Switching On the Growth Engine in Your Small Consulting Practice

Rosen Consulting Group Real GDP Growth. Rosen Consulting Group U.S. Employment Growth.

-

date post

22-Dec-2015 -

Category

Documents

-

view

226 -

download

0

Transcript of Rosen Consulting Group Real GDP Growth. Rosen Consulting Group U.S. Employment Growth.

Rosen Consulting Group

Real GDP Growth

-3%

-2%

-1%

0%

1%

2%

3%

4%

5%

6%

7%

73 75 77 79 81 83 85 87 89 91 93 95 97 99

Rosen Consulting Group

U.S. Employment Growth

-2%

-1%

0%

1%

2%

3%

4%

5%

6%

73 75 77 79 81 83 85 87 89 91 93 95 97 99

Rosen Consulting Group

U.S. Unemployment Rate

4%

5%

6%

7%

8%

9%

10%

73 75 77 79 81 83 85 87 89 91 93 95 97 99

Rosen Consulting Group

Consumer ConfidenceConference Board Survey

40

60

80

100

120

140

89 90 91 92 93 94 95 96 97 98 99

Index

Rosen Consulting Group

U.S. Merchandise Exports to East Asia plus Japan

11,000

11,500

12,000

12,500

13,000

13,500

14,000

14,500

15,000

15,500

1995 1996 1997 1998

3-Month Moving Average

$Million per Month

Rosen Consulting Group

U.S. Net Exports

-300

-250

-200

-150

-100

-50

1995 1996 1997 1998

$1992 (Billion)

