Return ofPrivate Foundation Form 990-PF990s.foundationcenter.org/990pf_pdf_archive/341/... ·...

Transcript of Return ofPrivate Foundation Form 990-PF990s.foundationcenter.org/990pf_pdf_archive/341/... ·...

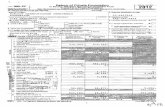

Return of Private Foundation OMB No 1545-0052

Form 990-PF or Section 4947 ( a)(1) Trust Treated as Private Foundation

2014► Do not enter social security numbers on this form as it may be made public.Department of the TreasuryInternal Revenue Service ► Information about Form 990-PF and its separate instructions is at www.irs.gov/form990pf. en o u i c I nspecti on

For calendar year 2014 or tax year beginning , and ending

Name of foundation A Employer identification number

MARION G. RESCH FOUNDATIONC/O FARMERS TRUST COMPANY 34-1853367

I1f

0CV

CV

rnLC (j1

.Z7Kin

Omu,c?_80

W_

r^

0

Number and street (or P 0 box number if mail is not delivered to street address) Room/suite B Telephone number

42 MCCLURG ROAD ( 330 ) 743-7000City or town, state or province , country, and ZIP or foreign postal code C If exemption application is pending , check here

YOUNGSTOWN , OH 44512G Check all that apply: 0 Initial return 0 Initial return of a former public charity D 1. Foreign organizations , check here

Final return 0 Amended return

Address chan g e D Name chan g e2. Fo,eign organizations meeting the 85% test,

check here and attach computation

H Check type of organization : ® Section 501 ( c)(3) exempt private foundation E If private foundation status was terminatedSection 4947 ( a)( 1 ) nonexem p t charitable trust 0 Other taxable p rivate foundatio n under section 507 (b)(1)(A), check here

I Fair market value of all assets at end of year J Accounting method: ® Cash 0 Accrual F If the foundation is in a 60-month termination(from Part Il, col. (c), line 16) 0 Other ( specify ) under section 507(b)(1)(B), check here

► $ 2 5 6 9 7 19 0 (Part 1, column (d) must be on cash basis)

Part I Analysis of Revenue and Expenses ( a) Revenue and (b ) Net investment (c) Adjusted net (d) Disbursements(The total of amounts in columns (b) (c), and (d) may notnecessarily equal the amounts in column (a)) exp enses p er books income income

for charitable purposes(cash basis only)

1 Contributions , gifts, grants , etc., received N/A2 Check►® if the foundation is not required to attach Sch B

Interest on savings and temporary3 cash investments

4 Dividends and interest from securities 632 , 544. 632 , 544 . STATEMENT 15a Gross rents

b Net rental income or (loss)

6a Net gain or (loss) from sale of assets not on line 10 2 , 103 , 946 .C b

Gross sales price for all16,262,884 .assets on line 6a --" ^+ '^ •}, `

7 Capital gain net income (from Part IV, line 2) 2 10 3 9 4 6 .8 Net short-term capital gain

9 Income modifications MAY I 1 ItGross sales less returns

10a and allowances1t

b Less Cost of goods sold IT Ic Gross profit or (loss)

11 Other income

12 Total . Add lines 1 throu g h 11 2 , 736 , 490. 2 , 736 , 490.13 Compensation of officers , directors , trustees , etc 119 , 15 9. 93 , 959. 25 , 200.14 Other employee salaries and wages

15 Pension plans , employee benefits

y 16a Legal fees

a b Accounting fees STMT 2 4 , 350 . 4 , 350. 0.W c Other professional fees

T 17 Interest

m 18 Taxes STMT 3 61 , 054. 5 , 329. 0.19 Depreciation and depletion

20 Occupancy

21 Travel, conferences , and meetings 13 , 578. 0 . 13 , 578.U

22 Printing and publications

0 23 Other expenses STMT 4 200. 0. 200.24 Total operating and administrative

0. expenses . Add lines 13 through 23 198 , 341. 103 , 638 . 38 , 978.0 25 Contributions, gifts, grants paid 1 , 224 , 185 . 1 , 224 , 185.

26 Total expenses and disbursements.

Add lines 24 and 25 1 422 526h . 103 638 . 1 , 263 , 163.27 Subtract line 26 from line 12:

a Excess of revenue over expenses and disbursements 1 , 313 , 964,b Net investment income ( if negative , enter - 0-) 2 , 632 , 852.c Adjusted net income ( if negative , enter -0-) N /A

N 4235010 11-24-14 LHA For Paperwork Reduction Act Notice , see instructions.

0t 108550219 759239 RESCHFOUNDAT 2014.02051 MARION G. RESCH FOUNDATION

Form 990-PF (2014) 4

RESCHF01

MARION G. RESCH FOUNDATIONn in rfluX'Mna mnrTOm r+nvn7 TV ZA-1 0[ZIIC 7 n n

v Balance Sheets Attached schedules and amounts in the descapbon Beginning of year End o f yearPart ll column should be inc end-of-year amounts only k V l(a) Book Value (b) Boo a u e (c) Fair Market Value

1 Cash - non-interest-bearing

2 Savings and temporary cash investments 475 , 943. 946 , 846. 946 , 846.3 Accounts receivable ►

Less: allowance for doubtful accounts ►4 Pledges receivable ►

Less: allowance for doubtful accounts ►

5 Grants receivable

6 Receivables due from officers, directors, trustees, and other

disqualified persons

7 Other notes and loans receivable ►

Less: allowance for doubtful accounts ►0 8 Inventories for sale or useW

9 Prepaid expenses and deferred charges

a 10a Investments- U.S. and state government obligations STMT 5 910 , 174. 1 , 058 , 065. 1 , 042 , 184.b Investments - corporate stock STMT 6 12 , 219 , 685. 12 , 112 , 199. 13 , 857 , 696.c Investments - corporate bonds STMT 7 9 , 074 , 442. 9 , 883 , 131. 9 1 850 , 464.

11 Investments - land,buddings , and equipment basis ►

Less accumulated depreciation ►

12 Investments - mortgage loans

13 Investments - other

14 Land, buildings, and equipment: basis ►Less accumulated depreciabon ►

15 Other assets (describe ►16 Total assets (to be completed by all filers - see the

instructions. Also , see p a g e 1 , item I 22 , 680 , 244. 24,000, 241. 25 , 697 , 190.17 Accounts payable and accrued expenses

18 Grants payable

w 19 Deferred revenue

•`-' 20 Loans from officers, directors, trustees, and other disqualified persons

m 21 Mortgages and other notes payable

' 22 Other liabilities (describe ►

23 Total liabilities ( add lines 17 throw h 22 ) 0. 0.

Foundations that follow SFAS 117, check here ► 0and complete lines 24 through 26 and lines 30 and 31.

24 Unrestricted

m 25 Temporarily restricted

m 26 Permanently restricted

C Foundations that do not follow SFAS 117, check here ►`L and complete lines 27 through 31.

y 27 Capital stock, trust principal, or current funds 22 , 680 , 244. 24 , 000 , 241.y 28 Paid-in or capital surplus, or land, bldg., and equipment fund 0. 0.LO

29 Retained earnings, accumulated income, endowment, or other funds 0. 0.

Z 30 Total net assets or fund balances 22 , 680 , 244. 24 000 , 241.

31 Total liabilities and net assets/fund balances 22 , 680 , 244. 1 24 , 000 , 241. 1

Part Ill Analysis of Changes in Net Assets or Fund Balances

1 Total net assets or fund balances at beginning of year - Part II, column (a), line 30

(must agree with end-of-year figure reported on prior year's return) 1 22 , 680 , 2442 Enter amount from Part I, line 27a 2 1 , 313 , 9643 Other increases not included in line 2 (itemize) ► ACCRUAL TO CASH CONVERSION 3 6 , 033.4 Add lines 1, 2, and 3 4 24 , 000 , 241 .

5 Decreases not included in line 2 (itemize) ► 5 0 .

6 Total net assets or fund balances at end of year (line 4 minus line 5) - Part II, column (b), line 30 6 24 , 000, 24 1 .

42351111-24-14

Form 990-PF (2014)

2

08550219 759239 RESCHFOUNDAT 2014.02051 MARION G. RESCH FOUNDATION RESCHF01

MARION G. RESCH FOUNDATIONForm 990-PF (2014) C / O FARMERS TRUST COMPANY 34-1853367 Page 3Part IV ' Capital Gains and Losses for Tax on Investment Income

(a) List and describe the kind(s) of property sold (e.g., real estate,2-story brick warehouse; or common stock, 200 shs. MLC Co.)

(b How acquired^ - PurchaseD - Donation

Date acquired(mo., day, yr.)

(d) Date sold(mo., day, yr.)

la SHORT TERM GAIN ( SEE ATTACHED FORM 1099-B ) P VARIOUS VARIOUSb LONG TERM GAIN ( SEE ATTACHED FORM 1099-B ) P VARIOUS VARIOUSc SHORT TERM GAIN ( SEE ATTACHED FORM 1099-B ) P VARIOUS VARIOUSd LONG TERM GAIN ( SEE ATTACHED FORM 1099-B ) P VARIOUS VARIOUSe CAPITAL GAINS DIVIDENDS

(e) Gross sales price (f) Depreciation allowed(or allowable)

(g) Cost or other basisplus expense of sale

(h) Gain or (loss)(e) plus (f) minus (g)

a 5 , 193 , 267. 4 , 902 , 178. 291 089.b 6 , 203 , 790. 5 , 210 , 666. 993 124.c 25 , 000. 24 , 981. 19.d 4 , 589 , 600. 4 , 021 , 113. 568 487.e 251 227. 251 227.

Complete only for assets showing gain in column (h) and owned by the foundation on 12/3 1/69 (I) Gains (Col. (h) gain minus

(i) F.M.V. as of 12/31/69(j) Adjusted basisas of 12/31/69

(k) Excess of col. (i)over col. (1), if any

col. (k), but not less than -0-) orLosses (from col. (h))

a 291 089.b 993 124.c 19.d 568 487.e 251 227.

2If gain, also enter in Part I, line 7

Capital gain net income or (net capital loss) If (loss), enter -0- in Part I, line 7 JV 2 2 , 103 , 946.

3 Net short-term capital gain or (loss) as defined in sections 1222(5) and (6):If gain, also enter in Part I, line 8, column (c).If ( loss ), enter -0- in Part I line 8 3 N /A

Part V (Qualification Under Section 4940(e) for Reduced Tax on Net Investment Income

(For optional use by domestic private foundations subject to the section 4940(a) tax on net investment income.)

If section 4940(d)(2) applies, leave this part blank.

Was the foundation liable for the section 4942 tax on the distributable amount of any year in the base period? 0 Yes ® No

If 'Yes,' the foundation does not qualify under section 4940 ( e). Do not complete this part.

