Return of Private Foundation990s.foundationcenter.org/990pf_pdf_archive/810/810504215/8105… ·...

Transcript of Return of Private Foundation990s.foundationcenter.org/990pf_pdf_archive/810/810504215/8105… ·...

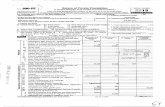

• Form 990-PF Return of Private Foundationor Section 4947(a)(1) Nonexempt Charitable Trust

• Treated as a Private FoundationDepart ment of the Treasury

Inter?jI Revenue Service Note: The foundation may be able to use a copy of this return to satisfy state reporting re

For calendar year 2007, or tax year beginning , 2007, and ending , 20

G Check all that apply: q Initial return q Final return q Amended return q Address change q Name change

CJ)

Z

ci

b.^

rv

Use the IRS Name of foundation A Employer identification number

label. The William H and Margaret M Wallace Foundation 81-0504215Otherwise , Number and street ( or P 0 box number if mail is not delivered to street address) Room/suite B Telephone number (see page 10 of the instructions)

printor type c/o Greg Hanson PO Box 7909 406-523-2500.

See Specific City or town , state, and ZIP code C If exemption application is pending, check here ► qInstructions . Missoula MT 59807-7909 D 1. Foreign organizations , check here ► q

H Check type of organization, ® Section 501 (c)(3) exempt private foundation 2. Foreign organizations meeting the 85% test,k h d h t th tt qq Section 4947 (a)(1) nonexempt charitable trust q Other taxable private foundation ere an a ac compu a ion .c ec

I Fair market value of all assets at end J Accounting method . ® Cash q AccrualE If private foundation status was terminated

under section 507(b)( 1)(A), check here ► q

of year (from Part fl, col (c), q Other (specify) F If the foundation is in a 60 - month terminationqline 16) ► $ 7, 5 07 , 8 52 . 0 0 (Part 1, column (d) must be on cash basis ) under section 507(b)( 1)(B), check here ►

Analysis of Revenue and Expenses (The total of (a) Revenue and (d ) Disbursements

amounts in columns (b), (c), and (d) may not necessanly equal expenses per (b ) Net investment ( c) Adjusted net for chartable

amounts in column (a) (see page 11 of the instructions)) booksmeincome i ncome purposes

(cash basis only)

received (attach schedule)grants etc1 Contributions gifts , ,, ,

2 Check ► ® if the foundation is not required to attach Sch. B

3 Interest on savings and temporary cash investments 127,132.00 127,132.00

4 Dividends and interest from securities 163 076.00 163 076.00

5a Gross rents . . . . . . . . . .b Net rental income or (loss)

6a Net gain or (loss ) from sale of assets not on line 10

b Gross sales price for all assets on line 6aWIMI VV Ile

y line 2)7 Capital gain net income (from Part IV 199, 127.00

IX,

8 Net short-term capital gain . . . . . .

d f tI ncome mo i ica ions .9 . . . . .

10a Gross sales less returns and allowances

b Less: Cost of goods sold

c Gross profit or (loss ) (attach schedule) 0.00. .

11 Other income (attach schedule) . . . .12 Total . Add lines 1 through 11 290 208.00 489 335.00 0.00

directors trustees etc.13 Compensation of officersin ,, ,

14 Other employee salaries and wages

employee benefits15 Pension plansCL ,

x 16a Legal fees (attach schedule) 1,797.00 1,797.00 11797.00

w

.

b Accounting fees (attach schedule ) 3,596.00 3,596.00 3,596.00

Z

. . .

c Other professional fees (attach schedule) 3,118-00 3 , 118 .00 3,118.00

Interest17

18 Taxes (attach schedule ) (see page 14 of the instructions ) 6,936.00 6,936-00

E 19 Depreciation (attach schedule) and depletion

20 Occupancy . . . . . . . . . . .and meetings21 Travel conferences ,, . . .

22 Printing and publications . . . . . .

t 23 Other expenses (attach schedule) . . . .

24 Total operating and administrative expenses.y Add lines 13 through 23 15 447.00 15 447.00 0 00 8 , 511 00

C grants paid25 Contributions gifts 300 , 000 00, , . . . .26 Total expenses and disbursements . Add lines 24 and 25 15 4 4 7. 0 0 15 4 447.00 0.00 308 4 511.00

27 Subtract line 26 from line 12:

a Excess of revenue over expenses and disbursements 274,761.00

b Net investment income ( if negative , enter -0-) 473 888.00

c Adjusted net income ( if negative , enter -0-) 0 . 00

OMB No 1545-0052

2007

For Privacy Act and Paperwork Reduction Act Notice, see page 30 of the instructions . Form 990-PF (2007) 4ISA

STF LLPH1001 1

Form 990-PF (2007) Page 2

Attached schedules and amounts in the description columnSh• B l t

Beginning of year End of yearance, a ee s should be for end-of -year amounts only (See instructions ) ( a) Book Value ( b) Book Value ( c) Fair Market Value

1 Cash-non - interest -bearing . . . . . . . . . . . 0 3 , 153 3 , 153

2 Savings and temporary cash investments . . . . _ 2 , 194 , 421 1,973,463 1,973,463

3 Accounts receivable ►Less: allowance for doubtful accounts ►

4 Pledges receivable ►Less: allowance for doubtful accounts ►

5 Grants receivable . . . . . . . . . . . . . .

6 Receivables due from officers , directors , trustees, and otherdisqualified persons (attach schedule) (see page 16 of theinstructions ) . . . . . . . . . . . . . . . .

7 Other notes and loans receivable ( attach schedule) ►Less : allowance for doubtful accounts ►

w 8 Inventories for sale or use . . . . . . . . . . .Q 9 Prepaid expenses and deferred charges . . . . . .

10a Investments-U S. and state government obligations (attach schedule)b Investments-corporate stock (attach schedule) . . . 5 , 029 , 458 5 , 532 , 078 5 , 531 , 236

c Investments-corporate bonds (attach schedule) . . . .

11 Investments-land, buildings , and equipment basis ►Less accumulated depreciation ( attach schedule) ►

12 Investments-mortgage loans . . . . . . . . . .

13 Investments-other (attach schedule) . . . . . . .

14 Land , buildings, and equipment- basis ►Less accumulated depreciation ( attach schedule) ►

15 Other assets (describe ►16 Total assets (to be completed by all filers-see the

instructions . Also, see page 1, item I) . 7,223,879.00 7,508,694.00 7,507,852 00

17 Accounts payable and accrued expenses . . . . . .

o 18 Grants payable . . . . . . . . . . . . . . .

19 Deferred revenue . . . . . . . . . . . . . .

20 Loans from officers , directors, trustees, and other disqualified persons

21 Mortgages and other notes payable (attach schedule) .

22 Other liabilities (describe ►23 Total liabilities (add lines 17 through 22) 0.00 0.00

Foundations that follow SFAS 117, check here ► q

ai and complete lines 24 through 26 and lines 30 and 31.

24 Unrestricted . . . . . . . . . . . . . . . .

25 Temporarily restricted . . . . . . . . . . . . .

26 Permanently restricted . . . . . . . . . . . .

c Foundations that do not follow SFAS 117 , check here ► qand complete lines 27 through 31.

p 27 Capital stock , trust principal , or current funds- . . . . .

28 Paid - in or capital surplus, or land, bldg., and equipment fund

N 29 Retained earnings, accumulated income, endowment , or other funds 7, 223 , 879.00 7 , 508 , 694.00N< 30 Total net assets or fund balances (see page 17 of they instructions) . . . . . . . . . . . . . . 7, 223, 879.00 7,508,694 00

Z 31 Total liabilities and net assets/fund balances (see page 17 of theinstructions ) -,223,879.00 , 7,508,694.00 ,

Analysis of Changes in Net Assets or Fund Balances

1 Total net assets or fund balances at beginning of year-Part II, column (a), line 30 (must agree withend-of-year figure reported on prior year ' s return) . . . . . . . . . . . . . . . . 1 7,223,879.00

2 Enter amount from Part I , line 27a . . . . . . . . . . . . . . . . . . . 2 274,761.00

3 Other increases not included in line 2 ( itemize) ► 3

4 Add lines 1, 2, and 3 . . . . . . . . . . . . . . . . . . . . . . . . 4 7, 498, 640.00

5 Decreases not included in line 2 (itemize) ► 56 Total net assets or fund balances at end of year ( line 4 minus line 5)-Part II, column (b), line 30 6 7,498,640.00

Form 990-PF (2007)

STF LLPH1001 2

Form 990-PF (2007) Page 3

Capital Gains and Losses for Tax on Investment Income

(a) List and describe the kind (s) of property sold (e g real estate,2-story brick warehouse , or common stock, 200 shs MLC Co )

(b) How acquiredP-PurchaseD-Donation

( c) Date acquired( mo, day, yr)

( d) Date sold(mo, day, yr)

1a Schedules attached

bc

d

e

(e) Gross sales price ( 1) Depreciation allowed(or allowable)

(g) Cost or other basisplus expense of sale

( h) Gain or (loss)(e) plus (f) minus (g)

a 0.00

b

c

d

eComplete only for assets showing gain in column ( h) and owned by the foundation on 12/31/69

(1) Ga (Col h nn

(Q F M V as of 12/31/69 (j) Adjusted basisas of 12/31/69

( k) Excess of col (i)over col 0), if any

) gaii s ( minuscol (k),

bu tno

l ess than -0-) orLoss es (from col (h))

a

bc

de

2 Capital gain net income or (net capital loss)If gain, also enter in Part I, Ilne 7If (loss), enter -0- in Part I, line 7 } 2 199,127 00

3 Net short-term capital gain or (loss) as defined in sections 1222 (5) and (6):

If gain , also enter in Part I , line 8, column (c) (see pages 13 and 17 of the instructions).If (loss), enter -0- in Part I, line 8 3

Qualification Under Section 4940 ( e) for Reduced Tax on Net Investment Income

(For optional use by domestic private foundations subject to the section 4940(a) tax on net investment income.)

If section 4940(d)(2) applies, leave this part blank.

Was the foundation liable for the section 4942 tax on the distributable amount of any year in the base period" q Yes q NoIf "Yes," the foundation does not qualify under section 4940(e). Do not complete this part.

1 Enter the appropriate amount in each column for each year; see page 18 of the instructions before making any entries( a )

Base period yearsCalendar year (or tax year beginning in)

Adjusted qualifying distributions Net value of nonchantable - use assets( d )

Distribution ratio(col (b) divided by col (c))

2006 298,097 00 7,223,879.00 0 0413

2005 96,258.00 1,909,010 00 0 0504

2004 50,000.00 1,830,422.00 0.0273

2003 210,000.00 2,034,386.00 0.1032

2002 3,000 00 377,250.00 0 0080

2 Total of line 1, column (d) . . . . . . . . . . . . . . . . . . . . 2 0 2302.

3 Average distribution ratio for the 5-year base period-divide the total on line 2 by 5, or by thenumber of years the foundation has been in existence if less than 5 years . . . . 3 .04608

4 Enter the net value of noncharitable - use assets for 2007 from Part X, line 5 . . . . . . 4 7 , 431 , 583.00

5 Multiply line 4 by line 3 . . . . . . . . . . . . . . . . . . . . . . . 5 342,447 34

6 Enter 1 % of net investment income (1 % of Part I , line 27b) . . . . . . . . . 6 4,839.00

7 Add lines 5 and 6 . . . . . . . . . . . . . . . . . . . . . . . 7 347,286.34

8 Enter qualifying distributions from Part XII , line 4 . . . . . . . . . . . . . 8 308, 511.00

If line 8 is equal to or greater than line 7, check the box in Part VI, line 1 b, and complete that part using a 1 % tax rate. Seethe Part VI instructions on page 18.

