Research Article Operational Efficiency Forecasting...

Transcript of Research Article Operational Efficiency Forecasting...

Research ArticleOperational Efficiency Forecasting Model ofan Existing Underground Mine Using Grey System Theory andStochastic Diffusion Processes

Svetlana Strbac Savic1 Jasmina Nedeljkovic Ostojic2 Zoran Gligoric3

Cedomir Cvijovic2 and Snezana Aleksandrovic3

1The School of Electrical and Computer Engineering of Applied Studies Vojvode Stepe 283 11000 Belgrade Serbia2Belgrade University College of Applied Studies in Civil Engineering and Geodesy Department of Geodesy Hajduk Stanka 211000 Belgrade Serbia3Faculty of Mining and Geology University of Belgrade Djusina 7 11000 Belgrade Serbia

Correspondence should be addressed to Svetlana Strbac Savic svetlanasviseredurs

Received 3 August 2015 Revised 28 October 2015 Accepted 29 October 2015

Academic Editor Paolo Maria Mariano

Copyright copy 2015 Svetlana Strbac Savic et al This is an open access article distributed under the Creative Commons AttributionLicense which permits unrestricted use distribution and reproduction in any medium provided the original work is properlycited

Forecasting the operational efficiency of an existing undergroundmine plays an important role in strategic planning of productionDegree of Operating Leverage (DOL) is used to express the operational efficiency of production The forecasting model should beable to involve common time horizon taking the characteristics of the input variables that directly affect the value of DOL Changesin the magnitude of any input variable change the value of DOL To establish the relationship describing the way of changingwe applied multivariable grey modeling Established time sequence multivariable response formula is also used to forecast thefuture values of operating leverage Operational efficiency of production is often associated with diverse sources of uncertaintiesIncorporation of these uncertainties intomultivariable forecastingmodel enablesmining company to survive in todayrsquos competitiveenvironment Simulation of mean reversion process and geometric Brownian motion is used to describe the stochastic diffusionnature ofmetal price as a key element of revenues and production costs respectively By simulating a forecastingmodel we imitateits action in order to measure its response to different inputs The final result of simulation process is the expected value of DOLfor every year of defined time horizon

1 Introduction

Efficiency is a prerequisite for the survival of every miningcompany especially in high competitive market environmentsuch as mineral resource industry Efficiency signifies com-panyrsquos ability tomeet its short or long-termgoals Operationalefficiency is defined as the ratio between the input requiredto run production process and the output gained from theproduction In the context of mining business operationalefficiency refers to the length of time until mineral assetsare transformed tomoney Peak operational efficiency occurswhen the right combination of mineral deposit character-istics human resources mining technology and mineralprocessing come together to optimize mining performance

Operational efficiency is related to finding the verybest way of mining to produce a mineral asset It enablesmanagement of themining company to increase productivityincrease profitability improve competitiveness use freed-upcapacity and enable company to grow or increase its futuremarket value

Mining companyrsquos management uses different strategiesto reach their defined goals One of the most importantelements of a companyrsquosmanagement operations is to forecastwhat goals are realistic and capability estimation of the com-pany in order to achieve them Planners try to forecast thebehavior of the input variables of production environmentand arrive at desirable states They create their strategieson realistic targets drawn from these forecasts A forecast

Hindawi Publishing CorporationMathematical Problems in EngineeringVolume 2015 Article ID 610307 18 pageshttpdxdoiorg1011552015610307

2 Mathematical Problems in Engineering

is based on past and current production indicators that isbusiness numbers In many cases the forecast might be bur-dened by some inaccuracies so it would be a mistake tobase a budget on that It is very important to emphasize theforecasting acts serve as a basis for further planning

The forecasting process is performed in a specific envi-ronment If we take into consideration the fact that theenvironment is changed over time then it is obvious thatthe forecasts and targets are changed as well Managementmust be able to describe environment changes in order tostrategically link the forecasting and planning functionsimproving the performance of both

Large capital intensive projects such as those in themineral resource industry are often associated with diversesources of both endogenous and exogenous uncertaintiesThese uncertainties can greatly influence the operationalefficiency Having the ability to plan for these uncertaintiesis increasingly recognized as critical to long-term miningcompany success In the mining industry in particular therelationships between input variables that are controllableand those that are not and the physical and economic out-comes are complex and often nonlinear Operational effi-ciency forecasting of mine in todayrsquos environment is muchcomplex than it was just a few years ago There are typicallymany variables which are directly or indirectly associatedwith the forecasting process

There is a considerable literature dedicated to the opera-tional efficiency measurement It includes many approacheswhich take into account various aspects of the problem

Briciu et al [1] applied the concept of Cost-Volume-Profit analysis inmonitoring andmeasuring the performanceof companies in the mining industry in Romania Zhaoet al [2] evaluated operating efficiency of Chinese CoalMining Companies by Malmqusit Productivity Index Factoranalysis was employed by Li et al to evaluate performanceof coal mine companies [3] Four types of empirical testshave been performed (parametric mean differences non-parametric Wilcoxon rank sum test static regression panelestimation and dynamic regression panel estimation) toestimate managerial and operational efficiency of privatizedmining companies in Jordan [4] A stochastic frontier analy-sis method was used to estimate profit efficiency in the SouthAfrican mining sector [5] The analytic hierarchy process(AHP) methodology was selected for ranking the efficiencyof selected platinummining methods [6] Improving the effi-ciency of truckshovel operations can increase the total oper-ational efficiency of mine To make the truck and shovel fleetmore optimum on the basis of productivity improvementsand associated costs reduction it was essential to calculatethe bestmatch factors and truckshovels assignments (or fleetsize) for the system [7]

This paper investigates the relationship between ore pro-duction rate fixed costs revenues production costs workingdays and degree of use of production capacity as inputvariables and Degree of Operating Leverage (DOL) as indi-cator of operational efficiency of an existing underground

mine Multivariable grey model is used to establish the timesequence response formula of DOL This formula enables usto predict the future values of DOL time series based onlyon a set of the most recent data To decrease uncertainty offuture values of the operational efficiency we use expertrsquosknowledge and simulation processes to find future values ofinput variables affecting them Estimation of future revenuesis based on the application ofmean reversion process normaland uniform distribution Geometric Brownian motion isused to define future values of production costs Values of oreproduction rate fixed costs working days and degree of useof production capacity are estimated by expertrsquos knowledge

By simulating a forecasting system we imitate its actionin order to measure its response (output) to different inputsThe simulation allows analysts to describe the uncertaintyof variables that influence the value of DOL by differenttime depending scenarios The first objective of the use ofsimulation in the forecasting is to determine the distributionof the DOL from the variables that affect his performancewhich results in the average or expected value of DOL forevery year of defined time horizon

2 Grey Information Systems andMultivariable Grey Model GM(hN)

The grey theory established by Dr Deng includes greyrelational analysis grey modeling prediction and decisionmaking of a system in which themodel is unsure or the infor-mation is incomplete [8] It provides an efficient solution tothe uncertainty multi-input and discrete data problem

Grey models predict the future values of a time seriesbased only on a set of the most recent data depending on thewindow size of the predictor It is assumed that all data valuesto be used in grey models are positive and the samplingfrequency of the time series is fixed From the simplest pointof view greymodels can be viewed as curve fitting approaches[9]

In grey system theory multivariable grey model (GM(ℎ119873)) denotes a grey model where ℎ is the order of the differ-ential equation and119873 is the number of variables The GM(ℎ119873) is defined as follows [10]

ℎ

sum119894=0

119886119894119889(119894)119909(1)

1(119896)

119889119905(119894)=

119873

sum119895=2

119887119895119909(1)

119895(119896) 119896 = 1 2 119899 (1)

where 119886119894 and 119887119895 are determined coefficients 119909(1)1(119896) is the

major sequence factor 119909(1)119895(119896) is the influencing sequence fac-

tors and 119896 is the time sequence variableIn this paper we are applying GM(1119873) [11ndash15] First we

separate the data into two sequences major sequence factor(it masters the system behaviors) and influencing sequencefactors (it influences the system behaviors)

The major sequence factor is represented as follows

119883(0)

1= [119909(0)

1(1) 119909

(0)

1(2) 119909

(0)

1(119896)]

119896 = 1 2 119899

(2)

Mathematical Problems in Engineering 3

The influence sequence factors are

119883(0)

2= [119909(0)

2(1) 119909

(0)

2(2) 119909

(0)

2(119896)]

119883(0)

3= [119909(0)

3(1) 119909

(0)

3(2) 119909

(0)

3(119896)]

119883(0)

119873= [119909(0)

119873(1) 119909

(0)

119873(2) 119909

(0)

119873(119896)]

(3)

Assume the original series of data with 119896 equal time samplesis represented as 119883(0)(119896) = [119909(0)(1) 119909(0)(2) 119909(0)(119896)] 119896 =1 2 119899 The first-order Accumulating Generation Opera-tor (AGO) of 119883(0) is defined as 119883(1)(119896) = [119909(1)(1) 119909(1)(2) 119909(1)(119896)] where 119909(1)(119896) = sum119899

119896=1119909(0)(119896) for 119896 = 1 2 119899

This operator is used to smooth the randomness of thedata and to weaken the tendency of variation The averagegeneration of adjacent sample sequence of 119883(1)(119896) is as fol-lows 119885(1)(119896) = [119911(1)(1) 119911(1)(2) 119911(1)(119896)] where 119911(1)(119896) =(12)(119909(1)(119896) + 119909(1)(119896 minus 1)) for 119896 = 1 2 119899

