Results for the Fiscal Year Ended March 31, 2012 · of 2,829 million yen, compared with the fiscal...

Transcript of Results for the Fiscal Year Ended March 31, 2012 · of 2,829 million yen, compared with the fiscal...

0

May 10, 2012May 10, 2012

MEITEC CorporationMEITEC Corporation

Results for the Fiscal Year Results for the Fiscal Year Ended March 31, 2012Ended March 31, 2012

ⅠⅠ.. Highlights of Highlights of FY Ended March 31, 2012 FY Ended March 31, 2012

Consolidated ResultsConsolidated Results

1

2

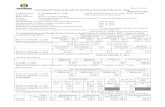

<Consolidated Results for FY2011><Consolidated Results for FY2011>-- For the Fiscal Year ended March 31, 2012 For the Fiscal Year ended March 31, 2012 --

Net Sales OperatingIncome

OrdinaryIncome

Net Income

FY2011 66,955 5,450 5,531 2,827

FY2010 61,790 2,620 4,588 3,690

Change(%) 8.4% 108.0% 20.6% (23.4%)

FY2011 53,188 4,613 4,988 2,590

FY2010 48,260 1,724 3,550 2,141

Change(%) 10.2% 167.5% 40.5% 21.0%

<NOTE:Past Forecasts for the Fiscal Year Ended March 31 , 2012>

(Million of Yen) Net Sales OperatingIncome

OrdinaryIncome

Net Income

Feb. 07, 2012 66,000 5,000 5,000 2,400

Nov. 08, 2011 64,000 4,200 4,200 2,400

May. 12, 2011 66,500 4,700 4,700 2,600

Revision of ForecastConsolidatedPerformances

(Million of Yen)

Consolidated

Non-Consolidated

※ For the fiscal year ended March 31, 2011, Ordinary Income includes subsidy income of 2,036 million yen consolidated and1,839 million yen non-consolidated.

Let me begin with an overview of consolidated results.On a consolidated basis, net sales for fiscal 2011, the year ended March 31, 2012, reached 66,955 million yen, up 8.4% from the previous fiscal year. On the profit front, operating income jumped 108.0%, to 5,450 million yen, and ordinary income climbed 20.6%, to 5,531 million yen, but net income dropped 23.4%, to 2,827 million yen. The main reason for comparatively sluggish growth in ordinary income when operating income resulted favorably is explained in the notes to the financial statements. To summarize, government subsidies for employment adjustment added about 2,000 millionyen to ordinary income in fiscal 2010, the year ended March 31, 2011, whereas such proceeds were essentially zero in fiscal 2011.The primary factor leading to lower net income was a reversal of deferred tax assets, totaling 520 million yen, which followed by a reduction in the corporate tax rate.The data in green shows changes in forecast for fiscal results, namely, initial forecast announced a year ago and the subsequent downward revisions in November 2011 and upward revisions in February 2012. In the end, actual results surpassed initial targets.

33

<Overview of the market for the Fiscal Year Ended March 31, 2012>

1. Status of Meitec Group’s main customer, manufacturers

2. Status of our core business, temporary engineer staffing

During the fiscal year, although the Great East Japan Earthquake caused power shortages, disrupted supply chains and other negative factors, and impacted domestic production activities among leading manufacturers, which are the major customers of the Company, investments in technological development continued on the whole.And although many customers applied restrictions on overtime work and a change in days off during the first half of the fiscal year, those production adjustment decreased from the 3rd quarter of the fiscal year.But the trend of suppressing the cost after the Lehman Shock still is continuing.

As many customers sustained in their investments in technological development, the Company was able to continue to land new contracts as the previous fiscal year.And the working hours had recovered since the 3rd quarter.

Here is an overview of market conditions in fiscal 2011.First—the status of the manufacturing industry. Three conditions affected the main customers of Meitec Group in the manufacturing industry. The Great East Japan Earthquake had the most profound consequences, as it occurred in March a year ago, just before fiscal 2011 started. The disruption to supply chains that arose immediately after the earthquake, as well as power shortages, had an incredibly huge impact on the domestic production activities of our main customers—leading manufacturers in Japan—especially in the first half of the fiscal year. However, despite the impact on production, most of Japan’s leading manufacturers continuedtheir effort to sustain the investment into technological development. Through the 2nd quarter, our customers curtailed production activities, in some cases adjusting the work schedule or limiting overtime. This caused a drop in the working hours of our engineers. And second—the status of our core business. As highlighted in red, a noteworthy development was that the working hours gradually started to increase from the 3rd quarter. The working hours through the 2nd quarter was much shorter than expected, which prompted management to revise performance forecasts downward in November. But as the recovery tone brightened from the 3rd quarter, management adjusted the revised targets upward in February, and in the end, consolidated results exceeded initial forecast.

4

< Consolidated Operating Results Consolidated Operating Results :FY2011>-- For the Fiscal Year ended March 31, 2012 For the Fiscal Year ended March 31, 2012 --

798

537

669

821

657

791

712

832 822

649640617

54

122101 91112 122 124

115

11392

(49)

26

12112291103

113 125114

11392

(2)

45 55

28364349 53 5467

472

53 49

(9)

8.1%

(9.2%)

11.6%14.1%

17.6%

15.7%13.9%

17.2%15.5% 15.0%

13.8%

4.2%0.2% 4.2%(1.7%)

5.4%

9.4%8.2%8.2%7.7%

5.9% 6.4% 6.0%

6.0%

(100)

0

100

200

300

400

500

600

700

800

900

01/3 02/3 03/3 04/3 05/3 06/3 07/3 08/3 09/3 10/3 11/3 12/3-15%

-10%

-5%

0%

5%

10%

15%

20%

25%

30%

35%

Net Sales Operating Income Ordinary IncomeNet Income Operating Income Margins Net Income Margins

(100 million yen)

This graph shows trends in consolidated fiscal results.Group profitability was seriously affected by fallout from the Lehman shock a few years back, but as the graph shows, fiscal results have since been charting an upward path.

5

< Results of Four Meitec Group< Results of Four Meitec Group’’s Business Domains for FY2011>s Business Domains for FY2011>--For the Fiscal Year ended March 31, 2012 For the Fiscal Year ended March 31, 2012 --

505.3

586.7

638.2

773.9

743.5

97

(44)

52

119

23

(100)

0

100

200

300

400

500

600

700

800

900

08/3

09/3

10/3

11/3

12/3

27.5

31.330.0

7.5

12.8

6.4

0.7 0.2

15.3

19.7

5.1 4.45.9

32.3

34.6

(5)

0

5

10

15

20

25

30

35

40

08/3

09/3

10/3

11/3

12/3

08/3

09/3

10/3

11/3

12/3

08/3

09/3

10/3

11/3

12/3

Net SalesOperating Income

(100 million yen)

Temporary EngineersStaffing Business

EngineeringSolutions Business

Global Business Recruiting & PlacementBusiness

(100 million yen)

This graph shows performance trends for each of the Group’s four business segments. Temporary Engineer Staffing is the Group’s flagship segment and contributes about 95% of consolidated net sales. This business involves Meitec Corporation, Meitec Fielders Inc. and Meitec Cast Inc. The operating environment was not necessarily ideal, but the segment was able to deliver higher sales and higher operating income nonetheless.The three business segments inside the red frame—Engineering Solutions, Global, and Recruiting & Placement—together contribute about 5% of consolidated net sales and do not have much of an impact on consolidated fiscal results. Recruiting & Placement has delivered steady improvement in net sales and operating income since the Lehman shock.In this business, Meitec Next Corporation recruits and places staff with engineering qualifications. By fine-tuning its focus on engineer placement service, the company is raising its profile somewhat within this specialized placement market and thereby securing favorable business results. In Engineering Solutions, net sales and operating income fell slightly. This is primarily because the impact of the Great East Japan Earthquake caused a slight decrease in orders for Meitec CAE’s analytical services using computers.Global is a segment that spotlights development of the Company’s engineer outsourcing operations in China. The segment is mainly engaged in temporary staffing services for Japanese manufacturers with a presence in China and a need for local staff with engineering expertise. This business is seen as a long-term upfront investment, but because front-loading can adversely affect consolidated results, the segment strives to cap the operating loss with an annual upper limit of 100 million yen.