1 Enter the appropriate amount in each column for each year ; see the instructions before making any entries.

Base period yearsCalendar year or tax year beginning in Adjusted qualifying distributions Net value of nonchantable-use assets

dDistribution ratio

(col. (b) divided by col. (c))

2013 1 , 001 , 006. 24 042 891. .0416342012 1 , 166 , 813. 23 106 842. .0504962011 1 , 107 , 345. 22 595 453. .0490072010 975 772 21 616 383. .0451402009 i , 281 , 234: 1 20 246 610. .063281

2 Total of line 1, column (d) 2 .2495583 Average distribution ratio for the 5-year base period - divide the total on line 2 by 5,

the foundation has been in existence if less than 5 years

or by the number of years

3 . 049912

4 Enter the net value of nonchantable-use assets for 2014 from Part X, line 5 4 25 , 159 , 771.

5 Multiply line 4 by line 3 5 1 , 255 , 774.

6 Enter 1% of net investment income (1% of Part I, line 27b) 6 26 , 329.

7 Add lines 5 and 6 7 1 , 282 , 103.

8 Enter qualifying distributions from Part XII, line 4 8 1 , 263 , 163.

If line 8 is equal to or greater than line 7, check the box in Part VI, line 1b, and complete that part using a 1% tax rate.See the Part VI instructions.

423521 11-a4-,4 Form 990-PF (2014)3

08550219 759239 RESCHFOUNDAT 2014.02051 MARION G. RESCH FOUNDATION RESCHF01

MARION G. RESCH FOUNDATIONForm 990-PF 2014 C / O FARMERS TRUST COMPANY 34-1853367 Pap e 4Part VI Excise Tax Based on Investment Income (Section 4940 (a), 4940 (b), 4940 (e), or 4948 - see instructions)

1a Exempt operating foundations described in section 4940 ( d)(2), check here ► EA and enter 'NIX on line 1.

Date of ruling or determination letter: ( attach copy of letter if necessary - see instructions)

b Domestic foundations that meet the section 4940 ( e) requirements in Part V, check here ►0 and enter 1% 1 52 , 657.

of Part I, line 27b

c All other domestic foundations enter 2% of line 27b . Exempt foreign organizations enter 4% of Part I , line 12, col. (b).

2 Tax under section 511 (domestic section 4947(a)(1) trusts and taxable foundations only. Others enter -0-) 2 0.

3 Add lines 1and2 3 52 , 657.

4 Subtitle A (income ) tax (domestic section 4947 ( a)(1) trusts and taxable foundations only. Others enter -0-) 4 0.

5 Tax based on investment income Subtract line 4 from line 3. If zero or less, enter -0 - 5 52 , 657.

6 Credits/Payments:

a 2014 estimated tax payments and 2013 overpayment credited to 2014 6a 58 , 145.b Exempt foreign organizations - tax withheld at source 6b

c Tax paid with application for extension of time to file ( Form 8868) 6c

d Backup withholding erroneously withheld 6d

7 Total credits and payments. Add lines 6a through 6d 7 58 , 145.

8 Enter any penalty for underpayment of estimated tax. Check here ® if Form 2220 is attached 8

9 Tax due If the total of lines 5 and 8 is more than line 7, enter amount owed ► 9

10 Overpayment If line 7 is more than the total of lines 5 and 8, enter the amount overpaid ► 10 5 , 488.Poo,11 Enter the amount of line 10 to be: Credited to 2015 estimated tax 110 5 4 8 8 . Refunded 11 0.

Part VII -A Statements Regarding Activities

la During the tax year, did the foundation attempt to influence any national, state , or local legislation or did it participate or intervene in Yes No

any political campaign'? is X

b Did it spend more than $ 100 during the year (either directly or indirectly ) for political purposes ( see instructions for the definition)' lb X

If the answer is "Yes " to la or 1b, attach a detailed description of the activities and copies of any materials published or

distributed by the foundation in connection with the activities

c Did the foundation file Form 1120 -POL for this year'? is X

d Enter the amount ( if any) of tax on political expenditures ( section 4955 ) imposed during the year:

(1) On the foundation . ► $ 0. (2) On foundation managers. ► $ 0.

e Enter the reimbursement ( if any) paid by the foundation during the year for political expenditure tax imposed on foundation

managers. ► $ 0.

2 Has the foundation engaged in any activities that have not previously been reported to the IRS? 2 X

If "Yes," attach a detailed description of the activities

3 Has the foundation made any changes , not previously reported to the IRS, in its governing instrument, articles of incorporation, or

bylaws, or other similar instruments ? If "Yes," attach a conformed copy of the changes 3 X

4a Did the foundation have unrelated business gross income of $1,000 or more during the years 4a X

b If 'Yes," has it filed a tax return on Form 990 -T for this years N/A 4b

5 Was there a liquidation , termination, dissolution, or substantial contraction during the year'? 5 X

If "Yes, " attach the statement required by General Instruction T.

6 Are the requirements of section 508(e) (relating to sections 4941 through 4945 ) satisfied either:

• By language in the governing instrument, or

• By state legislation that effectively amends the governing instrument so that no mandatory directions that conflict with the state law

remain in the governing Instruments 6 X

7 Did the foundation have at least $5,000 in assets at any time during the year'? If "Yes," complete Part ll, col (c), and Part XV XX

8a Enter the states to which the foundation reports or with which it is registered (see instructions) ►OH

b If the answer is 'Yes' to line 7, has the foundation furnished a copy of Form 990-PF to the Attorney General (or designate)

of each state as required by General Instruction G7 If "No, " attach explanation

9 Is the foundation claiming status as a private operating foundation within the meaning of section 4942(j)(3) or 4942(I)(5) for calendar

year 2014 or the taxable year beginning in 2014 (see instructions for Part XIV)' If "Yes, " complete Part XIV

0 Did any persons become substantial contributors during the tax year' if "Yes." attach a schedule listing their names and addresses

Form 990-PF (2014)

42353111-24-14

4

08550219 759239 RESCHFOUNDAT 2014.02051 MARION G. RESCH FOUNDATION RESCHFO1

MARION G. RESCH FOUNDATIONorm 990-PF 2014 C / O FARMERS TRUST COMPANY 34-1853367 Pa e 5

Part VII-A Statements Regarding Activities (continued)

11 At any time during the year, did the foundation, directly or indirectly, own a controlled entity within the meaning of

section 512(b)(13)9 If 'Yes; attach schedule (see instructions) 11 X

12 Did the foundation make a distribution to a donor advised fund over which the foundation or a disqualified person had advisory privileges?

If 'Yes, attach statement (see instructions) 12 X

13 Did the foundation comply with the public inspection requirements for its annual returns and exemption application? 13 X

Website address ► N/A

14 The books are in care of ► FARMERS TRUST COMPANY Telephone no. 10- (3 30 ) 743 - 7 0 0 0

42 MCCLURG ROAD, YOUNGSTOWN, OH ZIP+4 ►4451215 Section 4947(a)(1) nonexempt charitable trusts filing Form 990-PF in lieu of Form 1041 - Check here ►0

and enter the amount of tax-exempt interest received or accrued during the year ► 15 N/A

16 At any time during calendar year 2014, did the foundation have an interest in or a signature or other authority over a bank, Yes No

securities, or other financial account in a foreign country 16 X

See the instructions for exceptions and filing requirements for FinCEN Form 114, (formerly TD F 90-22.1). If 'Yes,' enter the name of the

foreign country

Part VII-B Statements Regarding Activitie s for Which Form 4720 May Be Required

File Form 4720 if any item is checked in the "Yes" column , unless an exception applies. Yes No

la During the year did the foundation ( either directly or indirectly):

(1) Engage in the sale or exchange , or leasing of property with a disqualified person'? EA Yes ® No

(2) Borrow money from, lend money to, or otherwise extend credit to (or accept it from)

a disqualified person? 0 Yes ®No

(3) Furnish goods , services, or facilities to ( or accept them from) a disqualified person' 0 Yes ® No

(4) Pay compensation to, or pay or reimburse the expenses of, a disqualified person? ® Yes 0 No

(5) Transfer any income or assets to a disqualified person (or make any of either available

for the benefit or use of a disqualified person )? EA Yes ® No

(6) Agree to pay money or property to a government official? ( Exception Check No'

if the foundation agreed to make a grant to or to employ the official for a period after

termination of government service, if terminating within 90 days .) 0 Yes ® No

b If any answer is 'Yes' to la( 1)-(6), did any of the acts fail to qualify under the exceptions described in Regulations

section 53.4941( d)-3 or in a current notice regarding disaster assistance (see instructions)' 1b X

Organizations relying on a current notice regarding disaster assistance check here ►0c Did the foundation engage in a prior year in any of the acts described in la, other than excepted acts , that were not corrected

before the first day of the tax year beginning in 20149 1c X

2 Taxes on failure to distribute income ( section 4942 ) ( does not apply for years the foundation was a private operating foundation

defined in section 4942 (l)(3) or 4942(1)(5)),

a At the end of tax year 2014, did the foundation have any undistributed income ( lines 6d and 6e, Part XIII) for tax year ( s) beginning

before 2014? 0 Yes ® No

If "Yes,' list the years ►b Are there any years listed in 2a for which the foundation is not applying the provisions of section 4942 ( a)(2) (relating to incorrect

valuation of assets ) to the year's undistributed income'? ( If applying section 4942 (a)(2) to all years listed , answer 'No" and attach

statement - see instructions .) N/A 2b

c If the provisions of section 4942 ( a)(2) are being applied to any of the years listed in 2a, list the years here.

