Retirement Plans Workshop - SoCalAFP Retirement Plans... · Keith Baumgg, ,arn, CLU, ChFCChFC, QPA...

Transcript of Retirement Plans Workshop - SoCalAFP Retirement Plans... · Keith Baumgg, ,arn, CLU, ChFCChFC, QPA...

Retirement Plans Retirement Plans WorkshopWorkshop

“Opportunities“Opportunities……Th ATh A T tT tThe Awareness The Awareness TestTest

11SMAR # 185-20130429-140984

Count the Squares Count the Squares --It’s NOT about thinking outside the box.It’s NOT about thinking outside the box.

2

Keith Baumgarn, CLU, Keith Baumgarn, CLU, ChFCChFC, , g , ,g , , ,,QPAQPA

Signature Resources is a servicemark of Signature Resources Insurance and Financial Services, Inc. Signature Resources Insurance and Financial Services, Inc. is independent of John Hancock.

Offering John Hancock Insurance Products.

33

2601 Main Street, Suite 700, Irvine, CA 92614. Phone: (949) 794-0800.CA Insurance License # 0G01527

W l !W l !Welcome !Welcome !

AgendaAgenda

►► Open forum to discuss benefit Open forum to discuss benefit packages/tax law changespackages/tax law changes

►► Review common 401k complianceReview common 401k compliance►► Review common 401k compliance Review common 401k compliance “red flags” and remedies“red flags” and remedies

►► Our Our Business Model / PlayersBusiness Model / Players 44

O1

Niche MarketNiche MarketNiche MarketNiche Market

►►Businesses with one to Businesses with one to ???employees???employees

►►Available toAvailable to a variety of tax entitiesa variety of tax entities►►Available to Available to a variety of tax entitiesa variety of tax entities►►Focus on employer benefit designs a Focus on employer benefit designs a

d employee benefitd employee benefitd employee benefitd employee benefit►►We help you with your benefit We help you with your benefit

packagepackage►►DA.D. / Attract, Reward and RetainDA.D. / Attract, Reward and Retain

We specialize in providing the package that allows you We specialize in providing the package that allows you to work the small business pension marketto work the small business pension market

5

SIMPLEsSIMPLEs and 401ks Aren’t and 401ks Aren’t SimpleSimple

SIMPLESIMPLESIMPLEsSIMPLEs

IRS IRS SIMPLE/401k SIMPLE/401k Compliance Checklist Compliance Checklist

6

pp

SIMPLE SIMPLE EGTRRA/401K cycle EGTRRA/401K cycle Document ComplianceDocument Compliance

Th P i P kTh P i P kThe Pension Package:The Pension Package:

►►Plan designPlan designgg►►Plan administration servicesPlan administration services►►Plan funding optionsPlan funding options►►Plan funding optionsPlan funding options►►Plan compliancePlan compliance►►Players / TeamPlayers / Team►►Players / TeamPlayers / Team

7

Players In The Pension MarketPlayers In The Pension MarketPlayers In The Pension MarketPlayers In The Pension Market

►► IRS / DOLIRS / DOL►►Small Business Owner/HR/CFOSmall Business Owner/HR/CFO►►Small Business Owner/HR/CFOSmall Business Owner/HR/CFO►►CPA/AccountantCPA/Accountant►►Third Party AdministratorThird Party Administrator►►Third Party AdministratorThird Party Administrator►►Agent/BrokerAgent/Broker►►Feasibility StudyFeasibility Study -- Objective:Objective:►►Feasibility Study Feasibility Study Objective: Objective:

Qualified or NonQualified or Non--QualifiedQualified

8

Retirement HeadlinesRetirement HeadlinesRetirement HeadlinesRetirement Headlines

►► Social Security in JeopardySocial Security in Jeopardy►► Social Security in JeopardySocial Security in Jeopardy►► Pensions FrozenPensions Frozen►► Pension Benefit Guaranty Corp onPension Benefit Guaranty Corp on►► Pension Benefit Guaranty Corp on Pension Benefit Guaranty Corp on

