Sector Report(Autosaved)

-

Upload

deep-ghosh -

Category

Documents

-

view

219 -

download

0

Transcript of Sector Report(Autosaved)

-

7/30/2019 Sector Report(Autosaved)

1/19

Registered Office: Kotak Securities Limited, Bakhtawar, 1st floor, 229 Nariman Point, Mumbai 400021 India.

December 19, 2005 FOR PRIVATE CIRCULATION

Jay Prakash [email protected]

+9122 56341207

Non Banking Finance Companies

Capital x Leverage = Growth

Sector Report

Non Banking Financial Institutions play a crucial role in broadening access to financial services, enhancing

competition and diversification of the financial sector.

RBI report on trends in banking, 2005

Non Banking Financial Companies (NBFCs) have come a long way from the era of concentrated

regional operations, lesser credibility and poor risk management practices to highly sophisticatedoperations, pan-India presence and most importantly an alternate choice of financial

intermediation (not an alternate choice of banking as NBFCs still operate with lots of limitingfactors, which make them non-comparable to banks).

It is true that the difference between commercial banks and NBFCs is getting increasingly

blurred as NBFCs are today present in almost all the segments of financial sector save chequeissuance and clearing facility. NBFCs are now recognized as complementary to the banking

system capable of absorbing shocks and spreading risks at times of financial distress. TheReserve Bank of India (RBI) also recognises them as an integral part of the financial system

and is trying to improve the credibility of the entire sector.

Today, NBFCs are present in the competing fields of vehicle financing, hire purchase, lease,

personal loans, working capital loans, consumer loans, housing loans, loans against shares,

investments, distribution of financial products, etc. More often than not, NBFCs are presentwhere the risk is higher (and hence the returns), reach is required (strong last-mile network),

recovery has to be the focus area, loan-ticket size is smal l, appraisal & disbursement has to

be speedy and flexibility in terms of loan size and tenor is required.

The key differentiating factor working in favour of NBFCs is service. Today, a borrower is

looking for more convenience, quick appraisal & decision-making, higher amount of loan-to-

value and longer tenor. Though banks are not behind on the service aspect, they are largelylimited to urban centres. When it comes to semi-urban and rural centres, particularly where

the banking culture still not fully developed, NBFCs enjoy an edge over banks. However, evenin the urban areas, NBFCs have created niches for themselves, which are often neglected by

banks e.g. non-salaried individuals, traders, transporters, stock brokers, etc, and all these

categories are growing at a rapid pace.

New opportunities like home equity, credit cards, personal finance, etc, is expected to take

NBFCs to a new level. Growth in all these segments is sustainable at a higher rate than beforegiven the low penetration and changing demography in the country.Secondly, 100% cover for

public deposits would ensure higher credibili ty to the sector.Thirdly, capital had always been

a limiting factor for the sector. In a booming economy and the capital market, we expect thatthese companies are now in a better posi tion to raise capital at competitive rates to fuel their

future growth plans. Fourthly, better risk management and regulatory practices, NBFCs enjoy

a higher credibility today. Last but not the least, due to an established reach and network,NBFCs could be the favourites of the foreign financial giants to make an inroad in the country.The RBI has proposed to open the domestic market for foreign banks after FY2009 and some

of the foreign banks would not hesitate to shake hands with NBFCs to hit the ground running.

We believe that the sector is today at an inflection point and is likely to take a big leap in terms

of growth and profitability going forward.

NBFCs growth had been

constrained due to lack

of adequate capital.

Going forward, we believe

capital infusion and

leverage thereupon would

catapult NBFCs into a

different zone altogether.

We believe that the

sector has a lot more

potential to grow BIG

over the next 2 years.

Potential upside could be

much larger than our

estimates, if the

expanded capital base is

adequately leveraged

Companies covered

Shriram Transport Finance (STF)

Shriram City Union Finance(SCUF)

Cholamandalam Investment (CIFL)

Sundaram Finance (SFL)

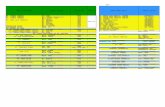

Comparision of key parameters

CMP Reco RoE (%) RoAA (%) Spread (%) P/ABV (x) D/E (x) CAR (%)

(Rs) FY06E FY07E FY06E FY07E FY06E FY07E FY06E FY07E FY06E FY07E FY06E FY07E

Shriram Transport (merged) 119 HOLD 25.8 25.8 3.1 2.9 8.7 8.7 3.2 2.7 6.8 7.4 13.7 12.6

Shriram City Union Finance 149 BUY 38.2 38.5 3.9 4.1 11.9 11.8 5.5 4.0 7.1 7.1 12.1 12.8

Cholamandalam Investment 179 BUY 12.2 17.5 2.2 2.8 7.7 7.6 2.3 2.1 4.6 5.8 17.8 14.8

Sundaram Finance 396 BUY 11.8 12.5 1.8 1.8 4.9 4.8 1.5 1.4 5.7 5.9 14.6 14.4

Source: Kotak Securities - Private Client Research

-

7/30/2019 Sector Report(Autosaved)

2/19

December 19, 2005 Kotak Securities - Private Client Research

Sector Report Please see the disclaimer on the last page For Private Circulation 2

SWOT analysis of NBFC

Strengths

High on service aspect

Strong last-mile approach

Focus on recovery

Easy and fast appraisal & disbursementsRegional kshatraps

Able to generate higher yield on assets

Attained critica l mass in terms of size

Own employees vs DSAs

Opportunities

Augmentation of capital and leveraging for growth

Large untapped market, both rural & urban and alsogeographically

Demographic changes and under-penetrationNew opportunities in credit card, personal finance,home equity, etc

Tie-up with global financial sector giants

Blurring gap with banks in terms of cost of funds

Securitisation, to liberate funds to fuel asset growth

Weakness

Weak in urban market

Weak credit history of most NBFCs

Largely restricted to the south India market

Weaker risk-management & technology systems

Too much of diversification from core business

Higher regulatory restrictions

Threats

Weak financial health of many of the NBFCs

High cost of funds

Asset quality deterioration may not only wipe out profits

but also networthEntry of foreign players in post-2009 scenario

Growing retail thrust within banks

Source: Kotak Securities - Private Client Research

Growth path for NBFCs in future

Get the global expertise

& products

Larger NBFCs

with critical mass;Focus on returns

& profits

Increase Reach,

Capital, Branding

Get innovativeproducts; Tie-ups

with globalfinancial giants

(preferably)

Multiply its size;look to convert

into a bank

Consolidate theirpositions; identify

various revenuestreams

Reduction in cost

of funds

Source: Kotak Securities - Private Client Research

-

7/30/2019 Sector Report(Autosaved)

3/19

December 19, 2005 Kotak Securities - Private Client Research

Sector Report Please see the disclaimer on the last page For Private Circulation 3

Profile

NBFCs operations can largely be categorised into equipment leasing, hire purchase,

investments and loans. There are 13,261 NBFCs, of which 507 were public deposit accepting

companies. Though the number of registered NBFCs is pretty high, there are only 16 companies

with an asset size of above Rs.5.00bn and collectively they held nearly 4/5 th of total assets ofall NBFCs.

