SA Mag - Issue 20

-

Upload

tnt-multimedia-limited -

Category

Documents

-

view

248 -

download

7

description

Transcript of SA Mag - Issue 20

PEOPLE CULTURE TRAVEL PROPERTY BUSINESS WINE SPORT ENTERTAINMENT

New � inking New Possibilities Q&A with Hyundai South Africa operations director Albrecht Grundel

Taking to the skiesEast London Airport’s airport manager Michael Kernekamp talks to South Africa Magazine

� e hungry LionLion of Africa Insurance is South Africa’s first insurance company to achieve a Level 1 B-BBEE rating

Preparing for the digital switchoverAltech UEC recently opened one of the worlds most advanced set-top-box factories

ISSUE 20

PEOPLE CULTURE TRAVEL PROPERTY BUSINESS WINE SPORT ENTERTAINMENT

New � inking New Possibilities Q&A with Hyundai South Africa operations director Albrecht Grundel

Taking to the skiesEast London Airport’s airport manager Michael Kernekamp talks to South Africa Magazine

� e hungry LionLion of Africa Insurance is South Africa’s first insurance company to achieve a Level 1 B-BBEE rating

Preparing for the digital switchoverAltech UEC recently opened one of the worlds most advanced set-top-box factories

ISSUE 20

M A L E M ASUSPENDEDF R O M T H E A N C

3www.southafricamag.com

YOUTH CALL FOR JOBS, END TO POVERTYThere has been a lot to shout about this month. South Africa recorded a trade surplus of R2.5 billion in September. The Kagiso purchasing managers’ index (PMI) remained largely unchanged in October. Sales of new vehicles increased by 19.8 percent year-on-year. And South Africa’s unemployment rate declined to 25 percent in the third quarter as manufacturing and retail sales rebounded.

Are these signals that the economy may have recovered from a slowdown in the second quarter?

Perhaps.

But the youth aren’t happy. Especially when it comes to jobs.

They have taken their frustration over poverty and joblessness to the streets responding to a call by tough-talking ANCYL leader, Julius Malema, who has been demanding more jobs, better housing and other help for the poor. He also wants to nationalise the mines.

What did this action teach us? Well, the protest may have been aimed as much at infl uencing ANC economic policy as showing older leaders Malema cannot be ignored. Next year, President Jacob Zuma faces an internal party leadership vote that could determine who will be South Africa’s next president.

Enjoy the magazine!

Ian ArmitageEditor

South Africa’s next president.

EDITORIAL Editor – Ian ArmitageSub editors – Jahn Vannisselroy Janine Kelso Tom Sturrock Writers –Colin ChineryJane BordenaveJohn O’hanlon

BUSINESSAdvertising Sales Manager – Andy Ellis Research manager – Chris BolderstoneResearchers – Jon JaffreyDave hodgson Marie SmithElle WatsonLuke AshfordSales – Andy WilliamsAlan RedmondSales administrators – Katherine EllisDaniel george

ACCOUNTSFinancial Administrator –Suzanne Welsh

PRODUCTION & DESIGNMagazine design – Optic JuiceProduction manager - Jon Cooke Images: getty, ThinkstockNews: NZPA, AAP, SAPA

DIGITAL & ITHead of digital marketing & development – Syed Ahmad

TNT PUBLISHING CEO - Kevin Ellis Chairman - Ken hurst Publisher - TNT Multimedia Ltd

South Africa Magazine, The Royal, Bank Plain, Norwich, Norfolk, UK. NR2 4SF

TNT Multimedia Limited, 10 greycoat Place, London, SW1P 1SB tntmagazine.com

ENQUIRIESTelephone: 0044 (0)1603 343267Fax: 0044 (0)1603 283602 [email protected]

SUBSCRIPTIONS Call: 00441603 [email protected]

www.southafricamag.com

181818

222222222222404040404040

848484848484 585858585858 343434343434

969696969696 2828284 www.southafricamag.com

06 NEWSAll the latest news from

South Africa

12 TRAVEL exploring the

Masai MaraAAP Travel Writer LeahmcLennan visits Kenya’sworld-famous masai maraNational reserve.

16 CULTURE Johannesburg

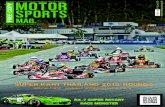

Motor showWhether you are a die-hard automotive freak or simply someone with a basic feeling toward cars, this was the event for you.

18 PEOPLE Julius Malema

suspended from the anc

Is this the end of his political career?

22 DUTOIT GROUP

28 STADIUM MANAGEMENT SOUTH AFRICA

34 UNITED NATIONAL BREWERIES

40 HYUNDAI SOUTH AFRICA

46 DAV PROFESSIONAL PLACEMENT GROUP

50 BOTSWANA RAIL

54 UNIVERSAL MINING AND CHEMICAL

INDUSTRIES

58 TROLLOPE MINING SERVICES

64 EAST LONDON AIRPORT

68 BKS GROUP

72 ALEXANDER FORBES

76 SWAZILAND ROYAL INSURANCE

CORPORATION

80 SWAZIBANK

84 LION OF AFRICA INSURANCE

88 ALTECH UEC

92 ZURICH INSURANCE

96 CENTRIQ INSURANCE

100 AFRIFRESH GROUP

REG

ULA

RS

FEATUR

ES

5www.southafricamag.com

Contents22

FEATUR

ES

6 www.southafricamag.com

Lifestyle

Young South Africans took their frustration over poverty and joblessness to the streets on 27 October, responding to a call by the tough-talking youth leader of the governing African National Congress, Julius Malema, who has clashed with older party leaders over economic policy.

Police and ANC Youth League marshals kept a close watch as around 1,000 protesters gathered in Johannesburg, in what was a party atmosphere.

The protesters, who carried placards that said “We Demand Nationalisation” and “Expropriation of Land Without Compensation”, sang and danced in downtown Johannesburg and showed support for Malema, who along with five other Youth League leaders are facing ANC disciplinary hearings and may be expelled for bringing the ruling party into disrepute.

The rally was at the start of a march organised by the ANCYL to the Chamber of Mines and the Johannesburg Stock Exchange

Youth call for jobs, end to povertY

and then to President Jacob Zuma’s office in Pretoria, some 60 kilometers away.

A tall fence was erected around the stock exchange and public access was restricted.

Malema, 30, led the “economic freedom march” and held an overnight vigil. He is demanding more jobs, better housing and other help for the poor, and wants to nationalise the mines.

ANC leaders say talk about nationalising mines undermines investor confidence. Malema says whites remain privileged 17 years after the end of apartheid, and that big business largely remains in white hands.

All the latest news from South Africa

European leaders have agreed a crucial plan to reduce Greece’s debt and provide it with more rescue loans.

After marathon talks last night in Brussels, the leaders said private banks holding Greek debt had accepted a loss of 50 percent.

Banks must also raise more capital to protect themselves against losses resulting from any future government defaults.

The deal is aimed at preventing the crisis spreading from Greece to larger economies like Italy, but the leaders said work still needed to be done.

It also approved a mechanism to boost the eurozone’s main bailout fund – The European Financial Stability Facility (EFSF) – to about 1 trillion euros.

The framework for the new fund is to be put in place in November.

Markets around the world have reacted well to the news.

eu leaders agree debt deal

7www.southafricamag.com

Eurozone crisis

china hopes eu will stick to bailout

China has said that it hopes the Eurozone will stick to a bailout plan reached at October’s debt crisis summit, after Greece called a surprise national referendum on 1 November.

Foreign ministry spokesman Hong Lei said China had “taken note” of developments.

World markets have plunged after the shock announcement that Greece will hold a vote on the package of measures agreed last week to try to rescue the eurozone from a worsening debt crisis.

Europe has approached China - which is already a major holder of European debt – to help finance an expansion of its bailout fund – the European Financial Stability Facility (EFSF).

China has so far been non-committal about what help it could provide.

“China is ready to explore ways to fight against the (debt) crisis with the EU,” Hong said. “China has been and will continue to be a major investor in the EU market.”

south africa records trade surplus in september

South Africa has recorded a trade surplus of R2.5 billion in September on increased exports of precious and semi-precious stones and mineral products.

The South African Revenue Service said that exports rose by 11.1 percent month-on-month to R67.8 billion, while imports increased by a negligible 0.8 percent to R65.3 billion.