Verge of BankruptcyVerge of Bankruptcy►►U.S. Hits Historically Low Savings U.S. Hits Historically Low Savings

RateRate►►Medicare Going BrokeMedicare Going Broke

S i li H lth C C tS i li H lth C C t►► Spiraling Health Care CostsSpiraling Health Care Costs►► Skyrocketing Drug CostsSkyrocketing Drug Costs

9

Business Owner Concerns►► I am getting killed with taxesI am getting killed with taxes

I d t d d ti i b iI d t d d ti i b i►► I need more tax deductions in my businessI need more tax deductions in my business

►► I would like to save more money todayI would like to save more money today

►►Will I have enough money to retire?Will I have enough money to retire?

►►Am I protected from creditors, judgments and sudden Am I protected from creditors, judgments and sudden d th di bilit ?d th di bilit ?death or disability? death or disability?

►►What benefits do I need to provide to A, R and RE and can What benefits do I need to provide to A, R and RE and can I legally discriminate?I legally discriminate?g yg y

10

401k Terms

►►TypesTypes TradTrad Vs RothVs Roth combo and noncombo and non qualifedqualifed►►TypesTypes--TradTrad. Vs Roth. Vs Roth--combo and noncombo and non--qualifedqualifed

►►Automatic enrollment/communicationAutomatic enrollment/communication

►►Protection from creditors and judgmentsProtection from creditors and judgments

►►FiduiciaryFiduiciary/administrator/resources/administrator/resources

►►Integrated with other benefit package and Integrated with other benefit package and l /b h ki t ll /b h ki t l

g p gg p gplayers/benchmarking toolsplayers/benchmarking tools

11

Compliance “Red Flags???

►►Corrective DistributionsCorrective Distributions--ADP Tests/Safe ADP Tests/Safe Harbor rules?Harbor rules?Harbor rules?Harbor rules?

►►Compensation/eligibility/liability/bonding?Compensation/eligibility/liability/bonding?p g y y gp g y y g

►►AuditsAudits--IRS/DOLIRS/DOL

►►Reporting/Integration/Benchmarking/turnkReporting/Integration/Benchmarking/turnkey packages?ey packages?ey packages?ey packages?

12

Available plan design optionsAvailable plan design optionsAvailable plan design optionsAvailable plan design options

►► New comparability/CrossNew comparability/Cross--tested vs. SEP’s tested vs. SEP’s ►► New comparability plans with 401(k) feature New comparability plans with 401(k) feature -- “the “the

simpler plan”simpler plan”simpler plansimpler plan►► 401(k) safe harbor profit sharing plans 401(k) safe harbor profit sharing plans -- D.A.S.H. D.A.S.H.

plansplans►► Traditional, Cash Balance and Floor Offset Traditional, Cash Balance and Floor Offset

defined benefit plansdefined benefit plans►► DB/401(k) or Roth 401(k)DB/401(k) or Roth 401(k)►► DB/401(k) or Roth 401(k)DB/401(k) or Roth 401(k)►► DB/DC carve outsDB/DC carve outs

Are you confused?? Are you confused?? 13

Plan Contribution ComparisonPlan Contribution ComparisonPlan Contribution Comparison Plan Contribution Comparison Larger Contributions & Deductions -

Example: Male, Age 50, Annual Compensation of At Least $265,000

TYPE OF PLAN CONTRIBUTION % OF SALARY

Retiring At Age 62

401(k) w/catch-up $24,000 9.0%

Profit Sharing /401k $59,500 22.00%

Money Purchase $53,000 20.0%

Traditional Defined Benefit $199,610 49.0%

Defined Benefit/401(k)/PS $ 259 010 64 0%Defined Benefit/401(k)/PS $ 259,010 64.0%

14

Case I(a)Case I(a) -- IncreasedIncreasedCase I(a) Case I(a) Increased Increased Individual Dollar Limit New Individual Dollar Limit New

