices. However, its bipolar logic IC and MOS memory IC businesses remained flat as a result of price erosion. NEC is expanding its manufacturing base in Scotland.

National Semiconductor, now at ninth position, saw litde growth in its semiconductor business. Negative growth was experienced in its bipolar digital IC, MOS memory IC and discrete product lines. This downward pressure was compensated by a pickup in its MOS microcomponent IC, MOS standard logic IC and analog IC product lines to give a top-line growth rate of 0.8 percent. National Semiconductor is also expanding its manufacturing base in Scotland.

AMD has seen the second-highest growth rate of the top 10, with a healthy 7.7 percent increase in semiconductor sales in 1991. It holds its tenth position as a result. This was achieved through strong growth in its MOS microcomponent IC, MOS logic IC and mixed signal telecoms IC product lines. The only major line to to show decline was bipolar digital ICs.

©1992 Dataquest Europe Limited August—^Reproduction Prohibited

Final 1991 European Semiconductor Market Share Rankings and Revised 1990 Rankings

A company that is expected to enter the top 10 in the near future is Samsung, which moved up three places to position 12 with a 27.4 percent growth in sales. This company derives over 80 percent of its sales from DRAM where it is Europe's second-largest supplier However, it is now diversifying into other product areas to stabilize its growth.

The strong 32.0 percent growth of Analog Devices at position 19 was largely due to its acquisition of Precision Monolithics Inc. Oki moved up 10 places to position 23, aided by an 83.7 percent growth rate in sales which was mainly caused by the inclusion of formerly overlooked sales channels into Europe. AT&T moved up 17 places to position 28 with an incredible growth rate of 144.8 percent for the same reason.

Integrated Circuits

The highest growth rate among the top 10 IC suppliers was experienced by Intel, which over-took SGS-Thomson Microelectronics and Siemens, both with declining sales, and is now close to Philips for the leading position.

Apart from Intel, the only other company in the top 10 to grow above the market average of 7.2 percent was AMD. This is another supplier of microcomponents which benefited from strong growth in market demand.

Bipolar Digital ICs

This is a product market in rapid decline. The only supplier estimated to have any positive growth in 1991 was Toshiba growing from a small base. The top three suppliers, all North .American, control more than half the European market.

Bipolar Digital Memory ICs

This market, as above, is in rapid decline. The cosmopolitan top three suppliers—a North American, a European and a Japanese—control around 80 percent of the market between them. Memories produced in BiCMOS (a hybrid technology of bipolar and CMOS) and pure CMOS are stealing business from the bipolar memory market.

Bipolar Digital M i c rocomponen t ICs

There are few suppliers in this small and declining market, and they are all North American. This

product market has little to offer except obsolescence.

Bipolar Digital Logic ICs

This is the largest of the bipolar digital IC markets, and is the one in least decline. However, only one supplier in the top 10, Philips Semiconductors, saw any positive growth in 1991.

MOS Digital ICs

Intel continues to hold its leading position unchallenged in this product market. It has a massive 13.1 percent market share of this large market. Generally, North American suppliers performed very well in 1991, while European suppliers declined.

MOS Digital Memory ICs

Samsung has shot to the top of the rankings in 1991 with a growth rate of 22.8 percent, overtaking Siemens and Toshiba which both saw declining sales. Samsung's success has been won by gaining market share in DRAMs with major OEMs. Hitachi also experienced high growth, and over-took SGS-Thomson for sixth place.

MOS Digital M i c rocomponen t ICs

The top three suppliers, Intel, Motorola and NEC, remain unchanged from the previous year. However, the gap is widening between these companies, as each one has a higher growth rate than the one below it. Philips Semiconductors has moved ahead of SGS-Thomson to take fourth place, and AMD has moved up two places by overtaking Toshiba and National Semiconductor.

MOS Digital Logic ICs

Philips Seinlconductors continues to lead this market, followed by Siemens. However, LSI Logic has now been displaced by ITT, which has moved up 13 places to third position. The sudden improvement in ITT's MOS logic IC sales is due to the reclassification of some of its dedicated IC business, which was formerly reported under the mixed signal IC category. Also displacing LSI Logic, as well as Motorola, is GEC-Plessey Seinlconductors, which saw a very healtnly increase in its business for gate arrays and cell-based ICs.

©1992 Dataquest Europe Limited August—Reproduaion Prohibited

Final 1991 European Semiconductor Market Share Rankings and Revised 1990 Rankings

Analog ICs

Philips Semiconductors and SGS-Thomson Microelectronics head up the analog IC rankings, helped by their strong penetration of the communications and consumer electronics end-user segments. Between them these two companies serve a third of the European analog IC market. Analog Devices has moved up two places in the rankings to fifth position, following its acquisition of Precision Monolithics Inc. ITT drops down the rankings due to product reclassification.

Monolithic Ana log ICs

While Philips Semiconductors continues to lead the ranlcings, it does not have positive growth, and is very close to being displaced by SGS-Thomson Microelectronics. Mietec saw a healthy 22.7 percent growth in sales of mixed signal ASICs. Overall, however, the monolithic analog IC market saw very litde growth.

Monoli thic Linear ICs

SGS-Thomson Microelectronics leads Philips Seinl-conductors by a small margin in this declining market. There are no changes from last year in the order of the top five ranked suppliers, although Texas Instruments has performed badly in 1991 and was nearly overtaken by Telefunlcen Electronic.

Monoli thic Mixed Signal ICs

The leading supplier in this product market, National Semiconductor, has seen reasonable growth in its dedicated telecoms IC product line. Nonetheless, it has grown below the market average, and is being challenged by Mietec which has already displaced Analog Devices. Harris has jumped up six places to fifth position following very strong growth in its dedicated telecoms IC sales in 1991. Austria Mikro Systeme has moved up seven places to eleventh position as a result of its strong sales in mixed signal ASICs. ITT moved down the rankings due to product reclassification.

Hybrid ICs

Philips Semiconductors has seen strong growth in its hybrid IC product line, and continues to lead this market unchallenged. Another European sup

plier, GEC-Plessey Semiconductors, has also seen a strong pickup in sales, and moved up two places to fourth position.