It is the first surplus registered by South Africa in three months.

Trade

8 www.southafricamag.com

Travel

Qantas passengers have again taken to the skies after Fair Work Australia (FWA) ordered all industrial action to be terminated.

Qantas’ decision to ground all flights from 29 October left nearly 70,000 people stranded.

The airline’s defiant chief Alan Joyce said 31 October that Qantas would return to “business as usual” as soon as possible.

FWA made its ruling terminating all industrial action between Qantas and the Transport Workers Union (TWU), the Australian International Pilots Association and the Australian Licensed Aircraft Engineers Association (ALAEA) following a meeting in Melbourne.

It gave the parties 21 days to resolve their differences.

Joyce apologised to all the airline’s customers

Qantas back in the air following strikes

million a day, it saved the airline in the long run, he said.

“I’ll make whatever tough decisions are needed to be made in order to ensure the survival of this great company,” he said.

The TWU says it hopes to settle the dispute but may challenge the ban on strike action.

“If the company negotiates in good faith, which is what we’re expecting the company to do, the next 21 days we will not be taking industrial action,” TWU national secretary Tony Mr Sheldon said.

“We are also considering with our legal advisers whether we should appeal this decision.”

and said he hoped the backlog could be cleared within 24 hours, adding he believed the Qantas brand would recover.

“I have every confidence that we will recover back to a 65 percent domestic market share and recover internationally,” he said.

Joyce added that it had been the right decision to ground the airline in a bid to stop the ongoing industrial action that was costing the airline A$15 million a week.

Although grounding all 108 planes had cost A$20

9www.southafricamag.com

new vehicles sales up 19.8% in october Sales of new vehicles increased by 19.8 percent year-on-year last month to 36,826 units, according to the latest stats from the National Association of Automobile Manufacturers of South Africa (Naamsa).

“October 2011 aggregate industry domestic sales had improved by 8,309 units or 18.9 percent to reach 52,338 vehicles from 44,029 vehicles sold during October last year. Total year to date domestic sales in calendar 2011 remained 16.5 percent ahead of the corresponding ten months in 2010. October 2011 export sales at 25,860 vehicles had registered a marginal decline of 712 units or 2.7 percent compared to the 26,572 units exported in October last year,” Naamsa said in a statement.

“Overall, out of total October 2011 industry reported sales of 52,338

Business

vehicles, 77.6 percent or 40,629 units represented dealer sales, 14.2 percent represented sales to the car rental industry, 5.2 percent sales to government and 3.0 percent represented industry corporate fleet sales,” it added.

A major contributor to the ongoing strength in the new-car market in recent months was the continued above-average demand by car-rental companies, with the car-rental industry during October 2011 accounting for 19.4 percent of total new-car sales.

“The new-car market for 2011 is now expected to show an improvement of between 16 percent and 18 percent on the 2010 figures,” Naamsa said.

“Over the medium term, domestic sales should continue to register growth, but probably at a more subdued rate, in line with the overall performance of the South African economy,” it added.

jobless rate declines to 25% in Q3South Africa’s unemployment rate declined to 25 percent in the third quarter as manufacturing and retail sales rebounded.

It is a signal that the economy may have recovered from a slowdown in the second quarter, where the unemployment rate increased by 174,000.

The jobless rate fell from 25.7 percent, Statistics South Africa (Stats SA) said.

The number of people in work rose 193,000 to 13.3 million. This is the highest increase observed since the recession in 2009, Stats SA said and was mainly driven by the growth in the formal sector, which grew by 2.6 percent.

The informal sector remains turbulent quarter-to-quarter. It contracted by 2.4 percent or 53,000 jobs after an increase of 34,000 jobs in the previous quarter.

Despite a decline in unemployment in the third quarter, 4.4 million people remain unemployed and just over 3.0 million have been unemployed for a period of a year or more.

60.2 percent of the job seekers do not have matric.

Last month young South Africans took their frustration over poverty and joblessness to the streets, responding to a call by tough-talking ANCYL leader, Julius Malema, who has been demanding more jobs, better housing and other help for the poor. He also wants to nationalise the mines.

10 www.southafricamag.com

Money Energy

South African President Jacob Zuma attended the G20 Summit in Cannes, France, from 3 to 4 November, where he promoted the need for enhanced growth, jobs and infrastructure development on the African continent.

He was accompanied by Finance Minister Pravin Gordhan.

According to a statement by The Presidency, Zuma called for global governance reforms to reflect the interests of the Africa and the developing world. The Presidency said that South Africa used the summit to call for strong action by Europe to implement already announced measures to prevent a global recession.

“As a small open economy, we pushed for better response measures to curb currency volatility,” Zuma said.

Issues discussed at the summit included the global economic situation; reforming the International Monetary Fund (IMF); strengthening the financial sector; as well as the volatility of commodities markets and their effect on food prices.

“We should refocus our attention (on) promoting growth that is inclusive in an effort to address poverty,” Zuma said.

“The reform of international financial institutions remains a critical point for South Africa.

“On IMF reform, South Africa has a specific objective: to increase the voice and participation of sub-Saharan Africa and the creation of a third chair for sub-Saharan Africa.”

SA urged the summit to agree on measures to help African countries transition to a greener economy.

The World Bank has approved an additional loan worth US$250 million (some R2 billion) for Eskom’s renewable energy support programme. The money will be used to help Eskom develop its concentrating solar power plant near Upington and its Sere wind power plant.

The loan is funded by the World Bank’s Clean Technology Fund which promotes scaled-up financing for demonstration, deployment and transfer of low-carbon technologies with significant potential for long-term greenhouse gas emissions savings.

“The loan will help Eskom to implement two of the largest renewable energy projects ever attempted on the African continent,” the bank said in a statement.

Eskom, a major supplier of energy to South Africa and neighboring countries, is keen to reduce its carbon footprint.

The state-owned utility is spending billions of dollars to build and upgrade existing coal-fired power plants to meet immediate energy needs, and wants to diversify the energy mix toward cleaner sources of energy.

Last month, Eskom signed two loan agreements worth US$365 million with the African Development Bank to develop the Sere and Upington projects.

Eskom said it hoped to begin construction of the Sere wind project early next year.

The World Bank came under fire last year for approving a US$3.75 billion loan for the development of a coal-fired plant in South Africa, but Eskom said the project was necessary to ease the country’s chronic power shortages.

Zuma heads for g20 summit, seeks help to curb volatile currencY

world bank approves second eskom loan

11www.southafricamag.com

Sport

henrY Quits new Zealand

role

sponsors concerned

about csa ‘brand integritY’

Graham Henry has stood down as New Zealand coach, nine days after guiding the All Blacks to a 8-7 World Cup final triumph over France.

He steered the All Blacks to 88 wins in 103 tests.

“I’ve had enough, it has been a privilege to be involved in the All Blacks. I’m very proud of what they’ve done over the last eight years,” the 65-year-old said.

Henry said he would be making no immediate announcement on his future plans.

The allegations of corruption in South African cricket have shaken the confidence of potential sponsors who have expressed their concern about Cricket South Africa’s (CSA) brand integrity to the sports ministry.

South Africa are currently playing Australia in a one-day and Twenty20 series, with no sponsors.

CSA has secured sponsorship only for the Proteas Test and one-day teams. There is believed to be a sponsor for the upcoming Test series that starts in Cape Town on November 9, but this has not been announced yet.

CSA fired its president for a second time after he challenged CEO Gerald Majola for receiving allegedly irregular bonuses from the Indian Premier League (IPL) two years ago and the turmoil has seriously affected its reputation.

Sponsors once lined up to be associated with CSA and the Proteas, but after major sponsors Standard Bank and mobile phone giant MTN withdrew, new sponsors have been very reluctant to come forward.

Potential sponsors and their agents met the Department of Sport and Recreation to discuss their concerns over the brand integrity of CSA’s properties.

The meeting with Gert Oosthuizen, deputy minister in the Department of Sports and Recreation, was arranged by SAIL, a rights commercialisation agency, in the wake of an announcement by sports minister Fikile Mbalula a fortnight ago that he would institute an inquiry into the affairs of CSA.

Financial services company Momentum also attended the meeting, according to Business Day.

