Schroder ISF* Global Multi Credit...Schroders Global Multi Credit team A global strategy utilising...

Transcript of Schroder ISF* Global Multi Credit...Schroders Global Multi Credit team A global strategy utilising...

Schroder ISF*

Global Multi Credit

November 2016 | For professional investors and advisers only *Schroder International Selection Fund is referred to as Schroder ISF throughout this presentation

November 2016

Patrick Vogel | Head of European Credit

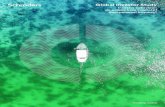

Make your capital work harder in credit High return potential from allocation across a broad credit universe

1

Source: Schroders, Barclays Capital, December 2015

1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015

EM

24%

EM

14%

US

Corp

11%

US

Corp

11%

US HY

29%

PE HY

14%

EM

10%

US HY

12%

EM

13%

ABS

6%

PE HY

65%

US HY

15%

US

Corp

8%

PE HY

27%

PE HY

10%

GBP

Corp

13%

PE HY

2%

PE HY

15%

ABS

11%

ABS

8%

EM

11%

EM

27%

EM

12%

GBP

Corp

9%

PE HY

11%

US HY

13%

Covrd

3%

US HY

58%

EM

12%

GBP

Corp

7%

EM

18%

US HY

7%

EUR

Corp

9%

ABS

2%

US HY

2%

GBP

Corp

9%

GBP

Corp

7%

EUR

Corp

9%

PE HY

26%

US HY

11%

PE HY

6%

EM

9%

ABS

12%

EUR

Corp

-3%

EM

35%

PE HY

11%

EM

6%

GBP

Corp

16%

Covrd

3%

US

Corp

8%

EM

1%

ABS

2%

US

Corp

9%

EUR

Corp

7%

ABS

9%

US

Corp

8%

EUR

Corp

8%

EUR

Corp

4%

ABS

5%

US

Corp

9%

US

Corp

-4%

US

Corp

19%

US

Corp

9%

ABS

6%

US HY

16%

EUR

Corp

2%

Covrd

6%

GBP

Corp

1%

EUR

Corp

1%

Covrd

6%

Covrd

6%

GBP

Corp

9%

EUR

Corp

7%

GBP

Corp

7%

Covrd

3%

US

Corp

4%

PE HY

9%

GBP

Corp

-9%

GBP

Corp

16%

GBP

Corp

9%

US HY

5%

EUR

Corp

14%

GBP

Corp

2%

ABS

6%

Covrd

1%

Covrd

0%

EUR

Corp

6%

US HY

4%

Covrd

8%

GBP

Corp

7%

Covrd

6%

ABS

3%

GBP

Corp

1%

Covrd

3%

EM

-15%

EUR

Corp

16%

ABS

6%

Covrd

4%

Covrd

11%

ABS

-1%

PE HY

6%

EUR

Corp

-1%

GBP

Corp

-1%

US HY

-7%

EM

-2%

US HY

-3%

Covrd

5%

US

Corp

6%

US HY

2%

Covrd

1%

GBP

Corp

1%

US HY

-26%

Covrd

9%

EUR

Corp

5%

EUR

Corp

2%

US

Corp

10%

US

Corp

-2%

EM

5%

US

Corp

-1%

US

Corp

-2%

PE HY

-16%

PE HY

-14%

PE HY

-9%

ABS

3%

ABS

5%

US

Corp

2%

EUR

Corp

1%

EUR

Corp

1%

PE HY

-32%

ABS

7%

Covrd

4%

PE HY

-3%

ABS

3%

EM

-3%

US HY

2%

US HY

-5%

Best

Worst

An unconstrained credit strategy, aiming for a high risk-adjusted total return

The Global Multi Credit strategy A Schroders perspective

2

Source: Schroders

A truly active strategy biased

towards more liquid credit

State of the art technique to optimise

top-down global allocation

A well established global credit

platform

Schroders innovative themes-based

credit investment process

Schroders: global credit capabilities Local expertise delivered globally

3

Source: Schroders, as at October 2016

Amsterdam: Loans

London: DM & EM Credit, Sovereigns

Paris: Infrastructure debt

Zurich: Convertibles, ILS

New York: DM & EM Credit, ABS,

Sovereigns

Philadelphia: Municipals

Buenos Aires: Credit, Sovereign

Sâo Paulo: Credit, Sovereign

Hong Kong: Credit, Sovereigns

Jakarta: Credit, Sovereign

Singapore: Credit, Sovereigns

Sydney: Credit, Sovereigns

Taipei: Credit, Sovereign

Schroders investment offices with credit expertise

Global credit scorecards Regional credit views

4

Note: For illustration purposes only

Top-down asset allocation and optimisation A multi-stage allocation process

5

Source: Schroders

Team views:

monthly scorecard

Black-

Litterman

model

&

optimiser

Objectives

Constraints

Investment team

validation

Glo

bal a

lloca

tion

Risk model

The credit team’s views expressed in a diversified way Team views integrated with Black Litterman model

6

Source: Schroders. For illustration purposes only

A credit allocation

committee collectively

making decisions on the

overall asset allocation

and model calibration

Utilising scorecards from

all asset classes

Formal discussions on a

monthly basis

Outcome: optimised

allocation across the full

portfolio

Team ensures allocation

decisions within each

sub portfolio are

appropriate at the fund

level

Risk budget is suitably

allocated

Bi-weekly discussions

Credit allocation committee

Fund risk and

construction team

Delegated sub portfolios

to regional experts

across the globe

Incorporate credit

allocation and themes

across asset classes

Sub-portfolio management

regional credit specialists

Investment strategy Global Multi Credit process summary

7

Source: Schroders

Schroders Global Multi Credit team A global strategy utilising our established global credit platform

8

Source: Schroders, as at 31 October 2016

Portfolio Management – Sub Portfolios

Pan European High

Yield

US

High Yield

Pan European

Investment Grade

US

Investment Grade Emerging Markets ABS

Michael Scott Wesley Sparks

Martha Metcalf Patrick Vogel Rick Rezek

James Barrineau

and team Chris Ames

Credit Research

EMEA Research Americas Research Asia Research

Patrick McCullagh David Knutson Raymond Chia

Over 35 Analysts Globally

Credit Allocation Committee

Senior PM

High Yield

Senior PM

Investment Grade

Lead

PM

Credit

Strategist

Quantitative

Strategists

Michael Scott Alix Stewart Patrick Vogel Rajeev Shah Szevak Nszdejan

Yow Tsu Lim

Themes-based investment process Innovative approach to credit

Themes based investment process combined with market strategy meeting. Implementing

forward looking themes within the context of current market conditions

9

Source: Schroders

Them

es

Consumer Trends Demographics

Technology

Investor Trends

Horizon

Schroder ISF

Global Multi Credit

The fund

Schroder ISF Global Multi Credit Fund profile

11

Source: Schroders as at 31 October 2016.

Schroder ISF Global Multi Credit

Type Unconstrained total return credit

Aim Outperform the reference index by 3-4% p.a. gross over a cycle

Expected risk Circa 3 – 6% volatility

Strategy Flexible credit, global universe including IG, HY, EM sovereign and credit, ABS, convertibles, munis

Reference index For reference only: Barclays Multiverse USD,EUR,GBP ex treasury, A+ to B- ($ hedged)

Fund manager Patrick Vogel and Schroders Credit Team

Vehicle Schroder ISF UCITS fund range

Liquidity Daily

Guidelines

Flexible unconstrained

ABS: max 20%

Convertibles: max 20%

Active duration: +/- 2 years

Launched June 2016

Schroder ISF Global Multi Credit Summary

12

Source: Schroders FIA. Based on un-audited data as at 31 October 2016

*Fund issuer number treats each CDS index as a single issuer and excludes the non-credit line items (futures fixed income, margin cash balance, SYN, synthetic cash fixed

income, currency). The fund is fully hedged to USD.