Discrete Semiconductors

In a declining product market, it is a reasonable result for Philips Semiconductors to have no growth in sales, and retain its top position. Siemens has moved up two places, overtaking Motorola and SGS-Thomson Microelectronics, despite declining sales in 1991. Another company to move up two places is International Rectifier, although this was managed with a healthy 10.1 percent growth in sales. ITT has had a disastrous year in this product market in 1991, with its sales in small signal discretes plummeting, and moves down four places.

Transistors

Philips leads this market again, but experienced a 9.5 percent erosion in sales. Its immediate competitors, Motorola and SGS-Thomson Microelectronics, also saw declining sales in 1991-Telefunken Electronic, with strong growth in power transistor sales, managed to move up three places to seventh position. Powerex Europe, in contrast, saw significant erosion in its power transistor sales, and moved down six places from eighth position.

Diodes

Nearly one-quarter of the European diode market is supplied by Philips Semiconductors. The company managed to produce the highest growth rate of the top 10, mainly through the strength of its power diode product line. Motorola moved up two places to second position, after displacing General Instrument and SGS-Thomson Microelectronics, which incidentally swapped positions with each other.

Thyristors

Leading the flat thyristor market in 1991 was Eupec, serving nearly 20 percent of demand. Eupec, a joint-venture company founded by Siemens and AEG, experienced declining sales in 1991, as did SGS-Thomson Microelectronics in third place. Powerex Europe and Philips Semiconductors both achieved double-digit growth.

©1992 Dataquest Europe Limited August—^Reproduction Prohibited

Final 1991 European Semiconductor Market Share Rankings and Revised 1990 Rankings

Other Discre te Semiconduc tors

This product market, covering miscellaneous dis-Crete devices such as inicrowave diodes, tuning diodes, varactors and selenium rectifiers, was headed up by Siemens in 1991. Its sales declined by 11.1 percent, which was better than the average market decline of 29.8 percent. The only companies to see any positive growth were NEC and International Rectifier, both from a small base.

Op toe lec tronic Semiconduc tors

Siemens continues to lead this product market with a 28.0 percent market share in 1991. The substantial 51.1 percent growth in its sales is partly due to the inclusion of revenue from previously overlooked sales channels. Telefunken Elec-tronic's sales declined by 4.4 percent, specifically in photosensors. The order of the top six suppliers is unchanged from 1990. AT&T moved up two places to seventh position, on the strength of its laser diode business, while Sharp moved up five places to ninth position, on the strength of its optocoupler and laser diode businesses.

©1992 Dataquest Europe Umited August—Reproduaion Prohibited

Taltfe 1

European Semiconductor Sales by Vendor Base Region 1977-1991 (Millions of Dollars)

@ h-t

N)

D 1 •8

g" ^

1 s ^ <§

-S

1 1 TJ

3 §; ft Q.

A n n u a l Sales

North American Companies

Japanese Comjiranies

Eurofjean Companies

Asia/Pacific Companies

Total All Companies

Percent Share

North American Companies

Japanese Companies

European Companies

Asia/Pacific Companies

Total All Compan ies

Percent Growth

North American Companies

Japanese Companies

European Companies

Asia/Pacific Companies

Total AJ] Companies

1977

955

30

865

0

$1,850

1977

51.6%

1.6%

46.8%

0.0%

100.0%

1977

NA

NA

NA

NA

NA NA - Not Appiicable Source: Dataquest (August 1992 Estimates)

1978

1,217

57

1,065

0

$2,339

1978

52.1%

2.4%

45.5%

0.0%

100.0%

1978

27.4%

90.0%

23.1%

NA

26.4%

1979

1,620

92

1,306

0

$3,018

1979

53.7%

3.0%

43.3%

0.0%

100.0%

1979

33.1%

61.4%

22.6%

NA

29.0%

1980

2,053

143

1,490

0

$3,686

1980

55.7%

3.9%

40.4%

0.0%

100.0%

1980

26.7%

55.4%

14.1%

NA

22.3%

1981

1,596

160

1,285

0

$3,041

1981

52.4%

5.3%

42.3%

0.0%

100.0%

1981

-22.3%

11.9%

-13.8%

NA

-17.5%

1982

1,656

214

1,297

0

$3,167

1982

52.2%

6.8%

41.0%

0.0%

100.0%

1982

3.8%

33.8%

0.9%

NA

4.1#

1983

1,680

332

1,358

0

$3,370

1983

49.8%

9.9%

40.3%

0.0%

100.0%

1983

1.4%

55.1%

4.7%

NA

6.4%

1984

2,475

609

1,721

0

$4,805

1984

51.5%

12.7%

35.8%

0.0%

100.0%

19»4

47.3%

83.4%

26.7%

NA

# ,6%

1985

2,377

534

1,809

0

$4,720

1985

50.4%

11.3%

38.3%

0.0%

100.0%

1985

-4.0%

-12.3%

5.1%

NA

-1.8%

1986

2,539

664

2,323

6

$5,532

1986

45.9%

12.0%

42.0%

0.1%

100.0%

1986

6.8%

24.3%

28.4%

NA

i7.m:

1987

2,746

845

2,714

50

$6,355

1987

43.2%

13.3%

42.7%

0.8%

100.0%

1987

8.2%

27.3%

16.8%

733.3%

14.9%

1988

3,664

1,466

3,196

165

$8,491

1988

43.2%

17.3%

37.6%

1.9%

100.0%

1988

33.4%

73.5%

17.8%

230.0%

53M

1989

4,010

1,772

3,478

238

$9,498

198^

42.2%

18.7%

36.6%

2.5%

100.0%

1989

9.4%

209%

8.8%

44.2%

11.9%

1990

4,469

1,643

4,064

239

$10,415

1990

42.9%

15.8%

39.0%

2.3%

100,0%

1990

11.4%

-7.3%

16.8%

0.4%

9.7%

1991

4,780

1,756

4,146

332

$11,014

1991

43.5%

15.9%

37.6%

3.0%

100.0%

1991

7.0%

6.9%

2.0%

38.9%

5.8

«tf

M \0 M

1 1 ^

1 1 S" Ui

1 f g H

VO

o

Final 1991 European Semiconductor Market Share Rankings and Revised 1990 Rankings

Table 2

European Total Available Market Share 1991 by Product Category and Vendor Base Region

(Percent)

Product Category North Euro- .Asia/

American Japanese pean Pacific Total Dominant Vendors

Total Semiconductor 43.4 15.9 37.7 3.0 lOO.O North .American

Total IC 47.1 17.2 32.1 3.6 lOO.O North American

Total Bipolar Digital

Bipolar Memory

Bipolar Microcomponent

Bipolar Logic

MOS Digital .