However, the size of NBFCs is very small compared to the banking industry. In June 2004,NBFCs size was merely 5.7% of gross banking credit, which further deteriorated to 4.5% in

June 2005. There are two reasons for such decline- one, the banking credit growth has beenextremely good in FY05 i.e. at nearly 32.2% compared to 4.3% growth in NBFCs case. Secondly,

the number of NBFCs (deposit taking) is consistently declining over a period of time. It declined

from 875 in FY03 to 777 in FY04 and further to 573 in FY05. Nonetheless, we expect thegrowth in larger NBFCs asset to be in the range of 25-30% over next two years.

Regional presence

NBFCs have typically grown in the southern part of the country. Most of the NBFCs have

started their journey as chit-funds and then largely catering to the growing needs of individuals,

forayed into much-better organized non-banking operations. Though there are no concrete

reasons why NBFCs are more deep-rooted in south India, we understand that it is largely

because of demographic patterns.

# of NBFCs accepting public deposits

Source: RBI, Trends & progress of Banking in India, 2004-05

NBFC assets as % of banks assets (%)

Source: RBI, Trends & progress of Banking in India, 2004-05

400

500

600

700

800

1999 2000 2001 2002 2003 2004 2005

0.0

2.0

4.0

6.0

FY 2004 FY 2005

Though the number of NBFCs in north India is also high, average deposit is far lower comparedto south India. Other parts of the country do not have significant presence of NBFCs and are

also on declining trend.

Geographical distribution of NBFCs

Source: RBI, Trends & progress of Banking in India, 2004-05

Public deposit - Regionwise

Source: RBI, Trends & progress of Banking in India, 2004-05

0%

25%

50%

75%

100%

FY03 FY04 FY05

South North Centre West East

0%

25%

50%

75%

100%

FY03 FY04 FY05

South North West East Centre

-

7/30/2019 Sector Report(Autosaved)

4/19

December 19, 2005 Kotak Securities - Private Client Research

Sector Report Please see the disclaimer on the last page For Private Circulation 4

Asset & liability mix

NBFCs have made a transient shift in their liabili ty composition. Once largely dependent on

the public deposits, now borrowing in the form of non-convertible debentures, bank borrowings,

commercial papers, etc, are the largest form of liabilities.

On the asset side, leasing, hire purchase and loans & advances constitute the larger pie of

nearly 85%. This includes auto loans, hire-purchase, leased assets, personal finance, housing

loans, loans against shares, consumer durable loans, etc. Investments also add another 12%of total asset size as some of the large NBFCs are purely engaged in the business of

investments. The diversified nature of asset mix gives stability to the NBFCs, which is importantfor the stable and consistent growth of the sector.

Financial performance

NBFCs, despite their numbers declining, have done well in the recent past. The surge in retailcredit, particularly in vehicle and home financing, has helped the sector most. Besides, the gapbetween the cost of funds between banks and NBFCs are also on the decline. The important

point in the picture is the growth in net owned funds of the NBFCs despite decline in numberof operational NBFCs indicates growing trend in financial health of the sector.

Liability mix (FY05)

Source: RBI, Trends & progress of Banking in India, 2004-05

Asset mix (FY05)

Source: RBI, Trends & progress of Banking in India, 2004-05

Reserves &

surpluses

11%

Paid up capital

6%

Public

deposits

11%Borrowings

65%

Other liabilities

7%

Bill business

1%

Equipment

leasing assets

6%

Hire purchase

assets

43%

Investments

10%

Loans &

advances

33%

Spread between banks and NBFCs deposit rates

Source: RBI, Trends & progress of Banking in India, 2004-05

Public deposit at less than 10% interest

Source: RBI, Trends & progress of Banking in India, 2004-05

3.50

4.00

4.50

5.00

5.50

FY00 FY01 FY02 FY03 FY04 FY05

0%

20%

40%

60%

80%

FY03 FY04 FY05

-

7/30/2019 Sector Report(Autosaved)

5/19

December 19, 2005 Kotak Securities - Private Client Research

Sector Report Please see the disclaimer on the last page For Private Circulation 5

The general decline in the interest rates has also helped NBFCs to a large extent. In FY03,

there were merely 23% companies which were having public deposits (which is typically the

costliest outside liability) at a cost more than 10%. The same increased to over 70% in FY05.But it is more important to note here that the gap between the cost of funds between banks

and NBFCs have declined from 5.5% to a more sustainable level of 4%. So, while the yie ld

on assets declined, spread has risen over the last two years.

Despite rising competition from banks and within NBFCs itself, return on assets in the category

have been on a rising trend and is now stabilizing around 1.6%. This is primarily due to better

yield on assets, higher recovery and limited overhead costs structure of NBFCs.

Spread (%)

Source: RBI, Trends & progress of Banking in India, 2004-05

Net owned funds (Rs bn)

Source: RBI, Trends & progress of Banking in India, 2004-05

0

4

8

12

16

FY03 FY04 FY055.6

6.0

6.4

6.8

7.2

Yield on assets (LHS)

Cost of funds (LHS)Spread (RHS)

46

48

50

52

54

56

FY03 FY04 FY05

In terms of asset quality, like banks, NBFCs also have seen commendable improvement in

their asset quality, both in terms of gross and net non-performing assets (NPA). In last fiveyears, gross NPA has declined secularly from 11.5% to 7.0%. In the same period net NPA also

improved from 5.6% to 3.4%.

Return on assets (%)

Source: RBI, Trends & progress of Banking in India, 2004-05

Asset quality

Source: RBI, Trends & progress of Banking in India, 2004-05

0.0

0.4

0.8

1.2

1.6

2.0

FY03 FY04 FY05

0

3

6

9

12

FY01 FY02 FY03 FY04 FY05

Gross NPA (%) Net NPA (%)

-

7/30/2019 Sector Report(Autosaved)

6/19

December 19, 2005 Kotak Securities - Private Client Research

Sector Report Please see the disclaimer on the last page For Private Circulation 6

However, during FY05, number of companies having less than regulatory requirement of 12%as capital adequacy is on rise. We expect the trend to reverse in FY06 onwards due to two

prime reasons: good profitability and capital raising programs.