►3a Did the foundation hold more than a 2% direct or indirect interest in any business enterprise at any time

during the year' Yes ® No

b If "Yes," did it have excess business holdings in 2014 as a result of (1) any purchase by the foundation or disqualified persons after

May 26, 1969; (2 ) the lapse of the 5-year period ( or longer period approved by the Commissioner under section 4943 (c)(7)) to dispose

of holdings acquired by gift or bequest; or (3) the lapse of the 10-, 15-, or 20 -year first phase holding period' (Use Schedule C,

Form 4720, to determine if the foundation had excess business holdings in 2014 .) N/A 3b

4a Did the foundation invest during the year any amount in a manner that would jeopardize its charitable purposes 4a X

b Did the foundation make any investment in a prior year ( but after December 31, 1969 ) that could jeopardize its charitable purpose that

had not been removed from jeopardy before the first day of the tax year beginning in 2014 4b X

Form 990-PF (2014)

42354111-24-14

508550219 759239 RESCHFOUNDAT 2014.02051 MARION G. RESCH FOUNDATION RESCHFO1

MARION G. RESCH FOUNDATION34-18533

Part VII - B Statements Regarding Activities for Which Form 4720 May Be Required (continued)

5a During the year did the foundation pay or incur any amount to:

(1) Carry on propaganda , or otherwise attempt to influence legislation ( section 4945(e))9 0 Yes ® No

(2) Influence the outcome of any specific public election (see section 4955 ); or to carry on , directly or indirectly,

any voter registration drive ? 0 Yes ® No

(3) Provide a grant to an individual for travel, study , or other similar purposes9 0 Yes ® No

(4) Provide a grant to an organization other than a charitable , etc., organization described in section

4945 ( d)(4)(A)9 ( see instructions ) ED Yes ® No

(5) Provide for any purpose other than religious , charitable, scientific , literary, or educational purposes, or for

the prevention of cruelty to children or animals? Yes ® No

b If any answer is 'Yes ' to 5a(1)-(5), did any of the transactions fail to qualify under the exceptions described in Regulations

section 53.4945 or in a current notice regarding disaster assistance ( see instructions )9 N/A 5b

Organizations relying on a current notice regarding disaster assistance check here ►c If the answer is 'Yes" to question 5a(4), does the foundation claim exemption from the tax because it maintained

expenditure responsibility for the grant? N/A 0 Yes No

If "Yes," attach the statement required by Regulations section 53 4945-5(d)

6a Did the foundation , during the year , receive any funds, directly or indirectly , to pay premiums on

a personal benefit contracts 0 Yes ® No

b Did the foundation , during the year , pay premiums , directly or indirectly , on a personal benefit contract'? 6b X

If "Yes" to 6b, file Form 8870.

7a At any time during the tax year, was the foundation a party to a prohibited tax shelter transaction' L Yes ® No

b If 'Yes , ' did the foundation receive any p roceeds or have an y net income attributable to the transaction '? N4 A 7b

Part VIII Information About Officers , Directors, Trustees , Foundation Managers , HighlyPaid Employees , and Contractors

1 List all officers. directors, trustees , foundation managers and their compensation.

(a) Name and address(b) Title, and average

hours per week devotedto position

(c) CompensationIf not aid ,

( enter p0

( d)contnbubonstoemploy ee eterre

dplans

compensation

(e)Expenseaccount, otherallowances

SEE STATEMENT 8 119 159. 0. 0.

2 Comnensation of five highest-paid emolovees (other than those included on line 1). It none. enter "NONE."

(a) Name and address of each employee paid more than $50,000(b) Title, and average

hours per weekdevoted to position

(c) Compensation

( d) Contnbubons toempoyeebenertplaos

compensation

(e) Expenseaccount, otherallowances

NONE

Total number of other employees paid over $50,000 ► 1 0Form 990-PF (2014)

42355111-24-14

608550219 759239 RESCHFOUNDAT 2014.02051 MARION G. RESCH FOUNDATION RESCHFO1

MARION G. RESCH FOUNDATIONForm 990-PF 2014 C / O FARMERS TRUST COMPANY 34-1853367 Pa e 7

- Part Vlll ' Information About Officers , Directors , Trustees , Foundation Managers , HighlyPaid Employees , and Contractors (continued)

3 Five highest - paid independent contractors for professional services. If none, enter " NONE."

(a) Name and address of each person paid more than $50,000 (b) Type of service (c) Compensation

NONE

Total number of others receivin g over $50 , 000 for p rofessional services ► 0

Part IX-A I Summary of Direct Charitable Activities

List the foundation's four largest direct charitable activities during the tax year. Include relevant statistical information such as thenumber of organizations and other beneficiaries served, conferences convened, research papers produced, etc. Expenses

N/A

2

3

4

Part IX-B Summary of Program-Related InvestmentsDescribe the two largest program-related investments made by the foundation during the tax year on lines 1 and 2. Amount

1 N/A

2

All other program-related investments. See instructions.

3

Total . Add lines 1 throug h 3 ► 0.

Form 990-PF (2014)

42356111-24-14

708550219 759239 RESCHFOUNDAT 2014.02051 MARION G. RESCH FOUNDATION RESCHF01

MARION G. RESCH FOUNDATIONForm 990-PF 2014 C / O FARMERS TRUST COMPANY 34-1853367 Page 8

Part XMinimum Investment Return (All domestic foundations must complete this part Foreign foundations, see instructions)

1 Fair market value of assets not used (or held for use) directly in carrying out charitable, etc., purposes:

a Average monthly fair market value of securities

b Average of monthly cash balances

c Fair market value of all other assets

d Total (add lines la, b, and c)

e Reduction claimed for blockage or other factors reported on lines 1a and

1c (attach detailed explanation) le

2 Acquisition indebtedness applicable to line 1 assets

3 Subtract line 2 from line 1d

4 Cash deemed held for charitable activities. Enter 1 1/2% of line 3 (for greater amount, see instructions)

5 Net value of noncharitable - use assets . Subtract line 4 from line 3. Enter here and on Part V, line 4

6 MinimPart XI

11b1 897.229.

1d 25.542.915.

1 3 Zn.n4L.J1n.

771.

Distributable Amount (see instructions) (Section 4942(j)(3) and (1)(5) private operating foundations and certain

foreign organizations check here p. and do not complete this part.)

1 Minimum investment return from Part X, line 6 1 1 , 257 , 989.

2a Tax on investment income for 2014 from Part VI, line 5 2a 52 , 657.b Income tax for 2014. (This does not include the tax from Part VI.) 2b

c Add lines 2a and 2b 2c 52 , 657 .

3 Distributable amount before adjustments. Subtract line 2c from line 1 3 1 , 205 , 332 .4 Recoveries of amounts treated as qualifying distributions 4 0 .

5 Add lines 3 and 4 5 1 , 205 , 332 .6 Deduction from distributable amount (see instructions) 6 0 .

7 Distributable amount as ad j usted. Subtract line 6 from line 5. Enter here and on Part XIII line 1 7 1 , 205 , 332 .Part XII Qualifying Distributions (see instructions)

1 Amounts paid (including administrative expenses) to accomplish charitable, etc., purposes,

a Expenses, contributions, gifts, etc. - total from Part I, column (d), line 26 laa 1 , 263 , 163.b Program-related investments - total from Part IX-B 1b 0.

2 Amounts paid to acquire assets used (or held for use) directly in carrying out charitable, etc., purposes 2

3 Amounts set aside for specific charitable protects that satisfy the:

a Suitability test (prior IRS approval required) 3a

b Cash distribution test (attach the required schedule) 3b

4 Qualifying distributions . Add lines la through 3b. Enter here and on Part V, line 8, and Part XIII, line 4 4 1 , 263 , 163.5 Foundations that qualify under section 4940(e) for the reduced rate of tax on net investment

income. Enter 1% of Part I, line 27b 5 0.

6 Adjusted qualifying distributions Subtract line 5 from line 4 6 1 , 263 , 163.Note . The amount on line 6 will be used in Part V, column (b), in subsequent years when calculating whether the foundation

4940(e) reduction of tax in those years.

qualifie s for the section

Form 990-PF (2014)

42357111-24-14

808550219 759239 RESCHFOUNDAT 2014.02051 MARION G. RESCH FOUNDATION RESCHF01

MARION G. RESCH FOUNDATION

Form 990-PF (2014) C/O FARMERS TRUST COMPANY 34-1853367 Page 9

Paft XIII Undistributed Income (see instructions)

(a) (b) (c) (d)

Corpus Years prior to 2013 2013 2014

1 Distributable amount for 2014 from Part XI,

IIne7 1 , 205 , 332.2 Undistributed income, if any, as of the end of 2014

a Enter amount for 2013 only 0.

b Total for prior years:

0.3 Excess distributions ca rryover, if any, to 2014:

aFrom2009 164 377.b From 2010

c From 2011 5 , 741.

dFrom 2012 43 , 165.e From 2013

f Total of lines 3a throug h e 213 , 283 .4 Qualifying distributions for 2014 from

Part X11, line 4: ► $ 1 , 263 , 163.a Applied to 2013, but not more than line 2a 0.

b Applied to undistributed income of prior

years (Election required - see instructions) 0.

c Treated as distributions out of corpus

(Election required - see instructions) 0.

d Applied to 2014 distributable amount 1 2 0 5 3 3 2.e Remaining amount distributed out of corpus 57 , 831.

5 Excess distributions carryover applied to 2014 0. 0

Of an amount appears in column (d), the same amount

must be shown in column (a) )

6 Enter the net total of each column asindicated below.

a Corpus Add lines 3f, 4c, and 4e Subtract line 5 271 , 114.b Prior years' undistributed income. Subtract

line 4b from line 2b 0

c Enter the amount of prior years'undistributed income for which a notice ofdeficiency has been issued, or on whichthe section 4942(a) tax has been previouslyassessed 0

d Subtract line 6c from line 6b. Taxable

amount - see instructions 0 .

e Undistributed income for 2013. Subtract line

4a from line 2a. Taxable amount - see instr. 0

f Undistributed income for 2014. Subtract

lines 4d and 5 from line 1. This amount must

be distributed in 2015 0

7 Amounts treated as distributions out of

corpus to satisfy requirements imposed by

section 170(b)(1)(F) or 4942(g)(3) (Election

may be required - see instructions) 0

8 Excess distributions carryover from 2009

not applied on line 5 or line 7 164 , 377.

9 Excess distributions carryover to 2015

Subtract lines 7 and 8 from line 6a 106 , 737.10 Analysis of line 9:

a Excess from 2010

b Excess from 2011 5 , 741.c Excess from 2012 43 , 165.

d Excess from 2013

e Excess from 2014 57 , 831.

„_24-14 Form 990-PF (2014)

908550219 759239 RESCHFOUNDAT 2014.02051 MARION G. RESCH FOUNDATION RESCHF01

MARION G. RESCH FOUNDATIONForm 990-PF (2014) C/O FARMERS TRUST COMPANY 34-1853367 Page 10

Part XIV Private Operating Foundations (see instructions and Part VII-A, question 9) N/A

a If the foundation has received a ruling or determination letter that it is a private operating

foundation, and the ruling is effective for 2014 , enter the date of the ruling ►

b Check box to indicate whether the foundation is a p rivate o p eratin g foundation described in section E:1 4942 (j)( 3 ) or

2 a Enter the lesser of the adjusted net

income from Part I or the minimum

investment return from Part X for

each year listed

b 85% of line 2a

c Qualifying distributions from Part XII,

line 4 for each year listed

d Amounts included in line 2c not

used directly for active conduct of

exempt activities

e Qualifying distributions made directly

for active conduct of exempt activities

Subtract line 2d from line 2cComplete 3a, b, or c for thealternative test relied upon:

a "Assets' alternative test - enter:(1) Value of all assets

(2) Value of assets qualifyingunder section 4942(j)(3)(B)(i)

b 'Endowment alternative test - enter2/3 of minimum investment returnshown in Part X, line 6 for each yearlisted

c "Support alternative test - enter:

(1) Total support other than grossinvestment income (interest,dividends, rents, payments onsecurities loans (section512(a)(5)), or royalties)

(2) Support from general publicand 5 or more exemptorganizations as provided insection 4942(I)(3)(B)(ui)

(3) Largest amount of support from

an exempt organization

( 4 ) Gross investment incomePart XV Supplementary Information (Complete this part only if the foundation had $5,000 or more in assets

at any time during the year-see instructions.)