MOS Memory

MOS Microcomponent

MOS Logic

.Analog IC

Total Discrete

Total Optoelectronic

64.4

58.1

lOO.O

63.8

47.9

29.2

66.3

48.8

417

29.3

29.7

8.6

23.3

o.o 7.5

22.7

37.7

16.8

10.8

5.2

10.3

15.1

27.0

18.6

o.o 28.7

24.3

19.6

16.8

39.9

52.3

60.0

53.6

o.o o.o 0 0

o.o

5.1

13.5

o.i 0.5

0.8

0.4

1.6

lOO.O

lOO.O

lOO.O

lOO.O

lOO.O

loo.o lOO.O

loo.o

loo.o

lOO.O

lOO.O

North American

North American

North American

North American

North .American

Japanese

North American

North American

European

European

European

Source: Dauquest (August 1992 Estimates)

©1992 Dataquest Europe IJmited August—Reproduction Prohibited

10 Final 1991 European Semiconductor Market Share Rankings and Revised 1990 Rankings

Table 3

European Total Available Markets by Product Category 1989-1991 (Millions of Dollars)

Product Category 1989 <:$M)

1990 C$M)

1991 C$M)

1989-90 AGR (%)

1990-91 AGR

CVo)

1991-96 CAGR

C%) Total Semiconductor $9,498 $10,415 $11,014 9.7 5.8 l O . l

Total IC $7,570 3,115 $8,701 7.2 7.2 11.5

Total Bipolar Digital Bipolar TTL Bipolar ECL

Total Bipolar Digital Bipolar Memory Bipolar Microcomponent Bipolar Logic

Bipolar ASIC Bipolar Standard Logic Bipolar other Logic

MOS Digital Total NMOS Total CMOS Total BiCMOS

MOS Digital MOS Memory MOS Microcomponent MOS Logic

MOS ASIC MOS Standard Logic other MOS Logic

.Analog IC Monolithic .Analog IC Hybrid IC

Total Discrete Total Transistor Total Diode Thyristor Other Discrete

Total Optoelearonic

$627 487 140

$627 71

NA 556 256 271

29

$5,251 1,841 3,344

66

$5,251 2,417 1,442 1,392

870 258 264

$1,692 1,556

136

$1,574 768

483 184

139

$354

$565 421 144

$565 55 21

489 211 244

34

$5,224 1,279 3,908

37

$5,224 2,050 1,802 1,372

913 226

233

$2,326

2,169 157

$1,895 914 617

233 131

$405

$486 376

no

$486

43 15

428 174 228

26

$5,853 1,153 4,642

58

$5,853 2,129 2,082 1,642

1,045 210 387

$2,362 2,184

178

$1,828 890

613 233 92

$485

-9.9 -13.6

2.9

-9.9 -22.5

NA -12.1 -17.6 -lO.O 17.2

-0.5 -30.5 169

-43.9

-0.5 -15.2 25.0 -1.4

4.9 -12.4 -11.7

37.5 39.4 15.4

20.4 19.0 27.7 26.6 -5.8

14.4

-14.0 -10.7 -23.6

-14.0 -21.8 -28.6

-12.5 -17.5 -6.6

-23.5

12.0 -9.9 18.8 56.8

12.0 3.9

15.5 19.7

14.5 -7.1 66.1

1.5 0 7

13.4

-3.5 -2.6 -0.6

o.o -29.8

19.8

-9.1 -18.2

8.2

-9.1 -10.3

-lOO.O

-8.3 -0.3

-18.5 -1.6

13.6 12.1 11.6 77.0

13.6 15.0 13.2

12.3 167

1.5 3.2

8.7 9.0 5.8

3.5 3.9 2.7

1.3 8.8

7.3 NA - Not Applicable AGR - annual growth rate CAGR - compound AGR Source: Dataquest (August 1992 Estimates)

©1992 Dataquest Europe Limited August—^ReproducUon Prohibited

Table 4

Worldwide Market Share Rankings of European Companies 1989-1991 (MUIlons of Dollars)

© VO VO K)

D B •g

? c 3 H

1 a ^

1 I S" 13 §. C

a 0 ID

•13

3 1 »• n p.

European Companies

Philips Semiconductors SOS-Thomson Mjcrolectronics Siemens GEC Plessey Semiconductors Telefunken Electronic Semikron Mietec Maua-MHS Eupec Ericsson AusUia Mikro Sj jt ^nie ABB-IXYS TMS ABB-HAFO TAG Euros! 1 Electronic Fagor Etectrotfecnica European Silicon StitliebUfiE^ Zetex STC Components Marconi Electronic Devices Ltd PIessey Semiconductors Other European Companies

Total European Companies Total Worldwide Market

Sales ($M)

1,643 1,271 1,154

NA

299 95 52

85 NA 54 56 50 45 37 22 30

29 18

NA

19 60

240 41

$5,300 $54,339

1989

WW Rank

10 12

15 NA 30 58 77 62

NA 74 71 79 84 90

110 101 102

117 NA 116

69 32

NA

WW Share

(%) 3.0

2.3 2.1 0.0 0.6 0.2 0.1 0,2 0.0 0.1 Ol 0.1

a i 0.1 0.0 0.1 0.1 0.0 0.0 0.0 0.1 0.4 0.1

9.8

Sales ($M)

1,955 1,441 1,204

390 295 106 92

100 96 56

59 58

45 42

25 39 30 27 24 24

NA NA

0

$6,108 $54,454

WW Rank

9 12 14 26

31 55 61

57 59 82

79 80 92 96

115 100

109 113 117 117 NA NA NA

1990

Rank Change

1 0 1

NA -1

3 16

5 NA

-8 -8 -1 -8 -6

-5 1

-7 4

NA -1

NA NA NA

WW Share

(%) 3.6 2.6 2.2 0.7 0.5 0.2 0.2 0.2 0 2 0.1 0.1 0.1 0.1 0.1 0.0 0.1 0.1 0.0 0.0 0.0 0.0 0.0 0.0