6

<Meitec Group Results for FY 2011><Meitec Group Results for FY 2011>-- For the Fiscal Year ended March 31, 2012 For the Fiscal Year ended March 31, 2012 --

(Millions of Yen)

Net SalesOperatingIncome

OrdinaryIncome

Net Income

Meitec 53,188 4,613 4,988 2,590

Meitec Fielders 8,510 537 540 275

Meitec Cast 2,370 67 68 33

Meitec CAE 1,150 124 124 70

Apollo Giken Group 1,855 19 23 (0)

Global Business Meitec Shanghai * 25 (67) (67) (67)

Meitec Next 593 147 147 147

all engineer.jp 9 1 1 1

66,955 5,450 5,531 2,827

*Amount for the Global Business is total of Meitec Shanghai, Meitec Xian, Meitec Chengdu and Meitec Shanghai Human Resources.**After Inter-Company Elimination Adjustments

Temporary EngineersStaffing Business

Engineering SolutionsBusiness

Recruiting & PlacementBusiness

Consolidated **

This table presents fiscal results for each company in the Group.All business segments showed operating income except Global Business.

7

<Comparison of Consolidated SG&A>- For the Fiscal Year ended March 31, 2012 -

11,629

10,337

△326

+898

+108

+90

+523

10,000

11,000

12,000

(million Yen)

+1,292

FY2010SG&A

FY2011SG&A

infrastructureupgrades

Existingcosts

Cost for Recruiting& Placement

Business

Education Costfor Un-assigned

Engineers

StrategicalInvestment

0

This graph shows comparison of consolidated SG&A expenses. Five factors were behind the 1,292 million yen increase in SG&A expenses. First—strategic investments totaling 898 million yen. This outlay of funds will pave the way for medium- to long-term growth under the medium-term management plan. The cost of recruiting is the Company’s biggest expense and is included in strategic investments . Next—cost for recruiting and placement amounting to 108 million yen. As I mentioned earlier, Meitec Next has achieved favorable business growth, and associated expenses have increased in the process.And then we had IT infrastructure upgrades—90 million yen. We continuously undertake investments to boost productivity. The fourth factor—existing costs. These are mostly employee training costs and costs incurred to normalize situations that caused employee benefits, such as health and welfare, to be scaled back as a contingency response following the Lehman shock. The fifth factor was actually a positive change that tempered rising SG&A expenses. It was a 326 million yen reduction in education and training costs for unassigned engineers. And also, as the engineer utilization ratio went up, the absolute number of unassigned engineers went down. The cost of education and training for those unassigned engineers also went down.As a whole, consolidated SG&A expenses amounted a year-on-year increase of 1,292 million yen.

8

<Comparison of Consolidated Operating Income> - For the Fiscal Year ended March 31, 2012 -

+5,164

5,450

(1,292)

(1,042)

2,620

0

2,000

4,000

6,000

8,000

+2,829

(million yen)

FY2010OperatingIncome

FY2011OperatingIncome

Net Sales Cost of SalesSG&A

This graph compares consolidated operating income in fiscal 2011 against the fiscal 2010 amount.In fiscal 2011, operating income reached 5,450 million yen—a significant improvement of 2,829 million yen, compared with the fiscal 2010 amount of 2,620 million yen. This reflects one positive factor and two negative factors.On the plus side— a 5,164 million yen increase in net sales. On the minus side—a 1,292 million yen increase in selling, general and administrative expenses; and a 1,042 million yen increase in cost of sales.A breakdown of selling, general and administrative expenses—SG&A— is provided on the next page.The increase in cost of sales is mainly due to higher labor cost for engineers, according to higher net sales.

9

<Comparison of Consolidated Net Income>- For the Fiscal Year ended March 31, 2012 -

3,690

2,827

+2,829

(1,886)

(1,657)

(149)

0

1,000

2,000

3,000

4,000

5,000

6,000

7,000

(862)

Extraordinary Income

Income Tax & OtherOther Income

(mainly from gov. subsidies)OperatingIncome

FY2010Net

Income

FY2011Net

Income

(million yen)

This graph compares consolidated net income in fiscal 2011 against the fiscal 2010 amount.Net income reached 2,827 million yen in fiscal 2011, down 862 million yen from fiscal 2010. Operating income added 2,829 million yen.We recorded a year-on-year decrease of 1,886 million yen in other income. As I mentioned earlier, this is because the receipt of government subsidies for employment adjustment was nearly zero.An increase in income tax and other taxes consumed 1,657 million yen, and after accounting for a drop in extraordinary income, net income ended 862 million yen below the level marked in fiscal 2010.

ⅡⅡ.. Highlights of Highlights of FY Ended March 31, 2012 FY Ended March 31, 2012 NonNon--Consolidated ResultsConsolidated Results

11

<Comparison of Non-Consolidated Net Sales>- For the Fiscal Year ended March 31, 2012 -

+201

48,260

53,188

+3,097

+1,630

45,000

50,000

55,000

(million Yen)

0

+4,928

Increase of WorkingEngineers

Increase inWorking Hours

FY 2010Net Sales

FY 2011Net Sales

Decrease Relatingto Ave. Hourly

Rates

This graph shows comparison of net sales for Meitec alone. On a non-consolidated basis, net sales reached 53,188 million yen, up 4,928 million yen from fiscal 2010. Factors contributing to higher net sales are an increase in the number of assigned engineers, which is a precursor to higher utilization ratio, as well as an improved contract rate per hour and increased working hours per day. And the main reason for higher net sales in fiscal 2011compared with fiscal 2010 was the combined effect of all three factors.The biggest boost came from an increase in the number of assigned engineers, which is a precursor to higher utilization ratio, and had a 3,097 million yen effect on net sales. An improvement in the average hourly rate for engineers had a 1,630 million yen effect on net sales. Other factors, aside from the increase in the number of working hours, contributed slightly, but still had a 201 million yen effect on net sales.

