Right Horizons PMS India 2012 Review & Outlook 2013

-

Upload

vinayak-kanvinde -

Category

Economy & Finance

-

view

693 -

download

0

Transcript of Right Horizons PMS India 2012 Review & Outlook 2013

India Equities – Upgrade could continueOutlook 2013

YOUR LOGORight Horizons PMSFor private circulation only

Agenda / Table of contentsWhy we could be closer to the take off point?

A review of the asset markets in 20121

Why we could be closer to the take off point?

The dud period, compared with earlier duds2

Where are we as compared to peers3

What is the outlook for 2013 and beyond4

How are we closer to the inflection point?5 How are we closer to the inflection point?5

Right Horizons PMS – why is there no traction?6YOUR LOGO

Page 2

g y

For private circulation only

2012: A year in review1

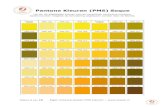

Equities have been a runaway success in 2012Though equities have had a stellar run in 2012 the returns has been volatile at Asset return in 2012 in India2012, the returns has been volatile at best.

Rise in equities has been on the back of poor performance in 2011 (-24%) and 30.00%

40.00%

Asset return in 2012 in India

p p ( )hence majority could have missed the bus.

Debt returns have been higher than in th it d i 2011 (7 5%)

10.00%

20.00%

those witnessed in 2011 (7.5%)

Gold performed badly as compared with earlier 3-5 year time frame and returns from real estate are showing signs of

0.00%Equities -

NiftyEquities -CNX Mid

Cap

Bond -Short Term

Bond -Long Term (GILT)

Gold -ETF

Real Estate -

Tier I

from real estate are showing signs of investor fatigue.

YOUR LOGOPage 3For private circulation only

The dud period; compared with earlier dud2

The seven year period 1996-2003 was classic dud where the stock markets did provide for high volatility, negative real returns and were highly frustrating to the average investor. 2008-2012 appears to be one such classic dud period where the volatility remained high, negative real returns ensued and considerable anxiety was created. Dud periods are followed by heavy bull periods where wealth creation is astounding 2003-2007 was one such period Investor should consolidate their position in dudcreation is astounding. 2003-2007 was one such period. Investor should consolidate their position in dud period to reap benefits during Bull ones.

?YOUR LOGO

Page 4For private circulation only

Where are we compared with our peer set? 3

Indian Fundamentals remain strong

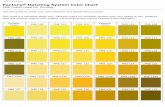

1. Barring the “expensive defensives”, which is a Asian

wide syndrome, the relative cheapness of other sectors

– notably investment/CAPEX driven ones in the region

is a mild positive.

Source: Credit Suisse December 2012 Asia Equity Strategy report

2. Bigger Asian markets such as China, Korea and

Australia are cheaper than India on this metric,

however, fundamental factors point to worse off

situation in these countries relative to India For

India still in the relatively cheaper territory

Relative value of the Asian region on the basis of P/B R E l ti d l M t f th hi h

Source: Credit Suisse December 2012 Asia Equity Strategy report.situation in these countries relative to India. For

instance, slow down in China appears to be far deeper

than that compared with India. Consumer confidence

indicators are also worse off in China than India –P/B versus RoE valuation model. Most of the higher valuation of the countries are driven by the “expensive defensives” sectors.

The same is true for India as well.

explaining the relative cheapness and inability for a

rapid turnaround on a relative basis.

YOUR LOGOPage 5

For private circulation only

Outlook for 2013 and beyond (Summary)4

Nifty target of around 6800 by December 2013, implying a 16% annual upside - Factors taking Nifty higher to these levels include

- Lower cost of borrowing levels than 2011 & 2012 by nearly 100-150 bps, driven by reversal of the yields

- Higher liquidity conditions, generally healthy business environment and easier availability of credit- Strong consumption due to end-use demand from staples, consumer discretionary and durables. - Sectors which have underperformed in the medium term could start to turn around Read – financialsSectors which have underperformed in the medium term could start to turn around. Read financials,

consumer discretionary, global cyclical and infrastructure.

The radical index levels would be reached by 2015, led by catalyst such as:as:- Strong policy level changes driven by fresh mandate in 2014, strong thrust on growth- Better corporate balance sheet and twin impact of low debt/low interest payouts and

strong earnings- Strong investments across a spectrum of growth sectors, infrastructure, energy, power,

industrials and housing.