Retail Finance

Retail finance is one of the major thrust areas for financial intermediaries due to the followingreasons:

Low penetration and high growth opportunity

Change in demography and lifestyle

Higher disposable income and higher affordability

Better margins and profitability

Low loan-ticket size

Lower delinquencies

Retail finance has grown up in size from Rs.272bn in FY99 to Rs.1,213bn in FY04 and is

expected to touch Rs.2,792bn by FY09 i.e. a CAGR of 18% over next five years. Banks havebecome very much active in the retail space and their share also has gone up from less than

40% in FY99 to over 65% in FY04. As per a Cris Infac study it is slated to go up to 75% by

FY09.

Housing finance constitutes the largest pie of retail finance wi th a total market share of over65%. The growth in housing finance is further expected to be in the range of 25-30% over next

couple of years given that the penetration level is still low and is catching up fast. Secondly,

the loan ticket size is also on rise.

Capital adequacy ratio

Source: RBI

Retail portfolio mix

Source: Cris Infac, Retail Finance Annual Review, March 2005

Retail finance portfolio, Rs bn

Source: Cris Infac, Retail Finance Annual Review, March 2005

0%

20%

40%

60%

80%

100%

FY04 FY09P

Housing Auto CV 2W

0

2000

4000

6000

8000

FY99 FY04E FY09P

0%

25%

50%

75%

100%

FY03 FY04 FY05

20%

-

7/30/2019 Sector Report(Autosaved)

7/19

December 19, 2005 Kotak Securities - Private Client Research

Sector Report Please see the disclaimer on the last page For Private Circulation 7

Though housing finance today constitutes nearly 40% of total housing cost, it is still merely 3%

of GDP, which is much lower than the global average of nearly 8%.

Similarly, increase in borrowing capacity due to various reasons like decl ine in interest rate,

longer tenure and increase in income levels have led to the spurt in retail finance.

Auto finance

Banks are slowly capturing the larger pie of the auto finance market; however, this has not

deterred the NBFC players too. Low loan ticket size, fabulous growth and rising financepenetration besides lucrative margins are some of the reasons why all sorts of financial

intermediaries are fiercely competing for larger market share.

Units financed (%) - FY04

Source: Cris Infac, Retail Finance Annual Review, March 2005

Increase in borrowing ability between FY99 & FY04 (%)

Source: Cris Infac, Retail Finance Annual Review, March 2005

0

20

40

60

80

100

Housing Auto loan CV loan 2W loan

0

10

20

30

40

50

60

Housing Auto loan CV loan 2W loan

Finance penetration (%)

1998-99 2003-04 2004-05 2008-09

2W finance 12 32 37 49

Car/UV finance 45 64 66 75

New CV finance 49 63 79 78

New utility vehicle 38 56 58 66

Source: Cris Infac, Retail Finance Annual Review, March 2005

Market share in 2W segment

Source: Cris Infac, Retail Finance Annual Review, March 2005

Average yield (%)

Source: Cris Infac, Retail Finance Annual Review, March 2005

0%

20%

40%

60%

80%

100%

2001-02 2002-03 2003-04

Banks NBFCs Others

10

14

18

22

26

1998-99 2003-04 2004-05 2008-09

-

7/30/2019 Sector Report(Autosaved)

8/19

December 19, 2005 Kotak Securities - Private Client Research

Sector Report Please see the disclaimer on the last page For Private Circulation 8

CAGR (%) (FY04-09)

Source: Cris Infac, Retail Finance Annual Review, March 2005

There is a growing competition amongst the players to go for used vehicle financing. Though

the return is substantially higher, risks are higher too. Even after considering higher expected

losses in used vehicle finance, net margin is higher by nearly 175 to 250 bps. However, superiorreturns are generated by way of focus on risk management and recovery.

Net margins

FY02 FY04 Remarks

New CVs 1.0-1.5 1.0-1.5 The decline in yield and cost of funds move more in

tandem compared to used vehicle financing.

Old CVs 1.5-2.25 2.5-3.25 Despite decline in yield, margins have improved.

Source: Cris Infac & Kotak Securities - Private Client Research

Though the overall market of used vehicle finance is small, competition is visibly growing.

Consumer durable finance

Consumer durable (CD) financing is also gaining momentum with the changing lifestyle andincrease in disposable income. As per Cris Infac, the market size is expected to grow from

Rs.141bn in FY04 to Rs.218bn in FY09 at a CAGR of 9.1%. Colour TVs, refrigerators, air

conditioners and washing machines contribute nearly 80-85% of total CD financing business.In CD financing, NBFCs are more aggressive than banks primarily due to low-ticket items, low

tenure and secondly banks book it under their personal finance segment. Net spread in theCD financing business is high at 4-6% compared to other segments of NBFCs.

0

5

10

15

20

25

30

2W finance Used CV finance Auto finance New utility

vehicle

New CV finance

-

7/30/2019 Sector Report(Autosaved)

9/19

December 19, 2005 Kotak Securities - Private Client Research

Sector Report Please see the disclaimer on the last page For Private Circulation 9

Companies

-

7/30/2019 Sector Report(Autosaved)

10/19

December 19, 2005 Kotak Securities - Private Client Research

Sector Report Please see the disclaimer on the last page For Private Circulation 10

Stock details

BSE code : 511218

NSE code : SRTRANSFIN

Market cap (Rs bn) : 7.2*

Free float (%) : 88.3

52-wk Hi/Lo (Rs) : 146/31

Wk Avg Qty : 132,812

Shares o/s (mn) : 65.43*

* Post merger equity shares o/s would be 126mn

and market cap at Rs.13.86bn.