12

<Trend of New Contracts (Non-Consolidated)>- From Apr-2009 to Mar-2012 -

0

100

200

300

400

500

2009/Apr July Oct

2010/Jan Apr July Oct

2011/Jan Apr July Oct

2012/Jan Apr

New Contract Ended Contracts

(Preliminary)

1,042

FY2009 Total New 1,748 FY2010 Total New 3,066

FY2011 Total Ended 2,439

FY2011 Total New 2,574

FY2009 Total Ended 2,770 FY2010 Total Ended 2,435

This graph shows trend of contracts, assuming higher sales, over the past three years. Since the Lehman shock, we provide this data in our financial statements as well. The blue line represents the number of monthly contracts started and the red line represents the number of monthly contracts ended. For the number of assigned engineers to increase, the blue line representing new contracts started must be above the red line representing completed contracts. In fiscal 2011, 2,439 contracts came to an end, and 2,574 contracts started up. The difference between new and completed contracts was the increase in assigned engineers. Comparing these results to fiscal 2010, there is no discernible difference in the number of contracts ended. But a closer look at such contracts in fiscal 2011 reveals that 167 of them were deliberately terminated following the presentation of business proposals by the Company. We call this “strategic rotation”, and it refers to the rotation of engineers. We implement it intentionally because if temporary placement continues long term, we could lose opportunities to implement higher hourly rates or improve service levels.We suspended the “strategic rotation” after the Lehman shock, but reintroduced it in fiscal 2010 as a way to enhance marketing results. The 167 contracts that were terminated because of strategic rotation provided an opportunity to implement an increase in hourly rates since the assignment of engineers would have been to customers anticipating a higher hourly rate.

13

<Trend in Average Rate (Meitec, Meitec Fielders)><Trend in Average Rate (Meitec, Meitec Fielders)>

Appendix-6

4,682 4,719 4,700 4,729 4,7524,804

4,8634,929

4,982

4,814 4,824

4,958

3,3843,437 3,458

3,5283,606

3,6703,596

3,4663,576

2,500

3,000

3,500

4,000

4,500

5,000

5,500

Mar-01 Mar-02 Mar-03 Mar-04 Mar-05 Mar-06 Mar-07 Mar-08 Mar-09 Mar-10 Mar-11 Mar-12

Average Rate(Meitec) Average Rate(MF)

3,300

(Yen)

<The average of temporary engineers staffing industry>

※Average Rate at the end of each fiscal year

This graph shows trend of average hourly rate. The Meitec average hourly rate rose slightly, to 4,985 yen.Hourly rates are an extremely important aspect of business. Even at the time of the Lehman shock, our policy was to “maintain prices” not to “maintain the utilization ratio by slashing prices.” This was the marketing approach we applied.We think that once hourly rates are slashed, it is nearly impossible to return to the level from which the rates were cut. Therefore, we responded to the challenges of a very difficult market after the Lehman shock without slashing hourly rates, and in fiscal 2011, as a result of energetic marketing efforts, rates began climbing, as you see in the graph. It is important to note, however, that Meitec recruited very few new graduates over the past two years. We just hired 220 newly graduated engineers this past April, but with the standard hourly rate for newly graduated engineers hovering at 4,000 yen, we are likely to see an average rate decrease if we deploy our new employees. The deployment of newly graduated engineers did not lead to rate reductions in the past two years, but downward pressure to lower rates overall is mounting now with the deployment of new graduates. With vigorous marketing efforts to sustain rates around the 4,900 yen level, we believe we can withstand the pressure to lower rates and move forward.

1414

【A】

【B】

<Breakdown of the Utilization>(Non-Consolidated)

Number of engineer utilized at the end of March 2012 increased by 134 compared to the end of previous fiscal year. Since the remaining number of engineer on the special scheme, a lower rate assignment for younger engineer, was resolved to 0 from 158 at the end of the previous fiscal year, actual improvement in number of assigned engineers was 292 (【A】-【B】)

5,165

4,873

0

158

0 5,000

End of March 31, 2011

End of March 31, 2012

Engineer under normal contracts Engineer under special scheme contracts

5,031

5,165【A】

【B】

This is a breakdown of assigned engineers.As of March 31, 2012, Meitec had 5,165 engineers on the job, up 134 from a year earlier. The text in the red-edged box states that the actual number of engineers in the field effectively rose by 292. The difference is explained by the add-back of 158 engineers—the red part of the top bar—who were placed with customers under so-called a special scheme in fiscal 2010 but then returned to ordinary services in fiscal 2011. The special scheme was our response to the Lehman shock, which caused the temporary staffing market to cool suddenly, creating an extremely difficult environment in which to place engineers, especially young, new graduates. To give these employees a chance to acquire at least a little practical experience and thereby not lose out on career opportunities due to their unassigned status, we came up with an approach—which we referred to as a “special scheme”. We expanded the sphere of services very close to that of manufacturing outsourcing services and then placed special scheme employees with customers at lower rates.At the end of fiscal 2011, the the special scheme was dissolved so that the number of engineers working under that format went from 158 to zero, giving us another reason to raise rates.

14

15

<Utilization Ratio (Non-Consolidated)>

90.0%

94.6%

96.2%

91.9%

90.8%

88.3%

83.4%

78.1%

76.9%

70.4%

68.7%

71.6%

91.7%

96.7%

97.7%

93.6%

98.6%98.9%

95.2%

98.5%

98.8%

98.7%

95.4%

98.8%

99.1%

99.0%

95.8%

98.4%98.6%

98.1%

95.0%

98.0%

98.5%

98.4%

94.2%

97.3%

60%

65%

70%

75%

80%

85%

90%

95%

100%

4 7 10 1 4 7 10 1 4 7 10 1 4 7 10 1 4 7 10 1 4 7 10 1 4 7 10 1 4 7 10 1 4 7 10 1

Quarter Period Average

Operating Ratio ,excluding new empioyees

Companywide Operating Ratio

WorldwideDepression

3

95%

04/ 05/ 09/ 11/03/ 06/ 07/ 08/ 10/ 12/

This graph shows one of important management index, trend of the utilization ratio, for Meitec alone.Utilization ratio have steadily improved after suddenly dropping, due to circumstances triggered by the Lehman shock.

16

<Utilization Ratio (Non-Consolidated)>From Apr-2008 to Mar-2012

96.2%94.6%91.9%90.0%90.8%88.3%83.4%78.1%76.9%70.4%68.7%71.6%91.7%96.7%97.3%94.2%60%

70%

80%

90%

100%

4 5 6 7 8 9 1011 12 1 2 3 4 5 6 7 8 9 10 11 12 1 2 3 4 5 6 7 8 9 10 1112 1 2 3 4 5 6 7 8 9 1011 12 1 2 3

Quarter Period Average

Companywide Operating Ratio

08/ 09/ 10/ 11/ 12/

95%

For us, topping the green line, which marks a utilization ratio of 95%, is an index of normal conditions.In the fourth quarter of fiscal 2011, the utilization ratio hit 96.2%, finally topping our benchmark level of 95% for the first time since the Lehman shock. The hiring of 220 engineers in April 2012 would cause a temporary drop in the April utilization ratio. But as the deployment of newly graduated engineers progresses, the utilization ratio should expand. We plan to achieve a utilization ratio of over 95% during the current fiscal year.

17

<Trend in New Orders by Month (Non<Trend in New Orders by Month (Non--Consolidated)>Consolidated)>From Apr-2003 to Mar-2012

0

100

200

300

400

500

600

03/4

03/1

0

04/4

04/1

0

05/4

05/1

0

06/4

06/9

07/4

07/1

0

08/4

08/1

0

09/4

09/1

0

10/4

10/1

0

11/4

11/1

0

12/0

3

250

100

This graph shows trend of new order activity on a monthly basis.As an index of performance in the Company, this index some what precedes the utilization ratio. Changes in monthly order activity in fiscal 2011 are on the far right. As the fiscal year started, in April and May, we recorded a slight drop in new orders, partly due to the effects of the March disasters. This situation was short-lived, however, and we were able to secure steady order activity at an extremely high level for the rest of the fiscal year.Following the Lehman shock, we switched to proactive marketing, and because we apply a more persistent approach in our marketing activities to capture orders and also pick up short-term staffing requests, it really isn’t possible anymore to compare current order trends to those that prevailed before the Lehman shock.At one time, business was considered brisk if we took in more than 250 orders a month. Moving forward, I would like to consider changing the level required to meet the definition of “brisk business.”.