Form 990-PF (2007)STF LLPH1001 3

Form 990-PF (2007) Page 4

EMM Excise Tax Based on Investment Income ( Section 4940 ( a), 4940(b), 4940 ( e), or 4948-see page 18 of the instructions)

1 a Exempt operating foundations described in section 4940(d)(2), check here ► q and enter "N/A" on line 1. 1

Date of ruling letter. (attach copy of ruling letter if necessary-see instructions) ..

b Domestic foundations that meet the section 4940(e) requirements in Part V, check

here ► q and enter 1% of Part I, line 27b . . . . . . . . . . . . . . . .

1

c All other domestic foundations enter 2% of line 27b. Exempt foreign organizations enter 4% ... ..... .- w, .of Part I, line 12, col. (b)

2 Tax under section 511 (domestic section 4947(a)(1) trusts and taxable foundations only. Others enter -0-) 2 9,478. 00

3 Add lines 1 and 2 . . . . . . . . . . . . . . . . . . . . . . . . 3 9,478.00

4 Subtitle A (income) tax (domestic section 4947(a)(1) trusts and taxable foundations only Others enter -0-) 4

5 Tax based on investment income . Subtract line 4 from line 3. If zero or less, enter -0- 5 91478.00

6 Credits/Payments:

a 2007 estimated tax payments and 2006 overpayment credited to 2007 6a 7,841.00

b Exempt foreign organizations-tax withheld at source . . . . 6b

c Tax paid with application for extension of time to file (Form 8868) 6c

d Backup withholding erroneously withheld . . . . . . 6d A

7 Total credits and payments. Add lines 6a through 6d . . . . . . . . . . . . 7 7 , 841.00

8 Enter any penalty for underpayment of estimated tax. Check here q if Form 2220 is attached 8

9 Tax due. If the total of lines 5 and 8 is more than line 7, enter amount owed . . . . . ► 9 1,637.00

10 Overpayment . If line 7 is more than the total of lines 5 and 8, enter the amount overpaid ► 10 0.00

11 Enter the amount of line 10 to be- Credited to 2008 estimated tax ► Refunded ► 11 0.00'statements Regarding Activities

1a During the tax year did the foundation attempt to influence any national state or local legislation or did it Yes No, , ,

participate or intervene in any political campaign? . . . . . . . . . . . . . . . . . 1a x

b Did it spend more than $100 during the year (either directly or indirectly) for political purposes (see page 19

of the instructions for definition)? . . . . . . . . . . . . . . . . . . . . . . . . lb x

If the answer is "Yes" to la or 1b, attach a detailed description of the activities and copies of any materials

published or distributed by the foundation in connection with the activities

c Did the foundation file Form 1120-POL for this year? . . . . . . . . . . . . . . . . . 1c x

d Enter the amount (if any) of tax on political expenditures (section 4955) imposed during the year:

(1) On the foundation. ► $ 0 (2) On foundation managers. ► $ 0

e Enter the reimbursement (if any) paid by the foundation during the year for political expenditure tax imposed on

foundation managers. ► $ 0

2 Has the foundation engaged in any activities that have not previously been reported to the IRS? . . . 2 x

If "Yes," attach a detailed description of the activities

3 Has the foundation made any changes, not previously reported to the IRS, in its governing instrument, articles of

incorporation, or bylaws, or other similar instruments? If "Yes,' attach a conformed copy of the changes . 3 x. .

4a Did the foundation have unrelated business gross income of $1 000 or more during the year" 4a x,

b If "Yes," has it filed a tax return on Form 990-T for this year? . . . . . . . . . . . 41b,

5 Was there a liquidation, termination, dissolution, or substantial contraction during the year? . . . . 5 x

If "Yes," attach the statement required by General Instruction T

6 Are the requirements of section 508(e) (relating to sections 4941 through 4945) satisfied either.

• By language in the governing instrument, or -

• By state legislation that effectively amends the governing instrument so that no mandatory directions that

conflict with the state law remain in the governing instrument? 6 x. . . . . . . . . . . .

7 Did the foundation have at least $5,000 in assets at any time during the year? If 'Yes " complete Part Il col (c) and PartXV 7 x, ,,

8a Enter the states to which the foundation reports or with which it is registered (see page 19 of the

instructions) ► Montana

b If the answer is "Yes" to line 7, has the foundation furnished a copy of Form 990-PF to the Attorney General - . :..

(or designate) of each state as required by General Instruction G7 If "No " attach explanation . . . . 8b x,

9 Is the foundation claiming status as a private operating foundation within the meaning of section 49420)(3)

or 4942(j)(5) for calendar year 2007 or the taxable year beginning in 2007 (see instructions for Part XIV onpage 27)? If "Yes," complete Part XIV . . . . . . . . . . . . . . . . . . . . . 9 x

10 Did any persons become substantial contributors during the tax year? If "Yes, "attach a schedule listing theirnames and addresses 10 x

Form 990-PF (2007)

STF LLPH1001 4

Form 990-PF (2007 ) Page 5

Statements Regarding Activities (continued)

11a At any time during the year , did the foundation , directly or indirectly , own a controlled entity within the• meaning of section 512 (b)(13)? If " Yes," attach schedule . (see page 20 of the instructions ) . . . . . 11a x

b If "Yes ," did the foundation have a binding written contract in effect on August 17, 2006, covering the interest,

rents , royalties , and annuities described in the attachment for line 11a? . . . . . . . . . . . 11b

12 Did the foundation acquire a direct or indirect interest in any applicable insurance contract? . . . 12 x

13 Did the foundation comply with the public inspection requirements for its annual returns and exemption application? 13 x

Website address ►14 The books are in care of ► Greg L Hanson Telephone no ► 406-523-2500

Located at ► 199 W. Pine St Missoula MT ZIP+4 ► 59802

15 Section 4947(a)(1) nonexempt charitable trusts filing Form 990-PF in lieu of Form 1041-Check here . . . . ► qand enter the amount of tax -exempt interest received or accrued during the year . ► 15

Statements Regarding Activities for Which Form 4720 May Be Required

File Form 4720 if any item is checked in the "Yes" column , unless an exception applies. Yes No

1a During the year did the foundation (either directly or indirectly)-

(1) Engage in the sale or exchange, or leasing of property with a disqualified person? . q Yes ® No

(2) Borrow money from, lend money to, or otherwise extend credit to (or accept it from) adisqualified person? . . . . . . . . . . . . . . . . . . . . . . q Yes © No

(3) Furnish goods, services, or facilities to (or accept them from) a disqualified person? q Yes ® No

(4) Pay compensation to, or pay or reimburse the expenses of, a disqualified person? . . q Yes ® No

(5) Transfer any income or assets to a disqualified person (or make any of either available for

the benefit or use of a disqualified person)? . . . . . . . . . . . . . . . q Yes © No -

(6) Agree to pay money or property to a government official? (Exception . Check "No" if

the foundation agreed to make a grant to or to employ the official for a period after

termination of government service, if terminating within 90 days.) . . . . . . . q Yes ® No

b If any answer is "Yes" to 1a(1)-(6), did any of the acts fail to qualify under the exceptions described in Regulationssection 53.4941(d)-3 or in a current notice regarding disaster assistance (see page 22 of the instructions) . . 1b

Organizations relying on a current notice regarding disaster assistance check here . . . . . ► q

c Did the foundation engage in a prior year in any of the acts described in 1a, other than excepted acts, thatwere not corrected before the first day of the tax year beginning in 2007? . . . . . . . . . . . 1c x

2 Taxes on failure to distribute income (section 4942) (does not apply for years the foundation was a privateoperating foundation defined in section 4942(1)(3) or 4942()(5)):

a At the end of tax year 2007, did the foundation have any undistributed income (lines 6d and6e, Part XIII) for tax year(s) beginning before 2007 . . . . . . . . . . . . . q Yes © No

If "Yes," list the years ► 20 _ , 20 _ , 20 _ , 20

b Are there any years listed in 2a for which the foundation is not applying the provisions of section 4942(a)(2)(relating to incorrect valuation of assets) to the year's undistributed income? (If applying section 4942(a)(2)to all years listed, answer "No" and attach statement-see page 22 of the instructions.). . . . . . 2b

c If the provisions of section 4942(a)(2) are being applied to any of the years listed in 2a, list the years here.

► 20_, 20_, 20_, 20

3a Did the foundation hold more than a 2% direct or indirect interest in any businessenterprise at any time during the year? . . . . . . . . . . . . . . . . q Yes © No

b If "Yes,' did it have excess business holdings in 2007 as a result of (1) any purchase by the foundation ordisqualified persons after May 26, 1969; (2) the lapse of the 5-year period (or longer period approved by theCommissioner under section 4943(c)(7)) to dispose of holdings acquired by gift or bequest, or (3) the lapseof the 10-, 15-, or 20-year first phase holding period? (Use Schedule C, Form 4720, to determine If thefoundation had excess business holdings in 2007) . . . . . . . . . . . . . . . . . . . 3b

4a Did the foundation invest during the year any amount in a manner that would jeopardize its charitable purposes? 4a x

b Did the foundation make any investment in a prior year (but after December 31, 1969) that could jeopardize its charitable - ;purpose that had not been removed from jeopardy before the first day of the tax year beginninq in 2007 . . . . 4b x

Form 990-PF (2007)

STF LLPH1001 5

Form 990-PF (2007) Page 6

n iiiUlea statements Regarding Activities for Which Form 4720 May Be Required (continued)

5a During the year did the foundation pay or incur any amount to:

(1) Carry on propaganda, or otherwise attempt to influence legislation (section 4945(e))? q Yes ® No

(2) Influence the outcome of any specific public election (see section 4955); or to carry on, - ~ xdirectly or indirectly, any voter registration drlve9 . . . . . . . . . . . . . q Yes ® No

(3) Provide a grant to an individual for travel, study, or other similar purposes? . . . . q Yes 2 No

(4) Provide a grant to an organization other than a charitable, etc., organization described insection 509(a)(1), (2), or (3), or section 4940(d)(2)? (see page 22 of the instructions) . . . q Yes 2 No

(5) Provide for any purpose other than religious, charitable, scientific, literary, oreducational purposes, or for the prevention of cruelty to children or animals? q Yes ® No

b If any answer is "Yes" to 5a(1)-(5), did any of the transactions fail to qualify under the exceptions described inRegulations section 53 4945 or in a current notice regarding disaster assistance (see page 22 of the instructions)? 5b

Organizations relying on a current notice regarding disaster assistance check here . . . . . . ► q

c If the answer is "Yes" to question 5a(4), does the foundation claim exemption from the taxbecause it maintained expenditure responsibility for the grant? . . . . . . . . . . q Yes q No

If "Yes," attach the statement required by Regulations section 53 4945-5(d)

6a Did the foundation, during the year, receive any funds, directly or indirectly, to pay premiumson a personal benefit contract? . . . . . . . . . . . . . . . . . . . . q Yes ® No

b Did the foundation, during the year, pay premiums, directly or indirectly, on a personal benefit contract'? . . 6b xIf you answered "Yes' to 6b, also file Form 8870

7a At any time during the tax year, was the foundation a party to a prohibited tax shelter transaction? q Yes ® Nob If yes, did the foundation receive any proceeds or have any net income attributable to the transactions 7b

Information About Officers , Directors , Trustees, Foundation Managers , Highly Paid Employees,and Contractors

1 List all officers, directors , trustees , foundation managers and their compensation (see Daae 23 of the instructions).