1 Information Regarding Foundation Managers:

a List any managers of the foundation who have contributed more than 2% of the total contributions received by the foundation before the close of any tax

year (but only if they have contributed more than $5,000). (See section 507(d)(2).)

NONEb List any managers of the foundation who own 10% or more of the stock of a corporation (or an equally large portion of the ownership of a partnership or

other entity) of which the foundation has a 10% or greater interest.

2 Information Regarding Contribution , Grant, Gift, Loan , Scholarship , etc., Programs:

Check here ►0 if the foundation only makes contributions to preselected charitable organizations and does not accept unsolicited requests for funds. If

the foundation makes gifts, grants, etc. (see instructions) to individuals or organizations under other conditions, complete items 2a, b, c, and d.

a The name, address, and telephone number or e-mail address of the person to whom applications should be addressed:

SEE STATEMENT 9b The form in which applications should be submitted and information and materials they should include:

c Any submission deadlines:

d Any restrictions or limitations on awards, such as by geographical areas, charitable fields, kinds of institutions, or other factors,

423601 11-24-14

4942(j)(5)

Tax year Prior 3 years

(a) 2014 (b) 2013 (c) 2012 ( d) 2011 (e) Total

Form 990-PF (2014)

1008550219 759239 RESCHFOUNDAT 2014.02051 MARION G. RESCH FOUNDATION RESCHFO1

MARION G. RESCH FOUNDATION

Form 990-PF (2014) C/O FARMERS TRUST COMPANY 34-1853367 Page 11

3 'Grants and Contributions Paid Durin q the Year or Approved for Future Pa ment

Recipient If recipient is an individual,show any relationship to Foundation Purpose of grant or

A tName and address (home or business) any foundation manager

or substantial contributorstatus ofrecipient

contribution moun

a Paid dung the year

COLLEGE OF WOOSTER /A PUBLIC CHARITY EDUCATIONAL GRANTS

1189 BEALL AVENUE

WOOSTER OH 44691 237380.

LAKE ERIE COLLEGE /A PUBLIC CHARITY EDUCATIONAL GRANTS

391 WEST WASHINGTON STREET

PAINESVILLE OH 44077 130 000.

MOUNT UNION UNIVERSITY /A PUBLIC CHARITY EDUCATIONAL GRANTS

1972 CLARK AVENUE

ALLIANCE OH 44601 110000.

THIEL COLLEGE /A PUBLIC CHARITY EDUCATIONAL GRANTS

75 COLLEGE AVENUE

GREENVILLE PA 16125 202 000.

WESTMINSTER COLLEGE /A UBLIC CHARITY DUCATIONAL GRANTS

319 SOUTH MARKET STREET

NEW WILMINGTON PA 16172 322 380 ,

Total SEE CONTINUATION SHEET S ► 3a 1 224 18s

b Approved for future payment

NONE

Total ► 3b 1 0.

Form 990-PF (2014)42361111-24-14

1108550219 759239 RESCHFOUNDAT 2014.02051 MARION G. RESCH FOUNDATION RESCHF01

MARION G. RESCH FOUNDATIONForm 990-PF (2014) C/O FARMERS TRUST COMPANY 34-1853367 Page 12

Part XVI -A Analysis of Income- Producing Activities

Enter

1 Pro

a

b

c

d

e

f

9

2 Me

3 Int

Inv

4 Div

5 Net

a

b

6 Net

pro

7 Ot

8 Gal

tha

9 Not

10 Gr

11 Ot

a

b

c

d

e

12 Su

t nles otherwise indicated Unrelate d business income Exclu ded by section 512 , 513, or 514 (e)cross amoun s u s .

gram service revenue:

(a)Businesscode

(b)Amount

ECC?„_

^d0

(d)Amount

Related or exemptfunction income

Fees and contracts from government agencies

mbershlp dues and assessments

rest on savings and temporary cash

estments

idends and interest from securities 14 632 , 544.rental income or (loss) from real estate:

Debt-financed property

Not debt-financed property

rental income or (loss) from personal

perty

er investment income

n or (loss) from sales of assets other

n inventory 18 2 , 103 , 946.income or (loss) from special events

ss profit or (loss) from sales of inventory

errevenue:

btotal. Add columns (b), (d), and (e) 0. 1 1 2 , 736 , 49 0.

B

t

o

h

t

o

h

0.13 Total Add line 12, columns (b), (d), and (e) 13 2,736,490.

(See worksheet in line 13 instructions to verify calculations )

Part XVI- 13 Relationship of Activities to the Accomplishment of Exempt Purposes

1208550219 759239 RESCHFOUNDAT 2014.02051 MARION G. RESCH FOUNDATION RESCHFO1

42362111-24-14

Form 990-PF (2014)

MARION G. RESCH FOUNDATIONForm 990-PF 2014 C / O FARMERS TRUST COMPANY 34-1853367 Pag e 13Part XVII Information Regarding Transfers To and Transactions and Relationships With Noncharitable

Exempt Organizations

Did the organization directly or indirectly engage in any of the following with any other organization described in section 501(c) of Yes No

the Code (other than section 501(c)(3) organizations) or in section 527, relating to political organizations?

a Transfers from the reporting foundation to a noncharitable exempt organization of.

(1) Cash la(l)

(2) Other assets la ( 2 ) X

b Other transactions:

(1) Sales of assets to a noncharitable exempt organization lb ( l ) X

(2) Purchases of assets from a noncharitable exempt organization 1b ( 2 ) X

(3) Rental of facilities, equipment, or other assets 1 b ( 3 ) X

(4) Reimbursement arrangements 1b ( 4 ) X

(5) Loans or loan guarantees lb ( 5 ) X

(6) Performance of services or membership or fundraising solicitations lb ( 6 ) X

c Sharing of facilities, equipment, mailing lists, other assets, or paid employees 1c X

d If the answer to any of the above is "Yes, complete the following schedule. Column (b) should always show the fair market value of the goods, ot

or services given by the reporting foundation. If the foundation received less than fair market value in any transaction or sharing arrangement, sh

her ass

ow in

ets,

(a) Name of organization (b) Type of organization (c) Description of relationship

N/A

SignHere

Paid

Under penalties of p tury, I decl e that I have a mi t

and belief, it is a correct, an co ete Decl ate n14

Stgnatur of o r trustee

nnt/Type preparer's name

KAREN S. COHEN

his return , including accompanying schedules and statements , and to the best of my knowledgeMay the IRS discuss this

reparer (other than taxpayer) is based on all information of r s owledger t with th r

Dat

Pr s slg e

08550219 RESCHFOUNDAT 2014.02051

2a Is the foundation directly or indirectly affiliated with, or related to, one or more tax-exempt organizations described

in section 501(c) of the Code ( other than section 501(c)(3 )) or in section 5279 Yes ® No

h If "Voc ° cmmnlata the fnllnwlnn sehp.diilp

MARION G. RESCH FOUNDATIONC / O FARMERS TRUST COMPANY 34-1853367

Part XV Supolementarv Information

3 Grants and Contributions Paid During the Year (Continuation)

Recipient If recipient is an individual,show any relationship to Foundation Purpose of grant or

AName and address (home or business) any foundation manager

or substantial contributorstatus ofrecipient

contribution mount

YOUNGSTOWN STATE UNIVERSITY

1 UNIVERSITY PLAZA

YOUNGSTOWN OH 44555

/A PUBLIC CHARITY EDUCATIONAL GRANTS

222425.

Total from continu ation sheets 222 425 ,

42363105-01-14

14

08550219 759239 RESCHFOUNDAT 2014.02051 MARION G. RESCH FOUNDATION RESCHF01

2014 Tax Information StatementPage 8 of 48

Payer's Name and Address: Account Number: 650047012 Recipient ' s Name and Address : Ref: KPB

FARMERS TRUST COMPANY Recipient 's Tax ID Number : 34-1853367 MARION G. RESCH FOUNDATION

42 MCCLURG ROAD Payer's Federal ID Number: 34-1853512 C/O PACKER THOMAS

YOUNGSTOWN, OH 44512 Payer's State ID Number : ATTN: KAREN COHENState : OH 6601 WESTFORD PLACE, STE. 101

q Corrected El 2nd TIN noticeCANFIELD, OH 44406

2014 Form 1099 -B: Proceeds from Broker and Barter Exchange TransactionsOMB No. 1545-0715

Reported to the IRS is proceeds less commissions and option premiums.Covered ( Box 5 is not checked)

Description of property (Box 1a)

Federal StateCusip Date Sold Date Form 8949 Cost or Code Net Gain Income TaxNumber or Disposed Acquired Checkbox Proceeds Other Basis if any Adjustments or Loss Tax Withheld Withheld

(Box 1c) (Box 1b) (Box 1d) (Box le) (Box 10 (Box 1g) (Box 4) (Box 16)

Short Term Sal es Reported on 1099-B3460.0 ALLSTATE CORP COM

020002101 01/17/2014 Various A 183,815.52 161,468.22 0.00 22,347.30 0.00 0 00

40.0 ALLSTATE CORP COM

020002101 03/05/2014 09/27/2013 A - 2,185.93 .... ....... 2,048.51 0.00 -- --- 137.42.... 0.00. ......... .. . .... 0,00.......... .

124.0 APPLE COMPUTER INC

037833100 01/17/2014 06/18/2013 A -- -- ------- ..... -53,565.51---- -- ... 0.00 ... ...... 14,61-2.23.. 0.00 0.00

72.0 APPLE COMPUTER INC

037833100 05/07/2014 06/18/2013 _-A ------- ------ ..... 2,467.54 31,102.55 0.00 11,364 99 0.00 0.00

4.0 APPLE COMPUTER INC

037833100-- --- .0.5/07/.2.0.1.4..08/05/201.3-----

A . -- ---- .2,359.31 1,853.48 .. ------ ---- 0.00 ...50.5-.83 0.00 0.00

908 0 CBS CORP NEW B

124857202 01/17/2014 02/07/2013 A 54,874.20 ....... 8,101.22 - 0.00 .. - •16,772.98-- - . 0.00. ............ .-• - 0.00- ---- ... .

7745.0 CISCO SYS INC COM

17275R102 01/02/2014 03/07/2013 A 170,538.05 169,723.15-- --- -- -

0.00- - --- ------ - -• --------- ------ ------

81490 --.. 0.00........ -•--- . ---- . --0.00

---- . .... ....