Strategy

AUM $196m

Effective yield 4.1%

OAS +256

Effective duration 6.0

Number of issuers* 332

Average credit rating BBB-

19.3

16.8

23.1

18.3

9.4

13.2

Duration (%MV)

0-2Y

2-4Y

4-6Y

6-8Y

8-10Y

10+Y

24.2

12.0 63.9

Hedged currency (%MV)

EUR

GBP

USD

DTS contribution

Global Multi Credit Strategy Regional allocation

13

Source: Schroders, Bank of America Merrill Lynch. Based on un-audited data as at 31 October 2016.

0

2

4

6

8

10

12

14

16

18

Nov15

Dec15

Jan16

Feb16

Mar16

Apr16

May16

Jun16

Jul16

Aug16

Sep16

Oct16

DM Europe DM North America DM Oceania

DM Asia EM Asia EM Europe

EM South America EM Africa/Midde East

MV%

0

10

20

30

40

50

60

70

80

90

100

Nov15

Dec15

Jan16

Feb16

Mar16

Apr16

May16

Jun16

Jul16

Aug16

Sep16

Oct16

DM Europe DM North America DM Oceania

DM Asia EM Asia EM Europe

EM South America EM Africa/Midde East

DTS contribution

Global Multi Credit Strategy Country allocation

14

Source: Schroders, Bank of America Merrill Lynch. Based on un-audited data as at 31 October 2016. MV chart will not add up to 100% as cash, forwards and CDS float are

excluded. Countries with <1% MV/ 0.25 DTS have been excluded.

MV%

0.0

0.4

0.8

1.2

1.6

2.0

High Low Current

0

3

6

9

12

15

High Low Current

50

40

30

20

10

0

10

8

6

4

2

0

DTS contribution

Global Multi Credit Strategy Sector allocation

15

Source: Schroders, Barclays Based on un-audited data as at 31 October 2016. Sectors based on Barclays level 3.

MV%

0.0

1.0

2.0

3.0

4.0

5.0

6.0

7.0

Non Cyclicals Cyclicals Fin Senior Fin Sub

High Low Current

5

10

15

20

25

30

35

Non Cyclicals Cyclicals Fin Senior Fin Sub

High Low Current

DTS contribution

Global Multi Credit Strategy Rating allocation

16

Source: Schroders, Bank of America Merrill Lynch. Based on un-audited data as at 31 October 2016. MV chart will not add up to 100% as cash, forwards and CDS float are

excluded. Ratings based on the average of Moodys, S&P and Fitch

0

2

4

6

8

10

12

14

16

18

20

Nov15

Dec15

Jan16

Feb16

Mar16

Apr16

May16

Jun16

Jul16

Aug16

Sep16

Oct16

DM IG DM HY EM IG EM HY NR

MV%

0

10

20

30

40

50

60

70

80

90

100

Nov15

Dec15

Jan16

Feb16

Mar16

Apr16

May16

Jun16

Jul16

Aug16

Sep16

Oct16

DM IG DMHY EM IG EM HY NR

Representative account* performance as at 31 October 2016

Source: Schroders, gross of fees at 31 October 2016. Periods of less than 1 year are not annualised. *Pooled fund launched 8 June 2016, prior to this performance from a

segregated account following the same strategy is used.

Global Multi Credit strategy

Investment objective

Guidelines

Total assets: $196 million

Achieve a total return of LIBOR +5% per annum before fees over a market cycle

Inception date: 30 November 2015

Flexible unconstrained credit strategy

Max ABS: 20%

Max Convertibles: 20%

Max VaR: 12%

17

-4

-2

0

2

4

6

8

10

Nov 15 Dec 15 Jan 16 Feb 16 Mar 16 Apr 16 May 16 Jun 16 Jul 16 Aug 16 Sep 16 Oct 16

Global Multi Credit EUR Hedged

%

London Credit Composite performance as at 31 October 2016

18

1 year

[Since Inception] 3 years (p.a.)

[2 years (p.a.)]

Information Ratio

(3 years) [2 years]

Peer Group

Ranking

Total Return Excess Return Total Return Excess Return **Sharpe Ratio 1y/3y [2y]

Benchmark Relative

Euro Corporate Bond 6.97 1.87 6.33 2.10 1.95 1 / 1

Euro Credit Conviction* 7.91 2.33 5.84 3.12 1.97 1 / 1

Euro High Yield 8.52 2.36 7.30 2.03 1.75 1 / 1

UK All Maturities Corporate Bond 12.15 1.65 7.46 0.59 0.77 1 / 2

UK Long Dated Corporate Bond 18.81 1.15 10.92 0.77 0.99 1 / 1

Absolute Return

Euro Credit Absolute Return* 4.14 4.36 - - - -

Strategic Credit 5.71 5.32 4.16 3.74 1.61** 2 / 1

Total Return

Monthly High Income 12.20 - 9.47 - 1.92** 1 / 1

Global Multi Credit (EUR hedged)* 7.70 - - - - -

Source: Schroders. Data as at 31 October 2016. Returns reflect performance gross of fees. Strategies are based on gross NAV pricing or internal B-one pricing.

*Inception dates: Euro Credit Conviction, January 2014; Euro Credit Absolute Return, November 2015; Global Multi Credit, November 2015.

Peer group rankings based on Morningstar peer groups.

Optimising returns through a holistic credit approach

Global Multi Credit strategy Summary

19

Source: Schroders

A truly active strategy biased

towards more liquid credit

State of the art technique to optimise

top-down global allocation

A well established global credit

platform

Schroders innovative themes-based

credit investment process

Recent questions from clients

“Following the election of Trump, how do you see US policies impacting your investment

decisions?”

“What is your current outlook and where do you see opportunities for Global Multi Credit?”

20

Source: Schroders

This presentation does not constitute an offer to anyone, or a solicitation by anyone, to subscribe for shares of Schroder International Selection Fund (the “Company”). Nothing in

this presentation should be construed as advice and is therefore not a recommendation to buy or sell shares

Subscriptions for shares of the Company can only be made on the basis of its latest Key Investor Information Document and prospectus, together with the latest audited annual

report (and subsequent unaudited semi-annual report, if published), copies of which can be obtained, free of charge, from Schroder Investment Management (Luxembourg) S.A.

An investment in the Company entails risks, which are fully described in the prospectus

Past performance is not a reliable indicator of future results, prices of shares and the income from them may fall as well as rise and investors may not get the amount

originally invested

Schroders has expressed its own views and opinions in this presentation and these may change

This presentation is issued by Schroder Investment Management Ltd., 31, Gresham Street, EC2V 7QA, who is authorised and regulated by the Financial Conduct Authority. For

your security, all telephone calls are recorded

Risk Considerations

Mortgage or asset-backed securities may not receive in full the amounts owed to them by underlying borrowers.

A failure of a deposit institution or an issuer of a money market instrument could create losses.

A decline in the financial health of an issuer could cause the value of its bonds to fall or become worthless.

The fund can be exposed to different currencies. Changes in foreign exchange rates could create losses.

A derivative may not perform as expected, and may create losses greater than the cost of the derivative.

Emerging markets, and especially frontier markets, generally carry greater political, legal, counterparty and operational risk.

High yield bonds (normally lower rated or unrated) generally carry greater market, credit and liquidity risk.

A rise in interest rates generally causes bond prices to fall.

The fund uses derivatives for leverage, which makes it more sensitive to certain market or interest rate movements and may cause above-average volatility and risk of loss.

In difficult market conditions, the fund may not be able to sell a security for full value or at all. This could affect performance and could cause the fund to defer or suspend

redemptions of its shares.

Failures at service providers could lead to disruptions of fund operations or losses.

Important information

21

Euro Corporate Bond Composite Disclosure as at 31 December 2015

22

Definition of Firm

The Firm is defined as all accounts managed by Schroder Investment Management in the UK and

US, by wholly owned subsidiaries of Schroders PLC. Prior to 1st January 2007 SIM London &

SIM North America existed as two separate Firms which were compliant & verified as separate

entities until 31st December 2006. The consolidation of these two Firms was made as part of a

move towards creating one global Firm. Composite and Firm assets reported prior to 1st January

2007 represent those of the legacy firm which managed the product. Prior to 1st January 2011 the

SPrIM (Schroder Property Investment Management) Firm existed separate to the Schroder

Investment Management UK and US Firm, from 1st January 2011 these Firms have been

combined into a single firm. On April 2, 2013, Schroder U.S. Holdings Inc., a subsidiary of

Schroders plc, purchased STW Fixed Income Management LLC (STW) and on July 2, 2013,

Schroders plc, purchased Cazenove Capital Holdings; assets managed by STW and Cazenove

are included in the Firm from 1st January 2014. Assets Managed against a liability driven

mandate are excluded from the GIPS Firm. A complete list and description of the Firm's

composites and performance results is available upon request.