Valuation table (merged)

Rs mn FY05 FY06E FY07E FY08E

Total income 6,896 8,321 9,914 11,958

Gross profit 1677 1,913 2,249 2,655

Net profit 963 1,156 1,374 1,632

EPS (Rs) 7.6 9.2 10.9 12.9

BVPS (Rs) 31.0 36.9 44.6 54.3

Adj. BVPS (Rs) 28.9 34.1 41.0 49.8

Dividend yield (%) 2.3 2.3 2.3 2.3

Debt/ Equity (x) 7.2 6.8 7.4 7.9

RoAA (%) 3.5 3.1 2.9 2.7

RoE (%) 31.7 25.8 25.8 25.4

Spread (%) 8.8 8.7 8.7 8.3

Net NPA (%) 0.9 0.9 0.9 0.9

P/E (x) 14.4 12.0 10.1 8.5

P/ABV (x) 3.8 3.2 2.7 2.2

CAR (%) 14.7 13.7 12.6 12.1

NPA (%) 0.9 0.9 0.9 0.9

Source: Company & Kotak Securities - Private

Client Research

Shareholding pattern

One-year performance (Rel to Sensex)

Source: Capitaline

STF

Sensex

Shriram Transport Finance (STF)(Rs.110, P/ABV: 3.2x, HOLD)

Price target: Rs.127 (18-month horizon)

STF is engaged in truck financing where the expertise lies in pre-owned

vehicles. It has a unique model in terms of pre-owned/ used truck financing,

which gives STF an advantage over other auto financers, both NBFCs and

banks. Due to its niche operations, STF and other group companies have

been able to generate supernormal spreads over their asset book. STF

has plans to merge other group company namely, Shriram Investments

and also Shriram Overseas. However, in our calculations we have taken

impact of Shriram Investments in terms of consolidation of accounts.

Given the growth expectation of 24.3% in used CV financing by Cris Infac

and also higher spread in used-vehicle financing, we believe that STF would

be able to sustain its high margins for the foreseeable future. STF also

manages portfolios for banks like UTI Bank and Citigroup for their used/

new vehicle financing due to its natural advantage in the last-mile(customer-centric) for both appraisal and recovery.

Investment rationale

Presence in high growth area of used-truck financing where margins are higher. SFL

had in the past margins over 10%, which post-merger we expect to sustain over 8%

albeit on a higher base.

The group has a nationwide presence with dominance in south and west India.

Merger would boost balance sheet; capital-raising to be easier to fuel asset growth

Group's foray into insurance and personal finance would help in cross-selling products

as it is currently using its nidhi-clients

Net interest income to grow at a CAGR of over 27% over next three years with profit

to rise at a CAGR of 20%. Asset in the same period is expected to register a CAGR

of 30%. STF has one of the highest RoAA in the industry at 3%.

Risks and concerns

General slowdown in the economy may reduce prospects of auto financing

Poor agricultural output/ poor monsoon can impact the business of the company

Stiff competition from the commercial banks entry into the auto-financing business

could negatively impact NBFCs business & margin in general.

Valuation & recommendation

We expect that STF would post an EPS of Rs.9.2, 10.9 and Rs.12.9 in FY06E, FY07E

and FY08E respectively. In the same period adjusted book value is expected to be at

Rs.34, 41 and Rs.50 respectively.

Based on FY08 earning estimates, the company is expected to post an RoE of 25.4%,

which translates the fair value to be at 2.6x its adjusted book value. We believe that FY08estimates would get factored in a 12 to 18 months timeframe, which is equal to Rs.127.

We recommend a HOLD on the stock with a price target of Rs.127 over 18-month horizon,

an upside of 16%.

Institutions

4%

Corp. holding

21%

Foreign

29%

Promoters

12%

Public &

others

34%

Jay Prakash Sinha

+9122 56341207

-

7/30/2019 Sector Report(Autosaved)

11/19

December 19, 2005 Kotak Securities - Private Client Research

Sector Report Please see the disclaimer on the last page For Private Circulation 11

Financials: Shriram Transport Finance - Merged entity

Profit & loss (Rs mn)

FY05 FY06E FY07E FY08E

Operating income 6,774 8,172 9,729 11,734

Other income 122 149 185 225

Total income 6,896 8,321 9,914 11,958

Interest expenditure 3,281 4,146 5,042 6,144

Employee expense 272 326 391 469

Operating expense 1,129 1,372 1,640 2,069

Other expense 537 564 592 622

Gross profit 1,677 1,913 2,249 2,655

Depreciation 158 188 199 219

Profit before tax 1,519 1,726 2,050 2,436

Provision for tax 557 569 677 804

Profit after tax 962 1,156 1,374 1,632

Extraordinary items (1) - - -

Net profit 963 1,156 1,374 1,632

Earning per share (Rs) 7.6 9.2 10.9 12.9

Book value per share (Rs) 31.0 36.9 44.6 54.3

Adjusted BVPS (Rs) 28.9 34.1 41.0 49.8

Source: Kotak Securities - Private client Research

Balance sheet (Rs mn)

FY05 FY06E FY07E FY08E

Share capital 1,261 1,261 1,261 1,261

Preference capital 536 536 536 536

Reserves & surpluses 2,642 3,395 4,366 5,586

Total networth 4,439 5,192 6,163 7,383

Unsecured loans 3,057 3,973 5,271 6,662

Secured loans 25,376 32,684 42,101 53,256

Total loans 28,433 36,658 47,373 59,918

Total liability 32,872 41,850 53,536 67,301

Net block 1,300 1,284 1,275 1,264

Investments 89 98 108 119

Loans & advances 30,173 40,734 52,954 66,283

Cash 4,721 2,974 2,411 2,738

Other current assets 3,088 3,627 4,263 5,012

Current liabilities 3,951 4,544 5,243 5,498

Provision 1,358 1,134 1,269 1,426

Net current assets 32,673 41,658 53,116 67,108

Deferred tax assets (1,191) (1,191) (1,191) (1,191)

Total assets 32,871 41,850 53,308 67,301

Source: Kotak Securities - Private client Research

Key financial ratios

FY05 FY06E FY07E FY08E

Debt-Equity Ratio 0.0 6.8 7.4 7.9

CAR (%) 14.7 13.7 12.6 12.1

Net NPA (%) 0.9 0.9 0.9 0.9

RONW (%) 31.7 25.8 25.8 25.4

RoAA (%) 3.2 3.1 2.9 2.7

Spread (%) 8.8 8.7 8.7 8.3

Source: Kotak Securities - Private client Research

-

7/30/2019 Sector Report(Autosaved)

12/19

December 19, 2005 Kotak Securities - Private Client Research

Sector Report Please see the disclaimer on the last page For Private Circulation 12