18

<Trend of Working Hours (Non-Consolidated>- SemiSemi--annual average annual average From Apr-2003 to Mar-2012 -

8.0

8.2

8.4

8.6

8.8

9.0

9.2

9.4

9.6

03/04 04/04 05/04 06/04 07/04 08/04 09/04 10/04 11/04

(H/Day)

9.2

9.35H/Day

9.32H/Day

9.23H/Day

9.21H/Day

9.12H/Day

8.86H/Day

8.60H/Day

8.83H/Day

8.83H/Day

12/03

This graph shows trend of working hours for Meitec alone.The two stars mark the first six months of fiscal 2010 and fiscal 2011. The star on the right shows a sizable drop compared with the second half of fiscal 2010, owing to repercussions from the March 2011 disasters. In the second half of fiscal 2011, however, the working hours rebounded and exceeded the level recorded in the second half of fiscal 2010. This had a positive effect on business results. Before the Lehman shock, working hours per day averaged longer than between 9.0 and 9.2. But since the trend to cut costs and restrict overtime has become common practice among our corporate customers rather than out-of-the-ordinary measures, average working hours per day is shifting into the green zone, in a range from 8.8 to 9.0.

19

<Comparison of Sales Trend by the Industrial Segments><Comparison of Sales Trend by the Industrial Segments>

0

20

40

60

80

100

120

140

Automo

bile/T

ranspo

rtaion

Aircraft/

Aerosp

ace

Indu

stria

l Mac

hine

ry

Prec

ision Eq

uipm

ent

IT Related

Hardw

are an

d De

vice

s

Elec

tric an

d Elec

tronics

Semic

ondu

ctor and

Integrated

Circ

uits De

sign

Semico

nduc

tor E

quipme

nt and

Dev

ices

Inform

ation Proc

essing

/Softw

are

Plan

t

Constru

ction

Othe

r

Mar-08 Mar-09 Mar-10 Mar-11 Mar-12

(100 million yen)

This graph shows changes in non-consolidated sales, according to industry segment. Sales to customers in nearly all segments were up, year-on-year.We are often asked regarding effects from the sluggish business results for major manufacturers of electric appliances, mainly due to lackluster demand for televisions. If I was to specify any particular segment, there was effect in form of sales reduction compared to the previous year in the semiconductor and integrated circuit design segment. This is evident in a year-on-year decrease in the sale of services to this segment. Nevertheless, one of our biggest strengths is an extensive, well-established customer base covering all manufacturing segments and underpinned by a solid track record of services to more than 4,000 companies. So even when order activity retreats in some segments, we are able to offset the situation by capitalizing on demand from other segments. That is, we are in a much better position now than when the Lehman shock occurred. The event triggered incredibly difficult conditions, swiftly eroding demand in all industry segments. At that time, we had no customer segments which can compensate for other segments. Under current conditions, I think that we can compensate condition differences between the segments within our wide customer base.

Ⅲ. Mid-Term Management Plan“Co-creation 21”

(From April 1, 2011 to March 31, 2014)

1.Recovery of the damage (damage to the corporate value) caused by the Lehman Shock

2.Building foundation for next growth

<Purpose of the Mid-Term Management Plan>

Our three-year medium-term management plan emphasizes two objectives. The first is to recover from the damage caused by the Lehman shock—that is, polish tarnished corporate value. The second is to build a platform for a new stage of growth.

21

22

《Damage Caused by the Lehman Shock》

Consolidated operating loss of 4,900 million yen for the fiscal year ended March 31, 2010

【Damaged Corporate Value】

・Value to employee: maximum of 2,300 engineers were not assigned (Meitec alone)

・Value to Customers: of which 1,001 customers (by location) at the end of March 31, 2008, we could not continue the contracts with 280 customers (Meitec alone)

・Value to Shareholders: stock price decreased significantly

The damage caused by the Lehman shock was essentially a 4,900 million yen operating loss on the consolidated books. In terms of corporate value, the Lehman shock eroded value to employees, as demonstrated by our inability to deploy as many as 2,300 engineers. Our value to customers was also negatively affected. Prior to the Lehman shock, we had contracts with 1,000-plus companies. We were unable to maintain business with 280 of these companies, marking a loss of close to 30% of the customer base.And finally, our value to shareholders withered, due to a significant and certainly regrettable decline in the price of our stock.

23

《Recovery of Damage Caused by the Lehman Shock: Fiscal Year Ended March 31, 2012》

Posted consolidated operating profit of 5,400 million yen for the fiscal year ended March 31, 2012

【Status of Recovering the Corporate Value】

・Value to employee: utilization ratio = 96.7% (for March 2012) (Meitec alone)

・Value to Customers: Number of customer at the end of March 2012 = 1,017 (by location) (Meitec alone)

・Value to Shareholders: stock price at the end of March 2012 = 1,669 yen

To see the progress we achieved toward bringing value back in the first year of the medium-term management plan, look first at performance. We rebounded from the operating loss posted in fiscal 2010, achieving instead operating income of 5,400 million yen on a consolidated basis in fiscal 2011. By and large, we restored value to employees, demonstrated by an improvement in the utilization ratio to 96.7%. Value to customers is on a positive trajectory now. After we lost nearly 30% of our customer base, we adopted a more proactive marketing approach, targeting new customers and different divisions at existing customer companies. The number of customers has returned to a same level to that prior to the Lehman shock. While we have reestablished a sense of corporate value among employees and customers, our stock price would suggest that we have not yet responded fully to shareholder expectations. And we acknowledge this situation.With this in mind, management is considering an enhanced return of profits to shareholders in fiscal 2012. I will elaborate on this point later.

24

①Sales and Profit Target<Fiscal Year Ending March 2014>

・Consolidated Sales: over 77,000 million yen*Non-consolidated sales to be recovered to the

level before the Lehman Shock・Consolidated Operating Income: over 7,500 million yen*Non-consolidated operating income ratio to be

equal or more 10%・Consolidated ROE: equal or more 10%

②Strategic Target (Meitec alone)Build a stronger business base to realize the continuous growth in mid- to long-term regardless of whether the market is in crisis or not

*Seven Strategic targets for Meitec alone are set in next page

We have laid out sales and profit targets in the three-years of the medium-term management plan, as described in 1. here. We made progress toward these targets in the first year of the plan and will strive to maintain the momentum in the second and third years. The strategic objective described in 2. is not directly connected to sources of sales and income. But the Lehman shock taught us a hard lesson but provided insight to promote investment activities that will reinforce our business foundation and make it more resilient to changes in the market.

25

These seven strategic targets will be the building blocks of a stronger corporate structure.