11.2

WW AGR

(%) 19.0 13.4

4.3 NA

-1.3 11.6

76.9 17.6 NA 3.7 5.4

16.0 0.0

13.5 13.6 30.0

3.4 50.0 NA

26.3 NA NA NA

15.2 0.2

Sales ($M)

2,022 1,436

1,263 392 300 108

105 104

93 74 70 54

51 38 30

29 29 28 26 18

NA NA 66

$6,336 $59,694

WW Rank

10

13 16 29 33 56 60 61

65 77 80 85 89 96

107 110 110 112

117 126 NA NA NA

1991

Rank Change

-1 -1 -2

-3 -2 -1 1

A -6

5 -1

-5 3 0 8

-10 -1 1 0

-9 NA NA NA

WW Share

(%) 3.4 2.4 2.1 0 7 0 5 0.2 0.2 0.2 0.2 0.1 0.1 0 1 0.1 0.1 0.1 0.0 0.0 0.0 0.0 0.0 0.0 0.0 a i

10.6

WW AGR

(%) 3.4

-0.3 4.9 0 5 1.7

1.9 14.1 4.0

-3.1 32.1 18.6

-6.9 13.3 -9.5 20.0

-25.6

-3.3 3.7

8.3 -25.0

NA NA NA

3.7 9.6

i 1 § f 1 S

1 f i 1 1 1 s &

I i a M

1 s

1 1

AGR - annual ( Fowih rate WW - woridwide NA - Nol Applicable Soun:^ EJataquest (August 1992 Estimates)

12 Final 1991 European Semiconductor Market Share Rankings and Revised 1990 Rankings

Table 5

European 1991 Semiconductor Market Share Rankings (Millions of Dollars)

1990 Rank

1

2

3 4

6

5 7

9 8

10

11

15 12

14

13

17

18

16

19

23 21

21

20

33

25

27

24

45

28

30

31 38

29

37

26

35

39 36

33 39

1991 Rank

1

2

3 4

5 6

7

8

9 10

11

12

13 14

15 16

17

18

19 20

21

22

23

23

25 26

27

28

29 30

31 32

32

34

34

36

37

38

39 40

Change in Rank

o o o o 1

-1

o 1

-1

o o 3

-1

o -2

. 1

1

-2

o 3

o -1

-3 10

o 1

-3 17

-1

0

o 6

-3 3

-8 -1

2

-2

-6 -1

Ranked Companies

Philips Semiconductors

Siemens

SGS-Thomson Microelectronics

Motorola

Intel

Texas Instruments

Toshiba

NEC

National Semiconductor

AMD

Hitachi

Samsung

i n

Telefunken Electronic

GEC Plessey Semiconductors

Fujitsu

Mitsubishi

Harris

Analog Devices

Mietec

LSI Logic

Matra-MHS

Hewlett-Packard

Oki

VLSI Technology

Intemational Rectifier

Eupec

AT&T

Semikron

Austria Mikro Systeme

Sony

Ericsson

General Instmment

Cypress

Matsushita

ABB-DCYS

TMS

Micron Technology

Burr-Brown

Siliconix

1990 Sales ($M)

1,128

949

897 761

622

637

450

386

397

273 246

190

232

213

217

153 122

166

103 84

85

85

88

49 74

69

78

29 66

59 58

43

65 44

70

47

41

46

49 41

1991 Sales ($M)

1,144

970

855 776

765

632

441

405

400

294

276

242

240

222

215

148

143 141

136

102

lOO

93 90

90

89 76

73 71

67

62

61

55

55

49

49

47

46

45

43 41

1990-91 Annual Growth

(%) 1.4

2.2

-4.7

2.0

23.0

-0.8

-2.0

4.9 0.8

7.7

12.2

27.4

3.4

4.2

-0.9

-3.3 17.2

-15.1

32.0

21.4

17.6

9.4

2.3

83.7

20.3 10.1

-6.4

144.8

1.5

5.1 5.2

27.9 -15.4

11.4

-30.0

o.o 12.2

-2.2

-12.2

o.o

1991 Cum. Sum C$M)

1,144

2,114

2,969

3,745 4,510

5,142

5,583 5,988

6,388

6,682

6,958

7,200

7,440

7,662

7,877

8,025 8,168

8,309

8,445

8,547

8,647

8,740

8,830

8,920

9,009

9,085

9,158

9,229 9,296

9,358

9,419 9,474

9,529 9,578

9,627

9,674

9,720

9,765 9,808

9,849

1991 Market

Share (%) 10.4

8.8

7.8

7.0

6 9 57

4.0

3.7

3.6

2.7

2.5 2.2

2.2

2.0

2.0

1.3

1.3

1.3 1.2

0.9

0.9 0.8

0.8

0.8

0.8

0.7

0.7

0.6

0.6

0.6

0.6

0.5

0.5 0.4

0.4

0.4

0.4

0.4

0.4

0.4

1991 Cum. Sum

(%) 10.4

19.2

27.0

34.0

40.9

46.6

50.6

54.3

57.9 60.6

63.1

65.3

67.5

69.5

71.5 72.8

74.1

75.4

76.6

77.5 78.4

79.2

80.0

80.8

81.6

82.3

83.0

83.6

84.2

84.8

85.4

85.9 86.4

86.8

87.2

87.6

880

88.4

88.8

89.2 (Continued)

©1992 Dataquest Europe Limited August—Reproduction Prohibited

Final 1991 European Semiconductor Market Share Rankings and Revised 1990 Rankings 13

Table 5 (Continued)

European 1991 Semiconductor Market Share Rankings (Millions of Dollars)

1990 Rank

47

57

32

39 44

63

43

51 54

42

48

49 54

54

58

51

59

49

51

61

60

64

62

45

1991 Rank

41

42

43 44

45 46

47 48

49 50

51 52

53

53

53 56

57

57

59 60

61

62

63

-

Change in Rank

6

15

-11

-5 -1

17

-4

3 5

-8

-3

-3 1

1

5 -5 2

-8 -8

1

-1

2

-1

NA

' •

Ranked Companies

Sharp

Western Digital

Powerex

Rockwell

IDT

Goldstar

ABB-HAFO

Sanyo

Rohm Electonics

Allegro Microsystems

European Silicon Structures

Unitrode

Honeywell

TAG

Zilog

Fagor Electrotecnica

Mitel

STC

Eurosil

Zetex

Raytheon

Seiko Epson

NMB

Precision Monolithics

North .American Others

Japanese Others

European Others

Rest of World Others

Total .All Companies

Total North American

Total Japanese

Total European

Total Rest of World NA - Not Applicable Source: Dataquest (August 1992 Estimates)