Stock details

BSE code : 532498

NSE code : SHRIRAMCIT

Market cap (Rs bn) : 3.8

Free float (%) : 26.6

52-wk Hi/Lo (Rs) : 159/28

Wk Avg Qty : 290,631

Shares o/s (mn) : 27.10

Valuation table

Rs mn FY05 F Y06E FY07E FY08E

Total income 1812 2081 2509 2955

Gross profit 414 554 732 830Net profit 231 335 450 511

EPS (Rs) 7.3 12.3 16.6 18.9

BV/share (Rs) 25.9 30.3 41.2 55.3

Adj. BVPS (Rs) 22.6 25.7 35.4 48.2

Debt-equity ratio 7.2 7.1 7.1 6.9

APATM (%) 11.5 15.1 17.1 16.6

CAR (%) 11.8 12.1 12.8 13.7

Net NPA (%) 1.2 1.2 1.2 1.2

RONW (%) 32.7 38.2 38.5 32.7

RoAA (%) 3.2 3.9 4.1 3.7

Spread (%) 11.3 11.9 11.8 11.0

Dividend/share (Rs) 2.5 2.5 2.5 2.5

Dividend yield (%) 1.8 1.8 1.8 1.8

P/E (x) 19.6 11.5 8.5 7.5

P/ABV(x) 6.3 5.5 4.0 2.9

Source: Company & Kotak Securities - Private

Client Research

Shareholding pattern

One-year performance (Rel to Sensex)

Source: Capitaline

Shriram City Union Finance

Sensex

Shriram City Union Finance(Rs.145, P/ABV: 5.5x, BUY)

Price target: Rs.176 (18-month horizon)

Shriram City Union Finance (SCUF) is primarily engaged in the financing

of consumer durables and has made a disbursement of Rs.2.63bn in FY05.

The segment though low-ticket in size is picking up smartly and is expected

to grow at a CAGR of 9% over next four years as per Cris Infac report.

SCUF is keen on the segment and is looking to enhance its overall portfolio

substantially. It has also exited from truck financing, which is already

catered by other group companies.

We believe that the company is well positioned with its wide network, large

clientele base and strong track record to take the advantage of lifestyle

and demographic changes. We estimate companys growth at a CAGR of

28% over next three years. However, the growth could easily be catapulted

to next level with increase in its capital base and leveraging on the same.

Investment rationale

Consistent track record of growth; strong parentage with ambitious growth plans

Focus on consumer durable & personal finance where the growth prospects are high;

given the talks of capital infusion, the asset could easily grow at a CAGR of 50% over

next three years.

Being low-ticket items and significantly lower tenure, capital turnover is high and

hence spreads are higher at 11.9% (one of the highest in the entire industry). Thisalso leads to high RoE for the company at 38% and hence demands for a premium

valuation.

Cross-selling and leveraging group strengths would help in sustaining growth

One of the highest EVA spread leading to higher valuation of the company. It is expected

to sustain at level of 16%, down from the current level of 20%.

Risks and concerns

General slowdown in the economy may reduce prospects of consumer durablefinancing

Given the higher margins in the business, stiff competition going ahead cannot beruled out.

Valuation & recommendation

We expect that SCUF to post an EPS of Rs.12.3, 16.6 and Rs.18.9 in FY06E, FY07Eand FY08E respectively. In the same period adjusted book value is expected to be

at Rs.26, 35 and Rs.48 respectively.

Based on FY08 earning estimates, the company is expected to post an RoE of 38%,which translates the fair value to be at 3.2x its adjusted book value. We believe that

FY08 estimates would get factored in a 12 to 18 months timeframe, which is equal

to Rs.169. This is well supported by our residual income valuation of the stock at

Rs.183. Based on the average of the two, we arrive at a fair value of Rs.176 (againbased on FY08E estimates). We recommend a BUY on the stock with a price target

of Rs.176 over 18-month horizon, an upside of 24%.

Public &

others

14.4%

Promoters

73.4%

Foreign

0.1% Corp. holding

10.2%

Institutions

1.9%

Jay Prakash Sinha

+9122 56341207

-

7/30/2019 Sector Report(Autosaved)

13/19

December 19, 2005 Kotak Securities - Private Client Research

Sector Report Please see the disclaimer on the last page For Private Circulation 13

Financials: Shriram City Union Finance

Profit & loss (Rs mn)

FY05 FY06E FY07E FY08E

Operating income 1,759 2,024 2,439 2,872

Other income 53 57 70 83

Total income 1,812 2,081 2,509 2,955

Interest expenditure 949 1,011 1,148 1,371

Employee expense 60 72 86 103

Operating expense 267 315 407 509

Other expense 123 129 135 142

Gross profit 414 554 732 830

Depreciation 50 55 60 66

Profit before tax 364 499 672 763

Provision for tax 133 165 222 252

Profit after tax 231 335 450 511

Extraordinary items 0 - - -

Net profit 231 335 450 511

Earning per share (Rs) 7.3 12.3 16.6 18.9

Book value per share (Rs) 25.9 30.3 41.2 55.3

Adjusted BVPS (Rs) 22.6 25.7 35.4 48.2

Source: Kotak Securities - Private client Research

Balance sheet (Rs mn)

FY05 FY06E FY07E FY08E

Share capital 271 271 271 271

Preference capital 233 233 233 233

Reserves & surpluses 431 668 1,021 1,436

Total networth 935 1,172 1,525 1,939

Unsecured loans 620 806 927 1,020

Secured loans 5,894 7,662 9,731 12,164

Total loans 6,514 8,468 10,658 13,184

Total liability 7,449 9,640 12,183 15,123

Net block 605 625 646 670

Investments 16 18 20 22

Loans & advances 7,666 10,349 12,936 16,170

Cash 945 581 677 537

Other current assets 14 16 20 24

Current liabilities 1,196 1,316 1,447 1,592

Provision 324 356 392 431

Net current assets 7,104 9,274 11,794 14,708

Deferred tax assets (277) (277) (277) (277)

Total assets 7,449 9,640 12,183 15,123

Source: Kotak Securities - Private client Research

Key financial ratios

FY05 FY06E FY07E FY08E

Debt-Equity Ratio 7.2 7.1 7.1 6.9

CAR (%) 11.8 12.1 12.8 13.7

Net NPA (%) 1.2 1.2 1.2 1.2

RONW (%) 32.7 38.2 38.5 32.7

RoAA (%) 3.2 3.9 4.1 3.7

Spread (%) 11.3 11.9 11.8 11.0

Source: Kotak Securities - Private client Research

-

7/30/2019 Sector Report(Autosaved)

14/19

December 19, 2005 Kotak Securities - Private Client Research

Sector Report Please see the disclaimer on the last page For Private Circulation 14