26

・Meitec will build stronger business base according to the 7 strategic targets of the plan

・Due to the strategic investments according to the plan, operating income will be lower than that of before the Lehman Shock for next three years

・Main purpose is to avoid losses in the scale of the recent crisis, even if we have to face a crisis in the same level as the Lehman Shock

・After achieving the targets of the plan, we will set higher target for the operating income

《 Key Points of Mid-term Management Plan》

The med-term management plan emphasizes four key points.This page is same as that from previous fiscal year.The first three points were described in the presentation materials disclosed last year. The fourth point—After achieving the targets of the plan, we will set higher target for the operating income —requires first and foremost that the damage caused by the Lehmanshock be repaired and that we establish a foundation for growth into the future. We will work tirelessly to achieve these targets during the three-years of the medium-term management plan. We will then apply the results of our efforts as a springboard to launch us forward to the next stage of our corporate development.

Ⅳ. Forecast for FY Ending March 31, 2013

28

<Assumptions for the Fiscal Year Ending March 2013>

1. Although factors of the world macroeconomy are uncertain, technological investment by the manufacturers will continue.

2. Complete work assignment of new engineers who joined in April 2012 (220 for Meitec and 169 for Meitec Fielders) by the end of 2nd quarter.

3. Achieve target for the mid-carrier hire. (see page 34 for hiring plan)

4. Continue to execute the strategic investment plan (for Meitec alone) to build stronger business base in order to realize the mid- to long-term continuous growth regardless of whether if we are in crisis or not.(* New Mid-term Management Plan “Co-creation 21”)

Progress in fiscal 2012 is conditioned upon four assumptions. First, macroeconomic factors at home and abroad are uncertain, creating a perfect storm scenario for crisis situations to appear at any time. Prevailing circumstances will surely sustain a sense of crisis and tension.As I mentioned earlier, fiscal 2011 was also characterized by several crisis situations. Despite the challenging conditions, however, manufacturers in Japan—our major customers—are likely to maintain their technological investment focus. Second, in April 2012 Meitec hired 220 newly graduated engineers and Meitec Fielders hired 169. We expect to have all these employees assigned to customers by the end of the second quarter of fiscal 2012. Third, our hiring plans will address mid-career recruitment. Details are provided on page 34. We plan to achieve our target.Fourth, we will mark steady progress on the aforementioned medium-term management plan.

29

Cost of Sales

+1,200 million yen compared to the previous fiscal year

Reason ⇒ increase in labor cost as result of aggressive recruiting

SG&A+ 1,400 million yen compared to the previous fiscal year(13,000-11,600 million yen)(Breakdown)

・Strategic Investment +800 million yen

・Other +600 million yen

<Change of Consolidated Cost>For the Fiscal Year Ending March 31, 2013

498

116130

510

0

100

200

300

400

500

600

FY Ended Mar.2012 FY Ending Mar.2013

Cost of Sales SG&A

(100 million Yen)

This graph shows cost estimates.We expect the cost of sales to be 51,000 million yen, up 1,200 million yen from the 49,800 million yen recorded in fiscal 2011. This is largely due to an increase in labor cost due to a increase in number of engineer following more aggressive recruitment. On the other hand, we expect the SG&A cost to be 13,000 million yen, up 1,400 million yen from the 11,600 million yen recorded in fiscal 2011. The intended allocation of funds is an increase of 800 million yen for strategic investments and an increase of 600 million yen to cover other costs.

30

<Forecasts ; Fiscal Year Ending March 31,2013>

(Millions of Yen)

Net SalesOperatingIncome

OdrdinaryIncome

Net Income

1st Half of FY2012Apr to Sep 2012

33,200 2,100 2,100 1,200

1st Half of FY2011Apr to Sep 2011 31,937 2,328 2,350 1,295

Change(%) 4.0% (9.8%) (10.6%) (7.3%)

FY2012 69,500 5,500 5,500 5,500

FY2011 66,955 5,450 5,531 2,827

Change(%) 3.8% 0.9% (0.6%) 94.6%

1st Half of FY2012Apr to Sep 2012

26,400 1,800 2,100 1,300

1st Half of FY2011Apr to Sep 2011 25,256 1,944 2,262 1,356

Change(%) 4.5% (7.4%) (7.2%) (4.1%)

FY2012 55,200 4,700 5,000 5,700

FY2011 53,188 4,613 4,988 2,590

Change(%) 3.8% 1.9% 0.2% 120.1%

Conso

lidate

dNon-conso

lidate

d

Consolidated performance forecast calls for net sales of 69,500 million yen. We expect operating income to reach 5,500 million yen, ordinary income, also 5,500 million yen, and net income, the same as well.Non-consolidated results will likely mirror the year-on-year change of consolidated results. First-half operating income will probably fall below the amount posted in the corresponding period a year earlier, on a consolidated basis as well as a non-consolidated basis. The main reason for this downward change is, as I mentioned earlier, related to the hiring of newly graduated engineers by Meitec and Meitec Fielders in April 2012, which will cause respective utilization ratio to shrink, albeit temporarily. On a full-year basis, operating income should expand, paralleling progress in the deployment of newly graduate engineers. Reason for the forecast for full-year consolidated net income being same amount as ordinary income, and expected to significantly increase by 94.5% over fiscal 2011, is described on the next page.

31

<Anticipated Effect of Dissolving a Subsidiary (BMOA) to the Performance>

• Effect of dissolution of a subsidiary (BMOA) to the consolidated performance is anticipated to be 2,200 million yen decrease of tax expenses.

• Also, effect to the non-consolidated performance is anticipated to be gain of 450 million yen from dissolution of subsidiary, in addition to above tax expense decrease.

• Please see separate press release for details.

Forcast for Fiscal Year Ending March 31, 2013(100Million of Yen) Consolidated Non-consolidated

Fiscal Year Fiscal Year1st Half 2nd Half 1st Half 2nd Half

Ordinary Income 21.0 55.0 34.0 21.0 50.0 29.0― ― ― ― +4.5 +4.5

21.0 55.0 34.0 21.0 54.5 33.5Tax Expenses (9.0) 0.0 +9.0 (8.0) +2.5 +10.5

Regular tax expenses (9.0) (22.0) (13.0) (8.0) (19.5) (11.5)Effect from liquidation of siubsidiary ― +22.0 +22.0 ― +22.0 +22.0

Net Income 12.0 55.0 43.0 13.0 57.0 44.0

Effect from liquidation of subsidiary

Income before income taxes

Anticipated fiscal 2012 performance results reflect the impact from liquidating subsidiary BMOA Corporation. Meitec once acquired a company named Drake Beam Morin–Japan, Inc. (hereafter, “DBM-J”). When this company was sold to Tempstaff Co., Ltd., in May 2009, claims held by DBM-J in a its former U.S. subsidiary were not transferred. Consequently, BMOA survived as a company to manage these claims. BMOA is slated for liquidation in October 2012 because the administrative services for this former U.S. subsidiary will more or less wind down in fiscal 2012. The loss carried forward on the books of DBM-J was assumed by BMOA, so with BMOA’s liquidation, this amount then transfers to Meitec, as the parent company. We expect the effect of this event to reduce tax expenses by about 2,200 million yen. The reduction in tax expenses will have a positive effect on consolidated net income, and could boost the bottom line to 5,500 million yen. On a non-consolidated basis, Meitec will book 450 million yen in liquidation proceeds under extraordinary income. On a consolidated basis, this amount is cancelled out and eliminated, so the effect will simply be to boost net income by 2,200 million yen.