(a) Name and address(b) Title, and average

hours per week( c) Compensation( If not paid , enter

( d) Contributions toemployee benefit plans

(e) Expense account,other allowances

devoted to position -0-) and deferred compensation

Greg--L_--Hanson---------------------------------- Pres & Dir

199 W Pine Missoula MT 59802 2 0 0 0

H-.- --J-.- --Hans-on ___ ________________________________ SecTR& Dir

P.O. Box 1962 Missoula MT 59806 neglig ible 0 0 0Gary L___Graham.................................. Director

48 Brookside Missoula MT 59802 negli g ible 0 0 0

Carol A-.- Graham-----------------------------------------------------

Director48 Brookside Missoula MT 59802 neg lig ible 0 0 0

2 Compensation of five hiqhest -paid employees ( other than those included on line 1-see oaae 23 of the instructions).If none , enter "NONE."

(a) Name and address of each employee paid more than $50,000(b) Title , and average

hours per weekdevoted to position

( c) Compensation

( d) Contributions toemployee eplans and deferred

compensation

( e) Expense account,other allowances

None-----------------------------------------------------------------

------------------------------------------------------------------

------------------------------------------------------------------

------------------------------------------------------------------

------------------------------------------------------------------

otal number of other employees paid over $50,000 ► 1

Form 990-PF (2007)

STF LLPH1001 6

Form 990-PF (2007) Page 7

jV Information About Officers , Directors , Trustees, Foundation Managers , Highly Paid Employees,and Contractors (continued)

3 • Five highest-paid independent contractors for professional services ( see page 23 of the instructions ). If none, enter"NONE."

(a) Name and address of each person pa id more than $50,000 (b) Type of service (c) Compensation

None

-------------------------------------

Total number of others receiving over $50,000 for professional services . ► 1

Summary of Direct Charitable Activities

List the foundation ' s four largest direct charitable activities during the tax year Include relevant statistical information such as the numberof organizations and other beneficiaries served , conferences convened , research papers produced, etc Expenses

1 None---------------------------------------------------------------------------------------------------------------------------

----------------------------------------------------------------------------------------------------------------------------

2----------------------------------------------------------------------------------------------------------------------------

----------------------------------------------------------------------------------------------------------------------------

3----------------------------------------------------------------------------------------------------------------------------

----------------------------------------------------------------------------------------------------------------------------

4

------------------------------------------------------------------------------------------------------------------------ ---

L;M summary of F rogram -Kelatea investments (see page 24 of the instructions)

Describe the two largest program - related investments made by the foundation during the tax year on lines 1 and 2 Amount

1 None----------------------------------------------------------------------------------------------------------------------------

----------------------------------------------------------------------------------------------------------------------------

2----------------------------------------------------------------------------------------------------------------------------

----------------------------------------------------------------------------------------------------------------------------

All other program-related investments See page 24 of the instructions

3-------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Total . Add lines 1 through 3 . ► 0.00

Form 990-PF (2007)

STF LLPH1001 7

Form 990-PF (2007) Page 8

Minimum Investment Return (All domestic foundations must complete this part. Foreign foundations,

see page 24 of the instructions.)

I Fair market value of assets not used (or held for use) directly in carrying out charitable, etc.,

purposes:

a Average monthly fair market value of securities . . . . . . . . . . . . . . . . . la 5,341,848 00

b Average of monthly cash balances . . . . . . . . . . . . . . . . . . . . . 1b 2,089,735 00

c Fair market value of all other assets (see page 25 of the instructions) . . . . . . . . . . 1c

d Total (add lines 1a, b, and c) . . . . . . . . . . . . . . . . . . . . . . . 1d 7 , 431 , 583.00

e Reduction claimed for blockage or other factors reported on lines 1a and

1c (attach detailed explanation) . . . . . . . . . . . . le

2 Acquisition indebtedness applicable to line 1 assets . . . . . . . . . . . . . . . . 2

3 Subtract line 2 from line 1d . . . . . . . . . . . . . . . . . . . . . . . . 3 7 431, 583.00

4 Cash deemed held for charitable activities. Enter 1 '/2 % of line 3 (for greater amount , see page 25

of the instructions) . . . . . . . . . . . . . . . . . . . . . . . . . 4

5 Net value of noncharitable -use assets . Subtract line 4 from line 3. Enter here and on Part V, line 4 5 7, 431, 583.00

6 Minimum investment return . Enter 5 % of line 5 6 371 579.15

Distributable Amount (see page 25 of the instructions) (Section 49420)(3) and 0)(5) pr ivate operatingfoundations and certain foreign organizations check here ► q and do not complete this part )

1 Minimum investment return from Part X, line 6 . . . . . . . . . . . . . 1 371 579.00

2a Tax on investment income for 2007 from Part VI, line 5 . . . . 2a 9,478.00

b Income tax for 2007 . (This does not include the tax from Part VI.) 2b

c Add lines 2a and 2b . . . . . . . . . . . . . . . . . . . . . . . . 2c 9,478.00

3 Distributable amount before adjustments . Subtract line 2c from line 1 . . . . . . . . . . 3 362, 101.00

4 Recoveries of amounts treated as qualifying distributions . . . . . . . . . . . . . . 4

5 Add lines 3 and 4 . . . . . . . . . . . . . . . . . . . . . . . . . 5 362, 101.00

6 Deduction from distributable amount (see page 25 of the instructions) . . . . . . . . . . 6

7 Distributable amount as adjusted . Subtract line 6 from line 5. Enter here and on Part XIII,line 1 7 362,101 00

Qualifying Distributions (see page 26 of the instructions)

1 Amounts paid (including administrative expenses) to accomplish charitable , etc., purposes:

a Expenses , contributions , gifts, etc.-total from Part I, column (d), line 26 . . . . . . . . . la 308,511-00

b Program - related investments-total from Part IX-B . . . . . . . . . . . . . lb

2 Amounts paid to acquire assets used (or held for use) directly in carrying out charitable, etc ,

purposes . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

3 Amounts set aside for specific charitable projects that satisfy the:

a Suitability test (prior IRS approval required ) . . . . . . . . . . . . . . . . . . . 3a

b Cash distribution test (attach the required schedule) . . . . . . . . . . . . . . . . 3b

4 Qualifying distributions . Add lines la through 3b Enter here and on Part V, line 8, and Part XIII, line 4 . . 4 3 08 , 511 00

5 Foundations that qualify under section 4940 (e) for the reduced rate of tax on net investment income.

Enter 1 % of Part I, line 27b (see page 26 of the instructions) . . . . . . . . . . . . . 5

6 Adjusted qualifying distributions . Subtract line 5 from line 4 . . . . . . . . . . . . 6 308 511.00

Note : The_amount_on_hne_6 will be_used In -Part _V,_ column-(b),-In subsequent years when calculating whether the foundation_qualifies for the section 4940(e) reduction of tax in those years

Form 990-PF (2007)

STF LLPH1001 8

Form 990-PF (2007) Page 9

Undistributed Income (see page 26 of the instructions)

(a) (b) (c) (d)

1 ' Distributable amount for 2007 from Part XICorpus Years prior to 2006 2006 2007

,

line 7 362, 101.00

2 Undistributed income, if any, as of the end of 2006

a Enter amount for 2006 only - - - - - ------- --------------- - --- --- - 0 - - - - -

b Total for prior years 20 ,20 ,20

- -

- 0- - ------ - ------

3 Excess distributions carryove r, if any, to 2007:

a From 2002. . .

b From 2003. . . . . -

c From 2004 . . . . .

d From 2005 . . . 59, 573.00

e From 2006 . . . 107 269.00

f Total of lines 3a through e . . . . . 166, 842.00

4 Qualifying distributions for 2007 from Part XII,

line 4: ► $ 308, 511.00 :..

a Applied to 2006, but not more than line 2a 0

b Applied to undistributed income of prior years (Election

required-see page 27 of the instructions) 0

c Treated as distributions out of corpus (Election -

required-see page 27 of the instructions)

d Applied to 2007 distributable amount 195, 259.00

e Remaining amount distributed out of corpus 113,252.00 -

5 Excess distributions carryover applied to 2007 166, 842 00 166, 842.00

(If an amount appears in column (d), the same

amount must be shown in column (a))

6 Enter the net total of each column asindicated below:

a Corpus Add lines 3f 4c and 4e Subtract line 5 113 , 252 . 00, ,

b Prior years' undistributed income. Subtract

line 4b from line 2b . . . . . . . 0.00

c Enter the amount of prior years' undistributed

income for which a notice of deficiency has been

issued, or on which the section 4942(a) tax has

been previously assessed . . . . .

d Subtract line 6c from line 6b. Taxable

amount-see page 27 of the instructions 0.00

e Undistributed income for 2006. Subtract line

4a from line 2a. Taxable amount-see page

27 of the instructions 0.00. . . . .

f Undistributed income for 2007. Subtract lines

4d and 5 from line 1. This amount must be

distributed in 2008 . . . . . . . 0 00

7 Amounts treated as distributions out of corpus

to satisfy requirements imposed by section170(b)(1)(E) or 4942(g)(3) (see page 27 of the

instructions) . . . . .. . . .

8 Excess distributions carryover from 2002 not

applied on line 5 or line 7 (see page 27 of the -

instructions) . . . . . . .

9 Excess distributions carryover to 2008.` •Subtract lines 7 and 8 from line 6a . , 113,252.00

10 Analysis of line 9: k ' -

a Excess from 2003

b Excess from 2004 ;4 1v v 4 v -•-i`

c Excess from 2005

d Excess from 2006 `:•' ke Excess from 2007 113,252.00 .v .`:-^..,•^•- ti:•`'^ ^`4:•^::-::::c-.