Rosen Consulting Group

Consumer and Producer Prices

-2%

0%

2%

4%

6%

8%

10%

12%

14%

16%

72 74 76 78 80 82 84 86 88 90 92 94 96 98

CPI

PPI

Annual Change

Rosen Consulting Group

3-Month T-Bill vs. 10-Year T-Bond

0%

2%

4%

6%

8%

10%

12%

14%

16%

18%

80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99

3-Month

10-Year

Rosen Consulting Group

U.S. Employment Growth

Growth Rate

less than 0%

0% to 1.3%

1.5% to 2.4%

2.5% and above

Rosen Consulting Group

Fastest Growing U.S. MSAsRanked by Annual Absolute Change in Employment

Rank Metropolitan Area Feb-98 Feb-99 Change

1 Chicago, IL 4,023.3 4,122.0 98.7

2 New York, NY 3,967.4 4,058.5 91.1

3 Washington, DC 2,487.0 2,568.8 81.8

4 Los Angeles, CA 3,901.4 3,982.1 80.7

5 Dallas, TX 1,791.0 1,860.6 69.6

6 Atlanta, GA 1,791.0 2,063.3 68.0

7 Tampa, FL 1,108.1 1,170.5 62.4

8 Phoenix, AZ 1,432.7 1,492.8 60.1

9 Minneapolis-St. Paul,MN

1,614.1 1,672.5 58.4

10 Houston, TX 1,946.4 2,001.4 55.0

Rosen Consulting Group

Fastest Growing U.S. MSAsRanked by Annual % Change in Employment

Rank Metropolitan Area Feb-99

1 West Palm Beach, FL 7.3%

2 Las Vegas, NV 6.4%

3 Tampa, FL 5.7%

4 Raleigh-Durham, NC 5.6%

5 Memphis, TN 5.3%

6 Orlando, FL 5.1%

7 Sarasota, FL 5.1%

8 Riverside, CA 5.0%

9 Ventura, CA 4.8%

10 Baton Rouge, LA 4.7%

Rosen Consulting Group

Fastest Growing U.S. MSAsRanked by Annual % Change in Employment

Rank Metr opolitan Area Feb- 99

11 Austi n, TX 4. 4%

12 Phoeni x, AZ 4. 3%

13 Jacksonvill e, FL 4. 1%

14 Des Moi nes, IA 4. 1%

15 Tul sa, OK 4. 0%

16 Col umbi a, SC 4. 0%

17 Dall as, TX 3. 9%

18 Wi l mi ngt on, DE 3. 8%

19 Fort Wort h, TX 3. 8%

20 Mi nneapoli s, MN 3. 7%

Rosen Consulting Group

Fastest Growing U.S. MSAsRanked by Annual % Change in Employment

Rank Metr opolitan Area Feb- 99

21 Madi son, WI 3. 6%

22 Sacra ment o, CA 3. 6%

23 Fresno, CA 3. 5%

24 Tucson, AZ 3. 5%

25 Atl ant a, GA 3. 4%

26 Kansas City, MO 3. 4%

27 Denver, CO 3. 4%

28 Washi ngt on, DC 3. 3%

29 Or ange Count y, CA 3. 3%

30 San Franci sco, CA 3. 3%

Rosen Consulting Group

Slowest Growing U.S. MSAsRanked by Annual % Change in Employment

Rank Metropolitan Area Feb-99

1 Honolulu, HI -0.7%

2 Dayton, OH -0.2%

3 Hartford, CT 0.2%

4 Buffalo, NY 0.3%

5 Rochester, NY 0.6%

6 San Jose, CA 0.7%

7 Little Rock, AR 0.8%

8 Springfield, MA 1.0%

9 Cleveland, OH 1.1%

10 Philadelphia, PA 1.1%

11 Albany, NY 1.1%

12 St. Louis, MO 1.2%

Rosen Consulting Group

Employment GrowthCalifornia vs. U.S.

-2%

-1%

0%

1%

2%

3%

4%

5%

6%

7%

72 74 76 78 80 82 84 86 88 90 92 94 96 98

California

U.S.

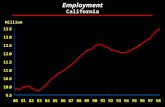

Rosen Consulting Group

EmploymentCalifornia

9.0

10.0

11.0

12.0

13.0

14.0

80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99

Million

Rosen Consulting Group

Unemployment RateCalifornia vs. U.S.

4%

5%

6%

7%

8%

9%

10%

11%

78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99

California

U.S.

Rosen Consulting Group

Leading California Export MarketsPercent Change in Exports vs. Year Ago

Country 1997 YTD 3Q98

South Korea -17.9% -40.6%

Japan -7.5% -15.9%

Singapore -4.2% -18.1%

Hong Kong 14.7% -12.2%

Taiwan 24.6% -17.5%

Malaysia -5.9% -13.5%

France 3.9% 1.7%

Germany -0.6% 12.9%

Canada 6.1% 12.3%

UK 6.7% 10.6%

Mexico 33.0% 14.9%

China 19.5% 12.7%

Total CA Exports 6.1% -3.3%

Rosen Consulting Group

California MSA EmploymentRanked by Percent Change in Jobs

Rank Metropolitan Area Feb-98 Feb-99Absolute

ChangePercentChange

1 Santa Rosa 169.8 179.1 9.3 5.5%

2 Modesto 134.3 141.6 7.2 5.4%

3 Vallejo 152.3 160.4 8.0 5.3%

4 Riverside 858.3 900.9 42.6 5.0%

5 Ventura 247.1 58.9 11.8 4.8%

6 Salinas 118.9 123.8 4.9 4.1%

7 Sacramento 638.8 661.6 22.8 3.6%

8 Fresno 275.0 284.7 9.7 3.5%

9 Stockton 170.3 176.2 5.9 3.4%

10 Orange County 1,276.7 1,319.1 42.4 3.3%

Rosen Consulting Group

California MSA EmploymentRanked by Percent Change in Jobs

Rank Metropolitan Area Feb-98 Feb-99Absolute

ChangePercentChange

11 San Francisco 997.5 1,030.6 33.1 3.3%

12 Oakland 961.2 991.8 30.6 3.2%

13 San Diego 1,084.4 1,118.1 33.7 3.1%

14 Bakersfield 182.5 187.5 5.1 2.8%

15 Los Angeles 3,916.9 3,999.8 82.9 2.1%

16 Santa Barbara 152.7 155.4 26 1.7%

17 San Jose 954.0 960.3 6.2 0.7%

Rosen Consulting Group

EmploymentSan Jose MSA

650

700

750

800

850

900

950

1000

80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99

Thousand

Rosen Consulting Group

Single Family Housing Starts

1151

1309

1132

888892

1162

14511433

1194

852

705663

106810841072

11791146

1081

1003

894840

1030

11261192

1076

11611134

12651210

0

200

400

600

800

1000

1200

1400

1600

71 73 75 77 79 81 83 85 87 89 91 93 95 97 99

Units (000)