32

<Forecasts for Meitec Group ><Forecasts for Meitec Group >-- Fiscal Year Ending March 31, 2013 Fiscal Year Ending March 31, 2013 --

(Millions of Yen)

Net SalesOperatingIncome

OrdinaryIncome

Net Income

Meitec 55,200 4,700 5,000 5,700

Meitec Fielders 8,800 430 430 260

Meitec Cast 2,400 50 50 30

Meitec CAE 1,200 130 130 80

Apollo Giken Group 1,800 30 30 30

Global Business Meitec Shanghai * 80 (50) (50) (50)

Meitec Next 740 150 150 140

all engineer.jp 80 0 0 0

Mar.31,2

013

Temporary EngineersStaffing Business

Engineering SolutionsBusiness

Recruiting & PlacementBusiness

*Amount for the Global Business is total of Meitec Shanghai, Meitec Xian, Meitec Chengdu and Meitec ShanghaiHuman Resources.

This table shows fiscal 2012 performance forecasts for Group companies. Non-consolidated net income of 5,700 million yen reflects the factors presented on the previous pages.

33

<Prerequisites of Performance Forecast>- (MT+MF) for Fiscal Year Ending March 31, 2013 -

※ ( ) indicate actual results of the fiscal year ended March 31, 2012

94.8% (93.2%) 89.9% (95.5%)

1st Half 92.9% (90.9%) 86.5% (94.4%)

2nd Half 96.5% (95.4%) 93.2% (96.5%)

8.81h/day (8.83h/day) 8.85h/day (8.84h/day)

1st Half 8.69h/day (8.72h/day) 8.72h/day (8.70h/day)

2nd Half 8.93h/day (8.95h/day) 8.97h/day (8.98h/day)

Fiscal Year2012

Fiscal Year2011

MT MF

OperatingHours

Utilizationratio

Our forecasts are conditioned upon certain prerequisites. In particular, the utilization ratio of Meitec and Meitec Fielders engineers and their working hours have a considerable impact on fiscal results, so estimated rates and hours are presented here.As mentioned earlier, Meitec’s utilization ratio is expected to drop temporarily in April, due to the hiring of newly graduated engineers, but should average out at 94.8% for the full-year, exceeding the rate—93.2%—realized in fiscal 2011. Meanwhile, Meitec Fielders’ utilization ratio is likely to stall at 89.9%, compared with 95.5% in fiscal 2011. Meitec has a total of about 5,600 engineers, including the 220 newly graduated engineers, while Meitec Fielders has a total of about 1,300 engineers, including 169 newly graduated engineers. The Meitec Fielders’ total is about a quarter of the Meitec total.Consequently, the impact of newly graduated employees on the utilization ratio of Meitec Fielders is greater than at Meitec, prompting the gap in utilization ratio estimates in the table. Both Meitec and Meitec Fielders will probably see their engineers log working hours on a par with the previous fiscal year. As I mentioned already, hours worked in the first half of fiscal 2011 were down from fiscal 2010. For fiscal 2012, we have conservatively set hours worked near fiscal 2011 levels, given that very few of our customers have decided on concrete steps to cope with such issues as power shortages and production adjustments. Even if there is no slump in the first half like there was in the previous fiscal year, it is still possible that net sales will exceed our forecast.

34

<Recruitment Plan of Meitec Group: for Fiscal Year Ending March 31, 2013>

180

330

970

Mid carrier(throughout the year)

Newly Graduate(April 1, 2013)

Sub total

Total

RecruitmentPlan

240

640

MT

400

MF

150

This is our recruitment plan for fiscal 2012.Meitec plans to recruit 400 new graduates, while Meitec Fielders plans to recruit 150. Mid-career recruitment during the fiscal year will see Meitec hire 240 engineers and Meitec Fielders, 180.This mid-career recruitment—the area outlined in green—will be undertaken during this fiscal year and to be deployed during this fiscal year. Since the engineers’ on-the-job activity will therefore impact fiscal results, the recruitment figures have been included here.Meitec and Meitec Fielders plan to hire total of 970 engineers during the fiscal year 2012. But for the future, we will establish a structure covering both companies that facilitates hiring of more than 1,000 engineers per year.

Ⅴ. Shareholders Return

36

<Dividend Forecast for the Fiscal Year Ending March 31, 2013><Dividend Forecast for the Fiscal Year Ending March 31, 2013>

• Dividend is determined according to the dividend policy with consideration of the performance forecast.

• Dividend forecasts are; 29.5 yen* per share which is equivalent to consolidated dividend on equity ratio (DOE) of 5% at the end of 2nd quarter, and 66 yen per share which is equivalent to payout ratio of 50% of consolidated net income for the 2nd half of the fiscal year at the year-end, total of 95.5 yen for the fiscal year (37 yen increase compared to that of previous fiscal year). Total dividend is anticipated to be about 3,100 million yen. *50% of Net Income (forecast)< 5% of DOE

• Purchase of treasury stock is planned to be 2,400 million yen according to the principle of total return ratio to be within 100%.

※ Total Return Ratio 100% = (total amount of expected dividend: 3,100 million yen + total amount to be used for the acquisition of the treasury stock: 2,400 million yen)/ forecasted consolidated net income: 5,500 million yen

First quarterdividends

Second quarterdividends

Third quarterdividends

Year-enddividends

Actual.Previous FiscalYear ending March

31,201229.00 29.50 58.50

Forcast.Fiscal Yearending March

31,201329.50 66.00 95.50

Total

At last, we would like to explain regarding our shareholder return.For fiscal 2012, we intend to distribute an annual dividend of 95.50 yen per share, an increase of 37 yen per share from fiscal 2011. This annual dividend will comprise an interim amount of 29.50 yen per share and a year-end amount of 66 yen per share.

Our dividend policy is detailed on page 10 of the Financial Highlights for the Fiscal Year ended March 31, 2012, but basically, we aim for a payout ratio of 50% or more. If 50% of net income is less than 5% of dividend-on-equity, then the distribution will be based on 5% DOE.In keeping with this dividend policy, we will apply the 5% DOE calculation to the interim dividend, arriving at 29.50 yen per share. For the year-end dividend, we will apply the 50% payout ratio, pegged to consolidated net income reflecting the aforementioned liquidation of BMOA. And this should come out to 66 yen per share. Consistent with the concept of a 100% total return ratio—as underlined in red—we plan to purchase 2,400 million yen worth of treasury stock in fiscal 2012.

37

≪TOPICS:Amendment of Worker Dispatch Law≫

Although, a bill to amend the Workers Dispatch Law was passed inMarch 2012, the Company understand that there will not be particular effect to our group’s temporary staffing business. (the amendment to be effective by Oct. 2012)

【Summary of the amendment to the Worker Dispatch law】

1.About "employment offer obligation", the dispatched workers of "no fixed term employment“, such as ours, are exempted.

2.Banned hiring temporary workers for 30 days or less (Hiyatoi Dispatch). (with some exceptions)

3.Strengthening restrictions to the dispatching temporary worker to the affiliated companies.

4.If a dispatch worker was dispatched in illegal condition, the customer is obligated to be deemed as that it had proposed employment contract to that particular worker. (Deemed employment contract offer rule)

The last topic I wish to address is amendment of the Worker Dispatch Law governing the actions of temporary staffing service providers.The law underwent changes in March 2012. These changes will take effect in October, but we have concluded that they will not have much of an impact on the temporary staffing services we provide.Regulations have become more strict through revisions of the Worker Dispatch Law since before the Lehman shock. But the specialized temporary staffing services that we provide—that is, hiring engineers on a full-time basis and placing them with customers—has always been exempt. The focus of tighter restrictions has been on outsourced labor characterized by job uncertainty, especially day labor, and so-called registration-type temporary staffing services, where potential workers sign up with an agency. Therefore, we do not feel that this recent round of legal adjustments will have any impact on our temporary staffing services.