The first-order grey differential equation of the GM(1119873)is

119889119909(1)

1(119896)

119889119896+ 119886119909(1)

1(119896) =

119873

sum119895=2

119887119895119909(1)

119895(119896) (4)

According to the GM(1119873) the constructed AGO sequenceis

119909(0)

1(119896) + 119886119911

(1)

1(119896) =

119873

sum119895=2

119887119895119911(1)

119895(119896) (5)

The constructed AGO sequence can be represented by thefollowing matrix form

[[[[[[[[[

[

119909(0)

1(2)

119909(0)

1(3)

119909(0)

1(119899)

]]]]]]]]]

]

=

[[[[[[[[[

[

minus119911(1)

1(2) 119909

(1)

2(2) sdot sdot sdot 119909

(1)

119873(2)

minus119911(1)

1(3) 119909

(1)

2(3) sdot sdot sdot 119909

(1)

119873(3)

minus119911(1)

1(119899) 119909

(1)

2(119899) sdot sdot sdot 119909

(1)

119873(119899)

]]]]]]]]]

]

[[[[[[[[

[

119886

1198872

119887119873

]]]]]]]]

]

(6)

Factors of the matrix 119886 = [119886 1198872 119887119873]119879 are obtained by

using the least square method as follows

119886 = (119861119879119861)minus1

119861119879119884 (7)

where

119884 =

[[[[[[[[[

[

119909(0)

1(2)

119909(0)

1(3)

119909(0)

1(119899)

]]]]]]]]]

]

119861 =

[[[[[[[[[

[

minus119911(1)

1(2) 119909

(1)

2(2) sdot sdot sdot 119909

(1)

119873(2)

minus119911(1)

1(3) 119909

(1)

2(3) sdot sdot sdot 119909

(1)

119873(3)

minus119911(1)

1(119899) 119909

(1)

2(119899) sdot sdot sdot 119909

(1)

119873(119899)

]]]]]]]]]

]

(8)

Finally the GM(1119873) can be expressed as follows

119889119909(1)

1

119889119896+ 119886119909(1)

1= 1198872119909(1)

2+ 1198873119909(1)

3+ sdot sdot sdot + 119887119873119909

(1)

119873 (9)

The time sequence response formula that is the solution of(9) is

119909(1)

1(119896 + 1) =

119909(0)

1(1) minus

119873

sum119895=2

119887119895minus1

119886sdot 119909(1)

119895(119896 + 1)

119890minus119886119896

+

119873

sum119895=2

119887119895minus1

119886sdot 119909(1)

119895(119896 + 1)

119896 = 0 1 2 119899 minus 1

(10)

According to (10) we can obtain 119883(1)(119896 + 1) = [119909(1)1(119896 + 1)]

The fitting forecast value of119909(0)119896

can be obtained by the inverseAGO as follows

119909(0)(119896) = 119909

(1)(119896) minus 119909

(1)(119896 minus 1) 119896 = 2 3 119899

119909(0)(1) = 119909

(0)(1) 119896 = 0

(11)

The predicted values when 119896 le 119899 can be used to check theadequacy of the model and predicted value when 119896 gt 119899 canbe used as the forecast value for the data series

The relative percentage error (RPE(119895 119896)) and the averagerelative percentage error (ARPE(119895 119896)) are as follows

RPE =10038161003816100381610038161003816119909(0)

119895(119896) minus 119909

(0)

119895(119896)10038161003816100381610038161003816

119909(0)

119895(119896)

times 100

ARPE = 1

119899 minus 1

119899

sum119896=2

10038161003816100381610038161003816119909(0)

119895(119896) minus 119909

(0)

119895(119896)10038161003816100381610038161003816

119909(0)

119895(119896)

times 100

(12)

4 Mathematical Problems in Engineering

Grey relational (relevance) analysis is part of grey systemtheory that gives us information about the relevance degreeof each input variable in the system It is utilized to ascertainthe primary factors that are needed to make a superioritycomparison in the system [11] The fundamental principleis to recognize the relevance degree among many factorsaccording to the similarity levels of the geometrical patternsof sequence curves We can judge whether they are close ornot according to the similar degree of sequence curve shapeThe more similar the curve is the higher the correlationdegree between relative series is and vice versa [11]

Set the major sequence factor variable to be analyzed1198830

1(119896) 119896 = 1 2 119899 as the dependent variable and the

influencing sequence factors1198830119895(119896) 119895 = 2 119873 as the inde-

pendent variables Because various variables have differentphysical significances that is dimensions it is difficult toobtain accurate conclusion To eliminate dimensions fromanalysis equalization method is used and formula is

1199091015840

119895(119896) =

119909119895 (119896)

sum119873

119895=1119909119895 (119896)

119895 = 1 2 119873 (13)

The grey relational coefficient is calculated as follows [16]

120585119895 (119896)

=

min⏟⏟⏟⏟⏟⏟⏟119895(119896)

1003816100381610038161003816100381611990910158401(119896) minus 119909

1015840

119895(119896)10038161003816100381610038161003816+ 120579 sdotmax⏟⏟⏟⏟⏟⏟⏟

119895(119896)

1003816100381610038161003816100381611990910158401(119896) minus 119909

1015840

119895(119896)10038161003816100381610038161003816

Δ 119895 (119896) + 120579 sdotmax⏟⏟⏟⏟⏟⏟⏟119895(119896)

1003816100381610038161003816100381611990910158401(119896) minus 1199091015840

119895(119896)10038161003816100381610038161003816

119895 = 2 3 119873

(14)

where 120579 refers to the discriminating coefficient and 120579 isin [0 1]Δ 119895(119896) = |119909

1015840

1(119896) minus 1199091015840

119895(119896)|

The aggregated value of the grey relational coefficient iscalculated as follows

120588119895 (119896) =1

119899

119899

sum119896=1

120585119895 (119896) 119895 = 2 3 119873 (15)

The higher 120588119895(119896) is the bigger impact the 119895th variable has onthe variable to be analyzed on the contrary the lower 120588119895(119896)is the smaller impact the 119895th element has on the variable tobe analyzed By this way we can see how contribution of theinput variables to output variable is changed over time

Finally the management of the company obtains theaggregated information vector AIV(119895 119896) = [119883(0)(119895 119896)

RPE(119895 119896) ARPE(119895 119896) 120585119895(119896) 120588(119895 119896)] which sublimates thefollowing important indicators

(i) The forecasting model

(ii) The relative percentage error of forecasting model

(iii) The average relative percentage error of forecastingmodel

(iv) The grey relational coefficient between inputs andoutput for the 119896th time point

(v) The aggregated grey relational coefficient betweeninputs and output

3 Forecasting Model

31 Concept of the Model Overall operational efficiencymeasures have enjoyed a great deal of interest amongplannersanalyzing the performance of an undergroundmine Supposethe production of mine in period 119896 can be represented bymining technology set (MTS)

MTS (119896) = (119868 (119896) 119874 (119896) 119868 (119896) isin 119877119892+ 119874 (119896)

isin 119877119897

+ 119868 (119896) can realize 119874 (119896))

(16)

where 119868(119896) = (1198941198961 1198941198962 119894119896

119892) is the input mining technology

vector and 119874(119896) = (1199001198961 1199001198962 119900119896

119897) is the output vector which

represents the indicators obtained fromproductionTheMTSis the space of the feasible combinations of input-outputvectors in period 119896

The input vector of the MTS is composed of many vari-ables but they can be divided into threemain subspaces char-acteristics of mineral deposit undergroundminingmethodsandmineral processingmethodsThe output vector is usuallycomposed of the following variables realized production rateand quality of produced mineral assets

Operational efficiency is usually expressed by some kindof economic indicator According to required type of oper-ational efficiency MTS can be transformed and joined toeconomic set (ES) This transformation means that somevariables of 119868(119896) and119874(119896) are used to calculate some variablesof ES

To express the operational efficiency of an existing under-ground mine we apply the concept of Degree of OperatingLeverage (DOL) The DOL is the leverage ratio that sumsup the effects of an amount of operating leverage on thecompanyrsquos earnings (revenues) before interests and taxes(EBIT)

The DOL during the period 119896 can be calculated withfollowing formula (Weygandt et al) [17]

DOL (119896) = REV (119896) minus PC (119896)REV (119896) minus PC (119896) minus FC (119896)

(17)

where REV is revenues (USD) PC is production costs (USD)and FC is fixed costs (USD)

Operating leverage refers to the amount of operatingfixed costs in the cost structure DOL is the ratio of therelative change in sales Implications are related to amplifyingthe changes in sales volume into larger changes in EBITEven in a perfectly competitive market price plays a rolein determining the DOL magnitude Assume that a firm iscurrently operating with a positive profitWhenmarket equi-librium price rises the denominator in (17) rises reducing

Mathematical Problems in Engineering 5

the DOL with no change in output operating fixed cost orunit variable cost Consequently breakeven output falls sincethe contribution margin is larger DOL can vary due tochanges in any of the variables appearing in (17) These vari-ables include management determined choices (operatingfixed cost and output levels) market determined parameters(price in a competitive market as time passes) and economicand engineering realities (unit variable costs given operatingfixed cost increases due to new capital acquisition) [18]