Rosen Consulting Group

California Single Family Permits

113

124

103

76

90

140

175

143

127

87

6051

103

113114

147

136

162163

104

74 7670

7869

74

8493

105

0

20

40

60

80

100

120

140

160

180

71 73 75 77 79 81 83 85 87 89 91 93 95 97 99

Units (000)

Rosen Consulting Group

Existing Single Family Home Sales

2018225223342272

2476

3064

3650

39863827

2973

2419

1990

27192868

32143474343635133346

32113220

3520

38023946

3802

40874215

4782

4410

0

1000

2000

3000

4000

5000

6000

71 73 75 77 79 81 83 85 87 89 91 93 95 97 99

Units (000)

Rosen Consulting Group

Existing Single Family Home SalesCalifornia

361

426405401

455

559573

605587

465

336

234

343

382405

488512

562539

453425428435

483

425

506

555

628

590

0

100

200

300

400

500

600

700

71 73 75 77 79 81 83 85 87 89 91 93 95 97 99

Units (000)

Rosen Consulting Group

Residential Mortgage Originations1-4 Family Homes

0

200

400

600

800

1000

1200

1400

1600

82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98

$Billion

Rosen Consulting Group

Residential Mortgage RatesFixed and Adjustable

5%

6%

7%

8%

9%

10%

11%

12%

13%

85 86 87 88 89 90 91 92 93 94 95 96 97 98 99

FRM

ARM

Rosen Consulting Group

Average Loan-to-Value Ratio

73%

74%

75%

76%

77%

78%

79%

80%

81%

1992 1993 1994 1995 1996 1997 1998 1999

Rosen Consulting Group

Loan-to-Value RatioPercent Above 90%

5%

10%

15%

20%

25%

30%

1992 1993 1994 1995 1996 1997 1998 1999

Rosen Consulting Group

Housing Affordability

35%

40%

45%

50%

55%

60%

84 85 86 87 88 89 90 91 92 93 94 95 96 97 98

% Able to Afford Median-Priced Home

Rosen Consulting Group

California Housing Affordability

15%

20%

25%

30%

35%

40%

45%

84 85 86 87 88 89 90 91 92 93 94 95 96 97 98

% Able to Afford Median-Priced Home

Rosen Consulting Group

Existing Median Home Price Appreciation

8.2

10.710.3

7.9

12.6

13.514.4

11.7

6.8

2.1

3.73.0

4.3

6.4 6.6

4.3 4.3

2.6

5.0

3.43.0 2.8 2.8

4.7 5.0 5.2

4.1

0

2

4

6

8

10

12

14

16

73 75 77 79 81 83 85 87 89 91 93 95 97 99

Annual % Change

Rosen Consulting Group

Existing Median Home Price AppreciationCalifornia

9.210.0

20.2

16.9

28.1

13.8

18.718.3

8.2

3.82.3

-0.1

4.9

11.5

6.3

18.416.6

-1.2

3.8

-1.6

-4.6

-1.7-3.7

-0.6

5.0

8.0

5.0

-10

-5

0

5

10

15

20

25

30

73 75 77 79 81 83 85 87 89 91 93 95 97 99

Annual % Change

Rosen Consulting Group

Real Estate CycleSingle Family

Overshooting Phase

AbsorptionPhase

DeclinePhase

GrowthPhase

Chicago/Denver - 8:30

12

9 3

6

Boston/San Diego/San Francisco - 8:00

Atlanta - 9:30

Los Angeles - 7:00

Ft. Lauderdale/Phoenix - 9:00

Rosen Consulting Group

Employment GrowthNew York MSA vs. U.S.

-6%

-4%

-2%

0%

2%

4%

6%

72 74 76 78 80 82 84 86 88 90 92 94 96 98

New York MSA

U.S.