Composite Definition

The Euro Corporate Bond Composite (the "Composite") is comprised of all Schroder Investment

Management (UK & US), fully discretionary accounts which seek to achieve returns above the

Merrill Lynch EMU Corporate Index ER00 (GDR) by investing in bonds and other fixed and

floating rate securities denominated in Euro issued by governments, government agencies,

supranational and corporate issuers. A minimum of 80% of net assets will be held in non-

sovereign securities. In February 2007 the Composite changed name from the Schroder Lux Euro

Corporate Composite to Euro Corporate Bond Composite. This change does not affect the

Composite history, investment decisions or strategy used. Derivatives may be used to achieve the

investment objective and to reduce risk or manage the fund more efficiently. The fund may use

leverage and take short positions.

Composite Construction

New accounts are included from the beginning of the first full month of management on a

discretionary basis. Terminated accounts are excluded from the end of the last full month of

discretionary management. This Composite has no minimum asset level for inclusion.

The composite currency is EURO

Composite Inception Date: 30/06/2000

Composite Creation Date: 04/04/2002

Calculation Methodology

The portfolio returns are time-weighted rates of return that are adjusted for cash flows. Portfolio

returns are combined using beginning of period asset weights to produce the composite return.

Periodic returns are geometrically linked to produce annual returns. Dividends on equities are

recognised net of irrecoverable withholding tax. Since January 1999 dividends have been

recognised as of the ex-dividend date having previously been recognised on a cash basis.

Performance results are presented before the deduction of management fees and custodian fees

but after trading expenses.

Dispersion

The dispersion of annual returns is measured by the asset weighted standard deviation of

portfolio returns represented within the composite for the full year provided a minimum of 5

portfolios are available.

Fee Schedule

The fee scale applied to the composite is 0.45% p.a.

Additional information

The exchange rates used are provided by WM. Each currency is valued at 4 pm on the last

business day of the month. Additional information regarding policies for valuing portfolios,

calculating and reporting returns and a description of all composites are available on request.

GIPS Compliance and Verification

Schroder Investment Management (UK & US) claims compliance with the Global Investment

Performance Standards GIPS® and has prepared and presented this report in compliance with

the GIPS standards. Schroder Investment Management (UK & US) has been independently

verified for the periods 1st January 1996 to 31st December 2013. The verification report(s) are

available upon request. Verification assesses whether (1) the firm has complied with all the

composite construction requirements of the GIPS standards on a firm-wide basis, and (2) the

firm's policies and procedures are designed to calculate and present performance in compliance

with the GIPS standards. Verification does not ensure the accuracy of any specific composite

presentation.

Definition of Firm

The Firm is defined as all accounts managed by Schroder Investment Management in the UK and

US, by wholly owned subsidiaries of Schroders PLC. Prior to 1st January 2007 SIM London &

SIM North America existed as two separate Firms which were compliant & verified as separate

entities until 31st December 2006. The consolidation of these two Firms was made as part of a

move towards creating one global Firm. Composite and Firm assets reported prior to 1st January

2007 represent those of the legacy firm which managed the product. Prior to 1st January 2011 the

SPrIM (Schroder Property Investment Management) Firm existed separate to the Schroder

Investment Management UK and US Firm, from 1st January 2011 these Firms have been

combined into a single firm. On April 2, 2013, Schroder U.S. Holdings Inc., a subsidiary of

Schroders plc, purchased STW Fixed Income Management LLC (“STW”) and on July 2, 2013,

Schroders plc, purchased Cazenove Capital Holdings; assets managed by STW and Cazenove

are included in the Firm from 1st January 2014. Assets Managed against a liability driven

mandate are excluded from the GIPS Firm. A complete list and description of the Firm's

composites and performance results is available upon request.

Composite Definition

The Euro Credit Conviction Composite (the "Composite") is comprised of all Schroder Investment

Management (UK & US), fully discretionary accounts which seek to achieve returns above the

IBOXX Euro Corporate BBB Index by investing in bonds and other fixed and floating rate

securities denominated in Euro issued by governments, government agencies, supranational and

corporate issuers worldwide. A maximum of 20% of the net assets will be invested in securities

issued by governments and government agencies. Accounts may also invest in derivatives and

may create short or long exposure to the underlying assets of the derivatives

Composite Construction

New accounts are included from the beginning of the first full month of management on a

discretionary basis. Terminated accounts are excluded from the end of the last full month of

discretionary management. This Composite has no minimum asset level for inclusion. The

composite currency is EURO

Composite Inception Date: 31/01/2014

Composite Creation Date: 18/02/2014

Calculation Methodology

The portfolio returns are time-weighted rates of return that are adjusted for cash flows. Portfolio

returns are combined using beginning of period asset weights to produce the composite return.

Periodic returns are geometrically linked to produce annual returns. Dividends on equities are

recognised net of irrecoverable withholding tax. Since January 1999 dividends have been

recognised as of the ex-dividend date having previously been recognised on a cash basis.

Performance results are presented before the deduction of management fees and custodian fees

but after trading expenses.

Dispersion

The dispersion of annual returns is measured by the asset weighted standard deviation of

portfolio returns represented within the composite for the full year provided a minimum of 5

portfolios are available.

Additional information

The exchange rates used are provided by WM. Each currency is valued at 4 pm on the last

business day of the month. Additional information regarding policies for valuing portfolios,

calculating and reporting returns and a description of all composites are available on request.

Schroder EURO Credit Conviction Disclosure as at 31 December 2015

23

Schroder All Maturities Corporate Bond Composite Disclosure as at 31 December 2015

24

Definition of Firm

The Firm is defined as all accounts managed by Schroder Investment Management in the UK and

US, by wholly owned subsidiaries of Schroders PLC. Prior to 1st January 2007 SIM London &

SIM North America existed as two separate Firms which were compliant & verified as separate

entities until 31st December 2006. The consolidation of these two Firms was made as part of a

move towards creating one global Firm. Composite and Firm assets reported prior to 1st January

2007 represent those of the legacy firm which managed the product. Prior to 1st January 2011 the

SPrIM (Schroder Property Investment Management) Firm existed separate to the Schroder

Investment Management UK and US Firm, from 1st January 2011 these Firms have been

combined into a single firm. On April 2, 2013, Schroder U.S. Holdings Inc., a subsidiary of

Schroders plc, purchased STW Fixed Income Management LLC (“STW”) and on July 2, 2013,

Schroders plc, purchased Cazenove Capital Holdings; assets managed by STW and Cazenove

are included in the Firm from 1st January 2014. Assets Managed against a liability driven

mandate are excluded from the GIPS Firm. A complete list and description of the Firm's

composites and performance results is available upon request.

Composite Definition

The Schroder All Maturities Corporate Bond Composite comprises of all Schroder Investment

Management (UK & US), fully discretionary accounts which seek to achieve returns above the

Merrill Lynch Sterling All Stocks, Non-Gilts Index. The Fund's investment objective is to provide

capital growth and income primarily through investment in non-government debt securities.

Composite accounts may also invest in a wide range of investments including transferable

securities, derivatives, cash, deposits, collective investment schemes and money market

instruments. None of the accounts in the Composite uses leverage.

Composite Construction

New accounts are included from the beginning of the first full month of management on a

discretionary basis. Terminated accounts are excluded from the end of the last full month of

discretionary management. This Composite has no minimum asset level for inclusion. The

composite currency is Pound Sterling

Composite Inception Date: 28/02/2001

Composite Creation Date: 30/01/2008

Calculation Methodology

The portfolio returns are time-weighted rates of return that are adjusted for cash flows. Portfolio

returns are combined using beginning of period asset weights to produce the composite return.