The higher value of DOL indicates that the business ofmining company is exposed to the greater risk

The input vector 119883(119896) = 119860(119896) cup 119861(119896) cup 119862(119896) that is usedto evaluate operational efficiency is represented as the unionof three following sets119860(119896) is a subset of the input mining technology variables119861(119896) is a subset of the output mining technology variables119862(119896) is a set of the external variables

According to our problem we create the vector space of inputvariables as follows

119883 (119896) = [119883119895 (119896)] = [1199096119896] =

[[[[[[[[[[[[[

[

11990911 11990912 sdot sdot sdot 1199091119896

11990921 11990922 sdot sdot sdot 1199092119896

11990931 11990932 sdot sdot sdot 1199093119896

11990941 11990942 sdot sdot sdot 1199094119896

11990951 11990952 sdot sdot sdot 1199095119896

11990961 11990962 sdot sdot sdot 1199096119896

]]]]]]]]]]]]]

]

(18)

where 1199091119896 is ore production rate (tyear) 1199092119896 is fixed costs(USD)1199093119896 is revenues (USD)1199094119896 is production costs (USD)1199095119896 is working days (daysyear) and 1199096119896 is degree of use ofproduction capacity ()

Let 119910(1) 119910(2) 119910(119896) be a sequence of observed DOLvalues on an annual basis that is the major sequence factorEquation (9) will be used for expressing the forecast model ofDOL of an existing underground mine as follows

119889119910(1)

119889119896+ 119886119910(1)= 1198871119909(1)

1+ 1198872119909(1)

2+ sdot sdot sdot + 119887119873119909

(1)

119873 (19)

The time sequence response formula of DOL is

119910(1)(119896 + 1) =

119910(0)(1) minus

6

sum119895=1

119887119895

119886sdot 119909(1)

119895(119896 + 1)

119890minus119886119896

+

6

sum119895=1

119887119895

119886sdot 119909(1)

119895(119896 + 1)

119896 = 0 1 2 119899 minus 1

(20)

Thefitting forecast value of119910(0)119896

can be obtained by the inverseAGO as follows

119910(0)(119896) = 119910

(1)(119896) minus 119910

(1)(119896 minus 1) 119896 = 2 3 119899

119910(0)(1) = 119910

(0)(1) 119896 = 0

(21)

For 119896 gt 119899 we can make forecasts of DOL as follows

119910(1)(119899 + ℎ + 1)

=

119910(0)(1) minus

6

sum119895=1

119887119895

119886sdot 119909(1)

119895(119899 + ℎ + 1)

119890minus119886(119899+ℎ)

+

6

sum119895=1

119887119895

119886sdot 119909(1)

119895(119899 + ℎ + 1)

ℎ = 0 1 2 119879 minus 1

119910(0)(119899 + ℎ) = 119910

(1)(119899 + ℎ) minus 119910

(1)(119899 + ℎ minus 1)

ℎ = 1 2 119879

(22)

where 119879 is future time horizonThe forecasting model should be able to involve a com-

mon time horizon taking the characteristics of the inputvariables that directly affect the value of DOL In this sec-tion the proposed method of forecasting of DOL undermultiple uncertainty and nonuniformity of input variables isoutlinedThemethod is based mainly on simulating multiplerealizations of the uncertain variables and making forecastsusing value expectations

According to the valuation function defined by (22) theexpected value of DOL over future time is defined as follows

119864 (119910(0)| 1199091 1199092 1199093 1199094 1199095 1199096 119899 + ℎ) (23)

Before we start to create forecasting process it is necessary todivide the set of input variables into two subsets 119883(119899 + ℎ) =EXP(119899 + ℎ) cup SIM(119899 + ℎ) where EXP(119899 + ℎ) denotes the setcomposed of variables defined by experts while SIM(119899 + ℎ)denotes the set composed of variables defined by some kindof stochastic law In our case these subsets are

EXP (119899 + ℎ) = [1199091 1199092 1199095 1199096]

SIM (119899 + ℎ) = [1199093 1199094] (24)

Values of 1199091 1199092 1199095 and 1199096 are of deterministic nature whilethe others are stochastic

32 Volatility of the Input Variables

321 Volatility of Revenues Mining companies not havingsmelting facilities realize their revenues by selling theirmetal concentrates as a final product Estimating revenues isindeed a difficult and risky activity Annual mine revenue iscalculated by multiplying the number of units produced andsold during the year by the sales price per unit The annualmine revenue (1199093) is calculated according to the followingequation

REVyear = 119876year sdot119899

sum119895=1

119881con119895sdot119866119895 sdot 119872119895

119898con119895

(25)

6 Mathematical Problems in Engineering

where 119876year is the annual production of ore (1199091) 119881con is

the value of the metal concentrate 119866 is the grade of oremined ()119872 is the mill recovery rate ()119898con is the metalcontent of the concentrate () and 119899 is the number of metalconcentrates derived from the ore (119899 gt 1 for polymetallicdeposits)

The first major component of the mine revenue calcu-lation is annual production of concentrate One of the keyvariables associated with annual concentrate production isthe tonnage of oremined Annual ore tonnage is derived fromthe mining project schedule and is denoted 119876

The second key variable associated with determining theannual production of saleable units is the grade of the oreminedThe concept of the ore grade (119866) is defined as the ratioof useful mass of metal to the total mass of ore and its criticalvalue fluctuates over space and can be estimated by normalprobability density function The use of normal distributionis based on geostatistical methods developed for evaluationof grades in mineral deposits The deposit is sampled bymeans of drill-holes Each sample gives us the informationabout mass of metal (grade) and we can create histogram ofgrades values According to the obtained histogram adequateprobability distribution function is selected In most cases ofmineral deposits normal distribution is used as representativefunction

119866 sim 119873(120583 1205902) (26)

At first sight it seems that 119866 does not change its value overtime but if we take into consideration the mining frontadvances over time through different parts of deposit thenit is also time depending For simplicity we adopt the valuesof 119866 which belong to the same interval defined by 120583 plusmn 2120590over future time horizon

Most ores require beneficiation before saleable productcan be produced The resulting milling losses must beestimated and appropriate recovery percentages establishedThese recoveries are commonly estimated from a metal-lurgical testing program Percentage recovery is the thirdbasic variable which must be estimated to arrive at a finalestimate of the annual production of saleable units extractedfrom the mine and is denoted 119872 A specific stochasticbehavior that is used to quantify uncertainty related to millrecovery rate (119872) is uniform probability density functionPerhaps it is virtually certain that mill recovery will lie ininterval [119886 119887] but it is possible to achieve it by mineralprocessing control For example flotation is the most widelyused method for the concentration of fine grained mineralsIt takes advantage of the different physicochemical surfaceproperties of minerals in particular their wettability whichcan be a natural property or artificially changed by chemicalreagents By altering the hydrophobic (water repelling) orhydrophilic (water attracting) conditions of their surfacesmineral particles suspended in water can be induced toadhere to air bubbles passing through a flotation cell orto remain in the pulp The air bubbles pass to the upper

surface of the pulp and form a froth which together with theattached hydrophobicminerals can be removedThe tailingscontaining the hydrophilic minerals can be removed fromthe bottom of the cell According to that within interval [119886 119887]no value is more likely than any other This gives rise to auniform distribution

119872 sim unif (119886 119887) (27)

It seems that119872 does not change its value over time but if wetake into consideration the fact that the flotation is influencedby many parameters and fact that it is very difficult to keepthem constantly over time then it is also time depending Forsimplicity we adopt the values of119872which belong to the sameinterval [119886 119887] but119872 takes the stochastic values for every yearof the time horizon

The second major component of the mine revenue calcu-lation is unit sales price or unit metal concentrate sales price(119881con) It directly depends on mineral asset price metal con-tent of the concentrate and metal recovery rate Estimatingfuture mineral prices is an exercise for which a high errorof estimation invariably exists The characteristically longpreproduction periods of mining projects mean that theirsuccess will be determined by mineral prices five to ten yearsin the future

The market risks related to mineral asset price (119875) aremodeled with a special stochastic process a mean reversionprocess The mean reversion process has economic logic forexample although the commodity prices have sensible short-term oscillations they tend to revert back to a ldquonormalrdquo long-term equilibrium level The past values of the changes in thisuncertain factor help predict the future We will use a modelwhere themetal spot price is assumed to follow the stochasticprocess [19]

119889119875 = 120572 (ln119875 minus ln119875)119875119889119905 + 120590119875119889119882 (28)

Let 119909 = ln119875 applying Itorsquos lemma allows the characterizationof the log price by an Ornstein-Uhlenbeck stochastic meanreverting process

119889119909 = 120572 (119909 minus 119909) 119889119905 + 120590119889119882 (29)

with

119909 = ln (119875) minus 1205902

2120572 (30)

where 119875 is the long-run equilibrium metal price 120572measuresthe speed of mean reversion to the long-run mean log price119875 119889119882 is an increment to a standard Brownian motionand 120590 refers to the price volatility rate The metal priceadjustmentmechanism is accounted for bymarket forcesThecorrect discrete-time format for the continuous-time processof mean reversion is the stationary first-order autoregressive

Mathematical Problems in Engineering 7

1000

1500

2000

2500

3000

3500

0 1 2 3 4 5 6 7 8 9 10Project time (year)