Form 990-PF (2007)STF LLPH1001 9

Form 990-PF (2007) Page 10

Private Operating Foundations (see page 27 of the instructions and Part VII-A, question 9 )

la If the foundation has received a ruling or determination letter that it is a private operating

• foundation , and the ruling is effective for 2007, enter the date of the ruling . . . . ► Lb Check box to indicate whether the foundation is a private operating foundation described in section

2a Enter the lesser of the adjusted netincome from Part I or the minimuminvestment return from Part X foreach year listed . . . . . .

b 85% of line 2a . . . . . . .

c Qualifying distributions from Part XII,line 4 for each year listed . . .

d Amounts included in line 2c not used directlyfor active conduct of exempt activities . .

e Qualifying distributions made directlyfor active conduct of exempt activitiesSubtract line 2d from line 2c . .

3 Complete 3a, b, or c for thealternative test relied upon:

a "Assets" alternative test-enter

(1) Value of all assets . . . .

(2) Value of assets qualifyingunder section 49420)(3)(8)(1)

b "Endowment" alternative test-enter '/3 ofminimum investment return shown in PartX, line 6 for each year listed . . .

c "Support" alternative test-enter

(1) Total support other than grossinvestment income (interest,dividends, rents, payments onsecurities loans (section512(a)(5)), or royalties)

(2) Support from general publicand 5 or more exemptorganizations as provided insection 49420)(3)(13)(m) . . .

(3) Largest amount of support froman exempt organization . . .

(4) Gross investment income . .

(-I 4942 (1)(3) or [1 4942(1)(5)

Tax year Prior 3 years (e) Total(a) 2007 ( b) 2006 (c) 2005 (d) 2004

0.00

0.00 0.00 0.00 0.00 0.00

0.00

0.00

0.00 0.00 0.00 0.00 0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

Supplementary Information (Complete this part only if the foundation had $5,000 or more in assetsat any time during the year-see page 28 of the instructions.)

1 Information Regarding Foundation Managers:a List any managers of the foundation who have contributed more than 2% of the total contributions received by the foundation

before the close of any tax year (but only if they have contributed more than $5,000) (See section 507(d)(2) )

None

b List any managers of the foundation who own 10% or more of the stock of a corporation (or an equally large portion of theownership of a partnership or other entity) of which the foundation has a 10% or greater interest.

None

2 Information Regarding Contribution , Grant, Gift, Loan, Scholarship , etc., Programs:

Check here ► © if the foundation only makes contributions to preselected charitable organizations and does not acceptunsolicited requests for funds. If the foundation makes gifts, grants, etc. (see page 28 of the instructions) to individuals ororganizations under other conditions, complete items 2a, b, c, and d.

a The name, address, and telephone number of the person to whom applications should be addressed:

b The form in which applications should be submitted and information and materials they should include:

c Any submission deadlines:

d Any restrictions or limitations on awards, such as by geographical areas, charitable fields, kinds of institutions, or otherfactors:

Form 990-PF (2007)STF LLPH1001 10

Form 990-PF (2007) Page 1

ONM. Supplementary Information (continued)3 Grants and Contributions Paid During the Year or Approved for Future Payment

Recipient If recipient is an individual, Foundationshow any relationship to status ofPurpose grant or

Amount

Name and address (home or business)any foundation manageror substantial contributor recipient

contribution

a Paid during the year

Ronald McDonald House

PO Box 1119

Missoula MT 59806 c 3 building fund 25,000.00

Missoula Art Museaum

335 N Pattee

Missoula Mr 59802 c 3 building fund 50,000.00

St Patrick Hospital Foundation

500 W Broadway

Missoula MT 59802 c 3 building fund 25,000.00

Montana Natural History Center

120 Hickory

Missoula MT 59801 c 3 youth education 35,000.00

Children's Oncology Camp

PO Box 1450

Missoula MT 59806 c 3 youth cancer camp 25,000.00

Rialto Community Foundation

418 Main St

Deer Lodge MT 59722 c 3 building fund 50,000.00

Missoula Food Bank

219 S Third W

Missoula MT 59801 c 3 food for low income 25,000.00

YWCA

1130 W Broadway

Missoula MT c 3 battered women shelter 20,000 00

From attachment 45,000 00

Total ► 3a. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 300 000.00

b Approved for future payment

Missoula Art Museum

335 N Pattee

Missoula MT 59802 C-3 building fund 50,000.00

Total . 10 ' 3bl 50,000.00

Form 990-PF (2007)

STF LLPH1001 11

Form 990-PF (2007) Page 12

Analysis of Income -Producing Activities

Enter

1 Pro

a

b

c

d

e

f

92 Me

3 Inte

4 Divi5 Net

a

b

6 Net

7 Oth

8 Gain

9 Net

10 Gro

11 Oth

b

c

d

e

12 Subtotal. Add columns (), (d), and (e)

13 Total. Add line 12, columns (b), (d), and (e) . . . . . . . . . . . . . . . . . 13 0 00(See worksheet in line 13 instructions on page 29 to verify calculations.)

Relationshi p of Activities to the Accom plishment of Exem pt Purposes.Line No . Explain below how each activity for which income is reported in column (e) of Part XVI-A contributed importantly to

the accomplishment of the foundation's exempt purposes (other than by providing funds for such purposes) (Seepage 29 of the instructions )

STF LLPH1001 12

ross amounts unless otherwise indicated . Unrelated business income Excluded by secti on 512, 513 , or 514 (e)

ram service revenue :

(a)Business code

(b)Amount

(c)Exclusion code

(d )Amount

Related or exemptfunction income(See page 28 ofthe instructions )

Fees and contracts from government agencies

mbership dues and assessments . . . .

rest on savings and temporary cash investments

dends and interest from securities . . .

rental income or ( loss) from real estate:D property . . . _ . .Not debt-financed property . . . . .

rental income or ( loss) from personal property

er investment income . . . . . . .or (loss ) from sales of assets other than inventoryincome or (loss) from special events . .

ss profit or ( loss) from sales of inventory

er revenue: a

b 0.00 0.00

g

0 00

Form 990-PF (2007)

Form 990-PF (2007 ) Page 13

Information Regarding Transfers To and Transactions and Relationships With NoncharitableExempt Organizations

1' Did the organization directly or indirectly engage in any of the following with any other organization described Yes No

in section 501(c) of the Code (other than section 501 (c)(3) organizations) or in section 527, relating to political

organizations?

a Transfers from the reporting foundation to a noncharitable exempt organization of:

x(1) Cash . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1a(1) x(2) Other assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1a(2) x

b Other transactions:

(1) Sales of assets to a noncharitable exempt organization . . . . . . . . . . . . . . . . 1 b ( l ) x

(2) Purchases of assets from a noncharftable exempt organization . . . . . . . . . . . . . . 1b(2) x

(3) Rental of facilities, equipment, or other assets . . . . . . . . . . . . . . . . . 1b(3) x

(4) Reimbursement arrangements . . . . . . . . . . . . . . . . . . . . . . . 1b(4) x

(5) Loans or loan guarantees . . . . . . . . . . . . . . . . . . . . . . . . . . 1b(5) x

(6) Performance of services or membership or fundraising solicitations . . . . . . . . . . 1b(6) x

c Sharing of facilities, equipment, mailing lists, other assets, or paid employees . . . . . . . . . . 1c x

d If the answer to any of the above is "Yes," complete the following schedule. Column (b) should always show the fair marketvalue of the goods, other assets, or services given by the reporting foundation. If the foundation received less than fair marketvalue in any transaction or sharing arrangement, show in column (d) the value of the goods, other assets, or se rvices rece ived.

(a) Name of organization (b) Type of organization (c) Description of relationship

Under penalties of perjury, I eclare that I have examined this return, includebelief, it is true, corr plete Declaration o preparer (other than t

Signature of officer or truste

2M:2

-WO 'Cl) Preparer sCL

. a signatured N

d Firm's name (or yours ifself-employed), address,and ZIP code

STF LLPH1001 13

2a Is the foundation directly or indirectly affiliated with, or related to, one or more tax-exempt organizationsdescribed in section 501(c) of the Code (other than section 501(c)(3)) or in section 527? . . . . . . q Yes © No

b If "Yes," complete the following schedule.

The William H. and Margaret M. Wallace Foundation81-0504215Form 990PF CY 2007

Schedule for Part II, Line 10 b

Quantum Financial holdings end of ye

Growth Fund of America $218,321.79Capital World $173,500.20Wash Mutual $642,319.18Inc Fund of America $233,630.14American Balanced $372,506.89Bond Fund of America $209,835.80Templeton Growth $128,723.98Franklin Income I $262,393.41Franklin US Govt Sec Fund A $673,717.89Franklin Money Fund $3.00

Thornburgh Value Class A $505,955.33Thornburgh Inv Income Builder A $281,084.26

Merrill Lynch holdings end of year on attached sheets

Merrill Lynch

THE WILLIAM H AND MARGARET M

EhII1II Fiscal Statement

CURRENT PORTFOLIO SUMMARY

Total/Adj Unrealized Est EstDate Cost Fiscal-Year - - Gain or Accrued Annual

Quantity Security Description Acquired Basis Value 12131 /07 (Loss ) Interest Income

Cash and Money Funds

CASH 2,542.94 2,542 9451,350 ML Bank Deposit Program 03/02/05 51,350.00 51,350.00 2,42886

Total Cash and Money Funds 53,892.94 \ 53,892.94 2,428.86

CURRENT PORTFOLIO SUMMARY

Total/Adj Unrealized EstDate Cost Fiscal Year Gain or Annual

Quantity Security Description Acquired Basis , Value 12/31107 (Loss) Income

60 ABBOTT LABS

10 ABBOTT LABS

10 ABBOTT LABS

15 ABBOTT LABS

30 ALLSTATE CORP DEL COM

10 ALLSTATE CORP DEL COM

25 ALLSTATE CORP DEL COM

10 ALLSTATE CORP DEL COM

15 ADOBE SYS DEL PV$ 0.001

05/01/06

05/24/06

12/01/06

06/19/07

03/08/06

03/14/06

03/15/06

06/19/07

03/22/07

PLEASE SEE REVERSE SIDEPage Statement Period Arrnunt No.