Periodic returns are geometrically linked to produce annual returns. Dividends on equities are

recognised net of irrecoverable withholding tax. Since January 1999 dividends have been

recognised as of the ex-dividend date having previously been recognised on a cash basis.

Performance results are presented before the deduction of management fees and custodian fees

but after trading expenses.

Dispersion

The dispersion of annual returns is measured by the asset weighted standard deviation of

portfolio returns represented within the composite for the full year provided a minimum of 5

portfolios are available.

Fee Schedule

The fee scale applied to the composite is 0.25% p.a.

GIPS Compliance and Verification

Schroder Investment Management (UK & US) claims compliance with the Global Investment

Performance Standards GIPS® and has prepared and presented this report in compliance with

the GIPS standards. Schroder Investment Management (UK & US) has been independently

verified for the periods 1st January 1996 to 31st December 2013. The verification report(s) are

available upon request. Verification assesses whether (1) the firm has complied with all the

composite construction requirements of the GIPS standards on a firm-wide basis, and (2) the

firm's policies and procedures are designed to calculate and present performance in compliance

with the GIPS standards. Verification does not ensure the accuracy of any specific composite

presentation.

Additional information

The exchange rates used are provided by WM. Each currency is valued at 4 pm on the last

business day of the month. Additional information regarding policies for valuing portfolios,

calculating and reporting returns and a description of all composites are available on request.

Schroder Sterling Over 15 Years Corporate Bond Composite

Disclosure as at 31 December 2015

25

Definition of Firm

The Firm is defined as all accounts managed by Schroder Investment Management in the UK and

US, by wholly owned subsidiaries of Schroders PLC. Prior to 1st January 2007 SIM London &

SIM North America existed as two separate Firms which were compliant & verified as separate

entities until 31st December 2006. The consolidation of these two Firms was made as part of a

move towards creating one global Firm. Composite and Firm assets reported prior to 1st January

2007 represent those of the legacy firm which managed the product. Prior to 1st January 2011 the

SPrIM (Schroder Property Investment Management) Firm existed separate to the Schroder

Investment Management UK and US Firm, from 1st January 2011 these Firms have been

combined into a single firm. On April 2, 2013, Schroder U.S. Holdings Inc., a subsidiary of

Schroders plc, purchased STW Fixed Income Management LLC (“STW”) and on July 2, 2013,

Schroders plc, purchased Cazenove Capital Holdings; assets managed by STW and Cazenove

are included in the Firm from 1st January 2014. Assets Managed against a liability driven

mandate are excluded from the GIPS Firm. A complete list and description of the Firm's

composites and performance results is available upon request.

Composite Definition

The Schroder Sterling Over 15 Yrs Corporate Bond Composite (the "Composite") is comprised of

all Schroder Investment Management (UK & US), fully discretionary accounts which seek to

achieve returns above the ML > 15 Yr All Stocks TL UNP8 index by investing in bonds and other

fixed and floating rate securities denominated in GBP and other currencies issued by

governments, government agencies, supra-national and corporate issuers worldwide. None of the

accounts in the composite use leverage.

Composite Construction

New accounts are included from the beginning of the first full month of management on a

discretionary basis. Terminated accounts are excluded from the end of the last full month of

discretionary management. This Composite has no minimum asset level for inclusion. The

composite currency is Pound Sterling

Composite Inception Date: 31/03/2001

Composite Creation Date: 25/02/2008

Calculation Methodology

The portfolio returns are time-weighted rates of return that are adjusted for cash flows. Portfolio

returns are combined using beginning of period asset weights to produce the composite return.

Periodic returns are geometrically linked to produce annual returns. Dividends on equities are

recognised net of irrecoverable withholding tax. Since January 1999 dividends have been

recognised as of the ex-dividend date having previously been recognised on a cash basis.

Performance results are presented before the deduction of management fees and custodian fees

but after trading expenses.

Dispersion

The dispersion of annual returns is measured by the asset weighted standard deviation of

portfolio returns represented within the composite for the full year provided a minimum of 5

portfolios are available.

Fee Schedule

The fee scale applied to the composite is 0.25% p.a.

GIPS Compliance and Verification

Schroder Investment Management (UK & US) claims compliance with the Global Investment

Performance Standards GIPS® and has prepared and presented this report in compliance with

the GIPS standards. Schroder Investment Management (UK & US) has been independently

verified for the periods 1st January 1996 to 31st December 2013. The verification report(s) are

available upon request. Verification assesses whether (1) the firm has complied with all the

composite construction requirements of the GIPS standards on a firm-wide basis, and (2) the

firm's policies and procedures are designed to calculate and present performance in compliance

with the GIPS standards. Verification does not ensure the accuracy of any specific composite

presentation.

Additional information

The exchange rates used are provided by WM. Each currency is valued at 4 pm on the last

business day of the month. Additional information regarding policies for valuing portfolios,

calculating and reporting returns and a description of all composites are available on request.

Definition of Firm

The Firm is defined as all accounts managed by Schroder Investment Management in the UK and

US, by wholly owned subsidiaries of Schroders PLC. Prior to 1st January 2007 SIM London &

SIM North America existed as two separate Firms which were compliant & verified as separate

entities until 31st December 2006. The consolidation of these two Firms was made as part of a

move towards creating one global Firm. Composite and Firm assets reported prior to 1st January

2007 represent those of the legacy firm which managed the product. Prior to 1st January 2011 the

SPrIM (Schroder Property Investment Management) Firm existed separate to the Schroder

Investment Management UK and US Firm, from 1st January 2011 these Firms have been

combined into a single firm. On April 2, 2013, Schroder U.S. Holdings Inc., a subsidiary of

Schroders plc, purchased STW Fixed Income Management LLC (“STW”) and on July 2, 2013,

Schroders plc, purchased Cazenove Capital Holdings; assets managed by STW and Cazenove

are included in the Firm from 1st January 2014. Assets Managed against a liability driven

mandate are excluded from the GIPS Firm. A complete list and description of the Firm's

composites and performance results is available upon request.

Composite Definition

The Euro High Yield Composite (the "Composite") is comprised of all Schroder Investment

Management (UK & US), fully discretionary accounts which seek to achieve returns above the

Bank of America Merrill Lynch Euro High Yield Constrained Index (HEC0) by investing in bonds

and other fixed and floating rate securities denominated in Euro issued by governments,

government agencies, supranational and corporate issuers worldwide. A minimum of 70% of the

net assets will be invested in securities with a credit rating below investment grade.

Composite Construction

New accounts are included from the beginning of the first full month of management on a

discretionary basis. Terminated accounts are excluded from the end of the last full month of

discretionary management. This Composite has no minimum asset level for inclusion.

The composite currency is EURO

Composite Inception Date: 31/12/2012

Composite Creation Date: 07/01/2013

Calculation Methodology

The portfolio returns are time-weighted rates of return that are adjusted for cash flows. Portfolio

returns are combined using beginning of period asset weights to produce the composite return.

Periodic returns are geometrically linked to produce annual returns.

Dividends on equities are recognised net of irrecoverable withholding tax. Since January 1999

dividends have been recognised as of the ex-dividend date having previously been recognised on

a cash basis. Performance results are presented before the deduction of management fees and

custodian fees but after trading expenses.

Dispersion

The dispersion of annual returns is measured by the asset weighted standard deviation of

portfolio returns represented within the composite for the full year provided a minimum of 5

portfolios are available.

Fee Schedule

Fee Schedule - The fee scale applied to the composite is 0.6% p.a.

Additional information

The exchange rates used are provided by WM. Each currency is valued at 4 pm on the last

business day of the month. Additional information regarding policies for valuing portfolios,

calculating and reporting returns and a description of all composites are available on request.

GIPS Compliance and Verification

Schroder Investment Management (UK & US) claims compliance with the Global Investment

Performance Standards GIPS® and has prepared and presented this report in compliance with

the GIPS standards. Schroder Investment Management (UK & US) has been independently

verified for the periods 1st January 1996 to 31st December 2013. The verification report(s) are

available upon request. Verification assesses whether (1) the firm has complied with all the

composite construction requirements of the GIPS standards on a firm-wide basis, and (2) the

firm's policies and procedures are designed to calculate and present performance in compliance

with the GIPS standards. Verification does not ensure the accuracy of any specific composite

presentation.

