Seasonality and a Trend

description

Transcript of Seasonality and a Trend

Seasonality and a TrendDr. Ron Lembke

Washoe Gaming Win, 1993-96

180

200

220

240

260

280

300

1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4

What did they mean when they said it was down three quartersin a row?

1993 1994 1995 1996

Look atyear-over-year

Seasonality•Seasonality is regular up or down

movements in the data•Can be hourly, daily, weekly, yearly•Naïve method

▫N1: Assume January sales will be same as December

▫N2: Assume this Friday’s ticket sales will be same as last

Seasonal Factors•Seasonal factor for May is 1.20, means

May sales are typically 20% above the average

•Factor for July is 0.90, meaning July sales are typically 10% below the average

Seasonality & No TrendSales Factor

Spring 200 200/250 = 0.8Summer 350 350/250 = 1.4Fall 300 300/250 = 1.2Winter 150 150/250 = 0.6

Total 1,000 4.0Avg 1,000/4=250

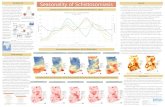

Seasonal Factors1 2 3 Average Index

Jan 90 95 92.5 0.4803Feb 95 89 92.0 0.4777Mar 158 169 155 160.7 0.8342Apr 240 220 235 231.7 1.2029May 250 240 225 238.3 1.2375Jun 310 300 313 307.7 1.5975Jul 380 400 420 400.0 2.0769Aug 340 350 320 336.7 1.7480Sep 135 140 150 141.7 0.7356Oct 105 100 90 98.3 0.5106Nov 80 70 65 71.7 0.3721Dec 130 150 140.0 0.7269

Avg 192.6 12

Year

• Compute average for each period

• Compute overall average• Divide period averages by

overall to get indexes.• Ok to have different # of

data points

050

100150200250300350400450

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

1

2

3

Seasonality & No TrendIf we expected total demand for the next

year to be 1,100, the average per quarter would be 1,100/4=275

ForecastSpring 275 * 0.8 = 220Summer 275 * 1.4 = 385Fall 275 * 1.2 = 330Winter 275 * 0.6 = 165Total 1,100

Trend & Seasonality• Deseasonalize to find the trend

1. Calculate seasonal factors2. Deseasonalize the demand3. Find trend of deseasonalized line

• Project trend into the future4. Project trend line into future5. Multiply trend line by seasonal component.

Seasonally AdjustingJa

nFe

bM

ar Apr

May Jun Jul

Aug

Sep

Oct

Nov

Dec Jan

Feb

Mar Apr

May Jun Jul

Aug

Sep

Oct

Nov

Dec Jan

Feb

Mar Apr

May Jun Jul

Aug

Sep

Oct

Nov

Dec Jan

Feb

Mar Apr

May Jun Jul

Aug

Sep

Oct

Nov

Dec

2009 2010 2011 2012

149000

150000

151000

152000

153000

154000

155000

Une

mpl

oym

ent,

in T

hous

ands

, Una

d-ju

sted

BLS report, 2012

•Makes it easier to see trends

BLS data, 2012

Washoe Gaming Win, 1993-96

180

200

220

240

260

280

300

1 2 3 4 1 2 3 4 1 2 3 4 1 2 3 4

Looks like a downhill slide- Silver Legacy

opened 95Q3- Otherwise,

upward trend

1993 1994 1995 1996

Source: Comstock Bank, Survey of Nevada Business & Economics

Washoe Win 1989-1996

150000

170000

190000

210000

230000

250000

270000

290000

1989 1990 1991 1992 1993 1994 1995 1996

Definitely a general upward trend, slowed 93-94

1989-2007

Red line shows “de-seasonalized” data

1989-2007 Linear Regression

1998-2007

CacheCreek

ThunderValley

CCExpands

9/11

Selecting Data•What data to use?•All of it? Representative?•Overall upward trend•2000-2003, downwards•From 2003, fairly stable?•From 2003 upward trend?•The data you select to use has significant

impact on the results you get and the conclusions you draw.▫Spend time making sure data are

representative

2003-2012 Data

2003-2012 LR using 2008Q3-2010Q4

R-squared = 0.78

2003 2004 2005 2006 2007 2008 2009 2010 2011 -

50,000,000

100,000,000

150,000,000

200,000,000

250,000,000

300,000,000

350,000,000

Washoe Win

Linear

Forecast

2011 Forecast using 2003-10 SR

Data for LR

Seasonal Indexes calculated using 2003-10 data

How Good Was It?

Pattern fits data pretty well, but win better than expected.

1.Compute Seasonal Indexes

Q1 Q2 Q3 Q4

2003 240,114,703 259,349,602 279,784,440 246,068,018

2004 231,607,546 259,849,383 297,401,507 259,617,607

2005 245,793,646 269,238,341 294,810,396 257,014,585

2006 245,775,176 269,670,481 294,839,349 257,155,338

2007 244,648,019 273,460,685 284,733,890 246,352,794

2008 227,915,101 237,045,466 258,990,669 206,203,166

2009 190,098,500 211,913,667 217,227,445 185,971,111

2010 187,016,132 198,330,968 209,608,491 175,601,589

2011 174,138,905 192,122,889 203,912,214 175,510,911 2012 175,417,340

Avg 216,252,507 241,220,165 260,145,378 223,277,235 235,223,821

Indexes 0.919 1.025 1.106 0.949

2.DeseasonalizeYear Quarter Gaming Win Seasonal Deseas

2003 1 240,114,703 0.919 261,179,391 2 259,349,602 1.025 252,902,590 3 279,784,440 1.106 252,981,489 4 246,068,018 0.949 259,234,039

2004 1 231,607,546 0.919 251,925,921 2 259,849,383 1.025 253,389,947 3 297,401,507 1.106 268,910,866 4 259,617,607 0.949 273,508,607

Deseasonalize by dividing actual number by indexUse same index value for All Q1s, same number forAll Q2s, etc.

3.LR on Deseasonalized data 2008 Q4-2012Q1

Period Deseasonalized1 217,236,193

2 206,775,386

3 206,645,836

4 196,417,365

5 195,921,610

6 203,422,609

7 193,400,781

8 189,528,296

9 184,997,260

10 189,415,694

Intercept = 210,576,193Slope = -2,065,456R-squared =0.75

4.Project trend line into future

Intercept = 210,576,193Slope = -2,065,456

5.Multiply by Seasonal RelativesPeriod Q

Linear Trend Line

Seasonal Relative

Seasonalized Forecast

11 1 189,789,679

1.025

194,627,812

12 2 186,820,177

1.106

206,613,451

13 3 183,850,675

0.949

174,513,237

14 4 180,881,173

0.919

166,292,712

Final Forecast

Summary1. Calculate indexes2. Deseasonalize

1. Divide actual demands by seasonal indexes

3. Do a LR4. Project the LR into the future5. Seasonalize

1. Multiply straight-line forecast by indexes