Lead

pric

e (U

S$t)

Forecast Pb priceLong-run equilibrium Pb price

Figure 1 One simulated lead price path on a yearly time resolution

process [20] so the sample path simulation equation for 119909119905 isperformed by using exact discrete-time expression

119909119905 = 119909119905minus1119890minus120572Δ119905

+ 119909 (1 minus 119890minus120572Δ119905)

+ 119873 (0 1) 120590radic(1 minus 119890minus2120572Δ119905)

2120572

(31)

where Δ119905 is the fixed time interval from time 119905 to 119905 + 1 and119873(0 1) is the normally distributed random variable

By substituting (31) to119875 = 119890119909 we have exact discrete-timeequation for 119875119905 given by

119875119905

= 119890ln(119875119905minus1)119890minus120572Δ119905+[ln(119875)minus12059022120572](1minus119890minus120572Δ119905)+119873(01)120590radic(1minus119890minus2120572Δ119905)2120572

(32)

In order to estimate the parameters of the mean reversionprocess we run the following regression

119889119909119905+1 = 1205730 + 1205731119909119905 + 120576 (33)

where 1205730 = 120572119909119889119905 and 1205731 = minus120572119889119905 Hence if we regress obser-vation 119889119909 against 119909 we can obtain estimates of 1205730 and 1205731 120590is the standard deviation obtained from the regression Thespeed of mean reversion (120572) is the negative of the slope whilethe long-run equilibrium (119875) is the intercept estimate of thatregression divided by the speed of mean reversion

Let 119875 = 119875119905 119905 = 0 1 119879 denote a price scenario withspot prices 119875119905 where 119875119905 is determined by (32) Figure 1presents a sample path of themetal price (eg lead) simulatedusing the above equation

In the purpose of 119875 simulation we apply a metal pricescenario for the time interval [119899 119899 + 119879] with incrementΔ119905 = 1

The unit value of metal concentrate sales price can beexpressed as follows

119881con(119905) = 119891 (119875 (119905) 119898

con 119898

mr) (34)

where119898mr is the metal recovery rate ()The value of119881con iscalculated in different ways with respect to type of metal

322 Volatility of Production Costs Production costs (PC)are incurred directly in the production process These costsinclude the ore and waste development of individual stopesthe actual stoping activities the mine services providinglogistical support to the miners and the milling and pro-cessing of the ore at the plant The uncertainties related tothe future states of unit production costs are modeled witha special stochastic process the geometric Brownian motionCertain stochastic processes are functions of a Brownianmotion process and these have many applications in financeengineering and the sciences Some special processes aresolutions of Ito-Doob type stochastic differential equations(Ladde Sambandham) [21]

In this model we apply a continuous time process usingthe Ito-Doob type stochastic differential equation to describemovement of unit production costs A general stochasticdifferential equation takes the following form

119889CO119905 = 120588 sdot (CO119905 119905) 119889119905 + 120590 sdot (CO119905 119905) sdot 119889119882119905

CO1199050

= CO0(35)

Here 119905 ge 1199050119882119905 is a Brownian motion and CO119905 gt 0 this isthe cost process

CO119905 is called the geometric Brownian motion whichis solution of the following linear Ito-Doob type stochasticdifferential equation

119889CO119905 = 120588 sdot CO119905119889119905 + 120590 sdot CO119905 sdot 119889119882119905 (36)

where 120588 is the drift 120590 is the volatility and119882119905 is normalizedBrownian motion

Using the Ito-Doob formula applied to (CO119905) = ln(CO119905)we can solve this equation

CO119905 = CO119905minus1 sdot 119890(120588minus120590

22)Δ119905+119873(01)120590radicΔ119905

(37)

Equation (37) describes an operating cost scenario with spotcosts CO119905

Let CO = CO119905 119905 = 0 1 119879 denote a cost scenariowith spot costs CO119905 where CO119905 is determined by (37)Figure 2 presents a sample paths (119904 = 1 2 119878) of the unitproduction cost simulated using (37) 119878 times

In the purpose of CO simulation we apply a cost scenariofor the time interval [119899 119899 + 119879] with increment Δ119905 = 1

8 Mathematical Problems in Engineering

Table 1 Expert estimation of the variables

Expert Value1198641 1198642 sdot sdot sdot 119864119901

x11 x12 sdot sdot sdot x1119901 119864(1199091) =11990911 + 11990912 + sdot sdot sdot + 1199091119901

119901

x21 x22 sdot sdot sdot x2119901 119864(1199092) =11990921 + 11990922 + sdot sdot sdot + 1199092119901

119901

x51 x52 sdot sdot sdot x5119901 119864(1199095) =11990951 + 11990952 + sdot sdot sdot + 1199095119901

119901

x61 x62 sdot sdot sdot x6119901 119864(1199096) =11990961 + 11990962 + sdot sdot sdot + 1199096119901

119901

0 1 2 3 4 5 6 7 8 9 10Year

Figure 2 Simulated cost paths on a yearly time resolution

The annual production costs are expressed as follows

PCyear = 119876year sdot CO (119905) (38)

33 Variables Based on Expertrsquos Knowledge To estimate anadequate value of these variables it is necessary to get opin-ions of experts dealing with them Suppose we have 119901 expertsand each of them has given hisher opinion The final valueis expressed by averaging the opinions of experts Table 1presents the expert estimation process

34 DOL Forecasting Model Based on Expertrsquos Knowledge andSimulation The model is developed on the basis of expertrsquosknowledge and simulation of DOL changing over definedtime horizon and takes into account the variability of inputparameters By simulating a forecasting system we imitate itsaction in order to measure its response (output) to differentinputsThe advantage of simulating a system is the possibilityof replicating its evolution as many times as necessary inindependent conditions The simulation allows analysts todescribe the uncertainty of variables that influence the valueof DOL by different time depending scenarios The values ofDOL are usually forecasted on an annual basis

The first objective of the use of simulation in the fore-casting is to determine the distribution of the DOL from thevariables that affect his performance which results in theaverage or expected value of DOL for every year of definedtime horizonThe relation between uncertain variables affect-ing the value of DOL is described by (22)

For each simulation the input values and DOL resultrepresent one possible state of nature Simulated values ofDOL are obtained by performing the following calculations

119910(1)119904(119899 + ℎ + 1)

= 119910(1)(1199091119899+ℎ 119909

119904

2119899+ℎ 119909119904

3119899+ℎ 119909119904

4119899+ℎ 1199095119899+ℎ 119909

119904

6119899+ℎ)

ℎ = 0 1 2 119879 minus 1

119910(0)119904(119899 + ℎ) = 119910

(1)119904(119899 + ℎ) minus 119910

(1)119904(119899 + ℎ minus 1)

ℎ = 1 2 119879

119904 = 1 2 119878

(39)

where 119878 denotes the number of simulationsSpace of simulation for 119904 = 1 and 119896 gt 119899 where the first

six rows concern the evolution path of the input variableswhile the last one concerns evolution path of the DOL canbe represented as follows

Mathematical Problems in Engineering 9

DOL119904=1119879=

[[[[[[[[[[[[[[[[[[[[[[[[[[[[[[

[

119904 = 1 119904 = 1 sdot sdot sdot 119904 = 1

11990911 11990912 sdot sdot sdot 1199091119879

11990921 11990922 sdot sdot sdot 1199092119879

11990931 11990932 sdot sdot sdot 1199093119879

11990941 11990942 sdot sdot sdot 1199094119879

11990951 11990952 sdot sdot sdot 1199095119879

11990961 11990962 sdot sdot sdot 1199096119879

darr darr darr darr

equation (22) equation (22) equation (22) equation (22)darr darr darr darr

119910(1)119904=1

1119910(1)119904=1

2sdot sdot sdot 119910

(1)119904=1

119879

darr darr darr darr

119910(0)119904=1

1119910(0)119904=1

2sdot sdot sdot 119910

(0)119904=1

119879

]]]]]]]]]]]]]]]]]]]]]]]]]]]]]]

]

(40)

Once the simulations DOL119904119879 119904 = 1 2 119878 have been

obtained they can be used to estimate the distribution of theDOL for every year of the defined time horizonThe expectedvalues of the DOL can be expressed by the following vectorspace

119864 (DOL119878119879) =

[[[[[[[[[[[[[

[

119910(0)119904=1

1119910(0)119904=1

2sdot sdot sdot 119910

(0)119904=1

119879

119910(0)119904=2

1119910(0)119904=2

2sdot sdot sdot 119910

(0)119904=2

119879

d

119910(0)119904=119878

1119910(0)119904=119878

2sdot sdot sdot 119910

(0)119904=119878

119879

darr darr darr darr

119864 (119910(0)

1) 119864 (119910

(0)

2) sdot sdot sdot 119864 (119910

(0)

119879)

]]]]]]]]]]]]]

]

(41)

According to (41) the management of the company obtainsthe forecasting information vector of DOL

FIV (119895 119879) = 119864 (DOL)

= [119864 (DOL1) 119864 (DOL2) sdot sdot sdot 119864 (DOL119879)] (42)

This vector concerns the information of the possible futurestates of the Degree of Operating Leverage over defined timehorizon

Space of simulation for 119904 = 1 and 119896 gt 119899 where the firstseven rows concern the evolution paths of the DOL and inputvariables while the rest concern evolution paths of the greyrelational coefficient can be represented as follows

