Roadshow Bankhaus Lampe

description

Transcript of Roadshow Bankhaus Lampe

Air Berlin PLC | Dusseldorf / Cologne 29 November 2012 | Roadshow Bankhaus Lampe

›

Second largest airline in Germany (in terms of fleet size)

35.3 million passengers (2011)

170 destinations in 40 countries (Oct. 2012)

9.300 employees (2011)

158 aircraft (Sept. 2012); average age 5.2 years

4.23 billion Euro business volume (2011)

manifold cooperations with other airlines:

strategic partnership with Etihad Airways, oneworld® membership, codeshare agreements

2

airberlin in a nutshell:

Air Berlin PLC | Roadshow Bankhaus Lampe Nov '12

›

The airberlin story

PAX in m per year .

3

Phase 1: Charter carrier

Phase 2: Mallorca /

Euro-Shuttle

Phase 3: Scheduled Business

Phase 4: International Connectivity

1992 – 1997 1998 – 2005 2006 – 2011 from 2011

1.6 1.4 1.1 1.0 0.5 0.8

Organic Growth Organic Growth IPO in 2006/ Acquisitions Alliances & Codeshare

Founded 1978 under US-law from Kim Lundgren (former PanAm Pilot) due to the status of West - Berlin

Licensed under German law in 1991 as Air Berlin GmbH & Co. Luftverkehrs KG

Codeshare with Etihad Airways

Codeshare with American Airlines, British Airways, Finnair, S7, Iberia, Royal Jordanian, Bangkok Airways, Pegasus, Hainan Airlines, JAL

Air Berlin PLC | Roadshow Bankhaus Lampe Nov „12

›

airberlin strategic development – transformation process

Etihad Airways and oneworld: airberlin’s development towards a full

service airline

4

HYBRID CARRIER FULL SERVICE AIRLINE

Cu

sto

mer

Ser

vice

Timeline

Global network (from America to Asia) alliance member

Global positioned frequent flyer program (topbonus)

Full service airline (lounge, priorities, etc.)

BUSINESS

LEISURE LOW COST

Stand-alone airline (cooperation with NIKI)

135 destinations (mainly Europe)

Air Berlin PLC | Roadshow Bankhaus Lampe Nov '12

›

Two complementary networks now combined

Etihad Airways’ and airberlin’s combined network

strategy enables a wider network reach and market

growth

Asia/Pacific

North America

Caribbean

Central- & South Africa

Australia

Central America

DUSBER

Russia

India

Europecovered by AB

AUH

Northern Africa

AB operated

EY operated

Jointly operated

Middle East

Asia/Pacific

North America

Caribbean

Central- & South Africa

Australia

Central America

DUSBER

Russia

India

Europecovered by AB

AUH

Northern Africa

AB operatedAB operated

EY operatedEY operated

Jointly operatedJointly operated

Middle East

Source: PaxISplus of airline

5 Air Berlin PLC | Roadshow Bankhaus Lampe Nov '12

›

Financial Performance [EUR m] – Q3 2012 & 9M 2012

6

EBITDAR EBIT Net result Revenue

30.2 101.2 96.8

279.5 269.3

1,395.1 1,375.5

+120.6% +4.5%

+3.8%

+1.4%

66.6

Despite reduction in capacity, increase in revenue is achieved from slightly higher seat load factor and increase in yield

Revenue growth and cost initiatives help to improve EBITDAR performance despite higher fuel cost of EUR 35 m in Q3 and EUR 99 m in the first 9 months

Due to higher leasing cost, EBIT proportionally does not develop in line with EBITDAR

Net result more than

doubled compared to

the previous year

quarter and increases

by 23.6% for the first 9

months

Q3/12

Q3/11

-123.7

434.8 385.9

3,343.2 3,273.3

+23.6% +37.4%

+12.7%

+2.1%

-102.5 -134.3 -77.5

9M/12

9M/11

Air Berlin PLC | Roadshow Bankhaus Lampe Nov '12

›

1) Total revenue

Topline development – Q3 2012 & 9M 2012

7

Revenue1) per ASK [EUR ct.]

+2.7%

Q3/12

7.61

Q3/11

7.41

+6.0%

Q3/12

121.79

Q3/11

114.86

Yield [EUR]

+6.7%

Q3/12

130.47

Q3/11

122.24

Revenue1) per Guest [EUR]

+3.2%

9M/12

7.05

9M/11

6.83

+7.8%

9M/12

114.14

9M/11

105.91

+7.7%

9M/12

127.36

9M/11

118.27

Air Berlin PLC | Roadshow Bankhaus Lampe Nov '12

›

1) Total revenue

Operational development – Q3 2012 & 9M 2012

8

Guests [m] SLF [%] Capacity [m]

+1.39%p

+0.40%p

80.03

78.64

84.54

84.14

-6.8%

-5.4%

32.80

35.19

12.65

13.37

Q3/12

9M/11

26.25 9M/12

27.68

-5.0%

-5.2%

10.69

Q3/11 11.25

Air Berlin PLC | Roadshow Bankhaus Lampe Nov '12

›

Development of Expenses [EUR m] – Q3 2012

9

Personnel expenses Net cost of leases & depreciation [EUR m]