A report by auditors KPMG is believed to have pointed to Majola as being in breach of the Companies Act on several counts for bonuses paid to him and other CSA staff by the organisers of the 2009 IPL and Champions Trophy, which were held in South Africa.

CSA has persisted in refusing to make the report public. Acting director-general of the sports ministry, Sumayya Khan said sponsors were concerned.

12 www.southafricamag.com

Travel Writer Leah McLennan visits Kenya’s world-famous Masai Mara National Reserve.By Leah McLennan, AAP Travel Writer

exploring the exploring the masai maraexploring the masai maraexploring the

W illiam in the driver’s seat turns around and

says to us: “They’re mating, get a photo”.

Not an everyday comment, but we are, after all, in Kenya’s world-famous Masai Mara National Reserve.

I’m in an open-top minibus in an area teeming with lions. A mixture of fear and excitement is pushing stress hormones through my body and lifting my heart rate.

Exploring the Masai Mara TRAVEL

13www.southafricamag.com

We are smack-dab in the middle of a pride of about 20 tawny beasts. On one side of the bus there is a group of females lazing about with their cubs. On the other side a male, his face encircled with a huge brown mane, sniffs a lioness.

“If we stay here they will mate again in another 15 or so minutes,” says William, who has an in-depth knowledge of African animals’ behaviour and social structure.

The four of us in the safari bus sit tight and eventually the large cats summon the energy to again “make love”, a euphemism for what could otherwise be described as one-minute of rough, frantic movement followed by a few loud, elongated groans.

“Look the zebras are mating too,” Maree, an Australian on her honeymoon, says, pointing into the distance.

All of a sudden, it’s like we’re on the set of the BBC’s Planet

Earth series with David Attenborough.We might have missed the Great

Migration but this Great Copulation is just as entertaining.

Intimate encounters with or between the “big fi ve” - lion, leopard, elephant, buffalo and rhino - are just some of the experiences you can expect in the Masai Mara, a sprawling, unfenced savannah grassland in the country’s remote southwestern corner. This predator-packed park is the northern continuation of the Serengeti National Park in Tanzania.

Our home for the next two nights is the Sarova Mara Game Camp, a property with 73 tents, a restaurant and swimming pool encircled by a 24-hour electric fence that stops the animals popping in to say hello.

Graceful antelopes the size of Chihuahuas, called Dik-diks, nibble on the grass outside our Club Tent. “If Dik-dik dead then lion here, if Dik-

dik ok then you should be fi ne,” Paul, a security guard, says half jokingly as he places our bags in the “tent”, which has an ensuite bathroom, king-size bed, permanent roof and heavy wooden doors.

After unpacking I sit outside on the balcony, with its uninterrupted bush views, and keep a close eye on Kenya’s version of the canary in the coalmine.

This camp provides all the elements to optimise the chances of a perfect night’s sleep - a mosquito net-covered bed and relaxing neutral-coloured furnishings - but I don’t know how much sleep I will get as my nerves are a mess.

I’m overwhelmed by irrational fears - from being trampled in my bed by an elephant to being whisked away by Somali pirates (though this is highly unlikely).

The affable Paul chuckles infectiously when I tell him of my fears

14 www.southafricamag.com

and I show him the tiny pocket knife I’ve brought along to defend myself from predators and pirates.

A wine should calm my nerves and help me sleep, I think, so I make a bee-line for the main lodge, an attractive high-ceiling dining room that serves a buffet full of meats and seafood and the camp’s own vegetables and herbs.

After sharing a bottle of South African wine with my travel companion I turn in early, hoping that I won’t come face-to-face with any animals before we start tracking them at 6am.

Thankfully the only animals I spot are in my dream and I bounce out of bed at dawn, eager to head out and wake up the animals. There’s no need to wake up the lions though, they’ve been hunting all night and are quite lazy by the time we fi nd them.

We’ve easily ticked off the big fi ve, so William goes in search of hippopotamus and stops the vehicle near a creek where a pod wallow in the water.

We get out of the car to

have a closer look. We watch the fat, jolly creatures from the safety of the top of the river bank, while a group of French tourists bravely (or stupidly) venture down to water level.

“The hippo is considered the most dangerous animal in Africa,” William says.

I glance back at the bus and plan my emergency evacuation should a rogue hippo emerge, bellowing loudly, swinging its head like a giant sledgehammer and coming towards me with its massive open mouth full of slashing teeth.

“The hippo is extremely aggressive, unpredictable and unafraid of humans,” William continues.

“And the last time I was here a dozen or so crocodiles were just there sunbaking on the rocks.”

That’s it, I’m off. I fi nd myself back in the bus, having returned without even knowing how I got there.

Our four drives over the two days in the Masai Mara are fi lled with highlights. There’s the moment we drive

15www.southafricamag.com

through a creek and fi nd ourselves temporarily bogged next to a pride of lions. I could have reached out and tickled their ears.

Then there’s the moment we spend watching a herd of larger-than-life elephants, as well as zebras, gazelles, jackals, ostriches and warthogs, against the backdrop of the setting sun.

The Masai Mara delivers some of the best animal viewing in Africa and on our third morning in Kenya I’m reluctant to leave. But the safari must go on and after an early breakfast we say goodbye to Paul and the other staff at Sarova Mara. We’re off to Lake Nukuru, the home of rhinos and waters that are coloured pink with the fl amingo population.

“Don’t forget to send me a baby kangaroo when you get home to Australia,” Paul says as we pile into the van and William hops back into the driver’s seat.

“I will send you a baby Dik-dik to keep you safe from the lions,” he says with a chuckle. END

Exploring the Masai Mara TRAVEL

WHEN TO GO: While many tourists fl ock to Kenya's Masai Mara National Reserve during the high season from July to October, to witness the wildebeest migration, the winter months are also a great time to go.

MORE INFORMATION: www.magicalkenya.com

Editor’s comment: If you've ever dreamed of taking a safari in east Africa now might be a good time to go. Kenya's tourism industry is facing tough times as it tries to prevent a drop in visitor numbers following a series of attacks on travellers and aid-workers near the Somali-Kenya border.

T he highly anticipated Johannesburg International Motor Show kicked off last month on

high octane, with lovers of all things motoring heading to the Nasrec grounds to see what manufacturers had in store for them this year.

And what a treat they got.Motoring manufacturers pulled

no punches, aiming to ensure their offering stood out.

They kept expo-goers enthralled in a bid to drive traffic to their dealerships.

Audi, Mini and Land Rover drafted in their celebrity ambassadors to give

their brands a bit of star quality.And audiences liked what they saw.Things got into full swing on Saturday,

October 8 as the public made its way through the Expo Centre gates for the first of nine days after the first two days had been reserved for the media and VIP guests.

A number of exciting concept cars and new models were unveiled during the first two days and underlined the fact that this is the biggest and best motor show in South Africa.

Was there a showstopper? Well, yes - the incredible Chevrolet Miray concept had to be the winner. The carbon fibre clad beast is powered by electric motors as well as a 1.5-litre

16 www.southafricamag.com

J O h A N N E S B U R g M O T O R S h O W

Whether you are a die-hard automotive freak or simply someone with a basic feeling toward cars, this was the event for you.

By Ian Armitage

turbocharged four-cylinder engine. It was flown to South Africa straight from the Frankfurt Motor Show where it was also a big hit.

This was not only a show confined to passenger cars though and there were large displays of motorcycles, scooters, trucks and buses as well as selection of accessories and components.

Of course, South Africans love their bakkies. The Toyota Hilux is the best

seller in the market overall and there were numerous models on display, suiting almost every requirement for business or leisure.

Volkswagen also got in on the act with its Amarok.

The bakkies market has changed considerably in recent years with the advent of the ‘lifestyle’ bakkie - the once simple bakkie is no longer simple.

Of note was the budget Chinese offering from Foton.

Johannesburg Motor Show Overview CULTURE

17www.southafricamag.com

The Ford Ranger and Mazda BT-50 also caught the eye, while Suzuki South Africa constructed a huge stand with an outdoor extreme theme, complete with a tree house as well as its entire range of passenger cars, boats and off-road vehicles.

In all the show was a huge success.

Website: www.jhbmotorshow.co.za END

A NC Youth League president Julius Malema has been suspended from the ruling party for fi ve years.

The ANC’s national disciplinary committee announced that it had found Malema guilty of misconduct and sowing division in the party. He was asked to step down as youth league president.