Stock details

BSE code : 511243

NSE code : CHOLAINV

Market cap (Rs bn) : 6.8

Free float (%) : 44.64

52-wk Hi/Lo (Rs) : 180/58

Wk Avg Qty : 107,018

Shares o/s (mn) : 38.25

Valuation table

Rs mn FY05 F Y06E FY07E FY08E

Total income 2147 2332 2979 4008

Gross profit 609 677 1000 1467Net profit 341 394 614 929

EPS (Rs) 9.0 10.4 16.2 24.4

BVPS (Rs) 79.7 84.5 95.2 114.1

Adj. BVPS (Rs) 72.6 77.1 84.8 99.6

Debt-equity ratio 4.3 4.6 5.8 6.8

CAR (%) 19.5 17.8 14.8 12.9

Net NPA (%) 1.8 1.6 1.6 1.7

RONW (%) 12.2 12.2 17.5 22.8

RoAA (%) 2.1 2.2 2.8 3.1

Spread (%) 8.2 7.7 7.6 7.3

P/E (x) 19.5 17.0 10.9 7.2

P/ABV(x) 2.4 2.3 2.1 1.8

Source: Company & Kotak Securities - Private

Client Research

Shareholding pattern

One-year performance (Rel to Sensex)

Source: Capitaline

Cholamandalam

Sensex

Cholamandalam Investment & Finance Co(Rs.177, P/ABV: 2.3x, BUY)

Price target: Rs.232 (18-month horizon)

Cholamandalam Investment & Finance Co (CIF), a Murugappa group

company, is primarily engaged into the business of vehicle financing and

Investments. It also has interests in asset management, capital market

and distribution of products. Its insurance arm is likely to be transferred

to other group company due to induction of DBS Bank as promoter.

With the induction of DBS Bank into the business, its retail finance business

is set to grow substantially. The expertise in product development, branding

& risk management of DBS Bank would allow the company to catapult into

a different league altogether.

Investment rationale

Strong parentage and track record

Diversified financial business with a growth focus on high margin business

Thrust on retail financing is the key growth driver for the company

Induction of DBS Bank would allow the company to develop new products; growth is

expected to rise from a moderate level of 5% to a CAGR of 32% over next threeyears. CIF has grown by 15-20% in the past against industry growth of 9-10%.

Eanings are also expected to post a CAGR of 33% over next three years and grow

by 2.7x by FY08E. Hence RoE is also slated to double from 12% to 23% by FY08E.

Asset management and the distribution business to get a big boost with the help of

DBS Bank association, presently neither of them is featuring in the top brackets. We

expect both to scale up in terms of business and valuation going forward.

Risks and concerns

Stiff competition from the commercial banks entry into the auto-financing/ retail

financing business could negatively impact NBFCs business & margin in general.

Reduction in DBS Banks commitment, if any, could reduce the growth.

Valuation and recommendation

We expect CIF to post an EPS of Rs.10.4, 16.2 and Rs.24.4 in FY06E, FY07E and

FY08E respectively. In the same period adjusted book value is expected to be at Rs.77,

85 and Rs.100 respectively.

Based on FY08 earning estimates, the company is expected to post a RoE of 23%, which

translates the fair value to be at 2x its adjusted book value. We believe that FY08 estimateswould get factored in a 12 to 18 months timeframe, which equals to Rs.201. We further

get Rs.31 as the value of its asset management and insurance business. We recommend

a BUY on the stock with a price target of Rs.232 over 18-month horizon, an upside of32%.

Sum of the part valuation

(FY 08E valuation)

Core business 201

AMC 20

Insurance 11

Total value 232

Source: Kotak Securities - Private Client Research

Public &

others

31%

Promoters55%

Foreign

6%

Corp. holding

7%

Institutions

1%

Jay Prakash Sinha

+9122 56341207

-

7/30/2019 Sector Report(Autosaved)

15/19

December 19, 2005 Kotak Securities - Private Client Research

Sector Report Please see the disclaimer on the last page For Private Circulation 15

Financials: Cholamandalam Investment & Finance Co

Profit & loss (Rs mn)

FY05 FY06E FY07E FY08E

Operating income 2,146 2,282 2,879 3,908

Other income 1 50 100 100

Total income 2,147 2,332 2,979 4,008

Interest expenditure 845 930 1,212 1,723

Operating expense 286 314 346 381

Miscellaneous expenses 177 204 234 269

Provisions 230 207 186 168

Gross profit 609 677 1,000 1,467

Depreciation 93 84 76 68

Profit before tax 516 593 925 1,399

Provision for tax 175 199 311 470

Net profit 341 394 614 929

Earning per share (Rs) 9.0 10.4 16.2 24.4

Book value per share (Rs) 79.7 84.5 95.2 114.1

Adjusted BVPS (Rs) 72.6 77.1 84.8 99.6

Source: Kotak Securities - Private client Research

Balance sheet (Rs mn)

FY05 FY06E FY07E FY08E

Share capital 380 380 380 380

Preference capital 100 100 100 100

Reserves & surpluses 2,647 2,832 3,237 3,957

Total networth 3,128 3,312 3,717 4,437

Unsecured loans 6,033 6,938 9,713 13,599

Secured loans 7,276 8,368 11,715 16,401

Total loans 13,309 15,306 21,428 29,999

Total liability 16,437 18,618 25,145 34,437

Net block 160 161 178 213

Investments 1,288 1,288 1,288 1,288

Stock on hire 12,007 14,048 19,667 27,534

Cash 417 151 104 323

Loans & advances 3,306 3,829 4,857 6,180

Current liabilities 504 570 650 740

Provision 293 315 338 363

Net current assets 14,933 17,144 23,640 32,934

Deferred tax assets 56 26 39 2

Total assets 16,437 18,618 25,146 34,437

Source: Kotak Securities - Private client Research

Key financial ratios

FY05 FY06E FY07E FY08E

Debt-Equity Ratio 4.7 4.4 5.2 6.3

CAR (%) 19.5 17.8 14.8 12.9

Net NPA (%) 1.8 1.6 1.6 1.7

RONW (%) 12.2 12.2 17.5 22.8

RoAA (%) 2.1 2.2 2.8 3.1

Spread (%) 8.2 7.7 7.6 7.3

Source: Kotak Securities - Private client Research

-

7/30/2019 Sector Report(Autosaved)

16/19

December 19, 2005 Kotak Securities - Private Client Research

Sector Report Please see the disclaimer on the last page For Private Circulation 16