Higher than last year driven by

FTE increase

+4.4%

Q3/12

126.7

Q3/11

121.4

+4.9%

9M/12

369.5

9M/11

352.4

+6%

-15%

160.9 152.0

17.5 20.5 Q3/12

Q3/11

+3.4%

178.4 172.5

+2%

-13%

Leases

457.1 446.6

Depreciation

55.1 63.0 9M/12

9M/11

+0.5%

Cost of a/c

ownership

512.2 509.6

Q3/12

Q3/11

9M/12

9M/11

Air Berlin PLC | Roadshow Bankhaus Lampe Nov '12

›

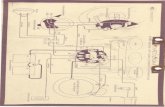

airberlin fleet – as of September 30th 2011/2012

10

Fleet development [number of aircraft]

10

10

15

14

72

69

Q3/11 170 7 66

158

-7.1%

-12

Q3/12 7 58

A320 family

Q400

E190

B737 family

A330 family

Air Berlin PLC | Roadshow Bankhaus Lampe Nov '12

›

Balance sheet structure

[EUR m]

11

2,264

Net debt: 813

B/S as of Dec 31, 2011

89%

11%

10%

24%

66%

Fixed assets

Other current assets

Liquid assets

Equity

Debt

Net debt: 853

B/S as of Sep 30, 2012

8%

9%

34%

57%

92%

Fixed assets

Other current assets

Liquid assets

Equity

Debt

2,385

Air Berlin PLC | Roadshow Bankhaus Lampe Nov '12

›

* as of 28 Sep 2012 / 30 Sep 2011

Dollar hedging profile and FX rate development, 2012/13 vs. 2011/12

Dollar hedging 2012/13

0

10

20

30

40

50

60

70

80

90

100

Sep Aug Jul Jun May Apr Mar Feb Jan Dec Nov Oct

FX rate development *[USD/EUR]

Hedging rate 2011 (as of 09/30/2011)

Hedging rate 2012 (as of 09/28/2012)

Jun May Apr Mar Feb Jan Dec Nov Oct

1.50

1.45

1.40

1.35

1.30

1.25

Sep Aug Jul

88 28

Hedging profile [%]

Hedge rate 2011

Market / Forward rate

Current Hedge rate

12

54 73

2011/12 2012/13 2011/12 2012/13

Air Berlin PLC | Roadshow Bankhaus Lampe Nov '12

›

* as of 28 Aug 2012 / 30 Sep 2011 // 1) excl. differentials

Fuel hedging profile and fuel price development, 2012/13 vs. 2011/12

Fuel hedging 2012/13

0

20

40

60

80

100

120

Sep Aug Jul Jun May Apr Mar Feb Jan Dec Nov Oct

Price1) development *[USD/t]

Hedging rate 2011 (as of 09/30/2011)

Hedging rate 2012 (as of 09/28/2012)

Jul Jun May Apr Mar Jan Dec Nov Oct

1,080

Feb

1,040

1,020

1,000

980

1,060

940

540

Sep Aug

960

88 16

Hedging profile [%]

Hedge price 2011

Market / Forward price

Current Hedge price

13

44 63

2011/12 2012/13 2011/12 2012/13

Air Berlin PLC | Roadshow Bankhaus Lampe Nov '12

›

[EUR m]

EBIT improvement now > EUR 230 m in 2012 with increasing impact in

the course of the year

14

≈ 30% Share of Total ≈ 26%

2012

>230

Q4

>60

Q3

>70

Q2

>50

Q1

>50

Implementation

Realization

Air Berlin PLC | Roadshow Bankhaus Lampe Nov '12

›

EBIT values without effects from cost avoidance

[EUR m]

Contribution to full year EBIT improvement of more than EUR 70 m in

the third quarter of 2012

15

SHAPE & SIZE

profitability

improvement in

Q3/12

> EUR 70 m

Q3 2012 Shape & Size performance

Yield

& Rev.

mgmt

Alliances

Cost

initiatives

MRO

6

Profitability

Improvement

EUR 2

3 4

5

1 Process

improvement

Network

reduction &

productivity

> 1.6

> 22.2

> 17.3

1 Enhanced yield development

2 Codeshare effects from partnership with

Etihad Airways and oneworld

3 Aircraft sourcing and improvement of

network productivity

4 Reduction of maintenance cost

5 Several cost measures

Q3

Q3

Q3

> 17.0

Q3

> 7.9

Q3

> 4.0

Q3

Air Berlin PLC | Roadshow Bankhaus Lampe Nov '12

›

Multiple difficulties affect airberlin‘s business

Present economic challenges and Shape & Size

16

Shape & Size

Goal:

Operating

improvement of

230m in 2012

• Cost reduction

• Increase in

revenue and

yield

• Adjusting the

network with

partners

• Focus on hubs

and profitable

routes

High oil prices

Strong competition

(Low-Cost-Carriers)

Aviation tax

Emission trading (only

European airlines!)