120585119904=1

119895119879=

[[[[[[[[[[[[[[[[[[[[[[[[[[[[[[[[[[[

[

119904 = 1 119904 = 1 sdot sdot sdot 119904 = 1

119910(0)

1119910(0)

2sdot sdot sdot 119910

(0)

119879

11990911 11990912 sdot sdot sdot 1199091119879

11990921 11990922 sdot sdot sdot 1199092119879

11990931 11990932 sdot sdot sdot 1199093119879

11990941 11990942 sdot sdot sdot 1199094119879

11990951 11990952 sdot sdot sdot 1199095119879

11990961 11990962 sdot sdot sdot 1199096119879

darr darr darr darr

equation (14) equation (14) equation (14) equation (14)darr darr darr darr

120585119904=1

11120585119904=112

sdot sdot sdot 120585119904=11119879

d

120585119904=161

120585119904=162

sdot sdot sdot 120585119904=16119879

]]]]]]]]]]]]]]]]]]]]]]]]]]]]]]]]]]]

]

(43)

10 Mathematical Problems in Engineering

Once the simulations 120585119904119895119879 119904 = 1 2 119878 have been obtained

they can be used to estimate the distribution of the 120585119895 for everyyear of the defined time horizon The expected values of the120585119895 can be expressed by the following vector space

119864 (120585119878

119895119879) =

[[[[[[[[[[[[[[

[

119864 (120585119878

11) 119864 (120585119878

12) sdot sdot sdot 119864 (120585119878

1119879)

119864 (12058511987821) 119864 (120585119878

22) sdot sdot sdot 119864 (120585119878

2119879)

119864 (12058511987831) 119864 (120585119878

32) sdot sdot sdot 119864 (120585119878

3119879)

119864 (12058511987841) 119864 (120585119878

42) sdot sdot sdot 119864 (120585119878

4119879)

119864 (12058511987851) 119864 (120585119878

52) sdot sdot sdot 119864 (120585119878

5119879)

119864 (12058511987861) 119864 (120585119878

62) sdot sdot sdot 119864 (120585119878

6119879)

]]]]]]]]]]]]]]

]

(44)

The expected values of the aggregated grey relational coeffi-cient are calculated as follows

120588119895 =1

ℎ

119879

sumℎ=1

119864 (120585119878

119895ℎ) 119895 = 1 2 6 (45)

According to (45) the management of the company obtainsthe forecasting information vector of the aggregated greyrelational coefficient

120588 (119895) =

[[[[[[

[

120588 (1)

120588 (2)

120588 (6)

]]]]]]

]

(46)

4 Application of the Procedure

41 A Numerical Example Statement A management of anoperating underground zinc mine is trying to forecast thefuture states of operational efficiency for five years aheadFor this problem the input parameters that are requiredfor the forecasting are given in Tables 2 and 3 In order todefine values of production rate fixed costs working daysand degree of use of production capacity three experts areincluded into process of estimation Note that the situationis hypothetical and numbers used are to permit calculation

Values of the input parameters are similar to the real environ-ment of mining

42 A Numerical Example Solution

Step 1 (forecasting model) Transformations of the originaldata sequences by AGO are as follows

119884(0)= [1219 1421 1333 1676 1437]

119884(1)= [1219 2640 3973 5649 7086]

119883(0)

1= [100000 95000 100000 100000 100000]

119883(1)

1= [100000 195000 295000 395000 495000]

119883(0)

2= [1200000 1500000 1100000 1400000 1600000]

119883(1)

2= [1200000 2700000 3800000 5200000 6800000]

119883(0)

3

= [11065884 10773877 10137834 9145279 10823137]

119883(1)

3

= [11065884 21839761 31977595 41122874 51946011]

119883(0)

4= [4387000 5714000 5740000 5676000 5564000]

119883(1)

4

= [4387000 10101000 15841000 21517000 27081000]

119883(0)

5= [330 310 340 300 320]

119883(1)

5= [330 640 980 1280 1600]

119883(0)

6= [90 85 93 82 88]

119883(1)

6= [90 175 268 350 438]

(47)

Calculation of the average generation of adjacent samplesequence of 119884(1)(119896) is as follows

119884(1)= [1219 2640 3973 5649 7086]

119885(1)(119884(1)) = [1929 3307 4812 6369]

(48)

Construction of the matrix 119861 and matrix 119884 is as follows

119861 =

[[[[[[

[

minus1219 195000 2700000 21839761 10101000 640 175

minus3307 295000 3800000 31977595 15841000 980 268

minus4812 395000 5200000 41122874 21517000 1280 350

minus6369 495000 6800000 51946011 27081000 1600 438

]]]]]]

]

119884 =

[[[[[

[

1421

1333

1676

1437

]]]]]

]

(49)

Mathematical Problems in Engineering 11

Table 2 Input parameters of observed period

ParameterObserved period

Year1 2 3 4 5

DOL 1219 1421 1333 1676 1437

Production rate (tyear) 100000 95000 100000 100000 100000

Fixed costs (USD) 1200000 1500000 1100000 1400000 1600000

Revenues (USD)Ore grade () 411 396 404 382 387

Mill recovery rate () 7852 7801 8105 7902 8156

Metal content of the concentrate () 538 538 538 538 538Metal recovery rate ()

119898mr =

(119898con minus 8) sdot 100119898con

le 85 119898con minus 8

(119898con minus 8) sdot 100119898con

gt 85 85

119898mr =(538 minus 8) sdot 100

538= 8513 85

85 85 85 85 85

Zinc metal price (USDt) 2160 2195 1950 1910 2160Unit value of metal concentrate sales price (USDt)119881con = 119875(119898con minus 119898mr) = 119875 sdot 085

1836 1866 1658 1624 1836

Revenues (USD) 11065884 10773877 10137834 9145279 10823137

Production costs (USD)Unit production costs (USDt) 4387 6011 5740 5676 5564

Production costs (USD) 4387000 5714000 5740000 5676000 5564000

Working days (dayyear) 330 310 340 300 320

Degree of use of production capacity () 90 85 93 82 88

Table 3 Input parameters required for simulation of DOL

ParameterValueYear

6 7 8 9 10Production rate (tyear) 100000 105000 97000 100000 110000Fixed costs (USD) 1600000 1800000 1500000 1700000 2000000Revenues (USD)

Ore grade ()-normal distribution Min 345 medium 406 max 468 volatility 0205Mill recovery rate ()-uniform distribution Min 77 medium 785 max 80 volatility 0866Metal content of the concentrate () 538Metal recovery rate () 85

Zinc metal price (USDt)-mean reversion process Spot value 2113 equilibrium metal price 2277 speed ofmean reversion 09221 price volatility rate 02734

Production costs (USD)Unit production costs (USDt)-geometric Brownian motion Spot value 65 drift 002382 cost volatility 009351

Working days (dayyear) 330 330 340 340 340Degree of use of production capacity () 86 90 92 85 93Number of simulations 500

12 Mathematical Problems in Engineering

Table 4 Fitted values of DOL

Error Year1 2 3 4 5

DOL-AGO values 2292 3642 5291 6546DOL-inverse AGO values 1219 1073 1350 1649 1255

Table 5 Error estimation of the model

Error Year1 2 3 4 5

DOL-observed values 1219 1421 1333 1676 1437DOL-fitted values 1219 1073 1350 1649 1255RPE () 0 2447 128 163 1270ARPE () 1002

The constructedAGOsequence of our problem is representedby the following matrix form

[[[[[

[

1421

1333

1676

1437

]]]]]

]

=

[[[[[

[

minus1219 195000 2700000 21839761 10101000 640 175

minus3307 295000 3800000 31977595 15841000 980 268

minus4812 395000 5200000 41122874 21517000 1280 350

minus6369 495000 6800000 51946011 27081000 1600 438

]]]]]

]

[[[[[[

[

119886

1198872

119887N

]]]]]]

]

(50)

According to 119886 = (119861119879119861)minus1119861119879119884we obtain the following factorsof the matrix 119886 = [15379 00001129 minus103377 sdot 10minus6 1304 sdot10minus7 minus14598 sdot 10minus7 minus00042024 minus00796303]119879 Values of thedetermined coefficients are 119886 = 15379 1198871 = 00001129 1198872 =minus103377 sdot 10minus6 1198873 = 1304 sdot 10

minus7 1198874 = minus14598 sdot 10minus7 1198875 =

minus00042024 1198876 = minus00796303

The AGO time sequence response formula of DOL is

119910(1)(119896 + 1) = 1219 minus 73462 sdot 10

minus5119909(1)

1(119896 + 1)

+ 6748 sdot 10minus7119909(1)

2(119896 + 1) minus 8479 sdot 10

minus8119909(1)

3(119896 + 1)

+ 9492 sdot 10minus8119909(1)

4(119896 + 1) + 00027325119909

(1)

5(119896 + 1)

+ 00517784119909(1)

6(119896 + 1) 119890

minus15379119896

+ 73462 sdot 10minus5119909(1)

1(119896 + 1) minus 6748 sdot 10

minus7119909(1)

2(119896

+ 1) + 8479 sdot 10minus8119909(1)

3(119896 + 1) minus 9492 sdot 10

minus8119909(1)

4(119896

+ 1) minus 00027325119909(1)

5(119896 + 1) minus 00517784119909

(1)

6(119896

+ 1) 119896 = 0 1 2 3 4

(51)