575.0 CISCO SYS INC COM

172758102 01/02/2014 03/07/2013 A 12,660.99 12,600.49 0.00 60.50 0.00 0.00

This is important tax inform ation and is being furnished to the Internal Revenue Service ( except as indicated). If you are required to file a return, anegligence penalty or othe r sanction may be imposed on you if this income is taxable and the IRS determines that it has not been reported. The

taxpayer is ultimately responsible for the accu racy of their own tax return.

2014 Tax Information StatementPage 9 of 48

Payer's Name and Address : Account Number : 650047012 Recipient ' s Name and Address : Ref: KPBFARMERS TRUST COMPANY Recipient's Tax ID Number: 34-1853367 MARION G. RESCH FOUNDATION42 MCCLURG ROAD Payer's Federal ID Number : 34-1853512 C/O PACKER THOMAS

YOUNGSTOWN, OH 44512 Payer's State ID Number : ATTN: KAREN COHEN

State : OH 6601 WESTFORD PLACE, STE. 101

q Corrected F-1 2nd TIN noticeCANFIELD, OH 44406

2014 Form 1099-B: Proceeds from Broker and Barter Exchange TransactionsOMB No. 1545-0715

Reported to the IRS is proceeds less commissions and option premiums.

Covered ( Box 5 is not checked)

Description of property (Box 1a)

Federal StateCusip Date Sold Date Form 8949 Cost or Code Net Gain Income TaxNumber or Disposed Acquired Checkbox Proceeds Other Basis if any Adjustments or Loss Tax Withheld Withheld

(Box 1c) (Box 1 b) (Box 1 d) (Box le) (Box 10 (Box 1g) (Box 4) (Box 16)356.0 CISCO SYS INC COM

17275R102- -------------

01/17/2014 03/07/2013- ------ ---- -- - -- . -- . -- . •

A---....... • ----- 8,038,33 ------ - --- 7,801-_35 0.00 236.98 ..... 0.00. .......... ..... 0.00.-- -- -1525.0 CITIGROUP INC NEW

172967424 07/15/2014 08/05/2013 A 75,043.13 80,833.09 0.00 -5,789.96 0.00 0.00

20.0 CITIGROUP INC NEW

172967424-----------

07/17/2014 08/05/2013-- ---- - --- - --

A------ •-----•-

995.77 1,060.11- -- ...... -----

0.00--

-64.34-- -- ---- -••-•--- . -- 0.00-- ---- -- ........ . --- 0.00--- . ...... ...

243.0 D R HORTON INC

23331A109 09/24/2014 01/17/2014------ --- -- ............. ----- .

A... .. -- ...

5,045.81---- ------ ....... 5,297.40-----•---.......... --- . . -- - . .. .. 0.00------ ..... ---- -- .

-251.59. ..... .... ---- . ---. 0.00....... ---• ---....... 0.00

2580.0 DARDEN RESTAURANTS INC COM

237194105. ...... -----

12/17/2014 Various-- - ---- -- -- ---------•

A 144,804.71 120,899.79----------- --- - 0.00••. . -- ---- . -----

23,904.92..... --- . 0.00...... .... . ---- . ..... 0.00.....

76.0 DARDEN RESTAURANTS INC COM

237194105. . ............. 12/17/2014 08/14/2014

. --- . . -A 4,265.57 3,594.59

- ---- - -- --- -------- 0.00--- -- -- -- -- - --••

670.98- •-• --- -- -- . ...... 0.00...... -- . . ..... ...... 0.00...... . ---- ....

401.0 EASTMAN CHEM CO COM

277432100 01/17/2014 09/27/2013 A 31,848.87 31,354.19 0.00 494.68 0.00 0.00

2671.0 EATON CORP PLC

G29183103 10/29/2014 05/07/2014 A 175,034.77 193,314.69 0.00 -18,279.92 0.00 0:00

This is important tax information and is being furnished to the Internal Revenue Service (except as indicated ). If you are required to file a return, anegligence penalty or other sanction may be imposed on you if this income is taxable and the IRS determines that it has not been reported. The

taxpayer is ultimately responsible for the accuracy of their own tax return.

2014 Tax Information Statement

Payer 's Name and Address:FARMERS TRUST COMPANY42 MCCLURG ROADYOUNGSTOWN, OH 44512

Account Number:Recipient's Tax ID Number:Payer's Federal ID Number:Payer's State ID Number:State:

q Corrected

65004701234-1853367

34-1853512

OH

q 2nd TIN notice

Page 10 of 48Recipient ' s Name and Address : Ref: KPBMARION G. RESCH FOUNDATIONC/O PACKER THOMASATTN: KAREN COHEN6601 WESTFORD PLACE, STE. 101CANFIELD, OH 44406

2014 Form 1099 -B: Proceeds from Broker and Barter Exchange TransactionsOMB No. 1545-0715

Reported to the IRS is proceeds less commissions and option premiums.

Covered (Box 5 is not checked)

Description of property (Box 1a)

Federal StateCusip Date Sold Date Form 8949 Cost or Code Net Gain Income TaxNumber or Disposed Acquired Checkbox Proceeds Other Basis if any Adjustments or Loss Tax Withheld Withheld

(Box 1c) (Box 1 b) (Box 1d) (Box 1 e) (Box 10 (Box 1g) (Box 4) (Box 16)204.0 EATON CORP PLC

G29183103 10/29/2014 05/07/2014 A 13,368.44 14,764.58 0.00 -1,396.14 0.00 0.00

896.0 EBAY INC

278642103 08/21/2014 01/17/2014 A 49,970.43 ----- 48,025.33 0.00 1,945:10 0.00 0.00

58838.061 FIDELITY CAPITAL & INCOME

316062108 07/25/2014 - 01/31/2014 A-- ------ - ------ ---598,971.46- 577,631.27... ---- ----- . ---- 0.00---- 21,340.19..-- . . -- .....-- .0.00...... -- - -- .. 0.00

101 1.123 FIDELITY CAPITAL & INCOME

316062108-- ------

12/24/2014 01/13/2014- ....... ....... -----• ........ --••------- -•--

A-

9,787.67 9,766.51--- -

0.00-- -- --

21.16. -- ...... --- . .......--- 0.00

. ...... .. ---- ..... 0.00--- . --.....

12001.92 GOLDMAN SACHS SMALL/MID CAP GROWTH CLASS I

38143H746--- -----

06/05/2014 01/31/2014----- --- ---- --- ----- ------

A--- -- --

250,000.00 244,479.11 0.00-- 5,520.89

-- -- 0.00-- 0.00

....19.0 GOOGLE INC CL A

38259P508 01/17/2014 01/02/2014 A 22,025.17 21,099.16 0.00 926.01 0.00 0.00

1360 GOOGLE INC CL C

38259P706 04/09/2014 01/02/2014 A 75,761.79 75,417.62 0.00 344.17 0.00 0.00

10.0 GOOGLE INC CL C

38259P706 04/09/2014 01/02/2014 A 5,570.72 5,545.41 0.00 25.31 0.00 0.00

This is important tax information and is being furnished to the Internal Revenue Service (except as indicated). If you are required to file a return, anegligence penalty or other sanction may be imposed on you if this income is taxable and the IRS determines that it has not been reported. The

taxpayer is ultimately responsible for the accuracy of their own tax return.

Payer's Name and Address:FARMERS TRUST COMPANY42 MCCLURG ROADYOUNGSTOWN, OH 44512

2014 Tax Information Statement

Account Number:Recipient's Tax ID Number:Payer's Federal ID Number:Payer's State ID Number:State:

q Corrected

65004701234-185336734-1853512

OH

q 2nd TIN notice

Page 11 of 48Recipient ' s Name and Address : Ref: KPBMARION G. RESCH FOUNDATIONC/O PACKER THOMASATTN: KAREN COHEN6601 WESTFORD PLACE, STE. 101CANFIELD, OH 44406

2014 Form 1099 -B: Proceeds from Broker and Barter Exchange TransactionsOMB No. 1545-0715

Reported to the IRS is proceeds less commissions and option premiums.Covered ( Box 5 is not checked)

Description of property (Box 1a)

Cusip Date Sold Date Form 8949 Cost or CodeNumber or Disposed Acquired Checkbox Proceeds Other Basis if any Adjustments

(Box i c) (Box 1b) (Box 1 d) (Box le) (Box 10 (Box 1g)67.0 GOOGLE INC CL C

38259P706 06/11 /2014 06/03/2014 A 37,425.26 36,492.89

3.0 GOOGLE INC CL C

38259P706 06/11 /2014 06/03/2014 A 1,675.76 1,634.01- ---- ------ - --- ----

15349. 939 HARBOR INTERNATIONAL FUND INST

Federal StateNet Gain Income Taxor Loss Tax Withheld Withheld

(Box 4) (Box 16)

0-- ••---- 0.00 ..... . ..... 932.37 ... ......... . ..Q Q..... ....... ... 0.00_

0.00 41. 75 0.00 0.00

411511306 09/23/2014 01/31/2014 A 1,075,877.23 984,984.33 0.00 90,892.90 0.00 0.00

2859.0 HELMERICH & PAYNE

423452101 01/17/2014 11/21/2013 A -- -- - -- --------242,829.22 _ ___ __--226,505.13 ...... ______ __ _ ...... _ _ _ 0.00 ....1.6,324..09 ..... _ _ _ ...... _0.00 0.00

4980.0 INTEL CORP COM

458140100 01/17/2014 10/02/2013 A 125,530.15 113,791.51 0.00 11,738.64 0.00 0.00

1440.0 INVESCO PLC NEW

G491 BT108 0.8/.14/2.014..09/2.7./201.3 A-- --- -- - -- --- --- 55,896.54 _____ _-_. 46,225.44_ ...... _ ...... ____ 0.0.0 ... _ . ..... .9,671:10 ..... _ __ _ ..._ 0.0.0. ..... .. .... .. ..0.00

65.0 INVESCO PLC NEW

G491BT108 08/14/2014 09/27/2013 A 2,523.11 2,086.57 0.00 436.54 0.00 0:00

4327.422 JPMORGAN SMALL CAP CORE FUND SELECT

4812A1233 04/09/2014 12/20/2013 A 240,647.94 233,626.84....... _ _ _ ...... _....... ___ 0.00 -7,0.21.10 .____ ____ _ ..... _ 0.00 .... __ ___ _.. 0.00

This is important tax information and is being furnished to the Internal Revenue Service (except as indicated). If you are required to file a return, anegligence penalty or other sanction may be imposed on you if this income is taxable and the IRS determines that it has not been reported. The

taxpayer is ultimately responsible for the accuracy of their own tax return.