X 00588717 18 of 171 Year Ending 12/31/07 4

Equities

2,552.11 3,369.00 816.00 78.001 •

418.16 561.50 143.00 13.00

466.97 1 561.50. 94.00 13.00

816.39 842.25 25.00 19.50

1,623.98 1,566.90 (57.00) 45.60

547.15 522.30 (24.00) 15.20

1,366.40 1,305.75 (60.00) 38.00

620.84 522.30 (98.00) 15.20

644.28 640.95 (3.00)

6060D 11.01

Merrill Lynch

THE WILLIAM H AND MARGARET M

EA^

1•• i, ^ ^ ^ may,}

:̂'r,:. ^' ^ .`Y^S I'

,.Fiscal`Statement`

CURRENT PORTFOLIO SUMMARY

Total/Adj Unrealized EstDate `Cost - Fiscal Year Gain or Annual

Quantity Security Description Acquired Basis Value 12/31107 (Loss) Income

Equities

25 ADOBE SYS DEL PV$ 0.001 03/30/07 - --1;040 73', `. 1,068.25 27.00

10 ADOBE SYS DEL PV$ 0 001 04/02/07 '. 414.11 '-- - _ 427.30 13.00

25 ADOBE SYS DEL PV$ 0 001 104/18/07.. •1,074.20 1,068.25 (5.00)

25 ADOBE SYS DEL PV$ 0.001 06/19/07 1,065.80 1,068.25 2.00

50 ALTRIA GROUP INC 03/03/05 2,504.24 3,779.00 \ \, 1,274.00 150.00

5 ALTRIA GROUP INC 05/23/06 271.56 377.90 106.00 15.00

30 ALTRIA GROUP INC 03/13/07 1,951.31 •, 2,267.40 316 00 90.00

10 ALTRIA GROUP INC 04/25/07 700.83 755.80 54.00 30.00

15 ALTRIA GROUP INC 06/19/07 1,045.33 1,133.70 88.00 45 00

15 ALTRIA GROUP INC 08/15/07 1,007.54 1,133.70. 126.00 45.00

15 ALTRIA GROUP INC 08/31/07 1,040.35 1,133.70 93.00 45 00

95 ABB LTD SPON ADR 11/12/07 ' 2,74274 2,736.00 (6.00) 15.49

25 ABB LTD SPON ADR 11/13/07 - -- 701 45- 720.00 18.00 4.08

9 AXA ADR 09/01%05 237.85 357-.39 119 00 10 89.

5 AXA ADR 11/1'6/05 141.7'7 ,/ % ;•\ 198.55 , 56.00 6.05

5 AXA ADR 11/17/05 ---- -J 14154 /

`^ i i

198.55 ,i 55.00 6 05

13 AXA ADR 11/18/05 379.170 516.231, 136.00 15.73PLEASE SEE REVERSE SIDE

L®

• Page StatementPeriod Account No. - ---00588718 19 of 171 Year Ending 12/31/0;

I I^I III I^ II I II I I^ ^ I II I II I I ^I ^ ^I I^ I I I^ III I I I I

;