Schroder Euro High Yield Composite Disclosure as at 31 December 2015

26

Definition of Firm

The Firm is defined as all accounts managed by Schroder Investment Management in the UK and

US, by wholly owned subsidiaries of Schroders PLC. Prior to 1st January 2007 SIM London &

SIM North America existed as two separate Firms which were compliant & verified as separate

entities until 31st December 2006. The consolidation of these two Firms was made as part of a

move towards creating one global Firm. Composite and Firm assets reported prior to 1st January

2007 represent those of the legacy firm which managed the product. Prior to 1st January 2011 the

SPrIM (Schroder Property Investment Management) Firm existed separate to the Schroder

Investment Management UK and US Firm, from 1st January 2011 these Firms have been

combined into a single firm. On April 2, 2013, Schroder U.S. Holdings Inc., a subsidiary of

Schroders plc, purchased STW Fixed Income Management LLC (“STW”) and on July 2, 2013,

Schroders plc, purchased Cazenove Capital Holdings; assets managed by STW and Cazenove

are included in the Firm from 1st January 2014. Assets Managed against a liability driven

mandate are excluded from the GIPS Firm. A complete list and description of the Firm's

composites and performance results is available upon request.

Composite Definition

The Schroder Monthly High Income Composite (the "Composite") is comprised of all Schroder

Investment Management (UK & US), fully discretionary accounts that seek to achieve a total

return in excess of the 100% HPCO £ Hedged, prior to 31/8/08 40% UC00 + 60% HPC0 100% £

hedged was used index. Composite account's objective is to achieve a high level of income from

a diversified portfolio of debt securities. The full spectrum of available securities, including

unrated issues and those of non-investment grade, will be utilised. Investments will be in directly

held transferable securities. The fund may also invest in collective investment schemes, warrants

and money market instruments. None of the accounts in the Composite use leverage. On

31/07/2014, the composite was restated for the periods 31/01/04-30/06/2014 so that returns were

reported gross of CT61 tax.

Composite Construction

New accounts are included from the beginning of the first full month of management on a

discretionary basis. Terminated accounts are excluded from the end of the last full month of

discretionary management. This Composite has no minimum asset level for inclusion.

The composite currency is Pound Sterling

Composite Inception Date: 31/03/2000

Composite Creation Date: 04/04/2002

Calculation Methodology

The portfolio returns are time-weighted rates of return that are adjusted for cash flows. Portfolio

returns are combined using beginning of period asset weights to produce the composite return.

Periodic returns are geometrically linked to produce annual returns.

Dividends on equities are recognised net of irrecoverable withholding tax. Since January 1999

dividends have been recognised as of the ex-dividend date having previously been recognised on

a cash basis. Performance results are presented before the deduction of management fees and

custodian fees but after trading expenses.

Dispersion

The dispersion of annual returns is measured by the asset weighted standard deviation of

portfolio returns represented within the composite for the full year provided a minimum of 5

portfolios are available.

Fee Schedule

The fee scale applied to the composite is 1.25% p.a.

GIPS Compliance and Verification

Schroder Investment Management (UK & US) claims compliance with the Global Investment

Performance Standards GIPS® and has prepared and presented this report in compliance with

the GIPS standards. Schroder Investment Management (UK & US) has been independently

verified for the periods 1st January 1996 to 31st December 2013. The verification report(s) are

available upon request. Verification assesses whether (1) the firm has complied with all the

composite construction requirements of the GIPS standards on a firm-wide basis, and (2) the

firm's policies and procedures are designed to calculate and present performance in compliance

with the GIPS standards. Verification does not ensure the accuracy of any specific composite

presentation.

Additional information

The exchange rates used are provided by WM. Each currency is valued at 4 pm on the last

business day of the month. Additional information regarding policies for valuing portfolios,

calculating and reporting returns and a description of all composites are available on request.

Schroder Monthly High Income Composite Disclosure as at 31 December 2015

27

Definition of Firm

The Firm is defined as all accounts managed by Schroder Investment Management in the UK and US, by

wholly owned subsidiaries of Schroders PLC. Prior to 1st January 2007 SIM London & SIM North

America existed as two separate Firms which were compliant & verified as separate entities until 31st

December 2006. The consolidation of these two Firms was made as part of a move towards creating one

global Firm. Composite and Firm assets reported prior to 1st January 2007 represent those of the legacy

firm which managed the product. Prior to 1st January 2011 the SPrIM (Schroder Property Investment

Management) Firm existed separate to the Schroder Investment Management UK and US Firm, from 1st

January 2011 these Firms have been combined into a single firm. On April 2, 2013, Schroder U.S.

Holdings Inc., a subsidiary of Schroders plc, purchased STW Fixed Income Management LLC (“STW”)

and on July 2, 2013, Schroders plc, purchased Cazenove Capital Holdings; assets managed by STW and

Cazenove are included in the Firm from 1st January 2014. Assets Managed against a liability driven

mandate are excluded from the GIPS Firm. A complete list and description of the Firm's composites and

performance results is available upon request.

Composite Definition

The Strategic Credit Composite is comprised of all Cazenove Capital, fully discretionary accounts that are

managed in a similar manner and seek to generate a total return above sterling cash interest rates.

Accounts in the composite invest primarily through a flexible allocation to investment grade bonds,

noninvestment grade bonds and derivative instruments. It invests in rated and unrated securities including

bonds, notes of fixed variable interest, preference shares, equities, convertible and other securities issued

by government, quasigovernment, supranational, bank and corporate entities, and derivative instruments.

The fund manager, has the flexibility to invest across the credit spectrum, depending on where he sees

the most relative value. Accounts in the composite invest in predominantly UK and Euro issuers, aiming

to generate a gross return substantially above cash over the medium term.

Composite Construction

New accounts are included from the beginning of the first full month of management on a discretionary

basis. Terminated accounts are excluded from the end of the last full month of discretionary

management. This Composite has no minimum asset level for inclusion. The composite currency is

Pound Sterling

Composite Inception Date: 31/12/2007

Composite Creation Date: 23/12/2013

Calculation Methodology

The portfolio returns are time-weighted rates of return that are adjusted for cash flows. Portfolio returns

are combined using beginning of period asset weights to produce the composite return. Periodic returns

are geometrically linked to produce annual returns. Dividends on equities are recognised net of

irrecoverable withholding tax as of the ex-dividend date. Unless otherwise stated performance results are

presented before the deduction of management fees and custodian fees but after trading expenses.

Dispersion

The dispersion of annual returns is measured by the asset weighted standard deviation of portfolio

returns represented within the composite for the full year provided a minimum of 5 portfolios are

available.

Additional information

The exchange rates used are provided by WM. Each currency is valued at 4 pm on the last business day

of the month. Additional information regarding policies for valuing portfolios, calculating and reporting

returns and a description of all composites are available on request. Net returns have been calculated

based on the highest fee rate charged to each account in the composite. The highest fee applied to the

composite is 1% p.a.

Leverage

Derivative instruments (including but not limited to: forward foreign exchange transactions, credit default

swaps, interest rate and government bond futures) may be used for the purposes of efficient portfolio

management and/or meeting the investment objectives of the fund. Such derivative contracts have the

potential to significantly increase the Fund’s risk profile and may create leveraged exposure to the credit

market. The Manager will employ a risk management process to manage any derivative exposure

achieved for the purposes of efficient portfolio management.