1990 Sales ($M)

28

18

50

41

30

9 32

22

20

33

25

23 20

20

17

22

16

23 22

13 14

1

10

29

397

28

0

40

10,415

4,469

1,643 4,064

239

1991 Sales ($M)

39 38

37

36

34

33 32

31 30

28

27

24

21

21

21

20

18

18

15 14

10

9

5

-:

470

29 48

57

11,014

4,780

1,756

4,146

332

1990-91 Annual Growth

(%)

39.3 111.1

-26.0

-12.2

13.3 266.7

o.o 40.9 50.0

-15.2

8.0

4.3 5.0

5.0

23.5

-9.1

12.5

-217

-31.8

7.7

-28.6

800.0

-50.0

NA

18.4

3.6

NA

42.5

5.8

7.0

6.9

2.0

38.9

1991 Cum. Sum ($M)

9,888

9,926

9,963

9,999

10,033 10,066

10,098

10,129

10,159

10,187

10,214

10,238

10,259 10,280

10,301

10,321

10,339

10,357

10,372

10,386

10,396

10,405

10,410

NA

10,880

10,909

10,957

11,014

1991 Market

Share (%) 0.4

0.3

0.3

0.3

0.3

0.3

0.3

0.3

0.3

0.3 0.2

0.2

0.2

0.2

0.2

0.2

0.2

0.2

O.l

O.l

o.l o.l

o.o NA

4.3

0.3 0.4

0.5

lOO.O

43.4

15.9 37.6

3.0

1991 Cum. Sum

(%) 89.6

89.9 90.2

90.5

90.8

91.1 91.4

91.7

92.0

92.3

92.5

92.7

92.9

93.1

93.3

93.5

93.7

93.9 94.0

94.1

94.2

94.3

94.3 NA

98.8

99.0

99.5

lOO.O

©1992 Dataquest Europe Limited August—Reproduction Prohibited

14 Final 1991 European Semiconductor Market Stiare Rankings and Revised 1990 Rankings

Table 6

European 1991 IC Market Share Rankings (Mllllons of Dollars)

1990 Rank

1

4

2

3

5

6

7

9

8

10

11

13

12

16

17

15

19

14

22

20

18

20

27

23

24

25

31

40

30

29

27

44

32

34

52

26

36

1991 Rank

1

2

3 4

5

6

7

8

9

10

11

12

13

14

15

16

16

18

19

20

21

22

23

23

25

26

27

28

29

30

31

32

33

34

35

36

37

Change In Rank

o 2

-1

-1

o o o 1

-1

o o 1

-1

2

2

-1

3

-4

3

o -3

-2

4

0

-1

' -1

4

12

1

-1

-4

12

-1

o 17

-10

-1

Ranked Companies

Philips Semiconductors

Intel

SOS-Thomson Microelectronics

Siemens

Texas Instmments

Motorola

National Semiconductor

NEC

Toshiba

AMD

Hitachi

Samsung

GEC Plessey Semiconductors

ITT

Analog Devices

Fujitsu

Mitsubishi

Harris

Mietec

LSI Logic

Telefunken Electronic

MaU-a-MHS

Oki

VLSI Technology

Austria Mikro Systeme

Sony

Ericsson

AT&T

Cypress

Micron Technology

Burr-Brown

Western Digital

Rockwell

IDT

Goldstar

Matsushita

TMS

1990 Sales ($M)

762

622

694

657

606

549

390

359

372

273

234

186

187

121

103

130

86

138

84

85

91

85

49

74

59

57

43

21

44

46

49

18

41

30

9

51

26

1991 Sales ($M)

775

765

666

634

601

577

394

375

353

294

263

236

187

180

136

119

119

111

102

lOO

95

93

89

89

62

60

55

54

49

45

43

38

36

34

33

31

30

1990-91 Annual Growth

(%)

1.7

23.0

-4.0

-3.5

-0.8

5.1

l.O

4.5

-5.1

7.7

12.4

26.9

0.0

48.8

32.0

-8.5

38.4

-19.6

21.4

17.6

4.4

9 4

81.6

20.3

5.1

5.3

27.9

157.1

11.4

-2.2

-12.2

111.1

-12.2

13.3

266.7

-39.2

15.4

1991 Cum. Sum ($M)

775

1,540

2,206

2,840

3,441

4,018

4,412

4,787

5,140

5,434

5,697

5,933

6,120

6,300

6,436

6,555

6,674

6,785

6,887

6,987

7,082

7,175

7,264

7,353

7,415

7,475

7,530

7,584

7,633

7,678

7,721

7,759

7,795

7,829

7,862

7,893

7,923

1991 Market

Share (%)

8.9

8.8

7.7

7.3

6.9

6.6

4.5

4.3

4.1

3.4

3.0

2.7

2.1

2.1

1.6

1.4

1.4

1.3

1.2

1.1

1.1

1.1

l.O

10

0.7

0.7

0.6

0.6

0.6

0.5

0.5

0.4

0.4

0.4

0.4

0.4

0.3

1991 Cum. Sum

(%)

8.9

17.7

25.4

32.7

39.6

46.2

50.7

55.0

59.1

62.5

65.5

68.2

70.3

72.4

74.0

75.4

76.8

78.1

79.3

80.4

81.5

82.6

83.6

84.6

85.3

86.0

86.6

87.2

87.8

88.3

88.8

89.2

89.6

90.0

90.4

90.8

91.1 (Continued)

(DI992 Dataquest Europe Limited August—^Reproduction Prohibited

Final 1991 European Semiconductor Market Share Rankings and Revised 1990 Rankings 15

Table 6 (Continued)

European 1991 IC Market Share Rankings (Millions of Dollars)