Rosen Consulting Group

-200

-150

-100

-50

0

50

100

(Th

ou

sa

nd

)

72 74 76 78 80 82 84 86 88 90 92 94 96 98

-34 -27

-104

-158

-23

3

52 57

34

65

-12

15

85

50 47 51

5

-3

-52

-199

-97

4

43 40 49

69

95

Absolute Change in Private EmploymentNew York MSA

Source: Bureau of Labor Statistics

Rosen Consulting Group

Table 2New York MSA New Job Creation (000)

1989 1990 1991 1992 1993 1994 1995 1996 1997 1998

Total Nonagricultural 3.2 -44.2 -215.0 -106.3 0.1 30.6 17.1 36.9 62.2 90.6

Construction & Mining -1.1 -8.1 -20.5 -16.0 -1.4 4.2 1.5 2.0 3.4 6.7

Manufacturing -14.7 -25.0 -33.5 -19.0 -9.3 -11.2 -8.7 -8.6 -3.4 -0.2

Apparel & Textiles -1.1 -5.9 -6.7 -3.2 -2.6 -4.6 -3.2 -1.5 0.4 -0.3

Printing & Publishing -2.5 -3.5 -7.6 -4.9 -0.1 0.3 0.0 -0.6 -0.5 0.7

T.C.P.U. -2.3 13.0 -10.8 -14.3 -0.8 -1.8 0.7 1.9 1.8 2.9

Communications* -54.0 52.1 -1.0 -4.1 -1.1 -1.0 0.1 1.6 3.2 1.8

Trade -6.4 -25.4 -50.1 -23.3 -7.5 8.2 14.0 8.9 13.9 19.6

Wholesale Trade -4.9 -9.2 -18.1 -9.2 -6.5 -0.3 1.9 -3.1 2.3 4.0

Retail Trade -1.5 -16.2 -32.0 -14.1 -0.9 8.4 12.2 11.9 11.6 15.7

General Merchandise -3.9 -5.3 -4.9 -4.6 -3.2 -2.5 0.7 2.3 -0.3 0.8

Apparel & Accessories 1.6 -0.2 -3.9 -1.1 1.2 0.9 1.8 -0.7 0.7 1.3

Eating & Drink. Places 0.2 -3.3 -11.7 -2.4 1.6 5.3 5.0 5.9 6.6 7.5

F.I.R.E. -11.0 -10.8 -27.5 -20.1 -3.0 8.3 -7.8 -4.5 3.1 8.1

Depository Institutions -5.4 -3.9 -11.9 -15.6 -6.0 -3.1 -5.2 -6.2 -5.9 -1.3

Security Brokers -7.4 -8.2 -8.0 1.7 4.6 10.8 -1.1 1.6 9.4 7.2

Services 32.1 4.8 -56.7 -3.9 26.1 35.4 40.1 49.7 50.2 58.0

Total Private -3.2 -51.6 -199.1 -96.6 4.1 43.3 39.8 49.1 69.0 95.2

Government 6.4 7.4 -15.9 -9.7 -4.0 -12.7 -22.7 -12.2 -6.8 -4.6

Local Government 8.5 4.3 -8.0 -7.6 -1.0 -12.5 -20.0 -6.4 -3.3 -2.2

*According to the Bureau of Labor Statistics, employment in this sector was affected by a strike in 1989.

Sources: Bureau of Labor Statistics, Rosen Consulting Group (RCG)

Rosen Consulting Group

Table 7New York MSA Employment Forecast (000)

1996 1997 1998 1999f 2000f 2001f 2002f

Total Nonagricultural 3,857.2 3,919.4 4,010.0 4,054.3 4,094.8 4,160.2 4,214.1% Change 1.0% 1.6% 2.3% 1.1% 1.0% 1.6% 1.3%

Construction & Mining 114.1 117.5 124.2 123.2 120.6 120.9 121.0% Change 1.8% 3.0% 5.7% -0.8% -2.2% 0.3% 0.1%

Manufacturing 320.3 316.9 316.7 311.9 307.2 304.8 301.7% Change -2.6% -1.1% -0.1% -1.5% -1.5% -0.8% -1.0%

T.C.P.U. 230.8 232.6 235.5 235.8 235.5 236.0 236.0% Change 0.8% 0.8% 1.2% 0.2% -0.1% 0.2% 0.0%