Schroder Strategic Credit Composite Disclosure as at 31 December 2015

28

Schroder Euro Corporate Bond composite Composite performance results as of: 31 December 2015

29

Composite - Euro Corporate Bond Composite

Primary Benchmark - Merrill Lynch EMU Corporate Index ER00 (GDR)

Secondary Benchmark - n/a

Year

Gross Composite

Return

Net Composite

Return

Primary

Benchmark

Return

3 Year

Composite Risk 1

3 Year Primary

Benchmark Risk1

Number of

Portfolios

(throughout

period)

Account

Dispersion2

Market Value at

end of Period

Average Account

Value at end of

Period

Percentage of

Firm Assets Total Firm Assets4

2015 1.82% 1.36% -0.43% 3.27% 2.92% < 5 n/a 7,388,111,330 2,462,703,777 n/a n/a

2014 9.97% 9.48% 8.25% 2.99% 2.81% < 5 n/a 5,217,294,487 1,739,098,162 2.23% 233,624,472,102.86

2013 5.03% 4.56% 2.39% 4.86% 3.91% < 5 n/a 3,476,851,647 1,738,425,824 1.87% 185,570,666,417.77

2012 14.16% 13.64% 13.03% 5.15% 3.84% < 5 n/a 3,788,172,424 3,788,172,424 2.23% 169,857,719,025.49

2011 -0.66% -1.10% 1.99% 5.36% 4.26% < 5 n/a 4,341,261,175 4,341,261,175 2.89% 150,181,474,947.82

2010 4.63% 4.16% 4.82% 4.73% 4.88% < 5 n/a 5,287,304,566 5,287,304,566 3.50% 151,277,519,306.48

2009 17.68% 17.15% 14.90% 4.20% 4.71% < 5 n/a 5,330,550,173 5,330,550,173 4.74% 112,342,282,237.88

2008 0.83% 0.38% -3.28% 3.26% 3.75% < 5 n/a 249,775,712 249,775,712 0.39% 64,491,545,975.88

2007 0.28% -0.17% 0.22% 2.24% 2.18% < 5 n/a 98,069,338 98,069,338 0.09% 110,204,532,829.05

2006 0.87% 0.42% 0.46% 2.38% 2.38% < 5 n/a 235,519,995 235,519,995 0.25% 94,818,131,792.34

2005 4.58% 4.11% 4.08% 2.56% 2.66% < 5 n/a 403,835,405 403,835,405 0.50% 81,145,632,932.60

2004 8.14% 7.65% 7.48% 2.69% 2.84% < 5 n/a 330,094,389 330,094,389 0.44% 75,762,917,408.50

2003 7.15% 6.67% 6.35% 2.97% 3.10% < 5 n/a 200,805,039 200,805,039 0.28% 72,079,501,076.53

2002 9.23% 8.74% 8.84% n/a n/a < 5 n/a 54,222,076 54,222,076 0.08% 69,967,330,959.83

2001 5.74% 5.27% 6.49% n/a n/a < 5 n/a 33,231,310 33,231,310 0.12% 26,792,715,571.07

2000* 4.10% 3.87% 4.55% n/a n/a < 5 n/a 23,202,209 23,202,209 0.07% 34,606,500,107.88

As at Dec 2015

Gross Composite

Return

Net Composite

Return

Primary

Benchmark

Return Composite Risk1

Primary

Benchmark Risk1

Annualised 3 Year 5.55% 5.08% 3.34% 3.27% 2.92%

Annualised 5 Year 5.93% 5.45% 4.93% 4.23% 3.49%

Annualised 7 Year 7.34% 6.86% 6.29% 4.31% 3.63%

Annualised 10 Year 5.29% 4.82% 4.08% 4.10% 3.76%

Annualised S.I.3 5.92% 5.45% 5.07% 3.64% 3.44%

1 Annualised standard deviation of gross monthly returns for the composite and monthly returns for the benchmark

2 Asset weighted standard deviation of annual gross returns of accounts that have been in the composite for the entire year

3 Since Inception

4 Since December 31, 2003 Total Firm Assets include non-fee paying accounts. 2003 Total Firm Assets value has been restated due to the inclusion of those non-fee paying accounts.

Total Firm Assets from 2007 incorporate the UK & US firm merger as detailed in the Definition of the Firm, from the start of 2011 Schroder Property Investment Management Multi

Manager accounts are included in the Total Firm Assets

* Returns are for a part period year

N/A - Information is not statistically meaningful due to an insufficient number of portfolios for the entire year

Currency: EUR

Gross Returns as of: 31-Dec-2015

Firm: UK-INT

Schroder Euro Credit Conviction composite Composite performance results as of: 31 December 2015

30

Composite - EURO Credit Conviction

Primary Benchmark - IBOXX EURO Corporates BBB

Secondary Benchmark - n/a

Year

Gross Composite

Return

Net Composite

Return

Primary

Benchmark

Return

3 Year

Composite Risk 1

3 Year Primary

Benchmark Risk1

Number of

Portfolios

(throughout

period)

Account

Dispersion2

Market Value at

end of Period

Average Account

Value at end of

Period

Percentage of

Firm Assets Total Firm Assets4

2015 2.43% 1.42% -0.91% n/a n/a < 5 n/a 989,956,119 989,956,119 n/a n/a

2014* 8.82% 7.83% 6.66% n/a n/a < 5 n/a 372,723,246 372,723,246 0.16% 233,624,472,102.86

As at Dec 2015

Gross Composite

Return

Net Composite

Return

Primary

Benchmark

Return Composite Risk1

Primary

Benchmark Risk1

Annualised 3 Year n/a n/a n/a n/a n/a

Annualised 5 Year n/a n/a n/a n/a n/a

Annualised 7 Year n/a n/a n/a n/a n/a

Annualised 10 Year n/a n/a n/a n/a n/a

Annualised S.I.3 5.83% 4.78% 2.93% 3.65% 3.23%

1 Annualised standard deviation of gross monthly returns for the composite and monthly returns for the benchmark

2 Asset weighted standard deviation of annual gross returns of accounts that have been in the composite for the entire year

3 Since Inception

4 Since December 31, 2003 Total Firm Assets include non-fee paying accounts. 2003 Total Firm Assets value has been restated due to the inclusion of those non-fee paying accounts.

Total Firm Assets from 2007 incorporate the UK & US firm merger as detailed in the Definition of the Firm, from the start of 2011 Schroder Property Investment Management Multi

Manager accounts are included in the Total Firm Assets

* Returns are for a part period year

N/A - Information is not statistically meaningful due to an insufficient number of portfolios for the entire year

Currency: EUR

Gross Returns as of: 31-Dec-2015

Firm: UK-INT

Schroder All Maturities Corporate Bond composite Composite performance results as of: 31 December 2015

31

Composite - Schroder All Maturities Corporate Bond Composite

Primary Benchmark - ML Non-Gilts All Stocks TL UNP0

Secondary Benchmark - n/a

Year

Gross Composite

Return

Net Composite

Return

Primary

Benchmark

Return

3 Year

Composite Risk 1

3 Year Primary

Benchmark Risk1

Number of

Portfolios

(throughout

period)

Account

Dispersion2

Market Value at

end of Period

Average Account

Value at end of

Period

Percentage of

Firm Assets Total Firm Assets4

2015 0.60% 0.35% 0.74% 5.79% 5.95% < 5 n/a 845,752,760 845,752,760 n/a n/a

2014 12.15% 11.87% 12.33% 5.02% 4.95% < 5 n/a 1,012,749,924 1,012,749,924 0.56% 181,303,377,699.73

2013 2.64% 2.38% 0.81% 5.77% 5.20% < 5 n/a 984,137,593 984,137,593 0.64% 154,389,192,281.00

2012 14.19% 13.91% 13.20% 5.57% 4.68% < 5 n/a 1,443,544,747 1,443,544,747 1.05% 137,767,097,276.00

2011 4.43% 4.17% 7.23% 6.12% 6.06% < 5 n/a 1,424,681,876 1,424,681,876 1.14% 125,447,599,076.00

2010 6.73% 6.46% 8.45% 6.15% 7.09% < 5 n/a 1,374,146,483 1,374,146,483 1.06% 129,624,298,705.00

2009 15.31% 15.02% 11.06% 5.36% 6.66% < 5 n/a 1,087,219,418 1,087,219,418 1.09% 99,813,040,697.00

2008 0.58% 0.32% -3.57% 4.12% 4.99% < 5 n/a 494,295,166 494,295,166 0.79% 62,351,920,495.00

2007 1.54% 1.28% 1.89% 3.19% 3.23% < 5 n/a 177,795,046 177,795,046 0.22% 80,942,699,545.00

2006 1.37% 1.11% 0.85% 3.26% 3.19% < 5 n/a 173,322,695 173,322,695 0.27% 63,884,694,460.00