1990 Rank

37

38

33

47

40

46

40

47

44

40

39

53

49

49

54

51

-

35

1991 Rank

38

39

40

40

42

42

44

45

45

47

48

48

50

51

52

53

54

-

Change in Rank

-1

-1

-7

7

-2

4

-4

2

-1

-7

-9

5

-1

-2

2

-2

NA

NA

Ranked Companies

European Silicon Structures

Sharp

Allegro Microsystems

Sanyo

ABB-HAFO

Zilog

Hewlett-Packard

Mitel

Siliconix

STC

Eurosil

Rohm Electonics

Unitrode

Raytheon

Seiko Epson

NMB

Honeywell

Precision Monolithics

North American Others

Japanese Others

European Others

Rest of World Others

Total .All Companies

Total North American

Total Japanese

Total European

Total Rest of Worid NA - Not Applicable Source: Dataquest (August 1992 Estimates)

1990 Sales ($M)

25

24

31

16

21

17

21

16

18

21

22

8

13

13

1

10

-

29

342

8

o 28

8,115

3.710

1,405

2,777

223

1991 Sales ($M)

27

26

25

25

21

21

19

18

18

16

15

15

14

10

9

5

1

- •

429

6

11

47

8,701

4,101

1,495

2,789

316

1990-91 Annual Growth

(%)

8.0

8.3

-19.4

56.3

0.0

23.5

-9.5

12.5

0.0

-23.8

-31.8

87.5

7.7

-23.1

800.0

-50.0

NA

NA

25.4

-25.0

NA

67.9

7.2

10.5

6.4

0.4

41.7

1991 Cum. Sum ($M)

7,950

7,976

8,001

8,026

8,047

8,068

8,087

8,105

8,123

8,139

8,154

8,169

8,183

8,193

8,202

8,207

8,208

NA

8,637

8,643

8,654

8,701

1991 Market

Share (%)

0.3

0.3

0.3

0.3

0.2

0.2

0.2

0.2

0.2

0.2

0.2

0.2

0.2

0.1

0.1

0.1

0.0

NA

4.9

0.1

0.1

0.5

100.0

47.1

17.2

32.1

3.6

1991 Cum. Sum

(%)

91.4

91.7

92.0

92.3

92.5

92.7

92.9

93.1

93.3

93.5

93.7

93.9

94.1

94.2

94.3

94.4

94.4

NA

99.3

99.3

99.5

100.0

©1992 Dataquest Eurojie Limited August—Reproduction Prohibited

16 Final 1991 European Semiconductor Market Share Rankings and Revised 1990 Rankings

Table 7

European 1991 Monolithic Bipolar Digital IC Market Share R a n k l i ^ (Millions of Dollars)

1990 Rank

1

2

3

4

5

7

8

6

9

10

11

14

15

12

-

17

17

15

12

1991 Rank

1

2

3

4

5

6

7

8

9

10

10

12

12

14

15

15

15

-

-

Change in Ratik

0

o o o o 1

1

-2

0

o 1

2

3

-2

NA

2

• 2

NA

NA

Ranked Companies

Texas Instruments

AMD

National Semiconductor

Philips Semiconductors

Motorola

Siemens

NEC

GEC Plessey Semiconductors

Fujitsu

STC

Telefunken Electronic

Hitachi

Toshiba

Raytheon

IDT

Matsushita

Mitsubishi

AT&T

SGS-Thomson Microelectronics

North American Others

Japanese Others

European Others

Rest of Worid Others

Total All Companies

Total North American

Total Japanese

Total European

Total Rest of World NA - Not Applicable Source: Dataquest (August 1992 Estimates)

1990 Sales ($M)

138

86

71

56

47

40

25

45

12

10

7

i 2

5

-

1

1

2

5

8

o o o

565

357

45

163

o

1991 Sales ($M)

131

75

59

54

41

38

24

21

8

7

7

4

4

2

1

1

1

-

-

4

0

4

o

486

313

42

131

o

1990-91 Annual Growth

(%)

-5.1

-12.8

-16.9

-3.6

-12.8

-5.0

-4.0

-53.3

-33.3

-30.0

o.o o.o

lOO.O

-60.0

NA

o.o o.o NA

NA

-50.0

NA

NA

NA

-14.0

-12.3

-6.7

-19.6

NA

1991 Cum. Sum ($M)

131

206

265

319

360

398

422

443

451

458

465

469

473

475

476

477

478

NA

NA

482

482

486

486

1991 Market

Share (%)

27.0

15.4

12.1

11.1

8.4

7.8

4.9

4.3

1.6

1.4

1.4

0.8

0.8

0.4

0.2

0.2

0.2

NA

NA

0.8

o.o 0.8

o.o

lOO.O

64.4

8.6

27.0

o.o

1991 Cum. Sum (%)

27.0

42.4

54.5

65.6

74.0

81.8

86.7

91.0

92.6

94.0

95.4

96.2

97.0

97.4

97.6

97.8

98.0

NA

NA

99.2

99.2

lOO.O

lOO.O

©1992 Dataquest Europe Limited August—Reproduction Prohibited

Final 1991 European Semiconductor Market Share Rankings and Revised 1990 Rankings 17

Table 8

European 1991 Monolithic Bipolar Digital TTL IC Market Share Rankings (Millions of Dollars)

1990 Rank

1

2

3

4

5

6

8

9

6

10

13

15

15

15

14

12

10

1991 Rank

1

2

3

4

5

6

7

8

9

10

10

10

13

13

-

-

-

Change In Rank

o o o o o o 1

1

-3

o 3

5

2

2

NA

NA

NA

Ranked Companies

Texas Instruments

AMD

National Semiconductor

Philips Semiconductors

NEC

Motorola

Siemens

Telefunken Electronic

GEC Plessey Semiconductors

Fujitsu

Hitachi

Toshiba

Matsushita

Mitsubishi

AT&T

Raytheon

SGS-Thomson Microelectronics

North American Others

Japanese Others

European Others

Rest of World Others

Total All Companies

Total North .American

Total Japanese

Total European

Total Rest of World NA - Not Applicable Source: Dataquest (August 1992 Estimates)

1990 Sales ($M)

138

74

56

51

22

20

10

7

20

5

3

1

1

1

2

4

5

1

o o o

421

295

33

93

0

1991 Sales ($M)

131

74

48

47

20

16

12

7

4

3

3

3

1

1

-

-

-

2

0

4

o

376

271

31

74

0

1990-91 Annual Growth

(%)