2014 Tax Information StatementPage 12 of 48

Payer's Name and Address : Account Number : 650047012 Recipient 's Name and Address : Ref: KPBFARMERS TRUST COMPANY Recipient 's Tax ID Number : 34-1853367 MARION G. RESCH FOUNDATION42 MCCLURG ROAD Payer ' s Federal ID Number : 34-1853512 C/O PACKER THOMASYOUNGSTOWN, OH 44512 Payer's State ID Number : ATTN. KAREN COHEN

State : OH 6601 WESTFORD PLACE, STE. 101

q Corrected q 2nd TIN noticeCANFIELD, OH 44406

2014 Form 1099 -B: Proceeds from Broker and Barter Exchange TransactionsOMB No. 1545-0715

Reported to the IRS is proceeds less commissions and option premiums.Covered ( Box 5 is not checked)

Description of property (Box 1a)

Federal StateCusip Date Sold Date Form 8949 Cost or Code Net Gain Income TaxNumber or Disposed Acquired Checkbox Proceeds Other Basis if any Adjustments or Loss Tax Withheld Withheld

(Box 1 c) (Box 1b) (Box id) (Box 1 e) (Box 1 f) (Box 1g) (Box 4) (Box 16)142.977 JPMORGAN SMALL CAP CORE FUND SELECT

4812A1233 . ...0.4 /09/2014 12/20/2013.. ... A--. --- ---- - 7,950:95 7,799.39-- -- ----- ---- - ----- --- - 0.00 .151:56 ... ----- .0,00 0.00

2650.645 JPMORGAN SMALL CAP CORE FU ND SELECT

4812A1233 06/05/2014 Various A 150,000.00 143,101.79 0.00 6,898.21 0.00 0.00

2194.0 KINDER MORGAN INC CLASS P

494568101 03/11/2014 06/18/2013 A 69,175.61 84,781.43 0.00 -15,605.82 0.00 0.00

82.0 KINDER MORGAN INC CLASS P

494568101-----------

03/11/2014 04/19/2013--- - - - ----- -------------

A. .. -

2,585.41.

3,161.91 0.00 -576.50. ---- 0.00

- 0.00.-

4455.0 KINDER MORGAN INC CLASS P

494568101 05/14/2014 Various A--- - - 147,579.30 170,128.20 0.00 .... -22,548:90 0.00 0.00

812.0 LEGGETT & PLATT

524660107- --------- --

07/09/2014 01/17/2014----- --- -- ------ --- ------ -- -

A-- --- ------ --- --

27,620.22----- ------ -- --

24,396.54 0.00---- ----• ... ------

3,223.68...... -- . -- -. ... 0.00. .... ..... . -- -- ...... 0.00......

0.5 NOW INC

67011P100 06/12/2014 03/11/2014--• •- A-- --- ------ -- --- --16.48 15.76 0.0.0...... .. ---•-• .0.72 ..... .. 0.00 ...0.00

0.75 NOW INC

67011P100 06/12/2014 03/11/2014 A 24.72 23.64 0.00 1.08 0.00 0.00

This is important tax information and is being furnished to the Internal Revenue Service (except as indicated). If you are required to file a return, anegligence penalty or other sanction may be imposed on you if this income is taxable and the IRS determines that it has not been reported. The

taxpayer is ultimately responsible for the accuracy of their own tax return.

2014 Tax Information StatementPage 13 of 48

Payer ' s Name and Address : Account Number: 650047012 Recipient ' s Name and Address : Ref: KPBFARMERS TRUST COMPANY Recipient ' s Tax ID Number : 34-1853367 MARION G. RESCH FOUNDATION42 MCCLURG ROAD Payer' s Federal ID Number : 34-1853512 C/O PACKER THOMASYOUNGSTOWN, OH 44512 Payer' s State ID Number: ATTN: KAREN COHEN

State : OH 6601 WESTFORD PLACE, STE. 101

El 2nd TIN noticeCANFIELD, OH 44406

2014 Form 1099 -B: Proceeds from Broker and Barter Exchange TransactionsOMB No. 1545-0715

Reported to the IRS is proceeds less commissions and option premiums.

Covered ( Box 5 is not checked)

Description of property (Box 1a)

Federal StateCusip Date Sold Date Form 8949 Cost or Code Net Gain Income TaxNumber or Disposed Acquired Checkbox Proceeds Other Basis if any Adjustments or Loss Tax Withheld Withheld

(Box 1c) (Box 1b) (Box id) (Box le) (Box 10 (Box 1g) (Box 4) (Box 16)4800 NOW INC

67011P100 07/09/2014 03/11/2014 A .161.7 .56.86 -- --- --- -- 15,127.24--- ---- -- -- ----- --- - 0.00 -1-,6-29:62 ...- - -- . ....... .0.00..... ..... 0.P0

22.0 NOW INC

67011P100--- -•-----•---•

07/09/2014 03/11/2014.. • ---• ............. --•-- -•---

A 768.02 693.33-- --- -

0.00- - ---- . . .... -- --

74.69....... ---- . -- ...... 0.00. -- ....... -- . ....... 0.00......

2964.0 NUCOR CORP COM

670346105 01/17/2014 07/05/2013 A 152,250.61 ----- --- .129,322.88 0.00 22,927.73 0.00 0.00

755.0 NUCOR CORP COM

670346105 06/04/2014 Various A 37,957.46 38,642.27 0.00 -684.81 0.00 0.00

45.0 NUCOR CORP COM

670346105-----

06/04/2014 02/18/2014--- - - -- - --- - ---- -

A--- --- - -

2,262.37-

2,309.13 0.00 -46.76-

0.00 0.00. ...

660.0 PARKER-HANNIFIN CORP

701094104 01/17/2014 04/24/2013 A 85,056.01 58,884.34 --.. ---. 0.00 ----- -- - 26,171.67 -- ------- ----- - 0.00- . -- ...... .. ..0.00

883.0 PNC FINL SVCS GROUP INC COM

693475105 01/17/2014 06/18/2013 A 73,867.31 63,419.53. . -- . ----- - 0.00 10,447.78 0.00 0.00

511.0 PNC FINL SVCS GROUP INC COM

693475105 04/29/2014 06/18/2013 A 42,606.03 36,701.45 0.00 5,904.58 0.00 0.00

This is important tax information and is being furnished to the Internal Revenue Service (except as indicated). If you are required to file a return, anegligence penalty or other sanction may be imposed on you if this income is taxable and the IRS determines that it has not been reported. The

taxpayer is ultimately responsible for the accuracy of their own tax return.

2014 Tax Information StatementPage 14 of 48

Payer's Name and Address: Account Number : 650047012 Recipient's Name and Address : Ref: KPBFARMERS TRUST COMPANY Recipient's Tax ID Number: 34-1853367 MARION G. RESCH FOUNDATION42 MCCLURG ROAD Payer's Federal ID Number: 34-1853512 C/O PACKER THOMASYOUNGSTOWN, OH 44512 Payer's State ID Number : ATTN: KAREN COHEN

State : OH 6601 WESTFORD PLACE, STE. 101

F1 Corrected F1 2nd TIN noticeCANFIELD, OH 44406

2014 Form 1099 -B: Proceeds from Broker and Barter Exchange TransactionsOMB No. 1545-0715

Reported to the IRS is proceeds less commissions and option premiums.

Covered ( Box 5 is not checked)

Description of property (Box 1a)

Federal StateCusip Date Sold Date Form 8949 Cost or Code Net Gain Income TaxNumber or Disposed Acquired Checkbox Proceeds Other Basis if any Adjustments or Loss Tax Withheld Withheld

(Box 1c) (Box 1 b) (Box 1d) (Box le) (Box 10 (Box 1g) (Box 4) (Box 16)2809.0 ROBERT HALF INTERNATIONAL

770323103.. ---- ....

01/17/2014 08/13/2013... .. . ... ... ... .. ......

A 118,887.16 - - - -109,447.07 0.00 9,440.09 0.00 0.00

0.559 SEVENTY SEVEN ENERGY INC

818097107 07/31/2014 05/14/2014 A 12.60 12:85 0.00 -0.25 0.00 0.00

0 857 SEVENTY SEVEN ENERGY INC

818097107. ----- ------

07/31/2014 05/14/2014- ---- - -- - --- - -- -- -- ------

A--------- --•- ---- .

19.31.. -- ----- ------ ....

19.70--- . --- ----- •- •-- ------ ------

0.00-- ... ------ --••-- -0.39

--- -- . -- ----- ..... 0.00---- -- . -- ---- ...... 0.00.... .. -- .. .

343.0 SEVENTY SEVEN ENERGY INC

818097107. -- . ----•--- --

08/11/2014 05/14/2014. ----

A 8,312.90 7,883.69-• --- ----

0.00 429.21 0.00.... ......... .....

0.00. .. . .........

12.0 SEVENTY SEVEN ENERGY INC

818097107- ------------

08/11/2014 05/14/2014--------- - - --- -- -- - ---- -- --

A••--- --•- ••---- .

290.83-------•-- . ----- . ------

275.80- .. 0.00----- ------ ----- ..

15.03. ---- ....... .. -- . 0.00...--...... .. ---- . 0.00...........

6518 0 SPDR S&P REGIONAL BANKING ETF

78464A698 01/17/2014 08/05/2013 A 261,242.09 244,988.16 0.00 16,253.93.. ......

0.00... .. .... .... .....

0.00.. .... .. .

700.0 STAPLES INC

855030102 02/24/2014 04/19/2013 A 9,323.70 9,005.50 0.00 318.20 0.00 0.00

100.0 TRAVELERS COMPANIES INC

89417E109 01/17/2014 11/13/2013- -- ------ - ----• -

A--- . ...

8,706.85. -- . -

8,718.90 0.00--

-12.05. . . .... .... . -•-- - 0.00- -- -- ------ ...... ...

0.00--- . -- .......

This is important tax information and is being furnished to the Internal Revenue Service (except as indicated). If you are required to file a return, anegligence penalty or other sanction may be imposed on you if this income is taxable and the IRS determines that it has not been reported. The

taxpayer is ultimately responsible for the accuracy of their own tax return.

2014 Tax Information StatementPage 15 of 48

Payer ' s Name and Address: Account Number: 650047012 Recipient ' s Name and Address : Ref: KPBFARMERS TRUST COMPANY Recipient ' s Tax ID Number : 34-1853367 MARION G. RESCH FOUNDATION

42 MCCLURG ROAD Payer's Federal ID Number: 34-1853512 C/O PACKER THOMASYOUNGSTOWN, OH 44512 Payer's State ID Number : ATTN: KAREN COHEN

State : OH 6601 WESTFORD PLACE, STE. 101

q Corrected q 2nd TIN noticeCANFIELD, OH 44406

2014 Form 1099-B: Proceeds from Broker and Barter Exchange TransactionsOMB No. 1545-0715

Reported to the IRS is proceeds less commissions and option premiums.Covered ( Box 5 is not checked)

Description of property (Box 1a)

Federal StateCusip Date Sold Date Form 8949 Cost or Code Net Gain Income TaxNumber or Disposed Acquired Checkbox Proceeds Other Basis if any Adjustments or Loss Tax Withheld Withheld

(Box 1c) (Box 1 b) (Box 1d) (Box 1 e) (Box 10 (Box 1g) (Box 4) (Box 16)120.0 VALERO ENERGY CORP NEW

91913Y100 01/17/2014 03/07/2013 A 6,145.69. 5,119.96...... 0.00 1,025.73 0.00 0.00-

804.829 VANGUARD REIT INDEX FUND SIGNAL SHARES

921908836 01/13/2014 02/19/2013- - - - --- - ...... ...... - ---- --- -- ------ ---- - -- -

A- - - -

20,000.00- -

21,247.49 0.00 -1,247.49- - -- 0.00

---- - 0.00

244.5 WASHINGTON PRIME GROUP INC

939647103 07/02/2014 03/05/2014- - -- - -- -- - - - -- - - - - -

A- - -

4,621.07----- ------ 4,674.73 0.00 -53.66 0.00

-- - 0:00.