2005 9.42% 9.15% 8.79% 3.88% 3.75% < 5 n/a 448,930,903 448,930,903 0.81% 55,754,866,657.00

2004 7.13% 6.86% 7.00% 4.54% 4.55% < 5 n/a 549,939,651 549,939,651 1.03% 53,638,602,879.00

2003 6.72% 6.45% 5.94% n/a n/a < 5 n/a 439,929,652 439,929,652 0.87% 50,787,751,863.00

2002 7.25% 6.98% 9.91% n/a n/a < 5 n/a 220,683,855 220,683,855 0.48% 45,605,358,759.00

2001* 6.39% 6.16% 5.58% n/a n/a < 5 n/a 110,640,140 110,640,140 0.24% 46,408,027,096.00

As at Dec 2015

Gross Composite

Return

Net Composite

Return

Primary

Benchmark

Return Composite Risk1

Primary

Benchmark Risk1

Annualised 3 Year 5.01% 4.75% 4.49% 5.79% 5.95%

Annualised 5 Year 6.67% 6.40% 6.73% 5.55% 5.38%

Annualised 7 Year 7.87% 7.60% 7.58% 5.73% 5.75%

Annualised 10 Year 5.81% 5.55% 5.15% 5.35% 5.61%

Annualised S.I.3 6.40% 6.14% 5.98% 5.12% 5.29%

1 Annualised standard deviation of gross monthly returns for the composite and monthly returns for the benchmark

2 Asset weighted standard deviation of annual gross returns of accounts that have been in the composite for the entire year

3 Since Inception

4 Since December 31, 2003 Total Firm Assets include non-fee paying accounts. 2003 Total Firm Assets value has been restated due to the inclusion of those non-fee paying accounts.

Total Firm Assets from 2007 incorporate the UK & US firm merger as detailed in the Definition of the Firm, from the start of 2011 Schroder Property Investment Management Multi

Manager accounts are included in the Total Firm Assets

* Returns are for a part period year

N/A - Information is not statistically meaningful due to an insufficient number of portfolios for the entire year

Currency: GBP

Gross Returns as of: 31-Dec-2015

Firm: SIM-UK

Schroder Sterling Over 15 Years Corporate Bond composite

Composite performance results as of: 31 December 2015

32

Composite - Schroder Sterling Over 15 Yrs Corporate Bond Composite

Primary Benchmark - ML > 15 Yr All Stocks TL UNP8

Secondary Benchmark - n/a

Year

Gross Composite

Return

Net Composite

Return

Primary

Benchmark

Return

3 Year

Composite Risk 1

3 Year Primary

Benchmark Risk1

Number of

Portfolios

(throughout

period)

Account

Dispersion2

Market Value at

end of Period

Average Account

Value at end of

Period

Percentage of

Firm Assets Total Firm Assets4

2015 -0.53% -0.78% -0.76% 9.77% 9.86% < 5 n/a 284,071,392 284,071,392 n/a n/a

2014 19.30% 19.00% 18.76% 7.89% 7.73% < 5 n/a 295,860,045 295,860,045 0.16% 181,303,377,699.73

2013 0.62% 0.37% -0.69% 8.01% 7.67% < 5 n/a 258,461,728 258,461,728 0.17% 154,389,192,281.00

2012 13.77% 13.48% 13.22% 7.64% 7.40% < 5 n/a 293,228,340 293,228,340 0.21% 137,767,097,276.00

2011 8.98% 8.71% 12.37% 8.76% 9.43% < 5 n/a 263,709,596 263,709,596 0.21% 125,447,599,076.00

2010 6.96% 6.69% 9.86% 9.77% 10.79% < 5 n/a 260,071,071 260,071,071 0.20% 129,624,298,705.00

2009 13.07% 12.79% 12.31% 8.81% 9.90% < 5 n/a 288,634,852 288,634,852 0.29% 99,813,040,697.00

2008 -2.85% -3.10% -4.20% 7.13% 7.42% < 5 n/a 239,739,641 239,739,641 0.38% 62,351,920,495.00

2007 -0.48% -0.73% -0.73% 5.32% 5.25% < 5 n/a 203,450,712 203,450,712 0.25% 80,942,699,545.00

2006 -0.11% -0.36% -0.08% 4.97% 4.82% < 5 n/a 210,405,163 210,405,163 0.33% 63,884,694,460.00

2005 11.95% 11.67% 11.60% 5.11% 5.09% < 5 n/a 296,645,085 296,645,085 0.53% 55,754,866,657.00

2004 7.98% 7.71% 7.80% 6.27% 6.55% < 5 n/a 306,545,686 306,545,686 0.57% 53,638,602,879.00

2003 7.77% 7.50% 6.72% n/a n/a < 5 n/a 423,741,472 423,741,472 0.83% 50,787,751,863.00

2002 8.38% 8.11% 10.69% n/a n/a < 5 n/a 354,125,727 354,125,727 0.78% 45,605,358,759.00

2001* 6.78% 6.58% 6.19% n/a n/a < 5 n/a 162,192,707 162,192,707 0.99% 16,391,633,816.00

As at Dec 2015

Gross Composite

Return

Net Composite

Return

Primary

Benchmark

Return Composite Risk1

Primary

Benchmark Risk1

Annualised 3 Year 6.09% 5.82% 5.38% 9.77% 9.86%

Annualised 5 Year 8.16% 7.89% 8.29% 8.66% 8.63%

Annualised 7 Year 8.68% 8.40% 9.08% 8.89% 9.23%

Annualised 10 Year 5.63% 5.36% 5.73% 8.47% 8.80%

Annualised S.I.3 6.71% 6.44% 6.79% 7.97% 8.25%

1 Annualised standard deviation of gross monthly returns for the composite and monthly returns for the benchmark

2 Asset weighted standard deviation of annual gross returns of accounts that have been in the composite for the entire year

3 Since Inception

4 Since December 31, 2003 Total Firm Assets include non-fee paying accounts. 2003 Total Firm Assets value has been restated due to the inclusion of those non-fee paying accounts.

Total Firm Assets from 2007 incorporate the UK & US firm merger as detailed in the Definition of the Firm, from the start of 2011 Schroder Property Investment Management Multi

Manager accounts are included in the Total Firm Assets

* Returns are for a part period year

N/A - Information is not statistically meaningful due to an insufficient number of portfolios for the entire year

Currency: GBP

Gross Returns as of: 31-Dec-2015

Firm: UK-INT

Schroder Euro High Yield composite Composite performance results as of: 31 December 2015

33

Composite - Euro High Yield Composite

Primary Benchmark - ML Euro High Yield Constrained (HEC0)

Secondary Benchmark - n/a

Year

Gross Composite

Return

Net Composite

Return

Primary

Benchmark

Return

3 Year

Composite Risk 1

3 Year Primary

Benchmark Risk1

Number of

Portfolios

(throughout

period)

Account

Dispersion2

Market Value at

end of Period

Average Account

Value at end of

Period

Percentage of

Firm Assets Total Firm Assets4

2015 4.41% 3.37% 0.73% 4.22% 4.45% < 5 n/a 292,731,005 292,731,005 n/a n/a

2014 6.10% 5.05% 5.35% n/a n/a < 5 n/a 136,649,999 136,649,999 0.06% 233,624,472,102.86

2013 10.06% 8.97% 10.04% n/a n/a < 5 n/a 116,541,067 116,541,067 0.06% 185,570,666,417.77

As at Dec 2015

Gross Composite

Return

Net Composite

Return

Primary

Benchmark

Return Composite Risk1

Primary

Benchmark Risk1

Annualised 3 Year 6.83% 5.77% 5.30% 4.22% 4.45%

Annualised 5 Year n/a n/a n/a n/a n/a

Annualised 7 Year n/a n/a n/a n/a n/a

Annualised 10 Year n/a n/a n/a n/a n/a

Annualised S.I.3 6.83% 5.77% 5.30% 4.22% 4.45%

1 Annualised standard deviation of gross monthly returns for the composite and monthly returns for the benchmark

2 Asset weighted standard deviation of annual gross returns of accounts that have been in the composite for the entire year

3 Since Inception

4 Since December 31, 2003 Total Firm Assets include non-fee paying accounts. 2003 Total Firm Assets value has been restated due to the inclusion of those non-fee paying accounts.