Trade 676.5 690.4 710.0 714.1 717.2 726.5 733.8% Change 1.3% 2.1% 2.8% 0.6% 0.4% 1.3% 1.0%

F.I.R.E. 501.0 504.1 512.2 516.7 520.9 527.6 532.4% Change -0.9% 0.6% 1.6% 0.9% 0.8% 1.3% 0.9%

Services 1,400.3 1,450.5 1,508.5 1,548.3 1,588.8 1,637.7 1,681.9% Change 3.7% 3.6% 4.0% 2.6% 2.6% 3.1% 2.7%

Total Private 3,242.9 3,311.9 3,407.1 3,450.1 3,490.2 3,553.6 3,606.9% Change 1.5% 2.1% 2.9% 1.3% 1.2% 1.8% 1.5%

Government 614.3 607.5 602.9 604.2 604.6 606.6 607.2% Change -1.9% -1.1% -0.8% 0.2% 0.1% 0.3% 0.1%

Sources: Bureau of Labor Statistics, Rosen Consulting Group (RCG)

Rosen Consulting Group

Table 8Components of Population Change (000)

New York, NY MSA

Natural NetYear Population % Change Births Deaths Increase Migration

1995 8,593.9 0.1% 145.3 82.5 62.8 (57.7)1996 8,596.7 0.0% 144.3 81.9 62.4 (59.6)1997 8,611.1 0.2% 144.6 80.7 63.9 (49.5)1998e 8,629.4 0.2% 143.6 81.1 62.5 (44.2)1999f 8,655.4 0.3% 142.8 81.5 61.3 (35.3)2000f 8,687.7 0.4% 142.4 82.1 60.3 (28.0)2001f 8,730.0 0.5% 142.3 82.7 59.6 (17.3)2002f 8,773.7 0.5% 142.2 82.5 59.7 (16.1)

Sources: Bureau of Labor Statistics, RCG

Rosen Consulting Group

-30

-20

-10

0

10

20

(00

0)

86 87 88 89 90 91 92 93 94 9596 97 98e99f00f01f02f

18.3

2.9 5.4 6.3

-28.6

-19.0

9.8

16.1

12.4

8.5 7.6

11.0 10.6 12.3

13.9 16.7 16.8

Absolute Household GrowthNew York MSA

Sources: U.S. Bureau of the Census, RCG

Rosen Consulting Group

Table 14Affordability Data

New York, NY MSA vs. U.S.

1991 1992 1993 1994 1995 1996 1997 1998e

Median Existing Home Price

New York MSA $173,500 $172,700 $173,200 $172,750 $169,575 $174,000 $177,900 $187,491

% Change -0.8% -0.5% 0.3% -0.3% -1.8% 2.6% 2.2% 5.4%

United States $100,300 $103,700 $106,800 $109,800 $112,900 $118,200 $124,500 $129,600

% Change 5.0% 3.4% 3.0% 2.8% 2.8% 4.7% 5.3% 4.1%

Household Income

New York MSA $68,600 $73,700 $74,200 $76,900 $81,200 $86,300 $90,400 $93,900

% Change 3.2% 7.4% 0.7% 3.6% 5.6% 6.2% 4.7% 3.9%

United States $37,922 $38,840 $41,428 $43,133 $44,938 $46,671 $48,403 $50,351

% Change 1.4% 2.4% 6.7% 4.1% 4.2% 3.9% 3.7% 4.0%

Mortgage Int. Rate 9.2% 8.4% 7.3% 8.4% 8.0% 7.8% 7.6% 6.9%

Households Able to Afford Median-Priced Home

New York MSA 23% 29% 32% 30% 35% 37% 39% 41%

United States 51% 55% 58% 57% 55% 54% 54% 55%

Sources: National Association of Realtors, Federal Reserve Board of Governors, U.S. Bureau of the Census, RCG

Rosen Consulting Group

Table 16Household Forecast & Demand for Rental Units

New York, NY MSA

CAGR Absolute Change NewAge Group 1990 1998e 2002f 1990-98e 1998e-02f 1990-98e 1998e-02f Rent Prop. Rental HH