High and increasing

production costs

BER - Airport delay;

European debt crisis -

weakness in consumer

confidence

Air Berlin PLC | Roadshow Bankhaus Lampe Nov '12

›

2012 2011 2013 2014

The efficiency program Shape & Size has accounted to operational improvement with more than EUR 170 m

and could offset rising fuel prices

Though the constantly worsening economic environment as well as other external factors such as aviation

tax, fuel price, BER opening delays and changing consumer behavior, claims for the implementation of

turnaround

Shape & Size is a continuously moving forward successful efficiency program, but it cannot compensate for

all negative influences which the airline will be facing in 2013

Turbine challenges status quo business assumptions and adapt business model to “lean and smart”

principles

Turnaround program Turbine is set to achieve our goal for 2013 to reach

a positive net result

17

SHAPE & SIZE – Internal continuous improvement; well embedded in the organization 1

TURBINE

Structural changes to refocus

business and operating model

2

Air Berlin PLC | Roadshow Bankhaus Lampe Nov '12

›

Turbine for long-term sustainability

airberlin requires structural changes towards a business model with

less fragmentation, more efficient operations and a lower cost base

18

Process & levers TURBINE 2013

Turbine`s major objective is to reduce costs

and apply efficient operational principles

while maintaining core brand attributes

Structural change to regain competitiveness

Challenge status quo business assumptions

and adapt business model to “lean and

smart” principles

Significantly lift operating performance

(RASK / CASK)

Develop Master Turnaround Plan by the end

of 2012

Building upon airberlin`s core brand

attributes (value for money, innovativeness,

service with heart)

Turbine sharpens our customer offering,

especially for high-value customers

Implement changes throughout 2013

The program is addressing all elements of the

operation, e.g.:

Where airberlin flies

Number and types of aircraft in the fleet

How airberlin routes aircraft and crew around its network

Ground processes supporting flights

Organizational setup and responsibilities

IT and systems supporting the head office

Commercial steering model (scheduled / tour operator)

Air Berlin PLC | Roadshow Bankhaus Lampe Nov '12

›

(1) 2012 data based on extrapolation from figures related to the period between 1 January and 31 August 2012.

topbonus member base

19

topbonus has a growing and attractive member base

Member base expected to grow to 3.1m members by year end 2012

Strong historical growth rates with a CAGR of 14% from 2010 to 2012

Number of members (in Mio.)

(1)

Status levels of members

Differentiation of members in standard, silver, gold and platinum

Status levels attractive for members

Higher revenue generated with premium members

airberlin intends to monetize topbonus

2.4

2.8 3.1

2012 2010 2011

Air Berlin PLC | Roadshow Bankhaus Lampe Nov '12

›

(1) Expected new oneworld alliance members

(2) Denotes coalition partner

topbonus has a reputable and significant partner network with more than 120 partners

topbonus partner network

20

Air travel Hotels Car rental Finance & insurance

Newspapers

Co-branded credit cards

Other partners

(1)

(1)

(2)

(2)

(2)

(2)

(2)

(2)

(2)

(2)

(2)

(2)

(2)

oneworld alliance

Earn + burn Selected earn partners

(1)

Air Berlin PLC | Roadshow Bankhaus Lampe Nov '12

›

Transaction benefits for airberlin and topbonus

Transaction rationale

21

Fully consistent with strategy of enhancing attractiveness of topbonus

Monetization of topbonus

Creating visibility of value contributed by topbonus

Strengthening of equity and reduction of financial leverage

Ability to participate in future development of topbonus

Highly compelling strategic logic evidences by precedent transactions

Separation as enabling event for topbonus to develop its full potential

Air Berlin PLC | Roadshow Bankhaus Lampe Nov '12

› 22

Back up

Air Berlin PLC | Roadshow Bankhaus Lampe Nov '12

›

Cancelled Long-Haul connections to North America

Modifications of airberlin‘s network, starting 14 Januar 2013 (1)

DUS

LAS

SFO

YVR

IATA Code Destination

DUS Düsseldorf

LAS Las Vegas

SFO San

Francisco

YVR Vancouver

23 Air Berlin PLC | Roadshow Bankhaus Lampe Nov '12

›

Cancelled

Short-Haul

Connections

Modifications of airberlin‘s network, starting 14 Januar 2013 (2)

TXL

OTP

VIE

SOF

PMI

SCQ

MAD

BCN

VRN BEG

HAJ

MUC

DUS

IATA Code Destination

BCN Barcelona

BEG Belgrad

HAJ Hannover

MAD Madrid

MUC München

OTP Bukarest

PMI Mallorca

SCQ Santiago de

Compostela

SOF Sofia

VIE Wien

VRN Verona

24 Air Berlin PLC | Roadshow Bankhaus Lampe Nov '12

›

Reductions of frequency in Spanish

domestic traffic

Modifications of airberlin‘s network, starting 14 Januar 2013 (3)

OVD

OPO

LIS

SVQ

PMI

AGP

ALC

IATA Code Destination

AGP Malaga

ALC Alicante

LIS Lissabon

OPO Porto

OVD Asturias

SVQ Sevilla

25 Air Berlin PLC | Roadshow Bankhaus Lampe Nov '12