39

<Trend of the Performance for Last 10 Years (non-consolidated)>- from Fiscal year ended March 2001to Fiscal year ended March 2012-

Appendix - 1

604

413

531

629

553

611712

614 617

556555

482

46

11293 80

103 122 124 106104

88

(29)

17

1171228294

105 125

155107

92

8

35 49

25212947 48

50 6068

0

6849

0

8.7%

(7.2%)

16.0%16.0%

18.7%

16.7%14.5%

18.1% 17.4%15.9% 16.0%

3.6%

10.9%

4.9%

0.1%

10.9%10.2%9.1%8.7%8.6%

(10.7%)

9.3%10.9%

4.4%

(100)

0

100

200

300

400

500

600

700

01/3 02/3 03/3 04/3 05/3 06/3 07/3 08/3 09/3 10/3 11/3 12/3 -15%

-10%

-5%

0%

5%

10%

15%

20%

25%

30%

35%

Net Sales Operating Income Ordinary IncomeNet Income Operating Income Margins Net Income Margins

(100 million yen)

40

<Core Business (Temporary engineers staffing business) <Core Business (Temporary engineers staffing business) Results FY2011>Results FY2011>

Appendix-2

MT+MF+CAE

MT+MF MT MF CAE

Actual - 93.6% 93.2% 95.5% -

Previous Year

- 86.4% 85.1% 92.2% -

Actual - - 8.83h/day 8.84h/day -

Previous Year

- - 8.83h/day 8.89h/day -

Actual 6,634 6,552 5,385 1,167 82

Previous Year

6,886 6,801 5,600 1,201 85

FY2011

UtilizationRatio

Operating Hours

Number of Engineers

41

<Sales by the Industrial Segments (Non<Sales by the Industrial Segments (Non--Consolidated)>Consolidated)>

Appendix-3

FY2007 FY2008 FY2009 FY2010

Net SalesTotal NetSales(%)

ChangeChange

(%)

Automobile/Transportation 12,927 12,408 7,629 8,981 10,463 +19.7% 1,482 +16.5%

Aircraft/Aerospace 3,056 3,029 3,156 3,563 4,006 +7.5% 443 +12.4%

Industrial Machinery 7,695 7,988 5,463 6,933 8,073 +15.2% 1,139 +16.4%

Precision Equipment 3,151 3,411 2,710 3,101 3,608 +6.8% 507 +16.4%

IT Related Hardware and Devices 7,009 6,312 4,518 5,021 5,241 +9.9% 220 +4.4%

Electric and Electronics 10,324 9,860 6,624 7,704 8,586 +16.1% 881 +11.4%

Semiconductors and Integrated Circuits Design 8,834 7,459 3,749 4,270 3,197 +6.0% △ 1,072 △25.1%

Semiconductor Equipment and Devices 2,976 2,676 962 1,310 1,807 +3.4% 496 +37.9%

Information Processing/Software 3,467 3,510 3,100 3,666 3,925 +7.4% 258 +7.1%

Plant 936 1,274 1,118 1,280 1,471 +2.8% 190 +14.9%

Construction 274 190 179 284 273 +0.5% △ 10 △3.8%

Others 2,302 2,335 2,106 2,141 2,531 +4.8% 390 +15.8%

Total 62,956 60,457 41,319 48,260 53,188 +100.0% 4,928 +10.2%

Segment

FY2011

Nete Sales

Millions of Yen

42

<Top 10 Clients by Sales and Shares of Net Sales><Top 10 Clients by Sales and Shares of Net Sales>(Non(Non--consolidated)consolidated)

Appendix-4

1 1 1

2 2 2

3 3 3

4 4 4

5 5 5

6 6 6

7 7 7

8 8 8

9 9 9

10 10 1020,875 33.8% 15,149 31.4% 15,476 29.1%

27,315 44.2% 19,899 41.2% 20,821 39.1%

34,480 55.8% 28,360 58.8% 32,367 60.9%

61,795 100.0% 48,260 100.0% 53,188 100.0%

Fiscal year ended March 31,2007 Fiscal year ended March 31,2011 Fiscal year ended March 31,2012

Companies Name Companies Name Companies Name

Panasonic Panasonic Mitsubishi Heavy

Sony Corp. Mitsubishi Heavy Nikon Corp.

Canon Inc. Canon Inc. Canon Inc.

Mitsubishi Heavy Nikon Corp. Panasonic

Toyota Motor Denso Corporation Denso Corporation

Omron Corp. Toyota Motor Toyota Motor

Nikon Corp. Sony Corp. Sony Corp.

Denso Corporation Kawasaki Heavy Kawasaki Heavy

Total Total Total

Top 10 Total Top 10 Total Top 10 Total

Top 20 Total Top 20 Total Top 20 Total

(millions of yen)

Others Others Others

Seiko Epson Daikin Industries Daikin Industries

Kawasaki Heavy Mitsubishi Electric Corp. Mitsubishi Electric Corp.

< Five years ago > < Current >

43

<Utilization Ratio (Non-Consolidated)>

95.4%

99.1%99.0%

98.8%98.7%98.8%98.5%

95.2%

98.9%98.6%97.7%

93.6%

96.1%

93.2%

99.0%

91.2%

99.2%

99.3%

91.2%

96.4%95.6%

96.2%

88.7%

92.4%

93.9%

97.3%

94.7%

98.9%99.1%

99.4%

92.5%

97.0%95.9%

94.7%

86.7%

90.7%

95.8%

98.4%98.6%98.1%

95.0%

98.0%98.5%98.4%

94.2%

97.3%

96.7%

71.6%

68.7%

70.4%

76.9%

83.4%

88.3%

78.1%

90.8%91.7%

60%

65%

70%

75%

80%

85%

90%

95%

100%

4 7 10 1 4 7 10 1 4 7 10 1 4 7 101 4 7 101 4 7 101 4 7 101 4 710 1 4 710 1 4 710 1 4 710 1 4 7 10 1 4 7 10 1 4 7 10 1 4 7 10 1

Quarter Period Average

Operating Ratio ,excluding new empioyees

Companywide Operating Ratio

WorldwideDepression

3

95%

ITRecession

Crisis in the

Japanese Financial System

97/ 99/ 00/ 01/98/ 03/ 04/ 08/ 10/02/ 05/ 06/ 07/ 09/ 11/ 12/

44

<Trend in New Orders by Month (Non<Trend in New Orders by Month (Non--Consolidated)>Consolidated)>-- From Apr-1999 to Mar-2012 -

0

100

200

300

400

500

600

99/4

99/1

0

00/4

00/1

0

01/4

01/1

0

02/4

02/1

0

03/4

03/1

0

04/4

04/1

0

05/4

05/1

0

06/4

06/9

07/4

07/1

0

08/4

08/1

0

09/4

09/1

0

10/4

10/1

0

11/4

11/1

0

12/0

3

250

100

45

<Trend of Working Hours (Non-Consolidated>- from FY ended March 31, 1999 to FY ended March 31, 2012 from FY ended March 31, 1999 to FY ended March 31, 2012 --(H/Day)