Malema was not in Johannesburg when his suspension was announced, because he was writing an exam at the Polokwane campus of the University of South Africa.

His statements on Botswana were considered “reckless” and brought the ANC into disrepute, the party’s national disciplinary committee chairperson Derek Hanekom said.

18 www.southafricamag.com

By Ian Armitage

Julius MaleMa suspended froM the anc for fiVe Years IS ThIS The eND of hIS PoLITICAL CAreer?

Earlier this year, Malema said the youth league would send a team to Botswana to consolidate opposition parties and help bring about regime change there. He apologised for the remarks, but the damage had been done – it caused serious diplomatic embarrassment for the ANC.

Malema was also found guilty of interrupting a meeting of ANC offi cials, which included President Jacob Zuma.

That guilty fi nding related to Malema, ANCYL deputy president Ronald Lamola,

treasurer general Pule Mabe, secretary general Sindiso Magaqa and deputy secretary general Kenetswe Mosenogi.

On that charge, the group was suspended from the ruling party for two years. The sanction was suspended for three years.

Malema was found not guilty on a third charge of inciting racial hatred and inflaming divisions in the country.

Once a close ally of President Zuma, Malema has become one of his strongest critics, accusing him of ignoring poor South

Julius Malema PEOPLE

19www.southafricamag.com

Africans who helped bring him to power.

His guilty verdict boosts Mr Zuma’s re-election bid. Malema wants him replaced as party leader ahead of the 2014 elections, but it is now diffi cult to see how he could infl uence or affect the ANC leadership contest next year.

It has been reported that Malema will appeal against the ANC’s decision to suspend him. He is able to appeal, but was already suspended for his statements on Zimbabwe (Malema, remember, declared the ANC’s support

for President Mugabe at a time when President Zuma was mediating between the country’s coalition members).

Following Malema’s suspension, an ANC spokesperson said: “Disciplinary procedures are not meant to end anybody’s political career, they are meant to correct behaviour.”

The ANC is to celebrate its 100th anniversary in 2012 and offi cials appeared keen to show that the party will not be dictated to by a young, outspoken, controversial and, often, unruly leader.

Malema is a hugely divisive fi gure. He has previously been found guilty of using hate speech by singing an anti-apartheid song Shoot the Boer [white farmer], which has since been banned.

He once vowed to “kill for Zuma”.In 2009, Malema launched a campaign

to nationalise mines and expropriate white land without compensation, which was consistently contradicted by leaders of his own party and ridiculed in the press and by the industry.

He was not a force to be reckoned with then.

This is now. In September, the one-time “buffoon” of South African politics was named as one of Africa’s 10 most powerful young men by international business magazine Forbes.

“The ANCYL wields enormous power in South African politics, and played a pivotal role in the election of incumbent president, Jacob Zuma, during the 2009 presidential elections,” Forbes said.

That statement was not far off the mark. Malema came from nowhere and, in just three years since his election in 2008 as ANC Youth League president, inserted himself at the very centre of debate about South Africa’s future political direction.

20 www.southafricamag.com

BIOJUlIUS SEllO MAlEMA

Julius Sello Malema was born 3 March 1981, in Seshego. He is best known for his controversial statements and speeches, and once intense support for African National Congress president Jacob Zuma. Malema, a Pedi, was raised by a single mother, a domestic worker in Seshego township, Limpopo. According to varying reports he joined the Masupatsela (”Trailblazers”) pioneer movement of the African National Congress at age nine. His school career was undistinguished and he failed two high school grades as well as several subjects in his fi nal secondary school examination. In fact, his marks were so low that they later attracted signifi cant media attention. Malema was elected as both chairman of the Youth League branch in Seshego and the regional chairman in 1995. In 1997 he became the chairman of the Congress of South African Students (Cosas) for the Limpopo province, and in 2001 he was elected as the national president of that organisation.He was elected as the president of the ANC Youth League in April 2008, in a close race at a national conference held in Bloemfontein. The election – and the conference – was characterised by what Malema himself later described as “unbecoming conduct”. Allegations of irregularities in the polling procedure saw the conference adjourned shortly after the election results were announced. It was resumed only in late June, when Malema’s election was offi cially accepted.

In October, Malema led a youth league march to persuade the government to seize mining and called for “economic freedom”. The protesters, who carried placards that said “We Demand Nationalisation” and “Expropriation of Land Without Compensation”, sang and danced in downtown Johannesburg and showed strong support for Malema. It showed it could not be ignored. On the two touchiest issues in South African politics – macro-economic policy and race relations – he is the central player.

What the ruling party has done with this ruling is to draw a line in the sand. This is in many ways Jacob Zuma’s victory in a long and bruising fi ght.

But the question remains - will Malema’s suspension save Zuma from his detractors within the broader structures of the ANC? They want to see him vacate the top job come next year when the party holds its leadership election.

Malema was, at one point, considered a president in waiting. Is that now history? END

Julius Malema suspended from the ANC PEOPLE

In September, the one-time “buffoon” of South African politics was named as one of Africa’s 10 most

powerful young men by international business

magazine Forbes

21www.southafricamag.com

22 www.southafricamag.com

A N U N W A V E R I N g F A I T h I N T h E

22 www.southafricamag.com

A N U N W A V E R I N g F A I T h I N T h EF A I T h I N T h E

The DuToit Group is a leading South African

producer and distributor of fruit and vegetables.

Pieter du Toit, Managing Director of the Dutoit

group: Marketing, talks to Ian Armitage.

T he name Dutoit is synonymous with quality – just ask its customers, which include the likes of UK supermarket group Asda. The company exports

about 60 percent of all its produce and 15 percent of that - around 10,000 tonnes of apples and pears - goes directly to the Walmart-owned fi rm. It has been supplying Asda for more than a decade.

Business Leader of the Year in the 22nd Business Leader of the Year awards run by Die Burger and the Cape Town Chamber of Commerce, Dutoit Group is without doubt a leading South African player in the production and distribution of fruit and vegetables.

“We feel very honoured to be recognised,” says Pieter du Toit, Managing Director of the Dutoit Group: Marketing at Western Cape business Dutoit Group, which employs 8,000 people in high season. “The previous winners have typically been from the corporate world – this was the fi rst time, as far as we are aware, that it has gone to an agricultural business.”

As South Africa’s leading fruit and vegetable producer, Dutoit Group, has, over a period of time, taken steps to position this family-owned business for full commercialisation. This included the appointment of core people to assist the Du Toit Family and the Dutoit Group’s management during the continual process of transformation.

“We have three divisions – Dutoit International, Dutoit Agri and Dutoit Invest,” Du Toit says.

“We are built by people who have an unwavering faith in the future.”

According toDu Toit, who grew up on the family farm in the Ceres region, the company was established in 1893.

Over the years it has introduced cutting-edge technology, innovation and high levels of client services, which fully integrates client needs in the production and packaging process.

Dutoit Group produces, packs and markets more than 15 million units of fruit and vegetables annually in both the local and international market.

DuToit Group FEATURE

23www.southafricamag.com

“We have extensive fruit and vegetable growing divisions, cold storage and packing facilities,” says Du Toit. “Our farms and business units are managed on a decentralised basis and we specialise in integrating the production process with the needs of our customers.

“We grow, pack, market and distribute quality agricultural products - apples, pears, nectarines, onions, potatoes and sweet potato,” he adds.

The key to Dutoit’s success is its supply chain and partnership model.

“We actively seek investment partners to join with us in building a superior supply chain,” says Du Toit.

The main criteria for prospective partners are a deep passion for fresh produce and “a specific field of expertise and interest”.

“The Dutoit Group offers market access through its Dutoit and Gydo brands and marketing and distribution team. We offer technical support through a team of experts in the respective disciplines of fruit production and handling. We offer financial support through access to competitive financial instruments. We aid with business development. We mentor to drive entrepreneurship and create wealth. We also offer BEE initiatives through the Crispy Group,” says Du Toit. “We have an integrated development model in the sense that we go from the seed through to planting, picking, production, pack-houses, shipping, etc. We don’t own shipping, but we try to negotiate and establish partners with knowledge to deliver to the customer a good business opportunity in our products.

“It is all about keeping costs down and making it simple – the process of delivery simple.”