Comp PS PlanComp PS PlanCensus Age Comp. Contrib. % of Pay % of

Comp. PS PlanComp. PS Plan TotalOwner 50 $150,000 $51,000 34% 90% EE 1 25 20,000 1,250 6.25% 2.3% EE 2 27 20,000 1,250 6.25% 2.3%EE 3 33 20,000 1,250 6.25% 2.3% EE 4 47 30,000 1,875 6.25% 3.1% Total $240,000 $56,625

($60,000)

15

IRS Code SecIRS Code SecIRS Code Sec IRS Code Sec 401(a)(4)401(a)(4)401(a)(4)401(a)(4)

Nondiscrimination in a Defined Nondiscrimination in a Defined Contribution or Defined Benefit Plan Contribution or Defined Benefit Plan

can be demonstrated by:can be demonstrated by:

Comparing Contributions (Traditional)or

Comparing Benefits (Age Weighted)

16

Plan DesignPlan DesignThis example highlights reasons business owners adopt pension plans.

Employer tax deductible contribution Less estimated tax savings (40%)

$56,225

-22,490g ( ) ,Net cost after estimated tax savings

33,735

Contribution for business owner 51,000Contribution for business owner 51,000

Net cost after taxes for owner (After tax savings and principal’s contribution)

-17,265

)

17Not having a Qualified Plan is costing you $17,265 per year!

Case II(a) Case II(a) -- New New C bilit P fitC bilit P fitComparability Profit Comparability Profit

Sharing PlanSharing PlanSharing Plan Sharing Plan Compensation (Corporation)

Profit Sharing Contribution(Corporation) Contribution

Owner – age 55

$ 250,000 $50,000

Spouse of owner – age 54

$ 52,000 $24,750

54Total $302,000 $74,750

18

Case II(b) Case II(b) -- New New C bilit P fitC bilit P fitComparability Profit Comparability Profit Sharing/401(k) PlanSharing/401(k) PlanSharing/401(k) Plan Sharing/401(k) Plan

ContributionContributionCompensation (Corporation)

Profit Sharing Contribution

401(k) Catch up Contribution

Total Profit Sharing + g401(k)

Owner-Age 55

$250,000 $33,500 $17,500 $5,500 $56,500

Spouse of Owner Age 54

$52,000 $33,500 $17,500 $5,500 $56,500

Total $302,000 $67,000 $35,000 $11,000 $113,00019

Case II(c) Case II(c) -- Traditional Traditional DB Plan/401(k) Plan DB Plan/401(k) Plan

CombinationCombinationCombinationCombinationCompensation Defined 401(k) Catch up Total (Corporation) Benefit

ContributionContribution Defined

Benefit + 401(k)

Owner-Age 55

$250,000 $230,000 $17,500 $5,500 $253,000

Spouse $52,000 $ 75,000 $17,500 $5,500 $ 98,555pof Owner Age 54

Total $302,000 $305,000 $35,000 $11,000 $351,555 l 6%plus 6%

PS20

Tax Entity TypesTax Entity TypesTax Entity TypesTax Entity Types

►►CorpsCorps►►CC►►SS

►►ProprietorshipProprietorship►►PartnershipsPartnerships►►PartnershipsPartnerships►► LLPs or LLCsLLPs or LLCs►►Tax ExemptTax Exempt►►Tax Exempt Tax Exempt

501(c)(3)501(c)(3)►►403b’s403b’s►►P/S or DB PlansP/S or DB Plans►►P/S or DB PlansP/S or DB Plans

21

Eligibility IssuesEligibility IssuesEligibility IssuesEligibility Issues

ll►►RulesRules►►EmployeesEmployees

P t TiP t Ti Part TimePart Time End Of YearEnd Of Year UnionUnionU oU o Independent ContractorsIndependent Contractors LeasedLeased

►►Vesting Vesting ►►Deadlines (Timetables)Deadlines (Timetables)

Cl ifi tiCl ifi ti►►ClassificationClassification22

D fi d B fit PlD fi d B fit PlDefined Benefit PlansDefined Benefit Plans

Past, Present, FuturePast, Present, Future

►►What What WhWh►►WhenWhen

►►WhyWhy►►WhoWho

24

Funding For A MonthlyFunding For A MonthlyFunding For A Monthly Funding For A Monthly Amount Maximum 415 Amount Maximum 415