AGO and inverse AGO values of the time sequence responseformula of DOL are represented by Table 4

The adequacy of the obtained time sequence responseformula is obtained by using (12) and summarized in Table 5

Step 2 (grey relevance analysis) Applying (13) we obtain thefollowing results of equalization (see Tables 6 and 7)

Absolute values of Δ 119895(119896) = |DOL1015840(119896) minus 1199091015840119895(119896)| are repre-

sented by Table 8Extreme values of Δ 119895(119896) are represented by Table 9Grey relational (relevance) analysis of GM(1 6) is repre-

sented by Table 10According to Table 10 we obtain the rank order of

relevancy of the influencing variables over observed time asfollows

Year 11198834 gt 1198832 gt 1198831 gt 1198836 gt 1198835 gt 1198833

Year 2 (1198831 = 1198835 = 1198836) gt 1198833 gt 1198834 gt 1198832

Year 31198832 gt 1198833 gt 1198831 gt 1198836 gt 1198835 gt 1198834

Year 41198833 gt 1198836 gt 1198835 gt 1198831 gt 1198832 gt 1198834

Year 51198835 gt 1198836 gt 1198831 gt 1198833 gt 1198834 gt 1198832

According to aggregated values we obtain the final rank orderof relevancy of the influencing variables as follows 1198833 gt1198836 gt 1198835 gt 1198831 gt 1198834 gt 1198832

Step 3 (simulation of the influencing sequence variables andDOL) Scenario of zinc price is represented by Table 11

Mathematical Problems in Engineering 13

Table 6 Sum of the major and influencing sequence variables

DOL(k) 1219 1421 1334 1677 1437X1(k) 100000 95000 100000 100000 100000X2(k) 1200000 1500000 1100000 1400000 1600000X3(k) 11065884 10773876 10137834 9145278 10823136X4(k) 4387000 5714000 5740000 5676000 5564000X5(k) 330 310 340 300 320X6(k) 90 85 93 82 88Sum 16753305 18083273 17078268 16321662 18087545

Table 7 Equalized values of the major and influencing sequence variables

DOL1015840(k) 728E minus 08 786E minus 08 781E minus 08 103E minus 07 795E minus 0811988310158401(119896) 0005969 0005253 0005855 0006127 0005529

1198831015840

2(119896) 0071628 008295 0064409 0085776 0088459

1198831015840

3(119896) 0660519 0595792 059361 0560315 0598375

1198831015840

4(119896) 0261859 0315983 03361 0347759 0307615

1198831015840

5(119896) 197E minus 05 171E minus 05 199E minus 05 184E minus 05 177E minus 05

1198831015840

6(119896) 537E minus 06 47E minus 06 545E minus 06 502E minus 06 487E minus 06

Table 8 Absolute values of Δ 119895(119896)

Δ 1(119896) 0005969 0005253 0005855 0006127 0005529Δ 2(119896) 0071628 008295 0064409 0085775 0088459Δ3(119896) 0660519 0595792 059361 0560315 0598375

Δ4(119896) 0261859 0315983 03361 0347759 0307615

Δ5(119896) 196E minus 05 171E minus 05 198E minus 05 183E minus 05 176E minus 05

Δ 6(119896) 530E minus 06 462E minus 06 537E minus 06 492E minus 06 479E minus 06

Table 9 Min and max of Δ 119895(119896)

Min MaxΔ 1(119896) 0005253 0006127Δ 2(119896) 0064409 0088459Δ3(119896) 0560315 0660519

Δ 4(119896) 0261859 0347759Δ 5(119896) 171E minus 05 198E minus 05Δ 6(119896) 462E minus 06 537E minus 06

Table 10 Correlation matrix

DOL(119896)119883119895120579 = 05

DOL(1) DOL(2) DOL(3) DOL(4) DOL(5) Aggregated value

X1

092078 1 093251 090497 096797 094524X2 093769 085421 1 083565 081875 088926X3 089886 096169 096396 1 095901 095670X4 1 088951 085442 083532 090497 089684X5 091331 1 090701 095695 098009 095147X6 091514 1 090739 096063 097805 095224

14 Mathematical Problems in Engineering

Table 11 Mean reversion process of zinc price

Year 6 1198756= 119890ln(2113)sdot119890

minus09221+[ln(2277)minus027342(2sdot09221)](1minus119890minus09221)+119873(01)sdot02734sdotradic(1minus119890minus2sdot09221)2sdot09221

Year 7 1198757 = 119890ln(1198756)sdot119890minus09221+[ln(2277)minus027342(2sdot09221)](1minus119890minus09221)+119873(01)sdot02734sdotradic(1minus119890minus2sdot09221)2sdot09221

Year 8 1198758 = 119890ln(1198757)sdot119890minus09221+[ln(2277)minus027342(2sdot09221)](1minus119890minus09221)+119873(01)sdot02734sdotradic(1minus119890minus2sdot09221)2sdot09221

Year 9 1198759 = 119890ln(1198758)sdot119890minus09221+[ln(2277)minus027342(2sdot09221)](1minus119890minus09221)+119873(01)sdot02734sdotradic(1minus119890minus2sdot09221)2sdot09221

Year 10 11987510 = 119890ln(1198759)sdot119890minus09221+[ln(2277)minus027342(2sdot09221)](1minus119890minus09221)+119873(01)sdot02734sdotradic(1minus119890minus2sdot09221)2sdot09221

Table 12 Geometric Brownian motion of unit production costs

Year 6 CO6 = 65 sdot 119890(002382minus009351

22)+119873(01)sdot009351

Year 7 CO7 = CO6 sdot 119890(002382minus009351

22)+119873(01)sdot009351

Year 8 CO8 = CO7 sdot 119890(002382minus009351

22)+119873(01)sdot009351

Year 9 CO9= CO

8sdot 119890(002382minus009351

22)+119873(01)sdot009351

Year 10 CO10 = CO9 sdot 119890(002382minus009351

22)+119873(01)sdot009351

Table 13 One simulation path of DOL

ParameterValueYear

6 7 8 9 10Production rate (tyear) 100000 105000 97000 100000 110000Fixed costs (USD) 1600000 1800000 1500000 1700000 2000000Revenues (USD)

Ore grade ()-normal distribution 407 378 431 401 386Mill recovery rate ()-uniform distribution 7927 7854 7862 7771 7832Metal content of the concentrate () 538 538 538 538 538Metal recovery rate () 85 85 85 85 85Zinc metal price (USDt)-mean reversion process 2025 1936 2064 2409 2120Revenues (USD) 13040642 12152559 13638024 15254913 14228955

Production costs (USD)Unit production costs (USDt)-geometric Brownian motion 7156 8833 9077 9801 9587Production costs (USD) 7156388 9274793 8805646 9801869 10546252

Working days (dayyear) 330 330 340 340 340Degree of use of production capacity () 86 90 92 85 93

119910(1)(119896 + 1) = 1219 minus 73462 sdot 10minus5119909(1)

1(119896 + 1) + 6748 sdot 10minus7119909

(1)

2(119896 + 1) minus 8479 sdot 10minus8119909

(1)

3(119896 + 1) + 9492 sdot 10minus8119909

(1)

4(119896 + 1)

+ 00027325119909(1)

5(119896 + 1) + 00517784119909

(1)

6(119896 + 1)119890

minus15379119896+ 73462 sdot 10

minus5119909(1)

1(119896 + 1) minus 6748 sdot 10

minus7119909(1)

2(119896 + 1)

+ 8479 sdot 10minus8119909(1)

3(119896 + 1) minus 9492 sdot 10minus8119909

(1)

4(119896 + 1) minus 00027325119909(1)

5(119896 + 1) minus 00517784119909

(1)

6(119896 + 1)

119896 = 5 + ℎ ℎ = 0 1 2 3 4DOL-AGO 7892 8981 9723 10955 12147DOL-inverse AGO 1346 1089 0742 1232 1192

Scenario of unit production costs is represented byTable 12

Results of forecasting of DOL generated by the GM(16)(see (51)) for a single simulation are represented by Table 13

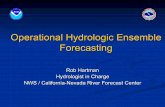

This act is repeated five hundred times and set of fivehundred possible states of nature is obtained for every yearof the time horizon The expected DOL values119864(DOL(6)) 119864(DOL(7)) 119864(DOL(10)) are calculated

from the simulation results that is from the sets of possiblestates of nature The forecasting of the DOL is represented byFigure 3 and summary Table 14

Probability and cumulative density function of forecastedDOL for 6th year are represented by Figure 4

Step 4 (grey relevance analysis of results obtained by sim-ulation) Applying (13) we obtain the following results ofequalization (see Tables 15 and 16)

Mathematical Problems in Engineering 15

Table 14 Summary statistics

Statistic parameterValueYear

6 7 8 9 10Sample 500 500 500 500 500Mean (expected) value of DOL 1491 1525 0951 1403 1574Median 1469 1494 0945 1397 1571Standard deviation 02512 02745 02631 02740 03163Max 2470 2543 1766 2471 2940Min 09073 08394 02065 05978 05828Range 1562 1703 1559 1872 2357Q (75) 1646 1698 1105 1573 1752Q (25) 1293 1340 0761 1227 1379Q (75)ndashQ (25) 0352 0358 0344 0346 0373Asymmetry (Skewness) 06235 05085 04129 03726 02453Kurtosis 03917 03205 02378 07502 11323Standard error 001123 001227 001176 001225 001414Reliability coefficient (1 minus 120572) 095 095 095 095 095Reliability factor 196 196 196 196 196Reliability interval-upper limit 1513 1549 0973 1427 1601Reliability interval-lower limit 1469 1501 0927 1378 1545Mean (expected) value () 5290 5380 5140 5020 5070