-5.1

o.o -14.3

-7.8

-9.1

-20.0

20.0

o.o -80.0

-40.0

o.o 200.0

o.o o.o NA

NA

NA

lOO.O

NA

NA

NA

-107

-8.1

-6.1

-20.4

NA

1991 Cum. Sum ($M)

131

205

253

300

320

336

348

355

359

362

365

368

369

370

NA

NA

NA

372

372

376

376

1991 Market

Share

(%) 34.8

19.7

12.8

12.5

5.3

4.3

3.2

1.9

1.1

0.8

0.8

0.8

0.3

0.3

NA

NA

NA

0.5

O.o 1.1

o.o

lOO.O

72.1

8.2

19.7

o.o

1991 Cum. Sum

(%)

34.8

54.5

67.3

79.8

85.1

89.4

92.6

94.5

95.6

96.4

97.2

98.0

98.3

98.6

NA

NA

NA

98.9

98.9

lOO.O

lOO.O

©1992 Dataquest Europe Liinited August—Reproduction Prohibited

18 Final 1991 European Semiconductor Market Share Rankings and Revised 1990 Rankings

Table 9

European 1991 Monolithic Bipolar Digital ECL IC Market Share Rankings (Millions of Dollars)

1990 Rank

1

2

3

4

8

6 7

9

10

5

10

--

10

1991 Rank

1

2

3

4

5

5

7

8

9

10

10

10

10

Change In Rank

o o o o 3

1

o - 1

1

-5

o NA

o

Ranked Companies

Siemens

Motorola

GEC Plessey Semiconductors

National Semiconductor

Philips Semiconductors

STC

Fujitsu

NEC

Raytheon

AMD

Hitachi

IDT

Toshiba

North .American Others

Japanese Others

European Others

Rest of World Others

Total All Companies

Total North .American

Total Japanese

Total European

Total Rest of World

1990 Sales C$M)

30

27

25

15

5

10

7

3

1

12

1

-

1

7

0

o o

144

62

12

70

o

1991 Sales C$M)

26

25

17

11

7

7

5

4

2

1

1

1

1

2

o o o

no 42

11

57

o

1990-91 Annual Growth

(%)

-13.3

-7.4

-32.0

-26.7

40.0

-30.0

-28.6

33.3

lOO.O

-917

o.o NA

o.o

-71.4

NA

NA

NA

-23.6

-32.3

-8.3

-18.6

NA

1991 Cum. Sum C$M)

26

51

68

79

86

93

98

102

104

105

106

107

108

no no no no

1991 Market

Share

t%) 23.6

22.7

15.5

lO.O

6.4

6.4

4.5

3.6

1.8

0.9

0.9

0.9

0.9

1.8

o.o o.o o.o

lOO.O

38.2

lO.O

51.8

o.o

1991 Cum. Sum

(%)

23.6

46.3

61.8

71.8

78.2

84.6

89.1

92.7

94.5

95.4

96.3

97.2

98.1

lOO.O

lOO.O

lOO.O

lOO.O

NA - Not Applicable Source: DaUquest (August 1992 Estimates)

©1992 Dataquest Europe Limited August—^Reproduction Prohibited

Final 1991 European Semiconductor Market Share Rankings and Revised 1990 Rankings 19

Table 10

European 1991 Monolithic Bipolar Digital Memory IC Market Share Rankings (Millions of Dollars)

1990 Rank

1

2

3

3

5

7

-

6

1991 Rank

1

2

3

4

4

6

7

-

Change In Rank

o o o

-1

1

1

NA

NA

Ranked Companies

AMD

Philips Semiconductors

NEC

Fujitsu

National Semiconductor

Hitachi

IDT

Raytheon

North .American Others

Japanese Others

European Others

Rest of World Others

Total .All Companies

Total North American

Total Japanese

Total European

Total Rest of World

1990 Sales ($M)

22

10

6

6

5

2

-

4

o o o 0

55

31

14

10

0

1991 Sales ($M)

21

8

5

3

3

2

1

-

o 0

o o

43

25

10

8

o

1990-91 Annual Growth

(%)

-4.5

-20.0

-16.7

-50.0

-40.0

o.o NA

NA

NA

NA

NA

NA

-21.8

-19.4

-28.6

-20.0

NA

1991 Cum. Sum ($M)

21

29

34

37

40

42

43

NA

43

43

43

43

1991 Market

Share

(%) 48.8

18.6

11.6

7.0

7.0

47

2.3

NA

o.o o.o o.o o.o

lOO.O

58.1

23.3

18.6

o.o

1991 Cum. Sum

(%)

48.8

67.4

79.0

86.0

93.0

97.7

lOO.O

NA

lOO.O

lOO.O

lOO.O

lOO.O

NA - Not AppUcable Source: Dataquest (August 1992 Estimates)

©1992 Dataquest Europe Umited August—Reproduction Prohibited

20 Final 1991 European Semiconductor Market Share Rankings and Revised 1990 Rankings

Table 11

European 1991 Monolithic Bipolar Digital Microcomponent IC Market Share Rankings (Millions of Dollars)

1990 Rank

1

2

3

1991 Rank

1

2

:

Change in Rank

o o

NA

Ranked CompaLnles

AMD

National Semiconductor

Philips Semiconductors

North American Others

Japanese Others

European Others

Rest of World Others

Total All Companies

Total North .American

Total Japanese

Total European

Total Rest of World

1990 Sales C$M)

13

7

1

o o 0

o

21

20

0

1

o

1991 Sales ($M)

9

5

-

1

o o o

15

15

0

o o

1990.91 Annual Growth

(%)

-30.8

-28.6

NA

NA

NA

NA

NA

-28.6

-25.0

NA

-lOO.O

NA

1991 Cum. Sum C$M)

9

14

NA

15

15

15

15

1991 Market

Share (%)

60.0

33.3

NA

6.7

o.o o.o o.o

lOO.O

lOO.O

o.o o.o o.o

1991 Cum. Sum (%)

60.0

93.3

NA

loo.o loo.o lOO.O

loo.o

NA - Not Applicable Source: Dataquest (August 1992 Estimates)

©1992 Dataquest Europe Limited August—Reproduction Prohibited

Final 1991 European Semiconductor Market Share Rankings and Revised 1990 Rankings 21

Table 12

European 1991 Monolithic Bipolar D ^ t a l Logic IC Market Share Rankings (Millions of Dollars)

1990 Rank

1

2

5

3

4

7

5

8

9

10

11

13

13

16

16

16

13

12

1991 Rank

1

2

3

4

5

6

7

8

9

9

11

12

13

13

15

15

-

-:

