Russia Ukraine Gas Conflict

-

Upload

akash-jauhari -

Category

Business

-

view

2.344 -

download

4

description

Transcript of Russia Ukraine Gas Conflict

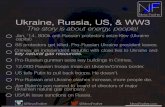

Gazprom-Naftogaz Ukrainy Dispute:Business or Politics?

-Akash Jauhari(10DCP056)Anurag Bansal(10DCP062)Harsh Rautela(10DCP069)

Lokesh Chaudhary(10DCP075)Neelakshi Misra(10DCP081)Raghav Agarwal(10DCP087)

Veena Choudhary(10DCP093)

Case OverviewGas supply contracts between Soviet Union and

EuropeImpact of disintegration of the Soviet Union on

Russia and Ukraine.World’s largest gas reserves with Russia

28 Trillion cubic meters16% of the world reserves

Evolution of Gazprom as a major supplier to Europe

Demand of Europe and UkraineMost Economic route for Gazprom to supply gas

to Europe is via UkraineDisputes on price hike

Bargaining power of Russia/ GazpromAvailability of resourcesStrategic position of RussiaMismatch between Ukraine production and

consumption of GasAlternate route to EuropeAlternative Markets

Reasons for DisputeDispute between the state controlled companies

of the Russian Federation and Ukraine - Gazprom and Naftogaz Economic Dispute

High mismatch between Ukraine production and consumption of Gas

Illegal siphoning off of gas by Ukraine Increasing debt Supply of gas to Ukraine at a highly subsidized price

Political Dispute Impact of elections in Ukraine:

Appointment of Pro-West president Signing with EU and NATO Black Sea Fleet in Sevastopol

Settlement in 2006Settlement in January 2006

A hasty Five Year Contract Damage to both the economies if European Nations

start searching for alternative suppliers Legal obligation for Russia to supply gas to Europe Attractive deal for both Gazprom and Naftogaz

Supply to Ukraine at $ 95 T cm. Gazprom will sell at $ 230 T cm.

Cost involved, gaining territory rights and capacity issues faced by Gazprom for the alternate path to Europe through Belarus and Baltic Sea

Critical IssuesFive Year Contract in January, 2006 : Some Questions Left Unanswered

Profitability of RosUkrEnergo: 23.3 % of gas $ 230 T cm, will they get the 76.7 % at $ 75 T Cm

The agreement only sets the price for next 6 months, no planning for future pricing.

Supply from Turkmenistan ??? Production at 58 B cmAgreement to supply

30 B cm to Gazprom 41 B cm to Ukraine

Critical Issues (Contd..)Problems of a comparatively smaller

nation trying to break free from the influence of its dominant neighbour

Dependence of the European countries on gas imports from Russia

How a company's exports become vulnerable when its exports are routed through third parties and its efforts to gain control over such transitory routes

Current SituationOn April 21, 2010, Russia and Ukraine signed

an agreementRussia agreed to a price drop of 30%Ukraine agreed to extend Russia's lease of

Black Sea port of Sevastopol for an additional 25 years with an additional five-year renewal option (to 2042-47).

As of June 2010, Ukraine pays Gazprom around $234/mcm (thousand cubic meter).

Russia and Ukraine – Consensus possible?

Even though resolving pipeline dispute will be in the economic benefit of both Russia and Ukraine, because of political reasons (Ukraine joining NATO and Russia-Georgia war), historical differences and ego clashes, consensus of Russia and Ukraine over pipeline issues is difficult to come in near future.

Possible Solutions1. Focus on North Stream and South Stream Projects

Details of North Stream Project:Planned offshore pipe line from Russia to GermanyCapacity – 55 billion cubic meters per yearCost – Euro 8.8 billion (financed 70% from banks and 30%

from equity)

Details of South Stream Project:Pipeline to run under the Black Sea from the Russkaya

compressor station on the Russian coast to the Bulgarian coast Capacity – 63 billion cubic meters per year Cost - Euro 19-24 billion

Possible solutions (Cont..)2. Increasing capacity of current existing routes- ( Blue Stream Project) Trans Black Sea pipeline, Connecting Russia and Turkey Capacity 16 Billion cm

Phase II proposed in 2002, as parallel to Blue Stream I, again connecting Russia to Turkey

3. Alternatives for Gazprom – China – Gazprom plans to supply natural gas to China by end of 2015. Currently working on a

plan to build natural gas pipelines from Siberia to China, with an estimated cost of US$14 billion.

South Korea – Ongoing commercial talks with South Korea's Kogas on delivering at least 10

billion cubic metres of gas a year from 2017.

USA – In 2009, Gazprom alongwith Royal Dutch Shell decided to deliver 1 million tons of gas to the US market until 2028.

All Possible Routes

Possible Solutions (Cont..)

4. Pricing – Present price is set politically. Price should be

decided based on some standard formulae which is acceptable to both. Also it should be revised monthly (as in case of Europe) rather than yearly.

5. Reducing dependence of European market on Russia- Europe should consider alternative sources like

Middle East and Turkmenistan.

Possible Solutions (Cont..)

6. Elimination of intermediary companies like Rosukrenergo and UkrGasEnergo. They are formed by political elite from both sides for self interest, corruption and rent seeking tool.

Referenceshttp://www.gks.ru/dbscripts/Cbsd/DBInet.cgiEnergy Charter Secreteriat: Gas Transit

Tariffs in Selected ECT Countries (2006), Brussels 2006, p.65,

http://www.encharter.org/index.php?Research Centre for East European Studies,

BremenInternational Energy Agency, Ukraine Energy

Policy Review 2006