15.5 WASHINGTON PRIME GROUP INC

939647103 07/02/2014 03/05/2014 A 292.95 296.35 0.00 :3.40 0.00 0.00

1733.0 WELLPOINT INC

94973V107 01/17/2014 Various.. ... --- . --

A 148,917.73 155,284.95 0.00 -6,367.22 0.00. - ----

0.00. --

Total Short Term Sales Reported on 1099-B 5,193 , 267.37 4,902,178 . 03 0.00 291 , 089.34 0 . 00 0.00

Report on Form 8949 , Part 1, with Box A checked

Long Term Sales Reported on 1099-B4445.0 ALLSTATE CORP COM

020002101 03/05/2014 02/07/2013-- - ----- ------- - - ----- ---- - - - - - - -- - - -- ------ - - --D- --

242,911.46- ---- - .200,278:36 - - 0.00 42,633.10

--- -- 0.00 - --.... 0.00

250 0 ALLSTATE CORP COM

020002101 03/05/2014 02/07/2013.... ------ - --- D- ---- 13,662.06- - .

11,264.25- 0.00 2,397.81

. 0.00 0.00

This is important tax information and is being furnished to the Internal Revenue Service (except as indicated). If you are required to file a return, anegligence penalty or other sanction may be imposed on you if this income is taxable and the IRS determines that it has not been reported. The

taxpayer is ultimately responsible for the accuracy of their own tax return.

2014 Tax Information Statement

Payer's Name and Address:FARMERS TRUST COMPANY42 MCCLURG ROADYOUNGSTOWN, OH 44512

Account Number:

Recipient ' s Tax ID Number:Payer 's Federal ID Number:

Payer 's State ID Number:State:

q Corrected

65004701234-1853367

34-1853512

OH

q 2nd TIN notice

Page 16 of 48Recipient ' s Name and Address : Ref: KPBMARION G. RESCH FOUNDATIONC/O PACKER THOMASATTN: KAREN COHEN6601 WESTFORD PLACE, STE. 101CANFIELD, OH 44406

2014 Form 1099 -B: Proceeds from Broker and Barter Exchange TransactionsOMB No. 1545-0715

Reported to the IRS is proceeds less commissions and option premiums.

Covered ( Box 5 is not checked)

Description of property (Box 1a)

Federal StateCusip Date Sold Date Form 8949 Cost or Code Net Gain Income TaxNumber or Disposed Acquired Checkbox Proceeds Other Basis if any Adjustments or Loss Tax Withheld Withheld

(Box 10 (Box 1b) (Box 1d) (Box 1 e) (Box if) (Box 1 g) (Box 4) (Box 16)762.0 AMERISOURCEBERGEN CORP

03073E 105 01/17/2014 12/10/2012 D --- . --- 53,720.1-4 ... ...32,339.66 --- ---- ----- -- -- 0.00- ... - - -- ---21,380.48..... ...... ...... .0.00...... ..... --- O.P .O.

1140.0 AMERISOURCEBERGEN CORP

03073E105 10/15/2014 Various D 85,454.56 46,808.70 0.00 38,645.86 0.00 0.00

100.0 AMERISOURCEBERGEN CORP

03073E105 10/15/2014 12/07/2012 D 7,496.01 4,236.99 0.00 3,259:02 0.00 0.00

185.0 ASHLAND INC NEW

044209104 01/17/2014 10/18/2012 D ...18,292.48- . 13,162.71 .. ----0.00 5,129.77...... ..... ..0.00...... .... 0.00... . ..-

1585.0 ASHLAND INC NEW

044209104 02/18/2014 10/18/2012. D. 151,955.11- ...... .-- 112,772.44 . . ..... 0.00 .... -- -- 39,182.67 . .. ....... .. .. 0.00--- . ...... .. ..0.00

105.0 ASHLAND INC NEW

044209104 02/18/2014 10/18/2012 D 10,066.43 7,470.73 0.00 2,595.70 0.00 0.00

2951.0 AUTOMATIC DATA PROCESSING

053015103 01/17/2014 01/15/2013 D 235,600.19 1.74,698.90 0.00 -. 60,901.29- ..... - 0.00...... 0.00.1974.0 AUTOMATIC DATA PROCESSING

053015103 08/06/2014 Various--- --- ---

D 158,452.63 127,517.89. -- . 0.00 30,934.74 0.00

... 0.00

This is important tax information and is being furnished to the Internal Revenue Service (except as indicated). If you are required to file a return, anegligence penalty or other sanction may be imposed on you if this income is taxable and the IRS determines that it has not been reported. The

taxpayer is ultimately responsible for the accuracy of their own tax return.

2014 Tax Information StatementPage 17 of 48

Payer ' s Name and Address : Account Number : 650047012 Recipient 's Name and Address : Ref: KPBFARMERS TRUST COMPANY Recipient ' s Tax ID Number: 34-1853367 MARION G. RESCH FOUNDATION42 MCCLURG ROAD Payer 's Federal ID Number: 34-1853512 C/O PACKER THOMASYOUNGSTOWN, OH 44512 Payer 's State ID Number : ATTN: KAREN COHEN

State : OH 6601 WESTFORD PLACE, STE. 101

q Corrected q 2nd TIN noticeCANFIELD, OH 44406

2014 Form 1099-B: Proceeds from Broker and Barter Exchange TransactionsOMB No. 1545-0715

Reported to the IRS is proceeds less commissions and option premiums.Covered ( Box 5 is not checked)

Description of property (Box 1a)

Federal StateCusip Date Sold Date Form 8949 Cost or Code Net Gain Income TaxNumber or Disposed Acquired Checkbox Proceeds Other Basis if any Adjustments or Loss Tax Withheld Withheld

(Box 1 c) (Box 1b) (Box 1 d) (Box 1 e) (Box 1 f) (Box 1g) (Box 4) (Box 16)255.0 AUTOMATIC DATA PROCESSING

053015103 08/06/2014 Various D. .. ... - 20,468.81 . -- -- . --- 16,801:67 0.00 . . . .. .3,667:14 -- -- ..... .0.00 ..... ....... ..0..0 .0.

3887.0 CBS CORP NEW B

1-248--5720--2--- ....0.4/29/2.01.4.. -02/07/-- 201-3- --222,795.97 ----- ..... 163,105-.13 -- ----- --- -- --0.00 9,690.84 . ... . 0.00. ..... ---- .._ 0.00-

290.0 CBS CORP NEW B

124857202 04/29/2014 02/07/2013 D 16,622.29 12,168.89 - 0.00 4,453.40 0.00 0.00

5475.0 CINCINNATI FINANCIAL CORP

172062101 01/17/2014 01/15/2013 _- _D 275,022.52 224,935.45 0.00 50,087.07 0.00 0.00

3459.0 CISCO SYS INC COM

17275.102 - - . -- 03/28/2014 03/07/2013 --- D. 77,457.05- ---- -------- 75,800.18 0.00 ---- .1,656.87 ... . ..... .... 0.00.---- 0.00

290.0 CISCO SYS INC COM

1727511102 03/28/2014 03/07/2013 D 6,493.94 6,355.03 0.00 138.91 0.00 0.00

95.0 CITIGROUP INC NEW

172967424-- - ----------

07/15/2014 04/16/2013- -- -- ... - - - - - - --

D- - - - ----

4,674.82- - - .. ..

4,421.10. - 0.00 253.72

- ---- - 0.00. -- 0.00

-- --7115.0 CONOCOPHILLIPS

20825C104 01/17/2014 Various-- ---- ----- -- -- ----- ----

D 483,148.46 409,323.05.

0.00 73,825.41. . - 0.00 0.00

This is important tax information and is being furnished to the Internal Revenue Service (except as indicated). If you are required to file a return, anegligence penalty or other sanction may be imposed on you if this income is taxable and the IRS determines that it has not been reported. The

taxpayer is ultimately responsible for the accuracy of their own tax return.

2014 Tax Information Statement

Payer 's Name and Address:FARMERS TRUST COMPANY42 MCCLURG ROADYOUNGSTOWN, OH 44512

Account Number:Recipient's Tax ID Number:Payer's Federal ID Number:Payer's State ID Number:State:

q Corrected

650047012

34-185336734-1853512

OH

q 2nd TIN notice

Page 18 of 48Recipient 's Name and Address : Ref: KPBMARION G. RESCH FOUNDATIONC/O PACKER THOMASATTN: KAREN COHEN6601 WESTFORD PLACE, STE. 101CANFIELD, OH 44406

2014 Form 1099 -B: Proceeds from Broker and Barter Exchange TransactionsOMB No. 1545-0715

Reported to the IRS is proceeds less commissions and option premiums.

Covered ( Box 5 is not checked)

Description of property (Box 1a)

Federal StateCusip Date Sold Date Form 8949 Cost or Code Net Gain Income TaxNumber or Disposed Acquired Checkbox Proceeds Other Basis if any Adjustments or Loss Tax Withheld Withheld

(Box 1c) (Box 1b) (Box 1d) (Box le) (Box 10 (Box 1g) (Box 4) (Box 16)10540.0 D R HORTON INC

23331A109 09/24/2014 08/07/2013 D 218,859.30 --. . --- .201,661.82 . ...... 0.00-- 17E197.48 -- - ---- .0.00--- .. -- -- ... 0.00

645.0 D R HORTON INC

23331A109 09/24/2014 08/07/2013 D 13,393.19 12,340.79 0.00 1,052.40 0.00 0.00

769.0 EBAY INC

278642103 03/28/2014 10/12/2012 D 42,520.91 36,928.69 0.00 5,592.22 0.00 0.00

42.0 EBAY INC

278642103 03/28/2014 10/16/2012 D 2,322.34 2,030.28 0.00 292.06 0.00 0.00

1480.0 EBAY INC

278642103 06/03/2014 10/12/2012 D 74,693.06 - 71,072.12 0.00 - 3,620.94 0.00 0.00

80.0 EBAY INC

278642103 06/03/2014--- ------ ... -

Various-- - - --- - ----

D--- --

4,037.46.. .. --

4,162.13- -- .. - - ----

0.00..