Total Firm Assets from 2007 incorporate the UK & US firm merger as detailed in the Definition of the Firm, from the start of 2011 Schroder Property Investment Management Multi

Manager accounts are included in the Total Firm Assets

* Returns are for a part period year

N/A - Information is not statistically meaningful due to an insufficient number of portfolios for the entire year

Currency: EUR

Gross Returns as of: 31-Dec-2015

Firm: SIM-UK

Schroder Monthly High Income composite Composite performance results as of: 31 December 2015

34

Composite - Schroder Monthly High Income Composite

Primary Benchmark - 100% HPCO £ Hedged, prior to 31/8/08 40% UC00 + 60% HPC0 100% £ hedged was used

Secondary Benchmark - n/a

Year

Gross Composite

Return

Net Composite

Return

Primary

Benchmark

Return

3 Year

Composite Risk 1

3 Year Primary

Benchmark Risk1

Number of

Portfolios

(throughout

period)

Account

Dispersion2

Market Value at

end of Period

Average Account

Value at end of

Period

Percentage of

Firm Assets Total Firm Assets4

2015 7.07% 5.75% 1.91% 4.07% 4.28% < 5 n/a 243,985,324 243,985,324 n/a n/a

2014 6.89% 5.57% 5.72% 5.93% 5.64% < 5 n/a 220,092,492 220,092,492 0.12% 181,303,377,699.73

2013 10.28% 8.92% 10.70% 11.70% 9.37% < 5 n/a 205,315,184 205,315,184 0.13% 154,389,192,281.00

2012 24.73% 23.19% 29.17% 13.40% 10.94% < 5 n/a 217,286,420 217,286,420 0.16% 137,767,097,276.00

2011 -9.45% -10.56% -2.70% 15.40% 15.06% < 5 n/a 201,066,016 201,066,016 0.16% 125,447,599,076.00

2010 12.38% 10.99% 16.28% 15.89% 18.98% < 5 n/a 281,919,367 281,919,367 0.22% 129,624,298,705.00

2009 52.89% 51.00% 78.26% 14.56% 18.17% < 5 n/a 151,673,641 151,673,641 0.15% 99,813,040,697.00

2008 -8.96% -10.09% -30.65% 10.95% 12.29% < 5 n/a 60,900,541 60,900,541 0.10% 62,351,920,495.00

2007 0.27% -0.97% 0.10% 3.06% 3.14% < 5 n/a 69,176,038 69,176,038 0.09% 80,942,699,545.00

2006 7.33% 6.00% 6.67% 2.64% 2.85% < 5 n/a 88,470,000 88,470,000 0.14% 63,884,694,460.00

2005 10.07% 8.71% 8.92% 3.40% 3.56% < 5 n/a 63,363,000 63,363,000 0.11% 55,754,866,657.00

2004 8.86% 7.51% 13.63% 3.89% 5.74% < 5 n/a 58,641,000 58,641,000 0.11% 53,638,602,879.00

2003 14.22% 12.81% 20.43% 4.17% 9.51% < 5 n/a 55,131,573 55,131,573 0.11% 50,787,751,863.00

2002 3.93% 2.64% -0.77% n/a n/a < 5 n/a 48,871,771 48,871,771 0.11% 45,605,358,759.00

2001 5.42% 4.12% -1.80% n/a n/a < 5 n/a 21,562,797 21,562,797 0.05% 46,408,027,096.00

2000* 3.20% 2.24% -4.45% n/a n/a < 5 n/a 18,898,279 18,898,279 0.03% 62,120,171,305.00

As at Dec 2015

Gross Composite

Return

Net Composite

Return

Primary

Benchmark

Return Composite Risk1

Primary

Benchmark Risk1

Annualised 3 Year 8.07% 6.73% 6.04% 4.07% 4.28%

Annualised 5 Year 7.35% 6.02% 8.43% 9.31% 7.76%

Annualised 7 Year 13.65% 12.25% 17.58% 10.87% 10.87%

Annualised 10 Year 9.15% 7.80% 8.69% 11.00% 11.78%

Annualised S.I.3 8.69% 7.34% 7.65% 9.00% 10.44%

1 Annualised standard deviation of gross monthly returns for the composite and monthly returns for the benchmark

2 Asset weighted standard deviation of annual gross returns of accounts that have been in the composite for the entire year

3 Since Inception

4 Since December 31, 2003 Total Firm Assets include non-fee paying accounts. 2003 Total Firm Assets value has been restated due to the inclusion of those non-fee paying accounts.

Total Firm Assets from 2007 incorporate the UK & US firm merger as detailed in the Definition of the Firm, from the start of 2011 Schroder Property Investment Management Multi

Manager accounts are included in the Total Firm Assets

* Returns are for a part period year

N/A - Information is not statistically meaningful due to an insufficient number of portfolios for the entire year

Currency: GBP

Gross Returns as of: 31-Dec-2015

Firm: SIM-UK

Schroder Strategic Credit composite Composite performance results as of: 31 December 2015

35

Composite - Strategic Credit Composite

Primary Benchmark - UK Treasury Bills 3 Month

Secondary Benchmark - n/a

Year

Gross Composite

Return

Net Composite

Return

Primary

Benchmark

Return

3 Year

Composite Risk 1

3 Year Primary

Benchmark Risk1

Number of

Portfolios

(throughout

period)

Account

Dispersion2

Market Value at

end of Period

Average Account

Value at end of

Period

Percentage of

Firm Assets Total Firm Assets4

2015 3.33% 2.45% 0.45% 1.99% 0.01% < 5 n/a 1,242,522,627 621,261,313 n/a n/a

2014 3.08% 2.20% 0.42% 2.57% 0.01% < 5 n/a 1,141,151,520 570,575,760 0.63% 181,303,377,699.73

2013 4.79% 3.84% 0.38% 4.57% 0.03% < 5 n/a 1,083,584,961 541,792,481 8.45% 12,820,807,398.92

2012 13.27% 12.24% 0.47% 4.94% 0.02% < 5 n/a 1,053,923,669 526,961,835 13.92% 7,569,738,495.91

2011 -0.95% -1.86% 0.58% 6.03% 0.05% < 5 n/a 1,032,854,043 516,427,021 17.42% 5,928,179,794.47

2010 8.09% 7.09% 0.54% 8.65% 0.60% < 5 n/a 805,284,674 402,642,337 12.10% 6,653,235,819.12

2009 28.38% 27.20% 0.66% n/a n/a < 5 n/a 431,873,465 215,936,732 6.15% 7,016,746,425.74

2008 -9.79% -10.63% 4.83% n/a n/a < 5 n/a 218,660,440 109,330,220 4.44% 4,921,902,420.08

As at Dec 2015

Gross Composite

Return

Net Composite

Return

Primary

Benchmark

Return Composite Risk1

Primary

Benchmark Risk1

Annualised 3 Year 3.73% 2.83% 0.42% 1.99% 0.01%

Annualised 5 Year 4.60% 3.67% 0.46% 3.68% 0.02%

Annualised 7 Year 8.21% 7.24% 0.50% 4.39% 0.04%

Annualised 10 Year n/a n/a n/a n/a n/a

Annualised S.I.3 5.78% 4.83% 1.03% 6.01% 0.42%

1 Annualised standard deviation of gross monthly returns for the composite and monthly returns for the benchmark

2 Asset weighted standard deviation of annual gross returns of accounts that have been in the composite for the entire year

3 Since Inception

4 Since December 31, 2003 Total Firm Assets include non-fee paying accounts. 2003 Total Firm Assets value has been restated due to the inclusion of those non-fee paying accounts.

Total Firm Assets from 2007 incorporate the UK & US firm merger as detailed in the Definition of the Firm, from the start of 2011 Schroder Property Investment Management Multi

Manager accounts are included in the Total Firm Assets

* Returns are for a part period year

N/A - Information is not statistically meaningful due to an insufficient number of portfolios for the entire year

Currency: GBP

Gross Returns as of: 31-Dec-2015

Firm: CAZ