Li it A tLi it A tLimit AmountLimit Amount$17 500 h b i i @ 65$17 500 h b i i @ 65►► $17,500 a month beginning @ age 65. $17,500 a month beginning @ age 65. No reductions for NRAs 62No reductions for NRAs 62--6565

►►With $255 000 salary capWith $255 000 salary cap►►With $255,000 salary cap With $255,000 salary cap

25

Defined Benefit vs. Defined Contribution

Defined Contribution PlansDefined Contribution Plans

Profit sharing plans, 401(k) plans, Simples, SEPs and IRAsProfit sharing plans, 401(k) plans, Simples, SEPs and IRAs

Defines and limits annual contributions Defines and limits annual contributions

Retirement nest egg is dependant upon market fluctuationRetirement nest egg is dependant upon market fluctuation

Defined Benefit PlansDefined Benefit PlansDefined Benefit PlansDefined Benefit Plans

Traditional and Fully InsuredTraditional and Fully Insured

Sets forth a defined, guaranteed income at retirementSets forth a defined, guaranteed income at retirement

Allows for larger contribution as needed to fund the benefit Allows for larger contribution as needed to fund the benefit

26

h f d f l b k?h f d f l b k?Why are Defined Benefit Plans back?Why are Defined Benefit Plans back?

►►Deductions and exemptions phasedDeductions and exemptions phasedout with adjusted gross income over out with adjusted gross income over $250 000$250 000$250,000$250,000

►►Repeal of 415(e) after Jan. 1, 2000Repeal of 415(e) after Jan. 1, 2000►►BabyboomersBabyboomers►►BabyboomersBabyboomers►►Social Security statementsSocial Security statements►►Market Impact on 401(k) PlansMarket Impact on 401(k) Plans►►Market Impact on 401(k) PlansMarket Impact on 401(k) Plans►►EGTRRA / PPA ‘06EGTRRA / PPA ‘06

27

Business ProfileBusiness ProfileLevel 1 Level 1 –– Safe Harbor PlansSafe Harbor Plans

►► Very small business (1 Very small business (1 -- 6 participants)6 participants)►► Stable cash flow projections for next 5Stable cash flow projections for next 5 -- 10 years10 years►► Stable cash flow projections for next 5 Stable cash flow projections for next 5 10 years10 years►► Business owner’s cash flow in excess of Business owner’s cash flow in excess of

$250,000$250,000►► Business owner will be working in business for Business owner will be working in business for

at least 5 yearsat least 5 years►► Business owner is at least age 45 and oldest inBusiness owner is at least age 45 and oldest in►► Business owner is at least age 45 and oldest in Business owner is at least age 45 and oldest in

the groupthe groupLevel 2 Level 2 –– Carveout/Combo Plans (401a4) TestingCarveout/Combo Plans (401a4) Testing66--?? Participants?? Participants

28

Other EntrepreneursOther Entrepreneurs

►►Moonlighting Income Moonlighting Income g gg g►►No controlled group (I.e. No controlled group (I.e.

Professors AuthorsProfessors AuthorsProfessors, Authors, Professors, Authors, Consultants, Board Of Consultants, Board Of Directors Coaches)Directors Coaches)Directors, Coaches)Directors, Coaches)

29

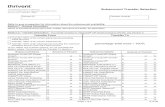

Samples of Practicing ProfessionalsA t l C D i R lt

Number of Number of Total Total Owner’s Owner’s Contribution s Contribution s % to Owners% to Owners