A great example of this partnership model in practice is Cape Fruit Coolers, which Du Toit is chairman of. It is a joint venture between Maersk Group, Goede Hoop Sitrus, Ceres Koelkamers and Dutoit Group, which offers a pallet cooling service for the fruit exporters that make use of the Cape Town harbour. “Cape Fruit Coolers prides itself in perfect protocol handling coupled with personal service levels unheard of in this very important part of the cold chain,” says DuToit.

The Dutoit Group has a 37.5 percent share in Cape Fruit Coolers, which recently increased its plant in the Killarney Yarns Industrial area by 30 percent. “It is to meet the growing needs of fruit growers to meet the shipment of their products,” Du Toit explains. “In a highly competitive market environment, Cape Fruit Coolers team is positive that this expansion will make export more competitive. The expansion includes new inspection facilities.

“Cape Fruit Coolers plays an important role in the value chain from farm to store shelves. They help to keep product fresh and enable it to enjoy a longer shelf life.”

Cape Fruit Coolers is an independent organisation with the sole aim of servicing the fruit export industry. It is a world-class cold

24 www.southafricamag.com

DuToit Group FEATURE

GEA Refrigeration TechnologiesGEA Refrigeration Africa (Pty) Ltd19 Chain Avenue, Montague Gardens, 7441, South AfricaTel. + 27 21 555 9000, Fax + 27 21 551 4036industrial @ geagroup.com www.gearefrigeration.co.za

In Touoch

Efficiency in food and energy processes

Services offered:System design• Project management• Component manufacturing• System installation & supervision• Commissioning• Service and maintenance• Energy audits• System surveys• Utilities evaluation and • implementation

GEA Refrigeration TechnologiesGEA Refrigeration TechnologiesGEA Refrigeration Africa (Pty) Ltd

SouthAfricaMag 2011 Quarterf Page.indd 1 2011/11/04 12:51:51 PM

www.quality-sorting.com

Aweta, Netherlands: +31(0)886688000, Norman van der Gaag, [email protected] Somerset West: +27(0)82-5663249, D. Schoeman, [email protected]

Dormas Johannesburg: +27(0)11-4962800, [email protected]

Proud supplier to the Dutoit Group.

Making it happen.

In advancing agricultural packaging, we’ve taken inspiration from our natural surroundings. The result is corrugated packaging that provides evolutionary product protection and brand enhancement through innovative structural designs and state-of-the-art printing.

JHB: +27 11 876 6026 | CT: +27 21 505 1361 DBN: +27 31 717 6136 | PE: +27 41 486 1035

Swaziland Area: +268 13 790 0007

Corrugated Ad_82.5x117.5mm.indd 1 2011/10/26 11:02 AM

Proudly associated with Du Toit Group South Africa

www.huhtamaki.co.za Tel: 011 7306300Head Office - Springs - Fax: 011 813 1911

Moulded Fibre Packaging - Springs - Fax: 011 813 3685 Customer service: 0800 11 2312 E: [email protected]

Rigid Packaging - Springs - Fax: 011 730 6573 Customer Service: 0800 00 6985 E: [email protected]

FFlexible Packaging - Kwazulu Natal - Fax: 011 730 6573 Tel 084 876 6155 E: [email protected]

Huhtamaki is the world leader in environmentally friendly moulded fibre and pulp packaging, producing egg packaging, fruit packaging including apple, pear, stone fruit and melon trays, wine bottle dividers, cup carriers and yoghurt trays, from recycled recovered paper.

storage facility, making use of cutting edge technology and state-of-the-art refrigeration facilities.

Dutoit’s growth target is to “double” the company every fi ve years. It has been successful in that over the last 50 years, according to Du Toit. “Obviously it gets more complicated the bigger you get. That is still our target and we believe we have got policy and strategy in place to do that.

“We will look to maximise our existing resources, while seeking out new partners. I think this partnership approach is unique in the industry – it certainly isn’t common. Agricultural land all over the world, but especially SA is a big investment. We can help partners maximise their investment.

“Of course the big uncertainties in SA these days are about land reform policy from Government. But you have to accept policy change as the rules of the game; we concentrate on what we can control and that is that we need to be internationally competitive and our customers want us bigger – and we will give them that. We are looking to grow. We want to be run as a commercial, internationally competitive company.”

The rand’s strength had made the past year diffi cult for the group - the currency’s 15 percent growth in the past year, with a fi ve percent growth in operational costs, had resulted in a 20 percent hit on the com¬pany’s income. Du Toit says labour makes up 40 percent of the company’s operational costs, and water and electricity made up another substantial contribution.

“But in spite of tougher times, the company has remained profi table - the operation is slick,” he says. “And we have a wealth of expertise and knowledge to draw on.

“Prices are set according to a seasonal programme and then reconfi rmed on a three-week basis,” Du Toit adds. “If price agreement can not be reached with a retailer for instance, the volumes are readjusted and

26 www.southafricamag.com

DuToit Group FEATURE

Cadiz Asset Management is a well established and recognized independent asset manager with R41 billion assets under its watchful care. With many industry awards, including the 2011 Morningstar award for Best Specialist Fund House, Cadiz Asset Management has the independent credentials and performance to satisfy all investors needs.

As a business we value partnerships and we believe that it is via partnerships that we unlock most of the value potential. The duToit Group investments which we manage is testimony to this philosophy and we believe that this partnership will grow from strength to strength.

Cadiz Asset Management

RISK SERVICESAn authorised financial services provider

Tel: +27 21 809 5500 www.alexanderforbes.co.za|

Alexander Forbes Risk Services are extremely proud of the long and mutually beneficial relationship which we have had with the Du Toit Group over many years.

The personal relationships which we have developed and the understanding of the key risk issues surrounding the business are very important to our client service team.

We look forward to working together with the Du Toit Group in the years ahead.

To find out more, visit www.cadiz.co.zaemail: [email protected] or call +27 21 670 4600Cadiz Asset Management (Pty) Ltd is an Authorised Financial Services Provider. FSP 636.

Harvesting a successful crop is the result of careful planning, attention to detail and skill. Real growth from investments requires the same level of dedication. Both deliver that same sense of satisfaction.

The Cadiz Inflation Plus Fund, winner of a 2011 Morningstar Award, is testament to our ability to achieve real growth for our clients. Cadiz Asset Management is a proud partnerof the Du Toit Group - a real partnership formed on trust, delivered in results.

Voted “Best Specialist Fund House” in South Africa at the 2011 Morningstar Fund Awards, Cadiz Asset Management is a signatory to the United Nations Principles of Responsible Investment and a multiple award winner for SRI investing in South Africa.

14

0 b

bdo

805

756

the fruit redirected elsewhere.”Up next is growth on the African

continent. Dutoit is the apple of Walmart’s eye (through it’s work with Asda, which it has been supplying with fruit and vegetables since 1997 when the South African agricultural market was deregulated).

“Our long-standing relationship with Asda has given us stability in tough times and, also, it means that where Walmart goes, our fresh produce could follow.

“We are looking to expand in Africa, the Middle East and the Far East. These are markets that are very interesting to us.

“We are very positive about our position. We are in a good production area and are in a position to capitalise on new opportunities,” Du Toit concludes. END

28 www.southafricamag.com

What is post-World Cup life like for Soccer City? South Africa Magazine asks Jacques grobbelaar, Director of Stadium

Management South Africa, how he plans to fill seats.By Ian Armitage

A lasting

T he Soccer City Complex and its main FNB Stadium,

formerly known as Soccer City, in Soweto is a world-class sport venue. Renovated specifi cally for the 2010 FIFA World Cup, it is no “white elephant” and its success as a venue looks set to continue.

The 94,000-capacity stadium, also referred to as

“The Calabash”, hosted the opening game of the 2010 World Cup as well as the fi nal between Spain and the Netherlands, both sell-

outs and huge successes. But the question following

the event was, what would this and the other massive stadiums be used for next?

Stadium Management South Africa already had some answers, having spent months before the tournament planning for life after the World Cup and securing new contracts.

The forward planning obviously paid off.