YOUR LOGOPage 6For private circulation only

Outlook 2013 – all the brass tacks4

Valuations appears cheap even with all those downgrades:It appears that most of the earnings downgrades have been factored in for the FY14 earnings. At the current level too; the 1 year forward multiple does not exceed the long period average, which is very reasonable given the consistent, through lower, growth in earningsearnings.

Long period average valuations and cheaper relative value is compelling for investors:

1. Improving earnings profile and a long period average valuations provide comfort to investors

2. Average premium over emerging markets also provide lot of scope for upside

YOUR LOGOPage 7For private circulation only

provide lot of scope for upside.

Outlook 2013 – all the brass tacks …cont’d4

The consumption story has just begun:

Domestic cyclical could take the lead in the upcoming upgrade season, followed by defensives.

The biggest let down has been during the ‘dud period’ (2008-2012) from the Infrastructure & cap goods sector due to a variety of issues, largely internal. The uptick on this segment could provide theuptick on this segment could provide the boost to this segment.

Global cyclical could remain the ‘wild card’. Domestically this is the most

d t d tunder-rated segment.

Expensive defensives, could lose favor if the re-rating begins.

YOUR LOGOPage 8For private circulation only

Inflexion point: closer than we might think!5

The Lessons from 2003

Bull markets in the past have all but been gradual and steady unlike ‘shock & awe’ bear phasesBull markets in the past have, all but, been gradual and steady, unlike shock & awe bear phases.

Bull markets are normally preceded by sustainable bond rallies and cooling of yields. The general level of

inflation is also lower

Bull markets start with defensives getting expensive and higher risk appetite for rate sensitive's beginning

YOUR LOGOPage 9For private circulation only

Bull markets start with defensives getting expensive and higher risk appetite for rate sensitive s beginning

to gather momentum.

Right Horizons PMS portfolios – wealth creation vehicles6

Right Horizons – Portfolios

Nifty Plus Portfolio1Flexicap Portfolio

Capital Protection Portfolio – December 2012 (hurry now)

23 Capital Protection Portfolio December 2012 (hurry now)

Super Value Portfolio

34

YOUR LOGOPage 10For private circulation only

Capital Protection Portfolio – (Open for subscription - hurry)3

Double Click to launch

YOUR LOGOPage 13For private circulation only

DisclaimerThe information contained herein has been obtained from reports secured from third parties, publicly available sources and Right Horizons, its affiliates, subsidiaries and/or Group companies take no responsibilities – express or implied forRight Horizons, its affiliates, subsidiaries and/or Group companies take no responsibilities express or implied for inaccuracies contained herein.

This document is meant for the use of the intended recipient only. Though dissemination to all intended recipients is simultaneous, not all intended recipients may receive this document at the same time. This document is neither an offer nor solicitation for an offer to buy and/or sell any securities mentioned herein and/or official confirmation of any transaction.

This document is provided for assistance only and is not intended to be, and must not be taken as, the sole basis for an investment decision. The user assumes the entire risk of any use made of this information. Each recipient of this document should make such investigation as he deems necessary to arrive at an independent evaluation, including the merits and risks involved, for investment in the securities referred to in this document and should consult his own advisors to determine the merits and risks of such investmentmerits and risks of such investment.

The investment discussed or views expressed may not be suitable for all investors. This document has been prepared on the basis of information obtained from publicly available, accessible resources. Right Horizons has not independently verified all the information given in this document. Accordingly, no representation or warranty, express or implied, is made as to accuracy, completeness or fairness of the information and opinion contained in this document. y, p p

The information given in this document is as of the date of this document and there can be no assurance that future results or events will be consistent with this information. Though Right Horizons endeavors to update the information contained herein on reasonable basis, Right Horizons, its associate companies, their directors, employees, agents or representatives (“Right Horizons and its affiliates”) are under no obligation to update or keep the information current. Also, there may be

l li h h f d iregulatory, compliance or other reasons that may prevent us from doing so.

Right Horizons and its affiliates expressly disclaim any and all liabilities that may arise from information, error or omission in this connection. Right Horizons and its affiliates shall not be liable for any damages whether direct, indirect, special or consequential, including lost revenue or lost profits, which may arise from or in connection with the use of this document. This document is strictly confidential and is being furnished to you solely for your information This document and/or any

YOUR LOGOPage 15For private circulation only

This document is strictly confidential and is being furnished to you solely for your information. This document and/or any portion thereof may not be duplicated in any form and/or reproduced or redistributed without the prior written consent of Right Horizons.

Q ti ?Reach us:

[email protected]+91 80 41209582+91 22 3225 2864

YOUR LOGOPage 16For private circulation only