Stock details

BSE code : 521305

NSE code : SUNDARMFIN

Market cap (Rs bn) : 11.16

Free float (%) : 63.05

52-wk Hi/Lo (Rs) : 409/240

Wk Avg Qty : 6,966

Shares o/s (mn) : 27.78

Valuation table

Rs mn FY05 F Y06E FY07E FY08E

Total income 4591 5240 5905 6777

Gross profit 1446 1497 1672 1974Net profit 760 843 985 1208

Earning/share (Rs) 27.4 30.4 35.4 43.5

BV/share (Rs) 245.9 268.8 296.7 332.7

Adj. BVPS (Rs) 235.1 258.0 285.9 321.9

Dividend/share (Rs) 7.5 7.5 7.5 7.5

Debt-equity ratio 5.3 5.7 5.9 6.1

APATM (%) 16.6 16.1 16.7 17.8

CAR (%) 14.7 14.6 14.4 14.2

Gross NPA (%) 1.5 1.8 2.0 2.0

Net NPA (%) 0.5 0.5 0.5 0.5

RONW (%) 12.6 11.8 12.5 13.8

RoAA (%) 2.0 1.8 1.8 1.9

Spread (%) 6.0 4.9 4.8 4.8

Dividend yield (%) 1.9 1.9 1.9 1.9

P/E (x) 14.7 13.2 11.3 9.2

P/ABV(x) 1.7 1.6 1.4 1.2

Source: Company & Kotak Securities - Private

Client Research

Shareholding pattern

One-year performance (Rel to Sensex)

Source: Capitaline

Sundaram Finance

Sensex

Sundaram Finance (SFL)(Rs.395, P/ABV: 1.6x, BUY)

Price target: Rs.518 (18-month horizon)

SFL is a major NBFC in financing automobiles with an asset base of over

Rs.44bn. The company has formidable presence in other financial sectorslike asset management, insurance, home finance and distribution offinancial products. Recently the company has also entered into softwareservices and BPO, though they are still in the nascent stage. The robustgrowth in the medium & heavy commercial vehicles, cars, multi-axles, two-wheelers, housing loans, personal loans and more importantly prospectsof insurance provide an investible opportunity in SFL.

We have valued the company using sum-of-the-parts valuation for itsvarious subsidiaries & divisions. Our estimate suggests a fair value ofRs.518 based on FY08 estimates, which we expect to be factored in another12-18months. We recommend a BUY with a price target of Rs.518, an upside

of 29% over an 18-month horizon.

Investment rationaleRobust growth of automobile segment, which provides over 20% growth opportunity

for the company. Given the low leverage, SFL has potential to step up its asset growthwithout having much capital concern.

The Sundaram group is associated with automobiles & related products and the global

phenomenon suggests that such a combination provides higher growth opportunity

for both the manufacturer and the finance company

Penetration level of General Insurance is still quite low at 0.56% of GDP against theglobal average of 2.19%. We believe that huge growth potential is still untapped

SFL has amalgamated Lakshmi General Finance (LGF) with itself, which has further

boosted the business potential for the company

Software and services business, which are into nascent stage, are likely to grow at

a rapid pace

The company has a healthy capital adequacy of 14.6% besides net NPA of merely0.45%

Sum of the parts valuation suggests that the stock is undervalued and would be re-

rated based on synergy of the group companies

Risks and concerns

Slowdown in the economy may impact the demand of automobiles and hence the

financing business

Poor agricultural output/ poor monsoon can impact the business of the company

Stiff competition from the commercial banks could negatively impact NBFCs business

& margins in particular

Low liquidity on bourses

Valuation & recommendation

We have valued the company using sum-of-the-parts valuation for its various subsidiaries

& divisions. Our estimate suggests a fair value of Rs.518 based on FY08 estimates,

which we expect to be factored in another 12-18months. We recommend a BUY with aprice target of Rs.518, an upside of 29% over an 18-month horizon.

Valuation

(Rs) Weight (%) Value for SFL

SFL, standalone 415 100 415

RSAICL, insurance 68 60 40

SHFL, housing finance 24 60 14

SAMCL, asset management 35 60 21

Cash in SFL 28 100 28

Total 518

Source: Kotak Securities - Private Client Research

Public &

others

42%

Promoters

37%

Foreign

11%

Corp. holding

1%

Institutions

9%

Jay Prakash Sinha

+9122 56341207

-

7/30/2019 Sector Report(Autosaved)

17/19

December 19, 2005 Kotak Securities - Private Client Research

Sector Report Please see the disclaimer on the last page For Private Circulation 17

Financials: Sundaram Finance

Profit & loss (Rs mn)

FY05 FY06E FY07E FY08E

Operating income 4,413 5,007 5,636 6,467

Other income 178 233 269 310

Total income 4,591 5,240 5,905 6,777

Interest expenditure 2,148 2,649 3,031 3,482

Employee expense 483 541 606 679

Operating expense 459 496 535 578

Other expense 55 58 61 64

Gross profit 1,446 1,497 1,671 1,974

Depreciation 222 238 202 172

Profit before tax 1,224 1,259 1,469 1,803

Provision for tax 464 415 485 595

Profit after tax 760 843 984 1,208

Net profit 760 843 984 1,208

Earning per share, Rs 27.4 30.4 35.4 43.5

Book value per share, Rs 245.9 268.8 296.7 332.7

Adjusted BVPS, Rs 235.1 258.0 285.9 321.9

Source: Kotak Securities - Private client Research

Balance sheet (Rs mn)

FY05 FY06E FY07E FY08E

Share capital 278 278 278 278

Reserves & surpluses 6,552 7,187 7,963 8,963

Total networth 6,830 7,465 8,241 9,241

Unsecured loans 23,260 27,912 33,494 40,193

Secured loans 14,804 15,544 16,322 17,138

Total loans 38,064 43,456 49,815 57,330

Total liability 44,894 50,921 58,057 66,571

Net block 1,666 1,547 1,596 1,788

Lease 223 190 161 137

Investments 3,111 3,267 3,430 3,602

Stock on hire 4,189 3,561 3,027 2,573

Cash 1,004 774 582 159

Loans & advances 37,612 46,034 54,194 63,845

Current liabilities 2,336 2,453 2,576 2,704

Provision 556 2,104 2,589 3,183

Net current assets 39,913 45,812 52,638 60,688

Deferred tax assets (20) 106 231 356

Total assets 44,894 50,921 58,056 66,571

Source: Kotak Securities - Private client Research

Key financial ratios

FY05 FY06E FY07E FY08E

Debt-Equity Ratio 5.3 5.7 5.9 6.1

CAR (%) 14.7 14.6 14.4 14.2

Net NPA (%) 0.5 0.5 0.5 0.5

RONW (%) 12.6 11.8 12.5 13.8

RoAA (%) 2.0 1.8 1.8 1.9

Spread (%) 6.0 4.9 4.8 4.8

Source: Kotak Securities - Private client Research

-

7/30/2019 Sector Report(Autosaved)