“The FNB Stadium -- built in the late 1980s specifi cally for soccer, on the brink of Soweto -- hosts big sport games like the Soweto Derby

between Orlando Pirates and Kaizer Chiefs as well as international football and rugby matches,” says Jacques Grobbelaar, Director of Stadium Management South Africa, which manages the Soccer City Complex, FNB Stadium, Soweto’s Orlando and Volkswagen

legacyA lasting legacyA lasting

Stadium Management South Africa (Pty) Ltd FEATURE

29www.southafricamag.com

Dobsonville stadiums and Rand Stadium in southern

Johannesburg. “The Complex and the main FNB stadium is a fi rst world stadium, with a super atmosphere.”

In addition to soccer and rugby, world-

famous entertainers also perform at the venue.

“We’ve hosted the 360 degree U2 concert, Neil Diamond, Coldplay and more recently Kings of Leon,”

Grobbelaar confi rms. “So, although there were initial concerns that the World Cup stadiums wouldn’t be used to their full potential, this is defi nitely not the case with

the stadia we manage.”Tournament CEO

Danny Jordaan promised South Africans that the new facilities would leave a legacy for generations to come.

“To ensure a lasting legacy and the commercial viability of the stadiums, they will be used for both rugby and soccer,” Jordaan said before the World Cup.

“This country has also used sports stadiums for major political rallies, concerts and church events. They can, therefore, also be used for other events outside of sport,” he added.

According to Grobbelaar, Stadium Management South Africa has a 10-year thoroughly thought out plan

30 www.southafricamag.com

Stadium Management South Africa (Pty) Ltd FEATURE

STAdIUM MANAGEMENT SOUTH AFRICA’S PORTFOlIO:

THE SOCCER CITY COMPlEX, FNB STAdIUM (NATIONAl STAdIUM)Situated off Nasrec Road on the outskirts of Soweto, the 94,000 capacity FNB Stadium hosted the opening ceremony, opening match, four fi rst-round matches, one second-round match, one quarter fi nal and the fi nal of the 2010 FIFA World Cup.

ORlANdO STAdIUMDemolished and rebuilt from scratch, the new Orlando Stadium, in Orlando East, Soweto, was one of the training venues for the 2010 FIFA World Cup. The stadium houses 40,000 seats, 120 hospitality suites, 2 VIP suites, One VVIP suite, Conference facilities, a Gymnasium, and a 200-seat auditorium.

vOlKSWAGEN dOBSONvIllE STAdIUMTucked away in the township of Dobsonville is one of Soweto’s famous football stadiums, the Volkswagen Dobsonville Stadium. Situated on Main Road, between Montlahla and Majova streets, the stadium has underwent refurbishments to the tune of R69 million in preparation for the 2010 FIFA World Cup.

RANd STAdIUMOne of Johannesburg’s oldest stadiums, Rand Stadium, underwent a R76 million revamp in preparation for the World Cup. Located just a few kilometres from the central business district and a stone’s throw from the Turffontein Racecourse, Rand Stadium has a contemporary design and a highly technical nature. A roof covers the 3,000 spectators who can be accommodated in the grandstand and houses a total of 25,000 fans.

Johannesburg. “The Complex and the main FNB stadium is a fi rst world stadium, with a super atmosphere.”

and rugby, world-famous entertainers also

recently Kings of Leon,”

“So, although there were initial concerns that the World Cup stadiums wouldn’t be used to their full potential, this is defi nitely not the case with

2 VIP suites, One VVIP suite, Conference the stadia we manage.”

Danny Jordaan promised South Africans that the new facilities would leave a legacy for

legacy and the commercial

for the Soccer City Complex. “Our advantage is that Soweto is home to South African football’s biggest teams, Orlando Pirates and Kaizer Chiefs.”

The Soccer City Complex is an obvious venue for Bafana Bafana games and, Grobbelaar says, Stadium Management South Africa is currently in talks with international music performers. “We have been given full responsibility to run the Stadium, which is owned by the City of Johannesburg, and, I think we are doing a great job,” he explains. “Perhaps our biggest problem is that there are just too many events , but it is a good position to be in.”

Stadium Management South Africa receives no funding from the City of Johannesburg for maintenance. It accepted full financial responsibility of the venue and Grobbelaar doesn’t have any concerns about future sustainability. “We know that the stadium will be utilised,” he says. “Stadium Management South Africa is the most dynamic and capable team to manage flagship sport venues and that is exactly why the City of Johannesburg has appointed us as the official management company for the Soccer City Complex, FNB Stadium, Orlando, Rand and the Volkswagen Dobsonville stadiums.”

We have been given full responsibility

to run the Stadium, and are doing a great job

31www.southafricamag.com

Grobbelaar says a large percent of the management group’s profit is ploughed into community development projects around Johannesburg, while the rest is held back for future development and maintenance. “We are committed to the community and making sure that our venues are managed in the most dynamic and competent way.”

Stadium Management South Africa was a recent winner at the Stadium Business Awards 2011. Barry Pollen, Director of Stadium Management SA attended the awards ceremony and presented the firm’s strategy for delivering a legacy for the Soccer City Complex. “The judging panel was amazed this year by the incredible levels of commitment, ingenuity and above all passion behind the delivery of outstanding venues and experiences for fans,” said judge Michael Bolingbroke, COO, Manchester United FC.

To learn more about Stadium Management South Africa and its fabulous sport venues visit www.stadiummanagement.co.za. END

32 www.southafricamag.com

Stadium Management South Africa (Pty) Ltd FEATURE

We know that the stadium will

be utilised. Stadium

Management South Africa is the most

dynamic and capable team to manage flagship

sport venuesJacques grobbelaar,

Director

C M Y CM MY CY CMY K

Your 360˚Sport & Entertainment Solution™

SAIL IS A PROUD PARTNER TOSTADIUM MANAGEMENT SOUTH AFRICA

PROUDPARTNERS

For all hospitality, suite, advertising and commercialopportunities contact us at www.sail.co.za.

34 www.southafricamag.com

South Africa Magazine profiles South African sorghum beer producer, United National

Breweries (UNB).By Ian Armitage

Sorghum beerS A ’ S L E A D I N g

producer

U nited National Breweries (SA) (Pty) Limited (UNB) engages in

the manufacture and sale of Sorghum beer (Umqombothi), an opaque beer made from sorghum grain.

Umqombothi is the core business of UNB. It produces and distributes it in five breweries and numerous distribution depots strategically situated throughout South Africa. UNB was formerly known as National Sorghum Breweries, was incorporated in 1970 and is based in Midrand.

“Although the company was registered as early as 1970, United National Breweries (SA) (Pty) Ltd. was re-structured and revived in 1996,” the company’s website says, detailing the company’s interesting past. “It has a

United National Breweries FEATURE

35www.southafricamag.com

rich and varied history and started out as scattered breweries under the control of various Development boards, Municipalities and Management boards. Decades earlier, various breweries that brewed for the local consumers in the municipalities and development areas were amalgamated under control of IDC by directive of the Government.

“This later gave rise to one of the first black economic empowerment companies in South Africa under the name of National Sorghum Breweries (NSB). Although the formation of this group was huge step forward for the Traditional Beer industry in South Africa the transition was not seamless and NSB ran into financial trouble. A global tender was advertised for investment and management assistance

and the UB Group of India became stakeholders in 1996. It also managed to take over the business of the traditional beer subsidiary of SAB, TBI in 2000.”

It adds: “UNB is a professionally managed company with employees of diverse backgrounds and talents. The early recovery and later growth objectives united the different teams into an effi cient unit working for a turn around of fortunes they were faced with.

“The nature of traditional beer in that it is an actively fermenting product with a very limited shelf life that necessitates on-the-ground and hands-on management requiring a decentralized operational base. UNB operates in this decentralised fashion with centralised strategic, fi nancial and corporate controls.”

UNB’s mission is to retain and consolidate its position as a leading South African manufacturer and marketer of Sorghum beer and alcoholic beverages, associated products and services, through “profi table operations, to extend the cause of Black Economic Empowerment and enhance the value for shareholders.”

Its Phelindaba Brewery is UNB’s largest sorghum brewery with a production of nine to ten million litres monthly, averaging 350,000-375,000

36 www.southafricamag.com

United National Breweries FEATURE

Nampak liquid is Southern Africa’s largest and most diversifi ed supplier of liquid packaging solutions, offering numerous options to the market. Nampak liquid’s product range includes PET bottles, mono-layer HdPE bottles, multi-layer PET bottles, HdPE jars and conical cartons.