Change In Rank

o o 2

-1

-1

1

-2

o o 1

o 1

0

3

1

1

NA

NA

•-

Ranked Companies

Texas Instruments

National Semiconductor

Philips Semiconduaors

AMD

Motorola

Siemens

GEC Plessey Semiconductors

NEC

STC

Telefunken Electronic

Fujitsu

Toshiba

Hitachi

Raytheon

Matsushita

Mitsubishi

AT&T

SGS-Thomson Microelectronics

North .American Others

Japanese Others

European Others

Rest of World Others

Total .All Companies

Total North American

Total Japanese

Total European

Total Rest of World NA - Not Applicable Source: Dataquest (August 1992 Estiinates)

1990 Sales ($M)

138

59

45

51

47

40

45

19

10

7

6

2

2

1

1

1

2

5

8

0

0

o

489

306

31

152

o

1991 Sales ($M)

131

51

46

45

41

38

21

19

7

7

5

4

2

2

1

1

-

-

3

o 4

o

428

273

32

123

0

1990-91 Annual Growth

(%)

-5.1

-13.6

2.2

-11.8

-12.8

-5.0

-53.3

o.o -30.0

o.o -16.7

lOO.O

o.o lOO.O

o.o o.o NA

NA

-62.5

NA

NA

NA

-12.5

-10.8

3.2

-19.1

NA

1991 Cum. Sum ($M)

131

182

228

273

314

352

373

392

399

406

411

415

417

419

420

421

NA

NA

424

424

428

428

1991 Market

Share (%)

30.6

11.9

10.7

10.5

9.6

8.9

4.9

4.4

1.6

1.6

1.2

0.9

0.5

0.5

0.2

0.2

NA

NA

0.7

O.o 0.9

ao

lOO.O

638

7.5

28.7

OO

1991 Cum. Sum

(%)

30.6

42.5

53.2

63.7

73.3

82.2

87.1

91.5

93.1

94.7

95.9

96.8

97.3

97.8

98.0

98.2

NA

NA

99.1

99.1

lOO.O

lOO.O

©1992 Dataquest Europe Limited August—Reproduction Prohibited

22 Final 1991 European Semiconductor Market Share Ranldngs and Revised 1990 Rankings

Table 13

European 1991 Monolithic MOS Digital IC Market Share Rankings (Millions of Dollars)

1990 Rank

1

2

3 4

7

4

6

8

9

10

11

21

12

19

15

13

16

20

18

17

14

34

24

21

34

25

40

26

27

28

21

28

31

34

37

31

37

1991 Rank

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

18

20

21

22

23

24

25

26

26

26

29

30

31

32

33

33

33

36

36

Change in Rank

0

0

0

0

2

-2

-1

0

0

0

0

9

-1

5

0

-3

-1

2

0

-3

-7

12

1

-3

9

-1

14

0

-2

-2

-10

-4

-2

1

4

-5

1

Ranked Companies

Intel

Siemens

Motorola

Texas Instruments

NEC

Toshiba

SGS-Thomson Microelectronics

Philips Semiconductors

Hitachi

Samsung

AMD

ITT

National Semiconductor

Mitsubishi

GEC Plessey Semiconductors

Fujitsu

LSI Logic

Oki

VLSI Technology

Matra-MHS

Harris

AT&T

Cypress

Micron Technology

Western Digital

Austria Mikro Systeme

Goldstar

IDT

European Silicon Structures

Sharp

Matsushita

Sony

ABB-HAFO

Mietec

Zilog

Hewlett-Packard

TMS

1990 Sales ($M)

622

459

387

343

330

343

339

301

225

184

166

46

140

73

86

114

83

49

74

82

87

18

44

46

18

37

9

30

25

24

46

24

21

18

17

21

17

1991 Sales ($M)

765

444

431

366

346

321

313

312

253

232

190

152

150

110

105

104

100

89

89

88

56

50

49

45

38

33

33

33

27

26

25

23

21

21

21

19

19

1990-91 Annual Growth

(%)

23.0

-3.3

11.4

6.7

4.8

-6.4

-7.7

3.7

12.4

26.1

14.5

230.4

7.1

50.7

22.1

-8.8

20.5

81.6

20.3

7.3

-35.6

177.8

11.4

-2.2

111.1

-10.8

266.7

10.0

8.0

8.3

-45.7

-4.2

0.0

16.7

23.5

-9.5

11.8

1991 Cum. Sum

i$m 765

1,209

1,640

2,006

2,352

2,673

2,986

3,298

3,551

3,783

3,973

4,125

4,275

4,385

4,490

4,594

4,694

4,783

4,872

4,960

5,016

5,066

5,115

5,160

5,198

5,231

5,264

5,297

5,324

5,350

5,375

5,398

5,419

5,440

5,461

5,480

5,499

1991 Market

Share C%) 13.1

7.6

7.4

6 3

5.9

5.5

5.3

5.3

4.3

4.0

3.2

2.6

2.6

1.9

1.8

1.8

1.7

1.5

1.5

1.5

1.0

0.9

0.8

0.8

0.6

0.6

0.6

0.6

0.5

0.4

0.4

0.4

0.4

0.4

0.4

0.3

0.3

1991 Cum. Sum t»A) 13.1

20.7

28.1

34.4

40.3

45.8

51.1

56.4

60.7

647

67.9

70.5

73.1

75.0

76.8

78.6

80.3

81.8

83.3

84.8

85.8

86.7

87.5

88.3

88.9

89.5

90.1

90.7

91.2

91.6

92.0

92.4

92.8

93.2

93.6

93.9

94.2 (Continued)

©1992 Dataquest Europe Limited August—Reproduction Prohibited

Final X991 European Semiconductor Market Sliare Rankings and Revised 1990 Rankings 23

Table 13 (Continued)

European 1991 Monolithic MOS Digital IC Market Share Rankings (Millions of Dollars)

1990 Rank

42

45

33

30

46

43

39

-

40

44

46

1991 Rank

38

39

40

41

41

43

44

44

46

46

48

Change in Rank

4

6

-7

-11

5

o -5

NA

-6

-2

-2

Ranked Companies

Ericsson

Sanyo

Telefunken Electronic

Eurosil

Seiko Epson

Analog Devices

NMB

Rohm Eleaonics

Rockwell

STC