18/19

December 19, 2005 Kotak Securities - Private Client Research

Sector Report Please see the disclaimer on the last page For Private Circulation 18

RoE (%) - FY06E

Source:

P/E (x) - FY 06E

Source:

NPA (%) - FY 06E

Source:

D/E (x) - FY06E

Source:

ROAA (%) - FY 06E

Source:

Spread (%) - FY 06E

Source:

P/ABV (x) - FY 06E

Source:

CAR (%) - FY 06E

Source:

Asset size (Rs bn) - FY 06E

Source:

Comparative analysis: charts

Source: Kotak Securities - Private Client Research

RoE: Return on equity D/E: Debt equity P/ABV: Price to adjusted book value

P/E: Price earnings ROAA: Return on average assets CAR: Capital adequacy ratio

NPA: Non-performing assets NIM: Net interest margin

STF: Shriram Transport Finance SCUF: Shriram City Union Finance

CIFL: Cholamandalam Investment & Finance SFL: Sundaram Finance

0.0

10.0

20.0

30.0

40.0

STF SCUF CIFL SFL

0.0

2.0

4.0

6.0

8.0

STF SCUF CIFL SFL

0.0

1.0

2.0

3.0

4.0

5.0

6.0

STF SCUF CIFL SFL

10.0

11.0

12.0

13.0

14.0

STF SCUF CIFL SFL 0.0

1.5

3.0

4.5

6.0

STF SCUF CIFL SFL0

5

10

15

20

25

STF SCUF CIFL SFL

0.0

0.3

0.6

0.9

1.2

1.5

STF SCUF CIFL SFL0.0

3.0

6.0

9.0

12.0

STF SCUF CIFL SFL

0

15

30

45

60

STF SCUF CIFL SFL

-

7/30/2019 Sector Report(Autosaved)

19/19

December 19, 2005 Kotak Securities - Private Client Research

Disclaimer

This document is not for public distribution and has been furnished to you solely for your information and must not be reproduced or redistributed to any other person. Persons into whosepossession this document may come are required to observe these restrictions.

This material is for the personal information of the authorized recipient, and we are not soliciting any action based upon it. This report is not to be construed as an offer to sell or the solicitation

of an offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal. It is for the general information of clients of Kotak Securities Ltd. It does not constitutea personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients.

We have reviewed the report, and in so far as it includes current or historical information, it is believed to be reliable though its accuracy or completeness cannot be guaranteed. Neither

Kotak Securities Limited, nor any person connected with it, accepts any liability arising from the use of this document. The recipients of this material should rely on their own investigationsand take their own professional advice. Price and value of the investments referred to in this material may go up or down. Past performance is not a guide for future performance. Certaintransactions -including those involving futures, options and other derivatives as well as non-investment grade securities - involve substantial risk and are not suitable for all investors. Reports

based on technical analysis centers on studying charts of a stock's price movement and trading volume, as opposed to focusing on a company's fundamentals and as such, may not matchwith a report on a company's fundamentals.

Opinions expressed are our current opinions as of the date appearing on this material only. While we endeavor to update on a reasonable basis the information discussed in this material,

there may be regulatory, compliance, or other reasons that prevent us from doing so. Prospective investors and others are cautioned that any forward-looking statements are not predictionsand may be subject to change without notice. Our proprietary trading and investment businesses may make investment decisions that are inconsistent with the recommendations expressedherein.

Kotak Securities Limited has two independent equity research groups: Institutional Equities and Private Client Group. This report has been prepared by the Private Client Group . Theviews and opinions expressed in this document may or may not match or may be contrary with the views, estimates, rating, target price of the Institutional Equities Research Group ofKotak Securities Limited.

We and our affiliates, officers, directors, and employees world wide may: (a) from time to time, have long or short positions in, and buy or sell the securities thereof, of company (ies) mentionedherein or (b) be engaged in any other transaction involving such securities and earn brokerage or other compensation or act as a market maker in the financial instruments of the company(ies) discussed herein or act as advisor or lender / borrower to such company (ies) or have other potential conflict of interest with respect to any recommendation and related information

and opinions.

The analyst for this report certifies that all of the views expressed in this report accurately reflect his or her personal views about the subject company or companies and its or their securities,and no part of his or her compensation was, is or will be, directly or indirectly related to specific recommendations or views expressed in this report.

No part of this material may be duplicated in any form and/or redistributed without Kotak Securities' prior written consent.

Research Team

Name Sector Tel No E-mail idJay Prakash Sinha Economy, Banking, FMCG, Agro-Industry +91 22 5634 1207 [email protected] Gorakshakar Auto, Auto Ancillary +91 22 5634 1522 [email protected] Shah IT, Media, Telecom +91 22 5634 1376 [email protected] Zarbade Capital Goods, Engineering +91 22 5634 1258 [email protected] Virmani Construction, Mid Cap, Power +91 22 5634 1237 [email protected]

Shrikant Chouhan Technical analyst +91 22 5634 1439 [email protected]

Sunil Singh Editor +91 22 5634 1223 [email protected]. Kathirvelu Production +91 22 5634 1567 [email protected]

![Case Report Joko .Pptx [Autosaved]](https://static.fdocuments.net/doc/165x107/577c7de91a28abe054a015fc/case-report-joko-pptx-autosaved.jpg)

![Alternative learning system report [autosaved]](https://static.fdocuments.net/doc/165x107/58a43f3a1a28ab41618b58d1/alternative-learning-system-report-autosaved.jpg)

![Training REPORT 2K12 [Autosaved]1](https://static.fdocuments.net/doc/165x107/577ce52b1a28abf1038ffd62/training-report-2k12-autosaved1.jpg)

![ATC ppt [autosaved] [autosaved] [autosaved] [autosaved]](https://static.fdocuments.net/doc/165x107/558ca444d8b42a27548b465c/atc-ppt-autosaved-autosaved-autosaved-autosaved.jpg)