-124.67. --- ----•- . -- ...... 0.00

----•• . . ...... ...... 0.00-•--- ...... -- .

1986.0 EBAY INC

278642103.. -- ....

08/21/2014. ---- -- --

10/12/2012- ----- -----

D--

110,760.34 95,371,09. --- ------ .

0.00 15,389.25 0.00 0.00

163.0 EBAY INC

278642103 08/21/2014 Various -- D 9,090.60 .7,842.81 ...... - 0.00 1,247.79 0.00 0:00

This is important tax information and is being furnished to the Internal Revenue Service (except as indicated). If you are required to file a return, anegligence penalty or other sanction may be imposed on you if this income is taxable and the IRS determines that it has not been reported. The

taxpayer is ultimately responsible for the accuracy of their own tax return.

2014 Tax Information Statement

Payer's Name and Address:FARMERS TRUST COMPANY42 MCCLURG ROADYOUNGSTOWN, OH 44512

Account Number:Recipient's Tax ID Number:Payer's Federal ID Number:Payer's State ID Number:State:

q Corrected

65004701234-1853367

34-1853512

OH

q 2nd TIN notice

Page 19 of 48Recipient ' s Name and Address : Ref: KPBMARION G. RESCH FOUNDATIONC/O PACKER THOMASATTN: KAREN COHEN6601 WESTFORD PLACE, STE. 101CANFIELD, OH 44406

2014 Form 1099 -B: Proceeds from Broker and Barter Exchange TransactionsOMB No. 1545-0715

Reported to the IRS is proceeds less commissions and option premiums.Covered ( Box 5 is not checked)

Description of property (Box 1a)

Cusip Date Sold Date Form 8949 Cost or Code Net GainNumber or Disposed Acquired Checkbox Proceeds Other Basis if any Adjustments or Loss

(Box 1c) (Box 1b) (Box id) (Box 1 e) (Box 10 (Box 1g)131 14.277 FIDELITY CAPITAL & INCOME

Federal StateIncome Tax

Tax Withheld Withheld

(Box 4) (Box 16)

316062108 . - 07/25 / 2014 --Various...--. .D-- -1-33, 503.34 ---- 1-28,746.87------ ------ -- ------ -- 0.00 .----- -- 4,756 . 47 . - 0.00 - - 0.00

3595.942 FIDELITY CAPITAL & INCOME

316062108 12/24/2014 Various------ ------- D ... - 34,808.72... ... 34 , 733.49 0.00 ... ...... --- 75.23..---- -- ...... -- 0.00 ----- ..... -- 0.00

4019 . 831 HARBOR INTERNATIONAL FUND INST

411511306 06/05 / 2014 05 / 22/2012 D 300,000.00 257,946 . 99... . -. 0.00 42,053.01 0.00 ------ .... 0.00

8478.808 HARBOR INTERNATIONAL FUND INST

411511306 09/23/2014 Various D 594,279.66 544,073.36

1107.069 HARBOR INTERNATIONAL FUND INST

411511306 09/23/2014 01/18/2013 D 77,594.47 70,000.00

460.0 HELMERICH & PAYNE

..... 0.00...... . -- . 50,20. 6..30...... -- . -- .... .0.00----- ---- ----0.00.

0.00 • 7, 594.47-•- 0.00 0.00

423452101 12/15/2014 11/21/2013 D 28,233.48 .......... --36,443.64..... . ---- 0.00 _8,210.16 ........ .. ...... 0.00 0:00

90.0 HELMERICH & PAYNE

423452101 ....1.2./.1.5/2.0.1.4..11/21/2.013 D-- ------ - ------ ------5,523.94 . ----- 7,130.28. . . --.. ------ . ...... 0.00 --.... .-l .,.60 .6.34 ...... -- . ...... 0.00 0.00

150.0 HERSHEY FOODS CORP COM

427866108 01/17/2014 12/07/2012 D ------ ---..14,840.85 -- ----- 10,804.65 -- ---- -- ------ ---- 0.00-..-- ,036.20....-- -- -- ..... 0.00 0.00----- . ....

This is important tax information and is being furnished to the Internal Revenue Service (except as indicated ). If you are required to file a return, anegligence penalty or other sanction may be imposed on you if this income is taxable and the IRS determines that it has not been reported. The

taxpayer is ultimately responsible for the accuracy of their own tax return.

Payer's Name and Address:FARMERS TRUST COMPANY42 MCCLURG ROADYOUNGSTOWN, OH 44512

2014 Tax Information Statement

Account Number:Recipient's Tax ID Number:Payer's Federal ID Number:Payer's State ID Number:State:

q Corrected

65004701234-185336734-1853512

OH

q 2nd TIN notice

Page 20 of 48Recipient ' s Name and Address : Ref: KPBMARION G. RESCH FOUNDATIONC/O PACKER THOMASATTN: KAREN COHEN6601 WESTFORD PLACE, STE. 101CANFIELD, OH 44406

2014 Form 1099-B: Proceeds from Broker and Barter Exchange TransactionsOMB No. 1545-0715

Reported to the IRS is proceeds less commissions and option premiums.Covered ( Box 5 is not checked)

Description of property (Box 1a)

Federal StateCusip Date Sold Date Form 8949 Cost or Code Net Gain Income TaxNumber or Disposed Acquired Checkbox Proceeds Other Basis if any Adjustments or Loss Tax Withheld Withheld

(Box 1 c) (Box 1 b) (Box 1d) (Box 1 e) (Box 10 (Box 1g) (Box 4) (Box 16)396 0 HERSHEY FOODS CORP COM

427-86

--6

-108

- -03/28/20

--1

-4

-1

-2/07/20

--1

-2

---- -- - ..... ------- ----- ----- -----

- - -401.8 -29.19 _ -- .. 281.524.28 - ,00 2L304.91 .00- ......-- -

. -- - 0.00

15840 HERSHEY FOODS CORP COM

427866108 06/25/2014 12/07/2012 D 153,766.41 114,097.10 0.00 39,669.31 0.00 0.00

160.0 HONEYWELL INTERNATIONAL INC

438516106. -------- ..

01/17/2014 06/29/2012------ ... . . ------ ---- ------ ---- --- --- D

-- -14,397.34 8,874.66

- - 0.00 5,522.68- -- 0.00

-- -- .000

20.0 INTERNATIONAL BUSINESS MACHINES

459200101 10/22/2014 05/10/2011 D 3,241.23 3,391.13 0.00 _149.90 0.00 0:00

1364.0 INVESCO PLC NEW

G491BT108 01/17/2014 01/15/2013 D 47,938.03 37,619.12 0.00 10,318.91 0.00 0.00

1115.0 INVESCO PLC NEW

G491BT108 06/04/2014 01/15/2013 D 41,412.64 30,751.70 0.00 10,660.94 0.00 0.00

75.0 INVESCO PLC NEW

G491BT108- --- -------•--

06/04/2014 01/15/2013- --- -- -- --- ------- ---- -

D 2,785.60 2,068.50 0.00 717.10• ..... 0.00 0.00

3041.0 INVESCO PLC NEW

G491BT108 08/14/2014 01/15/2013 D 118,042.62 83,870.78 0.00 34,171.84 0.00 0.00

This is important tax information and is being furnished to the Internal Revenue Service (except as indicated). If you are required to file a return, anegligence penalty or other sanction may be imposed on you if this income is taxable and the IRS determines that it has not been reported. The

taxpayer is ultimately responsible for the accuracy of their own tax return.

Payer's Name and Address:FARMERS TRUST COMPANY42 MCCLURG ROADYOUNGSTOWN, OH 44512

2014 Tax Information Statement

Account Number:Recipient's Tax ID Number:Payer's Federal ID Number:Payer's State ID Number:State:

q Corrected

650047012

34-1853367

34-1853512

OH

q 2nd TIN notice

Page 21 of 48Recipient ' s Name and Address : Ref: KPBMARION G. RESCH FOUNDATIONC/O PACKER THOMASATTN: KAREN COHEN6601 WESTFORD PLACE, STE. 101CANFIELD, OH 44406

2014 Form 1099 -B: Proceeds from Broker and Barter Exchange TransactionsOMB No. 1545-0715

Reported to the IRS is proceeds less commissions and option premiums.Covered ( Box 5 is not checked)

Description of property (Box 1a)

Federal StateCusip Date Sold Date Form 8949 Cost or Code Net Gain Income TaxNumber or Disposed Acquired Checkbox Proceeds Other Basis if any Adjustments or Loss Tax Withheld Withheld

(Box 1 c) (Box 1 b) (Box 1d) (Box le) (Box 10 (Box 1g) (Box 4) (Box 16)240.0 INVESCO PLC NEW

G491BT108 08/14/2014 01/15/2013 D -- - - -- -- 9,316.09 .6,61-9.20 . ....... 0.00 2,696,89 0.00 .... - O.P .O.

168.0 KINDER MORGAN INC CLASS P

49456B101 05/14/2014 04/19/2013-•- -- •---• ---• • -•--- ---

D--- ----

5,565.28..

6,478.07 0.00 -912.79•-•--- -- . ..... 0.00....... -- . -- ........ 0.00.... -- --.. ...

5840.0 KROGER CO

501044101 01/15/2014 05/09/2012 D 230,235.07 134,143.05 0.00 ----- ---. 96,092.02-- .. .... 0.00 0.00

310.0 KROGER CO

501044101. ....... 01/15/2014 05/09/2012

-----• ---- ....... ------D

. -- -- . ---12,221.38 7,120.61 0.00• ..... . .

5,100.77... .. ..... ... . .. ..

0.00......... ...... ....

0.00.. ... . ... ....

7040.0 LEGGETT & PLATT

524660107 07/09/2014 Various D 239,465.93 238,267.99 0.00 1,197.94 0.00 0.00

395.0 LEGGETT & PLATT

524660107 07/09/2014 04/25/2013---- .. . . ---- ... .. . ----- --- - - --

D- -- . ...

13,435.94 13,374.74 0.00 61.20. -•- ..... .--- ---- 0.00.......... . -- ----- 0.00...... ... ...

1220.0 PARKER-HANNIFIN CORP

701094104---....---- 05/07/2014 04/24/2013 D

.. ...150,072.54

..... ..108,846.81

. ... ..... ... . . 0.00. ---- --•-•- ---- .. .41,225.73

. ---- ...... --•-- . ---- 0.00. ---- --......... ... 0.00---- . -----.....

101.0 PARKER-HANNIFIN CORP

701094104- -------------

05/07/2014 04/24/2013-- -----

D 12,424.04 9,011.09 0.00 3,412.95. -- ...... 0.00.. --- ---- -••--- ...... 0.00

---- . --- -- •--•