15-24 114,319 97,083 98,477 -2.0% 0.4% (17,236) 1,395 91.8% 1,28125-34 679,015 598,000 585,815 -1.6% -0.5% (81,015) (12,186) 79.9% (9,738)35-44 784,742 728,890 718,734 -0.9% -0.4% (55,853) (10,156) 67.9% (6,899)45-64 1,111,485 1,081,693 1,113,755 -0.3% 0.7% (29,791) 32,061 58.1% 18,61265+ 562,339 803,330 851,754 4.6% 1.5% 240,990 48,424 62.1% 30,060

Total 3,251,900 3,308,995 3,368,534 0.2% 0.4% 57,095 59,540 --- 33,316

Sources: U.S. Census Bureau, RCG

Rosen Consulting Group

Table 17New York Apartment Market Trends*

88 89 90 91 92 93 94 95 96 97 98e

Total Stock 826,525 831,724 834,348 836,389 837,870 839,505 841,185 843,097 845,183 848,195 852,695New Construction 2,733 5,199 2,624 2,041 1,481 1,635 1,680 1,912 2,086 3,012 4,500Net Absorption 1,838 7,559 (774) 1,150 (1,074) (1,774) 2,462 3,533 4,555 3,773 4,800Occupied Stock 805,035 812,594 811,821 812,970 811,896 810,122 812,585 816,118 820,673 824,446 827,688Vacancy Rate 2.6% 2.3% 2.7% 2.8% 3.1% 3.5% 3.4% 3.2% 2.9% 2.8% 2.9%

Upper E. SideMonthly Rent $1,800 $2,000 $1,775 $1,700 $1,675 $1,775 $1,825 $1,925 $2,150 $2,375 $2,525Rent per SF $28.80 $32.00 $28.40 $27.20 $26.80 $28.40 $29.20 $30.80 $34.40 $38.00 $40.40 % Change 4.3% 11.1% -11.3% -4.2% -1.5% 6.0% 2.8% 5.5% 11.7% 10.5% 6.3%Upper W. SideMonthly Rent $1,725 $1,650 $1,500 $1,550 $1,550 $1,925 $1,650 $2,025 $2,150 $2,425 $2,625Rent per SF $27.60 $26.40 $24.00 $24.80 $24.80 $30.80 $26.40 $32.40 $34.40 $38.80 $42.00 % Change 0.0% -4.3% -9.1% 3.3% 0.0% 24.2% -14.3% 22.7% 6.2% 12.8% 8.2%Lower ManhattanMonthly Rent $1,675 $1,700 $1,650 $1,525 $1,625 $1,725 $1,700 $2,000 $2,150 $2,475 $2,475Rent per SF $26.80 $27.20 $26.40 $24.40 $26.00 $27.60 $27.20 $32.00 $34.40 $39.60 $39.60 % Change 0.0% 1.5% -2.9% -7.6% 6.6% 6.2% -1.4% 17.6% 7.5% 15.1% 0.0%

*Includes Manhattan, Bronx, Brooklyn & Queens; Condominium conversions taken out of new construction seriesNote: Monthly rent based on one bedroom, non-stabilized apt; Rent per SF calculation assumes 750 SF per aptSources: Feathered Nest, REIS, RCG

Rosen Consulting Group

(2,000)

0

2,000

4,000

6,000

8,000

10,000

12,000

82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99f00f01f02f

New ConstructionNet Absorption

Apartment Construction & AbsorptionNew York City

Sources: REIS, RCG

Rosen Consulting Group

1.5%

2.0%

2.5%

3.0%

3.5%

4.0%

80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99f00f01f02f

Apartment Vacancy RateNew York City

Sources: REIS, RCG

Rosen Consulting Group

$1,400

$1,600

$1,800

$2,000

$2,200

$2,400

$2,600

$2,800

88 89 90 91 92 93 94 95 96 97 98

Upper E. Side Upper W. Side Lower Manhattan

One-Bedroom/Non-Stabilized RentsManhattan

Source: Feathered Nest

Rosen Consulting Group

Table 18Pipeline for New Apartment Projects In Manhattan (100+ Unit Projects)