0

02

04

06

08

1

12

14

16

18

0 1 2 3 4 5 6 7 8 9 10

DO

L

Year

DOL originalDOL fitting

DOL forecastingDOL expected

Figure 3Original fitting one path forecasting and expected valuesof DOL after 500 simulations

Grey relational (relevance) analysis of GM(16) for onepath of simulation is represented by Table 17

According to Table 17 we obtain the simulated rank orderof relevancy of the influencing variables over time as follows

Year 11198834 gt 1198833 gt 1198832 gt 1198835 gt 1198831 gt 1198836Year 21198833 gt 1198835 gt 1198831 gt 1198834 gt 1198836 gt 1198832Year 31198832 gt 1198831 gt 1198833 gt 1198834 gt 1198835 gt 1198836Year 4 (1198831 = 1198836) gt 1198835 gt 1198832 gt 1198833 gt 1198834Year 51198835 gt 1198833 gt 1198836 gt 1198831 gt 1198832 gt 1198834

000

1000

2000

3000

4000

5000

6000

7000

8000

9000

10000

0

2

4

6

8

10

12

14

16

18

20

091

099

106

114

122

130

138

145

153

161

169

177

184

192

200

208

216

223

231

239

247

()

Figure 4 Distribution of forecasted DOL for the 6th year

According to aggregated values we obtain the final simulatedrank order of relevancy of the influencing variables as follows1198833 gt 1198835 gt 1198832 gt 1198831 gt 1198834 gt 1198836

Since 500 simulations are performed we obtain thecorrelation matrix as in Table 18

According to Table 18 we obtain the expected rank orderof relevancy of the influencing variables over time and finalexpected rank order as follows

Year 11198833 gt 1198832 gt 1198834 gt 1198831 gt 1198836 gt 1198835Year 21198833 gt 1198835 gt 1198836 gt 1198834 gt 1198831 gt 1198832Year 31198832 gt 1198833 gt 1198831 gt 1198834 gt 1198835 gt 1198836

16 Mathematical Problems in Engineering

Table 15 Sum of the major and influencing sequence variables for 119904 = 1

DOL(k) 1346 1089 0742 1232 1192X1(k) 100000 105000 97000 100000 110000

X2(k) 1600000 1800000 1500000 1700000 2000000X3(k) 13040642 12152559 13638024 15254913 14228955X4(k) 7156388 9274793 8805646 9801869 10546252X5(k) 330 330 340 340 340X6(k) 86 90 92 85 93Sum 21897447 23332773 24041102 26857208 26885641

Table 16 Equalized values of the major and influencing sequence variables for 119904 = 1

DOL1015840(k) 615E minus 08 467E minus 08 309E minus 08 459E minus 08 443E minus 081198831015840

1(119896) 0004567 00045 0004035 0003723 0004091

1198831015840

2(119896) 0073068 0077145 0062393 0063298 0074389

1198831015840

3(119896) 0595533 0520836 0567279 0568001 052924

1198831015840

4(119896) 0326814 0397501 0366275 0364962 0392263

1198831015840

5(119896) 151E minus 05 141E minus 05 141E minus 05 127E minus 05 126E minus 05

1198831015840

6(119896) 393E minus 06 386E minus 06 383E minus 06 316E minus 06 346E minus 06

Table 17 Correlation matrix for 119904 = 1

DOL(119896)119883119895120579 = 05

DOL(1) DOL(2) DOL(3) DOL(4) DOL(5) Aggregated value

1198831 0876886 0885498 0950716 1 094227 09310741198832 0904383 087252 1 099112 0893805 09323661198833 0916382 1 0946311 0945523 0989839 09596111198834 1 0881448 0930161 0932326 0889259 09266391198835 0893087 0930804 0930155 0999411 1 09506911198836

0871197 0879595 0881844 1 0944697 0915467

Table 18 Expected correlation matrix obtained after 500 simulations

DOL(119896)119883119895120579 = 05

DOL(1) DOL(2) DOL(3) DOL(4) DOL(5) Aggregated value

X1

0912041 0921771 0925088 0925480 0939693 0924814X2 0928070 0896937 0957765 0913864 0876159 0914559X3 0934076 0940820 0935899 0950123 0953475 0942879X4 0922037 0922130 0911800 0901827 0905551 0912669X5 0890792 0938745 0870543 0895710 0958414 0910841X6 0909324 0925922 0851819 0933881 0937900 0911769

Year 41198833 gt 1198836 gt 1198831 gt 1198832 gt 1198834 gt 1198835Year 51198835 gt 1198833 gt 1198831 gt 1198836 gt 1198834 gt 1198832Final1198833 gt 1198831 gt 1198832 gt 1198834 gt 1198836 gt 1198835

If we compare the final rank order of relevancy of the influ-encing variables obtained by observation to the final expectedrank order of influencing variables obtained by simulation itcan be seen that the revenues retain the greatest relevance

Level of relevancy of the influencing variable related toworking days is significantly changed from the second level inthe past to the sixth in the future Influencing variable relatedto the production rate is increased its relevance from thefourth level in the past to the second in the future while therest variables retain approximately the same level of relevancy

Key information obtained from the values of DOL can besummarized in Table 19

Mathematical Problems in Engineering 17

Table 19 DOLrsquos indications

Parameter DOL valueHigh Low

Variable costs (revenuesand fixed costs are fixed) High Low

Fixed costs (revenues andvariable costs are fixed) Low High

Revenues up (variable andfixed costs are fixed) Greater profits Lower profits

Revenues down (variableand fixed costs are fixed) Greater losses Lower losses

FromTable 19 we can seewhy itmatters if value ofDOL ishigh or low When DOL is high a change in revenues resultsin large change in profit or loss On the other hand whenDOL is low a change in revenues results in small change inprofit or loss

5 Conclusion

Multivariable grey model is used to establish the sequencetime response formula which defines the relationshipbetween ore production rate fixed costs revenues produc-tion costs working days and degree of use of productioncapacity as input variables andDegree ofOperating Leverageas indicator of operational efficiency of an existing under-ground mine The management of the company obtains theaggregated information vector which sublimates the follow-ing important indicators forecasting model relative percent-age error of forecasting model average relative percentageerror of forecasting model the grey relational coefficientbetween inputs and output for defined time interval andaggregated grey relational coefficient between inputs andoutput

Large capital intensive projects such as those in themineral resource industry are often associated with diversesources of both endogenous and exogenous uncertaintiesThese uncertainties can greatly influence the operationalefficiency Having the ability to plan for these uncertaintiesis increasingly recognized as critical to long-term miningcompany success To decrease uncertainty of future valuesof the operational efficiency we use expertrsquos knowledge andsimulation processes to find future values of input variablesaffecting them Estimation of future revenues is based onthe application of mean reversion process normal anduniform distribution Geometric Brownian motion is usedto define future values of production costs Values of oreproduction rate fixed costs working days and degree of useof production capacity are estimated by expertrsquos knowledgeSimulation results in the average or expected value of Degreeof Operating Leverage for every year of defined time horizonDegree of Operating Leverage is very important indicator tothe management of the mining company because it can beused as a good base for Cost-Volume-Profit analysis

The limitation of the developed model is related tothe expertrsquos estimation of the production rate fixed costsworking days and degree of use of production capacity

as deterministic or crisp values In order to overcome thisproblem we concern the possibility of application of intervalor fuzzy numbers as a way to decrease uncertainty ofthese variables It increases the complexity of the calculationbut makes the model much more realistic Another oneapproach of further exploration can be directed to developingsubmodels finding the future states of these variables andincorporation of them into main forecasting model

Conflict of Interests

The authors declare that there is no conflict of interestsregarding the publication of this paper

References

[1] S Briciu S Capusneanu I Sorina (Rakos) Boca and D IoanTopor ldquoCost analysis and reporting the performances of com-panies in the mining industryrdquo in Proceedings of the 6th Inter-national Conference on Applied Economics Business and Devel-opment (AEBD rsquo14) pp 51ndash56 Lisbon Portugal October2014 httpwwwwseasuse-libraryconferences2014LisbonAEBDAEBD-07pdf

[2] X Zhao L Li and X-S Zhang ldquoAnalysis of operating efficiencyof Chinese Coal Mining industryrdquo in Proceedings of the IEEE18th International Conference on Industrial Engineering andEngineering Management (IEampEM rsquo11) Part 2 pp 889ndash893Changchun China September 2011

[3] Z-W Li L-J Wang and D-P Wang ldquoPerformance evaluationof coal mine listed company based on factor analysisrdquo ChinaMining vol 17 no 2 pp 10ndash13 2008

[4] F A Khrisat A Y Khasawneh and A A Al-Waked ldquoMan-agerial and operational efficiency valuation of privatized firmscase of Jordan mining sectorrdquo European Journal of EconomicsFinance and Administrative Sciences no 49 pp 56ndash70 2012