• I299071010000710010

FA7Merrill Lynch

THE WILLIAM H AND MARGARET M

EhI#f Fiscal ' Statement

CURRENT PORTFOLIO SUMMARY

Total/Adj Unrealized Est-Date Cost Fiscal Year Gain or Annual

Quantity Security Description Acquired Basis Value 12/31/07 (Loss ) Income

Equities

5 AXA ADR 06/19/07 -- -'220 87'•, 198.55 (22 00) 6.05

10 AXA ADR 10/03/07 454.55 397.10 (57.00) 12.10

15 AMERICAN FINL GRP HLDGS 08/16/06 455.75 433.20 (22.00) 6.00

22 AMERICAN FINL GRP HLDGS 08/17/06 691.02 635.36' (55.00) 8.80

7 AMERICAN FINL GRP HLDGS 08/18/06 231,81 202.16 (29.00) 2.80

15 AMERICAN FINL GRP HLDGS 08/21/06 464.64, 433.20 (31.00) 6.00

7 AMERICAN FINL GRP HLDGS 08/22/06 233.00 202.16 (30 00) 2 80

16 AMERICAN FINL GRP HLDGS 08/23/06 464.30 - 462.08 (2.00) 6.40

5 AMERICAN FINL GRP HLDGS 06/19/07 175.10 144 40 (3000) 2 00

10 AMEREN CORP 09/11/07 - 505.86 542.10 36.00 2540

15 AMEREN CORP 09/12/07 769.83 81315 43.00 38.10

10 AMEREN CORP 09/14/07 519.46 542.10' 22.00 25.40

5 AMEREN CORP 09/17/07 260.37 271.05 10 00 12.70

20 AMEREN CORP 09/26/07 1,058.85 1,084.20 2500 50.80

25 AMEREN CORP 09/27/07 1,326.74 1,355.25 28.00 63.50

45 AMERICAN TOWER CORP CL A 07/18/07 1,955.00 1,917.00 (38.00)

35 AMERICAN TOWER CORP CL A 07/19/07 1,561 22 1,491.00 (70.00)PLEASE SEE REVERSE SIDE

Page Statement Periodx 00588719 20 of 171 Year Ending 12/31/07 4

6060D 11 .01

64^ Merrill 16ynch

THE WILLIAM H AND MARGARET M

Fiscal,'Statement

CURRENT PORTFOLIO SUMMARY

total/Ad' Unrealized Est

Date - - ; '• Cost - -Fiscal-Year - - --- -- Gain or Annual

Quantity Security Description Acquired,

Basis Value 12 /31107 (Loss) Income

Equities

35 AMERICAN TOWER CORP CL A 09/25 /07 -----1}480 .17\ 7/ 1,491. 00 10 00

60 ALCOA INC 09/20 /07 2,228 . 74 -- 2,193 00 ( 35.00) 40.80

55 ALCOA INC 09/24/07, \2, 049 01 2, 010.25-, (38.00) 37.40

20 ASAHI KASEI CORP ADR 07 /09/07 1 ,378.42 1 , 310.00 '--, -^ (68.00) 19.78

5 ASAHI KASEI CORP ADR 08 /31/07 370 58 327 50 (43 00) 4.94.

10 AEON COMPANY LTD ADR - 04/10/06 251.00 , 147.00 (10400) 1.05

50 AEON COMPANY LTD ADR - 04/13/06 ,1,233 .95 735 . 00 (498 . 00) 5.25

10 AEON COMPANY LTD ADR 08 /02/06 238 65 - 147:00---- / (91.00) 1 05

10 AEON COMPANY LTD ADR , 12/19/06 213.74 147.00 (66.00) 1.05

15 AEON COMPANY LTD ADR 10/12/07 244.37 220 50 (23.00) 1.58

15 AEON COMPANY LTD ADR 12 /06/07 241.83 220 50 • ( 21.00) 1.58

25 ASBURY AUTOMOTIVE GROUP '. 08/17/07 ! \ ` 544 .42 376.25\ (168.00) 22.50

30 ASBURY AUTOMOTIVE GROUP 08/20 /07 - 675.52, 451 . 50 (224.00) 27.00

45 ASBURY AUTOMOTIVE GROUP 08/21/07 1,026.90 2 677.25 (349.00) 40.50,

20 ASBURY AUTOMOTIVE GROUP '• 08/22 /07 442 . 63 301 .00 (141.00) 18.00

101 AT& T I NC 03 /03/05"---, _ J 571.98/2 4,1.97.56 / 1,625.00 161.60- ,

15 AT& T INC I I 05/23/06 ,90,85 , / 623.40i 242 . 00 24.00

PLEASE SEE REVERSE'SIDEPage Statement-Period

X 00588720 21 of 171 Year Ending 12/31/07 4

29 907 1 0 1 DOOD71DDII

6^ Merrill Lynch

THE WILLIAM H AND MARGARET M

Quantity Security Description

IMJ1IIM Fiscal Statement

CURRENT PORTFOLIO SUMMARY

Total/Adj Unrealized EstDate `,Cost Fiscal Year Gain or Annual

Acquired Basis Value 12/31/07 (Loss) Income

20 ANADARKO PETE CORP 1

60 ANADARKO PETE CORP

5 ANADARKO PETE CORP 0

40 ANHEUSR BUSCH COS INC 0

40 ANHEUSR BUSCH COS INC 0

5 ANHEUSR BUSCH COS INC 0

10 APPLE INC 0

10 APPLE INC 0

5 APPLE INC 0

10 APPLE INC 0

10 ATMOS ENERGY CORP COM 1

10 ATMOS ENERGY CORP COM 1

10 ATMOS ENERGY CORP COM 1

5 ATMOS ENERGY CORP COM

25 ATMOS ENERGY CORP COM

10 ATMOS ENERGY CORP COM 1

25 BANK HAWAII CORP 0

PLEASE SEE REVERSE SIDEPage Statement Period

• Ex 00588721 22 of 171 Year Ending 12/31 /07

Equities

2/02/05 - 927.07 \ 1,313 80 386 . 00 7.20

2/05/05 2,833.67 3,941 40 1,107 . 00 21.60

6/19/07 277 . 02 328 . 45 51.00 1 80

9/02/05 1 , 802.77 2 , 093.60 290 00 52.80

9/12/05 \1,81'2.09 2 , 093.60 281 00 52.80

6/19/07 272.60. 261.70 (10.00) 6.60

3/31/06 630.40 1,980.80 1,350.00

5/23/06 637 .17 - 1,980. 80 1,34300

9/26/06 386.02 990 .40- 604.00

6/19/07 1,238.99 1;980.80 741.003 ^

2/18/07 270.06 '1 1 280.40 10.00 13.00

2/19/07 275 45 280.40', 4.00 13.00

2/20/07 - - 277-.80 280.40 2.00 13.00

2/21/07 141.28 140.20 (1 00) 6.50

2/24/07' 715.32 701.00 ( 14.00) 32.50

2/26/07 284 . 01, / 280 .40 (3.00) 13.00

18/17/07 1,3 8.01 11 , 278.50/ (39 00) 44.00

6060D 11-01

MCI-

Merrill ImvnchTHE WILLIAM H AND MARGARET M

- Fiscal`Statement

CURRENT PORTFOLIO SUMMARY

Total/Adj Unrealized EstDate- Cost -- - Fiscal Year- -- - - - Gain or Annual

Quantity Security Description Acquired Basis Value 12/31/07 (Loss) Income

10 BANK HAWAII CORP 08/20/07

5 BANK HAWAII CORP 08/21/07

10 BANK HAWAII CORP 08/22/07,

70 BANCO SANTANDER SA ADR 10/29/07

20 BAYER AG SP ADR 06/11/07

5 BAYER AG SP ADR - 06/19/07

5 BAYER AG SP ADR 08/09/07

10 BP PLC SPON ADR 05/04/07

25 BP PLC SPON ADR 05/07/07

5 BP PLC SPON ADR 05/11/07

5 BP PLC SPON ADR 05/22/07

10 BP PLC SPON ADR 06/26/07

5 BP PLC SPON ADR 11/02/07

27 BANK OF AMERICA CORP 04/07/05' •

50 BANK OF AMERICA CORP 08/15/06

15 BANK OF AMERICA CORP 06/19/07

lb BARNES GROUP INC DE $.01 12/18/07

PLEASE SEE REVERSE SIDEPage Statement-Period n^^^"^' "'^

© 00588722 23 of 171 Year Ending 12/31/07

Equities 1

-'534.26 511.40 (22.00) 17 60

270.23 255.70 (14.00) 8.80

552.26 _ 511:40 (40.00) 17 60

1,483.57 1,507.80•' 24.00 43.33

,1,406.86 1,823.76 416.00 21.54

381.87' 455.94 74 00 5.39

359.19- 455.94 96.00 5 39

685.98 - 731.70 " 45.00 25.38

1,709.73 1,829.25 119.00 63 45

332.04 365.85 33.00 12.69

343 50 365.85 ' 22 00 12 69

706.66 731.70 25.00 25.38

391.71' 365.85 (25.00) 12 69

1,259.96 1,1"14.02 (145.00) 69.12

2,605.96 2,063.00 (542.00) 128.00

760.04/ 618.90 ,' - (141.00) 38.40

3294. ,' f / 333.90- 39.00 5.60

IIII II IIIIIIi IIIIff1IllIIIII I II I IIIIIIIIIIIIIII299071010000710012

Merrill Lynch

-THE WILLIAM H AND MARGARET M

EJM" Fiscal •Statejj n,tA To

CURRENT PORTFOLIO SUMMARY

Total/Adj Unrealized EstDate Cost - _ -- --Fiscal Year---- -- - Gain or Annual

Quantity Security Description - Acquired Basis Value 12/31107 (Loss) Income

Equities

10 BARNES GROUP INC DE $ 01 12/19/07 299.76 333.90 34 00 5.60

5 BARNES GROUP INC DE $.01 12/20/07 153 91 166.95 13.00 2.80

10 BARNES GROUP INC DE $.01 12/21/07 327 54 333.90 6.00 5.60

10 BARNES GROUP INC DE $.01 12/26/07 339.92 333 90 (600) 5.60

19 BNP PARIBAS SPONSORD ADR 03/03/05 684 12 1,028 85 344 00 29.66

10 BNP PARIBAS SPONSORD ADR 11/22/06 546.08 541.50 (400) 15.61

5 BNP PARIBAS SPONSORD ADR 04/11/07 271.63 270.75 7 80

5 BNP PARIBAS SPONSORD ADR 12/06/07 281.74 270.75 (10.00) 7.80

70 BAXTER INTERNTL INC 07/14/06 2,652.08 / -, 4,063.50 1,411.00 60.905

15 BAXTER INTERNTL INC 12/01/06 671.50 870.75 199.00 13.05

15 BAXTER INTERNTL INC 06/19/07 867.84 870.75 2.00 13.05

10 BECTON DICKINSON CO 11/08/05 578.03 835.80, 257.00 11.40

30 BECTON DICKINSON CO 11/09/05 --1,740.34 - 2,507.40 767.00 34.20

10 BECTON DICKINSON CO 05/23/06' 602.70 -;. 835.80 233.00 11.40{'

10 BECTON DICKINSON CO 08/31/07 770.70 835.80 65 00 11.40

20 BLACK AND DECKER CRP COM 07/30/07 - 1,718.63' 1393.00 (325.00) 33.60

5 BLACK AND DECKER CRP COM 07/31/07 437.26 348.25 (89.00) 8.40

PLEASE SEE REVERSE SIDEPage Statement Period

X 00588723 24 of 171 Year Ending 12/31 /07

6060D 11-0 1

Merrill Lynch

THE WILLIAM H AND MARGARET M

Fiscal =Statement; u=° : `X

CURRENT -PORTFOLIO SUMMARY

TotallAdj Unrealized EstDate - , Cost Fiscal Year - Gain or Annual

Quantity Security Description Acquired Basis -' Value 12131107 ( Loss) Income

Equities

15 BLACK AND DECKER CRP COM 08/02/07 - ---1+,334.35 1,044.75 (289.00) 25.20

10 BLACK AND DECKER CRP COM 08/03/07 890.14 _ 696 .50 (193 00) 16.80

105 BANCORPSOUTH INC I 03/03/05" 2,240 57 2,479.05. 238 00 88.20

20 BANCORPSOUTH INC 06119/07 500.39 472.20 -' (28.00) 16.80

60 CBL & ASSOC PPTYS INC 03/03/05 "\2,234.90 1,434.60 (800 00) 130.80REIT

10 CBL & ASSOC PPTYS INC •' 05/23/06 / 365.5 239.10 (126.00) 21 80REIT

10 CBL & ASSOC PPTYS INC 06/20/07 379.66 j --239.10 (140 00) 21.80REIT /

75 CABOT OIL & GAS CORP 03/03/05 1,415.47 "-3,027:75 1,612.00 9.00

15 CANADIAN NATURAL RES LTD 10/28/05",, 610.48 1,0971.10•\ 486 00 5.37

10 CANADIAN NATURAL RES LTD 10/31/05 ter- 414.60 731.40 316 00 3.58

7 CANADIAN NATURAL RES LTD 05/18/06' / I 366.10 511.98 145.00 2 51

5 CANADIAN NATURAL RES LTD 05/23/06 -- 258.05 -- 365.70 107.00 1.79

15 CANADIAN NATURAL RES LTD 09/26/06 ' 68558 1;097.10 411.00 5 37

15 CANADIAN NATURAL RES LTD 10/13/06 694i77/ / / _1,0,97.10 / I 402.00 5.37

.15 CANADIAN NATURAL RES LTD 06/19/07 1,044.2i5 1,097!10 52.00 5.37/

PLEASE SEE REVERSE SIDE 'Page Statement Period - ^- - -- -'i

x 00588724 25 of 171 Year Ending 12/31/07

IIIIIIIIIiIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIII29907101oooo710013

Merrill Lynch

THE WILLIAM H AND MARGARET M

EhV[ Fiscal Statement

CURRENT PORTFOLIO SUMMARY

Total/Adj Unrealized EstDate Cost Fiscal Year Gain or Annual

Quantity Security Description Acquired Basis Value 12/31/07 (Loss ) Income

- Equities

6 CANON INC ADR REP5SH 11/16/05 238 . 09. 274.98 36.00 4.84

12 CANON INC ADR REP5SH 11/17/05 447 . 69 - 549 96 102.00 9.68

7 CANON INC ADR REP5SH 12/14/05 - , 296.75 320.81 24.00 5.65

7 CANON INC ADR REP5SH 12/15/05 237.77 320.81 83.00 5.65

5 CANON INC ADR REP5SH 07/05/07 297 64 229.15 (68.00) 4.04

5 CHEVRON CORP 03 /03/05 305.90 466 . 65 160.00 11.60

40 CHEVRON CORP 11 / 15/05 2 , 318.08 3 , 733.20 1 , 41500 92.80

10 CHEVRON CORP 05/23/06 587 .49 933 . 30 345.00 23 20

30 CONOCOPHILLIPS 02/22 /06 1,853 . 25 2,649.00 795.00 49.20

30 CONOCOPHILLIPS 02/28/06 1,825.14 2,649.00 823 . 00 49.20

30 CATERPILLAR INC DEL 12 /03/07, 2,173.82 2,176.80 2 . 00 43.20

10 CATERPILLAR INC DEL 12/06/07 742.62 725.60- ( 17.00) 14.40

20 CATERPILLAR INC DEL 12/07/07 1_1,483.03 ; 1,451.20 (31.00) 28.80

20 CENTRICA PLC 05/ 16/07 - --1,566.52 1,441.00 (125.00) 44.60SPR ADR NEW - U- j

10 CENTRICA PLC 08 / 17/07 I 697 .72 720 .50 22.00 22.30SPR ADR NEW

,-

^ /l

PLEASE SEE REVERSE SIDEPage Statement - Period A

• qx 00588723 26 of 171 Year Ending 12/31/07 4

6060D 11 .01

IZI,

6^S Merrill 16ynch

THE WILLIAM H AND MARGARET M

t Fiscal S^tat^r^.„Y' •_y °,,ree{'.r • ' d

Br ent ` ` ^, : 4,;

CURRENT PORTFOLIO SUMMARY

Total/Adj Unrealized EstDate Cost Fiscal Year - Gain or Annual

Quantity Security Description Acquired Basis Value 12/31107 (Loss) Income

Equities j

5 CENTRICA PLC 10/24/07 - 388.12 360.25 (27.00)SPR ADR NEW '

25 CBS CORP NEW CL B 06/07 /06 667 81 - 681.25 13.00

45 CBS,CORP NEW CL B 06/08/06 , 1,205.34 1,226.25 2000

30 CBS•CORP NEW CL B 06/27/06 794.12 817.50 23.00

45 CBS CORP NEW CL B 06/28/06 11,193.90 1 , 226.25 32.00

30 CISCO SYSTEMS INC COM 12/07/05 537'.42 `- 812.09 274.00

21 CISCO SYSTEMS INC COM 01/20/06 ' 389.97 568.46 178.00

/35 CISCO SYSTEMS INC COM 05/24/06 723.10 947.44 - 224.00

25 CISCO SYSTEMS INC COM 06/16/06 498 . 65 ; 676 .7,4 178.00

35 CISCO SYSTEMS INC COM 01/11/07, 1,007.10 947.44\ (59.00)

70 CISCO SYSTEMS INC COM 04/23/07 1,860 31 1 , 894.89, 34 00

45 CISCO SYSTEMS INC COM 06/19/07 1,224.52 1,218 14 ' ( 6.00)

20 COCA COLA COM 03/ 14/06 _ 854.17 1,227.40 373.00

45 COCA COLA COM 03/17/06 . 1,926.29 2761.65 835.00

5 COCA COLA COM 05/23/06`, 218 !70 - -- 306.85 L / 88.00

20 COCA COLA COM 06/30/06 86 5.31 ' j 1,227. 40 ' 362.00

PLEASE SEE REVERSE SIDE •

FIPage Statement Period

/A 27 of 171 Year Ending 12/31 /07

I II I I I II I I I I I III I I II I I II I I III I I I II II I II I II II I I II299071010000710014

11 15

25.00

45.00

30.00

45.00

27.20

61.20

6.80

27.20

0

MN

Merrill Lynch

THE WILLIAM H AND MARGARET M

EWIp Fiscal Statement

CURRENT-PORTFOLIO SUMMARY

Total/Adj Unrealized Est-Date . ` Cost - -- Fiscal Year - - Gain or Annual

Quantity Security Description I Acquired Basis - Value 12/31/07 ( Loss) Income

Equities

50 COCA COLA COM 10/19/07 -^ c,----2;966 47, 3,068.50 102.00 68 00

50 COCA COLA COM 10/22/07 2,946.60 3,068.50 121.00 68.00

15 COLGATE PALMOLIVE 12/01/06 977.42 1,169.40 191.00 21.60

25 COLGATE PALMOLIVE 12/04/06 1,649.27 1,949.00 299 00 36.00

15 COLGATE PALMOLIVE 02/06/07 1,007,67 1,169.40 161.00 21.60

15 COLGATE PALMOLIVE 06/19/07 984.58 1,169.40 184.00 21 60

10 COLGATE PALMOLIVE 08/02/07 672.16 779.60 107.00 14 40

15 COLGATE PALMOLIVE 09/25/07 1,061.54 1,169.40 107.00 21.60

5 COMMERCIAL METALS CO COM 05/01/06 139.22 147.25 8 00 2.40

30 COMMERCIAL METALS CO COM 05/02/06 858.06, '883.50 25 00 14.40

50 COMMERCIAL METALS CO COM 05/03/06 1,43667 1,472.50 35 00 24.00

5 COMMERCIAL METALS CO COM 05/23/06 123.23 147.25 24.00 2.40

10 CONTINENTAL AG SPNRD ADR 02/22/07 1,336.02 1,282.50 - (53.00) 31.18

10 CONTINENTAL AG SPNRD ADR 10/11/07 - ,-_- 1,416.60 1,282 50 (13400) 31.18

110 DUKE REALTY CORP NEW 03/03/05 3,483.00 2,868.80 (61400) 211.20REIT

,

15 DUKE REALTY CORP NEWREIT

06/19/07 554.64/ /

;391.20 / (163 00) 28.80

'PLEASE SEE REVERSE SIDEPage Statement Period

x 00588727 28 of 171 Year Ending 12/3 1/07

6060D 11-01

6^ Merrill Lynch

THE WILLIAM H AND MARGARET M

Fiscal -Statement",EANK'