Total packaging solutions, coupled with the highest service levels, technical support and competitive fi lling systems are the hallmark of Nampak liquid’s operations, who’s products are supplied to the non-carbonated beverage industry, including South Africa’s leading Sorghum beer producer, United National Breweries.

Nampak liquid supplies UNB with the iconic conical carton, which is synonymous with sorghum beer and representative of the longstanding partnership between the two companies.

Nampak Liquid – proud packaging supplier to United National Breweries

UNB is a professionally

managed company with

employees of diverse

backgrounds and talents

Sorghum Beer Ad.indd 1 2011/11/01 3:52 PM

litres per day, distributing and selling Umqombothi in northern Gauteng and all of the provinces north, west and east of it up to the borders of Botswana, Zimbabwe, Mozambique and Swaziland. The success of this mammoth operation is due to the enthusiasm of the entire Phelindaba team led by the No-Nonsense Mr. Pierre van der Vyver, Sr. Vice-President-Operations.

“Beer has many names, from Cerveza in Spanish, Pia in Hawaii to Utshwala in South Africa,” it adds.

38 www.southafricamag.com

United National Breweries FEATURE

Beer is defined as an alcoholic beverage that is produced by

brewing and fermenting of starches derived from cereals. It is differentiated from other fermented alcoholic products

that use non-starch raw materials such as wine, which main ingredient is grape juice,

and mead, which is mostly comprised of honey

“The word Beer has its roots in the Latin ‘Bibere’, meaning ‘to drink’ and was simply named ‘The Drink’. Passionate Beer drinkers today will almost certainly agree that there is just one drink. Cultures across the globe seem to have started brewing beer independently and beer is theorised to be the glue that gave the critical mass to the agricultural revolution that started around 10,000 years ago and caused the formation of small cooperative communities forming larger economic alliances leading to the domination of regional cultures.

“Beer is defined as an alcoholic beverage that is produced by brewing and fermenting of starches derived from cereals. It is differentiated from other fermented alcoholic products that use non-starch raw materials such as wine, which main ingredient is grape juice, and mead, which is mostly comprised of honey.

“According to analysts, beer is also the oldest and most consumed alcoholic beverage and the most popular drink worldwide after water and tea.”

Today, competition is fierce - there many different types and brands of beer, with global companies buying out strong regional brands to try and achieve market domination. “UNB also caters for a niche market, for consumers who cannot tolerate the gluten content of mainstream beers that use wheat, barley and rye,” UNB’s website says.

UNB is Sorghum’s champion. It describes the beer as the “mother of all beers”.

“Sorghum Beer is an unfiltered alcoholic beverage made according to the different recipes that survived the long journey from mother to daughter over thousands of years as it’s recipe and use migrated down from North Africa to Central and Southern Africa with tribes moving down to seek a better life,” UNB’s website says.

United National Breweries is the leading South African manufacturer and distributor of sorghum beer. END

40 www.southafricamag.com

Hyundai South Africa operations director Albrecht grundel talks brand awareness, reliability, business, style and strategy in an exclusive interview with South Africa Magazine. By Ian Armitage

A ssociated Motor Holdings, a division of Imperial Holdings,

announced in April 2000 that it had signed a distribution agreement with Korea’s Hyundai Motor Company to import and distribute of Hyundai vehicles and parts for Southern Africa. More than a decade on, Hyundai Automotive SA is today still committed to becoming the best automotive brand in South Africa.

With a network of more than a 100 dealerships in Southern Africa, including Namibia, Botswana and Swaziland, and good name for maintaining high customer service standards, it is well placed to achieve just that.

Operations director Albrecht Grundel (AG) tells us more…

h Y U N D A I

40 www.southafricamag.com

Hyundai South Africa operations director Albrecht grundel talks brand awareness, reliability, business, style and strategy in an exclusive interview with South Africa Magazine. By Ian Armitage

Q&A

A ssociated Motor Holdings, a division of Imperial Holdings,

announced in April 2000 that it had signed a distribution agreement with Korea’s Hyundai Motor Company to import and distribute of Hyundai vehicles and parts for Southern Africa. More than a decade on, Hyundai Automotive SA is today still committed to becoming the best automotive brand in South Africa.

With a network of more than a 100 dealerships in Southern Africa, including Namibia, Botswana and Swaziland, and good name for maintaining high customer service standards, it is well placed to achieve just that.

Operations director Albrecht Grundel (AG) tells us more…

h Y U N D A IQ&A

h Y U N D A IQ&A

Hyundai South Africa FEATURE

41www.southafricamag.com

South Africa Magazine (SA Mag): Albrecht, thanks for taking the time to talk with us. Could you tell us about Hyundai in South Africa and your future goals?

AG: We have recently had the groundbreaking ceremony in Bedfordview where Hyundai Automotive South Africa’s new head office is being built. We expect to open it officially in a year’s time, and the finished building will be a token of Hyundai’s

commitment to the local market and our customers – present or future. Our goal is not merely to be successful in terms of the number of cars sold – we aim to be a most-loved automotive brand, and that means that we would like to deliver even higher levels of service through our dealer network in South Africa, Namibia, Botswana and Swaziland.

Hyundai South Africa FEATURE

41www.southafricamag.com

South Africa Magazine (SA Mag): Albrecht, thanks for taking the time to talk with us. Could you tell us about Hyundai in South Africa and your future goals?

AG: We have recently had the groundbreaking ceremony in Bedfordview where Hyundai Automotive South Africa’s new head office is being built. We expect to open it officially in a year’s time, and the finished building will be a token of Hyundai’s

commitment to the local market and our customers – present or future. Our goal is not merely to be successful in terms of the number of cars sold – we aim to be a most-loved automotive brand, and that means that we would like to deliver even higher levels of service through our dealer network in South Africa, Namibia, Botswana and Swaziland.

SA Mag: How do you think the business is performing? Has this been a good year? AG: Yes, our year has been better than 2010 thus far, and Hyundai Automotive South Africa’s business is performing well. As in many other industries, the downturn in the economy and slow recovery has had an effect in the car business too. However with our new styling Hyundai is a favourable brand with South African consumers and therefore we are in the fortunate position that several of our models are doing very well. The demand for our models have seen us increase our market share in many of the segments where Hyundai is represented.

SA Mag: How would you sum up the current state of the industry then?AG: The industry is still subdued, both from a buyer’s perspective as well as a retailer. People are buying down into lower segments due to diffi culties with affordability. The challenge is to be able to offer the desired products in such a scenario. I can confi dently say

that Hyundai South Africa is meeting that challenge. Buyers spending their hard-earned money in diffi cult fi nancial times also want good, reliable and quality products at accessible prices. We are also meeting that challenge with the Hyundai product offering.

SA: Are there lots of opportunities for the company?AG: Hyundai Motor Company and Hyundai Automotive South Africa have experienced unprecedented growth, regardless of the diffi cult times encountered locally and in the global economy. When these diffi culties were at their worst in 2009, many people were holding back on the acquisition of a new car or vehicle. Now that we have moved away from those extreme diffi cult fi nancial times, people have found their fi nancial situations less restraining and have replaced their vehicles or bought their fi rst car. Our strength lies in the wide product offering of

42 www.southafricamag.com

Hyundai South Africa FEATURE

SA Mag: How do you think the business is performing? Has this been a good year? AG: Yes, our year has been better than 2010 thus far, and Hyundai Automotive South Africa’s business is performing well. As in many other industries, the downturn in the economy and slow recovery has had an effect in the car business too. However with our new styling Hyundai is a favourable

that Hyundai South Africa is meeting that challenge. Buyers spending their hard-earned money in diffi cult fi nancial

Hyundai South Africa FEATURE

Hyundai, and all of them at very reasonable prices in each of the segments where they are represented, and with the attractive design and the build and material quality that have taken the Hyundai brand to the next level.

While our range is almost complete and completely overhauled over the past three years, we are about to add a few more models within the next year that would really make Hyundai one of the manufacturers with the widest variety and most comprehensive range of models. Hyundai Commercials have also grown their market share and we are looking at possibilities of expanding our range of commercial vehicles.