[5] O A Akinboade E C Kinfack M P Mokwena and W LKumo ldquoEstimating profit efficiency in the SouthAfricanminingsector using stochastic frontier approachrdquo Problems and Per-spectives in Management vol 8 no 1 pp 136ndash142 2010

[6] C Musingwini and R C A Minnitt ldquoRanking the efficiency ofselected platinum mining methods using the analytic hierar-chy process (AHP)rdquo in Proceedings of the 3rd InternationalPlatinum Conference lsquoPlatinum in Transformationrsquo pp 319ndash326The Southern African Institute of Mining and MetallurgyJohannesburg South Africa October 2008

[7] S Nel M S Kizil and P Knights ldquoImproving truck-shovelmatchingrdquo in Proceedings of the 35th APCOM Symposium pp381ndash391 Wollongong Australia September 2011

[8] J L Deng ldquoIntroduction to grey systemrdquo The Journal of GreySystem vol 1 no 1 pp 1ndash24 1989

[9] E Kayacan B Ulutas and O Kaynak ldquoGrey system theory-based models in time series predictionrdquo Expert Systems withApplications vol 37 no 2 pp 1784ndash1789 2010

[10] Y M Chang M L You J M Tseng C P Lin and C M ShuldquoApplying grey system theory to rank the influence factors in thebenzene and methanol mixtures of fire and explosion hazardevaluationrdquo in Proceedings of the 37th Annual Conference onThermal Analysis (NATAS rsquo09) Paper no 25-3873565 LubbockTex USA September 2009

18 Mathematical Problems in Engineering

[11] H Hui F Li and Y Shi ldquoAn optimal multi-variable grey modelfor logistics demand forecastrdquo International Journal of Innova-tive Computing Information and Control vol 9 no 7 pp 2907ndash2918 2013

[12] K Tang F Wang J Liu P Jia and J Liu ldquoWater vapor perme-ability of leathers by grey system theoryrdquo Reviews on AdvancedMaterials Science vol 33 no 4 pp 373ndash382 2013

[13] Y-H Lin P-C Lee and T-P Chang ldquoAdaptive and high-pre-cision grey forecasting modelrdquo Expert Systems with Applica-tions vol 36 no 6 pp 9658ndash9662 2009

[14] Y-T Lee and C-S Chiu ldquoSkin physiology analysis via greyGM(1 N) and GM(0 N) modelrdquo International Journal of Bio-Science and Bio-Technology vol 1 no 1 pp 25ndash36 2009

[15] YWangG Zhang K SMoon and JW Sutherland ldquoCompen-sation for the thermal error of a multi-axis machining centerrdquoJournal of Materials Processing Technology vol 75 no 1ndash3 pp45ndash53 1998

[16] X Wang ldquoGrey relational analysis of teaching skills and learn-ing results of aerobicsrdquo Advances in Information Sciences andService Sciences vol 4 no 10 pp 321ndash328 2012

[17] J J Weygandt P D Kimmel and D E Kieso ManagerialAccounting Tools for Business Decision Marketing John Wileyamp Sons 5th edition 2010

[18] HKiymaz andRHodgin ldquoEnhancing clarity and completenessof basic financial text treatments on operating leveragerdquo Journalof Economics and Finance Education vol 2 no 1 pp 35ndash452003

[19] F H M Sszlignchez Y C Vargas and M P Cardozo ldquoNumericalcomparison of pricing of european call options formean revert-ing processesrdquo International Journal of Research and Reviews inApplied Sciences vol 14 no 2 pp 358ndash395 2013

[20] J Janczura S Orzeł and A Wyłomanska ldquoSubordinated 120572-stable OrnsteinndashUhlenbeck process as a tool for financial datadescriptionrdquo Physica A Statistical Mechanics and Its Applica-tions vol 390 no 23-24 pp 4379ndash4387 2011

[21] G S Ladde andM Sambandham Stochastic Versus Determinis-tic Systems of Differential Equations Marcel Dekker New YorkNY USA 2004

Submit your manuscripts athttpwwwhindawicom

Hindawi Publishing Corporationhttpwwwhindawicom Volume 2014

MathematicsJournal of

Hindawi Publishing Corporationhttpwwwhindawicom Volume 2014

Mathematical Problems in Engineering

Hindawi Publishing Corporationhttpwwwhindawicom

Differential EquationsInternational Journal of

Volume 2014

Applied MathematicsJournal of

Hindawi Publishing Corporationhttpwwwhindawicom Volume 2014

Probability and StatisticsHindawi Publishing Corporationhttpwwwhindawicom Volume 2014

Journal of

Hindawi Publishing Corporationhttpwwwhindawicom Volume 2014

Mathematical PhysicsAdvances in

Complex AnalysisJournal of

Hindawi Publishing Corporationhttpwwwhindawicom Volume 2014

OptimizationJournal of

Hindawi Publishing Corporationhttpwwwhindawicom Volume 2014

CombinatoricsHindawi Publishing Corporationhttpwwwhindawicom Volume 2014

International Journal of

Hindawi Publishing Corporationhttpwwwhindawicom Volume 2014

Operations ResearchAdvances in

Journal of

Hindawi Publishing Corporationhttpwwwhindawicom Volume 2014

Function Spaces

Abstract and Applied AnalysisHindawi Publishing Corporationhttpwwwhindawicom Volume 2014

International Journal of Mathematics and Mathematical Sciences

Hindawi Publishing Corporationhttpwwwhindawicom Volume 2014

The Scientific World JournalHindawi Publishing Corporation httpwwwhindawicom Volume 2014

Hindawi Publishing Corporationhttpwwwhindawicom Volume 2014

Algebra

Discrete Dynamics in Nature and Society

Hindawi Publishing Corporationhttpwwwhindawicom Volume 2014

Hindawi Publishing Corporationhttpwwwhindawicom Volume 2014

Decision SciencesAdvances in

Discrete MathematicsJournal of

Hindawi Publishing Corporationhttpwwwhindawicom

Volume 2014 Hindawi Publishing Corporationhttpwwwhindawicom Volume 2014

Stochastic AnalysisInternational Journal of

2 Mathematical Problems in Engineering

is based on past and current production indicators that isbusiness numbers In many cases the forecast might be bur-dened by some inaccuracies so it would be a mistake tobase a budget on that It is very important to emphasize theforecasting acts serve as a basis for further planning

The forecasting process is performed in a specific envi-ronment If we take into consideration the fact that theenvironment is changed over time then it is obvious thatthe forecasts and targets are changed as well Managementmust be able to describe environment changes in order tostrategically link the forecasting and planning functionsimproving the performance of both

Large capital intensive projects such as those in themineral resource industry are often associated with diversesources of both endogenous and exogenous uncertaintiesThese uncertainties can greatly influence the operationalefficiency Having the ability to plan for these uncertaintiesis increasingly recognized as critical to long-term miningcompany success In the mining industry in particular therelationships between input variables that are controllableand those that are not and the physical and economic out-comes are complex and often nonlinear Operational effi-ciency forecasting of mine in todayrsquos environment is muchcomplex than it was just a few years ago There are typicallymany variables which are directly or indirectly associatedwith the forecasting process

There is a considerable literature dedicated to the opera-tional efficiency measurement It includes many approacheswhich take into account various aspects of the problem

Briciu et al [1] applied the concept of Cost-Volume-Profit analysis inmonitoring andmeasuring the performanceof companies in the mining industry in Romania Zhaoet al [2] evaluated operating efficiency of Chinese CoalMining Companies by Malmqusit Productivity Index Factoranalysis was employed by Li et al to evaluate performanceof coal mine companies [3] Four types of empirical testshave been performed (parametric mean differences non-parametric Wilcoxon rank sum test static regression panelestimation and dynamic regression panel estimation) toestimate managerial and operational efficiency of privatizedmining companies in Jordan [4] A stochastic frontier analy-sis method was used to estimate profit efficiency in the SouthAfrican mining sector [5] The analytic hierarchy process(AHP) methodology was selected for ranking the efficiencyof selected platinummining methods [6] Improving the effi-ciency of truckshovel operations can increase the total oper-ational efficiency of mine To make the truck and shovel fleetmore optimum on the basis of productivity improvementsand associated costs reduction it was essential to calculatethe bestmatch factors and truckshovels assignments (or fleetsize) for the system [7]

This paper investigates the relationship between ore pro-duction rate fixed costs revenues production costs workingdays and degree of use of production capacity as inputvariables and Degree of Operating Leverage (DOL) as indi-cator of operational efficiency of an existing underground

mine Multivariable grey model is used to establish the timesequence response formula of DOL This formula enables usto predict the future values of DOL time series based onlyon a set of the most recent data To decrease uncertainty offuture values of the operational efficiency we use expertrsquosknowledge and simulation processes to find future values ofinput variables affecting them Estimation of future revenuesis based on the application ofmean reversion process normaland uniform distribution Geometric Brownian motion isused to define future values of production costs Values of oreproduction rate fixed costs working days and degree of useof production capacity are estimated by expertrsquos knowledge

By simulating a forecasting system we imitate its actionin order to measure its response (output) to different inputsThe simulation allows analysts to describe the uncertaintyof variables that influence the value of DOL by differenttime depending scenarios The first objective of the use ofsimulation in the forecasting is to determine the distributionof the DOL from the variables that affect his performancewhich results in the average or expected value of DOL forevery year of defined time horizon

2 Grey Information Systems andMultivariable Grey Model GM(hN)