CURRENT PORTFOLIO SUMMARY

Quantity Security DescriptionDate

Acquired -

Total/AdjCostBasis

- Fiscal - Year-- -- -Value 12131/07

UnrealizedGain or(Loss)

EstAnnualIncome

Equities {

'

5 DIAMOND OFFSHORE DRLNG 12/24/07 - 710.79' 710.00 2 50

10 DIAMOND OFFSHORE DRLNG 12/26/07 \` 1,458 .42• ^' - 1,420.00 (3800) 500^

20 DANAHER CORP DEL COM 11/14/05 '1,089 . 56 - _1,754:80• _-• 665.00 2 40

8 DANAHER CORP DEL COM / - 01/20/06 \ `436.16 701.92--.\ 265.00 0 96,\

10 DANAHER CORP DEL COM / 05/23 /06 624.83 877 .40 252.00 1.20

5 DANAHER CORP DEL COM 03 /30/07 357.25\ 438.70 81.00 0.60

5 DANAHER CORP DEL COM - 04/02 /07 ' 356 . 56-, •- 438 . 70 / 82.00 0.60\

10 DANAHER CORP DEL COM 06/19/07 ,752.41 ; 877-40- - 124.00 1.20

15 DEUTSCHE TELE AG SPN ADR 11/19 /07 333 .50 (8.00) 11.58

1 5 90 3 00 470 DEUTSCHE TELE AG SPN ADR 11/20 /07 1 , 580 . 79 , 16 (6 . ) .045

15 DEUTSCHE TELE AG SPN ADR 12 / 13/07 331 . 38 325:05 (6.00) 11.58

5 DRS TECHNOLOGIES INC

15 DRS TECHNOLOGIES INC

08/21//06 , /'

08/22/06

5 DRS TECHNOLOGIES INC 09/05/06 -- ---

20 DRS TECHNOLOGIES INC 09/06/06

10 DRS TECHNOLOGIES INC 09/07/06

55 R R DONNELLEY SONS 01/24/06

PLEASE SEE REVERSE SIDEPage Statement Period

x 00588726 29 of 171 Year,Ending 12/31/07

198.45 271.35\

602.27, 814.05

-219.29

844.38/I l 7I

J% 416.27/

1,757.88,'

L-

1- 271.35

72 00

211.00

61.00

241.00

126.00

317.00

- 1,085.40

542.70

2,075.70'

qll II II I I I II R II I I II I II I I IIII I II n ll III I I I II IIII

0.60

1.80

0.60

2 40

1.20

57.20

0

Merrill Lynch

THE WILLIAM H AND MARGARET M

IMJ Fiscal Statement

CURRENT PORTFOLIO SUMMARY

Total/Adj Unrealized EstDate Cost Fiscal Year Gain or Annual

Quantity Security Description Acquired Basis Value 12/31/07 (Loss) Income

Equities -

5 R R DONNELLEY SONS 05/05/06 168.22, 188.70

20 R R DONNELLEY SONS 05/08/06 668 .97 ' 754.80

5 R R DONNELLEY SONS 05/18/06 167.05 188.70

25 R R DONNELLEY SONS 05/19/06 839 .74 943.50

15 DOW CHEMICAL CO 03/03/05 821.85 591.30

50 DOW CHEMICAL CO 03/04/05 2,789.07 1, 971.00

30 DOW CHEMICAL CO 05/24/06 1 , 196.27 1,182.60

60 DOW CHEMICAL CO 02/15/07 2, 602.24 2,365.20

35 DOW CHEMICAL CO 03/09/07 /' 1,502.97 1,379.70

15 DOW CHEMICAL CO 03/13/07 644.57 ' 591.30

10 DOW CHEMICAL CO 06/19/07 - 453. 89 ' 394 20

85 E M C CORPORATION MASS 02/06/06 1,138.21 1,575.05

35 E M C CORPORATION MASS 05/24/06 - 432.25 648.55

60 E M C CORPORATION MASS 03/30/07 833.27 1,11.1.80

30 E M C CORPORATION MASS 06/19/07 541 . 50 555.90

- / / / 55 EQUITY ONER IT

09/23/05 ` 11 ) 35^ / 115.1E

PLEASE SEE REVERSE SIDE / ^Page Statement- P6riod - - ^

qx 00589729 30 of 171 Year Ending 12/31/07

6060D 11-01

20.00 5.20

85.00 20.80

21.00 5.20

103.00 26.00

(230.00) 25.20

(818.00) 84.00

(13.00) 50.40

(237.00 ) 100.80

(123.00) 58.80

(53.00) 25.20

(59.00) 16.80

436.00

216.00

278.00

14.00

3.00 6.00

/j.

MMerrill Lynch

THE WILLIAM H AND MARGARET M

EM -K r' Fiscal Statement

CURRENT PORTFOLIO SUMMARY

Total/Adj Unrealized EstDate ' 'Cost - Fiscal-Year - Gain or Annual

Quantity Security Description Acquired ^ Basis Value 12131107 (Loss) Income

Equities !` -

5 EQUITY ON E 09/27 /05 111.99'. ". 115.15 3.00REIT S

10 EQUITY ONE 09/28 /05 ' 224 73 230.30 5.00REIT

5 EQUITY ONE 09/30/05 115.72 115.15REIT

15 EQUITY ONE 10/03/05 351.89 345 .45 (6.00)REIT

30 EQUITY ONE 10/04/05 704 . 90- , 690 . 90 (14.00)REIT

5 EQUITY ONE 10/05/05 114 . 81 115.15.- -REIT '

20 EQUITY ONE 10/06/05 457.15 460.60, 3.00REIT - l , 1

8 EQUITY ONE 10/07/05 182 .23 ^• ^. 184.24 2.00REIT ,

10 EQUITY ONE 05/23 /06 219.64, 230.30 10.00REIT

45 EXELON CORPORATION 11/03/05 2 , 351.92 3 , 673.80 1,321.00

10 EXELON CORPORATION 05/23 /06 '-_ 551 . 30 816 . 40 265 00.

5 EXELON CORPORATION 12/01/06 307 .48 '408 . 20 100 00.

PLEASE SEE REVERSE SIDEPage Statement Period ------

00588730 31 of 171 Year Ending 12/31/07

. IIIIIIIIIIIIIIIIilllllllill 11111 IIIIIIIIIIIIIIII299071010000710016

6.00

12 00

6.00

18.00

36.00

6 00

24.00

9.60

12 00

90.00

2000

10.00

Merrill Lynch

THE WILLIAM H AND MARGARET M

;IM„ Fiscal - Statement

CURRENT PORTFOLIO SUMMARY

Total/Adj Unrealized EstDate 'Cost Fiscal Year Gain or Annual

Quantity Security Description Acquired Basis Value 12131/07 (Loss) Income

Equities

10 EXELON CORPORATION 06/19/07 , - - 739.79 , 816 40 76.00 2000

40 EMERSON ELEC CO 11/08/05 1,42064 '. _ 2,266.40 845 . 00 48.00

10 EMERSON ELEC CO 11 / 15/05 361 . 03 566 . 60 20500 12.00

14 EMERSON ELEC CO 01 /20/06 544 . 79 793 . 24- 248 . 00 16.80

10 EMERSON ELEC CO 05/23/06 402.90 566 . 60 163.00 12.00

20 EMERSON ELEC CO 03 /30/07 861 . 90. 1,133 . 20 271.00 24.00

10 EMERSON ELEC CO 06 / 19/07 490 . 08 566.60 76 . 00 12 00

50 ENERGEN CRP COM PV 1CENT 03 /03/05 1 , 647.75 3 , 211.50 1,563 . 00 23.00

5 ENERGEN CRP COM PV 1CENT 05/23/06 .' 164.94 321 15 156.00 2.30

5 ENNIS INC 03 /05/07 126 . 14 90.00 (36 00) 3.10

5 ENNIS INC 03 /06/07 128.10 90.00 ( 38.00) 3.10

5 ENNIS INC 03 /07/07 129 21 90.00 ( 39.00) 3.10

5 ENNIS INC 03 /08/07 - - 129.97 90 . 00 (39.00) 3.10

5 ENNIS INC 03 / 13/07 129 . 88 90 . 00 (39.00) 3.10

5 ENNIS INC 03/16/07 130 . 00 90 . 00 (40.00) 3.10

j30 ENNIS INC 04/25/07 - 765!00, 540.00 i (225.00) 18.60

15 ENNIS INC 04/26/07 380 . 59 .^ / 270 . 00, (110.00) 9 30

PLEASE SEE REVERSE SIDE iPage Statement - Period ^----^ i----

x 00588731 32 of 171 Year Ending 12 /31 /07

6060D 11-01

ip

MN

Merrill Lynch

THE WILLIAM H AND MARGARET M

'" Fiscal Statement.: r. =Y -x =

CURRENTENT PORTFOLIO SUMMARY

Total/Adj Unrealized EstDate ' •', Cost - -Fiscal -Year - Gain or Annual

Quantity Security Description Acquired Basis - Value 12/31/07 (Loss) Income

Equities

15 ENNIS INC 04/27/07 - ' -- 373.05, 270 00 (103 00) 9 30

25 ENNIS INC 04/30/07 616.16 450.00 (166.00) 15 50

10 ENNIS INC 06/19/07 254.10 -- 180.00,` (74.00) 6.20

30 FPL GROUP INC 10/15/07 1\;892.28 2,033 40 -1

141.00 49 20\

25 FPL GROUP INC 10/16/071

\1,584.83 1,694.50 109.00 41.00

20 FPL GROUP INC 10/17/07 1,268 62. 1,355.60 86.00 32 80

115 FOSTERS GROUP LTD ADR 11/09/07 668 13 661.25 (6 00) 20 36

55 FOSTERS GROUP LTD ADR 11/12/07 30686 316.25- 900 9.74

60 FOSTERS GROUP LTD ADR 11/13/07 / 337.03 , ` . 345.-0 7.00 10 62

50 FOSTERS GROUP LTD ADR 11/14/07 288.42

'