Actual Case Design Results

Owners/Owners/ProfessionalsProfessionals

EmployeesEmployees ContributionsContributions to to EmployeesEmployees

11 2424 $ 304,503 $ 304,503 $ 83,520 $ 83,520 78%78%

$$ $$22 11 $ 309,997 $ 309,997 $ 9,000 $ 9,000 97%97%

22 88 $ 278,242 $ 278,242 $ 20,013 $ 20,013 93%93%

22 1515 $ 214,796 $ 214,796 $ 107,972 $ 107,972 67%67%

22 3333 $ 357,099 $ 357,099 $ 105,682 $ 105,682 77%77%

33 22 $ 453,226 $ 453,226 $ 28,000 $ 28,000 94%94%

44 2525 $ 234,121 $ 234,121 $ 68,711 $ 68,711 77%77%$ ,$ , $ ,$ ,

44 175175 $ 785,361 $ 785,361 $ 393,710 $ 393,710 67%67%

99 100+100+ $ 2,062,319 $ 2,062,319 $ 223,448 $ 223,448 90%90%

1414 100+100+ $ 1 128 954$ 1 128 954 $ 322 323$ 322 323 78%78%1414 100+100+ $ 1,128,954 $ 1,128,954 $ 322,323 $ 322,323 78%78%

5656 6464 $ 3,898,558 $ 3,898,558 $ 252,468 $ 252,468 94%94%30

S Corp. ExampleS Corp. Examplep pp p

AgeAge WW--2*2* SEP PSSEP PS--401(k) 401(k) TradTrad DefDef Benefit**Benefit**5050 $50,000 $12,500 $50,000 $12,500 $35,500$35,500 $95,000$95,000, ,, , ,, ,,

* Consider adding spouse as a participant * Consider adding spouse as a participant –– bona fide employee bona fide employee g p p pg p p p p yp yand reasonable compensation issuesand reasonable compensation issues

** Additional ** Additional $26,000 profit sharing 401(k$26,000 profit sharing 401(k) plan could be ) plan could be addedadded. This is for 2013 tax year and based on 2013 IRS plan . This is for 2013 tax year and based on 2013 IRS plan limits.limits.

31

ResourcesResourcesResourcesResources

►►WebsitesWebsites►►WebsitesWebsites Freeerisa.comFreeerisa.com Benefitlinks comBenefitlinks com Benefitlinks.comBenefitlinks.com IRSGov.orgIRSGov.org

P bli ti / CP bli ti / C►►Publications / CoursesPublications / Courses Dearborn / CorbelDearborn / Corbel IRS Publications / NewslettersIRS Publications / Newsletters

►►Free Feasibility Studies/Pension SeasonFree Feasibility Studies/Pension Season32

Pursuant to IRS Circular 230, we are providing you with the following notificationPursuant to IRS Circular 230, we are providing you with the following notification::The The information contained in this presentation is not intended information contained in this presentation is not intended to (and to (and cannot) be used cannot) be used pp (( ))

by anyone to avoid IRS penalties. This presentation supports the promotion and by anyone to avoid IRS penalties. This presentation supports the promotion and marketing of insurance. You should seek advice based on your particular marketing of insurance. You should seek advice based on your particular

circumstances from an independent tax advisor.circumstances from an independent tax advisor.

John Hancock Financial Network, its agents, and representatives may not give legal John Hancock Financial Network, its agents, and representatives may not give legal or tax advice. Any discussion of taxes herein or related to this document is for general or tax advice. Any discussion of taxes herein or related to this document is for general

information purposes only and does not purport to be complete or cover every information purposes only and does not purport to be complete or cover every situation. situation.

Tax law is subject to interpretation and legislative change. Tax results and the Tax law is subject to interpretation and legislative change. Tax results and the appropriateness of any product for any specific taxpayer may vary depending on the appropriateness of any product for any specific taxpayer may vary depending on the facts and circumstances. You should consult with and rely on your own independent facts and circumstances. You should consult with and rely on your own independent y y py y p

legal and tax advisers regarding your particular set of facts and circumstances.legal and tax advisers regarding your particular set of facts and circumstances.

Although care is taken in preparing this material and presenting it accurately, John Although care is taken in preparing this material and presenting it accurately, John Hancock Financial Network disclaims any express of implied warranty as to the Hancock Financial Network disclaims any express of implied warranty as to the y p p yy p p y

accuracy of any material contained herein and any liability with respect to it. This accuracy of any material contained herein and any liability with respect to it. This information is current as of September, 2011.information is current as of September, 2011.

33