SA Mag: Have you identifi ed a clear market strategy? What is it?AG: Hyundai will offer high-end, high-quality values at a surprisingly attainable price and values that customers never experienced or expected. This will not be limited to just the product, but throughout Hyundai’s entire business, operations and services. At the beginning of 2011 we launched “New Thinking, New Possibilities”. This encompasses Hyundai’s new brand concept, “Modern Premium”, which aims to provide customers with emotional value and experiences beyond expectations through new thinking and new possibilities. The new brand direction also captures the

44 www.

spirit of change at the automaker, which has shown dramatic growth in all areas of business. Customers do not believe that expensive cars with unnecessary technology are premium – they want their core needs fulfi lled at an accessible price, with a car that exceeds their expectations, and a car that refl ects their values and the times in which they live. Hyundai is not just a company that makes cars, but also one that creates new possibilities. Our goal is not to become the biggest car company, but to become the most-loved car company and a trusted lifetime partner of our owners.

complete and completely overhauled over the past three years, we are about to add a few more models within the next year that would really make Hyundai one of the manufacturers with the widest variety and most comprehensive range of models. Hyundai Commercials have also grown their market share and we are looking at possibilities of expanding our range of commercial vehicles.

limited to just the product, but throughout Hyundai’s entire business, operations and services. At the beginning of 2011 we launched “New Thinking, New Possibilities”. This encompasses Hyundai’s new brand concept, “Modern Premium”, which aims to provide customers with emotional value and experiences beyond expectations through new thinking and new possibilities. The new brand direction also captures the

44 www.

price, with a car that exceeds their expectations, and a car that refl ects their values and the times in which they live. Hyundai is not just a company that makes cars, but also one that creates new possibilities. Our goal is not to become the biggest car company, but to become the most-loved car company and a trusted lifetime partner of our owners.

Park Distance Control

Protect your loved ones.Prevents costly vehicle damage.Reversing and parking made easy.

Cruise Control

Avoid unintended speeding fines.Reduce driving stress.Improve fuel economy.

Hands-Free Car Kits

With iPod/iPhone connection*User friendly.Perfect voice reproduction.

*CC9060 Music only

AutoBlue

Tel: +27(0) 12 665 0131/2www.bestech.co.za

A selection of the world's finest automotive accessories

APPROVED

SA Mag: do you continue to innovate? How so? AG: Our innovations are visible on the road, in every new Hyundai that has been sold. The fresh, attractive new design of our cars – on the outside as well as inside the cabin – have been applauded by the motoring media as well as the customers who buy them. The suspension and steering systems have undergone an equally exponential improvement to create cars that are not only well built, but also fun to drive. We are incorporating new technology in our sound systems, Bluetooth interactivity with cell phones and media players, and globally Hyundai is developing interactive communication systems through Blue Link that would make the life of a motorist in future products even more enjoyable.

Hyundai has spent millions of rand over the past few years in the development of new, more refi ned and better performing engines and drivetrains. They are developed in-house and a new range of very effi cient turbocharged engines with a small displacement is about to be implemented in our model range in the near future. Hyundai is also well aware of the challenges posed by the need to curb global warming and the lowering of emissions by motor vehicles. This also drives the development of engines that conform to and exceed the standards of the most stringent regulations regarding emissions such as Euro 6 or California’s ULEV2 (Ultra-Low Emission Vehicle standards). Hybrid drivetrains and electric vehicles are also developed at a fast pace, and Hyundai’s Blue Drive models with exceptional fuel consumption are a spin-off of this drive to make a contribution to global efforts to keep our planet and our air clean.

SA Mag: How do you see the industry developing?AG: The need for individual transport in South Africa will continue to drive a high demand for cars, given the lack of ample public transport. The challenge would be to provide smaller cars that are safe, able to travel longer distances when needed, with engines that can provide the performance needed on the oxygen-starved Highveld where the highest concentration of vehicles is found in South Africa. Bigger, luxury models will also have to be equipped with more effi cient engines delivering lower fuel consumption and lower emissions of CO2.

Albrecht thanks for answering our questions; we wish you well.

To learn more visit Hyundai SA’s website, www.hyundai.co.za. END

Hyundai South Africa FEATURE

The suspension and steering systems have undergone an equally exponential improvement to create cars that are not only well built, but also fun to drive. We are incorporating new technology in our sound systems, Bluetooth interactivity with cell phones and media players, and globally Hyundai is developing interactive communication systems through Blue Link that would make the life of a motorist in future products even more enjoyable.

Hyundai has spent millions of rand over the past few years in the development of new, more refi ned and better performing engines and drivetrains. They are developed in-house and a new range of very effi cient turbocharged engines with a small displacement is about to be implemented in our model range in the near future. Hyundai is also well aware of the challenges posed by the need to curb global warming and the lowering of emissions by motor vehicles. This also drives the development of engines that conform to and exceed the standards of the most stringent regulations regarding emissions such as Euro 6 or California’s ULEV2 (Ultra-Low Emission Vehicle standards). Hybrid drivetrains and electric vehicles are also developed at a fast pace, and Hyundai’s Blue Drive models with exceptional fuel consumption are a spin-off of this drive to make a contribution to global efforts to keep our planet and our air clean.

A t a time when skills shortage is a term on every leader’s lips, attracting and keeping

top talent is key challenge. Having the right people is fundamental to the success of any company.

So how do you attract the right people to your company?“When considering a new position, candidates will care about many different things from growth and development to fairness and equality,” says Kast, a superb leader and businesswoman, who has been CEO at DAV since its inception in 1975.

46 www.southafricamag.com

Ingrid Kast, CEO at DAV Professional Placement Group - a recognised leader in the recruitment industry and a company that attracts as many sector excellence awards as it does top candidate CV’s - chats to South African Magazine about this critical challenge.By Ian Armitage

t a time when skills shortage is a term on every leader’s lips, attracting and keeping

top talent is key challenge. Having the right people is fundamental to the success of any company.

So how do you attract the right

Ingrid Kast, CEO at DAV Professional Placement Group - a recognised leader in the recruitment industry and a company that attracts as many sector excellence awards as it does top candidate CV’s - chats to South African Magazine about this

toptoptalenttalenttoptalenttoptoptalenttoph O W T O A T T R A C T A N D K E E P

“Over the past 37 years,” Kast continues, “we’ve spoken to and interviewed thousands of candidates, and discovered that compensation is not the only reason we are able to attract top talent to both DAV and our client’s companies.

“The vast majority of people want to know how their goals, strengths and values fi t with the company’s vision, needs and culture. At DAV our main focus has always been putting the right person in the right position. Our candidates know that we will not send them on an interview unless we know the position is a great fi t for them, that they will walk away knowing ‘this will be the best career move of my life.’ And our clients know that the candidates we send them are ones that take the team and the company forward.”

This insistence on quality and integrity is at the root of DAV’s success at a time when many recruitment fi rms throw any CV at a position; it is one of the many reasons that 80 percent of business is repeat business and 63 percent of DAV’s candidates come to them through referral.

So, is there an advantage to using a recruitment company over sourcing directly or through the HR department? “The biggest advantage that our clients talk about is the sheer scope of our network,” says Kast. “At any given time, only 33 percent of the potential candidate pool is actively looking to move. It’s our knowledge of how and where to find the ones that aren’t, that we bring to the process. With the skills shortage a reality, our clients find this to be an invaluable advantage.”

DAV enjoys an additional advantage over its competitors, however, and that is in its very strong core of people, senior consultants and team leaders. This is remarkable in an industry, which - because of its competitiveness - is notorious for large staff turnover. Typically, within the recruitment sector, for every four people that join, only one remains. But at DAV, it is the other way around - out of four three remain. For their clients and candidates this means dealing with expert, trustworthy and industry savvy people who build and maintain long-term relationships.

In-house training is a major key. “This has always been our strength,” says Kast.

“Training is fundamental to our success. “We are constantly monitoring the countries

that lead the edge in recruitment practices, namely the US and UK, for the world’s best in training innovation. We have access to the best and latest material, and we bring international trainers to us – whenever there is cutting edge development in the art of attracting, leading and keeping people, we have it.”

Is there anything else companies should be aware of in attracting and hiring top talent?“The key to successful hiring is uncovering what candidates really care about right from the earliest moment of contact. In a very deep and sincere way, put yourself in their shoes. Address what they care about and you will be rewarded with a committed candidate and the best talent on board for your company,” says Kast.