'287.50 8.85

50 FOSTERS GROUP LTD ADR 11/15/07 288.16 , 287.50 8 85

45 FIAT S P A NEW SPND ADR 10/24/07 1,496.88 1,16452•

(332.00) 6.79I

20 GRUPO TELEVISA SA ADR 11/27/06 499.47, 475.40 (24.00) 3 24

30 GRUPO TELEVISA SA ADR 11/28/06 751.01 713.10 (37.00) 4 86

10 GRUPO TELEVISA SA ADR 01/25/07 290.21 237.70 (52.00) 1.62

20 GRUPO TELEVISA SA ADR 10/03/07 -- 489.84' / 475.40 (14.00) 3 24

10 GANNETT CO 05/22/07 584,71 / / 390.00/ (194.00) 16.00

PLEASE SEE REVERSE SIDE^Page Statement -Period Z - -f

X 00588732 33 of 171 Year Ending 12/31/07

illllilillillllillllliilllIlil i IliIllllllilllIII299071010000710017

6Z Merrill Lynch

THE WILLIAM H AND MARGARET M

EhUE Fiscal Statement

CURRENT PORTFOLIO SUMMARY

Total/Adj Unrealized EstDate Cost Fiscal Year Gain or Annual

Quantity Security Description Acquired Basis Value 12131/07 (Loss) Income

20 GANNETT CO 0

10 GANNETT CO 0

30 GANNETT CO 0

10 GANNETT CO 0

5 GANNETT CO 0

70 GLAXOSMITHKLINE PLC ADR 0

65 GLAXOSMITHKLINE PLC ADR 0

45 GLAXOSMITHKLINE PLC ADR 0

5 GLAXOSMITHKLINE PLC ADR 0

80 GOLDCORP INC 0

45 GOLDCORP INC 0

20 GOLDCORP INC 0

9 GOOGLE INC CL A 0

3 GOOGLE INC CL A 0

30 GENCO SHIPPING AND 0TRADING LTD

Equities

5/23/07 -1,,16889, 780.00 (388.00) 32.00

5/24/07 583.44 '-^ 390.00 (193.00) 16.00

6/06/07 1,763.01 1,170.00 (593.00) 48.00

6/07/07 "580.98 390.00 (190.00) 16.00

6/19/07 280.83 195.00 (85.00) 8.00

3/03/05 3,539.66 3,527.30 (12.00) 144.13

6/05/07 3,366.89, 3,275.35 (91.00) 133.83

6/11/07 2,351.95 , - 2,267.55 (84.00) 92.65

6/19/07 262.11 251.95 (10.00) 10.29

6/08/07 1,888.70 2,714.40 825.00 14.401

6/11/07 1,081.41 1,526.85 445.00 8.10

6/19/07 •' 499.10 '`, S • 678.60\ 179.00 3 60

9/15/06 --3,674.70 6,223.32 2,548.00

9/26/06' _ ,- 1,220.07 -- 2,074.44 854.00

8/17/07 1,537.45 1;642.80 105.00 79 20i

15 GENCO SHIPPING AND 08/20/07TRADING LTD

PLEASE SEE REVERSE SIDEPage Statement-Period

Rx 00588733 34 of 171 Year Ending 12/31/07

791/.51 '821.40^ 29.00 39.60

6060D 11-01

Merrill Lynch

THE WILLIAM H AND MARGARET M

E*I'F Fiscal ` Staterne"nt'

CURRENT PORTFOLIO SUMMARY

Total/Adj Unrealized EstDate - Cost - Fiscal Year - - Gain or Annual

Quantity Security Description Acquired Basis Value 12131/07 (Loss) Income

Equities

10 GENCO SHIPPING AND 08/28/07 - -516.47•, 547.60 31.00 26.40TRADING LTD

60 HEALTHCARE REALTY TR -03/03/05 2, 196.00 1,523.40 (672.00) 92.40REIT

20 HEALTHCARE REALTY TR - 05/25/06 640.68 507.80' (132.00) 30.80REIT -

25 HEALTHCARE REALTY TR 06/20/07 720.43 634 75 (85.00) 38.50REIT

60 HARSCO CORPORATION 03/03/05 1,765.50 3,84420 2,078.00 46.80

70 HEWLETT PACKARD CO DEL 03/05/07 2,727 42 -3,53360 806 00 22.40

15 HEWLETT PACKARD CO DEL 06/19/07 687.70 757,20 69.00 4 80

10 HEWLETT PACKARD CO DEL 08/06/07 476.60 i 504.80, 28.00 3.20

15 HOLLY CORP COM $0 01 03/29/05 267.81 763.35 495 00 7.20

24 HOLLY CORP COM $0 01 03/30/05 429.54 1,221.36', 791.00 11.52

75 HOME DEPOT INC 11/14/07 2,207.75 2,020 50 (187.00) 67 50

75 HOME DEPOT INC 11/30/07 2,159.38 2,020.50 (138.00) 67.50

40 IAMGOLD CORP COM 12/28/06 354.64 ' 324.00 / (30 00) 2 40

20 IAMGOLD CORP COM 12/29/06 - - _., 176.26/ 162.00 ; (14.00) 1 20

25 IAMGOLD CORP COM 01/03/07 217.98; ;'" 202.50 (15.00) 1.50

PLEASE SEE REVERSE SIDE j ;Page Statement Period --' '

• 00588734 35 of 171 Year Ending 12/31/07

1 11 111 1 II I II I I• 299071010000710018

^AczlMerrill Lynch

THE WILLIAM H AND MARGARET M

Quantity Security Description

wt

CURRENT-PORTFOLIO SUMMARY

Total/Ad) Unrealized EstDate `Cost Fiscal Year Gain or Annual

Acquired Basis Value 12/31107 (Loss) Income

15 IAMGOLD CORP COM 0

25 IAMGOLD CORP COM 0

25 IAMGOLD CORP COM 0

25 IAMGOLD CORP COM 0

20 IAMGOLD CORP COM 0

30 IAMGOLD CORP COM 0

35 IAMGOLD CORP COM 0

20 IAMGOLD CORP COM 0

25 IAMGOLD CORP COM 0

100 IAMGOLD CORP COM 0

215 INTEL CORP 0

30 INTEL CORP 0

21 INTESA SANPAOLO SPON ADR 0

21 INTESA SANPAOLO SPON ADR 0

10 INTESA SANPAOLO SPON ADR 0

5 INTESA SANPAOLO SPON ADR 0

5 INTESA SANPAOLO SPON ADR 0

PLEASE SEE REVERSE SIDEPage Statement Period

x 00588735 36 of 171 Year Ending 12/31 /07

Equities

1/04/07 126.42 121 50 (4.00) 0.90

1/05/07 205 . 96 - 202 . 50 (3.00) 1.50

1708/07 209.87 202 . 50 (7.00) 1 50

1/09/07 210.02 202 . 50 (7.00) 1.50

1/10/07 166 89 162 . 00 (400) 1.20

1/11/07 250 . 79. 243 00 ( 7.00) 1 80

1/12/07 360 ' 09 283 . 50 (16.00) 2.10

1/16/07 172 . 72 - ---162.00 (10.00) 1.20

1/17/07 / 217.48 202.50 (14.00) 150

6/20/07 776 . 60 810 . 00 33.00 6.00

4/25/07' 4,750 . 27 5,731 90 981 . 00 96.75

6/19/07 727 . 75 799 80 72 00 13.50

9/14/06 - 845.76 - 990.36 144.00 27.15

9/21/06 841.11 990 . 36 149.00 27.15

6/12/07 _ 440.55 471.60 31 .00 12.93

^6/19/07 -- 231 *25, 235 80 4.00 6.46.

8/16/07 . 25 1, 235.80' 17.00 6461 11

6060D 11 .01

46

5Z Merrill 16ynch

THE WILLIAM H AND MARGARET M

Fiscal :IStatem̂e_,nt , ;; .EMk

CURRENT-PORTFOLIO SUMMARY

` Total /Adj Unrealized Est

Date-- \ 'Cost Fiscal -Year - - -- - - - Gain or Annual

Quantity Security Description Acquired - Basis Value 12/3110 7 (Loss) Income

Equities

90 JPMORGAN CHASE & CO 03/03/05 ---3',329 10 3,928.50 599.00 136.80

5 JPMORGAN CHASE & CO 06/19/07 253.42 218.25 (35.00) 7.60

60 JPMORGAN CHASE & CO

20 JPMORGAN CHASE & CO

50 JOHNSON AND JOHNSON COM

10 JOHNSON AND JOHNSON COM

10 JOHNSON AND JOHNSON COM

10 JOHNSON AND JOHNSON COM

95 KEYCORP NEW COM

20 KEYCORP NEW COM

15 KEYCORP NEW COM

18 KRAFT FOODS INC VA CL A

65

30

10

20

40

X 00588736

KRAFT FOODS INC VA CL A

KRAFT FOODS INC VA CL A

KRAFT FOODS INC VA CL A

,11/1-4/07

11/15/07

12/06/05

05/23/06

06/20/06

06/19/07

03/03/05

09/29/05

06/19/07

2,71246

'89220

\3,042 61

602.98,

61'6.15,

622 51 ',

3,189.54

642.35

544 52

04/12/07

05/61/07

05/09/07

05/10/07

KRAFT FOODS INC VA CL A 05/22/07

KELLWOOD CO 03/03/05

PLEASE SEE REVERSE'SIDEPage Statement-Period

37 of 171 Year Ending 12/31/07

2,619.00 _ ( 93.00)

873.00 ( 19.00)

3,335 . 00 292.00

667.00 64 00

667.00 50.00

667.00 -' 44.00

227. 752 (961.00),

'469.00 (173.00)

351'75 ' , ( 192.00)

587 07 587 34`•

^-2,176.57, 2,120.95 (55.00)

982.26 -- 978.90 (3.00)

327 91 !^^ \ `` 326. 30 (1.00)

669.20' X652 60/

(16.00)i

1 160 49 665 60' (49400), . .

IIII II II I299071010000710019

91.20

30.40

83 00

16.60

16.60

16.60

142.50

30 00

22 50

19.44

70 20

32.40

10 80

21.60

25.60

M Merri116ynch

THE WILLIAM H AND MARGARET MEhIdF Fisca'I Statement

CURRENT PORTFOLIO SUMMARY

Total/Adj Unrealized EstDate ',Cost Fiscal Year Gain or Annual

Quantity Security Description Acquired Basis Value 12131/07 (Loss) Income

Equities

15 KELLWOOD CO 06/20/07

50 KENNAMETAL INC 06 /24/05

24 KENNAMETAL INC 06/27/05

55 KIMBERLY CLARK 03/03/05

10 KIMBERLY CLARK 05/23/06

5 LOCKHEED MARTIN CORP 08/24/07

30 LOCKHEED MARTIN CORP 08/27/07

10 LOCKHEED MARTIN CORP 10/09/07

20 L-3 COMMNCTNS HLDGS 06/07/06

15 L-3 COMMNCTNS HLDGS 06/30/06

5 L-3 COMMNCTNS HLDGS 06/19/07

40 LINCOLN ELEC HLDGS INC 03/03/05

55 LAFARGE ADR NEW 03/31/06

5 LAFARGE ADR NEW 08 / 10/06

10 LAFARGE ADR NEW 08/11/06

5 LAFARGE ADR NEW 01/12/07

25 LAFARGE ADR NEW 01/24/07

PLEASE SEE REVERSE SIDEPage Statement Period

00588737 38 of 171 Year Ending 12/31/07

442.60 249.60

1,132.41 _ 1,893.00

543 18 908.64

3,626.15 3,813.70

597.68 693.40

499.28 526.30

3,033.86 - 3,157.80

1,114.68 _1,052.60 -

'1',544.69 2,118.80

1,132.381 1,589.10

493.07 ' 529.70

1,270.56 2,847.20

1,559.73 2,502.85

153.51 227.53