Estimated Completion Date, 1999-2005

Address Developer Units Location

W. 64th St. at WEA Tishman/Speyer 947 West SideW. 41st St./11th Ave. Silverstein 921 Midtown/Chelsea6th Ave./Center Six sites Adell 870 Midtown/ChelseaRiverside South (Sites E & F) Trump 800 West SideE. 61st. St./1st Ave. Milstein Properties 600 East Side250 Water St. Milstein Properties 571 Downtown101 West End Ave. Tishman/Speyer 507 West Side252 Seventh Ave. Rockrose 500 Downtown1739 Broadway 55th/56th St. Related Companies 500 Midtown/Chelsea240 E. 39th St. (Saxony) L. Litwin/Glenwood 418 Midtown/ChelseaBattery Park City - Tribeca Park Related Companies 395 Downtown110/120 Church St. Zar Realty 355 DowntownBattery Park City - Tribeca Pointe Rockrose 340 DowntownE. 8th Ave./53rd/54th St. Andalex Group 337 Midtown/ChelseaBattery Park City - River Terrace Rockrose 300 Downtown95th St./Broadway Related Companies 300 West SideW. 23rd St./Sixth Ave. Manchurian 300 Midtown/ChelseaE. 39th St./2nd Ave. Related Companies 250 Midtown/Chelsea10 E. 29th St. Rose Associates 244 Midtown/Chelsea2nd Ave./29th St. Kalikow 240 Midtown/ChelseaLe Rivage - 21 West St. Rose Associates 230 Downtown345 E. 94th St. Harold Fetner 220 East SideBattery Park City - River Watch Brodsky 209 DowntownBattery Park City - Site 13 DeMatteis Organization 208 Downtown10th & 11th Ave./58th & 59th St. Joe Kauf 200 Midtown/Chelsea82nd St./1st Ave. RFR/Davis 180 East SideW. 96th St./Amsterdam Ave. Essex Capital 160 West Side90th St./1st Ave. RFR/Davis 128 East Side75th St./1st Ave. RFR/Davis 125 East Side120 Greenwich St. Barrington Development 113 Downtown305 E. 63rd St. Kalimian 109 East Side339 E. 28th St./1st Ave. Macklowe 105 Midtown/ChelseaHouston St./Mercer and Greene Eichner/Sopher 103 Downtown51st St./1st Ave. Herman --- Midtown/Chelsea296-98 W. 10th St. Robert Haskell --- Midtown/Chelsea

Sources: New York Times, The Related Companies, RCG

Rosen Consulting Group

Table 20New York Apartment Market Forecast*

1997 1998e 1999f 2000f 2001f 2002f

Total Stock 848,195 852,695 856,995 861,095 865,795 870,695New Construction 3,012 4,500 4,300 4,100 4,700 4,900Net Absorption 3,773 4,800 3,800 4,000 4,200 4,600Occupied Stock 824,446 827,688 831,488 835,488 839,688 844,288Vacancy Rate 2.8% 2.9% 3.0% 3.0% 3.0% 3.0%

Upper E. SideMonthly Rent $2,375 $2,525 $2,626 $2,739 $2,859 $2,980Rent per SF $38.00 $40.40 $42.02 $43.82 $45.75 $47.67 % Change 10.5% 6.3% 4.0% 4.3% 4.4% 4.2%Upper W. SideMonthly Rent $2,425 $2,625 $2,735 $2,858 $2,993 $3,130Rent per SF $38.80 $42.00 $43.76 $45.73 $47.88 $50.09 % Change 12.8% 8.2% 4.2% 4.5% 4.7% 4.6%Lower ManhattanMonthly Rent $2,475 $2,475 $2,525 $2,580 $2,639 $2,695Rent per SF $39.60 $39.60 $40.39 $41.28 $42.23 $43.12 % Change 15.1% 0.0% 2.0% 2.2% 2.3% 2.1%

*Includes Manhattan, Bronx, Brooklyn & Queens; Condominium conversions taken out of new construction seriesNote: Monthly rent based on one bedroom, non-stabilized apt; Rent per SF calculation assumes 750 SF per aptSources: Feathered Nest, REIS Reports, RCG