9.2

8.0

8.2

8.4

8.6

8.8

9.0

9.2

9.4

9.6

98/04 99/04 00/04 01/04 02/04 03/04 04/04 05/04 06/04 07/04 08/04 09/04 10/04 11/04

9.2

12/03

9.10H/Day

9.23H/Day

9.06H/Day

9.05H/Day

9.18H/Day

9.35H/Day

9.32H/Day

9.23H/Day

9.12H/Day

8.86H/Day

8.60H/Day

8.83H/Day

8.83H/Day

9.21H/Day

46

<Utilization Ratio (Meitec Fielders)><Utilization Ratio (Meitec Fielders)>

Appendix-5

96.3%

96.1%

92.0%

84.7%

70.5%

78.5%

88.8%

95.4%

98.4%

92.3%

98.8%

99.1%

92.6%

98.6%

99.0%

99.1%

91.9%

98.9%

99.2%

99.3%

92.9%

98.7%98.4%

98.5%

91.5%

96.1%

97.9%

97.5%

91.6%

96.2%

66.0%

65.1%

94.0%

94.8%

96.3%96.8%

50%

60%

70%

80%

90%

100%

03/04 04/04 05/04 06/04 07/04 08/04 09/04 10/04 11/04 12/03

47

<Capital Investments and Depreciations (Non<Capital Investments and Depreciations (Non--Consolidated)>Consolidated)>-- From the FY ended March 31, 2002 to the FY ended March 31, 2012From the FY ended March 31, 2002 to the FY ended March 31, 2012 --

Appendix-7

4.9

6.1

22.7

2.3

10.310.7

9.9 9.9 9.9

12.212.7

11.3 11.0

9.7

2.1

4.8 5.0

3.0

11.0

3.2

9.3

11.3

0

5

10

15

20

25

Mar-02 Mar-03 Mar-04 Mar-05 Mar-06 Mar-07 Mar-08 Mar-09 Mar-10 Mar-11 Mar-12

Capital Investment Depreciation

11

5

(100 Million Yen)

48

<Return on Equity (ROE) From the FY2000 to the FY2011><Return on Equity (ROE) From the FY2000 to the FY2011>

Appendix-8

7.4%6.3%

0.2%

8.3%

△0.2%

10.4%

11.7%

14.6%

15.6%

14.3%

10.0%

13.0%

7.6%

10.5%

(2.6%)

11.8%

0.7%

10.2%11.1%10.2%

15.2%

12.1%11.2%

13.1%

-5%

0%

5%

10%

15%

20%

Mar-01 Mar-02 Mar-03 Mar-04 Mar-05 Mar-06 Mar-07 Mar-08 Mar-09 Mar-10 Mar-11 Mar-12

Non-consolidated

Consolidated

15%

49

<Consolidated SG&A Expenses and Cost of Sales,<Consolidated SG&A Expenses and Cost of Sales,and Their Ratio to the Sales>and Their Ratio to the Sales>

Appendix-9

439 464 482 496 544 566 577 577 571498

87 83 82 93123

140 129 129 134

119 103 116112 101 91122

122124 115 113 92

54

467488

(49)

26

74.5%

13.7% 12.9% 12.6% 13.1%15.6% 16.9% 15.7% 15.8%

22.2%

17.4%

82.4%84.3%

86.1%82.8%

84.5% 85.0% 85.9% 86.2%

91.9%

79.0%

68.1%68.8%69.7%

73.5%71.4%

68.7%70.2% 70.4% 71.6%

87.0%

16.8% 16.7%

95.8%

109.2%

88.4%

(100)

100

300

500

700

900

1,100

1,300

1,500

Mar-01 Mar-02 Mar-03 Mar-04 Mar-05 Mar-06 Mar-07 Mar-08 Mar-09 Mar-10 Mar-11 Mar-12

0%

30%

60%

90%

Cost of Sales SG&A Expenses Operating Income

Cost of Sales to Net Sales SG&A Expenses to Net Sales Cost of Salse+SG&A Expenses to Net Saless

0

50

<Non<Non--Consolidated SG&A Expenses and Cost of Sales, and Their Ratio toConsolidated SG&A Expenses and Cost of Sales, and Their Ratio to the Sales>the Sales>

Appendix-10

376 391 403 409 420 423 431 438 431 399

75 71 70 78 78 79 80 86 85

8277 85

103 93 80107 112 111 106 104 88

46

387

360

17

(29)

75.2%

13.6% 12.9% 12.7% 13.1% 12.8% 12.9% 13.0% 13.7%16.1%

81.3%83.3%

85.5%

81.9% 81.6% 81.9% 82.8% 83.4%

91.3%

87.3%

71.3%69.7%69.8%

67.7%70.4%

72.8%

68.8% 68.9% 69.0%

80.4%

16.1%14.1%

19.9%

85.4%

107.2%

96.4%

(100)

100

300

500

700

900

1,100

Mar-01 Mar-02 Mar-03 Mar-04 Mar-05 Mar-06 Mar-07 Mar-08 Mar-09 Mar-10 Mar-11 Mar-120%

30%

60%

90%

Cost of Sales SG&A Expenses Operating Income

Cost of Sales to Net Sales SG&A Expenses to Net Sales Cost of Salse+SG&A Expenses to Net Saless

0

51

<Policy for Profit Return: revised May 2011>

• In view of maximizing shareholder’s return in mid- to long-term, unless major capital demends are expected, total return ratio to be within 100% for the total shareholders return by dividend and purchase of treasury shares.

• Three Month Net Sales = Working capital : Consolidated two month net sales + Fund for strengthening the financial base (a fund to sustain the business operation in the event of a crisis equivalent to that of fiscal year ended March 2010) : consolidated one month net sales

ShareholdersReturn

Dividend

TreasuryStock

Acquisition

Dividend related to performances Equal or more than 50% of consolidated net profit

Minimum DividendEqual or more than Dividend on Equity ratio (DOE)5%

Acquisition of treasury stock

Cash excess of working capital (2 months of net sales) to be applied to the acquisition of the treasury stock

Acquisition of treasury stock

Consolidated cash position excess of 3 months net sales to be planned for acquisition of the treasury stock

Retain Maximum of 2 million shares Retired Excess above maxim to be retired

Changed

Not Changed

Changed

Not Changed

Total Return Ratio

Basically within100%

Before After Change

52

<Shareholders by Business Segments (Non<Shareholders by Business Segments (Non--Consolidated)>Consolidated)>

Appendix-11

Shareholders % Shares Held %Banks 3 0.04% 875,501 2.52%

Trust Banks 19 0.28% 5,958,700 17.17%Life and nonlife insurancecompanies

17 0.25% 4,074,083 11.74%

Securities financingand other financial companies

3 0.04% 42,960 0.12%

Securities companies 32 0.47% 283,131 0.82%Business concernsand other companies

112 1.65% 276,392 0.80%

Overseas companiesand investors

140 2.06% 17,304,335 49.87%

Individuals and others 6,458 95.19% 5,884,898 16.96%

Total 6,784 100.0% 34,700,000 100.0%

Shareholder Segment(As of the Fisical year ended March 31, 2012)

53

(Note) This document has been translated from the Japanese original for reference purposes only. In the event of any discrepancy between this translation and the Japanese original, the original shall prevail.

53